PRUShield is among the 7 integrated shield plans available in Singapore, to complement the national MediShield Life coverage.

Sometimes the unexpected may happen when it comes to matters of your health. The escalating cost of healthcare in Singapore could put financial pressure on you if you are not prepared for the unforeseen.

Hence, it is prudent to take out supplementary cover from policies like PRUShield, so that you don’t have to worry about hospital bills while you recover.

Our comprehensive review will help you to learn the advantages of Prudential PRUShield plans in addition to your MediShield.

Continue reading.

My Review of Prudential’s PRUShield Plans

PRUShield’s plans across all tiers are generally priced higher than its competitors and have lower cost-benefit ratios as compared to plans in similar tiers – seen in the Standard and Premier plans.

Oh, something I didn’t mention in the post is that Prudential adopts claims-based pricing, so if you and your family history are healthy, this might be priced better in the long term for you.

Apart from price, the PRUShield Standard doesn’t provide pre- and post-hospitalisation coverage, which in my opinion, I believe to be highly important when purchasing a shield plan for myself.

The PRUShield Plus might not be the best out there, but it seems great if you want to go for a reputable brand in the industry.

Given the fast and fuss-free claims process by Prudential – backed by customer reviews – I believe makes the higher price worth it.

I mean, I buy insurance so that I get my claims when I need it most, so it’s definitely a few plus points there.

However, for value seekers and those looking for the cheapest, Prudential’s PRUShield plans might not be for you.

For the cheapest shield plan, NTUC Income Enhanced IncomeShield plans are the cheapest across all tiers that you might need – from standard to private hospitals.

I think Great Eastern’s Supreme Health plans are the best for B1 and A wards in restructured hospitals, while Singlife Shield Plan 1 is the overall best for private hospitals.

Everyone’s situation, needs, and wants are different, so I recommend reading our post on the best integrated shield plan and the best shield plan riders available and select one that best suits you.

For a policy as critical as a shield plan, it’s best that you understand what you’re truly looking for in a shield plan and choose one that meets those needs.

This will be the plan you will claim from the most, so ensuring you find the right fit is essential.

You should also consider getting a second opinion from an unbiased financial advisor to determine if the Prudential PRUShield plans are the best for you.

If you’d like to talk to someone for a second opinion, we partner with MAS-licensed financial advisors who can help you with this.

Click here for a free second opinion.

Let’s explore Prudential PRUShield plans in detail:

Prudential PRUShield Integrated Shield plans

There are 3 base plans under the PRUShield, as discussed below:

PRUShield Standard

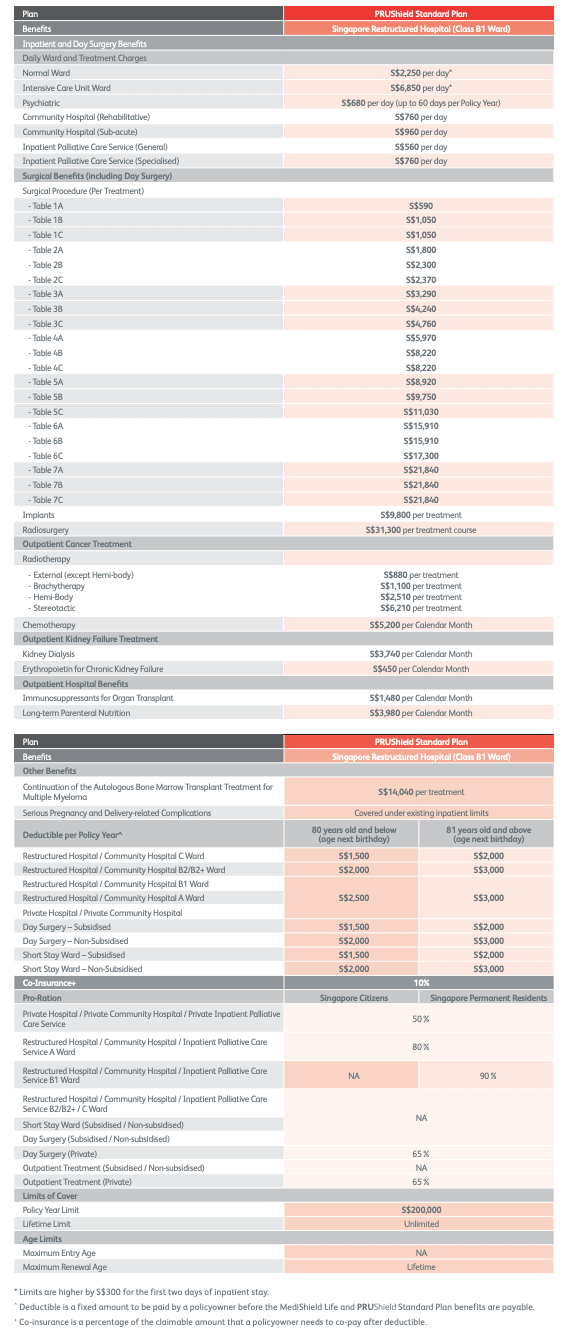

PruShield Standard covers medical and surgical charges in restructured hospitals (up to Class B1 ward) for up to $200,000 per year.

I would consider this to be on the lower end as other ward B1 plans offer up to $500,000 in annual claim limits.

| Integrated Shield Plan (IP) | Annual Premium for

Age Next Birthday (31 – 35) |

Pre Hospitalisation Coverage | Post Hospitalisation Coverage | Annual Claim Limit | Cost-Benefit Ratio |

| AIA Healthshield Gold Max B Lite | $102 | 100 days | 100 days | $300,000 | $2941.18 |

| Singlife with Aviva MyShield Plan 3 | $100 | 180 days | 365 days | $500,000 | $5000 |

| Great Eastern Supreme Health B Plus | $77 – $80 | 180 days | 365 days | $500,000 | $6493.51 |

| NTUC Income Enhanced IncomeShield Basic | $44 | 100 days | 100 days | $250,000 | $5681.82 |

| Raffles Health Insurance Raffles Shield B | $83 | 90 days | 90 days | $300,000 | $3614.46 |

| AXA Shield Standard Plan | $62 | – | – | $150,000 | $2,419.36 |

| PRUShield Standard Plan | $63 | – | – | $200,000 | $3,174.60 |

It’s also worth noting that the PRUShield Standard Plan does have pre- and post-hospitalisation coverage, which is arguably a large portion of your hospital fees.

Other similar plans such as the Great Eastern Supreme Health B Plus and the Singlife with Aviva MyShield Plan 3 offer up to 180 days of pre-hospitalisation and 365 days of post-hospitalisation.

Calculating the cost-benefit ratios, which is how much coverage you’ll get for every dollar you pay, non-smoking males aged 31-35 only get $3,174.60 of coverage per dollar paid, as compared to Great Eastern’s Supreme Health B Plus.

Here’s the table of benefits provided by Prudential:

PRUShield Plus

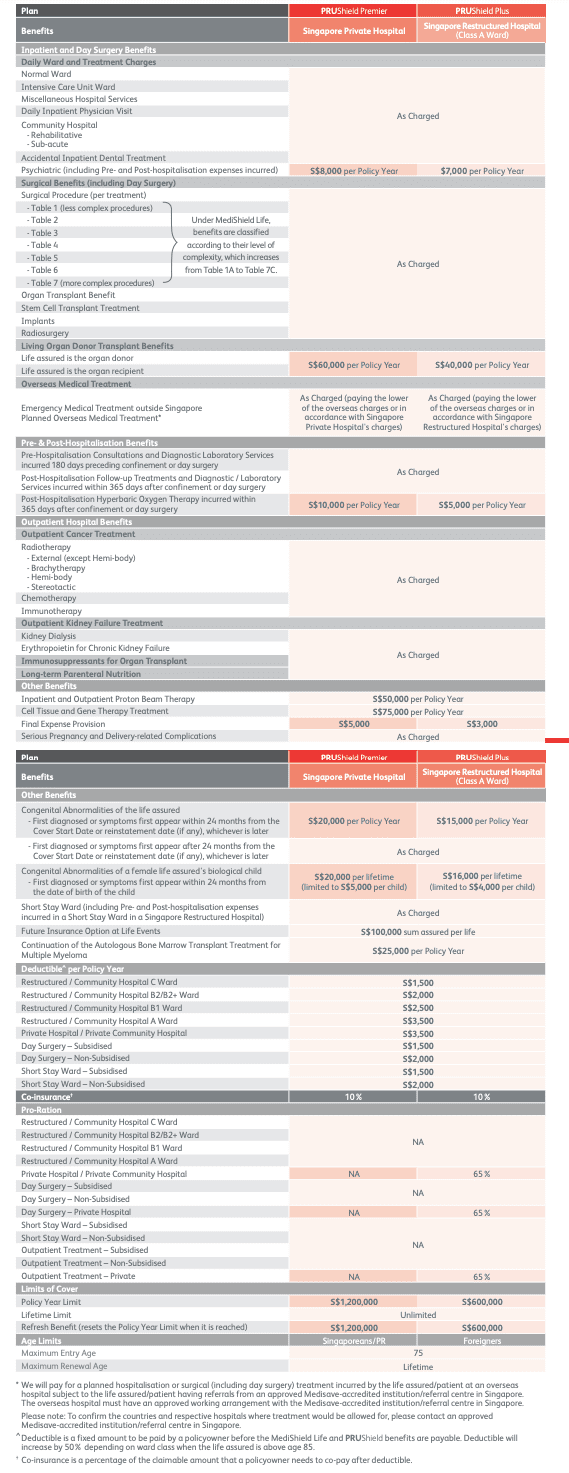

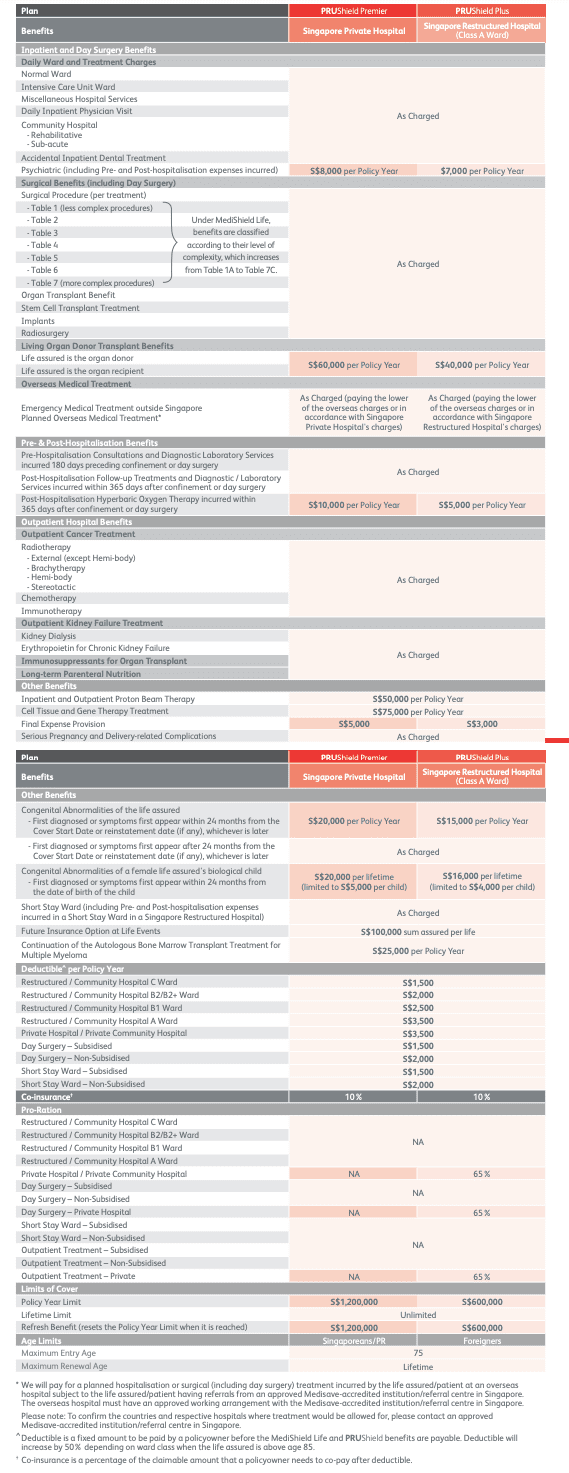

The PRUShield Plus covers you for medical and surgical expenses in Class A hospital wards at public or restructured hospitals.

Unlike the PRUShield Standard, the annual claim limit for this plan is up to $600,000.

However, similarly to the PRUShield Standard, the annual claim limit is on the lower end as compared to its competitors.

Here’s the table of premiums and benefits for other shield plans covering Class A wards:

| Integrated Shield Plan (IP) | Annual Premium for Age Next Birthday

(31 – 35) |

Pre Hospitalisation Coverage | Post Hospitalisation Coverage | Annual Claim Limit | Cost-Benefit Ratio

(Annual Claim Limit/Annual Premium) |

| AIA Healthshield Gold Max B | $168 | 180 days | 180 days | $1,000,000 | $5,952.38 |

| AXA Shield Plan B | $156 | 180 days | 365 days | $550,000 | $3,525.64 |

| Singlife with Aviva MyShield Plan 2 | $168 | 180 days | 365 days | $1,000,000 | $5,952.38 |

| Great Eastern Supreme Health A Plus | $106 – $123 | 180 days | 365 days | $1,000,000 | $9,433.96 |

| NTUC Income Enhanced IncomeShield Advantage Plan | $74 | 100 days | 100 days | $500,000 | $6,756.76 |

| Prudential PRUShield Plus | $119 | 180 days | 365 days | $600,000 | $5,042.02 |

| Raffles Health Insurance Raffles Shield A | $112 | 180 days | 365 days | $600,000 | $5,357.14 |

| Raffles Health Insurance Raffles Shield A with Raffles Hospital Option | $223 | 180 days | 365 days | $600,000 | $2,690.58 |

As seen from the table above, the highest claim limits offered by a few of its competitors go up to $1,000,000 yearly!

This time, there are 180 days of pre-hospitalisation coverage and 365 days of post-hospitalisation coverage. This is on par with many of its competitors.

In terms of the cost-benefit ratio, you’ll get $5,042.02 of coverage for every dollar spent. This isn’t the highest as compared to Great Eastern’s Supreme Health A Plus and NTUC Income’s Enhanced IncomeShield Advantage Plan.

Despite not being as competitive as its competitors, we would still recommend the PRUShield Plus plan if you have a little extra to spend.

Here are other benefits offered by the PRUShield Plus plan:

PRUShield Premier

Prudential’s PRUShield Premier provides coverage for medical and surgical expenses for up to private hospitals in Singapore.

You’ll have an annual claim limit of up to $1,200,000 – reasonable, but not as competitive.

| Integrated Shield Plan (IP) | Annual Premium for Age Next Birthday

(31 – 35) |

Pre Hospitalisation Coverage | Post Hospitalisation Coverage | Annual Claim Limit | Cost-Benefit Ratio |

| AIA Healthshield Gold Max A | $360 | 13 months | 13 months | $2,000,000 | $5,555.56 |

| AXA Shield Plan A | $292 | 180 days | 365 days | $2,500,000 | $8,561.64 |

| Singlife with Aviva MyShield Plan 1 | $409 | 180 days | 365 days | $2,000,000 | $4,889.98 |

| Great Eastern Supreme Health P Plus | $322 | 120 days | 365 days | $1,500,000 | $4,658.39 |

| NTUC Income Enhanced IncomeShield Preferred | $225 | 180 days | 365 days | $1,500,000 | $6,666.67 |

| Prudential PRUShield Premier | $300 | 180 days | 365 days | $1,200,000 | $4,000.00 |

| Raffles Health Insurance Raffles Shield Private | $339 | 180 days | 365 days | $1,500,000 | $4,424.78 |

| Raffles Health Insurance A with Raffles Hospital Option | $223 | 180 days | 365 days | $600,000 | $2,690.5 |

In comparison, pre- and post-hospitalisation coverages are 180 days and 365 days respectively, similar to most competitors.

I would say in terms of cost-benefit, the PRUShield Premier is above average, although there are plans such as AXA Shield Plan A and AIA Healthshield Gold Max offering higher ratios.

In my opinion, it’s a little bit harder to recommend the PRUShield Premier as compared to PRUShield Plus due to its premiums being significantly higher than others.

Here are the other benefits offered by PRUShield Premier:

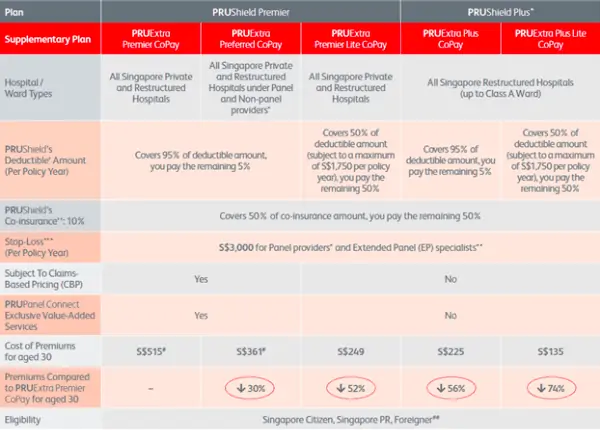

PRUShield Riders – PRUExtra

Several riders if you decide to be included in your PRUShield plan can reduce your out-of-pocket expenses if you end up in the hospital.

You can increase your primary PRUShield health insurance plan’s coverage by up to 95% by adding riders.

All riders cap your out-of-pocket costs at $3,000 per policy year.

PRUShield Plus Riders

PRUShield Plus has 2 available riders depending on your budget.

PRUExtra Plus CoPay

The PRUExtra Plus CoPay covers up to 95% of your deductibles and 50% of your co-insurance at all Singapore Restructured Hospitals up to Class A ward, with a S$3,000 annual limit on out-of-pocket expenses if you go to a panel provider.

PRUExtra Plus Lite CoPay

The PRUExtra Plus Lite CoPay covers up to 50% of your deductibles subject to a maximum of S$1,750 per policy year.

It also covers 50% of your co-insurance at all Singapore Restructured Hospitals up to Class A ward, with a S$3,000 limit per year on out-of-pocket expenses if you go to their panel.

PRUShield Premier Riders

If budget is not an issue, you can enjoy a variety of riders on top of your PRUShield Premier plan.

Except for PRUExtra Premier Lite CoPay, the other riders below give you access to PRUPanel Connect, which has the following benefits;

- Hassle-Free Online Appointment Bookings

- Allows you to receive cashless medical treatment from participating specialists

- Comprehensive health screening packages for early interventions

- The Extended Panel allows you to choose from a variety of doctors

PRUExtra Premier CoPay

The PRUExtra Premier CoPay covers up to 95% of your deductibles and up to 50% of your co-insurance at all private hospitals in Singapore with a S$3,000 limit per year on out-of-pocket expenses if you visit their panel.

This supplementary plan gives you access to PRUPanel Connect.

PRUExtra Preferred CoPay

The PRUExtra Preferred CoPay covers up to 95% of your deductibles and up to 50% of your co-insurance at all private and restructured hospitals under Prudential’s panel.

The limit per year on out-of-pocket expenses if you visit their panel is S$3,000. This plan gives you access to PRUPanel Connect.

PRUExtra Premier Lite CoPay

The PRUExtra Premier Lite CoPay rider covers up to 50% of your deductibles subject to a maximum of S$1,750 per policy year.

It also covers 50% of your co-insurance at all Singapore private and restructured hospitals, with a S$3,000 limit per year on out-of-pocket expenses if you go to their panel of hospitals.

PRUShield Riders Comparison Table

The most economical rider (if you end up in the hospital) is to choose the highest tiers as it covers up to 95% of your deductibles and 50% of your co-insurance amount.

Also note that you must pay for these riders in cash, not with Medisave, and that the premiums may increase depending on your prior claims.

How to Make Claims from PruShield?

To make a claim, you need to complete the claim form and attach all supporting documents.

Then submit them through your Financial Consultant or at the Prudential Customer Service Center.

Alternatively, you may mail it to Prudential Assurance Company Singapore (Pte) Limited Robinson Road.

Frankly, you should leave your claims to be handled by your financial advisor so that you can focus on recovery.

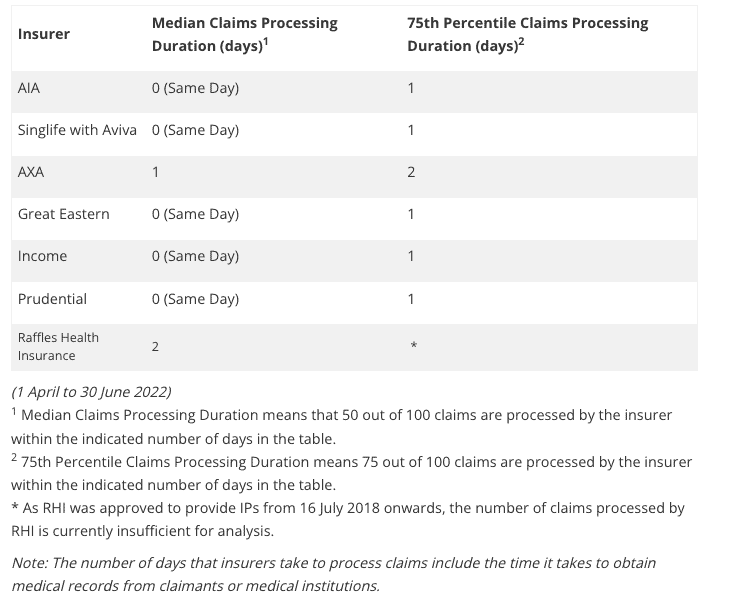

PRUShield Claims Duration

According to MOH, the median claims processing time for PRUShield is 0 days, with the 75th percentile being 1 day.

Many reviews mention that Prudential’s claim process is fast and fuss-free, as long as you have a good agent servicing you.

This is why choosing a good agent from the start is important.