When you’re exploring the world of life insurance, one term you might frequently encounter is “participating funds.”

These funds are crucial to many life insurance policies, and understanding them can significantly impact your financial planning.

Let’s delve into what participating funds are and why they matter to you as a policyholder.

What Are Participating Funds and How Does it Work?

Participating funds, often referred to as “par funds,” are investment pools managed by life insurance companies.

When you buy a participating life insurance policy, a portion of your premiums goes into these funds.

These funds are more than just a savings component; they are a dynamic investment mechanism that can significantly impact the value of your policy.

Here’s a closer look at how participating funds work:

Premium Allocation and Investment

Each premium payment you make is not solely for insurance coverage; a significant portion is channelled into the participating fund managed by the insurer.

This allocation is crucial as it directly influences your policy’s potential growth and returns.

The participating fund acts as a collective investment, pooling the premiums of numerous policyholders.

This pool of funds is then strategically invested by the insurer with the aim of generating returns over time.

Insurers invest in a wide array of assets to strike a balance between risk and potential returns.

This diversification is a critical aspect of the fund’s investment strategy, designed to optimise returns while mitigating risks associated with market volatility.

A significant portion of the fund is usually invested in government and corporate bonds.

These fixed-income securities offer stable returns and act as a buffer against the volatility of the equity markets.

Bonds are generally considered lower-risk investments and provide a steady income stream to the fund, contributing to the stability of the policyholder’s returns.

Equities or stocks form another vital component of the fund’s portfolio.

Investing in equities offers the potential for higher returns, especially in a growing economy.

However, equities are subject to market fluctuations, which can introduce a higher level of risk.

By balancing this with more stable investments like bonds, insurers aim to harness the growth potential of equities while cushioning the impact of market downturns.

The unique aspect of this arrangement is that you, as a policyholder, indirectly become a participant in these investments, which can range from conservative to moderately aggressive, depending on the participating fund’s investment objectives.

Sharing in Profits of Participating Funds

As a policyholder of a participating life insurance policy, one of the most significant advantages you have is the opportunity to share in the fund’s profits.

This profit-sharing aspect is a key feature that differentiates participating policies from non-participating ones.

Essentially, when the fund performs well, generating returns above the projected benchmarks, you stand to benefit from this positive performance.

However, it’s crucial to understand that these profits are not guaranteed.

The performance of the participating fund is subject to various market risks and economic conditions.

Therefore, the profits you share in will vary depending on how well the fund performs in a given period. In years when the fund’s investments yield high returns, the profits shared with policyholders are likely to be higher.

Conversely, in years of poor market performance, the shared profits might be lower, or in some cases, there might be no profit distribution at all.

This variability is an inherent aspect of participating funds and something you should be mindful of when considering such policies.

Types of Bonuses in Participating Policies

The mechanism through which profits are typically shared with policyholders in participating policies is through bonuses.

These bonuses are additional amounts credited to your policy, enhancing its value over time.

There are primarily 2 types of bonuses that you might encounter: reversionary bonuses and terminal bonuses.

- Reversionary Bonuses: These bonuses are added to your policy on an annual basis, and once declared, they are usually guaranteed. Reversionary bonuses are a way of distributing the fund’s profits to the policyholders incrementally over the policy’s life. The key characteristic of these bonuses is that they compound over time, as each year’s bonus adds to the previous years’ accumulated bonuses. They are paid out along with the death benefit or the maturity amount, thereby increasing the total payout from the policy.

- Terminal Bonuses: In addition to reversionary bonuses, you might also receive terminal bonuses. These are additional sums paid out at the end of the policy term or upon the death of the insured. Unlike reversionary bonuses, terminal bonuses are not guaranteed and are paid at the discretion of the insurer, based on the fund’s performance. They are typically declared in years when the fund’s performance exceeds expectations and are intended as a final additional payout to the policyholder.

Risk Management in Participating Funds

The management of risk in participating funds is a critical aspect that insurers handle with a high degree of prudence.

Given the long-term nature of life insurance policies, insurers typically adopt a conservative approach to managing these funds.

This conservative management style is designed to prioritise steady, long-term growth over potentially riskier short-term gains.

The rationale behind this approach is twofold: firstly, it aligns with the fundamental nature of life insurance, which is a long-term commitment, and secondly, it seeks to protect the interests of policyholders by ensuring a more stable and predictable growth trajectory for the fund.

Insurers achieve this by carefully selecting a mix of investments that can offer stable returns while minimising the risk of significant losses.

This often involves a diversified portfolio that spreads risk across various asset classes and investment types.

The conservative management of participating funds is particularly important because the returns from these funds directly impact the bonuses and benefits that policyholders receive.

Therefore, insurers are not just managing investments but also safeguarding their policyholders’ financial security.

Tracking Fund Performance

For policyholders, keeping track of the performance of their participating fund is an essential part of managing their life insurance investment.

Regular tracking allows you to gauge how well your investment performs and understand the potential impact on your policy benefits.

Most insurers provide regular reports and updates on fund performance, offering transparency and insights into how the fund is managed and faring in the current economic climate.

These reports typically include information on the fund’s asset allocation, returns generated, and any changes in investment strategy.

They might also provide a comparison with benchmark indices or similar funds, giving you a context for evaluating the fund’s performance.

By regularly reviewing these reports, you can stay informed about the health of your investment and make more educated decisions regarding your policy.

For instance, if you notice a consistent underperformance, it might prompt you to discuss your concerns with your insurer or seek advice from a financial advisor.

Types of Participating Insurance Policies

When delving into the realm of life insurance, you’ll encounter various types of participating policies.

Each type caters to different financial goals and coverage needs. Understanding these can help you choose the most suitable policy for your unique situation.

Whole Life Participating Policies

- Lifelong Coverage: Whole life participating policies provide coverage for your entire life. They are designed to offer a combination of life protection and savings.

- Accumulation of Cash Value: These policies typically accumulate cash value over time, which can be borrowed against or withdrawn under certain conditions.

Endowment Participating Policies

- Savings and Protection: Endowment policies are a blend of savings and life insurance. They are ideal if you’re aiming for a financial goal at a specific time, like funding education or retirement.

- Fixed Term: These policies have a fixed term, and you receive a lump sum at the end of the policy period, which includes any bonuses accrued.

- Types of Endowment: Endowment policies also come in 2 types – either as a savings plan or a retirement annuity plan. The latter gives you payouts over X years once you reach retirement age.

In summary, participating policies come in various forms, each with its unique features and benefits.

Whether you’re looking for lifelong coverage, a disciplined savings mechanism, or a policy for retirement, there’s a participating policy out there to meet your needs.

It’s also important to note that a life insurer can have multiple participating funds with different goals.

So ensure you get a policy that aligns with your financial goals, risk tolerance, and premium payment capacity.

Guaranteed vs. Non-Guaranteed Returns

In the landscape of participating life insurance policies, understanding the difference between guaranteed and non-guaranteed returns is crucial.

This knowledge will help you set realistic expectations and plan your finances more effectively.

Understanding Guaranteed Returns

- Fixed Benefits: Guaranteed returns refer to the benefits that the insurance company promises to pay, regardless of the fund’s actual returns. These are outlined in your policy document and include a portion of the death benefit and maturity value.

- Safety Net: These returns provide a safety net, ensuring that you receive a minimum benefit from your policy. It’s particularly reassuring during times of economic downturn or poor fund performance.

- Lower but Stable: While guaranteed returns are typically lower than potential non-guaranteed returns, they offer stability and predictability, which is essential for long-term financial planning.

The Role of Non-Guaranteed Returns

- Dependent on Investment Performance: Non-guaranteed returns, such as bonuses or dividends, depend on the investment performance of the participating fund. They can fluctuate based on market conditions and the fund’s management.

- Potential for Higher Returns: These returns have the potential to significantly increase the value of your policy. In good economic times, they can substantially boost the death benefit and maturity value.

- Variable and Uncertain: It’s important to remember that non-guaranteed returns are not assured. They can vary from year to year, and in some cases, may not be paid at all.

Balancing Expectations

- Read the Illustrations Carefully: Policy illustrations usually show different scenarios of how your policy might perform with various illustration rates. It’s important to read these illustrations carefully to understand the range of possible outcomes.

- Consider Economic Conditions: Keep in mind that economic conditions play a significant role in the actual returns of participating funds. A robust economy might boost non-guaranteed returns, while a recession could reduce them.

- Long-term Perspective: When considering participating policies, adopt a long-term perspective. Over time, the ups and downs of market conditions tend to balance out, potentially leading to favourable overall returns. The life insurance company knows this, and smooths out your actual investment returns – which just means that they average out your returns.

The blend of guaranteed and non-guaranteed returns in participating policies offers a mix of stability and growth potential.

Understanding this balance is key to making informed decisions about your life insurance investment.

Remember, while non-guaranteed returns can be enticing, it’s the guaranteed portion that forms the backbone of your policy’s benefits.

Participating Fund Performance Comparison

When considering participating life insurance policies, it’s beneficial to conduct a comparative analysis of different funds.

This analysis can help you understand how various funds stack up against each other in terms of features, performance, and suitability for your financial goals.

Using Investment Moat’s compilation of the insurer’s participating fund returns, I’ve also added the latest data in the table below:

| Insurer | AIA | Etiqa | Great Eastern | HSBC Life | Manulife | NTUC Income | Prudential | Singlife | Tokio Marine |

|---|---|---|---|---|---|---|---|---|---|

| Average Returns | 4.10% | 4.31% | 4.34% | 3.06% | 4.90% | 4.64% | 4.26% | 3.83% | 4.69% |

| 2005 | - | - | - | 5.01% | 3.53% | 6.80% | - | 3.25% | 13.23% |

| 2006 | - | - | 8.39% | 10.01% | 15.44% | 10.00% | 13.80% | 11.67% | 15.50% |

| 2007 | 9.29% | - | 10.95% | 5.82% | 10.69% | 10.70% | 8.80% | 7.36% | 12.30% |

| 2008 | -11.20% | - | -11.27% | -7.92% | -8.71% | -11.10% | -23.90% | -9.44% | -17.13% |

| 2009 | 13.10% | - | 9.52% | 4.11% | 16.65% | 12.00% | 23.40% | 12.31% | 20.05% |

| 2010 | 7.20% | - | 6.58% | 4.62% | 7.32% | 5.90% | 7.20% | 6.63% | 6.68% |

| 2011 | 2.50% | - | 1.54% | 4.15% | -0.94% | -0.88% | 0.20% | 1.30% | -0.72% |

| 2012 | 9.80% | - | 9.76% | 9.98% | 10.65% | 8.56% | 11.00% | 9.35% | 10.57% |

| 2013 | 1.00% | - | 3.62% | -3.24% | -0.92% | 1.63% | 5.20% | 0.19% | 2.35% |

| 2014 | 6.50% | - | 7.08% | 7.42% | 5.15% | 5.45% | 5.90% | 5.42% | 6.41% |

| 2015 | 1.40% | -0.20% | 2.24% | -2.10% | -3.00% | 1.79% | 0.20% | -0.53% | -0.15% |

| 2016 | 4.90% | 3.97% | 3.81% | 6.00% | 4.82% | 4.49% | 8.32% | 3.45% | 3.49% |

| 2017 | 10.50% | 10.99% | 9.63% | 11.70% | 12.70% | 9.04% | 10.63% | 12.59% | 10.55% |

| 2018 | -0.50% | -3.32% | -1.24% | -0.10% | -1.20% | 0.82% | -2.12% | -3.79% | -2.51% |

| 2019 | 9.50% | 10.84% | 11.02% | 10.72% | 11.90% | 9.59% | 12.26% | 13.35% | 13.05% |

| 2020 | 8.90% | 3.56% | 8.41% | 10.18% | 8.57% | 9.14% | 9.36% | 8.00% | 9.69% |

| 2021 | 1.90% | - | 1.62% | -7.24% | 3.09% | 0.54% | 0.49% | 1.50% | -4.92% |

| 2022 | -9.20% | - | -7.91% | -14.07% | -7.47% | -0.87% | -18.24% | -13.60% | -13.94% |

From the table, you can quickly derive which insurer has the best-performing and worst-performing participating fund.

Manulife is ranked #1, Tokio Marine #2, while NTUC Income is #3. The insurer with the lowest average returns is HSBC Life.

However, the issue is that – (1) we don’t have data for all years equally for all insurers, and (2) this is just the average returns.

To get a clearer and more fair returns calculation, I’ve also calculated the geometric average returns for each of the major life insurers:

| Insurer | Geometric Mean | 3-Year Geometric Mean (2020-2022) | 5-Year Geometric Mean (2018-2022) | 10-Year Geometric Mean (2013-2022) | 15-Year Geometric Mean (2008-2022) |

|---|---|---|---|---|---|

| AIA | 3.88% | 0.25% | 1.88% | 3.33% | 3.53% |

| Etiqa | 4.17% | - | - | - | - |

| Great Eastern | 4.14% | 0.48% | 2.15% | 3.69% | 3.43% |

| HSBC Life | 2.80% | -4.24% | -0.58% | 1.59% | 1.99% |

| Manulife | 4.65% | 1.17% | 2.74% | 3.17% | 3.65% |

| NTUC Income | 4.49% | 2.84% | 3.74% | 4.09% | 3.58% |

| Prudential | 3.62% | -3.50% | -0.26% | 2.82% | 2.64% |

| Singlife | 3.57% | -1.79% | 0.65% | 2.37% | 2.82% |

| Tokio Marine | 4.22% | -3.54% | -0.22% | 2.10% | 2.43% |

In this table, I did 5 different calculations – the geometric average (annualised returns) for the entire period with data available, 3-year returns, 5-year returns, 10-year returns, and 15-year returns.

These tell you a slightly different story instead.

Looking at annualised returns across years with data – Manulife is first, NTUC Income is second, and Tokio Marine is now third. The last position is still HSBC Life.

But it’s not really a fair comparison as we don’t have the complete picture, so it’s better to take based on selected years where all information is available.

The 3, 5, 10, and 15-year annualised returns also show how well these insurers perform in specific periods – giving you a better understanding of past performance and a benchmark when comparing insurers.

However, with this data, you can now make more accurate projections of how much your returns will be years later.

This is why I emphasise that if you’re looking at participating policies, only focus on the guaranteed returns as a way of prudent planning.

Financial advisors will tend to take the average of the lowest + highest illustrated returns to give you a rough gauge of how much you’ll receive.

But if you look at the performance of the investment funds, especially at the 10-year and 15-year annualised returns (since most par plans are long-term), most insurers are unable to meet the 3% illustrated returns.

So even if you take the lowest illustrated returns as a way of prudent financial planning, you might get even less than 3% per annum.

And if you’ve made your financial plans based on this number, you’ll get much less than what you’ve planned.

In fact, our partnered financial advisors – Xavier, Claudia, and Jordan – have encountered many policies that brought in returns below 3% upon maturity.

As a result, these individuals (most of whom are readers like yourself) have no choice but to find ways to supplement the gap, and there’s nothing they can do about it.

Because it’s the non-guaranteed portion.

Expense Ratios

It won’t be a complete comparison of par plans if I don’t talk about expense ratios.

Total Expense Ratios (TER) are a crucial aspect to consider when evaluating participating life insurance policies.

The TER represents the total costs of managing and operating an insurance fund, expressed as a percentage of the fund’s assets.

These costs include management fees, administrative expenses, and, importantly, distribution costs.

Distribution costs, a key component of the TER, refer to the expenses incurred in marketing and distributing the insurance product.

This includes commissions paid to agents or brokers, marketing and advertising expenses, and other costs related to the sale and distribution of the policy.

These costs can significantly impact the overall expense ratio, influencing the fund’s net returns and, consequently, your benefits.

| Insurer | AIA | Etiqa | Great Eastern | HSBC Life | Manulife | NTUC Income | Prudential | Singlife | Tokio Marine | Industry Average |

|---|---|---|---|---|---|---|---|---|---|---|

| Average Expense Ratio | 1.54% | 6.56% | 1.68% | 4.44% | 3.99% | 0.90% | 2.78% | 2.64% | 0.95% | 2.83% |

| 2016 | 1.70% | - | - | - | - | - | - | - | - | 1.70% |

| 2017 | 1.60% | 5.32% | 1.82% | 8.45% | 4.98% | 0.81% | 2.99% | 2.54% | 1.35% | 3.32% |

| 2018 | 1.70% | 8.07% | 1.59% | 5.55% | 4.88% | 0.85% | 2.95% | 2.58% | 1.33% | 3.28% |

| 2019 | 1.70% | 7.46% | 1.71% | 4.84% | 4.74% | 0.83% | 2.92% | 2.80% | 1.06% | 3.12% |

| 2020 | 1.50% | 5.40% | 1.20% | 3.72% | 3.67% | 0.82% | 2.50% | - | 0.74% | 2.44% |

| 2021 | 1.40% | - | 2.02% | 2.20% | 3.30% | 1.01% | 2.67% | - | 0.63% | 1.89% |

| 2022 | 1.20% | - | 1.74% | 1.88% | 2.35% | 1.07% | 2.65% | - | 0.58% | 1.64% |

In the above table, I’ve compiled the total expense ratios of all major insurers and averaged them out across the years.

As a policyholder, you should know that the higher the distribution costs, the more your insurer spends on acquiring new customers.

So this will cause the TER to increase, negatively impacting your returns.

However, you don’t have to think so much about this as the fund returns usually will have TER in its calculations – so even if TER is high, but if the returns are within illustrated rates, it’s fine.

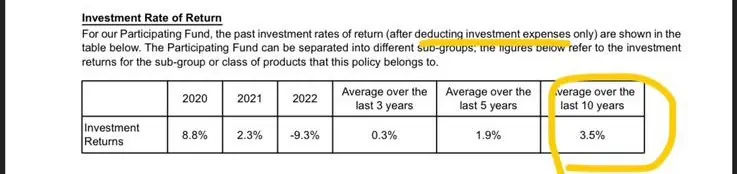

It’s only a major concern if the product summary says that the returns only include investment expenses – which is only a portion of the TER. In this case, chances are your actual returns will be lower than what’s displayed.

Our partner, Xavier, highlighted this in a product summary he saw recently:

Investment expenses are usually limited to the fund management fees and any sales charges involved. These are the costs it will take to produce the returns on those funds.

The issue with this is that the distribution costs tend to be the major cost in most TER, so you’re not seeing the actual returns on the fund.

I won’t be naming the insurer as any insurance company can do this – so take note of small details like these when you’re evaluating any policy.

Now, one last concern we have to answer before I end this post:

What is the Difference Between a Participating and Non-Participating Life Insurance Policy?

The difference between a participating and non-participating life insurance policy lies in profit sharing. Participating policies allow policyholders to share in the insurer’s profits through bonuses, whereas non-participating policies do not offer this benefit and typically have fixed benefits without profit sharing.

Conclusion

Navigating the world of life insurance, particularly when it comes to understanding participating funds, requires a careful consideration of various factors.

Each aspect plays a pivotal role in shaping your policy’s overall value and suitability, from the allocation of premiums and the diverse investment portfolio to the management of risks and the array of policyholder benefits.

Whether you’re considering a participating or non-participating policy, it’s essential to weigh the potential returns against the costs, including total expense ratios and distribution costs, to ensure that your choice aligns with your long-term financial goals.

If you find yourself needing a second opinion on any policies or are seeking tailored financial advice, don’t hesitate to reach out to one of our partnered financial advisors.

Our experts are equipped with the knowledge and experience to guide you through the complexities of life insurance, helping you make informed decisions that best suit your financial needs.

Whether it’s understanding the nuances of participating funds or evaluating different insurance products, our advisors are here to assist you every step of the way.

Contact us today to schedule a free non-obligatory consultation.