It is truly a blessing when a mother brings a child into this world.

But at times, unexpected complications may arise during the pregnancy or delivery that affect both mother and the child. These can become very costly and may be a heavy financial burden — especially for new parents.

And although Medishield Life or Integrated Shield Plans (IPs) may offer maternity coverage to a certain extent, most parents cannot help but wonder if other insurance plans can provide more comprehensive protection when it comes to their precious one.

This is where maternity insurance plans come into the picture, as they provide a suitable complement to these limited coverages and to offset any additional expenses.

But with many maternity insurance plans on the market, how do you pick the best option?

Read on to find out.

Comparing The Best Maternity Insurance Plans in Singapore

First of all, you need to know that there are 2 types of maternity insurance plans, standalone maternity insurance plans and those that come bundled with another – either a whole-life insurance plan or an investment-linked plan.

In this article, we will only be discussing the best standalone maternity insurance plans on the market, which include:

- Great Eastern GREAT Maternity Care (Essential and Enhanced Plan)

- Manulife ReadyMummy

- NTUC Income Maternity 360

- Singlife Maternity Care (previously known as Aviva MyMaternityPlan)

- Prudential PRUMum

Cheapest Maternity Insurance Plan – Singlife Maternity Care

The annual premiums will be based on the lowest-tiered plans from each insurer, where they offer a basic sum assured of $5,000 at a contract term of 3 years.

| Maternity Insurance Plan | Annual Premium for a 30-year-old non-smoker expectant mother |

| Great Eastern GREAT Maternity Care Essential Plan | $398 |

| Manulife ReadyMummy | $399 |

| NTUC Income Maternity 360 | $390.55 |

| Singlife Maternity Care (without IVF, ICSI, IUI, ICI) | $326 |

| Prudential PRUMum | $390 |

The cheapest maternity insurance plan on the market would have to be the Singlife Maternity Care.

You must be thinking – their cheap premium would mean that their coverage may not be that great.

Guaranteed that it won’t be the highest coverage (which we will talk about in the next category), but you’ll be surprised; it provides coverage up to a reasonable extent.

For instance, Singlife Maternity Care and NTUC Income Maternity 360 offer a 100% sum assured for 10 pregnancy complications and 23 congenital illnesses.

But why wouldn’t you want the same coverage for $64.55 cheaper annually?

That’s money you can use to purchase baby milk formulas and diapers!

Best Maternity Insurance Plan for Highest Coverage – Great Eastern GREAT Maternity Care

| Coverage for Mother | Coverage for Child | ||||||||

| Maternity Insurance Plan | No. of Pregnancy Complications | Death or TPD Benefit | Daily Hospital Cash Benefit | Additional Benefits (if any) | No. of Congenital Illnesses | Death Benefit | Daily Hospital Cash Benefit | Juvenile Conditions Benefit | Additional Benefits (if any) |

| Great Eastern GREAT Maternity Care | 100% of the sum assured for 19 pregnancy complications | 100% of the sum assured | 2% of the sum assured for each day of hospitalisation (up to 30 days) | – $100 per Psychological Consultation Benefit (up to 3 sessions) – Mum Again Benefit (for the mother to purchase another GMC policy without medical underwriting for her subsequent policy – Guaranteed Insurability Benefit (for the mother to purchase any eligible plan for each of herself and the insured child without medical underwriting within 90 days from the birth of the insured child) | 100% of the sum assured for 26 congenital illnesses | 100% of the sum assured | 2% of the sum assured for each day of hospitalisation (up to 30 days) for 6 hospitalisation events | 100% of the sum assured for 15 juvenile conditions | – Major Organ Benefit (50% of the sum assured if the insured child undergoes any surgery on any of the 5 major organs: heart, lungs, liver, kidneys or brain) |

| Manulife ReadyMummy | 100% of sum assured for 14 pregnancy complications | 100% of sum assured | 1% of sum assured for each day of hospitalisation (up to 30 days) | – Mental Wellness Benefit (10% of the sum insured for psychotherapy treatment) – Guaranteed Insurability Benefit | 100% of sum assured for 24 congenital illnesses | 100% of sum assured | 1% of sum assured for each day of hospitalisation (up to 30 days) | N.A. | – Outpatient Phototherapy Treatment Benefit (1% of sum assured for each day of rental of phototherapy machine of up to 10 days) |

| NTUC Income Maternity 360 | 100% of sum assured for 10 pregnancy complications | 100% of sum assured | 1% of sum assured for each day of hospitalisation (up to 30% of sum assured) | – Guaranteed Insurability Benefit | 100% of sum assured for 23 congenital illnesses | 100% of sum assured | 1% of sum assured for each day of hospitalisation (up to 30% of sum assured) | N.A | – Outpatient Phototherapy Treatment Benefit (1% of sum assured for each day of rental of phototherapy machine of up to 10% of sum assured) |

| Singlife Maternity Care | 100% of sum assured for 10 pregnancy complications | 100% of sum assured | 1% of sum assured for each day of hospitalisation (up to 30 days) | – Guaranteed Insurability Benefit – Financial Assistance in the event of hospitalisation due to illnesses and pregnancy complications | 100% of sum assured for 23 congenital illnesses | 100% of sum assured | 1% of sum assured for each day of hospitalisation (up to 30 days) | N.A | – Outpatient Phototherapy Treatment Benefit (1% of sum assured for each day of hospitalisation, up to 30 days (per contract term)) – Stem cell treatment (for transplant surgery only) – Development delay |

| Prudential PRUMum | 100% of sum assured for 13 pregnancy complications | 100% of sum assured | 1% of sum assured for each day of hospitalisation (up to 50 days) | – Gestational Diabetes Mellitus (GDM) Benefit – Mental Wellness Care (Psychological Consultations and postpartum Depression diagnosis) – Hospital Care Accelerator Benefit (ICU or hospitalisation) | 100% of sum assured for 25 congenital illnesses | 100% of sum assured | 1% of sum assured for each day of hospitalisation (up to 50 days) | N.A | – Gestational Diabetes Mellitus (GDM) Benefit |

In terms of highest coverage, Great Eastern GREAT Maternity Care takes the win for this category.

After all, they offer a 100% sum assured for the highest number of pregnancy complications and congenital illnesses amongst the insurers – at 19 and 26, respectively.

Not to mention, Great Eastern’s GREAT Maternity Care’s daily hospital cash benefit for both mum and child is at 2% of the sum assured, while others only offer 1%.

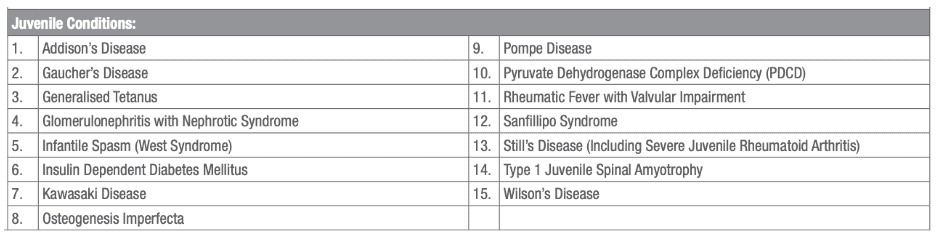

Moreover, they are the first insurer to offer a juvenile benefit in maternity insurance, where they will pay 100% of the sum assured if the insured child is diagnosed with any of the 15 covered juvenile conditions shown below.

Finally, they offer the most additional benefits for mothers, such as their psychological consultation benefit, Mum Again Benefit, and Guaranteed Insurability Benefit. There is also a Major Organ Benefit for the baby.

All these supplementary perks can seem like a good deal for an extra $72 compared to the cheapest maternity insurance plan (Singlife Maternity Care).

Best Maternity Insurance Plan for Longest Coverage Period – Prudential PRUMum

| Maternity Insurance Plan | Coverage Period | Minimum Entry Age | Maximum Entry Age | Pregnancy Period |

| Great Eastern GREAT Maternity Care | 3 years | 18 | 45 | 13 to 40 weeks |

| Manulife ReadyMummy | 3 years | 18 | 46 | 13 to 36 weeks |

| NTUC Income Maternity 360 | 3 years | 17 | 44 | 13 to 35 weeks |

| Singlife Maternity Care | 3 years | 18 | 45 | 13 to 36 weeks |

| Prudential PRUMum | 4 years | 19 | 46 | 13 to 36 weeks |

As you can see, PRUMum offers the longest coverage period of up to 4 years!

All other insurers only offer up to 3 years; sometimes, an extra year could mean a lot for some.

This is because complications might still develop after the baby is born and upon reaching his/her toddler age, so this plan is especially great for parents who wish to stay protected longer.

Plus, you and your baby are protected against 13 Pregnancy Complications and 25 Congenital Illnesses from as early as 13 weeks of pregnancy and up to 3 years old, respectively.

The minimum entry age is 19 years old, and the pregnancy period coverage is shorter than Great Eastern GREAT Maternity Care’s at 13 to 40 weeks, but it compensates with lower premiums and mental wellness payouts.

These mental wellness care payouts last up to 60 days and consist of $200 for psychological consultations and up to 5% of the sum assured for postpartum depression diagnosis. In fact, they are among the few insurers offering such benefits.

PRUMum can also be purchased as part of a bundle (PRUFirst Gift II) with Prudential’s investment-linked whole life insurance plan, PRUActive LinkGuard.

This allows the transfer of the policy benefits of PRUActive LinkGuard to the newborn baby without going through another underwriting process, thus accumulating wealth for his/her future needs.

Best Maternity Insurance Plan for Pregnancies from IVF or Assisted Conception Procedures and Mothers Expecting More Than 2 Foetuses – Singlife Maternity Care

| Maternity Insurance Plan | Annual Premium | Coverage for IVF/Assisted Conception Conception Procedures? | Coverage for Mothers Expecting More Than 2 Foetuses |

| Great Eastern GREAT Maternity Care | $398 x 1.5 x 1.5 = $895.50 | Yes (with 50% premium loading, i.e. single premium x 1.5 x 1.5) | Yes |

| Manulife ReadyMummy | $399 x 1.75 = $698.25 | Yes (with 75% loading applied to premiums) | No |

| Singlife Maternity Care | $569 | Yes | Yes (up to 4 babies in a single pregnancy) |

| Prudential PRUMum | $390 | Yes, with multiple criteria to meet | No |

We understand that some parents might choose to go through IVF or Assisted Conception Procedures to try to conceive a baby, or you could be expecting more than 1 child.

It might disappoint you that most insurers usually cover either one of such cases.

Luckily, certain insurers cover both events – such as Great Eastern’s GREAT Maternity Care and Singlife Maternity Care.

However, Singlife Maternity Care takes an easy win for this category.

Simply because they do not incur any premium loading for pregnancies due to IVF/Assisted Conception Procedures, and they are the only insurer offering coverage for up to 4 babies in a single pregnancy!

In simpler terms, no premium loading means you will not be charged additional premiums (on top of your base premium) even if you opt for any of the covered procedures.

For the price you pay, Singlife Maternity Care offers really good coverage.

Yes, Prudential’s PRUMum offers the cheapest premium at $390, but there are multiple criteria to meet;

- You must be 39 ANB (Age Next Birthday) and below,

- Have no risk factors,

- Have no past pregnancy complications, and

- Must have a normal sized baby

Due to the criteria above, we gave this category to Singlife’s Maternity Care – especially since it covers up to 4 babies.

However, if you meet the criteria laid out by Prudential, then it might be the best for you.

Most Value Maternity Insurance Plan – Singlife Maternity Care

For this comparison, we will use the lowest tier across all insurers as a basis.

| Maternity Insurance Plan | Sum Assured | Annual Premium for a 30-year-old non-smoker expectant mother | Cost-to-benefit Ratio |

| Great Eastern GREAT Maternity Care Essential Plan | $5,000 | $398 | 12.56 |

| Manulife ReadyMummy | $399 | 12.53 | |

| NTUC Income Maternity 360 | $390.55 | 12.80 | |

| Singlife Maternity Care | $326 | 15.34 | |

| Prudential PRUMum | $390 | 12.82 |

To all mums, we know that you only want the best for your child.

But we also want to ensure you spend your money wisely, as every penny counts.

In terms of cost-to-benefit ratio, I believe Singlife Maternity Care is the best value for mothers. is said to provide the best value to expectant mothers.

And for good reason.

Let’s summarise the other factors that make it a worthy plan to consider:

- #1: They are considered the most affordable plan on the market (having won the category for cheapest maternity plan!).

- #2: Reasonable extent of coverage (10 types of pregnancy complications, 23 congenital illnesses and even loss of life).

- #3: They provide coverage for pregnancies from IVF or Assisted Conception Procedures and for as many as 4 babies in a single pregnancy.

- #4: They provide outpatient phototherapy treatment, stem cell treatment and development delay benefits (some insurers don’t!).

- #5: They provide the option of purchasing a new whole-life plan for your baby without the need for health check-ups.

Bundled Maternity Insurance Plans

Remember that this article only covers standalone maternity insurance plans. Don’t forget that some come bundled with other policy types as a rider – either a whole-life insurance plan or an investment-linked plan.

In case you’re interested, here are some bundled maternity insurance plans for your reference.

- AIA Mum2Baby

- AIA Mum2Baby Protect

- HSBC Life (previously AXA) HappyMummy

- Singlife Maternity Care

- Prudential PRUFirst Promise

What is Maternity Insurance?

Maternity insurance is a single-premium insurance policy that seeks to protect eligible mothers against unforeseen complications during the course of their pregnancy or delivery and even after the birth of their newborn child.

It can also be referred to as pregnancy insurance or prenatal insurance.

What do Medishield Life and IPs cover in terms of maternity coverage?

Medishield Life only offers limited maternity coverage – specifically a total of 24 pregnancy complications.

They do not provide coverage for maternity charges (including Caesarean operations) or abortions, including their related complications, except treatments for serious complications related to pregnancy and childbirth.

However, Medishield Life only covers your bills in lower-class wards (Class B2 or C) in public hospitals.

So for those who wish to deliver in higher class wards (B1 and A) or private hospitals, you may have to fork out a lot of your savings to cover the bulk of those hospital bills unless you have an IP.

And even if you have purchased or upgraded an IP previously to cover pregnancy complications, a 10-month waiting period is imposed for pregnancy complications.

So even if you have surpassed the waiting period, the IP maternity coverage is typically limited with only a few listed pregnancy complications. Evidently, those that are unlisted would not be eligible for reimbursement.

Furthermore, unlike maternity insurance, IPs only offer protection for the mother and not the newborn.

What does Maternity Insurance cover?

Here’s a table detailing maternity insurance coverage for both mothers and newborn babies.

Note that although all insurers should have these benefits, the extent of the coverage depends on the insurer and does not extend to all maternity insurance plans.

Coverage for mother | Coverage for newborn baby |

Pregnancy complications benefit

| Congenital illnesses benefit

|

Lump sum payout for Death or total & permanent disability (TPD) | Lump sum payout for Death |

Daily cash benefit due to pregnancy complications (Hospitalisation benefit)

| Daily cash benefit due to congenital illnesses (Hospitalisation benefit)

|

What does Maternity Insurance NOT cover?

Maternity insurance does not cover typical pregnancy costs like childbirth, prenatal and postnatal check-ups, or vaccinations.

Some maternity insurance plans do not cover pregnancies as a result of methods like In-Vitro Fertilisation (IVF) or other Assisted Conception Procedures (such as Intracytoplasmic Sperm Injection (ISCI), Intrauterine Insemination (IUI), and Intracervical Insemination (ICI)).

It is common for maternity insurance plans to exclude mothers expecting more than 2 foetuses, such as triplets or quadruplets.

Conclusion

So to all loving mothers (and caring fathers!) out there, there you have it– the best maternity insurance plans in Singapore laid out for you to have a stress-free journey.

Remember that no specific maternity insurance plan can be considered the best; it always depends on your needs as new parents.

From us at Dollar Bureau, congratulations on your maternity journey!

Need someone to help you choose the best maternity insurance for yourself?

We partner with financial advisors licensed by the Monetary Authority of Singapore to help you with this.