If you are getting right into that adulting stage, CPF MediShield Life is definitely one of the important aspects you must know especially in terms of health insurance.

So without further ado, let’s get right into it.

What is CPF MediShield Life?

If you are a Singaporean or a Permanent Resident, lucky for you!

You are automatically enrolled into CPF MediShield Life – which is a basic hospital insurance plan that defrays large hospital bills and selected outpatient treatment costs for as long as you live.

It largely covers your bills in the lower ward classes (Class B2 or C) in public hospitals.

And just like any insurance plan, MediShield has premiums which are paid through your MediSave Account (MA).

The MediSave account is dedicated specifically toward your hospitalisation expenses.

Who is eligible for MediShield Life?

As mentioned previously, MediShield Life is compulsory for ALL Singaporeans and PRs.

There is no need to apply as you are automatically covered!

This is also regardless of your age, or health conditions (including any pre-existing conditions).

MediShield Life Benefits

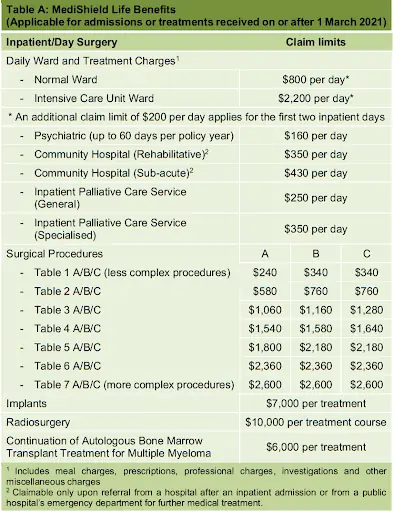

MediShield Life offers numerous benefits (i.e the amount you can claim) ranging from inpatient and outpatient treatments.

You can check out the full list of benefits here.

Source: Ministry of Health

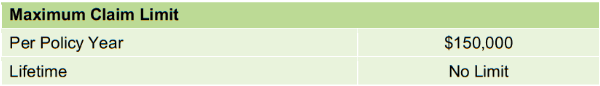

Keep in mind, that MediShield Life’s claim limit is the maximum amount of money you claim per policy year.

This is set at $150,000 with no lifetime limit* on claims.

*A lifetime limit is the maximum total amount of all claim reimbursements that is liable through your lifetime.

Exclusions in MediShield Life

In simple terms, exclusions refer to items that MediShield Life is unable to pay for.

The basis here is that if the medical procedure is optional, it is most likely to be excluded from MediShield Life coverage.

According to the Ministry of Health, these exclusions (as of 2022) are as follows:

- Ambulance fees

- Cosmetic surgery

- Dental work (except due to accidental injuries)

- Vaccination

- Infertility, sub-fertility, assisted conception or any contraceptive operation, including their related complications

- Sex change operations, including their related complications

- Maternity charges (including Caesarean operations) or abortions, including their related complications, except treatments for serious complications related to pregnancy and childbirth

- Treatment for injuries arising from the insured’s criminal act

- Treatment of injuries arising directly or indirectly from nuclear fallout, war and related risk

- Treatment of injuries arising from direct participation in civil commotion, riot or strike

- Expenses incurred after the 7th calendar day from being certified to be medically fit for discharge from inpatient treatment and assessed to have a feasible discharge option by a medical practitioner

- Surgical interventions, including related complications, for the following rare congenital conditions which are severe and fatal by nature: Trisomy 13, Bilateral Renal Agenesis, Bart’s Hydrops and Anencephaly

- Optional items which are outside the scope of treatment

- Overseas medical treatment

- Private nursing charges

- Purchase of kidney dialysis machines, iron lung and other special appliances

- Treatment which has received reimbursement from Workmen’s Compensation and other forms of insurance coverage

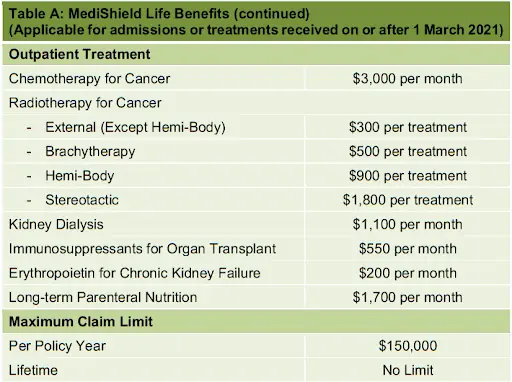

How much are MediShield Life premiums?

These are the annual premiums for the respective age groups.

Source: Ministry of Health

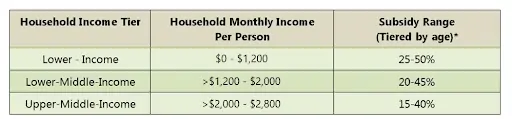

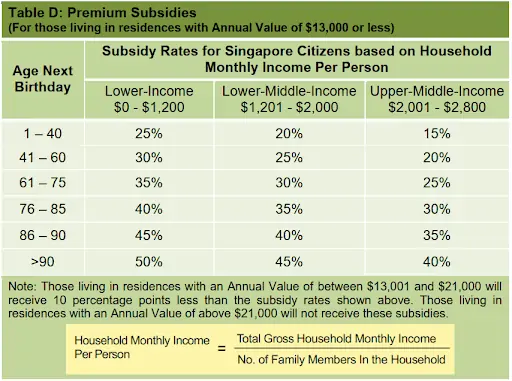

In case you are wondering which income group you belong to, the classification is as follows:

| Income Group | Monthly Per Capita Household Income

= Total gross household monthly income* / Total number of family members living together |

| Lower Income | < $1,200 |

| Lower-Middle Income | $1,201 – $2,000 |

| Upper-Middle Income | $2,001 – $2,800 |

| Higher Income | > $2,801 |

*Total gross household monthly income includes your CPF contributions, basic income, overtime pay, allowances, cash awards, commissions and bonuses over the last 12 months, excluding rental income and pocket money.

Annual Withdrawal Limits

These annual premiums are payable via your MediSave Account.

However, do take note that MediShield Life premiums are fully payable by MediSave up to an Additional Withdrawal Limit, where the remainder are payable by cash.

So, it is important to understand how much you can actually withdraw until you have to dip into your savings.

These are the MediSave Annual Withdrawal Limits as of 2022, which are dependent on age on the next birthday.

| Age | Additional Withdrawal Limits |

| 40 years and below on next birthday | $300/year |

| 41 to 70 years on next birthday | $600/year |

| 71 years on next birthday | $900/year |

Pre-Existing Conditions

If you are one of those identified with serious pre-existing conditions, you may be subjected to Additional Premiums (of 30% of standard MediShield Life premiums) for the first 10 years because of higher health risks.

Unfortunately, that’s just how it is when it comes to insurance premiums and medical claims. Not only do you have to pay more, but it is also common for coverage to be excluded for pre-existing conditions given how there are not any benefits derived from it.

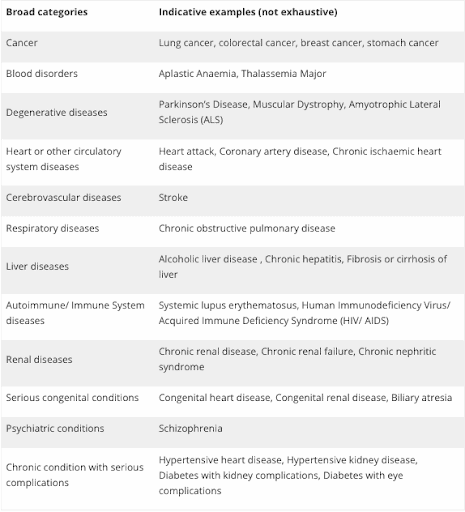

Examples of serious pre-existing conditions are as follows:

Source: Ministry of Health

After this 10 years, you’ll go back to paying the standard premium of your respective age group.

What else can you expect to pay?

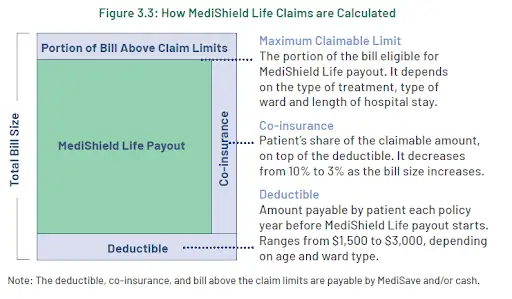

Besides paying for premiums and before awaiting your MediShield Life claims, there are components of your hospitalisation bill you’ll first have to pay namely (1) Deductibles, (2) Co-Insurance, and (3) Portion of Bill above Claim Limit.

Here’s a diagram from MOH for better visualisation.

Source: Ministry of Health

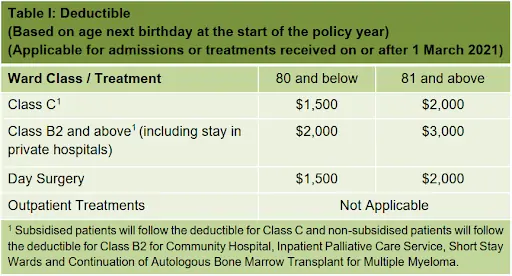

Deductibles

Deductibles are specific amounts of your medical expenses that you must first pay out of your own pocket before you are able to receive your MediShield claim payout.

This deductible is paid only once in a policy year and can be accumulated if you are hospitalised more than once (i.e. making more than 1 claim) in the same policy year, via MediSave or in cash.

Source: CPF Board

For those aged 80 and below, the deductible is $1,500 for Class C wards, $2,000 for Class B2 wards, and $1,500 for day surgeries respectively.

For those 81 and above, the deductible is $2,000 for Class C wards, $3,000 for Class B2 wards, and $2,000 for day surgeries respectively.

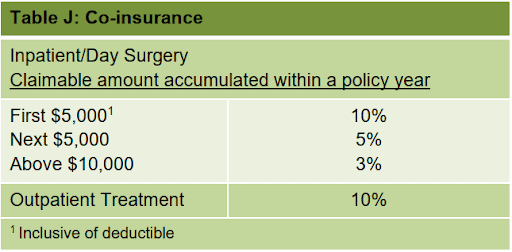

Co-Insurance

Co-insurance is the percentage of your medical bill you would have to pay on top of your deductible.

They are usually in place to reduce over-consumption and over-servicing by healthcare providers.

This is paid every time you make a claim, and calculated as a portion of the amount you’re trying to claim.

The co-insurance rate will be 10% of the hospital bill after the paid deductible for the first $5,000 of the bill, 5% for the next $5,000, and 3% thereafter for anything above $10,000.

Source: Ministry of Health

For example, if you had incurred a hospital bill of $20,000, the co-insurance payment would be 10% of the first $5,000, 5% of the next $5,000, and 3% of the remaining.

So essentially, you’ll be paying a total co-insurance amount of $500 + $250 + $300 = $1050.

Portion of Bill above Claim Limit

As mentioned previously, MediShield Life’s claim limit is the maximum amount of money you claim per policy year.

This is set at $150,000 with no lifetime limit on claims.

Source: Ministry of Health

This simply means, that if you’ve already claimed $150,000 from MediShield Life in one policy year (be it from other hospitalisation cases) – you are required to pay the rest of the bill yourself.

How to make a MediShield Life claim?

In the event you are hospitalised, here are the steps you can take to make a MediShield Life claim.

First, you should inform the hospital admission or outpatient treatment staff that you are making a MediShield claim.

They will then proceed to submit your claim, which will be processed by the CPF Board afterwards.

This is where the MediShield benefit payout (depending on your treatment) will be offset as part of your hospitalisation bill.

The remaining portion of the bill can then be covered by your MediSave account or cash.

Keep in mind, that this is where deductible (if you’ve not paid previously) and co-insurance will kick in.

What if I don’t have enough in my Medisave Account for premiums?

If you have insufficient funds in your MediSave account, there are 2 ways you can go about this – cash top-ups or seeking help from your immediate family members.

Cash Top-Ups

Whether you are a working individual or a self-employed person, you or your employer can easily make e-payments to your MediSave account.

As a safety measure, do ensure you are making regular top-ups so as to ensure no late payments or incurring penalties for your premiums.

Help from Family Members

The MediSave accounts of your immediate family members, such as your spouse or parents can be used to pay for your premiums if the need arises.

Keep in mind, that they must be either a Singapore Citizen or PR for you to do so.

By submitting an application through CPF, they would be able to become the payer of your MediShield Life cover.

Are there any subsidies for MediShield Life?

Yes, there are!

There are 5 subsidies in total mainly (1) Premium Subsidies, (2) Pioneer Generation Subsidies, (3) Merdeka Generation Subsidies, (4) COVID-19 Subsidies, and (5) Additional Premium Support.

Depending on the situation and the information Ministry of Health (MOH) has on you and your family, 2 or more subsidies may be automatically applied to your MediShield Life annual premiums.

It’s useful to note that premium subsidies are always applied first, followed by the other subsidies such as those for the Pioneer Generation or the Merdeka Generation.

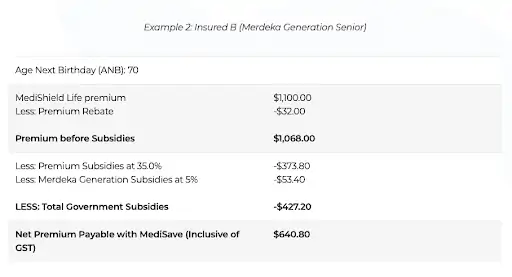

Here’s an example of how MediShield Life premiums are computed for a person of the Merdeka Generation.

Source: CPF Board

Premium Subsidies

Premium subsidies are meant for lower- to middle-income families with a household monthly income per person of $2,800 and below, and those living in homes with an Annual Value of $21,000 and below.

If you own more than one property, you will not be eligible for this subsidy.

Source: Ministry of Health

Source: Ministry of Health

If you are eligible, you can receive up to a 50% subsidy for your premiums.

For PRs, you will receive half of the subsidy rate that is applicable to Singaporeans.

Premium subsidies are also automatically applied – so that’s something you won’t have to worry about!

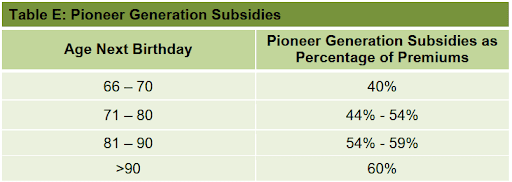

Pioneer Generation Subsidies

The Pioneer Generation in Singapore ranges from those aged 65 and above in 2014.

Regardless of household monthly income per person or your home annual value, pioneers will receive Pioneer Generation Subsidies of between 40% and 60%.

Source: Ministry of Health

Depending on the year of birth, pioneers are also entitled to receive $250 to $900 a year in MediSave top-ups.

For pioneers who have serious pre-existing conditions, they will also receive additional MediSave top-ups of $50-$200 annually from 2021 to 2025.

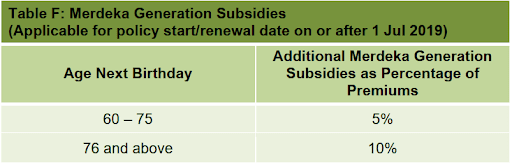

Merdeka Generation Subsidies

The Merdeka Generation in Singapore are those aged 60 years and above in 2019 or those born in 1959 and earlier.

Source: Ministry of Health

This is regardless of their household monthly income or home Annual Value and on top of the Premium Subsidies that they may receive as seen earlier.

Merdeka seniors also receive a yearly MediSave top-up for 5 years from 2021 to 2023.

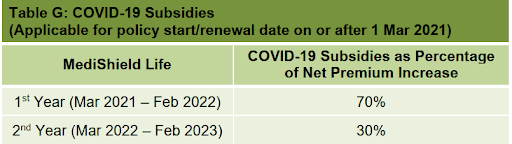

COVID-19 Subsidies

This subsidy is in light of the ongoing COVID-19 pandemic and provided to all Singaporeans after the increase in MediShield Life premiums on 1 Mar 2021.

Source: Ministry of Health

Since we’re already in the 2nd year as stated in the table, a 30% subsidy will be applied on the net premium increase over MediShield Life premiums before 1 Mar 2021.

This subsidy is applied on top of the other subsidies (whenever applicable).

Additional Premium Support

These are for families who need assistance with their premiums even after the above subsidies and where Medisave use is not sufficient.

You as the insured will be assessed for Additional Premium Support if you have insufficient MediSave savings to pay for your premiums, have limited family support, and if you are not covered under an Integrated Shield Plan or active paying ElderShield/CareShield Life Supplements.

The eligibility for additional premium support will be based on you and your immediate family members’ financial situation.

This process requires certain additional documents such as detailed information (IC number, Name as per NRIC, contact number, etc.) of your immediate family members.

How long do I need to pay for MediShield Life?

As this is a lifelong coverage, you’ll need to pay for MediShield Life for as long as you live.

Is MediShieldLife enough?

In any case you are hospitalised, it is evident that you’ll still have to fork up a significant amount of money from your pockets such as the deductible, co-insurance, or anything above the claim limit – despite having MediShield Life.

You can see why a basic MediShield Life is certainly not enough because it can easily wipe out your savings just like that.

Retrospectively, the average hospitalisation bill in Singapore for B2 and C wards in public hospitals ranges from about $1,178 – $3,380 and $1,012 – $2,558 respectively – according to MOH.

There have been instances that 5% of patients have paid way more than that range with about $3,434 – $10,389 (for Class B2) and $2,973 – $8,466 (for Class C).

Plus, looking at the benefits provided by MediShield Life – there are relatively few and not sufficient.

Thus, there are many insurers that offer Integrated Shield Plans (IPs) that seek to provide additional support on top of your MediShield Life.

Especially if you seek a higher comfort level (i.e Class B1 or A wards) or wish to get treated at private hospitals, IPs can also provide you with the ability to do so.

So, for your convenience, I have compiled a comprehensive guide to IPs and identified the best based on a few select criteria.

Conclusion

As you can see, the government takes very good care of us by providing a basic health insurance plan that guarantees us a lifetime of coverage.

That’s why it is important that we understand how MediShield Life fully works – especially if we get hospitalised due to unexpected situations.

But whether you feel is sufficient, it’s solely up to you and your financial situation to be the judge.

Not sure if you should supplement this coverage?

It’s best to talk to a MAS-licensed financial advisor.

Share this article with anyone you feel is also going through the #adulting stage so that they can also be well-informed about their MediShield Life coverage today!

References

https://www.cpf.gov.sg/member/cpf-overview

https://www.cpf.gov.sg/member/healthcare-financing/medishield-life