Most Singaporeans dream of having a lavish retirement where they can have fancy meals, visit luxurious places, and even travelling around the world. However, the harsh reality is that this rarely happens – unless you have a fortune.

The majority of Singaporean retirees are unfortunately cash-poor. The dreams of spending your days enjoying as a retiree are all limited due to the rising costs of healthcare, utilities, and daily essentials.

So how can you plan to retire while having a comfortable lifestyle for yourself and your loved ones? Retirement planning.

What is retirement planning?

Retirement planning is a lifelong process that helps you achieve your retirement goals. Be it retiring luxuriously or comfortably, planning for retirement early means that you’ll ensure a living a lifestyle that you choose – by investing smaller amounts and letting your investments compound.

With the compounding of your investments, you’ll be able to cash out more for less, as long as you start early. This phenomenon is known as the compounding effect. That’s why many financial advisors recommend you conduct your retirement planning in Singapore early.

Firstly, let’s begin by finding out what is the official retirement age in Singapore.

The current official retirement age in Singapore as of 2020 is 62 years (MOM). However, according to the 2019 National Day Rally, the retirement age will increase up to 63 years old in 2022, and eventually to 65 years old by 2030.

The ages set above are meant to ensure that you are not asked to retire by your employer. Should this be suggested by your employer, an appeal can be made to the Ministry of Manpower for unfair dismissal.

If your employer doesn’t mind hiring you past the retirement age, you may choose to continue until you’re 67. This is known as the re-employment age. Similar to the retirement age, the re-employment age will increase to 68 years old in 2022, and 70 years old by 2030.

Fortunately, this doesn’t mean that you can’t withdraw from your CPF Retirement Account when you retire. Thankfully, the age where you can start taking out money from your CPF account is 55.

Let us break down the timeline to show the relationship between your CPF withdrawal and your retirement age.

|

Age |

Implications |

|

55 years old |

You can begin withdrawing from your CPF Retirement Account |

|

62 years old |

The official retirement age. Employers are not allowed to ask you to retire before this age |

|

65 years old |

You may start getting monthly sums if your CPF balance meets the retirement sum |

| 67 years old |

Assuming you work past the official retirement age (62), you can get reemployed by your employer until this age |

From the timeline above, it can be seen that your retirement funds are only available to you at age 55. Assuming you didn’t withdraw your entire CPF fund at 55, you’ll only get your first CPF monthly payout at 65 years old or later.

Retirement in Singapore – How much would you need?

We all know that the living costs in Singapore are high, and it’ll only get higher as you age.

To make it worse, your own living costs might be even higher. As you age you incur a few other costs such as healthcare costs, and money spent to replace the free time you have.

So how would you determine how much you would need to retire?

Here are a few factors you should consider when planning for retirement:

- Daily Living Expenses

- Recreational Costs

- Old Age Costs

- Emergency Costs

Daily Living Expenses

These expenses are your daily necessities for you to get by. Expenses such as transport, utilities, personal insurance, loan payments, food etc should be factored in. All these costs that you will incur monthly should be included and should serve as the minimum amount you would require to retire.

Recreational Costs

On top of your normal living expenses, you’d definitely like to have some funds left for recreational purposes with your spouse and grandchildren. This depends on how often you plan on going out, what you plan to spend on, and of course what you can afford.

Old Age Costs

Let’s be honest, you won’t be as healthy when you’re retiring as compared to how you are now. Old age costs should include medical bills, eldercare services, and costs related to disabilities. Expenses for these could be cushioned with the purchase of health insurance, but you should still however set aside funds for unexpected costs due to age.

Emergency Costs

As much as we all would hate to admit it, emergencies can happen anytime. A fall, unexpected plumbing emergencies, and even family issues could arise where you will need an emergency fund to tap on. It is advisable to keep aside extra money to provide a buffer for these costs.

Do you have a number in mind right now? Do you think you’re capable of having that in your savings during your retirement years?

According to a recent Nielson study, Singaporeans expect $3,314 monthly to retire comfortably.

It’s worth noting that this amount should take into account the typical inflation rate of 3%, which could be more dependent on the lifestyle you’re currently living.

How about my CPF Retirement Account?

The only way you can fully withdraw your CPF funds is if your account balance is below $5,000 in both Ordinary and Special Accounts, at the age of 55.

With this only $5,000, you technically don’t even have a Retirement Account, that’s why you can withdraw it all. Once your balance in both accounts hits above $5,000 when you’re 55, CPF will merge the two to form your CPF Retirement Account.

Once this is met, you can start withdrawing money. However, you would need to ensure that you leave the account with the minimum needed. This amount is based on either the Basic Retirement Sum (BRS) or the Full Retirement Sum (FRS). With the current amounts as of March 2020, we will illustrate the minimum required in your CPF Retirement Account.

|

CPF balance at the age of 55 |

Minimum for property owners |

Minimum for non-property owners |

|

<$5,000 |

Can withdraw full sum |

|

|

$5,000 to $192,000 (FRS) |

$96,000 (BRS) |

Withdraw up to $5,000 |

|

>$192,000 |

$96,000 (BRS) |

$192,000 (FRS) |

Numbers are accurate as of 2022.

As seen above, the numbers vary based on whether you own a property. There are some calculations you will need to make in order to qualify as a property owner. If you were to sell your property, the amount you have should be sufficient to top up your CPF to the Full Retirement Sum.

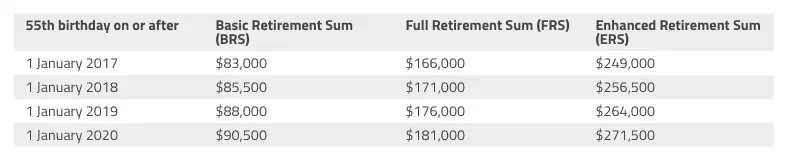

It is also important to take note that these numbers change yearly.

Click here to view the updated numbers.

What is the CPF Retirement Scheme, CPF Life, and how does it work?

Since most people can’t withdraw their CPFs in full once they’re 55, there is thankfully an alternative. A pension scheme called the CPF Retirement Scheme and/or CPF Life.

Singaporeans born after 1957 will automatically be enrolled in the improved version of the CPF Retirement Scheme – CPF Life. The main difference between both these schemes is that for CPF Life, you get payouts until you pass on while the CPF Retirement Scheme gives you payouts till you are 95.

If you are not automatically enrolled in CPF Life, you may choose to opt-in for it.

With 3 tiers in CPF Life, you can choose which tier you’d like when you retire. This, of course, depends on how much retirement income you want and whether you meet the minimum required in your CPF.

| Amount | Standard Plan (Default Plan) | Escalating Plan (Payouts increase by 2% yearly) | Basic Plan | |

| Basic Retirement Sum | $96,000 | $750 to $810 | $580 to $640 | $710 to $740 |

| Full Retirement Sum | $192,000 | $1,390 to $1,490 | $1,070 to $1,180 | $1,310 to $1,360 |

| Enhanced Retirement Sum | $288,000 | $2,030 to $2,180 | $1,560 to $1,720 | $1,920 to $1,980 |

Use the CPF Life Estimator to estimate how much you’ll receive under each plan.

Previously we covered that Singaporeans would need to maintain their BRS in order to qualify for either the CPF Retirement Scheme or CPF Life. Looking at the payouts, BRS gives out low monthly sums – a far number from the desired $3,314 per month.

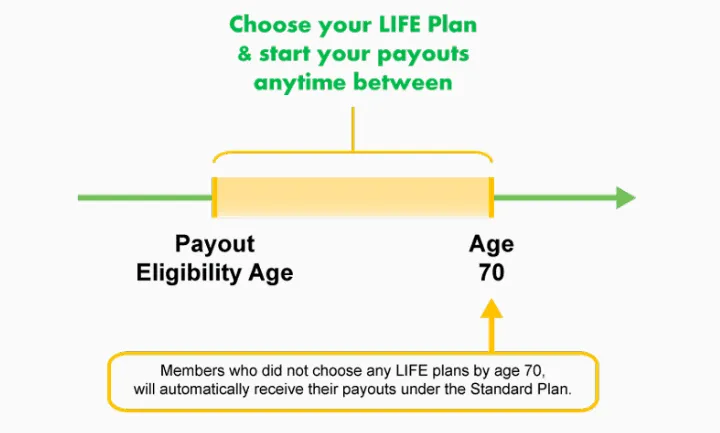

To have a more comfortable retirement, the Full Retirement Sum and Enhanced Retirement Sum can be chosen for higher monthly income. These choices can be made 6 months before the payout eligible age (65) to when you’re 70 years old.

Is my CPF Retirement Account sufficient for me to retire?

As seen above the Basic Retirement Sum has been increasing by about 3% yearly. This isn’t exactly bad for you. Assuming the monthly payouts increase by 3% too, the continuous increment in BRS indicates that the CPF Retirement Scheme takes into consideration Singapore’s inflation rate.

It is also critical to note that even though this sum now seems achievable, this value is based in 2020. This means that you would need to do some projections on how much it would be in the future when you retire.

However, assuming this number compounds by 3% yearly, in 2040, below will be the projected balances.

|

Balance in 2022 |

Projected balance in 2040 |

|

|

Basic Retirement Sum |

$96,000 | $163,500 |

|

Full Retirement Sum |

$192,000 | $326,900 |

|

Enhanced Retirement Sum |

$288,000 |

$490,400 |

If these numbers don’t scare you then… good for you! Unfortunately, most Singaporeans can be easily overwhelmed by these numbers. To make things worse, the majority of Singaporean’s CPF Ordinary Accounts are used for housing. This means less CPF funds for retirement.

This brings up the next question…

So how can I conduct proper retirement planning in Singapore?

You should not rely fully on the CPF Retirement Scheme for your retirement plan. Here are a few questions you could ask yourself before deciding on your next step.

- Do I have enough money in my CPF and savings to get the retirement income that I want?

- Can I rely on someone else to provide me with my retirement?

- Can the CPF Retirement Scheme or CPF Life beat inflation?

- How much control do I want over the retirement income?

- Is the retirement income from CPF Life and my savings sufficient for the lifestyle I want?

- Should I diversify risks by investing in other products?

From here, you should have a rough idea of whether you will need some diversification in your retirement portfolio.

Conclusion

A common way is to supplement the CPF Retirement Scheme / CPF Life is with a retirement plan. These plans are commonly issued by financial institutions, more commonly known as insurance companies and banks.

All you have to do is pay monthly or annual premiums while you’re still young and working, in return for receiving supplementary retirement income when you retire. The amounts paid and received depend on the retirement plan you purchase and the financial institution it’s bought from.

Another way you can prepare for retirement is to get a savings plan. When you make premium payments into savings/endowment plans, it forces you to save money until it matures. Most endowment plans offer some sort of returns for you to combat your savings against inflation while some form of insurance protection as well.

Having one that matures when you’re retiring would be a pleasant surprise for you in your retirement years.

Lastly, you can opt for investment-linked policies as well. These are riskier but provide you with relatively higher returns. If you’re willing to take the risk for higher returns, this might be an option for you.

However, before you make any financial decisions for yourself, it’s always best to talk to a certified financial advisor. They will properly evaluate your current financial standing and give you their opinion.

Talk to one of the financial advisors in our network, they will provide you with impartial advice on what’s the next best move you should take.

References

blog.moneysmart.sg/budgeting/retirement-planning-singapore/