PRUActive Life II is a life insurance policy that allows you to choose a commitment term of between 5 to 35 years.

A plus point about this policy is the variety of benefits you can include in your policy, enhancing your protection in customisable ways.

Here’s our review of Prudential’s PRUActive Life II.

My Review of Prudential’s PRUActive Life II

Overall, Prudential’s PRUActive Life II seems like a comprehensive policy that covers some of the most common risks – critical illness, terminal illness, and total permanent disability.

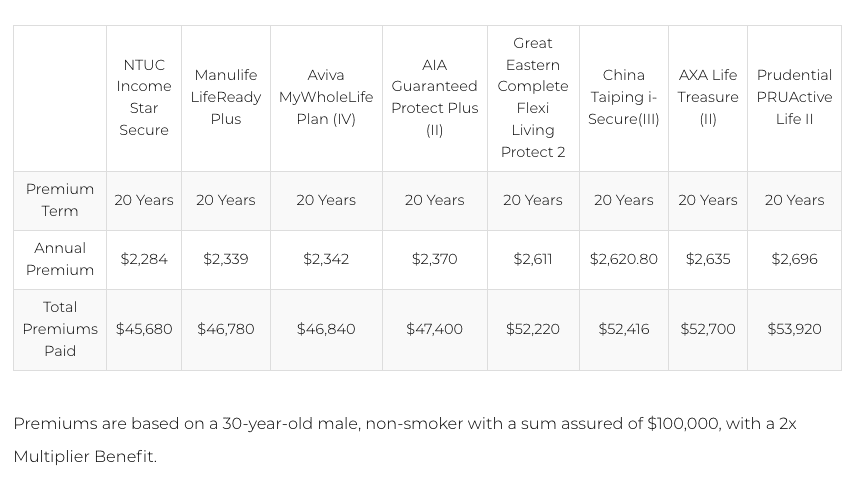

In terms of premiums, the PRUActive Life II is one of the most expensive whole life plans in the market.

The CI coverage is also the lowest available in the market.

| NTUC Income Star Secure | Manulife LifeReady Plus II | Aviva MyWholeLife Plan (IV) | AIA Guaranteed Protect Plus (III) | Great Eastern Complete Flexi Living Protect 2 | China Taiping i-Secure (II) | AXA Life Treasure (II) | Prudential PRUActive Life II | |

| Early Critical Illness | 142 | 125 | 72 | 150 | 35 | 42 | 41 | 74 |

| Intermediate Critical Illness | 33 | 40 | 37 | |||||

| AdvancedCritical Illness | 59 | 52 | 55 | 56 | ||||

| Total CI Conditions | 142 | 125 | 131 | 150 | 120 | 137 | 134 | 74 |

|

Additional Coverage |

||||||||

| Special Benefits (Diabetic Complications, Osteoporosis, etc) | 15 | 10 | 16 | 15 | 10 | 12 | 14 | – |

| Juvenile Benefits (Kawasaki Disease, Severe Hemophilia, etc) | 15 | 12 | 11 | – | 16 | 12 | 14 | – |

| Total additional coverage | 30 | 22 | 27 | 15 | 10+16+5(Senior Conditions)= 31 | 24 | 28 | 0 |

| Total Conditions Covered | 172 | 147 | 158 | 165 | 151 | 161 | 162 | 74 |

If having this coverage does not provide enough assurance for you, there are a variety of added benefits and riders you can further consider for different stages of your life.

However, do take a close read to the terms and conditions to better understand specific exclusions to claims and benefits.

This policy might be suitable for you if you like the different multiplier expiry options and also looking to have a high surrender value. It’s currently only third to China Life Multiplier Guardian and NTUC Income’s Star Secure Pro.

However, relative to other whole life plans in Singapore, in my opinion, there are much better options when you consider price, features, and coverage.

For instance, the Manulife LifeReady Plus II is the best whole life plan if you’re looking for retirement income or a plan that gives you the highest overall returns.

HSBC Life’s – Life Treasure II is great for severe disability coverage and critical illness coverage, while the NTUC Income’s Star Secure Pro is the best overall whole life plan, the cheapest whole life plan, and the most comprehensive whole life plan for critical illness coverage.

Not saying that the PRUActive Life II is bad – it’s the only policy in the market that offers 1X to 5X multipliers with 4 different expiry ages.

It’s just that if you compare with other policies, some might consider ECI/CI coverage more important while others might want the higher potential returns.

It’s all about your needs, preferences, current life stage, and future financial goals.

With so many nuances to consider for each individual, there’s no way to determine if something is good for you just by reading a review of the PRUActive Life II.

Thus, I suggest starting your research by reading our comparison of the best whole life insurance plan in Singapore to get an understanding of your alternatives first.

Then, consider getting a second opinion from an unbiased financial advisor to understand if the PRUActive Life II is the best option for you or if there might be better ones that suit your needs better.

Remember, a whole life insurance policy requires a long-term commitment of 20 to 30 years, so take your time to explore your options so that you don’t make financial decisions you might regret in the near future.

If you need someone to assist you with this, we partner with MAS-licensed financial advisors who are more than happy to help.

Click here for a non-obligatory chat.

Now let’s dive deeper into the Prudential PRUActive Life’s features.

Criteria

- Minimum premium payment term of 5 to 35 years

Basic Product Features

Coverage

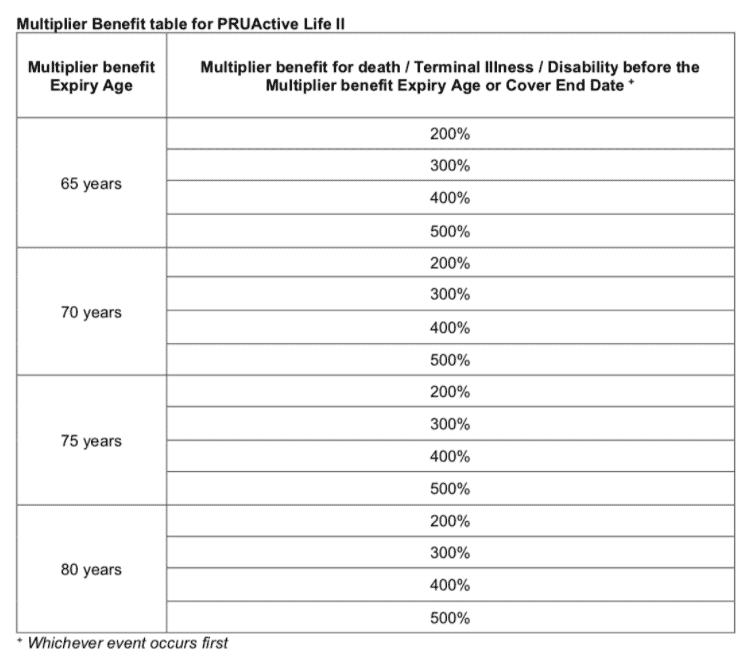

Before you know what types of coverage PRUActive Life II offers, one of its main features is the life benefit multiplier.

The life benefit multiplier will allow you to boost your coverage against death, terminal illness, total and permanent disability, and critical illness at different stages of life.

The percentage of coverage will be determined by your preference and should be declared at the commencement of your policy date.

The following reflects the different multiplier amounts you can opt for:

Death

There are 2 occurrences that can happen in the case of death:

| Occurrence | Payout |

| The policyholder has added the multiplier benefit prior or dies before the selected multiplier benefit expiry age | Higher of:

|

| The policyholder did not add the multiplier benefit or has passed away above the multiplier benefit expiry age | Sum assured as reflected in the certificate of death assurance, including any bonuses added. |

Do note that the sum assured for death benefit will only be paid in full in the following circumstances:

- If the policyholder has not made a prior claim for Accelerated Terminal Illness, Accelerated Disability, Crisis Care, or Early Crisis Care Benefit.

- If the death was not due to suicide within a year from the commencement of the policy

- If the policyholder did not die directly or indirectly from a special term or condition declared in the certificate of life assurance

After a claim is being made for death coverage and the payout has been completed, the whole policy will automatically end.

Accelerated Terminal Illness

A terminal illness will be defined as a condition that will most possibly lead to death within a year, as advised by a doctor – whose opinion will be subjected to approval by Prudential. Where required, a medical examination may be carried out for the company’s certification.

In this case, the policyholder will receive:

| Occurrence | Payout |

| The policyholder has added the multiplier benefit prior or dies before the selected multiplier benefit expiry age | Higher of:

|

| The policyholder did not add the multiplier benefit or has been diagnosed above the multiplier benefit expiry age | Sum assured as reflected in the certificate of terminal illness assurance, including any bonuses added. |

Should the Terminal Illness benefit be lower than the sum assured of the death benefit, the bonuses will be pro-rated to the sum assured for the former.

Again, there are certain terms that must be adhered to:

- The symptoms should not have existed during the commencement of this policy

- The terminal illness should not have been caused by: self-inflicted injuries, AIDS-related infection by HIV (with exception of blood transfusion), using unprescribed drugs, or any special exclusions stated in the certificate of life assurance prior.

Once the Accelerated Terminal Illness claim has been claimed, the benefit will end.

Accelerated Disability Benefit

This benefit protects against total and permanent disability, as long as the policyholder is below 70 years old.

There are different categories of definitions for the accelerated disability benefit, as according to the age of the life assured:

| Age of life assured | Circumstance |

| 28 days to 15 years old | When life assured requires constant care and medical attention for at least 6 months |

| 16 to 65 years old | Unable to work for income

Total and permanent loss of:

|

| 66 years old to end of the cover date | Total and permanent loss of:

Inability to perform three and above of any following daily living activities: washing, dressing, feeding, toileting, mobility and transferring |

In the case where the multiplier benefit has been added:

| Age of Life Assured During Date of Disability | Payout |

| Below 1 year old | 20% of multiplier benefit |

| 1 year old to before the end of the cover date | The higher of:

This amount will only be paid out six months after the confirmation of a total and permanent disability unless the life assured has a total loss of sight in one or both eyes, or physical loss in one or both limbs. |

If the multiplier benefit was not added, the sum assured for Accelerated Disability – as reflected in the certificate of life assurance – will be paid.

Do note that the Accelerated Disability benefit is capped at $2 million. With anything above this amount, Prudential will pay the balance either when the life assured dies, or a year from the date of the first lump sum payment.

Surrender Benefit

The surrender benefit allows policyholders to receive their guaranteed surrender value, alongside the non-guaranteed surrender value – if the policy’s premium has been paid for at least 3 years.

In the case that the policyholder terminates the policy before the stipulated commitment date, the surrender value might be either none at all or less than the total premiums paid.

Other Features and Benefits

Besides these basic benefits, there are also other features of PRUActive Life II that you can consider, should you face any changes in life events:

Purchasing another policy for a loved one

You can choose to purchase another whole life, endowment, or term policy for a loved one, should there be any changes in life events and there is someone else the policyholder would like to assure (e.g. a newly-adopted child, a newborn, child entering primary school, etc.).

This is only allowed, however, if the new life assured is below 50 years old.

Loans

Some loans that PRUActive Life II offers are automatic premium loans, policy loans, and surgical and nursing loans.

Automatic Premium Loan

This allows for Prudential to deduct any outstanding premiums from the policy value when premiums are due – this ensures that the policyholder can prevent a case of policy lapse, should he be unable to pay during the stipulated term.

Policy Loan

With this loan, Prudential can use the cash value of your life insurance policy as collateral. However, this carries the danger of having your money withdrawn from the death benefit, should you be unable to repay this loan.

Currently, it has an interest rate of 5.75% per year, which might vary accordingly to notice by Prudential.

Surgical and Nursing loan

Something unique about the PRUActive Life II is perhaps its Surgical and Nursing loan, which is an interest-free loan that allows you to pay for your medical bills first – with the exception of dental treatments, cosmetic surgeries, pregnancies, and AIDS conditions.

While there are a couple of loans here that PRUActive Life II offers, do note that these do come with consequences. It is not desirable if the value of your policy depletes just because you were unable to repay them punctually.

Kinship Booster Benefit

The kinship booster benefits will add an additional 10% benefit to your basic death assured sum when an immediate family member purchases PRUActive Life II as well.

Once again, there are some terms to this benefit:

- When your immediate family purchases this policy, you must be below 55 years of age.

- No claims have been made on your policy yet.

- The booster benefit does not apply to multiplier benefit and does not have any surrender value.

Premium Defer Benefit

This benefit allows you to postpone paying premiums for 2 years if the surrender value of the policy is at least 100% of 2 years’ premiums.

During the 2 years (or remaining premium term), an interest-free policy loan will be provided by PRUActive Life II instead so your surrender value will not be affected. Do note that interest will, however, be charged after the deferment period.

Add-on riders

Crisis Care Benefit

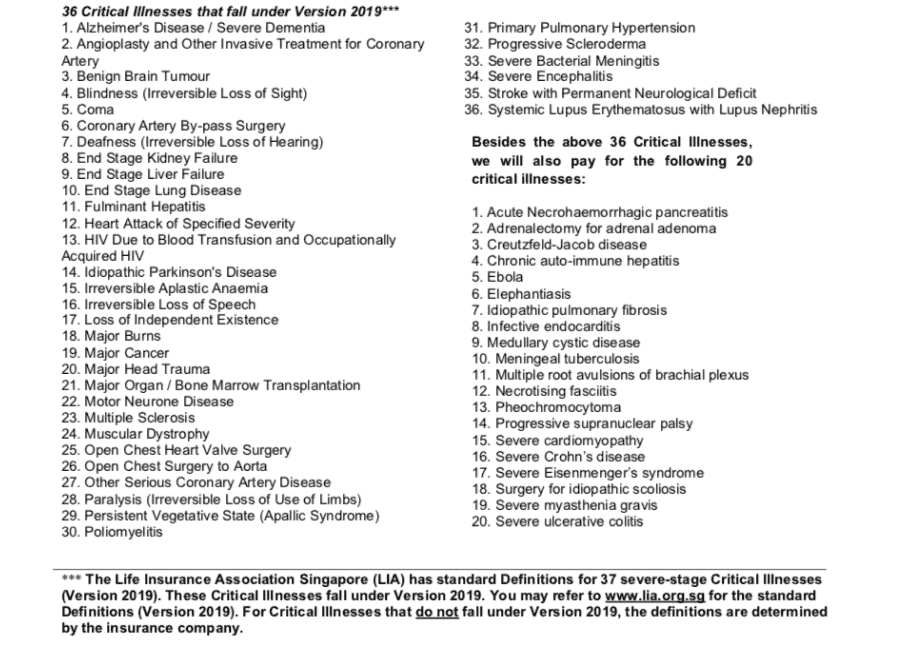

This benefit provides critical illness coverage and protects you from any of the following 56 Critical Illnesses:

In this case, the policyholder will receive:

| Occurrence | Payout |

| The policyholder has added the multiplier benefit prior or dies before the selected multiplier benefit expiry age | Higher of:

|

| The policyholder did not add the multiplier benefit or has been diagnosed above the multiplier benefit expiry age | Sum assured as reflected in the certificate of Crisis Care assurance, including any bonuses added. |

Should the policyholder undergo invasive treatment for coronary artery, Prudential will pay 10% of the multiplier benefit if it is before the multiplier benefit expiry age, and 10% of sum assured of Crisis Care benefit if it is after the multiplier benefit expiry age.

Either way, the maximum receivable amount is $25,000 – with the total payout being reduced from sums assured from death, accelerated disability, accelerated terminal illness, and crisis care.

Crisis Care Accelerator Benefit

The crisis care accelerator benefit takes into consideration the same 56 medical conditions for Crisis Care. In this case, PruActive Life II will pay 50% from the Crisis Care benefit should the life assured:

- Undergone surgery due to an illness or accident for the heart, lung, brain, kidney, or liver

- Is admitted for a minimum of 3 days in the Intensive Care Unit due to a surgery

For each policy, only one claim is allowed – and only up to $100,000. However, there is a list of terms which the policyholder must abide by as well – for example, the surgery cannot be potentially foreseen circumstances such as organ donations, for research purposes, self-inflicted injuries, sex-change operations, misuse of drugs or alcohol, etc.

To better understand the full list of exclusions for this benefit, it will be helpful to read the full clause as provided by PruActive Life II.

Once the claim has been made, the Crisis Care benefit will continue with the remaining sum assured.

Due to the existing conditions, the sum assured for death, accelerated terminal illness, and accelerated disability benefits will all be reduced as well.

Early Crisis Care Benefit

The Early Crisis Care benefit provides coverage for early to intermediate critical illnesses and special benefits such as the Juvenile Medical Conditions.

Unfortunately, we are unable to find the table of early critical illnesses that they cover under this benefit.

Bonus features

PRUActive Life II offers guaranteed and non-guaranteed benefits. The guaranteed benefits ensure that policyholders receive a certain amount regardless of how the fund performs. On the other hand, non-guaranteed benefits come as 2 different types of bonuses.

Reversionary bonuses

This bonus will be added to the policy annually at the start of the year after the policy has entered its second year.

For illustration purposes, the reversionary bonus will offer $7.30 per $1,000 sum assured and $16.40 per $1,000 on accumulated reversionary bonuses. The difference between this reversionary bonus and the performance bonus lies wherein the former is cumulative while the latter is not.

Performance bonus

The performance bonus is a one-off occurrence that will be paid during the surrender of policy or when any claims are made for basic benefits.

These bonuses come from a percentage of the accumulated reversionary bonus, and will be reviewed annually.

Participating fund performance

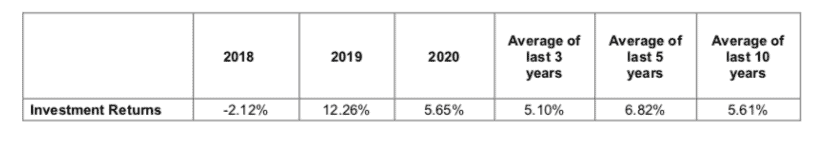

PRUActive Life II’s participating funds include a couple of sub-funds that are managed separately. To get a better idea of how the rate of returns has been like in the past years for regular premium life sub-funds, take a look at the table below:

Geometric Average

The Geometric Average will be more suitable and accurate in calculating profits for investment portfolios such as that of participating funds.

Instead of just taking the average rate of return, the geometric average takes into account compounding and returns and losses, which has a part to play in the amount reinvested in the following years.

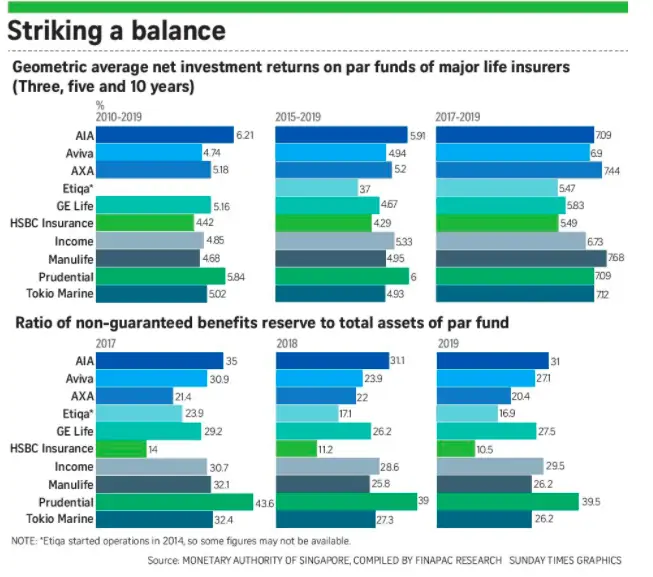

As seen above, Prudential has consistently achieved the top 3 positions over the years as compared to other insurers in Singapore.

Expense Ratio

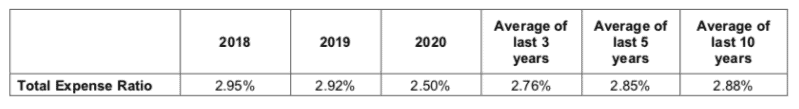

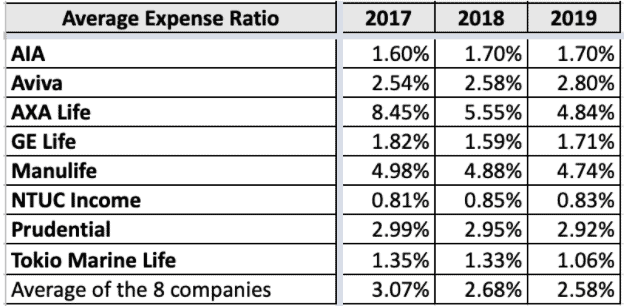

There are also total expenses incurred by the participating funds – costs such as investment, management, distribution, taxation, etc. are factored into the total premiums which you will be paying for your policy. This is important as the total expense ratio might vary from year to year, which will affect your proportion of non-guaranteed benefits.

Although performing at the top 3 positions based on geometric average, Prudential is also in the top 3 highest average expense ratios in the past 3 years.

The expense ratio is one of the important factors to take note of as it can significantly affect the final profits generated for the participating fund.

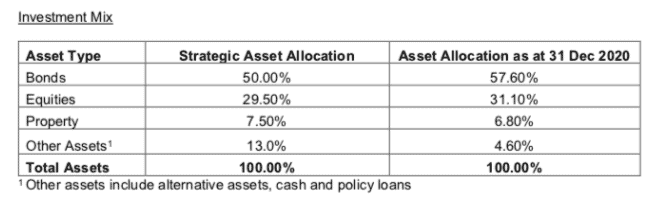

In order to maximise long-term returns for policyholders, PRUActive Life II manages its funds with a balanced mix as shown below:

*However, do note that these figures shown above might not be indicative of future performances.

For greater peace of mind, Prudential will keep you updated on the performance of your plans each year so you can better understand its future outlook, bonuses you will receive that year, and any potential changes in your future bonuses.