As 1 of 7 integrated shield plans offered in Singapore, Great Eastern’s GREAT SupremeHealth complements MediShield Life.

The GREAT SupremeHealth is also one of a few shield plans that offer protection for Singaporeans, Singapore Permanent Residents, and foreigners with valid work passes.

And like other shield plans, you can use your MediSave account to pay for premiums!

We reviewed each plan tier of the GREAT SupremeHealth so that you can make an informed choice.

Read on.

My Review of the Great Eastern GREAT SupremeHealth

Considering the price, the benefits, and the coverage offered on the higher tiers, I think the Great Eastern GREAT SupremeHealth is a pretty good health insurance policy.

However, the 120-day pre-hospitalisation coverage is a little on the short side, given that other insurers cover up to 180 days.

It’s also worth noting that Great Eastern adopts claims-based pricing, where your premiums increase every time you claim.

The claims-adjusted pricing is a fair and sustainable price structure that gives healthy policyholders lower premiums instead of subsidising it for others.

Despite the lower pricing you pay, this is something we don’t recommend as premiums will drastically increase once you make a claim.

We talked more about claims-based pricing here.

If you’re alright with claims-based pricing, then I’d say the GREAT SupremeHealth is the go-to plan, especially for B1 and ward A classes.

Otherwise, I suggest considering other plans such as Raffles Shield, NTUC Income Enhanced IncomeShield, HSBC Life Shield (previously AXA Shield), or Singlife Shield.

For instance, the HSBC Life Shield Plan offers the most value on private hospital coverage for every dollar you pay.

The NTUC Income Enhanced IncomeShield has the cheapest shield plan across all wards, including private hospital coverage.

Not sure which one is for you?

I recommend reading our post on the best integrated shield plans and the best riders to accompany them.

It’s best to take some time to research your options, especially for hospitalisation plans, as this will be the policy that you will make the most claims from.

You want to ensure you have the best coverage your budget offers, whether you prefer longer pre-/post-hospitalisation claims or the highest sum assured offered.

If you’re still confused or not confident in choosing one, we partner with unbiased financial advisors to help you find the best plan for you.

It’s also best to get a second opinion as to whether the GREAT SupremeHealth is for you.

Interested?

Click here for a non-obligatory chat.

Great Eastern GREAT SupremeHealth P Plus

The Great Eastern Supreme Health P Plus provides the broadest coverage, covering both public and private hospital wards, all inpatient surgeries, and pre- and post-hospitalisation.

| Integrated Shield Plan (IP) | Annual Premium for Age Next Birthday

(31 – 35) |

Pre Hospitalisation Coverage | Post Hospitalisation Coverage | Annual Claim Limit | Cost-Benefit Ratio |

| Raffles Health Insurance Raffles Shield Private | $237 | 180 days | 365 days | $1,500,000 | $6,329.11 |

| AIA Healthshield Gold Max A | $367 | 13 months | 13 months | $2,000,000 | $5,449.60 |

| AXA Shield Plan A | $292 | 180 days | 365 days | $2,500,000 | $8,561.64 |

| Singlife with Aviva Shield Plan 1 | $409 | 180 days | 365 days | $2,000,000 | $4,889.98 |

| Great Eastern SupremeHealth P Plus | $322 | 120 days | 365 days | $1,500,000 | $4,658.39 |

| NTUC Income Enhanced IncomeShield Preferred | $225 | 180 days | 365 days | $1,500,000 | $6,666.67 |

| Prudential PRUShield Premier | $300 | 180 days | 365 days | $1,200,000 | $4,000.00 |

The GREAT SupremeHealth P Plus offers an annual claim limit of $1,500,000, which isn’t the highest for private hospital plans.

Singlife Shield Plan 1 and AIA’s HealthShield Gold Max have a yearly claim limit of $2,000,000, while AXA’s Shield Plan A is at an astounding $2,500,000.

So if you think $1,500,000 isn’t enough, there are 3 other options available for you.

In terms of pre- and post-hospitalisation cover, the GREAT SupremeHealth P Plus provides 120 days and 365 days of coverage respectively.

The post-hospitalisation coverage is on par with other shield plans at this tier, but the pre-hospitalisation cover is only at 120 days, which is the lowest amongst others.

The cost-benefit analysis shows that for every $1 you pay in premiums, you get up to $4,658.39 in hospitalisation coverage with this plan. This ranks it as the second-last best, just in front of Prudential’s PRUShield Premier.

Thus, if you’re a value seeker, you might want to consider AXA Shield Plan A or Raffles Shield Private with a cost-benefit ratio of $8,561.84 and $6,329.11 respectively.

Premium-wise, the Great Eastern GREAT SupremeHealth P Plus is also on the higher end, with NTUC Income’s Enhanced IncomeShield Preferred being the cheapest.

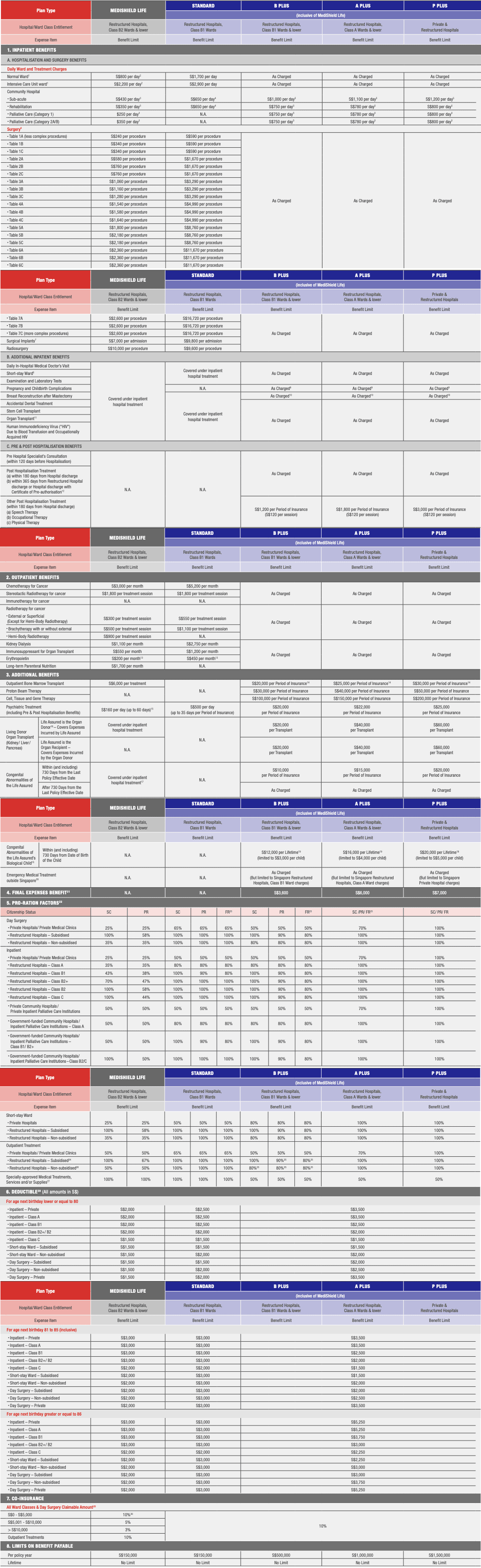

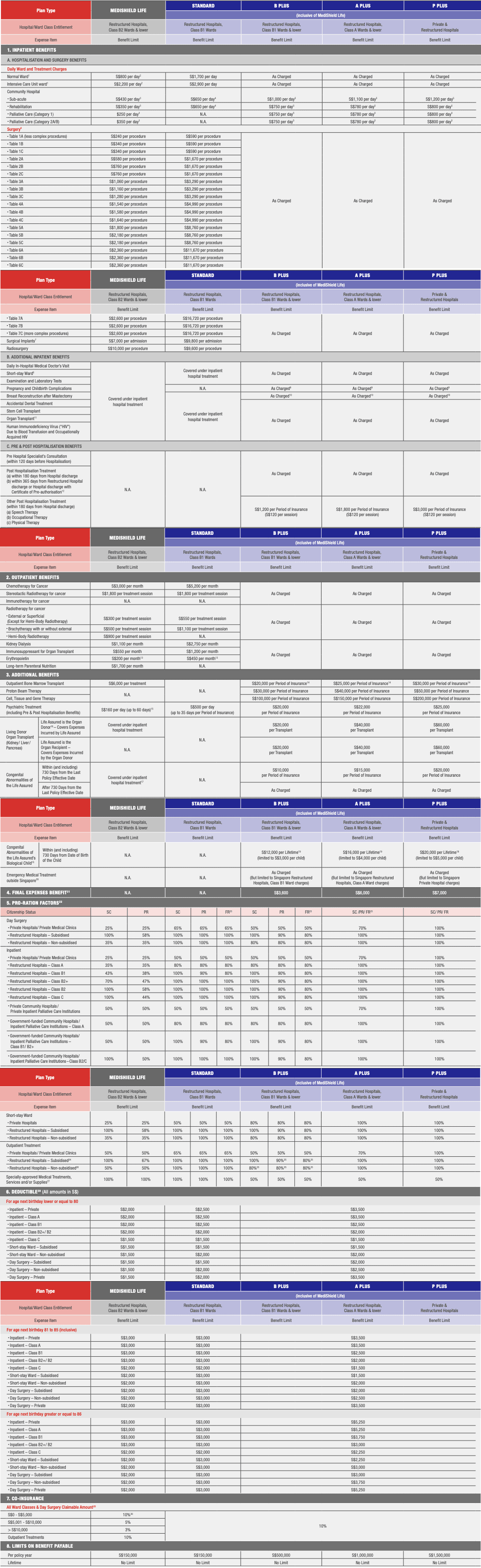

Here is what’s covered by the GREAT SupremeHealth P Plus:

Great Eastern GREAT SupremeHealth A Plus

The A Plus plan from Great Eastern Supreme Health lets you access treatment at Class A wards at public and restructured hospitals with an annual claim limit of up to $1,000,000.

The post-hospitalisation coverage is up to 365 days and pre-hospitalisation is up to 120 days.

| Integrated Shield Plan (IP) | Annual Premium for Age Next Birthday

(31 – 35) |

Pre Hospitalisation Coverage | Post Hospitalisation Coverage | Annual Claim Limit | Cost-Benefit Ratio |

| Raffles Health Insurance Raffles Shield A | $156 | 180 days | 365 days | $600,000 | $3846.14 |

| AIA Healthshield Gold Max B | $157 | 180 days | 180 days | $1,000,000 | $5952.38 |

| AXA Shield Plan B | $156 | 180 days | 365 days | $550,000 | $3525.64 |

| Singlife with Aviva MyShield Plan 2 | $168 | 180 days | 365 days | $1,000,000 | $5952.38 |

| Great Eastern Supreme Health A Plus | $106 – $123 | 120 days | 365 days | $1,000,000 | $9433.96 |

| NTUC Income Enhanced IncomeShield Advantage | $74 | 100 days | 100 days | $500,000 | $6756.76 |

| Prudential PRUShield Plus | $119 | 180 days | 365 days | $600,000 | $5042.02 |

In comparison with competing insurers, Great Eastern Supreme Health A Plus offers the best coverage in terms of an annual claim limit of $1,000,000, for Class A wards in public or restructured hospitals.

Additionally, if you are looking for value, this plan offers you $9,433.96 for every $1 you spend and is the best among all the other options.

SOP

Pre-hospitalisation coverage is slightly below the median of 180 days, but post-hospitalisation coverages are also at par with the best, making Great Eastern Supreme Health A Plus the best Class A option.

The GREAT SupremeHealth A Plus is also one of the cheapest plans starting at $106, just behind NTUC Income’s Enhanced IncomeShield Advantage.

Oh, I also bought this plan for myself.

With great pricing, great value, and pretty decent pre- and post-hospitalisation cover, I think the GREAT SupremeHealth A Plus is easily the best in its category.

Here’s what’s covered by the GREAT SupremeHealth A Plus:

Great Eastern GREAT SupremeHealth B Plus

The Great Eastern GREAT SupremeHealth B Plus plan offers access to Class B1 wards at public/restructured hospitals and lower,

It has a $500,000 claim limit and is the best alongside Singlife’s Shield Plan 3.

| Integrated Shield Plan (IP) | Annual Premium for

Age Next Birthday (31 – 35) |

Pre Hospitalisation Coverage | Post Hospitalisation Coverage | Annual Claim Limit | Cost-Benefit Ratio |

| AIA Healthshield Gold Max B Lite | $102 | 100 days | 100 days | $300,000 | $2941.18 |

| Singlife with Aviva Shield Plan 3 | $100 | 180 days | 365 days | $500,000 | $5000 |

| Great Eastern Supreme Health B Plus | $77 – $80 | 120 days | 365 days | $500,000 | $6493.51 |

| NTUC Income Enhanced IncomeShield Basic | $44 | 100 days | 100 days | $250,000 | $5681.82 |

| Raffles Health Insurance Raffles Shield B | $66 | 90 days | 90 days | $300,000 | $4545.45 |

| AXA Shield Standard Plan | $62 | – | – | $150,000 | $2,419.36 |

| PRUShield Standard Plan | $63 | – | – | $200,000 | $3,174.60 |

Unlike other plans, Great Eastern’s GREAT SupremeHealth B Plus has maintained its pre- and post-hospitalisation coverage of 120 days and 365 days respectively, which is the second-best offer.

Other insurers reduced the coverage to 100 days for both, while others like the PRUShield Standard Plan and the AXA Shield Standard Plan totally removed pre- and post-hospitalisation.

This is not entirely the fairest comparison because the GREAT SupremeHealth has a Standard plan which doesn’t have any pre- and post-hospitalisation either.

In terms of value for your money, Great Eastern offers the best returns among the 7 integrated plans at $6,493.51 for every $1.

It is, however, not the cheapest plan, but it’s definitely what I consider the best in this category.

Here is the list of coverage offered by the GREAT SupremeHealth B Plus:

Great Eastern GREAT SupremeHealth Standard

Now, the lowest tier in the GREAT SupremeHealth series is the GREAT SupremeHealth Standard.

This plan covers you for wards B1 at public and restructured hospitals with an annual claim limit of $200,000.

For 31 to 35-year-olds, the premiums you’ll have to pay is $53/year, which is cheaper than AXA’s and Prudential’s standard plans.

This also brings the cost-benefit ratio to $3,773.58, which is higher than AXA’s and Prudential’s standard plans.

So if you’re a value seeker, you can consider the GREAT SupremeHealth Standard.

However, I find it a little bit hard to recommend this as NTUC Income’s Enhanced IncomeShield Basic covers wards B1 in public and restructured hospitals, has 100 days of pre- and post-hospitalisation, and has a much higher cost-benefit ratio at $5,681.82 – all for the price of $44/year.

Here’s what’s offered at this tier:

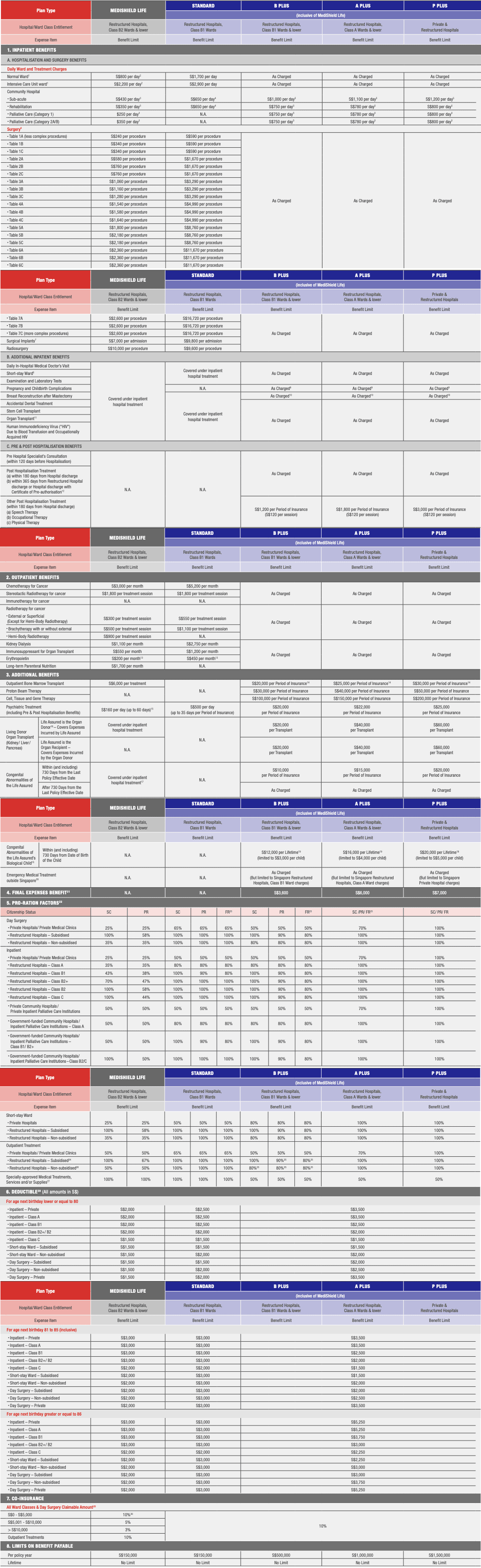

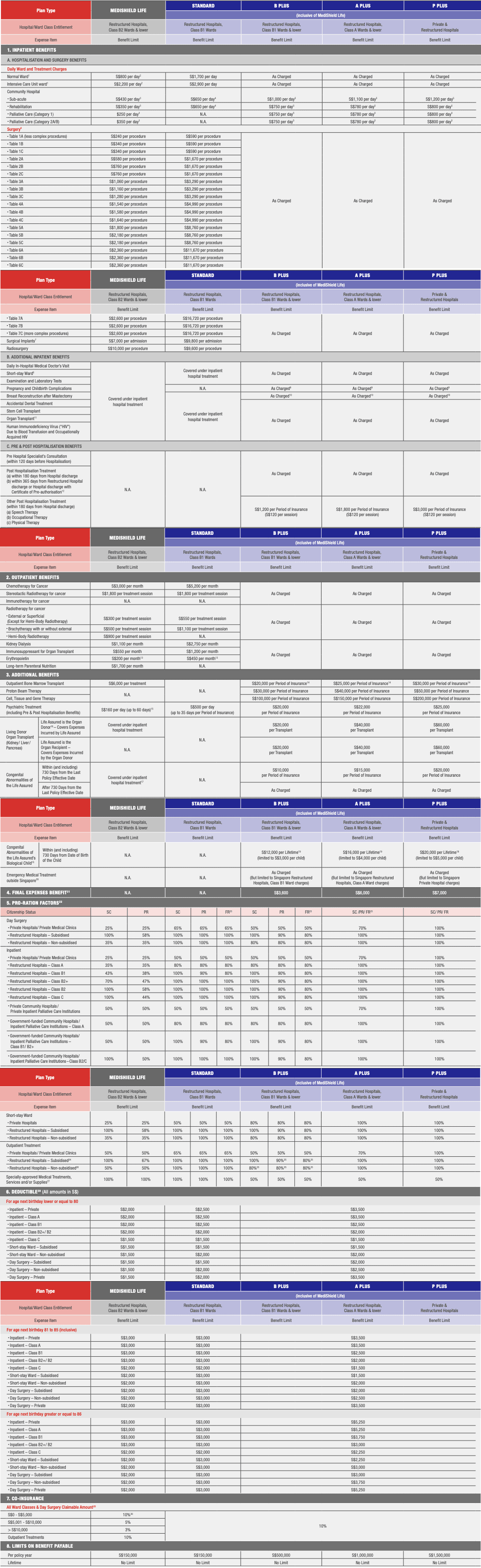

Great Eastern GREAT SupremeHealth Riders

Great Eastern offers 2 types of riders to complement the GREAT SupremeHealth integrated shield plan, namely

- GREAT TotalCare

- GREAT TotalCare Plus

You can add these riders to your plan to lower your out-of-pocket expenses and boost your medical benefits.

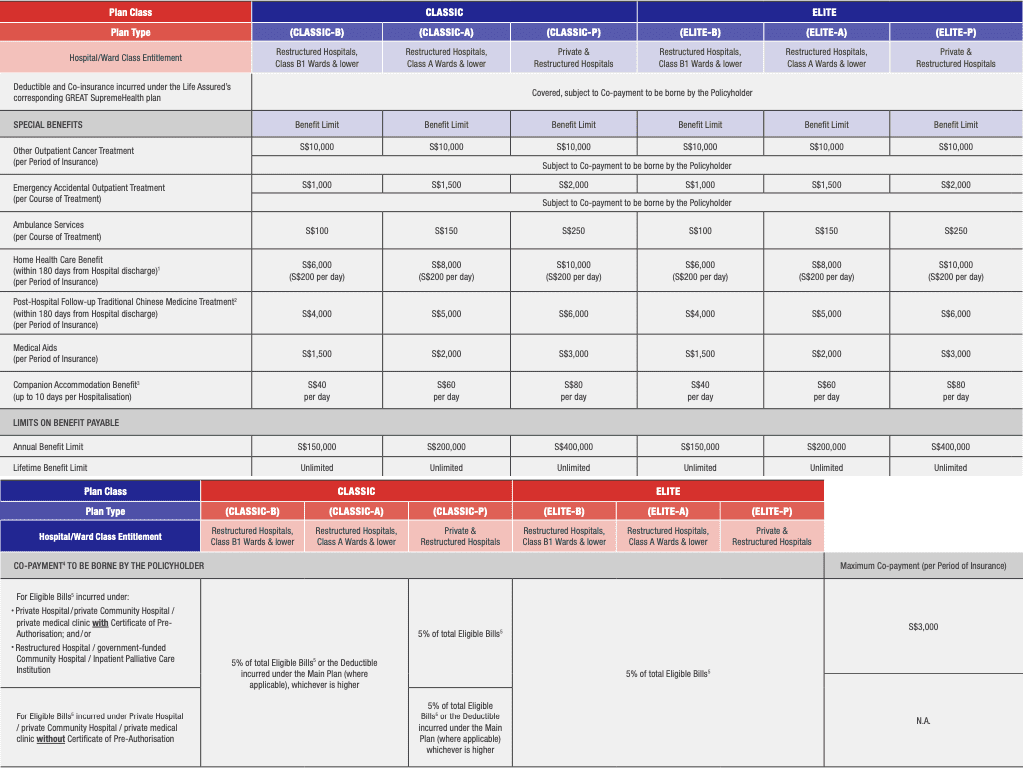

GREAT TotalCare

The GREAT TotalCare rider, which has an annual benefit cap of up to $400,000, can be added if you’re seeking more protection.

Firstly, it’s important to break down the riders.

They have 6 levels – broken into Elite and Classic – with 3 tiers in each.

So you’ll have the:

- Classic B

- Classic A

- Classic P

- Elite B

- Elite A

- Elite P

All of them limit your co-payment to 5% and deductibles at $3,000, if you meet its criteria.

Worth noting is that the GREAT TotalCare has special benefits such as

- Other Outpatient Cancer Treatment

- Emergency Accidental Outpatient Treatment

- Ambulance Services

- 180 days of Home Health Care Benefit

- 180 days of Post-Hospital Follow-up Traditional Chinese Medicine Treatment

- Medical Aids

- 10 days of Companion Accommodation Benefit

Not all shield plan offers special benefits. The only ones I know are the NTUC Income Enhanced IncomeShield and Singlife Shield plans.

So do check them out and see if it’s what you need.

Here’s what’s also covered:

For me, I added the Elite A rider to my plan so that 5% is for all eligible bills.

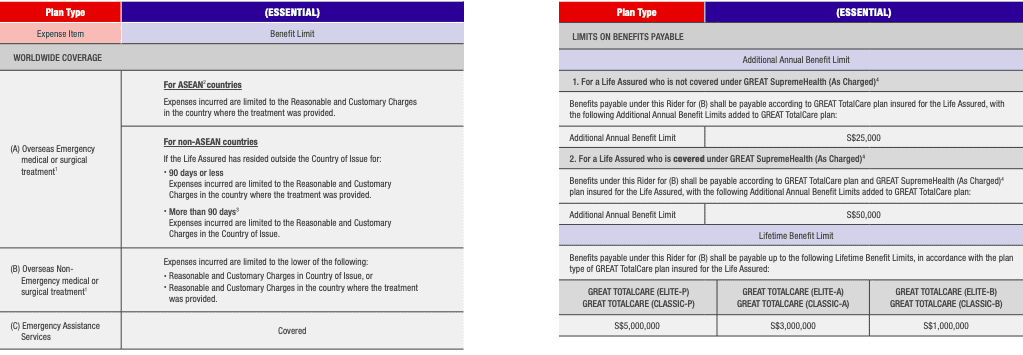

GREAT TotalCare Plus

When you add the GREAT TotalCare Plus rider, you’ll have access to top-notch medical facilities anywhere in the world and an additional annual claim limit of up to $50,000.

How to make claims from Great Eastern?

Fortunately for you, the hospital will automatically submit the claims for you – just like any other insurer.

For foreigners, overseas bills, and pre- and post-hospitalisation bills, you’ll need to submit the claim online directly on Great Eastern’s website.

However, I believe that your financial advisor should help you with these claims, so just engage whoever you bought your policy from and ask them for their help.

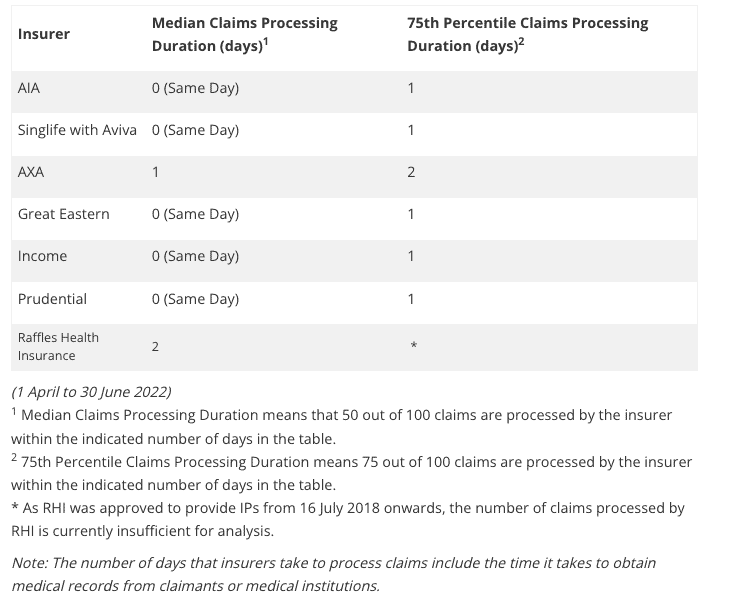

GREAT SupremeHealth Claims Duration

According to MOH, Great Eastern processes your claims within the same day, with its 75th percentile at 1 day.

This is fast and on par with most insurers. Customer reviews on Seedly are also pretty positive, so you don’t have much to worry about.