Previously the Aviva MyShield, the Singlife Shield is 1 of 7 participating Integrated Shield Plans offered in Singapore.

It is intended to supplement your existing MediShield Life coverage. Due to the high cost of healthcare, relying solely on Medishield may result in you footing much of the bill.

As a result, it is prudent to obtain additional coverage from shield plans such as the Singlife Shield so that you can focus on recovery when in the hospital.

Thankfully, as with all shield plans, you can opt to pay your premiums using your MediSave account.

In this post, we reviewed Singlife’s Shield plan.

Is this hospitalisation plan for you or are there better hospital plans in the market?

Read on to find out.

My Review of the Singlife Shield Integrated Shield Plan

Singlife Shield’s basic plans across all tiers are pretty expensive and do not have much value as compared to its competitors.

If you’re looking to just get a basic plan without any riders, Singlife Shield might not be for you.

Thus, value seekers and those looking for the cheapest should consider NTUC Income’s Enhanced IncomeShield or AXA Shield Plan A and B.

However, if you like the special benefits offered by Singlife Shield – coverage for 5 critical illnesses, cancer prevention coverage, planned and emergency overseas treatment, and “As Charged” coverage for hospitalisation, pregnancy complications, cancer, and accidental dental treatment – then Singlife Shield is a plan you should consider.

This is something that Singlife Shield blossoms in, providing you with more comprehensive coverage rather than low pricing.

Speaking of pricing, the Singlife Shield does not adopt a claims-based pricing, which is something we like.

Families with children will also find Singlife Shield to be attractive as it provides free coverage for newborns if both parents purchase Plans 1 & 2 for minimally 10 months.

Furthermore, if both parents have Plan 1 & 2 and your child is at Plan 2 minimally, he/she will receive free coverage until they are 20 years old – with a limit of 4 children maximum.

This is definitely a bang for your buck for families!

Lastly, if you’re looking to get riders to your shield plan, do consider Singlife Shield as, despite the expensive base plans, its base plans, coupled together with its riders are one of the cheapest in Singapore.

So if there are already plans to get riders for your shield plan, then Singlife Shield is one of the policies you should definitely consider.

Nevertheless, no insurance plan is best for everyone, that’s why we recommend you read our post on the best integrated shield plans in Singapore.

Since this is a health insurance policy, it’s something you should consider taking some extra time researching as this will be the backbone of all your insurance coverages.

You’ll be relying heavily on this plan when you’re hospitalised and will make the most claims from this policy throughout your life.

So making sure you have the best one is crucial.

One of the best ways our readers ensure that they’ve evaluated and selected the best insurance policy for themselves is by getting an unbiased second opinion from financial advisors.

This way, they explore alternatives, compare them, and select the best for themselves.

If this interests you, we partner with MAS-licensed financial advisors who’ve helped thousands of our readers with their health insurance policies.

We believe they can help you, too.

Click here for a free, non-obligatory chat.

Now let’s explore what Singlife Shield Plans have to offer:

Singlife Shield Plans

Singlife Shield Plan 1

The Singlife Shield Plan 1 covers any standard ward of a private hospital for up to $2,000,000 claim limit if you visit public hospitals or panel specialists, and up to $1,000,000 for the rest.

It provides 180 days of pre-hospitalisation and 365 days of post-hospitalisation coverage.

| Integrated Shield Plan (IP) | Annual Premium for Males Age Next Birthday

(31 – 35) |

Pre Hospitalisation Coverage | Post Hospitalisation Coverage | Annual Claim Limit | Cost-Benefit Ratio |

| AIA Healthshield Gold Max A | $360 | 13 months | 13 months | $2,000,000 | $5,555.56 |

| AXA Shield Plan A | $292 | 180 days | 365 days | $2,500,000 | $8,561.64 |

| Singlife with Aviva Shield Plan 1 | $409 | 180 days | 365 days | $2,000,000 | $4,889.98 |

| Great Eastern Supreme Health P Plus | $322 | 120 days | 365 days | $1,500,000 | $4,658.39 |

| NTUC Income Enhanced IncomeShield Preferred | $225 | 180 days | 365 days | $1,500,000 | $6,666.67 |

| Prudential PRUShield Premier | $300 | 180 days | 365 days | $1,200,000 | $4,000.00 |

| Raffles Health Insurance Raffles Shield Private | $339 | 180 days | 365 days | $1,500,000 | $4,424.78 |

| Raffles Health Insurance A with Raffles Hospital Option | $223 | 180 days | 365 days | $600,000 | $2,690.5 |

In terms of pricing, the Singlife Shield Plan 1 is easily the most expensive private hospital shield plan.

However, the cost-benefit analysis shows that for every $1 you pay in premiums, you get up to $4,889.98 in hospitalisation coverage with this plan.

This isn’t the lowest and ranks as the fourth best amongst similar plans, which is good value if you were to claim the entire S$2,000,000.

Thus, if value is what you’re looking for, perhaps AXA Shield Plan A is of the best value.

Here’s a list of coverage you’ll expect from Singlife Shield Plan 1:

Singlife Shield Plan 2

The Singlife Shield Plan 2 covers you for up to ward A of a restructured public hospital for up to $1,000,000 per year.

For ward A plans, the $1,000,000 annual claim limit is one of the highest in the market, alongside the AIA Healthshield Gold Max B and the Great Eastern Supreme Health A Plus.

| Integrated Shield Plan (IP) | Annual Premium for Males Age Next Birthday

(31 – 35) |

Pre Hospitalisation Coverage | Post Hospitalisation Coverage | Annual Claim Limit | Cost-Benefit Ratio |

| AIA Healthshield Gold Max B | $168 | 180 days | 180 days | $1,000,000 | $5952.38 |

| AXA Shield Plan B | $156 | 180 days | 365 days | $550,000 | $3525.64 |

| Singlife Shield Plan 2 | $168 | 180 days | 365 days | $1,000,000 | $5952.38 |

| Great Eastern Supreme Health A Plus | $106 – $123 | 180 days | 365 days | $1,000,000 | $9433.96 |

| NTUC Income Enhanced IncomeShield Advantage | $74 | 100 days | 100 days | $500,000 | $6756.76 |

| Prudential PRUShield Plus | $119 | 180 days | 365 days | $600,000 | $5042.02 |

| Raffles Health Insurance Raffles Shield A | $112 | 180 days | 365 days | $600,000 | $5357.14 |

| Raffles Health Insurance Raffles Shield A with Raffles Hospital Option | $223 | 180 days | 365 days | $600,000 | $2690.58 |

In terms of pre- and post-hospitalisation coverage, the Singlife Shield Plan 2 is on par with its competitors with 180 days and 365 days respectively.

Premium-wise, it’s the second most expensive plan for ward A just behind the Raffles Health Insurance Raffles Shield A with Raffles Hospital Option, but it has the third best value as its cost-benefit ratio is at $5,952.38 per dollar spent.

Value seekers should look into the Great Eastern Supreme Health A Plus and those looking for the cheapest should go for NTUC Income’s Enhanced IncomeShield Advantage.

Here’s a list of coverage you’ll expect from Singlife Shield Plan 2:

Singlife Shield Plan 3

The Singlife Shield Plan 3 covers up to any 4-bed (Class B1) standard ward of a public hospital with an annual claim limit of up to $500,000.

Compared to similar plans at this tier, Singlife’s Shield Plan 3 boasts 180 days of pre-hospitalisation and 365 days of post-hospitalisation – whereby other competitors offer a max of 100 days respectively, with some competitors offering no coverage at all.

| Integrated Shield Plan (IP) | Annual Premium for Males Age Next Birthday

(31 – 35) |

Pre Hospitalisation Coverage | Post Hospitalisation Coverage | Annual Claim Limit | Cost-Benefit Ratio |

| AIA Healthshield Gold Max B Lite | $102 | 100 days | 100 days | $300,000 | $2941.18 |

| Singlife with Aviva Shield Plan 3 | $100 | 180 days | 365 days | $500,000 | $5000 |

| Great Eastern Supreme Health B Plus | $77 – $80 | 180 days | 365 days | $500,000 | $6493.51 |

| NTUC Income Enhanced IncomeShield Basic | $44 | 100 days | 100 days | $250,000 | $5681.82 |

| Raffles Health Insurance Raffles Shield B | $83 | 90 days | 90 days | $300,000 | $3614.46 |

| AXA Shield Standard Plan | $62 | – | – | $150,000 | $2,419.36 |

| PRUShield Standard Plan | $63 | – | – | $200,000 | $3,174.60 |

As you can see, its $500,000 yearly claim limit is the best and it’s on par with Great Eastern’s Supreme Health B Plus!

However, Singlife Shield Plan 3 isn’t a plan for value seekers as its cost-benefit ratio is third among similar plans.

It isn’t the cheapest either – second most expensive for the same demographic compared.

Singlife Shield Seems Pretty Expensive, Why Should I Choose It?

Across all Singlife Shield plans, it is consistently more expensive than the average and median prices.

However, Singlife Shield stands out in other ways that make sense for certain groups of individuals.

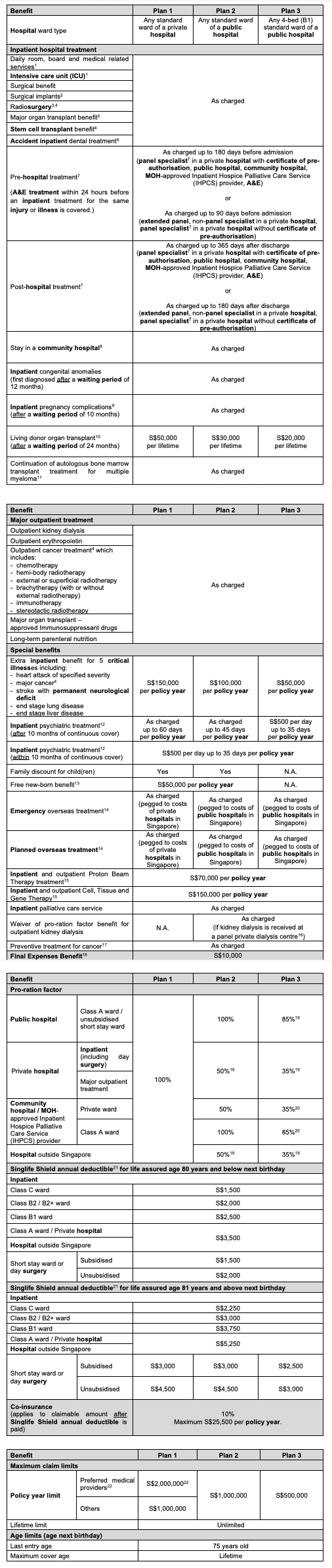

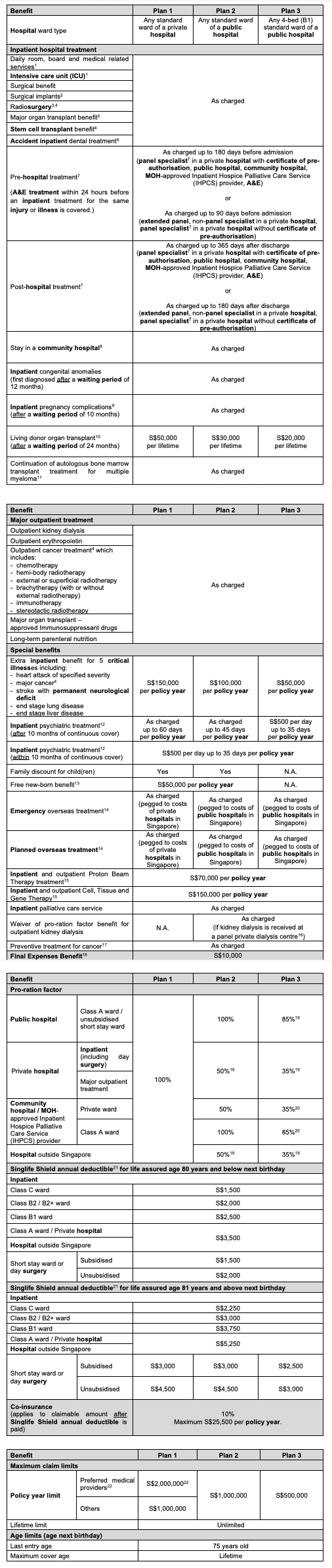

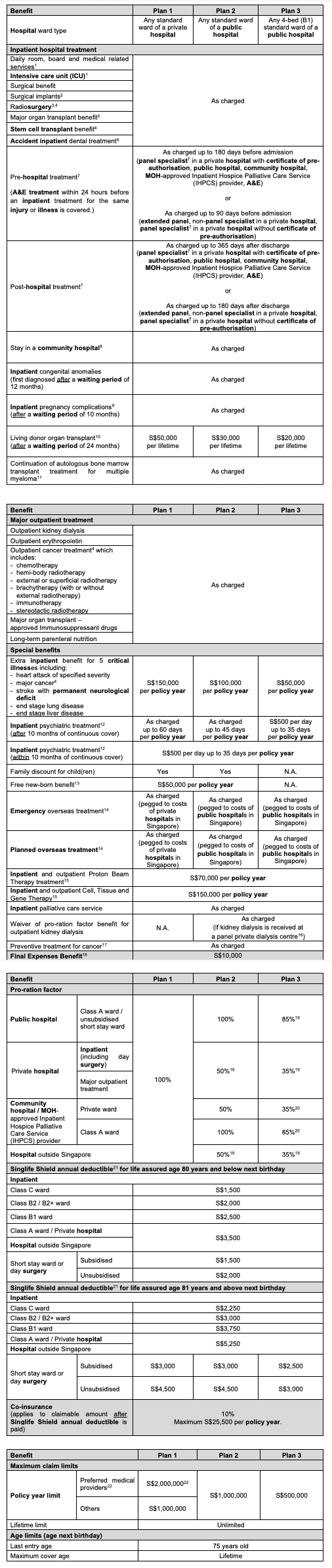

The table below shows you the differences between the 3 Singlife Shield plans:

Singlife Shield Plan 3

Unlike some other shield plans, for hospitalisation, pregnancy complications, accidental dental treatment, and cancer, the Singlife Shield Plan 3 labels them as “As Charged”, which means full coverage for you.

It also has unique benefits such as planned and emergency overseas treatment and cancer prevention coverage.

To top it off?

You’ll have inpatient benefits for 5 major critical illnesses for up to $50,000 per year and $10,000 of final expenses covered.

Here are the 5 critical illnesses:

- Heart attack of specified severity

- Major cancer

- Stroke with permanent neurological deficit

- End-stage lung disease

- End-stage liver disease

It’s downsides?

It doesn’t have the family-related benefits you’ll get from Plan 2 and Plan 3.

Singlife Shield Plan 2

The Singlife Shield Plan 2 provides a family discount for your children and a free newborn benefit of $50,000 per year – something that Aviva usually stands out for – family discounts.

These discounts are crazy attractive, which we cover why in our conclusion later.

On top of this, your coverage for 5 critical illnesses is now up to $100,000 and preventive treatment for cancer is now “As Charged”.

Singlife Shield Plan 1

Similar to Plan 2, the Singlife Shield Plan 1 provides you with a family discount and free $50,000 yearly benefits for newborns.

However, you now have $150,000 in yearly coverage for the 5 major critical illnesses.

Oh and we didn’t mention this but although your co-insurance is at 10%, Singlife caps your payment at $25,500 per year for all plans – something that probably no other shield plan offers.

Singlife Shield Plan Riders – Singlife Health Plus

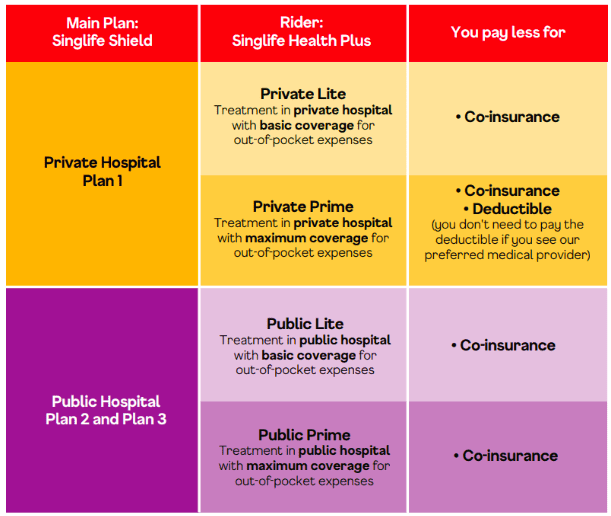

Singlife has 4 riders for the Singlife Shield –Singlife Health Private Lite, Singlife Health Plus Private Prime, Singlife Health Plus Public Lite, and Singlife Health Plus Public Prime.

Wow, its riders are certainly a mouthful.

For Private Lite and Private Prime, they are only available for Plan 1, while the other 2 are available for Plans 2 and 3.

Here’s a table to showcase the differences:

To elaborate on the Singlife Health Plus riders, here’s our effort at summarising it:

- Your co-insurance with any of the riders is now capped at $3,000 per year.

- You get an additional $10,000 payout should you incur the 5 critical illnesses mentioned above.

- You get an additional $3,000 for kidney dialysis due to kidney failure.

- You get the mental wellness benefits that cover outpatient psychiatric consultation, capped at $100 per visit and $1,000 per year.

- Covers 50% of the annual deductible for Singlife Shield, if you stay in a ward lower than your entitlement.

- Free or discounted rider coverage for your children.

Oh, and did I mention that if you get a rider together with your base plan, it can be cheaper than its competitors?

How to Make Claims from Singlife?

If you obtained a letter of guarantee prior to your treatment from the hospital, Singlife will settle your hospital bills directly with the hospital.

Should you don’t have it, you’ll need to pay the deposit and make a claim from Singlife’s claims department.

However, we believe claims should be made by the financial advisor you bought your plan from so that you can focus on recovery.

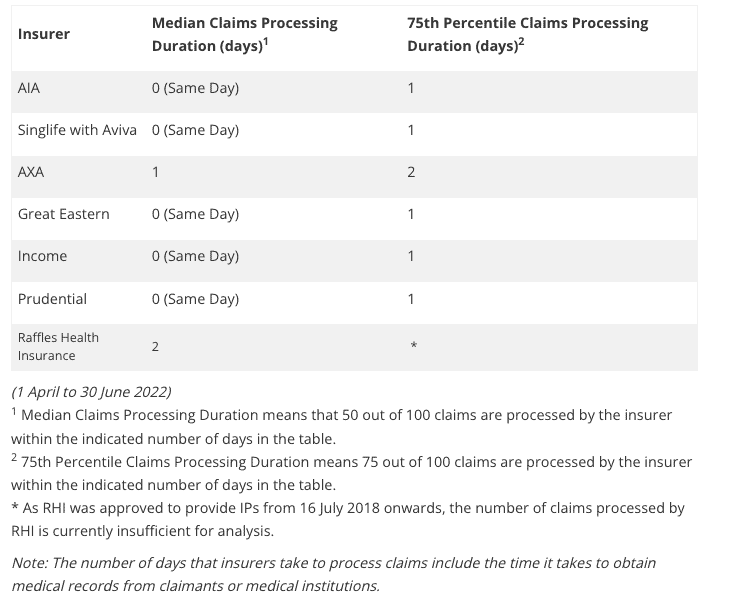

Singlife Shield Claims Duration

According to MOH, Singlife with Aviva takes 0 days to process your claims, with its 75th percentile being 1 day.

There are insufficient reviews online to justify how good the claims process is.