What is health insurance?

Health insurance is an insurance policy that pays for your healthcare expenses should you be warded in the hospital. In Singapore, all Singaporeans are covered by MediShield Life, which is fully payable by your MediSave account.

MediShield Life is a basic health insurance that is issued by the government to help Singaporeans defray large medical expenses. If you are interested in additional coverage, you may consider purchasing an Integrated Shield Plan (IP) from different private insurance companies.

Depending on the health insurance policy of the IP, the policyholder will receive either cash reimbursements or have their treatment costs partially covered by the insurance company. There are many different types of health insurance available in Singapore, therefore it is always recommended to only purchase a plan that you need and provides you with the most comprehensive coverage.

Types of health insurance

There are 5 types of health insurance plans in Singapore. The table below adapted from a government website shows the different coverage each policy covers.

| If you want to | You should buy |

| Cover your hospital, medical, and surgical costs | MediShield Life. If you want more coverage, an Integrated Shield Plan can provide you with it. |

| Receive a fixed amount of cash for each day you are in a hospital | Hospital cash insurance |

| Receive a lump sum to help you with expenses if you are diagnosed with a major illness like cancer | Early Critical Illness Insurance |

| Replace your income when you are disabled and unable to work | Disability income insurance |

| Pay for the care you need if you’re severely disabled | Long-term care or severe disability insurance |

What health insurance covers

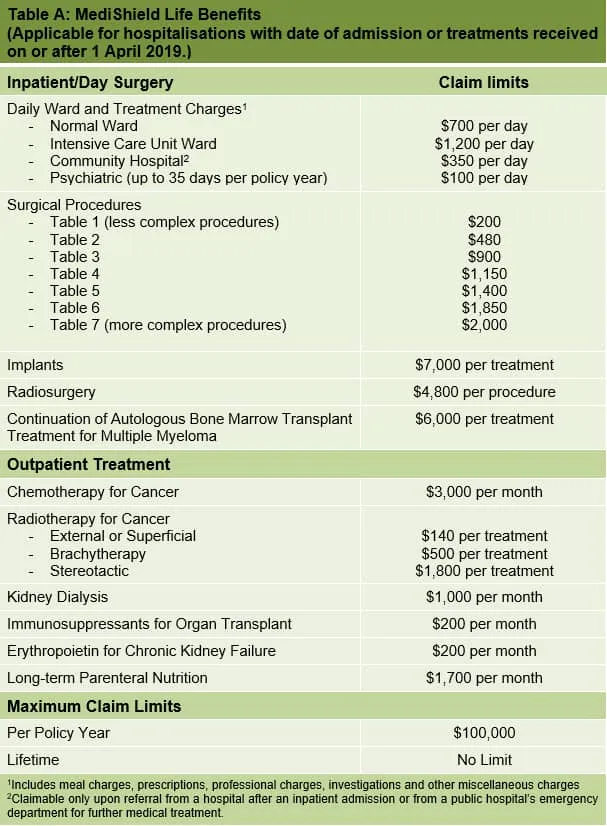

In this situation, we will be talking about what MediShield Life covers, since it’s the health insurance that every Singaporean and Permanent Resident has. Here is a table from the Ministry of Health (MOH).

As you can see from the above, the coverage for MediShield Life is pretty basic. So the question that comes to mind now is, is this sufficient coverage for you? Will you need more health insurance?

The answer is, it depends. You will need to consult a financial consultant for a review to find out if your current coverage is sufficient.

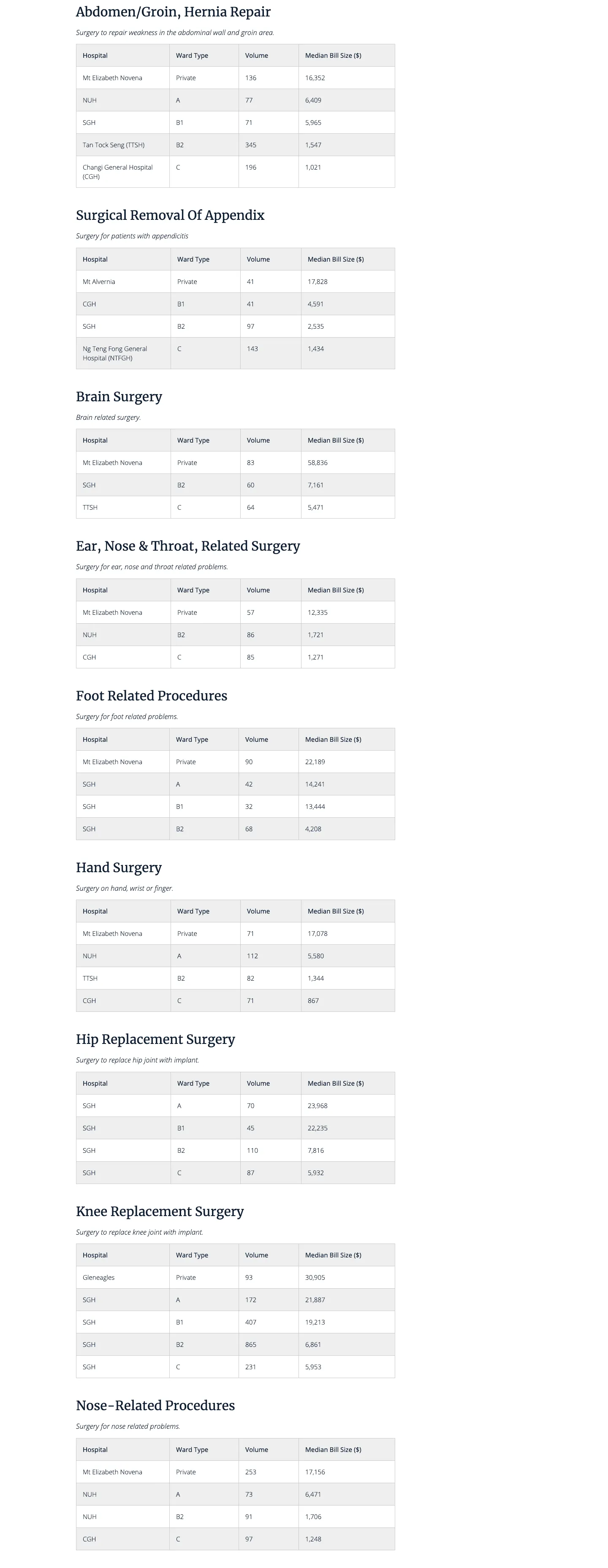

Most Singaporeans also do not know how expensive healthcare costs can be in Singapore until they incur it themselves. To give you a guideline, Dollarsandsense.sg has compiled a list of common surgical conditions faced by Singaporeans and have arranged by the hospital, ward type, the number of cases seen, and the median bill size incurred. (Click to enlarge)

As you can see from the above, the median bill size of these surgical procedures is much higher than what you are able to claim from MediShield Life, even at ward C types.

Furthermore, these prices are the median, which means that you might incur even more than what was shown above. To add on, payouts are also only available for Class B2 and C wards in public hospitals.

If you want to stay in higher ward classes in private hospitals, you can still benefit from MediShield Life, but only a small portion of it will be covered. This means that additional cash payment has to be made to cover the differences.

Fortunately, if you want to stay at higher ward classes, you are able to also make payments from your MediSave savings account for yourself and your immediate family.

However, you are limited to withdraw up to $450 a day for hospitalisation fees, and depending on the complexity of your condition, you can withdraw a variable amount based on it.

The variable amount is highly dependent on the type of treatment you are getting, and it is important to take note that you have to be hospitalised before withdrawing from your MediSave account.

What if you are not hospitalised and need more coverage? To make things worse, MediShield Life does not cover pre-hospitalisation and post-hospitalisation treatments, something that most patients incur.

That’s why an upgraded version of health insurance is offered in Singapore – Integrated Shield Plans.

Health Insurance Upgraded – Integrated Shield Plans

Integrated Shield Plans are an extension to the basic health insurance coverage that you have. They are provided by 7 different insurance companies in Singapore and have varying degrees of coverage provided by each individual company.

Here are the 7 IPs available in Singapore:

- AIA HealthShield GoldMax

- Aviva MyShield

- AXA Shield

- Great Eastern SupremeHealth

- NTUC IncomeShield

- Prudential PruShield

- Raffles Health Insurance

These plans each have their own variations of coverage that is suited to what you need – from basic plans to private hospital plans.

Should you buy these health insurance upgrades?

There are many reasons why you should buy integrated shield plans. IPs provide you with higher claim limits, which means that you can choose better quality treatments from either public or private hospitals, while also giving you the ability to recover in more comfortable higher class wards.

Furthermore, you are able to make claims for pre-hospitalisation treatments, hospitalisation fees, and post-hospitalisation treatments. All this while your agent helps you process your claims and paperwork so that you can focus on your recovery.

Due to rising medical costs and the rate of medical inflation, Medishield Life alone may or may not be sufficient to help bear your hospitalisation and medical treatment expenses.

Hence, an integrated shield plan could be an option used to complement Medishield Life.

To add on, most Singaporeans have opted to purchase integrated shield plans to have comprehensive health insurance coverage. This is mainly because you have the choice to make these payments with your MediSave account – putting that money to good use!

If you are worried about your recovery and want to have the best healthcare treatments possible while staying in a comfortable ward, an integrated shield plan is definitely something you should minimally consider.

We listed the best integrated shield plans in Singapore here.

Integrated Shield Plans Rider

Riders are optional supplementary add-ons to help further bear your medical expenses by taking care of the co-payment and deductibles in the event you land up in the hospital.

Previously, rider plans allowed insurance companies to pay your medical fees fully. However, you must minimally co-pay 5% of your medical bills as of April 2019.

The premiums of an Integrated Shield Plan Rider is dependent on your age and will increase in accordance to your age band.

You might or might not want to supplement your health insurance coverage with it. Furthermore, it is not payable by MediSave and can only be paid in cash. However, despite the potential extra costs you incur, the additional benefits obtained from it is also something you should consider.

Benefits of Integrated Shield Plan Riders:

- Co-payment

- Deductibles

These benefits vary across the riders, IP, and the insurance provider you choose. Therefore it is always best to consult an experienced financial advisor in Singapore to ensure that you only get what you need and what is best for you.

What health insurance should you get?

This question is a very common question that our financial planners receive. There are some questions that you need to ask yourself first before you purchase any health insurance policy.

- What are your current medical conditions?

- What is your medical history?

- What is your family’s medical history?

- Are you or your loved ones prone to falling sick or have a serious health condition?

- What coverage do you need?

- How much coverage do you need?

- What level of healthcare treatments or comfort do you need?

- What are you able to afford for yourself and your family?

After asking yourself these questions, start analysing whether the MediShield Life is sufficient for you.

If you feel like you need more coverage, consider purchasing an integrated shield plan with the supplemental rider so that your healthcare costs are bearable enough for you to cope with.

Speak to experienced financial planners who will get to know more about you in-depth before actually recommending you your best options.

References

blog.moneysmart.sg/health-insurance/health-insurance-singapore/

sg.finance.yahoo.com/news/cost-guide-much-hospitalisation-treatments-234041349.html