Are you worried about the financial impact of an early critical illness diagnosis?

You’re not alone.

Many people in Singapore are concerned about how they would cover the costs of treatment and recovery if they were to fall seriously ill.

One way to protect yourself financially is with early critical illness insurance policy.

This type of insurance pays out a lump sum if you are diagnosed with a covered condition, which you can use to pay for medical bills, living expenses, or anything else you need.

But how much coverage do you actually need?

This article will explore the factors you should consider when deciding how much early critical illness cover to buy in Singapore.

With the right amount of coverage, you can have peace of mind knowing you’re financially prepared for any health challenges that come your way.

Keep reading.

What is the difference between an early critical illness plan and a critical illness plan?

In simple terms, an early critical illness plan covers early- to intermediate-stage critical illness conditions, while a critical illness plan covers late or advanced-stage critical illnesses.

An early critical illness (ECI) plan pays out a lump sum upon diagnosis of a covered illness, even if it is in its early and intermediate stages that may not require extensive medical treatment.

On the other hand, a critical illness (CI) plan typically requires that the illness meet certain severity criteria before a payout is made.

Additionally, early critical illness plans tend to cover a broader range of illnesses than traditional critical illness plans, including some illnesses that may not be life-threatening but can still significantly impact a person’s quality of life.

Both ECI and CI plans will pay you a lump sum amount should you be diagnosed with any of the conditions covered under the policy.

Is early critical illness insurance necessary in Singapore?

Early critical illness insurance is not necessary in Singapore but is highly recommended.

Early critical illness insurance is important in Singapore because it provides financial protection to individuals diagnosed with an early- or intermediate-stage critical illness.

ECI insurance allows policyholders to receive a lump sum payment upon diagnosis, which can help to cover medical expenses, loss of income, and other related costs. We covered more on what you can do with your ECI payouts here.

Getting treated for these critical illnesses early on also prevents your conditions from progressing into late-stage CIs, which has more serious implications for your health.

In the late stages, you’ll spend more on recovery and care. It might even be too late to cure in certain scenarios – like Stage 4 Cancer.

In Singapore, where healthcare costs are high, early critical illness insurance can provide you with peace of mind and financial security.

Additionally, with the rising incidence of critical illnesses such as cancer, heart disease, and stroke, this type of insurance can be crucial in ensuring you receive the best possible care and treatment.

However, I also have to caveat and say that, unlike other types of insurance, ECI coverage is usually the most expensive.

So it’s best to have it if you can afford it.

How much early critical illness coverage is recommended for me to get in Singapore?

The recommended amount of early critical illness coverage in Singapore is, on average, between 1X to 3X of your annual income.

This is because the total cost of ECI treatment, including medical treatment, ongoing care expenses, and providing for your dependents, will cost at least 1 to 3 years’ worth of your income.

For example, if your annual income is $50,000, you should consider getting early illness coverage between $50,000 to $150,000.

How to calculate my early critical illness coverage gap?

To calculate your early critical illness coverage gap in Singapore, you must first determine the amount of coverage you currently have for ECI.

This can include any insurance policies you have in place and any coverage provided by your employer.

Calculate how much liquid savings you have that can be used to pay for ECI treatment as part of the same calculation.

It is usually not recommended to do this as you will lose your savings, and you may have gaps in your other insurance coverage.

You can then compare this information with Singapore’s estimated cost of treatment for early critical illnesses.

Your recovery expenses may include medical treatment, hospitalisation, transportation, and home care for you and your dependents.

Based on the 2017 LIA study, this is, on average, up to 3X of your annual income.

Thus, the formula to calculate your critical illness coverage gap would be:

Current ECI coverage + savings (not recommended) – (Annual income X 3) = early critical illness coverage gap

A coverage gap exists if your current coverage is less than the estimated cost of treatment.

An alternative is to use annual expenses rather than annual income. However, annual expenses should be used by those with higher incomes and/or those who are thriftier.

Why? Getting 1X to 3X annual expenses makes more sense if your annual income is $200,000 and your expenses are only $100,000.

If you earn $200,000 and spend almost $200,000 annually, taking a multiple of your income might be safer.

A financial advisor or insurance agent can help you determine the best way to fill this gap, which may include purchasing additional critical illness insurance.

Considerations before deciding how much early critical illness insurance coverage you’ll need

It might not be necessary to top up your early critical illness coverage despite having gaps. The thing about LIA guidelines is that they are, well, guidelines. Just a rule of thumb.

It might be more or might be less, and this depends on a case-by-case basis.

There are other considerations to consider when deciding how much ECI coverage you need.

Are you diagnosed with any early critical illnesses?

Before deciding how much early critical illness insurance coverage you’ll need, it’s important to consider whether you have been diagnosed with any early critical illnesses.

If you have already been diagnosed with one of these illnesses, you may need more coverage than someone who has not.

It’s important to review your medical history and current health status to determine how much coverage is appropriate for your individual needs.

Keep in mind that some policies may exclude coverage for pre-existing ECI conditions, so it’s important to read the fine print and understand the terms of your policy before you sign up.

Are you diagnosed with any medical conditions?

One of the most important considerations before deciding how much early critical illness insurance coverage you’ll need is whether or not you have any pre-existing medical conditions.

If you have a history of medical issues, you’ll want to ensure that your policy covers whatever those conditions might lead to, and that you have enough coverage to pay for any potential medical expenses.

Note that pre-existing medical conditions, even if not an ECI, may lead to exclusions for certain ECI conditions.

For example, if you have high cholesterol, you are at a higher risk of getting a heart attack.

The insurer may then decline to cover you for any heart-related issues, include additional premiums, or may even outright reject your application.

There are times when you may be eligible for full coverage or reduced loading if your pre-existing medical condition has recovered (or not relapsed) after 1 to 2 years.

You won’t know what will happen in those 2 years, and your premiums will increase as you age, so it may not be worth waiting until then to buy an ECI plan.

If you have and manage to get it covered, it might be better to increase your coverage. Otherwise, a healthy person can consider opting for less coverage.

If you find yourself rejected due to any medical conditions or you might have an existing condition/ECI/CI, there are 2 plans in the market for you – Singlife Essential Critical Illness or Manulife Critical SelectCare.

Does your family have a history of early critical illness or critical illness?

Before deciding how much early critical illness insurance coverage you’ll need, you must consider whether your family has a history of early critical illness or critical illness.

If there is a history of these illnesses in your family, you may want to consider purchasing a higher level of coverage to ensure that you have adequate financial protection in case you are diagnosed with a critical illness.

This is because you may be at a higher risk of developing these illnesses yourself.

If your family history is relatively healthy, you might get away with opting for lower coverage.

Reviewing your family’s medical history and speaking with a healthcare professional to determine if you may be at higher risk for developing a critical illness is important.

How long do you want the early critical illness insurance coverage for?

When considering how much early critical illness insurance coverage you’ll need, it’s important to determine how long you want the coverage for.

Some policies may offer coverage for a specific period, such as 5 or 10 years, while others may offer coverage for up to a certain age – like 65, 70, and 75.

It’s important to consider factors such as your age, health, and financial situation when deciding on the duration of coverage.

If you’re younger and in good health, you may want coverage for a longer period of time, while if you’re older or have existing health concerns, you may want coverage for a shorter period of time.

This is because ECI premiums are much cheaper when you’re younger, and you are able to budget better due to lesser responsibilities.

When you get older, premiums get substantially more expensive. You’ll also have other obligations like mortgage payments and caring for your parents and children.

So it makes more sense to opt for a shorter period if finances are a constraint.

It’s also important to consider the cost of the coverage and how it fits into your overall financial plan.

Ultimately, the duration of coverage will depend on your individual needs and circumstances.

What do you want to be covered under your early critical illness insurance?

Before deciding how much early critical illness insurance coverage you’ll need, it’s important to consider what you want to be covered for.

Early critical illness insurance typically covers a range of illnesses across different stages of the 37 major critical illnesses.

So imagine the early-stage and intermediate stages of these 37 CIs – about 111 conditions in total.

Across insurers, the majority of these conditions are similar, but specific illnesses covered can vary depending on the insurance provider.

For example, unlike the 37 critical illnesses with a standard definition across all policies, early- and intermediate-stage critical illnesses do not.

This means each insurer, although technically covering the “same” condition, might have different definitions to qualify for a claim.

Some policies may offer optional coverage for additional illnesses or conditions, with the AIA Absolute Critical Cover covering an astonishing 187 conditions.

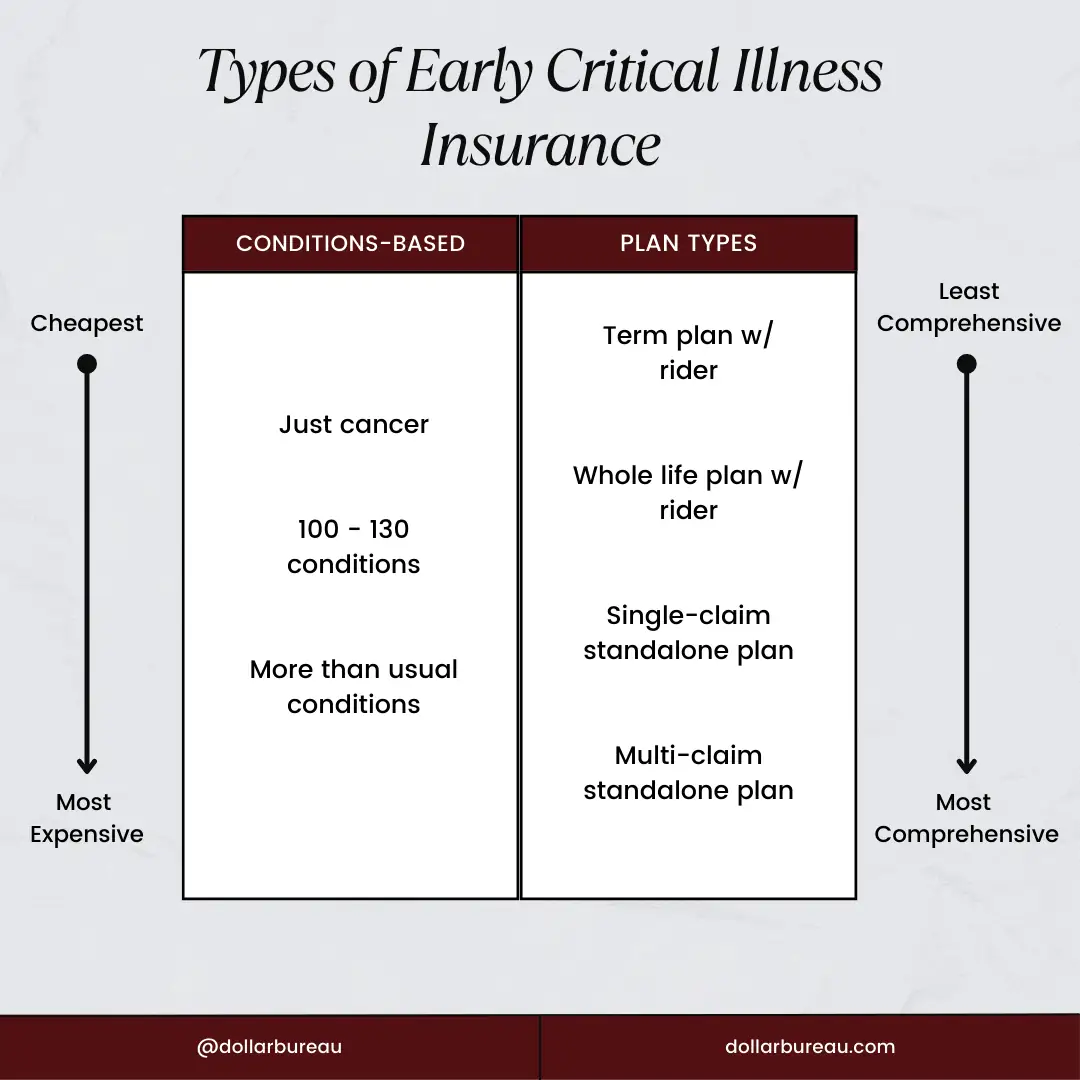

Most policies cover anywhere between 100 too 130 conditions, inclusive of ECI and CI. These are usually enough to cover most of the most common conditions.

Thus, reviewing the policy details carefully is important to ensure that the coverage meets your specific needs.

Do you want an early critical illness rider or a standalone plan?

When deciding how much early critical illness insurance coverage you’ll need, one important consideration is whether you want an early critical illness rider or a standalone plan.

An ECI rider is an add-on to a life insurance policy (such as a term life policy or a whole life policy) that provides coverage for specific illnesses.

Usually, term life insurance plans with ECI riders are cheaper than whole life insurance plans with ECI riders.

On the other hand, the standalone policy usually covers a wider range of illnesses.

A standalone plan can let you claim once – like the Manulife CI FlexiCare – or make multiple claims (AKA multiclaim or multipay policies) – like the Manulife CI FlexiCare with Cover Me Again Benefit or the Singlife Multipay Critical Illness.

Your individual circumstances and needs will determine whether you should choose a rider or a standalone plan.

As riders are added to your existing policy, they can be less expensive and more convenient. However, you may not be covered for all illnesses due to limited coverage.

Furthermore, riders will reduce your death, total and permanent disability (TPD), and terminal illness (TI) coverage, while standalone policies will not touch this coverage at all.

Thus, standalone plans may offer more comprehensive coverage and even allow you to make multiple claims, but they may also be more expensive and require a separate application process.

If you might be interested in a standalone plan, open and read our post on the best critical illness insurance plans in Singapore.

How much can you afford to pay for an early critical illness insurance policy?

When considering how much early critical illness insurance coverage you’ll need, you must consider how much you can afford to pay for the policy.

After all, this will be one of your biggest concerns.

While having comprehensive coverage is ideal, it may not be financially feasible for everyone.

You should take into account your current budget and any other financial obligations you have, such as rent or mortgage payments, car payments, and other insurance policies.

It’s also important to consider your age, health, and lifestyle habits when deciding how much coverage you need and how much you can afford to pay.

I covered many more things to note when choosing critical illness coverage in detail here.

I’m interested in getting a rider. Should I get both ECI/CI riders or just an ECI rider?

Because an ECI rider also covers CI, some might think that getting both ECI and CI riders is a waste of money when you can cover all conditions with just the ECI rider.

Early critical illness riders are the most expensive riders you can get, followed by CI. It also covers what CI riders cover, so this is a valid point.

The answer to this depends on whether you can afford it and think you’ll want the additional coverage.

If you can’t afford it, then the ECI rider is sufficient. But if you can afford it, here are some considerations.

If you opted for just the ECI rider, should you be diagnosed with an ECI condition, your coverage for both ECI and CI is gone.

This means should your ECI progresses into a late-stage critical illness, you don’t get any additional payouts that you would’ve gotten if you had the CI rider as well.

Similarly, if you are diagnosed with a late-stage CI directly, you don’t get additional payouts if you already claimed the ECI rider.

Should this happen, you not only get lesser payouts but might not even have enough coverage for critical illness when it happens.

Also, the limit for ECI coverage by most insurers is $250,000, with the others limiting up to $350,000.

If you need more coverage than this, you won’t get it if you only take up the ECI rider.

I’d say, if you can afford it, go for both.

So, how much early critical illness insurance coverage do you think you need?

The amount of critical illness insurance coverage you need depends on various factors such as your age, lifestyle, family history, and financial situation.

It is recommended to have enough coverage to pay for medical bills, treatment costs, and other expenses in case of a critical illness diagnosis.

If cost is a concern, in my opinion, the minimum you should have is a cancer insurance plan.

Why? 1 in 4 Singaporeans is diagnosed with cancer. That’s a 25% chance – pretty high if you ask me.

A cancer insurance plan will also cover all stages of cancer, so at least you have the highest risk covered.

Here’s our comparison of the best cancer insurance plans in Singapore.

The image below will also summarise the differences in ECI policies mentioned in this post:

And as you can tell by now, there is no standard answer to how much coverage specifically you’ll need for early critical illness.

If in doubt, use the guideline of 1X to 3X of your annual income to determine how much ECI coverage you’ll need.

A financial advisor can also help you determine how much coverage to purchase based on your specific needs.

And if you need a trusted financial advisor, we partner with MAS-licensed financial advisors to help you with this.

Remember, always disclose any medical conditions you might have!