Raffles Shield is 1 of 7 integrated shield plans that act as a complement to your MediShield Life coverage to cover your hospitalisation bills.

For Singaporeans or Permanent Residents, like other shield plans in the market, you may make premium payments via your MediSave account as long as it is within annual withdrawal limits.

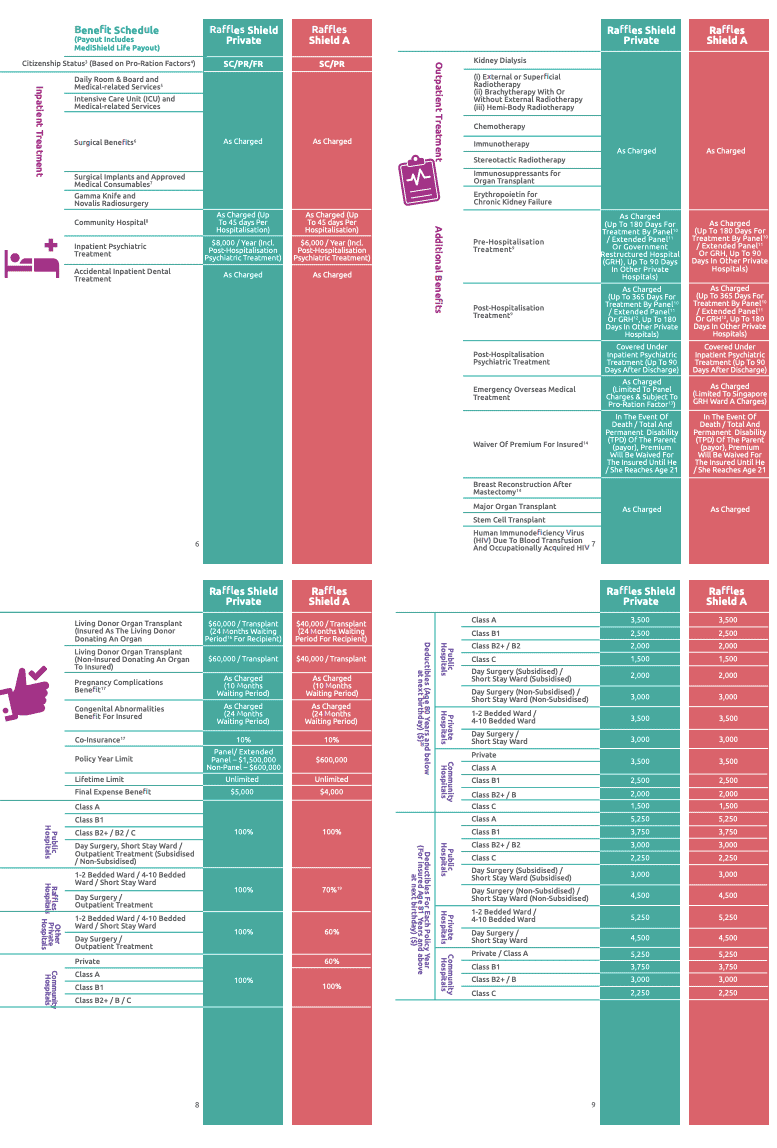

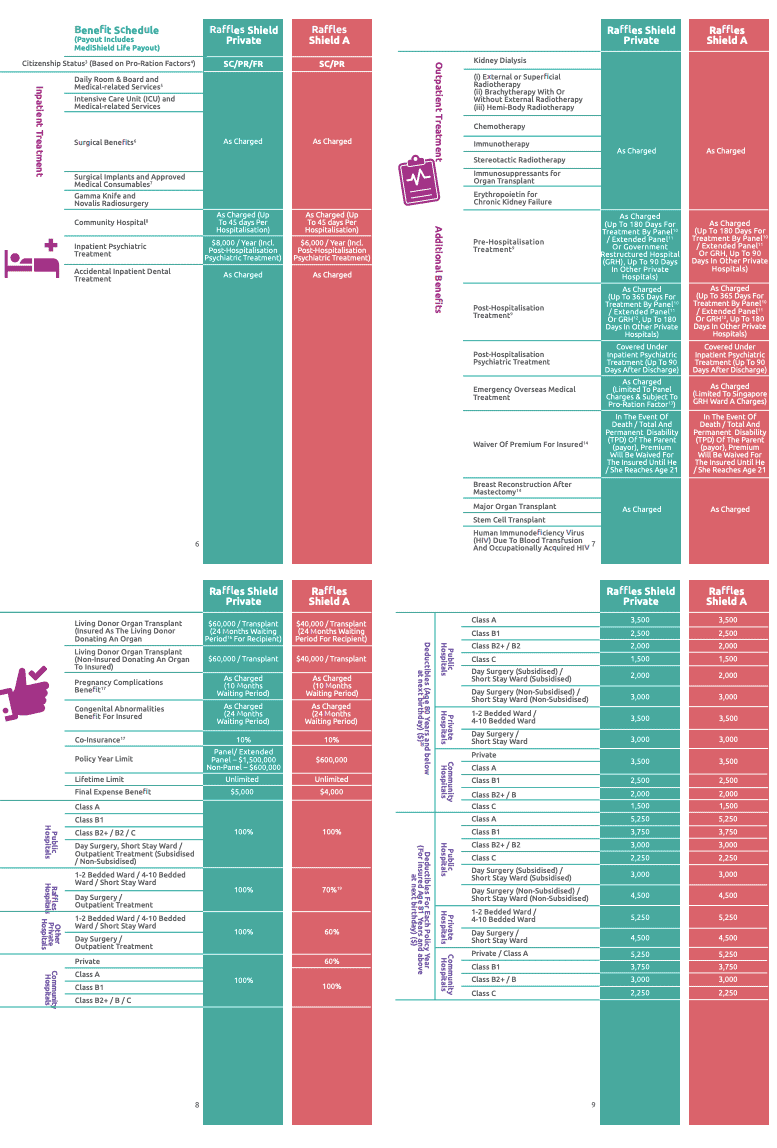

There are 4 Raffles Shield Integrated plans, each with its own set of entitlements.

My Review of the Raffles Shield Plans

I think Raffles Shield plans, across all its tiers, is a pretty interesting shield plan because of its pro-ration factors if you decide to get treated at Raffles Hospital.

These plans are designed to cater to different healthcare needs and preferences, from private hospital coverage to Class B1 wards in public restructured hospitals.

Here’s a detailed analysis of the pros and cons of Raffles Shield plans to help you decide if they align with your healthcare financing needs.

Pros

1. Comprehensive Coverage Across Different Tiers: Raffles Shield provides a variety of plans (Private, A, B, and Standard), allowing you to choose the coverage that best suits your healthcare preferences and financial capability. This range ensures that there’s a plan for everyone, from those seeking private hospital care to those comfortable with Class B1 wards in public hospitals.

2. High Annual Claim Limits: Particularly for the Raffles Shield Private plan, the annual claim limit of up to $1,500,000 for panel specialists is competitive, offering substantial financial protection against large medical bills.

3. Pre- and Post-Hospitalisation Coverage: Raffles Shield plans offer extensive pre- and post-hospitalisation coverage, ensuring that you are covered for treatments related to a hospital stay. This feature is crucial for comprehensive healthcare coverage, allowing for early diagnosis and follow-up treatments without additional financial stress.

4. Flexibility with Riders: The availability of riders, such as the Raffles Key Rider and Raffles Premier Rider, allows you to enhance your coverage according to your needs. These riders can provide additional benefits like family accommodation, TCM treatment, and emergency outpatient coverage due to accidents.

5. MediSave Payment Option: Like other integrated shield plans, Raffles Shield premiums can be paid using MediSave, up to the annual withdrawal limits. This feature makes it easier for Singaporeans and Permanent Residents to afford additional coverage without significantly impacting their cash flow.

Cons

1. Limited Hospital Options for Higher Coverage: For plans like Raffles Shield A with the Raffles Hospital Option, the annual claim limit remains at $600,000, which might be insufficient for extensive treatments at private hospitals. You need to carefully consider your choice of hospital and plan to ensure adequate coverage.

2. Cost-Benefit Ratio Variability: While Raffles Shield plans offer competitive coverage, the cost-benefit ratio varies across different plans. For instance, the Raffles Shield Private plan ranks third in terms of value for money when compared to other insurers’ plans for private hospital coverage. However, its cost-benefit ratio is pretty low on its other tiers, giving other shield plans a better bang for your buck.

3. Pre- and Post-Hospitalisation Coverage Limitations: Although Raffles Shield plans provide pre- and post-hospitalisation coverage, the duration and extent of coverage vary depending on whether treatment is received from panel or non-panel providers. This discrepancy will affect the continuity of coverage and cost of care.

4. Annual Premiums and Deductibles: The premiums for Raffles Shield plans, especially for higher-tier options, may be higher compared to some competitors. Additionally, the high deductible option increases the deductible to $10,000, which could lead to higher out-of-pocket expenses for policyholders before their insurance coverage kicks in.

5. Claims Processing Duration: While Raffles Health Insurance’s claims processing time is relatively quick, there is limited data on its performance due to its status as a newer player in the market. Potential delays in claims processing could impact your overall experience.

In conclusion, the Raffles Shield plans offer a comprehensive range of options for individuals looking for additional medical coverage beyond MediShield Life.

The plans are designed to cater to various healthcare needs and preferences, with the flexibility to enhance coverage through riders.

However, potential policyholders should carefully consider the plans’ coverage limits, cost-benefit ratios, and their own healthcare needs before making a decision.

Of all their plans, I prefer the Raffles Shield Private most, as it provides the most value for every dollar you pay.

Premiums are also competitive across tiers, just not the cheapest around. When it comes to value, I’d say is pretty decent.

Before you purchase this plan, we recommend you read our post on the best integrated shield plans in Singapore and the riders available so that you can find something suitable for yourself.

With an insurance policy as important as a hospitalisation plan, you definitely want to choose one that’s the absolute best in meeting your needs.

I recommend talking to an unbiased financial advisor so that they compare policies and recommend what’s best for you.

We partner with MAS-licensed financial advisors to help you with this.

Click here for a free comparison session.

Let’s now explore what the Raffles Shield plans offer.

Raffles Shield Private

Raffles Shield Private covers all private hospitals and wards in public restructured hospitals.

Your claim limit is $1,500,000 per policy year if you visit a panel specialist and up to $600,000 for non-panel ones.

It also provides pre-hospitalisation coverage of up to 180 days for treatment by panel hospitals & 90 days in other private hospitals.

The post-hospitalisation coverage is up to 365 days for treatment by panel & up to 180 days in other private hospitals.

| Integrated Shield Plan (IP) | Annual Premium for Males Age Next Birthday

(31 – 35) |

Pre Hospitalisation Coverage | Post Hospitalisation Coverage | Annual Claim Limit | Cost-Benefit Ratio |

| Raffles Health Insurance Raffles Shield Private | $237 | 180 days | 365 days | $1,500,000 | $6,329.11 |

| AIA Healthshield Gold Max A | $367 | 13 months | 13 months | $2,000,000 | $5,449.60 |

| AXA Shield Plan A | $292 | 180 days | 365 days | $2,500,000 | $8,561.64 |

| Singlife with Aviva Shield Plan 1 | $409 | 180 days | 365 days | $2,000,000 | $4,889.98 |

| Great Eastern Supreme Health P Plus | $322 | 120 days | 365 days | $1,500,000 | $4,658.39 |

| NTUC Income Enhanced IncomeShield Preferred | $225 | 180 days | 365 days | $1,500,000 | $6,666.67 |

| Prudential PRUShield Premier | $300 | 180 days | 365 days | $1,200,000 | $4,000.00 |

Suppose you’re alright with the $1,500,000 yearly claim limits, the Raffles Shield Private is ranked third based on how much value it gives ($6,329.11 worth of coverage for every $1 spent), just behind AXA’s Shield Plan A and NTUC Income’s Enhanced IncomeShield Preferred.

However, if you’re looking for the most value, this would not be the best plan for you – AXA Shield Plan A is.

Also, I think $237/year for private hospital coverage is not too bad, given that other plans in the market are much more expensive than this.

But if you’re looking for the cheapest, NTUC Income’s Enhanced IncomeShield Preferred is for you.

Here’s what Raffles Shield Private covers:

Raffles Shield A

The Raffles Shield covers Class A wards in public restructured hospitals and below with an up to S$600,000 annual limit.

This plan also gives you a 70% proration at Raffles Hospital – should you decide to go private.

It covers pre-hospitalisation for up to 180 days for treatment by panel hospitals & 90 days in other private hospitals.

The post-hospitalisation coverage is up to 365 days for treatment by panel & up to 180 days in other private hospitals.

| Integrated Shield Plan (IP) | Annual Premium for Males Age Next Birthday

(31 – 35) |

Pre Hospitalisation Coverage | Post Hospitalisation Coverage | Annual Claim Limit | Cost-Benefit Ratio |

| Raffles Health Insurance Raffles Shield A | $156 | 180 days | 365 days | $600,000 | $3846.14 |

| AIA Healthshield Gold Max B | $157 | 180 days | 180 days | $1,000,000 | $5952.38 |

| AXA Shield Plan B | $156 | 180 days | 365 days | $550,000 | $3525.64 |

| Singlife with Aviva MyShield Plan 2 | $168 | 180 days | 365 days | $1,000,000 | $5952.38 |

| Great Eastern Supreme Health A Plus | $106 – $123 | 180 days | 365 days | $1,000,000 | $9433.96 |

| NTUC Income Enhanced IncomeShield Advantage | $74 | 100 days | 100 days | $500,000 | $6756.76 |

| Prudential PRUShield Plus | $119 | 180 days | 365 days | $600,000 | $5042.02 |

The above table compares Class A wards coverage from the different integrated shield plans and it’s clear that Raffles Shield A is among the most expensive. The cost-benefit analysis shows you get $3,846.14 for every $1 spent.

This is the second lowest amongst its competitors, with AXA Shield Plan B just behind.

Thus, if value is what you’re looking for, Great Eastern’s Supreme Health A Plus has a cost-benefit ratio of $9,433.96.

Again, if the cheapest is what you’re after, then NTUC Income’s Enhanced IncomeShield Advantage is your go-to.

Also, $600,000 in annual claim limit isn’t the highest – $1,000,000 is. So consider other plans if you’re looking for higher limits.

However, if you can afford to upgrade to Raffles Shield A with Raffles Hospital Option at a small extra fee (~$67/year for the above demographic), you may receive treatment at Raffles Hospital for a lower price tag.

But your annual limits still stay at $600,000 – which you might exceed if your Raffles Hospitals bills come out high.

Also, for 31 to 35-year-old males, the difference between Raffles Shield A + Raffles Hospital option is just $4 cheaper than Raffles Shield Private. That’s $4 more for $900,000 higher limits.

So make sure to check with your financial advisor if this makes sense for you.

Here’s a list of coverage you’ll expect from Raffles Shield A:

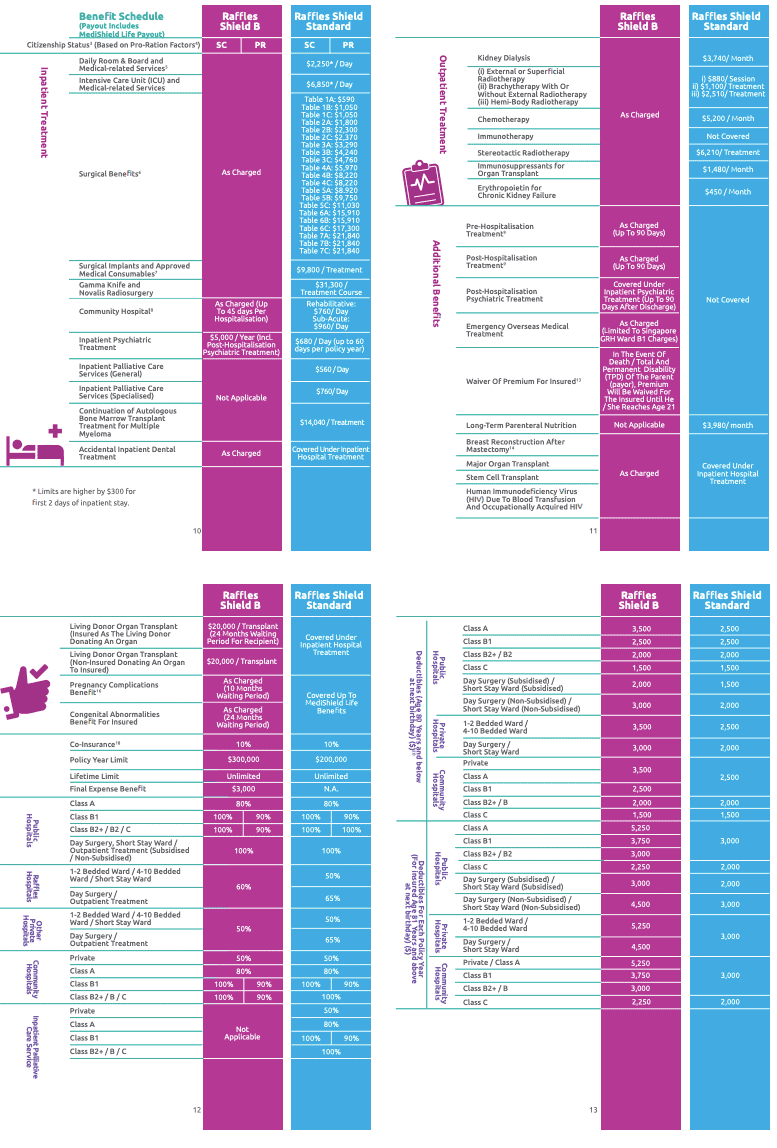

Raffles Shield B

The Raffles Shield plan B fully covers Class B1 wards in public restructured hospitals and below up to a limit of S$300,000.

It also includes pre & post-hospitalisation coverage as charged for up to 90 days.

You also enjoy up to 60% proration in Raffles Hospital should you wish to get treatment there.

| Integrated Shield Plan (IP) | Annual Premium for Males Age Next Birthday

(31 – 35) |

Pre Hospitalisation Coverage | Post Hospitalisation Coverage | Annual Claim Limit | Cost-Benefit Ratio |

| AIA Healthshield Gold Max B Lite | $102 | 100 days | 100 days | $300,000 | $2941.18 |

| Singlife with Aviva MyShield Plan 3 | $100 | 180 days | 365 days | $500,000 | $5000 |

| Great Eastern Supreme Health B Plus | $77 – $80 | 180 days | 365 days | $500,000 | $6493.51 |

| NTUC Income Enhanced IncomeShield Basic | $44 | 100 days | 100 days | $250,000 | $5681.82 |

| Raffles Health Insurance Raffles Shield B | $83 | 90 days | 90 days | $300,000 | $3614.46 |

| AXA Shield Standard Plan | $62 | – | – | $150,000 | $2,419.36 |

| PRUShield Standard Plan | $63 | – | – | $200,000 | $3,174.60 |

Based on the comparison above, 90 days is pretty short as other shield plans offer up to 180 days of pre-hospitalisation and 365 days of post-hospitalisation.

Yes, it’s not too bad as some shield plans don’t even offer any pre- and post-hospitalisation coverage, but for the price you pay, you could get them from other insurers.

Furthermore, you get lower yearly claim limits at $300,000 as compared to Singlife Shield Plan 3’s $500,000.

I mean, $300,000 seems like the average here as the limit for PRUShield Standard and AXA Shield Standard plans are only $200,000 and $150,000 respectively.

But for kiasi Singaporeans like me, I like higher coverage.

Not only higher coverage, but value for money too. This is where Great Eastern’s Supreme Health B Plus triumphs with a cost-benefit ratio of $6,493.51.

And again, as per usual, the cheapest goes to NTUC Income’s Enhanced IncomeShield Basic at $44/year with a cost-benefit ratio of $5,681.82.

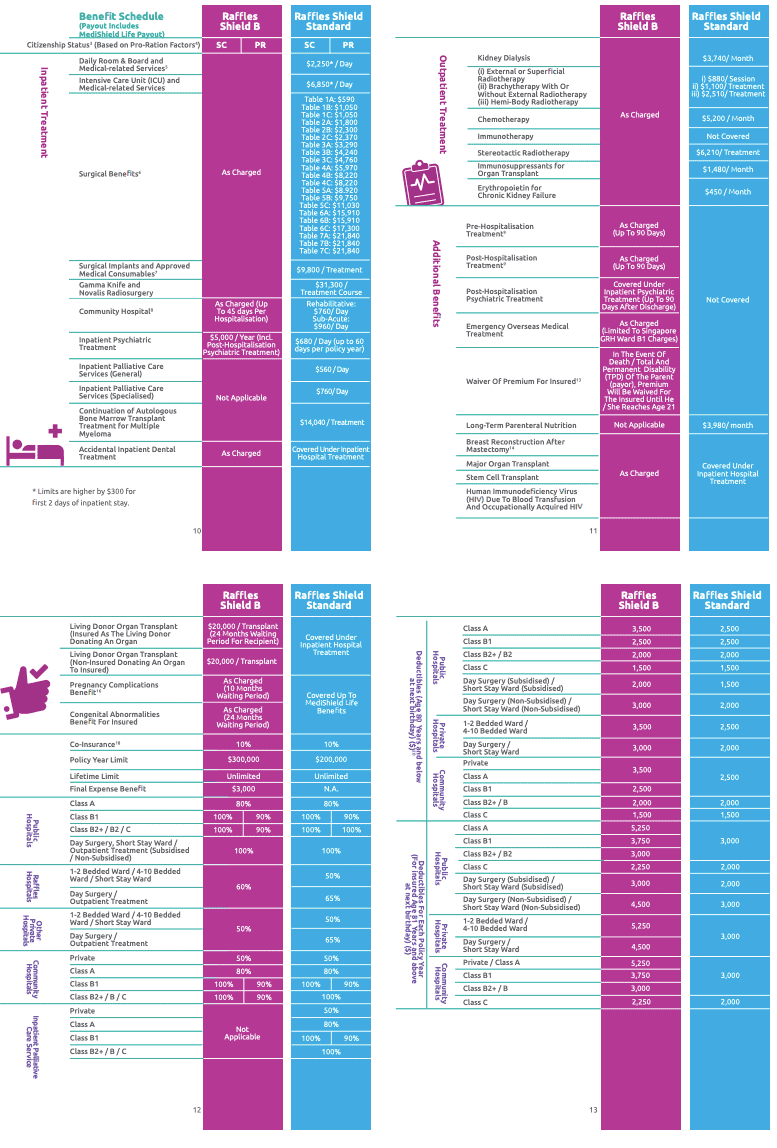

Here’s what’s covered under the Raffles Shield B:

Raffles Shield Standard

The Raffles Shield Standard covers Class B1 wards in public restructured hospitals and below for up to $200,000 in annual claims.

You also enjoy up to 50% proration in Raffles Hospitals if you decide to go there.

It’s also the cheapest shield plan from Raffles Health Insurance, albeit doesn’t cater for pre- or post-hospitalisation cover.

| Integrated Shield Plan (IP) | Annual Premium for

Age Next Birthday (31 – 35) |

Pre Hospitalisation Coverage | Post Hospitalisation Coverage | Annual Claim Limit | Cost-Benefit Ratio |

| AIA Healthshield Gold Max B Lite | $102 | 100 days | 100 days | $300,000 | $2941.18 |

| Singlife with Aviva Shield Plan 3 | $100 | 180 days | 365 days | $500,000 | $5000 |

| Great Eastern Supreme Health B Plus | $77 – $80 | 180 days | 365 days | $500,000 | $6493.51 |

| NTUC Income Enhanced IncomeShield Basic | $44 | 100 days | 100 days | $250,000 | $5681.82 |

| Raffles Health Insurance Raffles Shield B | $66 | 90 days | 90 days | $300,000 | $4545.45 |

| Raffles Health Insurance Raffles Standard | $62 | – | – | $200,000 | $3225.80 |

| AXA Shield Standard Plan | $62 | – | – | $150,000 | $2,419.36 |

| PruShield Standard Plan | $63 | – | – | $200,000 | $3,174.60 |

Both Raffles Health Insurance’s Raffles Shield B and Standard plans offer 100% Class B1 public restructured hospitals but with an annual limit of $300,000 and $200,000 respectively.

Claim limits are low here, so if you want higher limits, this is not for you.

I would say based on the pricing, it’s pretty competitive offering decent coverage for every dollar you spend.

However, you may not like the standard plan if pre- and post-hospitalisation coverage is part of your considerations – which in my opinion, is important.

For example, NTUC Income’s Enhanced IncomeShield Basic and AIA’s Healthshield Gold Max B Lite offer 100 days of pre- and post-hospitalisation at only $44 and $102 respectively.

Also, Great Eastern’s Supreme Health B Plus and Singlife’s Shield Plan 3 give you 180 days of pre-hospitalisation and 365 days of post-hospitalisation at $77 and $100 respectively.

Nevertheless, if you like the idea of going to Raffles Hospital for treatment and are considering a plan from Raffles Health Insurance, then I would opt for Raffles Shield B as there are higher claim limits, pre- and post-hospitalisation coverage, and a cost-benefit ratio that is higher for only $4 more.

Don’t forget, you can use your MediSave account for this!

Here is what you get under the Raffle Shield Standard:

Raffles Shield Riders

There are 4 riders available for your Raffles Shield plan.

Raffles Key Rider

This rider is applicable for Raffles Shield B, Raffles Shield A, and Raffles Shield Private Plans.

In summary, here are the key benefits that may motivate you to add a rider to your Raffles Shield cover;

- For each claim, you are only obligated to pay a 5% co-payment. After proration and within the permitted limits, the co-payment shall be applied to the Reasonable and Customary Expenses.

- Raffles caps your co-payment at $3,000 per policy year for pre-authorised treatment under the Extended Panel, treatment by an Extended Panel Specialist, or for treatment by a Government Restructured Hospital Specialist.

- There’s no cap on the co-payment for procedures not pre-approved by Raffles Health Insurance or performed by a specialist not on Raffles Shield’s panel/Extended Panel of Specialists list.

What does this mean in simple terms? Make sure you get pre-authorisation before undergoing any treatment, otherwise you will have to pay more than $3,000 in co-payment.

You can ask your financial advisor for help.

Raffles Premier Rider

With the Raffles Premier Rider, you have the advantage of supplementing your Raffles Shield Private, A, and B plans with additional benefits.

| Benefits | Raffles Shield Plans | ||

| Raffles Shield Private | Raffles Shield A | Raffles Shield B | |

| Immediate Family Accommodation | Standard charges for an additional bed (up to 30 days at Raffles

Hospital (RH) & Government Restructured Hospitals (GRH), up to 10 days in other hospitals) |

RH or GRH – Standard charges for an additional bed (up to 30 days)

Other Private Hospitals – capped at $70 / day (up to 10 days) |

RH or GRH – Standard charges for an additional bed (up to 30 days)

Other Private Hospitals – capped at $70 / day (up to 10 days) |

| Post-Hospitalisation Follow Up

Traditional Chinese Medicine (“TCM”) Treatment |

$6,000 / year

(within 180 days, TCM clinics at RH or GRH only) |

$5,000 / year

(within 180 days, TCM clinics at RH or GRH only) |

$3,000 / year

(within 180 days, TCM clinics at RH or GRH only) |

| Post-Hospitalisation Home Care | $100 / day, up to $3,000 / year | $100 / day, up to $2,000 / year | $100 / day, up to $1,500 / year |

| Emergency Outpatient due to

Accident |

$2,500 / year | $1,500 / year | $1,000 / year |

| Ambulance Services | $200 per hospitalisation | $150 per hospitalisation | $100 per hospitalisation |

High Deductible Option

The high deductible option offered by Raffles Shield basically means that you can pay lower premiums for your policy, but your deductible increases to $10,000.

This is only available for Raffles Shield B, Raffles Shield A, and Raffles Shield Private Plans.

Raffles Hospital Option

As mentioned earlier in this post, you can add the Raffles Hospital Option to your Raffles Shield A plan, and only the Raffles Shield A plan.

This option gives you access to the facilities and treatment in Raffles Hospital for a lower price tag.

However, your claim limit every year is only $600,000 as it’s attached to Raffles Shield A instead of the $1,500,000 that’s offered by Raffles Shield Private.

How to Make Claims from Raffles Shield Plans?

Your hospital bill claims from Raffles Shield are automatically submitted by the hospital if you visited a medical institution in the MediShield Life scheme. If not, it can be done online at Raffles Health Insurance’s website.

Personally, I think that if you need to make claims, it should be your financial advisor helping you as you’ve paid them for their service through the commissions they earn.

So contact whoever you bought your plan from and request them to help you.

Raffles Shield Claims Duration

As you can see, Raffles Health Insurance takes about 2 days to process your claims, which is higher than their competitors. But 2 days isn’t too bad too!

However, as they’re fairly new, there is insufficient data to determine the 75th percentile.

Reviews on Seedly mention that the claims process is simple and easy, just rather slow.