The AXA Shield is now known as the HSBC Life Shield plan.

HSBC Life Shield is 1 of 7 integrated shield plans available in Singapore, and it is intended to complement your existing MediShield Life coverage.

Because of the high cost of healthcare in Singapore, sole reliance on MediShield is inadequate due to numerous exclusions, restrictions, and even the high hospital bills you might incur.

Fortunately, as with all shield plans, you can opt to pay your premiums using your MediSave account.

Here we have a comprehensive review of the HSBC L ife Shield – should you consider this to supplement your MediShield.

Read on.

My Review of the HSBC Life Shield, previously AXA Shield

Undoubtedly HSBC Life Shield has its pros and cons that make it attractive to some and not to others.

Personally, I think if you’re looking for private hospital coverage and are looking based on how much value you’re getting for every dollar you’re spending, then the HSBC Life Shield Plan A is the best shield plan in Singapore.

Furthermore, its 180-day pre-hospitalisation and 365-day post-hospitalisation coverage is pretty attractive as well.

If price is an issue, then the NTUC Income Enhanced IncomeShield Preferred is the cheapest private hospital plan there is.

A worthy mention in the private hospital plan category would be the Raffles Health Insurance A + Raffles Hospital Option.

It provides 100% coverage in public hospital class A wards, 100% proration in Raffles Hospital, and a premium waiver for your child!

But when it comes to Class A and B1 wards, the HSBC Life Shield Plan B and HSBC Life Shield Standard Plan fall short of expectations.

Other policies from Great Eastern, NTUC Income, and Prudential fare better in these categories.

We also didn’t dive deep into the nitty-gritty of what’s covered under the policy as it’s a long list of things to be covered. We compared the most important (and most commonly referred to) parts of the policy.

So if the details are important to you, please check out the brochures.

Nevertheless, these are just my thoughts and opinions.

Everybody has their own situation, and the best integrated shield plan for me might not be the best for you.

Thus, you should always consult a financial advisor so that you get one that’s suited for you.

If you need someone to help compare which shield plan is the best for you or even get a second opinion as to whether the HSBC Life Shield is any good for you, we partner with unbiased financial advisors who can help you with that.

Click here for a free comparison session.

Let’s now explore what the HSBC Life Shield has to offer.

HSBC Life Shield Plan A

The HSBC Life Shield Plan A covers you for up to a Standard Room in private hospitals.

It has a generous annual limit of $2,500,000 and provides 180 days of pre-hospitalisation treatment and 365 days of post-hospitalisation treatment.

When it comes to premiums, the HSBC Life Shield Plan A provides the most value amongst all other insurers in Singapore.

Here’s the table of premiums and benefits for shield plans covering private hospitals:

| Integrated Shield Plan (IP) | Annual Premium for Age Next Birthday

(31 – 35) |

Pre Hospitalisation Coverage | Post Hospitalisation Coverage | Annual Claim Limit | Cost-Benefit Ratio |

| AIA Healthshield Gold Max A | $360 | 13 months | 13 months | $2,000,000 | $5,555.56 |

| AXA Shield Plan A | $292 | 180 days | 365 days | $2,500,000 | $8,561.64 |

| Singlife with Aviva MyShield Plan 1 | $409 | 180 days | 365 days | $2,000,000 | $4,889.98 |

| Great Eastern Supreme Health P Plus | $322 | 120 days | 365 days | $1,500,000 | $4,658.39 |

| NTUC Income Enhanced IncomeShield Preferred | $225 | 180 days | 365 days | $1,500,000 | $6,666.67 |

| Prudential PRUShield Premier | $300 | 180 days | 365 days | $1,200,000 | $4,000.00 |

| Raffles Health Insurance Raffles Shield Private | $339 | 180 days | 365 days | $1,500,000 | $4,424.78 |

| Raffles Health Insurance A with Raffles Hospital Option | $223 | 180 days | 365 days | $600,000 | $2,690.58 |

Looking at the HSBC Life Shield Plan A, premiums for a 31-35-year-old non-smoker male are $292 per year and it provides an annual limit of $2,500,000.

We did the cost-benefit calculation and found that for every $1 you pay in premiums, you receive up to $8,561.64 in hospitalisation coverage for this plan.

That’s the highest value you’ll get with the NTUC Income Enhanced IncomeShield Preferred pretty far behind at $6,666.67 – and $1,500,000 is the claim limit!

Because of this, we believe the HSBC Life Shield Plan A is definitely one of the best hospitalisation plans in Singapore, especially if value is what you’re looking for.

HSBC Life Shield Plan B

Now comes the HSBC Life Shield Plan B. The HSBC Life Shield Plan B covers up to Class A wards in public or restructured hospitals.

A good thing about this plan is that it includes extensive pre- and post-hospitalisation coverage of 180 days and 365 days respectively with an annual limit of $550,000.

It is, however, more expensive than other Class A plans from other insurers.

| Integrated Shield Plan (IP) | Annual Premium for Age Next Birthday

(31 – 35) |

Pre Hospitalisation Coverage | Post Hospitalisation Coverage | Annual Claim Limit | Cost-Benefit Ratio

(Annual Claim Limit/Annual Premium) |

| AIA Healthshield Gold Max B | $168 | 180 days | 180 days | $1,000,000 | $5952.38 |

| AXA Shield Plan B | $156 | 180 days | 365 days | $550,000 | $3525.64 |

| Singlife with Aviva MyShield Plan 2 | $168 | 180 days | 365 days | $1,000,000 | $5952.38 |

| Great Eastern Supreme Health A Plus | $106 – $123 | 180 days | 365 days | $1,000,000 | $9433.96 |

| NTUC Income Enhanced IncomeShield Advantage | $74 | 100 days | 100 days | $500,000 | $6756.76 |

| Prudential PRUShield Plus | $119 | 180 days | 365 days | $600,000 | $5042.02 |

| Raffles Health Insurance Raffles Shield A | $112 | 180 days | 365 days | $600,000 | $5357.14 |

| Raffles Health Insurance Raffles Shield A with Raffles Hospital Option | $223 | 180 days | 365 days | $600,000 | $2690.58 |

With an annual claim limit of just $550,000, the HSBC Life Shield Plan B provides one of the lowest coverage for Class A wards in public/restructured hospitals.

But you shouldn’t just look at the annual claim limit if value is what you’re looking for, as the cost-benefit ratio is an important factor in determining value.

However, the HSBC Life Shield Plan B also falls short here.

A 31-35-year-old non-smoking male will pay $156 yearly for his premiums, only to get $3,525.64 for every dollar spent.

This is the second lowest in the market and a far cry from Great Eastern’s $9,433.96.

If value is what you’re looking for, the Great Eastern Supreme Health A Plus is your best bet.

Otherwise, we think Prudential’s PRUShield Plus is the best for Class A wards due to the multitudes of riders you can add to your health insurance policy.

The cheapest?

Well, the NTUC Income Enhanced IncomeShield Advantage takes the cake here.

HSBC Life Shield Standard Plan

The HSBC Life Shield covers up to Class B1 wards in public/restructured hospitals with an annual limit of $150,000.

Unlike the HSBC Life Shield Plan A and B, the HSBC Life Shield Standard Plan does not provide pre- and post-hospitalisation coverage of 180 days and 365 days, respectively.

In fact, it doesn’t provide pre- and post-hospitalisation coverage at all.

Something that we find strange given that its competitors provide at least some form of coverage.

If you’re looking for a bargain for a Class B1 ward plan, you’ll find that AXA’s Standard plan isn’t very competitively priced.

| Integrated Shield Plan (IP) | Annual Premium for

Age Next Birthday (31 – 35) |

Pre Hospitalisation Coverage | Post Hospitalisation Coverage | Annual Claim Limit | Cost-Benefit Ratio |

| AIA Healthshield Gold Max B Lite | $102 | 100 days | 100 days | $300,000 | $2941.18 |

| Singlife with Aviva MyShield Plan 3 | $100 | 180 days | 365 days | $500,000 | $5000 |

| Great Eastern Supreme Health B Plus | $77 – $80 | 180 days | 365 days | $500,000 | $6493.51 |

| NTUC Income Enhanced IncomeShield Basic | $44 | 100 days | 100 days | $250,000 | $5681.82 |

| Raffles Health Insurance Raffles Shield B | $83 | 90 days | 90 days | $300,000 | $3614.46 |

| AXA Shield Standard Plan | $62 | – | – | $150,000 | $2,419.36 |

| PruShield Standard Plan | $63 | – | – | $200,000 | $3,174.60 |

If you look solely at the premiums for a 31-35-year-old non-smoking male, the HSBC Life Shield Standard Plan may seem competitively priced amongst the other shield plans.

However, as it only covers you for up to $150,000 per year, the cost-benefit ratio of this policy is only $2,419.36.

This is the lowest in the market and definitely not the most value-for-money policy available.

Looking for a bang for your buck? Check out the Great Eastern Supreme Health B Plus.

Looking for the cheapest? The NTUC Income Enhanced IncomeShield Basic is your best bet.

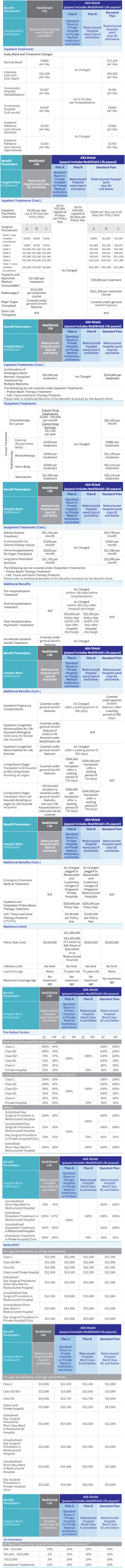

What Does HSBC Life Shield Cover?

Here is a list of what HSBC Life Shield covers:

As you’re looking for an integrated shield plan, the coverage you receive is a pretty important consideration to have.

So make sure to check out the benefits you’ll receive from comparing.

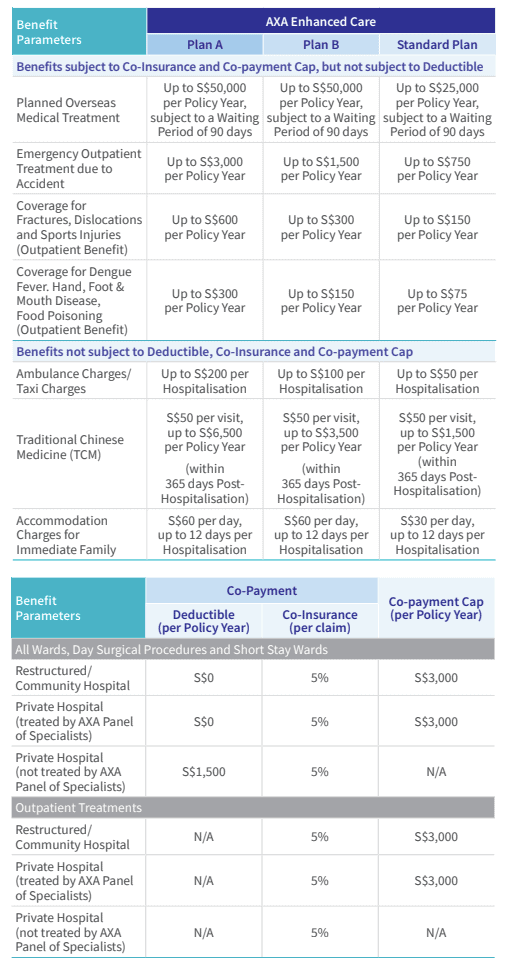

HSBC Life Shield Rider – HSBC Life Enhanced Care

A review of an integrated shield plan isn’t complete without checking out the riders offered.

HSBC Life only offers 1 rider for their shield plans – the HSBC Life Enhanced Care.

This rider includes perks such as pre-planned foreign treatment, post-hospitalisation TCM therapies, and more, and it limits out-of-pocket costs to 5% of the total hospital bill.

Additionally, it covers the following benefits, subject to various caps for Plans A, B, and Standard Plans.

- Urgent outpatient care due to an accident

- Sports injuries, dislocations, and fractures

- Fees for ambulances and taxis

- Accommodation costs for your immediate family members

- Dengue fever, food poisoning, and hand, foot, and mouth disease.

Although subject to deductibles, coinsurance, and copayment caps under HSBC Life Enhanced Care, all deductible and coinsurance amounts under HSBC Life Shield are covered.

Here’s a table provided by HSBC Life indicating the benefits covered under its rider:

How to Make Claims from HSBC Life Shield?

All hospitalisation claims and supporting documents should be e-filed.

AXA may require you to pay part or all of your hospital bill before submitting your claim, but if your claim is successful, the hospital will reimburse you.

The required forms and original bills must be submitted within 90 days of the date the claim was incurred for other medical claims – your pre- and post-hospitalisation and psychiatric claims.

If you have trouble, contact your financial advisor whom you purchased your policy from.

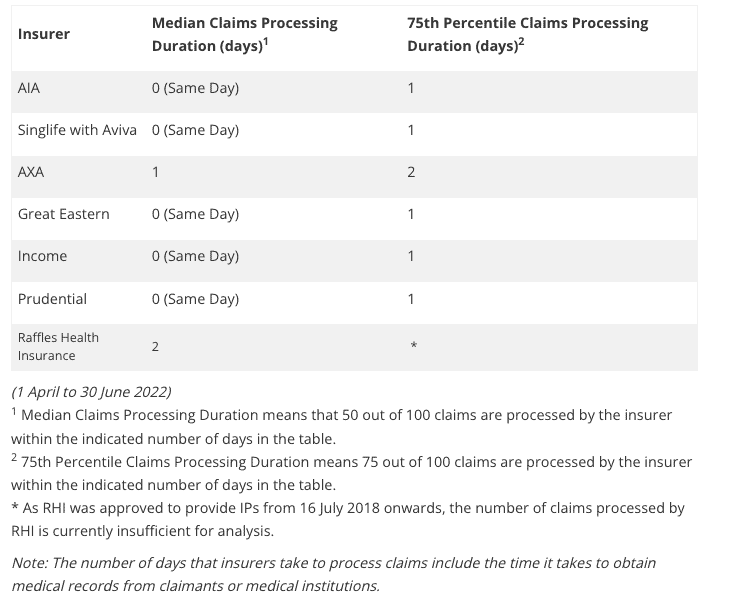

HSBC Life Shield Claims Duration

According to MOH, HSBC Life takes about 1-2 days to process your claims. This is higher than the other health insurers which mostly process within the same day.