Are you looking for the best whole life insurance in Singapore?

Choosing the right insurance policy can be overwhelming, especially with so many options available in the market.

But don’t worry; I’ve researched for you and found Singapore’s top whole life insurance policies that offer comprehensive coverage, competitive premiums, and excellent benefits.

In this article, I’ll provide an overview and compare the best whole life insurance policies in Singapore offered by the biggest life insurance companies to help you make an informed decision when choosing the right one for your needs.

Keep reading.

Comparison of the Best Whole Life Insurance Policies in Singapore

Before we delve deeper into why these plans are selected, here’s a comparison between Singapore’s different whole life plans.

| Manulife LifeReady Plus II^ | Singlife Whole Life (previously Aviva MyWholeLifePlan IV) | NTUC Star Secure | China Taiping i-Secure (III) | China Life Multiplier Guardian | AXA Life Treasure (II) | Prudential PRUActive Life II | Great Eastern Complete Flexi Living Protect 2 | AIA Guaranteed Protect Plus (III) | |

| Premium Term Options | – 10, 15, 20, 25 years; or – to age 99 |

– Single, 10, 15, 20 or 25 years; or – to age 65 |

– 5, 10, 15, 20, 25, 30 years, or – to age 64 |

– 5, 10, 15, 20 or 25 years | – 5, 10, 15, 20 or 25 years | – 10, 15, 20, 25 or 30 years | 5 to 35 years | – 20 years – to age 65 |

– 15, 20 or 25 years |

| TPD Expiry | 99 | No TPD on the basic plan, available as a rider | 85 | 99 | 85 | 80 | 70 | 99 | 70 |

| TPD Activities of Daily Living (ADL) Definition | 3 ADL (18 to 70) | – 3 ADL (before 65) – 2 ADL (65 to 70) |

No ADL definition for TPD | – 3 ADL (before 65) – 2 ADL (65 to 70) |

No ADL definition for TPD | – 3 ADL (16 – 70) – Option to advance TPD payout at 2 ADL (16 – 70) (part of the basic plan) |

3 ADL (66 to 70) | No ADL definition for TPD | – 2 ADL (65 – 70) |

| Multiplier Options | 1X to 5X | 1X to 4X | 1X to 5X | 1X to 4X | 1X to 4X | 1X to 5X | 1X to 5X | 2X or 3X | 2X, 3X, 5X |

| Multiplier Expiry Age Options | 70 or 80 | 65, 70, or 75 | 70 | 71, 86 or end of the policy | 88 | 65, 70, 80 | 65, 70, 75, 80 | 100 | 65, 75 |

| Additional Riders Beyond ECI, CI, Payor Benefit & Premium Waiver Riders | – | TPD | – Advanced Secure Accelerator rider (CI rider that covers future unknown diseases or serious infections) – Hospital CashAid – Advanced Restoration Benefit (additional protection for stroke, major cancer & heart attack) |

– | No ECI/CI Rider Available | -Accidental Death Rider – Disability Cash Benefit Rider (annual cash benefit when TPD) |

– Accidental Death rider | – Complete Living Multiplier Rider (No limit on multiplier factor, subject to maximum allowable coverage) | – |

| # of Critical Illness Covered by ECI Rider (across various stages)~ | 125 + 10 special + 12 juvenile conditions | 131 + 27 special conditions | 142 + 15 Special + 15 Juvenile conditions | 137 + 12 Juvenile + 12 special conditions | No ECI/CI Rider; Normal plan does not cover CI, only Plus plan | 134 + 14 Special Conditions + 14 Juvenile Conditions | 74 | CI Benefit part of Basic Plan; covers 120 CI Conditions + 10 Special + 16 Juvenile + 5 Senior Conditions | 150 + 15 special conditions |

| Total Death Benefit at 90* Guaranteed Death Benefit is your policy’s basic sum assured. In this case, it is 100K. |

292,470 | 253,278 | 339,101⁼ | 281,907 | 385,142 | 287,843 | 294,842 | 256,570 | 239,868 |

| Guaranteed Surrender Value at 70* | 33,500 | 61,100 | 49,200 | 55,500 | 48,177 | 58,100 | 46,165 | 45,800 | 33,800 |

| Non-Guaranteed Surrender Value at 70* | 88,783 | 54,453 | 67,013 | 53,586 | 70,374 | 61,843 | 57,152 | 46,130 | 56,080 |

| Total Surrender Value at 70* | 122,283 | 115,553 | 116,213 | 109,086 | 118,551 | 119,943 | 103,317 | 91,930 | 89,880 |

| Annual Premium⁺ | 2,339.46 | 2,342.00 2,464.00 (with TPD) |

2,284.50 | 2,620.80 | 2,873.00 | 2,778.00 | 2,696.00 | 2,611.00 | 2,370.00 |

| Notable Features | – GIO at selected life events – Premium discounts for good health – Retrenchment Benefit – Option to access cash value via annual payouts for 10 years in your later years |

– Purchase new non-par supplementary benefit at selected life events without underwriting – Income payout option: Recieve monthly income from cash value up to 99 – Waiver of APL interest if you’re unable to pay premiums due to involuntary unemployment |

– Coverage for accidental death – Premium waiver upon retrenchment – Premium waiver and 24-month lump sum payout upon death, TI and TPD of a family member |

– Guaranteed Benefit (Multiplier) Extender to end of the policy term | – Optional Retirement Benefits: Receive 5 to 15 annual payments between age 55 to 70 – GIO at selected life events – Retrenchment/Loss of Income benefit |

– GIO at selected life events | – GIO at selected life events – Premium deferment for up to 2 years without affecting coverage – Kinship benefit: 10% increase in coverage when an immediate family buys PAL II |

– | – Payment deferment for retrenchment – Encash payouts via annual payouts for 10 years as retirement income – GIO at selected life events |

| Accessing Cash Value Surrender is only available after the end of 3rd policy year unless otherwise stated |

– Full Surrender | – Policy Loan – Full or Partial Surrender |

– Full surrender Able to surrender after the end of 2nd policy year or end of 1st policy year for the 5-year premium term |

– Full Surrender – Partial Surrender (must maintain basic SA) |

– Full Surrender | – Full surrender | – Policy Loan – Surgical & Nursing Loan – Partial or Full Surrender of Reversionary Bonus |

– Full Surrender |

*Values are based on an illustration rate of 4.25%

~Numbers are taken from online sources or the insurer’s website. For a more accurate number, please refer to your policy contract

⁺Based on a 30-year-old male, non-smoker, 100K sum assured with 2X multiplier, and premium term of 20 years

^Values for LifeReady Plus is based on the assumption that you don’t exercise the financial flexibility option

⁼ Death Benefit at age 85

Best Whole Life Insurance in Singapore

NTUC Income Star Secure Pro

If we’re talking about the best whole life insurance, NTUC Income Star Secure Pro takes the cake for me. It has a little bit of everything you require, sprinkles.

NTUC Income Star Secure provides comprehensive all-around coverage for various conditions and needs.

Apart from offering the standard coverage for death, TI, and TPD, NTUC’s whole life plan is the only one that covers accidental death in its basic plan.

And if your family member were to pass on, it waives your premiums and pays out a lump sum equal to 24 months of your premiums.

You also get to have peace of mind, knowing that your premiums will be waived, and your coverage will remain if you were to get retrenched.

Its riders don’t fall short either. Notably, its Advance Secure Accelerator, a Critical Illness rider, doesn’t just cover CI conditions but also protects you from future unknown diseases. Its Early Critical Illness rider covers most CI conditions, including 5 mental illnesses.

Besides the standard riders, it also has a hospitalisation benefit rider – Hospital CashAid Rider, which gives you daily income and more when you are hospitalised.

What’s more, the basic plan comes at a very competitive price – it is the cheapest plan based on the comparison table above – there is much to like about it.

Unfortunately, there’s no such thing as a perfect plan. It falls short for TPD definitions, which are limited and have no ADL definition at all.

Guess in the end, you win some and lose some, but it shouldn’t take away from the multitude of benefits offered.

Best Whole Life Insurance Plan with Multiplier Option

If you’re looking for the best whole life plan with the best multiplier feature, 2 plans immediately come to mind – Prudential’s PRUActive Life III and China Taiping’s i-Secure. Both of which fulfil different needs.

Prudential PRUActive Life III

PRUActive Life III offers a multiplier factor of 1X to 5X, which is the maximum you can find in the market now.

You can also choose from 4 different multiplier expiry ages, the only insurer offering this many options.

However, this should be taken with a pinch of salt, as the ECI rider only covers 74 CI conditions, and the TPD coverage expires when you turn 70.

In this instance, you would really need to consider whether the multiplier is more important to you or the CI/TPD coverage.

China Taiping i-Secure II

On the other hand of the spectrum, you have China Taiping’s i-Secure II.

With a multiplier factor of 1X to 4X, the only plan in the market gives you the option to extend your multiplier until the end of the policy term (99 years old).

If you choose not to do so, your multiplier will end at your selected age of either 71 or 86.

While ideally, your protection coverage needs would reduce as you get older, not everyone’s circumstances are the same.

If you’re worried that you might still need high coverage in your later years, this plan gives you added assurance with its multiplier extender.

At most, if you do not require additional coverage, you can always terminate the feature.

It’s better than having your multiplier expire when you need the highest life insurance coverage.

Cheapest Whole Life Insurance Plan in Singapore

NTUC Income Star Secure Pro

The table above is an absolute mess – I know. But it’s a super detailed comparison across all the whole life insurance plans in Singapore.

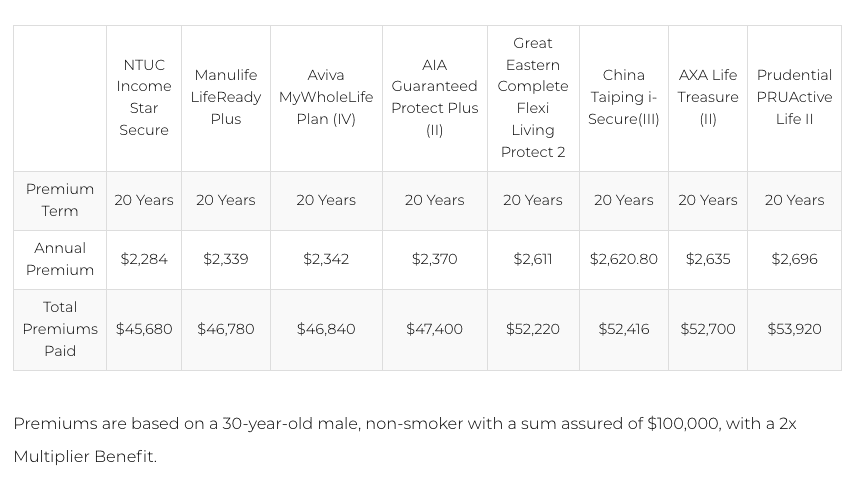

Since we’re comparing based on price, here’s the table of comparisons based on premiums for a 30-year-old male, non-smoker, with a sum assured of $100,000 with 2X Multiplier Benefit.

As you can see, the NTUC Income Star Secure Pro is the cheapest whole life insurance plan in Singapore with everything kept constant.

You may think that the cheapest means there’s something not as good elsewhere, right?

That is not really true.

As previously mentioned, the NTUC Income Star Secure Pro is the best whole life plan in Singapore because of the riders, extra features, ECI/CI coverage, and one of the highest surrender values at 90 – especially at the premium amount you’re paying.

However, do take this with a pinch of salt as the comparison is only for the basic plan and a specified demographic.

If you’re looking to add ECI/CI to your life policy, the premiums might change.

Discussing your needs with a financial advisor and getting their help to compare before deciding is always best.

Best Whole Life Insurance Plan for Early & Late-Stage Critical Illness Coverage

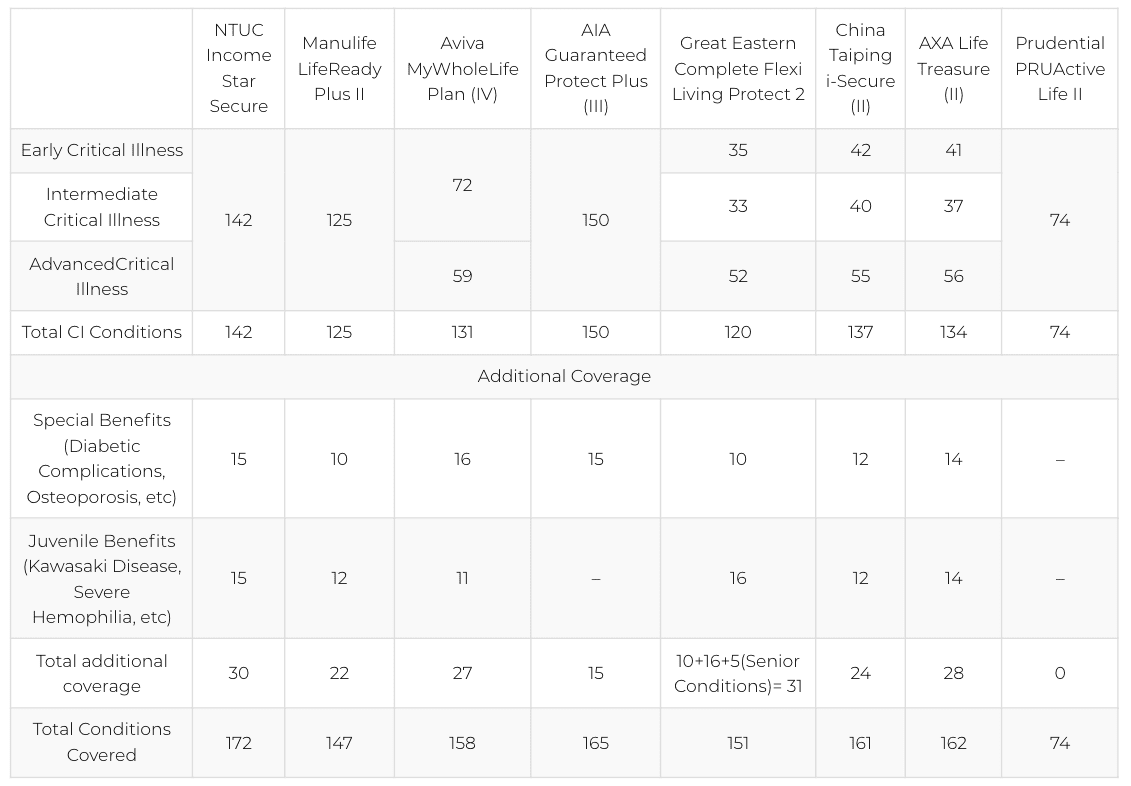

Again, we’ve extracted the most important information for this category.

And if you can’t tell who’s the winner for this category, it’s…

NTUC Income Star Secure Pro

If you’re looking to combine your whole life and CI coverage into 1 plan, then you might want to consider NTUC Income’s Star Secure Pro.

Its ECI rider covers a whopping 172 conditions, the highest in the market. This includes 142 CI conditions across various stages, 15 Special conditions, and 15 Juvenile conditions.

You also get the added assurance of getting an extra 50% coverage for:

- Stroke with permanent neurological deficit

- Major cancer

- Heart attack of specified severity

However, you must attach the CI rider to get the ECI rider. This is usually recommended, and we’ve covered more about it here.

If you don’t fancy adding 2 CI riders and you’re okay if your plan covers fewer CIs, an alternative to consider would be HSBC Life’s Life Treasure II (previously AXA Life Treasure II).

HSBC Life’s Life Treasure II

With just its ECI rider, you will be covered for 162 conditions – 134 CI conditions across different stages and 24 Special or Juvenile conditions.

While it ranks 3rd in terms of CIs covered, it pays an additional 50% of your rider’s sum assured if you get an advanced stage diagnosis for any of the top 5 common illnesses, slightly more than NTUC Income’s plan.

In my opinion, this puts it on top of AIA’s Guaranteed Protect Plus III’s 165 conditions because the likelihood of you being diagnosed with the top 5 common illnesses is well… more common.

Here are the top 5 common illnesses:

- Major Cancer

- Heart Attack

- Stroke

- Coronary Artery By-pass Surgery, and

- End-Stage Kidney Failure

If your family has a medical history of the above conditions, you may want to consider this plan.

Best Whole Life Insurance Plan for Severe Disability

HSBC Life’s Life Treasure II

Clinching the top spot for the second time in a row is HSBC Life’s Life Treasure II. This time, it’s for its comprehensive TPD coverage.

It’s the most lenient insurer when it comes to defining TPD.

With its advanced disability payout feature, you can claim for TPD if you cannot perform 2 ADLs independently. This covers you from 16 – 70, the only one in the market to do so.

Whereas for other insurers, the inability to do 2 out of 6 ADLs TPD definition only applies for those aged 65 to 70.

Lastly, you can also choose to add on a Disability Cash Benefit rider that provides you with an annual cash benefit if you suffer from TPD.

Best Whole Life Insurance Plan to Supplement Retirement Needs

Manulife LifeReady Plus II

We’re welcoming a new contender at the end of this list – Manulife’s LifeReady Plus II, which is the best whole life plan that provides you with the option to cash out your policy’s cash value for your retirement needs.

With its Financial Flexibility Option, you will get an annual payout with an additional 5% interest on your annual payout for 10 years.

You can choose to use 50% or 75% of your net surrender value for this option. This can start anytime from 70 (or your multiplier expiry age) to 89.

This basically acts like an annuity policy, giving you additional retirement income during your golden years should you decide to maintain or reduce your life coverage.

AIA’s Guaranteed Protect Plus III

Coming as a close second is AIA’s Guaranteed Protect Plus III, which allows you to encash your cash value through annual payouts for 10 years with the Income Drawdown Facility option.

Unlike the Manulife LifeReady Plus II, you can choose to use either 50% or 100% of your policy’s cash value.

Choosing the latter option means your policy will terminate after these 10 years, so be careful.

Some might still need coverage for their entire life – so the 50% option (or Manulife’s) would be better.

In my opinion, Manulife LifeReady Plus II has a slight edge over AIA’s with its additional 5% interest on your annual payouts.

However, if you would like to encash your entire plan for your retirement, then the AIA Guaranteed Protect Plus II would be a better fit for you.

Best Whole Life Insurance Plan with Highest Guaranteed Returns

Again, before selecting the best whole life plan with the highest guaranteed returns, here is the table extracting the most relevant information:

| Prudential PRUActive Life II | Manulife LifeReady Plus II^ | China Taiping i-Secure (III) | China Life Multiplier Guardian | Singlife Whole Life (previously Aviva MyWholeLifePlan IV) | NTUC Star Secure Pro | Great Eastern Complete Flexi Living Protect 2 | HSBC Life’s Life Treasure (II) | |

| Guaranteed Surrender Value at 70* | 46,165 | 33,500 | 55,500 | 48,177 | 61,100 | 49,200 | 45,800 | 58,100 |

| Non-Guaranteed Surrender Value at 70* | 57,152 | 88,783 | 53,586 | 70,374 | 54,453 | 67,013 | 46,130 | 61,843 |

| Total Surrender Value at 70* | 103,317 | 122,283 | 109,086 | 118,551 | 115,553 | 116,213 | 91,930 | 119,943 |

| Annual Premium⁺ | 2,696.00 | 2,339.46 | 2,620.80 | 2,873.00 | 2,342.00 | 2,284.50 | 2,611.00 | 2,778.00 |

| 2,464 (with TPD) | ||||||||

| Total Premiums Paid | 53,920 | 46,789.20 | 52,416 | 57,460 | 46,840 / 49,280 (with TPD) | 45,690 | 52,220 | 55,560 |

| ROI | 85.62% | 71.60% | 105.88% | 83.84% | 130.44% / 123.99% (with TPD) | 107.68% | 87.71% | 104.57% |

We created this new category because many financial advisors use the investment component as part of the selling point of a whole life policy, and they compare it against other plans in the market.

Because of this, we get many requests to include cash value as part of the consideration when selecting a whole life insurance policy.

The Dollar Bureau team agrees, but with 1 caveat – we only consider the guaranteed surrender value instead of the total surrender value.

The reason for this is that when financial planning, you should always opt for the prudent numbers, and in this case, take only what is guaranteed to you.

Singlife Whole Life

Based on the table above, Singlife Whole Life is Singapore’s best whole life insurance plan, with the highest guaranteed returns of $61,100.

Of course, we don’t just take the face value of the guaranteed portion, but we also factor in the premiums you pay because it directly affects your returns.

In this case, we calculated the total premiums you’d pay and then found the ROI of each plan.

Considering ROI for an insurance plan is pretty extreme, but if there is an investment, there should be an ROI.

As you can see, only half of the policies give a guaranteed positive ROI, and Singlife Whole Life gives you the highest guaranteed ROI at 130.44%.

Even with the higher premiums for TPD, it boasts the highest ROI at 123.99%.

Best Whole Life Insurance Plan with Highest Overall Returns

Okay, I must admit that using the guaranteed returns purely may be taking it a bit too extreme, but I’m just careful when financial planning.

Realistically, you will also get the non-guaranteed portion. So here are the total surrender value as illustrated by each insurer:

| Prudential PRUActive Life II | Manulife LifeReady Plus II^ | China Taiping i-Secure (III) | China Life Multiplier Guardian | Singlife Whole Life (previously Aviva MyWholeLifePlan IV) | NTUC Star Secure Pro | Great Eastern Complete Flexi Living Protect 2 | HSBC Life’s Life Treasure (II) | |

| Guaranteed Surrender Value at 70* | 46,165 | 33,500 | 55,500 | 48,177 | 61,100 | 49,200 | 45,800 | 58,100 |

| Non-Guaranteed Surrender Value at 70* | 57,152 | 88,783 | 53,586 | 70,374 | 54,453 | 67,013 | 46,130 | 61,843 |

| Total Surrender Value at 70* | 103,317 | 122,283 | 109,086 | 118,551 | 115,553 | 116,213 | 91,930 | 119,943 |

| Annual Premium⁺ | 2,696.00 | 2,339.46 | 2,620.80 | 2,873.00 | 2,342.00 | 2,284.50 | 2,611.00 | 2,778.00 |

| 2,464 (with TPD) | ||||||||

| Total Premiums Paid | 53,920 | 46,789.20 | 52,416 | 57,460 | 46,840 / 49,280 (with TPD) | 45,690 | 52,220 | 55,560 |

| ROI | 191.61% | 261.35% | 208.12% | 206.32% | 246.70% / 234.48% (with TPD) | 254.35% | 176.04% | 215.88% |

Similarly, we factored in premiums to calculate the total ROI based on the total surrender value consisting of guaranteed and non-guaranteed returns.

Manulife LifeReady Plus II

In this case, the Manulife LifeReady Plus II comes out on top with an ROI of 261.35% – which is pretty fantastic given that this is supposed to be an insurance-first policy and investment second.

This means that when you’re retired, you have a large lump sum ($122,283, to be specific) added to your retirement funds.

Let’s not forget that you can also opt for the Financial Flexibility Option – giving you 50% or 75% of your cash value as payouts as well!

However, I must emphasise that you should take the illustrations with a (large) pinch of salt.

These are illustrations, and the exact amount you’re getting will differ based on the participating policy.

Nevertheless, it’s good to know that at least most of the whole life plans illustrate at least a 200% ROI when you surrender it at 70.

Now that we’ve shown you which is the best according to specific needs, we’re going to share with you how to choose one for yourself.

Factors to Consider Before Choosing a Whole Life Insurance Plan in Singapore

#1 Protection Coverage

Naturally, when getting life insurance, the first thing to consider is the type of protection you require.

To alleviate the financial strain that might occur if anything untoward happens to you, it is recommended that you are sufficiently covered for:

- Death

- Terminal Illness (TI)

- Total and Permanent Disability (TPD)

- Early Critical Illness (ECI)

- Critical Illness (CI)

However, it is up to you to decide whether you want an all-encompassing whole life plan that covers everything; or do you already have existing insurance for TPD and/or CI and are just looking for death coverage?

At its most basic, all whole life plans cover you for death and terminal illness.

Most insurers provide coverage for total and permanent disability (TPD) in their basic plans.

Some insurers even offer critical illness protection in your basic plan.

But more often, CI and ECI coverage are available as riders that you can choose to add on if you do not have any existing or want to boost your CI coverage.

If you require more coverage in your later years, some plans allow you to add to your coverage by purchasing a new insurance plan without any medical underwriting at key life stage events.

Subject to certain terms and conditions, of course.

Alternatively, you should consider other types of life insurance, like a term life insurance plan instead.

Term life insurance is usually cheaper and can be used to temporarily bridge any gaps in life insurance coverage.

Ultimately, the right type of life policy varies based on individual, so consider your circumstances and priorities before deciding to ensure you get the right coverage for you and your loved ones.

After all, life insurance is a long-term commitment, and having to change or buy a new plan will incur unnecessary costs.

Total & Permanent Disability Definition

From being unable to carry out any income-generating activity to the permanent loss of specific limbs to an inability to perform a number of Activities of Daily Living (ADL), what constitutes as TPD is different for each insurer.

To further complicate this, insurers also have varying definitions of TPD depending on your age.

If TPD coverage is particularly important to you, then it’s good to do a bit more research and comparison in this area.

Some insurers cover more definitions, while other insurers, not as much. Certain insurers are also more lenient.

For example, HSBC Life’s Life Treasure gives you the option to claim for TPD if you are unable to carry out 2 of the 6 ADLs.

Even if TPD coverage is not your highest priority, it’s good to familiarise yourself with your plan’s definitions so you know what you’re eligible to claim.

#2 Premium Payment Term Options

Most insurers offer you a limited pay option when paying for your whole life plan.

In other words, you will pay off your premium within a selected number of years before your policy term ends.

The premium term options range from 5 to 30 years but differ depending on the insurance company.

Oftentimes the premium terms are often in multiples of 5.

Apart from the limited pay option, some insurers allow you to choose to pay off your premiums by a certain age. However, this option is not as common.

As a rule of thumb, the longer your premium term, the higher your total premiums will be.

There’s no free lunch in this world, so the flip side – that is opting for a shorter premium term – would mean having to fork out slightly more money as compared to a longer premium term.

Although, if you look at everything in totality, the total premiums paid are lower.

You should also consider how often you would like to pay your annual, quarterly, monthly premiums, etc. Similarly, the higher the payment frequency, the higher your total premiums.

While as Singaporeans, we’re all very kiasu and would want to pay the lowest amount, it’s important to choose a premium payment term where you can comfortably pay the premiums due.

If you choose a premium term that is too short, and you’re unable to pay your premiums when they are due, it would cause the automatic premium loan to kick in.

This means that your insurer will draw down from your policy’s cash value (the investment component) to pay off your premiums.

This affects your policy’s cash value and incurs interest that you would need to pay off.

If this occurs, your total cost would most likely be much more than choosing a longer premium term that you can afford.

#3 Expected Rate of Return & Cash Value

If you’re not aware, whole life plans allow you to grow your wealth on top of providing you with protection.

For a quick crash course, they partake in the profit of your insurer’s participating fund to accumulate cash value in the form of guaranteed and non-guaranteed bonuses.

Unlike certain investment instruments, your non-guaranteed bonus is not equal to the rate of return but is heavily linked to it.

Your insurer might declare your non-guaranteed bonus, which will be added to your policy’s guaranteed cash value. But this is usually not immediately accessible until your policy matures or a claim is made.

The following affect the non-guaranteed bonuses you can expect to receive from your policy:

- Smoothing of Bonuses: Where your insurer might declare lower bonuses in years that the par fund performs well and higher bonuses in years where the par fund does not do as well to reduce fluctuation in your non-guaranteed returns.

- Investment Performance: The participating fund’s rate of return

- Insurer’s Expense: Includes claims made to other participating policyholders and your insurer’s expense in managing the par fund

While I am of the opinion that mixing both protection and investment in the same plan is not the wisest use of your hard-earned money, there are instances that a whole life plan is suitable.

Now that you’re well-acquainted, if you’re looking to get a whole life plan, taking a look at the expected cash value that the different insurers can offer is a good call.

Yes, it may be confusing and headache-inducing, but future you will thank yourself for the effort that you’ve put in.

If anything, you can reach out to your financial advisor (or one of our knowledgeable financial advisors if you don’t have an existing one) to help you break down the expected returns and cash value in layman’s terms.

Alternatively, if you want to do your own research before going to a financial advisor, here are the key things to look out for:

Geometric Average of the Par Fund’s Net Investment Returns

Rather than looking at the annual investment performance of the different par funds, the geometric average of their net investment returns will better indicate how the fund is performing.

It considers the effects of compounding within the calculations. Below is a quick breakdown of the geometric average of the investment returns:

Insurer’s Expense Ratio

If your insurer’s par fund boasts high investment returns, but it comes with a high expense ratio, your expected returns would be adversely affected.

Therefore, this factor comes hand in hand with looking at the par fund’s performance. Here’s a quick view of the expense ratios from a few insurers for the last 3 years:

| 2018 | 2019 | 2020 | |

| NTUC Income | 0.85% | 0.83% | 0.82% |

| Prudential | 2.95% | 2.92% | 2.50% |

| Manulife | 4.98% | 4.88% | 4.74% |

| Great Eastern | 1.59% | 1.71% | 1.20% |

| Aviva | 2.58% | 2.80% | 2.58% |

| China Life | N.A. | N.A. | 30.0% |

| China Taiping | No available expense ratio as fund was set up in December 2018 | ||

Benefit Illustration

Lastly, once you’ve narrowed your options to a few whole life plans, speak to a financial advisor to look at the plan’s benefit illustration.

This will give you a clearer view of the breakdown between the guaranteed and non-guaranteed cash value your policy will generate.

The guaranteed cash value is what your insurer will definitely pay you if you surrender your policy or make a claim.

You’ll also receive the non-guaranteed bonuses, but this amount may not be the same as what is indicated in the benefit illustration.

It’s important that you don’t take the non-guaranteed numbers provided in your benefit illustration at face value.

With this, you can better gauge whether you’ll be satisfied with your plan’s returns.

#4 Multiplier Feature

As its name suggests, this feature allows you to multiply your plan’s basic coverage by a selected factor up to a certain age.

Available on the whole life plans from all the major insurers in Singapore, this is a good feature to exercise on your policy.

One of the golden rules of insurance is only to get the coverage you require; no more, no less.

When we’re younger, our liabilities are higher – paying off various loans like our housing loan or saving up for our child’s education.

On top of that, we also want to ensure that our loved ones can continue to enjoy their standard of living if we were to face an untimely death.

In such cases, we would definitely need more financial coverage.

However, as we grow older, ideally, our loans get paid off, and our dependents become financially self-reliant.

Say you need $200,000 of coverage in your earlier years, but in your later years, you expect only to require a sum assured of $100,000.

Instead of getting $200,000 worth of coverage throughout your entire policy term, why not buy a plan with a basic sum of $100,000 and add a 2X multiplier up to age 70?

You can also choose to get $50,000 coverage with a 4X multiplier too!

If you get a base coverage with a sum assured of $200,000 throughout the policy, the additional $100K coverage when you’re older is unnecessary, and you have to pay for the added coverage that you don’t require.

The money put into your premiums for the extra coverage can be placed in other investment instruments to work much harder for your retirement.

Before you jump in headfirst into getting any plan with a multiplier, there are 2 factors to consider:

Multiplier Factor

When selecting your multiplier factor, most plans allow you to select between a factor of 1X (no multiplier) to 4X or 5X multiplier.

One way to determine which factor to select is to consider the coverage you require in your later years and work backwards from there.

For example, perhaps you would like to have a coverage of $100,000 mainly for TPD and/or ECI/CI in your later years.

And if you calculate, your current liabilities at this point in time amount to $300,000.

Then, you should get a basic plan with a sum assured of $100K and a 3X multiplier.

Multiplier Expiry Age

Another thing to consider would be when your multiplier will expire.

Expiry ages usually range from 65 to 80 years old. Depending on your selected insurer, you might be able to select from a few options while others only offer you one choice.

Similarly, when selecting your multiplier expiry age, it’s important to consider when your protection needs will reduce.

If you’re unsure, opting for a later expiry age is better.

You don’t want to face a situation where you’re not financially covered when you and your loved ones need it the most. It’s always best to be safe than sorry.

So, if you want to get a multiplier on your whole life plan, select an insurer with a multiplier factor and expiry age that aligns with your needs.

#5 Riders Available

Riders are additional benefits you can add to your whole life plan to provide you with added assurance.

Common riders available include CI, ECI, TPD (if your basic plan doesn’t cover it), premium waiver, and payor benefit riders.

CI/ECI riders cover you in the unfortunate event of a CI/ECI diagnosis.

ECI riders tend to cover various stages of CI. The number of conditions your rider covers can vary greatly based on your insurer of choice.

If getting comprehensive CI coverage matters to you, it’s good to compare the type and number of conditions various CI/ECI riders offer before deciding.

In fact, ECI/CI riders are one of the biggest reasons why a whole life plan would make sense over a term life insurance policy.

ECI/CI riders on term insurance plans usually cover lesser medical conditions, while standalone multiclaim critical illness plans have expensive premiums (though with more medical conditions).

A whole life plan offers a good balance between the number of ECI/CI covered and the premiums you pay.

Premium waiver riders mostly cover TPD or ECI/CICI diagnosis, and as its name implies, waives your premiums if the covered event happens.

Working similarly, payor benefit riders also waive your premiums if anything happens to you, but for 3rd party policies that you buy on behalf of your loved ones.

These are optional but wise add-ons, especially if you think you are at higher risk of ECI/CI.

Learn how to calculate how much ECI coverage you need here, and how much CI protection you need here.

In addition to the standard riders mentioned above, certain insurers might offer other riders, which you can take a look at to determine whether they are relevant to your needs.

Some examples are accidental death and hospitalisation riders.

#6 Accessing your Whole Life Plan’s Cash Value

While not recommended, if you find yourself requiring some cash, some plans give you the option to access your policy’s cash value in the form of a policy loan or a partial withdrawal (aka partial surrender).

If you’re worried about locking your money in your whole life plan, you can choose a plan offering these features.

It should be noted that if you take a policy loan, you’ll be charged interest that must be paid back.

If your interest exceeds your policy’s cash value, your policy will terminate.

Additionally, if you choose to surrender your plan partially, your policy’s death benefit will also be reduced accordingly.

Alternatively, if you do not require your coverage anymore and would like to cash out on your cash value, you can usually surrender your policy after the end of your 3rd policy year.

However, the surrender value will be much lower than your death benefit, and in some cases, your surrender value might be less than the total premiums paid thus far.

If you wish to purchase another life insurance plan after surrendering your policy, you might also face certain exclusions and/or higher premiums.

#7 Affordability

While affordability is definitely one of the factors to consider, I wouldn’t put it at the top of the list, and it would not be the first factor I consider.

I recommend that before even looking at the cost, you should first figure out what coverage you require based on your priorities and circumstances.

This includes the factors above, like types of protection coverage, multipliers, riders, etc.

Once identified, you can narrow down the insurers that check all the boxes and select the most affordable plan.

Of course, to each their own. As everyone’s situation is different, if affordability is the top of your list, then, by all means, put affordability on top.

Again, if affordability is an issue, you can always consider a term life policy.

Bonus: Growing your Retirement Nest Egg

As mentioned previously, as you grow older, your protection needs decrease.

At the same time, you would probably want to live out your dream retirement. But unfortunately, this requires money.

Aware of this, some insurers’ whole life plans have features that allow you to tap into your policy’s cash value to supplement your retirement income.

This will work similarly to a private annuity plan.

Conclusion

All in all, when it comes to choosing a whole life insurance plan, it’s really a delicate balancing act of what coverage, features, and benefits are of particular importance to you.

There is no one plan that is perfect for everyone.

To be able to identify the right plan for you, it’s good first to list down your priorities and motivations.

Are you looking for something that provides more comprehensive coverage for TPD, terminal illness, and/or ECI/CI?

Or are you in the market for a plan that can double up to supplement your retirement plan?

These are important considerations to make, but it’s not limited to just the above.

We hope our piece on the best whole life plans in Singapore and factors to consider when getting life insurance has clarified your questions.

With all things said, the above is based on personal opinion and should not be relied upon as financial advice.

If you’re still unsure and want more advice, we have well-versed financial advisors who are always here to help you and provide their expertise without any biases.