In Singapore, there are many Integrated Shield Plans (IPs) available.

Before diving straight into which one you should get, let’s first explore what exactly is an IP and some of its basic elements so you can determine what works best for you.

What is an Integrated Shield Plan (IP)?

First and foremost, it is important to note that all Singaporeans are covered by MediShield Life – a basic health insurance plan that is issued by the Government to help Singaporeans defray large medical expenses and selected outpatient treatment costs.

MediShield Life can be paid annually using your MediSave account, or a family member’s MediSave account.

MediShield Life covers Class B2 and C wards in public hospitals which provides substantial coverage of up to 80% and also, certain surgeries. These are pretty basic – but it is good to wonder if there’s more to offer.

If you’re getting an Integrated Shield Plan (also known as a hospitalisation plan), it is comparable to getting additional coverage on top of your MediShield Life.

Thus, a shield plan is made up of two parts – the MediShield Life Component and the additional private insurance coverage component.

These IPs are provided for by approved private insurers such as AIA, AXA, Great Eastern, or Prudential.

Needless to say, IPs would require additional premiums, especially when they start rising substantially with age.

However, some of the benefits these plans provide may be enough consolation to outweigh the additional costs incurred.

The benefits included can be exhaustive, for instance, having the choice of Class A and B1 wards in public and private hospitals or being able to choose your own doctors.

Here’s a quick breakdown to compare the main differences between MediShield Life and IPs.

(This would be a good reference for later portions.)

| MediShield Life | Integrated Shield Plans (IPs) |

| 1. It is administered by the CPF Board. | 1. It is administered by private insurers, as approved by MOH. |

| 2. Its coverage is sized for stays in Class B2/C wards of public hospitals. | 2. It provides for enhanced coverage beyond MediShield Life, with various plan types available for stays in private hospitals. |

| 3. It covers all pre-existing conditions. | 3. Coverage for the private insurance component of the IP may be declined or imposed with exclusions and/or restrictions, arising from pre-existing conditions. |

| 4. There is no minimum or maximum age limit. | 4. It may have a minimum or maximum entry age limit. |

| 5. There are sub-limits available. | 5. It may have sub-limits, although most do not have sub-limits. |

| 6. MediShield Life premiums are fully payable by MediSave. | 6. MediShield Life component of the plan is fully payable by MediSave, while the private insurance component is payable by MediSave up to the Additional Withdrawal Limit, and the remainder is payable by cash. |

Comparison of the Best Integrated Shield Plans

Firstly, let’s compare the premiums payable for every single hospitalisation plan available:

| MediShield Life Premium (Payable by Medisave) | $390 | $390 | $525 | $525 | $800 | $800 | $1,020 | $1,100 | |

| Integrated Shield Plan (IP) | Ward Type | Annual Premium for Age Next Birthday (31 – 35) | Annual Premium for Age Next Birthday (36 – 40) | Annual Premium for Age Next Birthday (41 – 45) | Annual Premium for Age Next Birthday (46 – 50) | Annual Premium for Age Next Birthday (51 – 55) | Annual Premium for Age Next Birthday (56 – 60) | Annual Premium for Age Next Birthday (61 – 65) | Annual Premium for Age Next Birthday (66 – 70) |

AIA Healthshield Gold Max | Standard | $86 | $86 | $134 | $158 | $187 | $226 | $336 | $504 |

| B Lite | $102 | $102 | $162 | $199 | $215 | $238 | $360 | $580 | |

| B | $168 | $168 | $328 | $328 | $460 | $501 | $730 | $1,364 | |

| A | $360 | $401 | $905 | $982 | $1,398 | $1,776 | $2,399 | $3,527 | |

| AXA Shield Plan | Standard | $62 | $62 | $107 | $107 | $142 | $161 | $279 | $419 |

| B | $156 | $156 | $229 | $312 | $411 | $468 | $667 | $947 | |

| A | $292 | $300 | $600 | $600 | $906 | $1,184 | $1,601 | $2,196 (66 – 68) $2,247 (69 – 70) | |

| Singlife with Aviva MyShield | MyShield Plan 3 | $100 | $100 | $180 | $196 | $278 | $286 | $480 | $719 |

| MyShield Plan 2 | $168 | $168 | $312 | $340 | $468 | $494 | $773 | $1,219 | |

| MyShield Plan 1 | $409 | $409 | $714 | $924 | $1,166 | $1,483 | $1,957 | $2,774 | |

| Great Eastern Supreme Health | Standard | $53 | $53 | $84 | $84 | $113 | $113 | $231 | $367 |

| B Plus | $77 – $80 | $81 – $99 | $140 – $142 | $144 – $156 | $225 – $260 | $278 – $312 | $346 – $527 | $585 – $889 | |

| A Plus | $106 – $123 | $126 – $135 | $195 – $233 | $235 – $242 | $287 – $369 | $394 – $518 | $555 – $799 | $891 – $1,313 | |

| P Plus | $322 | $322 | $649 | $649 | $1,047 – $1,207 | $1,290 – $1,437 | $1,894 – $1,907 | $2,656 – $2,870 | |

| NTUC Income Enhanced IncomeShield | Basic | $44 | $53 | $78 | $78 | $78 | $88 | $176 | $373 |

| Advantage | $74 | $80 | $155 | $167 | $231 | $248 | $401 | $643 | |

| Preferred | $225 | $236 | $320 | $375 | $477 | $506 | $874 | $1,288 | |

| Prudential PRUShield | Standard | $63 | $63 | $108 | $108 | $141 | $179 | $250 | $396 |

| Plus | $119 | $119 | $192 | $192 | $285 | $273 | $461 | $849 | |

| Premier | $300 | $300 | $600 | $600 | $965 – $1,112 | $1, 188 – $1323 | $1,742 – $1,754 | $2,441 – $2,638 | |

| Raffles Health Insurance Raffles Shield | Standard | $62 | $62 | $108 | $125 | $141 | $163 | $275 | $395 |

| B | $83 | $83 | $126 | $126 | $224 | $233 | $378 | $612 | |

| A | $112 | $126 | $217 | $221 | $349 | $375 | $605 | $946 | |

| A with Raffles Hospital Option | $223 | $228 | $336 | $423 | $642 | $718 | $1,029 | $1,452 | |

| Private | $339 | $342 | $537 | $632 | $958 | $1,057 | $1,537 | $2,233 | |

Next, we compare what each hospitalisation plan offers in terms of the in-patient coverage provided.

| Plan | In-Patient Treatments | |||||||||

| Daily room and board | ICU | Surgery and surgical implants | Community Hospital | Major organ transplant | Stem cell transplant | Pre and post hospitalisation treatment | Accident Dental Treatment | Hospice Palliative Care Service | Psychiatric treatment | |

| NTUC Income’s IncomeShield | No | Yes | Yes | No | Yes | No | Yes | No | No | Yes |

| AIA HealthShield | Yes | Yes | No | Yes | Yes | Yes | Yes (Extended post-hospitalisation for 30 CIs) | No | Yes | Yes |

| Singlife with Aviva Ltd. MyShield | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | No | Yes |

| Great Eastern Supreme Health | Yes | Yes | Yes | Yes | No | No | No | Yes | No | Yes |

| Prudential PRUShield | Yes | Yes | Yes | Yes | No | No | No | No | No | No |

| AXA AXA Shield | Yes | Yes | Yes | Yes | No | No | No | No | No | Yes |

| Raffles Health Insurance Raffles Shield | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | No | Yes |

Next, we check out what’s covered under the outpatient and other treatments for each hospitalisation plan.

| Plan | Outpatient | Others | |||||||||

| Cancer therapy | Kidney dialysis | Approved immunosuppressant drugs | Pregnancy complication | Prosthesis benefit | Congenital abnormalities | Final expense | Emergency overseas medical treatment | Waiver of premium for TPD | Breast Reconstruction after mastectomy | HIV/AIDs treatment | |

| NTUC Income’s IncomeShield | Yes | Yes | No | Yes | Yes | Yes | Yes | No | No | No | No |

| AIA HealthShield | Yes | Yes | No | Yes | No | Yes | Yes | Yes | Yes | No | No |

| Singlife with Aviva MyShield | Yes | Yes | Yes | Yes | No | Yes | Yes | Yes | No | No | No |

| Great Eastern Supreme Health | Yes | Yes | Yes | No | No | No | No | No | No | Yes | No |

| Prudential PRUShield | Yes | Yes | Yes | No | No | No | Yes | No | No | No | No |

| AXA Shield | No | Yes | Yes | No | No | No | No | No | No | No | No |

| Raffles Health Insurance Raffles Shield | Yes | Yes | Yes | Yes | No | Yes | Yes | Yes | Yes | Yes | Yes |

Lastly, we compare the deductibles and co-insurance you’ll incur across shield plans from the insurers.

| Plan | Deductibles (based on 80 years and below) | Co-insurance |

| NTUC Income’s IncomeShield Plan A | Up to $3,500 for Ward class A at a public hospital or private hospital | 10% |

| AIA HealthShield Gold Max | Up to $3,500 for Ward class A at a public hospital or private hospital (all ward types) | 10% |

| Singlife with Aviva MyShield | Up to $3,500 for Ward class A at a public hospital or private hospital or hospital outside Singapore | 10% |

| Great Eastern Supreme Health | $2,500 for private hospitals (all ward types), Up to $2500 for Ward class at public hospitals | 10% |

| Prudential PRUShield A & B Plans | Up to $3,500 for Ward class A at a public hospital or private hospital or hospital outside Singapore | 10% |

| AXA Shield Standard Plan | Up to $2,500 for Ward class at public hospitals | 10% |

| Raffles Health Shield | Up to $3,500 for Ward class A at a public hospital or private hospital | 10% |

Take note that the comparisons vary across different insurers and different plans within each specific insurer.

It’s best that you manually refer to the brochures or get a financial advisor to compare this for you.

We’ve identified the best health insurance plans in Singapore based on a few select criteria.

Do take note that the choices may be based on our personal opinions.

So, before you proceed with any purchase of a hospitalisation plan, it’s best to first speak to a qualified financial advisor that can better advise you on a suitable hospital plan based on your situation

Cheapest Health Insurance in Singapore

I’m Singaporean… so I understand that when it comes to choosing the ‘best deal’ – it might mean paying the lowest premiums for some people.

When getting an IP, the total premium payable would be the sum of (1) your MediShield Life premium and (2) the specific’s IP annual premium on the age of your next birthday.

As you can see, NTUC Income Enhanced IncomeShield Plans fit the bill since they provide the lowest premium amounts for all its plans across all IPs.

In fact, they have been priced below the market average consistently for the past few years.

It also provides three-tier offerings (Basic, Advantage, and Preferred) like most IP insurers, with a policy year claim limit of $250,000, $500,000, and $1,500,000 respectively.

What stands out from this IP is the ability to reimburse for emergency inpatient hospital treatment expenses while overseas.

I mean, now that we’re all starting to travel again, this wouldn’t hurt, right?

NTUC Income Enhanced IncomeShield Plans have since covered hospitalisation due to COVID-19 vaccination if it is deemed necessary! So that’s a plus as well.

Now, does cheap means it’s bad?

Not necessarily. With the cheapest premiums amongst health insurance plans, NTUC Income’s benefits puts up a great fight.

Instead of offering the minimum maximum annual claims, shortest pre- and post-hospitalisation coverage, and have long claim times, NTUC Income’s shield plan is in the middle range when it comes to these.

Across all its plans, it provides great value for the lowest premiums involved, giving you a bang for your buck!

Most importantly, you can get the highest level of comfort during your hospital stay without ever paying cash, and even if you need to, it’s not a lot!

Best Health Insurance for Highest Policy Claim Limits (Private & Standard)

| Integrated Shield Plan (IP) | Highest Annual Claim Limit (Private) | Lowest Annual Claim Limit (Standard) | Annual Premium for Age Next Birthday (31 – 35) Standard to Private |

| AIA Healthshield Gold Max | $2,000,000 | $300,000 | $86 – $360 |

| AXA Shield Plan | $2,500,000 | $150,000 | $62 – $292 |

| Singlife with Aviva MyShield | $2,000,000 | $500,000 | $100 – $409 |

| Great Eastern Supreme Health | $1,500,000 | $200,000 | $53 – $322 |

| NTUC Income Enhanced IncomeShield | $1,500,000 | $250,000 | $44 – $225 |

| Prudential PRUShield | $1,200,000 | $200,000 | $63 – $300 |

| Raffles Health Insurance Raffles Shield | $1,500,000 | $200,000 | $62 – $339 |

If you fall into the category of “kiasu” Singaporeans and simply wish to opt for an IP that provides you the highest claim limits, you should definitely consider AXA’s Shield Plan A.

The best thing is that they do not have the highest premiums in the market, yet AXA Shield Plan A provides the highest policy year claim limit of a whopping $2.5 million!

Now do you actually need $2.5 million in annual claim limits?

Realistically, we doubt so, but it’s great to have because you can never be too sure!

However, in its lowest tier, the AXA Shield Plan only provides $150,000 worth of claim limits, which is pretty low as compared to everyone else.

Thus, if you’re looking for the highest claim limits for the standard plans, Prudential’s PRUShield offers the highest claims at $600,000 even at their Standard plan! It’s also priced competitively at $63 for this age group, which definitely brings the most value to the table.

Best Health Insurance for Maximum Coverage Period (For Pre & Post Hospitalisation) (Panel)

| Integrated Shield Plan (IP) | Pre Hospitalisation Coverage | Post Hospitalisation Coverage |

| AIA Healthshield Gold Max | 13 months (panel) 100 days (non-panel) | 13 months (panel) 100 days (non-panel) |

| AXA Shield Plan | 180 days | 365 days |

| Singlife with Aviva MyShield | 180 days (panel) 90 days (non-panel) | 365 days (panel) 180 days (non-panel) |

| Great Eastern Supreme Health | 120 days (panel) | 365 days (panel) |

| NTUC Income Enhanced IncomeShield | 180 days (panel) 100 days (non-panel) | 365 days (panel) 100 days (non-panel) |

| Prudential PRUShield | 180 days | 365 days |

| Raffles Health Insurance Raffles Shield | 180 days (panel) 90 days (non-panel) | 365 days (panel) 180 days (non-panel) |

Based on the table above, AIA HealthShield Gold Max clearly wins hands-down with the longest coverage periods for both pre- and post-hospitalisation.

However, keep in mind that these coverage periods only apply if you go to a healthcare provider listed on AIA’s listed panel of doctors and specialists.

If you go to a non-panel doctor/specialist, the coverage period would evidently be shorter and you would not receive the same privileges.

In this case, it changes to 100 days for both pre- and post-hospitalisation.

Best Health Insurance for Maximum Coverage Period (For Pre & Post Hospitalisation) (Non-Panel)

If you’re looking for the maximum coverage period for IPs that don’t restrict you to only their panels, then you need to consider another insurer.

In this case, AXA Shield and Prudential’s PRUShield offers you the longest coverage.

Both shield plans gives you 180 days of pre-hospitalisation coverage and 365 days of post-hospitalisation coverage for non-panels.

In fact, they don’t even limit to panel and non-panels, you can visit either and you can make claims as long as they fall within the periods above!

Best Health Insurance for Public Hospital Class B1

As mentioned, B1 wards are a step up the Class C and B2 wards.

Integrated Shield Plan (IP) | Annual Premium for Age Next Birthday (31 – 35) | Pre Hospitalisation Coverage | Post Hospitalisation Coverage | Annual Claim Limit | Cost-Benefit Ratio |

AIA Healthshield Gold Max B Lite | $102 | 100 days | 100 days | $300,000 | $2941.18 |

Singlife with Aviva MyShield Plan 3 | $100 | 180 days | 365 days | $500,000 | $5000 |

Great Eastern Supreme Health B Plus | $77 – $80 | 180 days | 365 days | $500,000 | $6493.51 |

NTUC Income Enhanced IncomeShield Basic | $44 | 100 days | 100 days | $250,000 | $5681.82 |

Raffles Health Insurance Raffles Shield B | $83 | 90 days | 90 days | $300,000 | $3614.46 |

AXA Shield Standard Plan | $62 | – | – | $150,000 | $2,419.36 |

PruShield Standard Plan | $63 | – | – | $200,000 | $3,174.60 |

So I assume you’re looking for the best value? Might I suggest you check out Great Eastern Supreme Health B Plus.

If you calculate the cost-benefit ratios of these policies, you’ll understand why we selected Great Eastern’s Supreme Health B Plus instead of other lower priced plans.

But wait, what’s the cost-benefit ratio?

It’s basically how much coverage you’re getting based on the premiums you pay. It just makes sure that you get the most value for every dollar you pay.

Here’s the formula for it:

Annual Claim Limit / Annual Premium = Cost-Benefit ratio

With multiple plus points such as its mid-tier premiums and the highest annual claim limit among all insurers, it is certainly the best choice for someone looking for additional coverage yet not too concerned about comfort!

Not to mention, its pre- and post-hospitalisation coverage periods are *chef’s kiss* up to a year of coverage? An easy win over some others who only provide 90 or 100 days.

Best Health Insurance for Highest Ward Class (Public Hospital) – Class A

The Class A wards are the highest ward class public hospitals can offer to patients who require hospitalisation.

This usually means having a single room, with additional amenities like an attached bathroom and toilet or a sleeper unit for your accompanying loved ones.

Let’s look at the comparisons across all IP insurers’ plans that cover Class A wards.

| Integrated Shield Plan (IP) | Annual Premium for Age Next Birthday (31 – 35) | Pre Hospitalisation Coverage | Post Hospitalisation Coverage | Annual Claim Limit | Cost-Benefit Ratio (Annual Claim Limit/Annual Premium) |

| AIA Healthshield Gold Max B | $168 | 180 days | 180 days | $1,000,000 | $5952.38 |

| AXA Shield Plan B | $156 | 180 days | 365 days | $550,000 | $3525.64 |

| Singlife with Aviva MyShield Plan 2 | $168 | 180 days | 365 days | $1,000,000 | $5952.38 |

| Great Eastern Supreme Health A Plus | $106 – $123 | 180 days | 365 days | $1,000,000 | $9433.96 |

| NTUC Income Enhanced IncomeShield Advantage | $74 | 100 days | 100 days | $500,000 | $6756.76 |

| Prudential PRUShield Plus | $119 | 180 days | 365 days | $600,000 | $5042.02 |

| Raffles Health Insurance Raffles Shield A | $112 | 180 days | 365 days | $600,000 | $5357.14 |

| Raffles Health Insurance Raffles Shield A with Raffles Hospital Option | $223 | 180 days | 365 days | $600,000 | $2690.58 |

If you’re looking for something in the mid-range and still of good value, I would suggest looking at Prudential PRUShield Plus.

It provides a reasonable annual claim limit of $600,000 and allows you to refresh your annual coverage*.

This IP also comes with 2 supplementary plan options – PRUExtra Plus Copay or PRUExtra Plus Lite Copay.

The only difference is these two supplementary plan options lies in the deductible amount – where Prudential covers 95% and you pay the remaining 5% for the former, and Prudential covers 50% (subject to a maximum of $1,750 per policy year) and you pay the remaining 5% for the latter option.

However, one downside is that Prudential PRUShield Plus policyholders are unable to access Prudential’s exclusive suite of value-added healthcare services such as appointment bookings, cashless transactions, or concierge services.

Only Prudential PRUShield Premier policyholders are able to do so.

* Applicable when Life Assured has exceeded the Policy Year Limit and is hospitalised for a different medical condition within the same Policy Year. The Policy Year Limit will be refreshed only once in the same Policy Year.

Best Health Insurance for Highest Ward Class (Public Hospital) – Class A (Option 2)

However, if you’re looking for the most value in terms of the cost-benefits you might receive, then PRUShield might not be for you.

Instead, you should consider looking into Great Eastern’s Supreme Health A Plus for as low as $106, your annual claim limit is $1,000,000. This means you get $9433.96 worth of coverage for every dollar you spend!

This plan does not lack in terms of the pre- and post-hospitalisation periods either – providing you with 180 days and 365 days respectively.

Definitely one to consider if you’re a value hunter!

Best Health Insurance for Private Hospitals (Overall Best)

In Singapore, private hospitals are known to be the epitome of top-tier healthcare and premium experiences.

You are also given the chance to choose your own doctor, as well as enjoy a more comfortable stay should you be hospitalised.

However, when it comes to private hospitals, many tend to have varying needs and thus look out for different things.

We point out 4 best options for you.

| Integrated Shield Plan (IP) | Annual Premium for Age Next Birthday (31 – 35) | Pre Hospitalisation Coverage | Post Hospitalisation Coverage | Annual Claim Limit | Cost-Benefit Ratio |

| AIA Healthshield Gold Max A | $360 | 13 months | 13 months | $2,000,000 | $5,555.56 |

| AXA Shield Plan A | $292 | 180 days | 365 days | $2,500,000 | $8,561.64 |

| Singlife with Aviva MyShield Plan 1 | $409 | 180 days | 365 days | $2,000,000 | $4,889.98 |

| Great Eastern Supreme Health P Plus | $322 | 120 days | 365 days | $1,500,000 | $4,658.39 |

| NTUC Income Enhanced IncomeShield Preferred | $225 | 180 days | 365 days | $1,500,000 | $6,666.67 |

| Prudential PRUShield Premier | $300 | 180 days | 365 days | $1,200,000 | $4,000.00 |

| Raffles Health Insurance Raffles Shield Private | $339 | 180 days | 365 days | $1,500,000 | $4,424.78 |

| Raffles Health Insurance A with Raffles Hospital Option | $223 | 180 days | 365 days | $600,000 | $2,690.58 |

The best bet? Singlife with Aviva MyShield Plan 1.

They have some substantial benefits that can certainly outweigh the pricier premiums as compared to other insurers.

Here are some examples:

- They have an additional $150,000 per year for 5 critical illnesses, which is on top of your Overall Policy Year Limit and the Overall Lifetime Limit.

(Other than AIA HealthShield Gold Max A, no other IP insurers provide this benefit.)

- They also have planned overseas treatment benefits which other IPs do not provide!

(However, this can only be reimbursed if the inpatient treatment or day surgery was received at selected overseas hospitals that have an approved working arrangement with Medisave-accredited institution/referral centres.)

- It also has relatively high benefits for subsidised and unsubsidised day surgeries – which amounts to $3,000 (day surgery), $2,000 (subsidised short stay ward), and $3,500 (unsubsidised short stay ward). (This can be compared to most who only offer up to $3,000 for their unsubsidised short-stay wards.)

We were also informed that Singlife with Aviva’s MyShield is the only integrated shield plan that provides coverage for A&E visits – which makes this policy even more attractive!

We know how painful those A&E fees are when there are no claims that can be made.

So you see, it’s really a matter of getting what you’re paying for.

Plus, they rank 2nd in terms of the annual claim limit and still have a relatively long pre- and post-hospitalisation coverage – so not too shabby, right?

Despite the more expensive premiums, rest assured that the payoff here is certainly the nitty-gritty benefits you can get if you pick this IP over the others.

Best Health Insurance for Private Hospitals (Most Value)

What’s our second pick for the best health insurance for private hospitals?

AXA Shield Plan A.

The same reason why we chose AXA for previous categories, the same reason we’re giving here. In terms of the cost-benefits you’ll get from AXA Shield Plan A, you’re paying $1 for every $8,561.64 of coverage.

That’s higher than every other insurance company offers – 30% higher than your next best option – which makes it a highly attractive option.

So for all our value hunters out there, this plan is for you.

Best Health Insurance for Private Hospitals (Cheapest)

Our third pick is for those looking for the cheapest shield plan, especially for private hospitals.

As you may have guessed, the cheapest shield plan for private hospitals is NTUC Income’s Enhanced IncomeShield Preferred.

At only $225, you get 180 days pre-hospitalisation, 365 days of post-hospitalisation, and $1,500,000 in yearly claims. This plan is also the second most value policy with a cost-benefit ratio of $6,666.67 for every dollar you pay.

With the NTUC Income Enhanced IncomeShield Preferred, you get access to the standard wards in private hospitals.

So if you’re not looking to put up much cash outlay, but still want to enjoy the comfort and treatment from private hospitals, this is for you.

Best Health Insurance for Private Hospitals (Worthy Mention)

Our last pick for this category isn’t actually for private hospitals. In fact, the policy itself is meant for Ward A in public/restructured hospitals.

However, this plan lets you stay in all wards in one specific private hospital.

This plan is Raffles Shield A + Raffles Hospital Option. Why is this plan worthy of mention?

Well, unlike most private hospital shield plans, you can only stay in the standard wards in the private hospitals.

However, with Raffles Health Insurance A + Raffles Hospital Option, you get to enjoy staying in Raffles Hospital – conveniently located in central Singapore – in ALL wards.

It also provides 100% coverage in public hospital class A wards, 100% proration in Raffles Hospital, and a premium waiver for your child!

It’s also pretty competitive as it comes with 180 days of pre-hospitalisation and 365 days of post-hospitalisation – on par with many of the best shield plans.

However, their annual claim limit is only $600,000.

So if you opt for this plan and decide to stay in the most luxurious suite in Raffles Hospital, do be careful of the total bills you might need to pay.

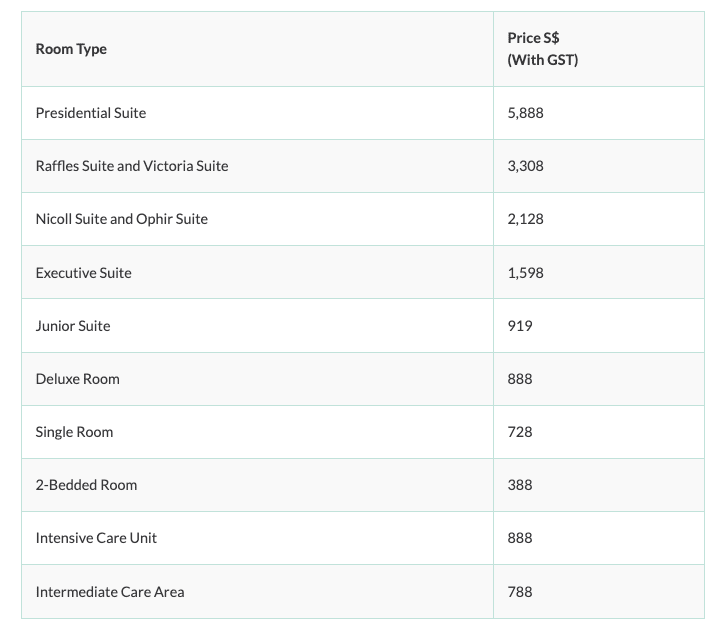

Here’s a screenshot of the daily room rates at Raffles Hospital that you will incur, excluding treatment fees.

Factors to Consider When Choosing An Integrated Shield Plan

Now that you’ve understood the differences between the two, you may be more inclined to take up an IP to provide yourself with the most comprehensive coverage.

So, what’s there to consider when you’re selecting such plans? Let’s take a look.

Protection Coverage

Essentially, this refers to the amount of risk or liability the plan will cover for you.

This can also be constituted to risk management, where you would want to ensure that you are prepared for any uncertainties.

For example, some IPs like AIA HealthShield Gold Max provide coverage for 30 critical illnesses per policy year.

Coverage Amounts

This is a key factor to consider because you would want to presume that the premium you’re paying is worth the protection amount you require when the need arises.

It is typically referred to as the sum assured in IPs.

Using the same AIA HealthShield Gold Max example, their coverage amount is up to $100,000 for the 30 critical illnesses per policy year.

Pre-existing Conditions

As its name suggests, pre-existing conditions mean underlying health issues that currently affect an individual before your IP starts.

While MediShield Life covers all pre-existing conditions, IPs do not – which comes in the form of exclusions or restrictions.

Some insurers are stricter with certain pre-existing conditions while some are more lenient.

So if you have one, you might want to shop around from different insurers to see what you can be covered for.

There may also be a need for you to check if there are other options to bridge this gap of pre-existing conditions you may have like asthma or diabetes.

Exclusions

In simple terms, exclusions in IPs or any insurance plans refer to certain events or risks that the IP insurer will not cover for.

For example, one such general exclusion can be “the use of medical devices, drugs, therapeutic products that are not registered by the Health Sciences Authority of Singapore”.

So do keep a lookout for these exclusions you might encounter in different health insurance plans on top of your pre-existing conditions.

Underwriting

Underwriting refers to the process of where your IP insurer will assess the risk and determine whether or not to accept your application, and if accepted, what coverage terms the IP will offer to you.

The main purpose of underwriting is to ensure the premiums charged to you correspond closely with the risk you present.

Retrospectively, your insurance representative will also be considered your field underwriter.

Underwriting includes both medical and non-medical factors.

This will determine the exclusions you might face mentioned above. It’s important to note that you should not hide anything during the underwriting process.

Hiding or not declaring any of the below factors might cause you problems in the long run when attempting to make claims.

You can refer to the table below for a brief idea of the underwriting process. This information is usually gathered from forms provided by your representative that you would have to fill up.

| Medical Factors | Non-Medical Factors |

Medical History (e.g. Declared medical conditions, medical checkups, or treatments currently received.) | Financial Factors (e.g. Your income, assets, or debts.) |

| Current Physical Conditions | Occupational Factors (e.g. Those in blue-collar jobs possess a higher risk of being hospitalised.) |

| – | Age Factors |

| – | Lifestyle Factors and Habits (e.g. Drug abuse, multiple sexual partners, or hazardous sports) |

Annual Withdrawal Limits

The additional coverage provided by IPs is payable by MediSave up to an Additional Withdrawal Limit, where the remainder is payable by cash.

So, it is important to understand how much you can actually withdraw until you have to dip into your personal savings accounts.

These are the MediSave Annual Withdrawal Limits as of 2022, which are dependent on age on the next birthday.

| Age | Additional Withdrawal Limits |

| 40 years and below on the next birthday | $300/year |

| 41 to 70 years on the next birthday | $600/year |

| 71 years on next birthday | $900/year |

Premium Terms

This refers to the number of years you, as an IP holder, have to pay for the premium. Premium payments for IPs are usually up to age 60, but this will be dependent on what is stated by the insurer in your plan.

Depending on your preferences, this also includes the intervals at which you would like to pay for your premiums – either monthly, quarterly, half-quarterly, or yearly.

Premium Increases

As mentioned earlier, premiums increase substantially with age or are relatively dependent on the plan’s pricing structure.

So when looking at the premiums, make sure to look at how much you’ll pay in entirety for as long as you’re paying.

Some IPs charge higher while you’re younger and can be cheaper than others as you get older, while some may charge lower now but get more expensive than others as the years go by.

Most plans, if not all, would typically state that their premiums can be expected to be adjusted from time to time – which are in line with their claims experiences, medical inflation, and general costs of treatments, supplies, or medical services in Singapore.

Budget

How much money are you willing to dedicate to such health insurance plans?

Do you have a steady income of which you can set aside a portion towards IPs?

You do not want to end up in a situation where you’re unable to pay for the premium amounts stated in your IP.

As you can pay for your health insurance using your MediSave, you can decide to fork out additional cash for more coverage or not.

Make sure you’re only paying for what you need, and not having to overspend or make ends meet just to pay for coverage.

Comfort Level

In unexpected situations, you may find yourself needing to stay at hospitals for treatments or monitoring.

Thus, you would need to ask yourself what exactly you are comfortable with: whether you prefer to stay at a private or public hospital, or a ward type in either hospital that guarantees you a higher level of privacy – such as a single room or with additional amenities.

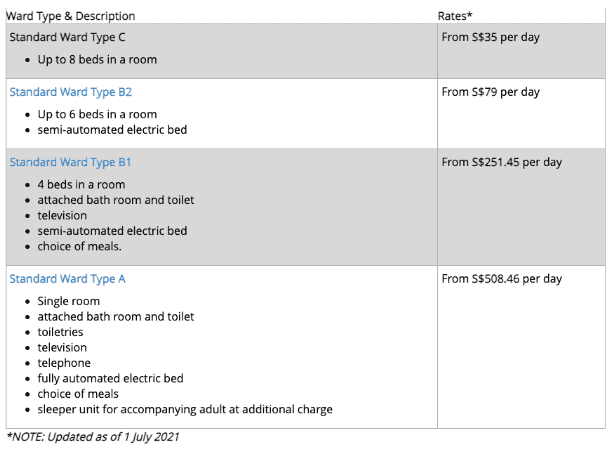

Here’s an example of the ward types and facilities offered in Singapore General Hospital, so you know roughly what to expect. These vary in different medical institutions.

This level of comfort also lies in the freedom to choose your own doctors, which are offered by certain IPs.

Claim Limits

There are two types of claim limits as follows:

- Lifetime limit: The maximum total amount of all claim reimbursements that your IP insurer is liable to you through your lifetime. Once a lifetime limit is reached, the IP will also terminate.

- Annual limit: This is the maximum amount of reimbursable costs payable to you over an annual period, either a calendar year or policy year depending on your IP.

Ease of Claims

This refers to the time and process involved when it comes to claims. Given that the claim process is regulated by the Ministry of Health, IP insurers are relatively timely.

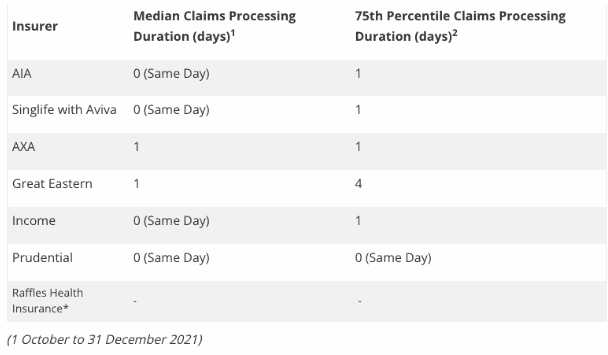

You can check out the table of claims return rates across each IP insurer here, for a better representation. Currently, AIA, Singlife with Aviva, NTUC Income, and Prudential hold the top spots.

Pre and Post Hospitalisation Treatments

Pre-hospitalisation treatments refer to any medical charges that are incurred before you are admitted to the hospital as a patient.

Pre-hospitalisation can generally include,

- Diagnostic & Laboratory Test Charges,

- Specialist Consultation Charges, or

- Treatment in the A&E, that is prescribed by the attending physician or specialist.

As such, post-hospitalisation treatments refer to medical charges incurred after hospitalisation.

Post-hospitalisation can generally include,

- Follow-up specialist consultation charges (e.g physiotherapy after a broken ankle)

- Prescribed drugs or procedures that have to be followed through

Do also keep in mind that the limit on these expenses is generally between 30 to 60 days before and after the hospital admission.

This means that you can only claim the benefits stated on your IP if the expenses are within the stipulated period.

Panel of Doctors

The panel of doctors refers to your IP provider’s list of approved doctors whom you can receive treatment from. At times, this ensures enhanced coverage and higher claim limits.

Generally, the more panel of doctors the IP has, the better it is for you.

But more importantly, the panels must be convenient and have the speciality you might require.

Deductibles

Deductibles are specific amounts of your medical expenses that you must first pay out of your own pocket before your IP insurer can provide you with the claim benefits.

Additionally, if the bill is less than the deductible amount, you would be forking out the entire hospital bill.

Here’s a simple example to illustrate:

“My IP has a per annum deductible of $1,000 and a 20% co-insurance. I had been admitted to the hospital for one day of observation and incurred a charge of $250. Since the charges were below the deductible, I had to pay the full cost of the hospital bill from my own pocket.

It is also common that the deductible amount is tiered to the hospital ward class you stay in as well. As you can probably guess, the higher the ward class, the higher the deductible amount.”

Plans with lower premiums, however, usually have higher deductibles.

Deductibles can exist in three types:

- A per annum deductible,

- A per disability/per year deductible, and

- A per disability (or a per claim) deductible.

Currently, the per annum deductible is the most common, where you only pay for it once in a policy year.

Co-insurance

Co-insurance is the percentage of your medical bill you would have to pay on top of your deductible. These are usually in place to reduce over-consumption and can range from 10 to 20% of the remaining amount after the deductible.

Let me explain this with the example mentioned earlier:

“My IP has a per annum deductible of $1,000 and a 20% co-insurance. I had been admitted to the hospital for one day of observation and incurred a charge of $250. Since the charges were below the deductible, I had to pay the full cost of the hospital bill from my own pocket.

Despite how this amount was not claimable, I was advised by my IP insurer to file the claim, for it to be considered as fulfilling part of the deductible amount for that policy year.

Yet again, I was admitted to the hospital for a major surgery – where the cost of the bill had been $3,500. This time, you would be required to pay for deductible and co-insurance. Here’s the breakdown.”

| Hospital Bill | $3,500 |

| Less: Deductible* | ($750) |

| Claimable Amount from IP Insurer | $2,750 |

| Less: Co-insurance (20%) | $550 |

| Benefits Paid by Insurer | $2,200 |

*Since I had fulfilled a $250 deductible during my earlier admission to the hospital, the deductible I must pay is the difference.

Riders

Riders are optional ‘attachments’ that can be purchased on top of your IP. They are additional payments that are stacked on your premiums.

It can exist in two ways, in the form of (1) monetary benefits (such as to offset deductibles and co-insurance), and (2) other benefits (such as daily hospital cash benefits, allowances, medical coverage, or even home visits for post-care).

Riders also expire when your IP reaches its end date, or when you reach a specified age – whichever is earlier.

The term of your rider will never be longer than the basic IP, since it cannot stand on its own.

Just a quick note:

In 2018, the Ministry of Health had announced fee benchmarks which included haltering the sale of full riders – where anyone who is looking to purchase a new rider from April 2019 would be required to pay at least 5% of the hospital bill. This new fee structure is typically referred to as co-payments.

This comes with a cap of $3,000 a year, provided that you go to your insurer’s approved panel of doctors.

Claim Procedure

There are many ways you can proceed with a claim if the need arises.

It may differ slightly across all insurers but ultimately, the process is quite similar and straightforward.

Let’s look at AXA for example, where their claim procedure can be broken down into four simple steps:

However, you can just ask your financial advisor to make these claims for you.

Downgrading your Integrated Shield Plan

Should you wish to downgrade to a lower coverage plan due to unforeseen financial circumstances, you can do so with the same insurer at any point in time – without any additional underwriting involved.

This also applies to the process of downgrading back to the basic MediShield Life coverage.

Switching Health Insurers

In the event you wish to switch to a new IP, do bear in mind that this process is slightly tricky.

Once you make the switch, it is expected that your original IP with the previous insurer will be terminated.

With this switch, you would have to undergo the underwriting process again which may be time-consuming.

What’s more – it is likely that you would have aged since the change, thus premium costs and terms would be subjected to changes as well.

In addition, you may lose coverage for your existing medical conditions covered by your original plan with the existing insurer, and may not be able to re-apply for your original coverage subsequently.

However, once you’ve made the switch, you have the option of going back to the previous insurer within 30 days from the date of termination.

That being said, if you do decide to switch back, there will be no incidence of re-underwriting – as if the initial IP had never been terminated.

That’s why it’s important to make a good selection at the start, taking into consideration all these factors mentioned above.

This way, you don’t face any issues with your health insurance plans.

Integrated Shield Plan Providers

Now that we’ve understood the various factors above, we will now look at the providers of IPs in Singapore:

- AIA HealthShield Gold Max

- AXA Shield

- Singlife with Aviva MyShield

- Great Eastern Supreme Health

- NTUC Income Enhanced IncomeShield

- Prudential PRUShield

- Raffles Health Insurance Raffles Shield

Some of these insurers provide a standard IP, also known as the “no-frills” product, that is mainly targeted at covering large Class B1 ward hospital bills and selected outpatient treatments.

Given how this standard IP is regulated by MOH, the benefits provided are identical across all policies.

The standard IP is an affordable option for Singaporeans who want additional coverage beyond MediShield Life and may find other IPs with higher coverage too expensive.

Conclusion

Wow, that was a heck load of information thrown at you, wasn’t it?

Well, I certainly have to be extensive and thorough! Here at Dollar Bureau, we’re your go-to personal finance resource after all.

And, especially when it involves you forking out your hard-earned money (be it from your Medisave or with cash) to pay for your IP premiums – I should be as detailed as possible.

So, I hope that this guide has made it easier for you to make an informed decision when you decide to opt for additional coverage on top of your MediShield Life.

Personally, I do find health insurance to be an essential form of insurance – especially with the rising costs of healthcare that will continue to pose a challenge in the future.

On top of that, I’m able to get a more comfortable stay in the case of emergencies – so what more can I ask for?

However, we do have to acknowledge that there are some limitations to our choices above.

We focused more on the value for money you can get instead of considering all the factors we’ve mentioned above.

Our selection is also limited to age groups 31-35, which many don’t fall under too!

Thus, take our selections as a guideline rather than a solution.

Different individuals and families might have different needs and factors to consider. If you don’t fall within the same age group, you’ll need to compare the price and value for the respective age group you’re in.

As health insurance is the most important type of insurance for you to get, it’s definitely worth doing additional research and talking to different people for their input.

If you’re unsure about which is the best for you or would prefer to get qualified advice, we suggest talking to a financial advisor.

We partner with qualified, unbiased, and MAS-licensed financial advisors to help you make the best choices for yourself.