AIA HealthShield Gold Max is 1 of 7 integrated shield plans available in Singapore that can be used to complement your MediShield Life coverage.

The AIA HealthShield is also one of a few shield plans that offer protection for Singaporeans, Singapore Permanent Residents, and foreigners with valid work passes.

As with all shield plans, you can opt to pay your premiums using your MediSave account.

In this post, we reviewed the AIA HealthShield Gold Max and its plans from the varying tiers.

Keep reading.

My Review of the AIA HealthShield Gold Max

AIA Healthshield Gold Max is one of the most competitively priced plans available, with the A Plan being especially well-priced due to its claim-based pricing approach.

With a S$2 million claim limit, it offers you financial security while allowing you to concentrate on your recuperation.

In order to provide you with even more protection, you can opt for their shield plan riders, which reduces your deductibles and co-insurance.

The AIA HealthShield Gold Max Plan A gives you the longest pre- and post-hospitalisation benefit in the market of up to 13 months when you receive care from AQHP experts or in public hospitals.

Plan B is also pretty decent if you consider the GP consultations, CI coverage, and other benefits provided.

However, the AIA HealthShield Plan B Lite and Standard are undesirable as your annual claim limits drop significantly to $300,000 and $200,000, respectively.

Nevertheless, if you’re interested in the $50,000 of CI coverage in Plan B Lite, it’s still worth it if $50,000 of critical illness coverage is sufficient for you. However, note that this will reduce your annual claim limits to $250,000.

All in all, I would consider AIA’s HealthShield Gold Max pretty good due to the CI coverage and GP consultations, as both can be expensive in the long term.

However, if you’re a value seeker or looking for the cheapest plan, AIA’s HealthShield Gold Max Plans aren’t for you.

Also, we’re not really big fans of claims-based pricing because we prefer more prudent financial planning – which includes removing the uncertainty of not knowing when and how much your insurance premiums will shoot to.

As such, we prefer policies that adopt fixed and predictable premiums, such as the Singlife Shield, HSBC Life Shield Plan, and NTUC Income Enhanced IncomeShield.

But not all policies are for everyone; that’s why it’s important to research your alternatives.

Check out our post on the best integrated shield plans in Singapore to find out what your other options are.

It’s also crucial to get a second opinion from an unbiased financial advisor to understand if the AIA HealthShield Gold Max is for you.

If you’re still unsure, we partner with unbiased MAS-licensed financial advisors to help you with this.

Click here for a free second opinion.

Continue reading for a detail break down of what the AIA HealthShield Gold Max offers.

AIA HealthShield Gold Max Plans – Plan A, B, B Lite, and Standard

There are 4 tiers available for AIA’s HealthShield Gold Max Shield plan.

AIA HealthShield Gold Max A

Choosing the A Plan offers you the option of using private hospitals with a yearly claim limit of $2,000,000.

| Integrated Shield Plan (IP) | Annual Premium (31 – 35) | Pre Hospitalisation Coverage | Post Hospitalisation Coverage | Annual Claim Limit | Cost-Benefit Ratio |

| AIA Healthshield Gold Max A | $360 | 13 months | 13 months | $2,000,000 | $5,555.56 |

| AXA Shield Plan A | $292 | 180 days | 365 days | $2,500,000 | $8,561.64 |

| Singlife with Aviva MyShield Plan 1 | $409 | 180 days | 365 days | $2,000,000 | $4,889.98 |

| Great Eastern Supreme Health P Plus | $322 | 120 days | 365 days | $1,500,000 | $4,658.39 |

| NTUC Income Enhanced IncomeShield Preferred | $225 | 180 days | 365 days | $1,500,000 | $6,666.67 |

| Prudential PRUShield Premier | $300 | 180 days | 365 days | $1,200,000 | $4,000.00 |

| Raffles Health Insurance Raffles Shield Private | $339 | 180 days | 365 days | $1,500,000 | $4,424.78 |

| Raffles Health Insurance A with Raffles Hospital Option | $223 | 180 days | 365 days | $600,000 | $2,690.58 |

* For Male Singapore citizens aged 35.

As you can see, AIA’s HealthShield Gold Max is one of the most expensive ward A plans among its competitors.

However, it provides up to 13 months for pre- and post-hospitalisation coverage if you visit their panel specialist – the longest period as compared to other insurers.

Despite being one of the most expensive, the AIA HealthShield Gold is the second most-value ward A plan with a cost-benefit ratio of $5,555.56, just behind AXA Shield Plan A and NTUC Income’s Enhanced IncomeShield Preferred.

If you don’t know what the cost-benefit ratio is, it basically means that for every dollar you pay, you’ll get $5,555.56.

So if you’re a value seeker, you can consider the AXA Shield Plan A, while if you’re looking for the cheapest, the NTUC Income Enhanced IncomeShield Preferred might be better for you.

If you’re willing and able to pay an extra premium for longer coverage and the benefits covered by AIA, the AIA HealthShield Gold Max Plan A is a good option for you.

With $2,000,000 annual coverage and 13 months of pre- and post-hospitalisation, there’s much to like about this plan.

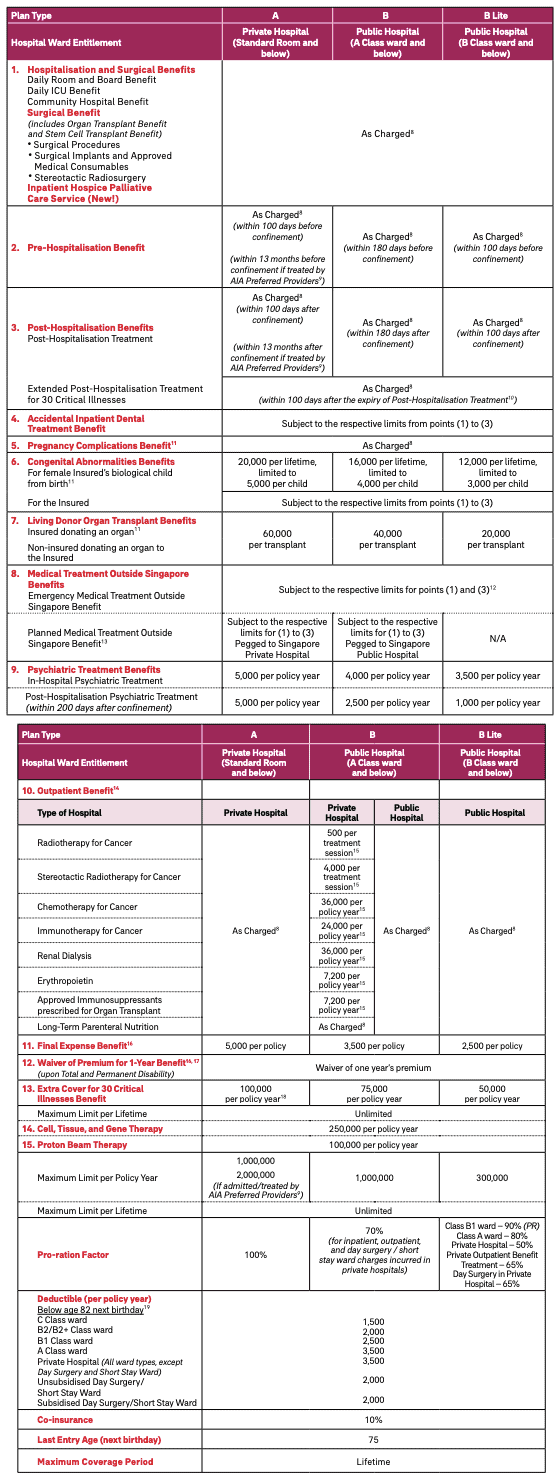

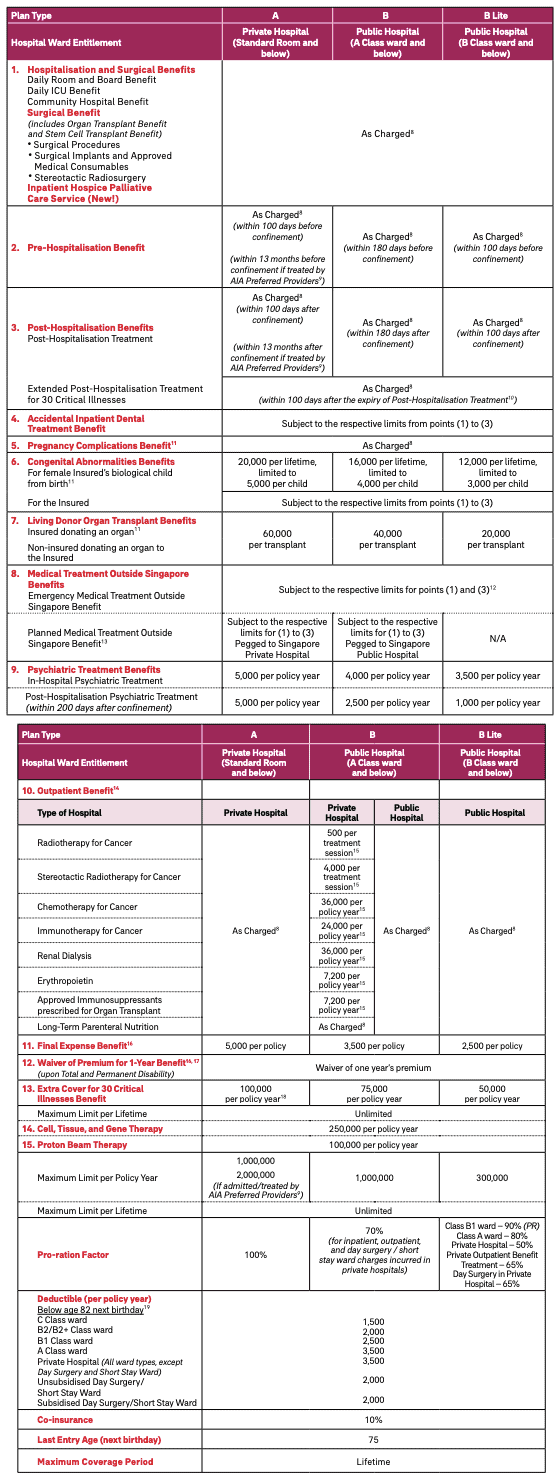

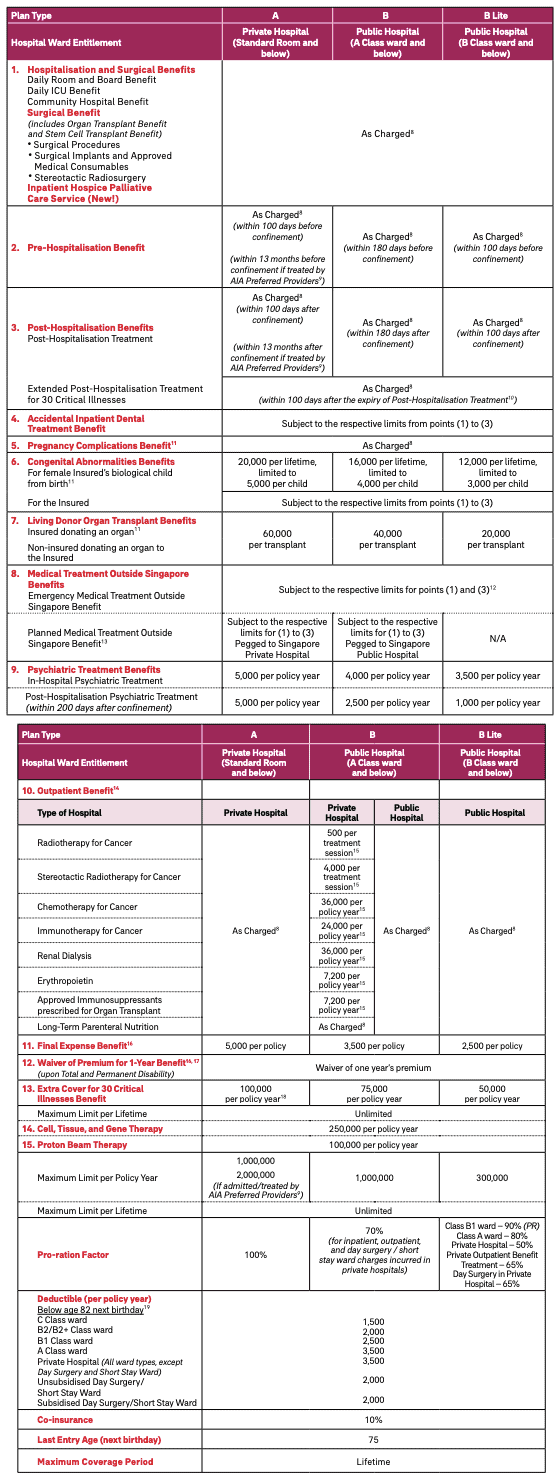

Here is what is covered by AIA’s HealthShield Gold Max Plan A:

AIA HealthShield Gold Max B

The AIA HealthShield Gold Max Plan B covers you up to Class A wards in public or restructured hospitals with an annual claim limit of $1,000,000.

| Integrated Shield Plan (IP) | Annual Premium (31 – 35) | Pre Hospitalisation Coverage | Post Hospitalisation Coverage | Annual Claim Limit | Cost-Benefit Ratio

(Annual Claim Limit/Annual Premium) |

| AIA Healthshield Gold Max B | $168 | 180 days | 180 days | $1,000,000 | $5952.38 |

| AXA Shield Plan B | $156 | 180 days | 365 days | $550,000 | $3525.64 |

| Singlife with Aviva MyShield Plan 2 | $168 | 180 days | 365 days | $1,000,000 | $5952.38 |

| Great Eastern Supreme Health A Plus | $106 – $123 | 180 days | 365 days | $1,000,000 | $9433.96 |

| NTUC Income Enhanced IncomeShield Advantage | $74 | 100 days | 100 days | $500,000 | $6756.76 |

| Prudential PRUShield Plus | $119 | 180 days | 365 days | $600,000 | $5042.02 |

| Raffles Health Insurance Raffles Shield A | $112 | 180 days | 365 days | $600,000 | $5357.14 |

| Raffles Health Insurance Raffles Shield A with Raffles Hospital Option | $223 | 180 days | 365 days | $600,000 | $2690.58 |

*For Male Singapore citizens aged 35

Similar to Plan A, the AIA HealthShield Gold Max B is also one of the most expensive shield plans in Singapore, just behind Singlife with Aviva’s Shield Plan 2.

In terms of value, the cost-benefit ratio is at $5,952.38 – on par with Singlife Shield Plan 2, and behind Great Eastern’s Supreme Health A Plus and NTUC Income Enhanced IncomeShield Advantage.

So if value is what you’re looking for, AIA’s Plan B isn’t too bad, just not the most value. Check out Great Eastern’s Supreme Health A Plus too.

If the cheapest is what you’re looking for, then NTUC Income’s Enhanced IncomeShield Advantage.

Also, its pre-hospitalisation coverage is up to 180 days, which is on par with most insurers.

Its post-hospitalisation coverage, however, could be better as it only covers up to 180 days, while most competitors cover 365 days.

Here is what is covered by the AIA HealthShield Gold Max B:

AIA HealthShield Gold Max B Lite

The AIA HealthShield Gold Max B Lite plan offers you coverage to Class B wards and below in public/restructured hospitals.

It has an annual claim limit of $300,000 with premiums for 31-35 males being $102/year.

| Integrated Shield Plan (IP) | Annual Premium (31 – 35) | Pre Hospitalisation Coverage | Post Hospitalisation Coverage | Annual Claim Limit | Cost-Benefit Ratio |

| AIA Healthshield Gold Max B Lite | $102 | 100 days | 100 days | $300,000 | $2941.18 |

| Singlife with Aviva MyShield Plan 3 | $100 | 180 days | 365 days | $500,000 | $5000 |

| Great Eastern Supreme Health B Plus | $77 – $80 | 180 days | 365 days | $500,000 | $6493.51 |

| NTUC Income Enhanced IncomeShield Basic | $44 | 100 days | 100 days | $250,000 | $5681.82 |

| Raffles Health Insurance Raffles Shield B | $83 | 90 days | 90 days | $300,000 | $3614.46 |

| AXA Shield Standard Plan | $62 | – | – | $150,000 | $2,419.36 |

| PruShield Standard Plan | $63 | – | – | $200,000 | $3,174.60 |

*For Male Singapore citizens aged 35

Although AIA HealthShield Gold Max B Lite seems affordable, it doesn’t give you as much coverage as compared to the Plan B. This is because its annual premium is less by only $66 while the annual claim limit ($300,000) has been reduced by 70%.

In addition, competing plans from Singlife with Aviva and Great Eastern have a higher claim limit ($500,000) and more pre- and post-hospitalisation coverage days at a lower premium.

You also only get 100 days of pre- and post-hospitalisation which is not too bad, but other plans are much better compared to the Lite plan.

As the Dollar Bureau team are value seekers, we prefer the Great Eastern Supreme Health B Plus as it provides the highest cost-benefit ratio, a $500,000 annual claim limit, 180 days of pre-hospitalisation and 365 days of post-hospitalisation.

We also like NTUC Income’s Enhanced IncomeShield Basic as it’s the cheapest plan in this category.

Here’s what is covered by the AIA HealthShield Gold Max B Lite:

AIA HealthShield Gold Max Standard

The last tier on this shield plan, the AIA HealthShield Gold Max Standard covers you for wards B1 and below in public/restructure hospitals for up to $200,000.

You have no pre- and post-hospitalisation coverage with the Gold Max Standard.

This plan is similar to the B Lite plan but cheaper with lesser coverage.

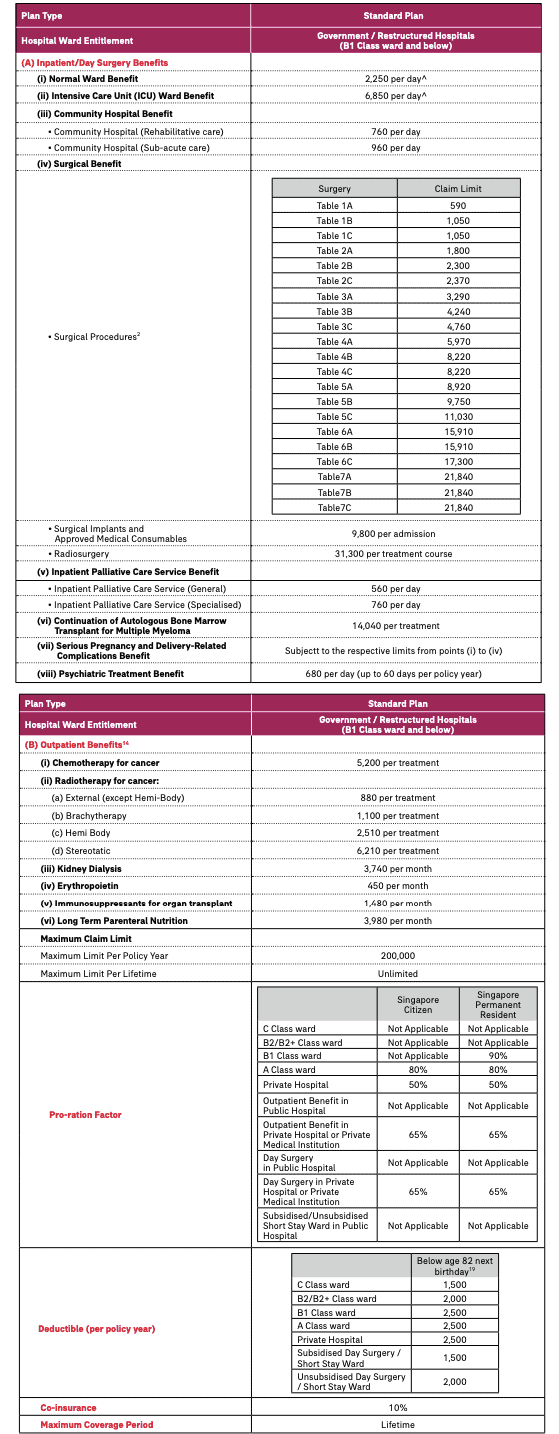

Here’s what is covered by the AIA HealthShield Gold Max Standard:

For Singaporean males aged 31 to 35, the annual premiums are $86.

Again, compared to its competitors, it’s not cheap nor does it have a high cost-benefit ratio.

If cheap is what you’re going for, check out NTUC Income’s Enhanced IncomeShield Basic, while Great Eastern’s Supreme Health B Plus offers the most value here.

AIA HealthShield Gold Max Riders – AIA Max VitalHealth

AIA offers AIA Max VitalHealth as a rider, which can be added to any plans above B Lite.

These riders provide added medical cost security to keep your out-of-pocket medical cost to the minimum.

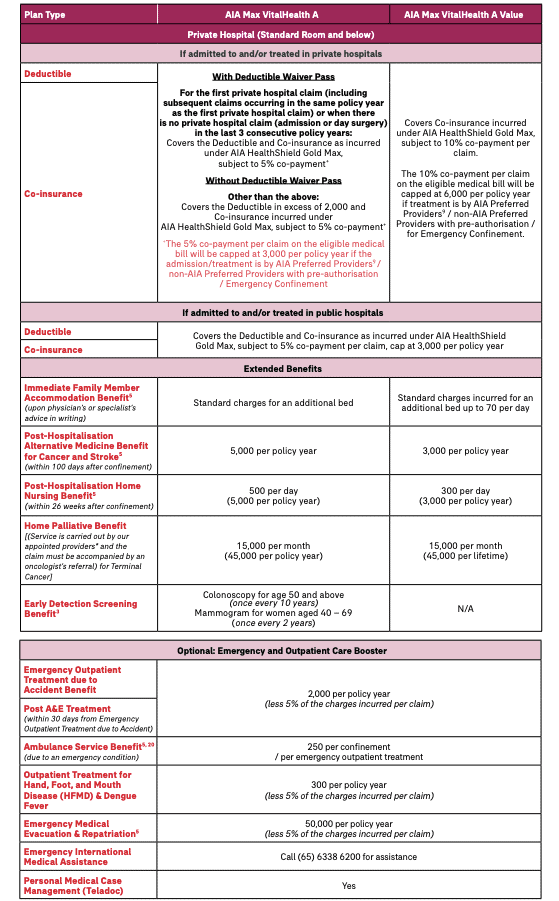

There are 2 riders available for AIA’s HealthShield Gold Max Plan A – AIA VitalHealth Max A and the AIA VitalHealth Max A Value, which differs in the coverage provided.

Here’s what you can expect with AIA’s shield plan riders for Plan A:

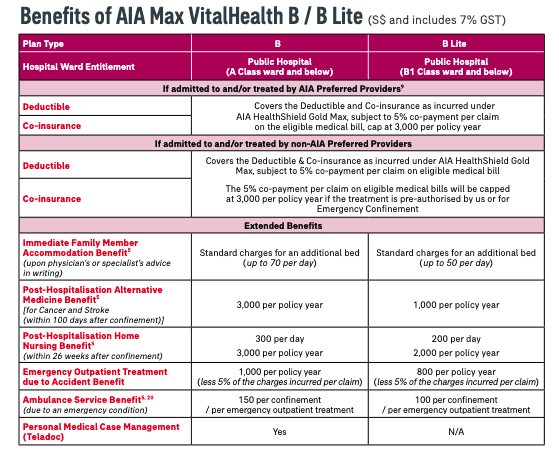

There are also 2 riders for AIA’s HealthShield Gold Max Plan B and B Lite – AIA Max VitalHealth B and the AIA Max VitalHealth B Lite.

Here’s what you can expect with AIA’s shield plan riders for Plan B and B Lite:

To summarise, the riders cover:

- You only pay 5% of your cost for deductible and/or co-insurance coverage. This is subject to a cap of $3,000 each policy year.

- Accommodation benefits for immediate family members.

- Home nursing care after hospitalisation.

- Alternative cancer and stroke treatment after hospitalisation.

- Premiums vary depending on the plan you add it to, but they are paid entirely in cash.

Additional Benefits for Plan-A Holders

- First-in-market early detection screening starting at age 40

- No matter which doctor you see, you can enjoy a zero-deductible on your private hospital claim during the first policy year the claim occurs.

- Home palliative care for cancer patients

- Emergency and Outpatient Care Booster is an optional add-on.

Why are AIA’s HealthShield Gold Max Plans so expensive?

We dug deeper into why AIA’s HealthShield Gold Plans are expensive. We found that they provide extra cover for 30 critical illnesses.

| Plan A | Plan B | Plan B Lite | Standard Plan | |

| Critical Illness Coverage | $100,000/year | $75,000/year | $50,000/year | – |

Here are the 30 critical illnesses covered:

- Heart Attack of Specified Severity

- Stroke

- Coronary Artery By-pass Surgery

- HIV Due to Blood Transfusion and Occupationally Acquired HIV

- Angioplasty & Other Invasive Treatment for Coronary Artery

- Major Cancers

- Fulminant Hepatitis

- Primary Pulmonary Hypertension

- Kidney Failure

- Major Organ / Bone Marrow Transplantation

- Multiple Sclerosis

- Blindness (Loss of Sight)

- Paralysis (Loss of Use of Limbs)

- Muscular Dystrophy

- Alzheimer’s Disease / Severe Dementia

- Coma

- Deafness (Loss of Hearing)

- Heart Valve Surgery

- Loss of Speech

- Major Burns

- Surgery to Aorta

- Terminal Illness

- End Stage Lung Disease

- End Stage Liver Failure

- Motor Neurone Disease

- Parkinson’s Disease

- Aplastic Anaemia

- Benign Brain Tumor

- Bacterial Meningitis

- Viral Encephalitis

As you can see, AIA covers late-stage critical illness, which could supplement your critical illness insurance plan, or act as your CI cover.

This is probably why the plans are higher than usual.

Furthermore, AIA partners with WhiteCoat – a GP – that lets you teleconsult for as low as $12, has specialist consultants for you (through AIA Quality Healthcare Partners [AQHP]), and a partnership with Taledoc Health that offers personal case management for you.

These also probably increase the premiums you pay.