China Taiping i-Secure is an insurance plan that offers coverage against total permanent disability, death, and terminal illness. Beyond, it offers a minimum death benefit if an insured person is diagnosed with a terminal illness or dies.

Multiplier options are common in whole life insurance; however, i-Secure is more advanced. You can boost your sum insured by a multiplier of 2, 3, or 4 up to ages 71 or 86 and extend it indefinitely.

However, you’ll need to pay for the insurance cost attached to the cash value to extend. Currently, the 86 option is one of the highest on the market.

Because it’s a participating policy, it accumulates the cash value as bonuses.

Here’s our review of the China Taiping i-Secure.

My Review of the China Taiping i-Secure II

Are you looking for an insurance policy that offers permanent death benefit coverage and savings components? The China Taiping i-Secure can provide you with this with its multiplier benefit that lasts until you’re 99 years old!

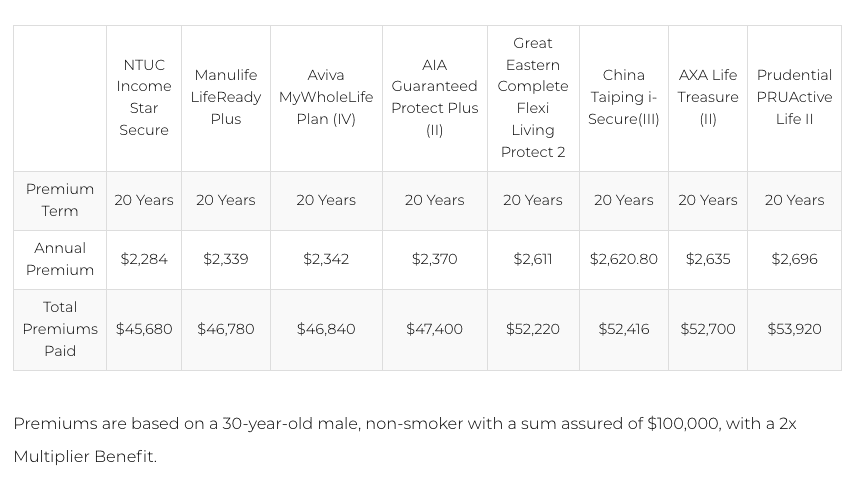

When you compare the annual premiums on whole life plans, China Taiping’s i-Secure II may not be the most affordable on the market. However, it has favourable coverage for critical illness conditions (up to 161!) compared to other providers, as highlighted in the table below:

| NTUC Income Star Secure | Manulife LifeReady Plus II | Singlife Whole Life | AIA Guaranteed Protect Plus (III) | Great Eastern Complete Flexi Living Protect 2 | China Taiping I-Secure(III) | HSBC Life – Life Treasure (II) | Prudential PRUActive Life II | |

| Early Critical Illness | 142 | 125 | 72 | 150 | 35 | 42 | 41 | 74 |

| Intermediate Critical Illness | 33 | 40 | 37 | |||||

| AdvancedCritical Illness | 59 | 52 | 55 | 56 | ||||

| Total CI Conditions | 142 | 125 | 131 | 150 | 120 | 137 | 134 | 74 |

| Additional Coverage | ||||||||

| Special Benefits (Diabetic Complications, Osteoporosis, etc) | 15 | 10 | 16 | 15 | 10 | 12 | 14 | – |

| Juvenile Benefits (Kawasaki Disease, Severe Hemophilia, etc) | 15 | 12 | 11 | – | 16 | 12 | 14 | – |

| Total additional coverage | 30 | 22 | 27 | 15 | 10+16+5(Senior Conditions)= 31 | 24 | 28 | 0 |

| Total Conditions Covered | 172 | 147 | 158 | 165 | 151 | 161 | 162 | 74 |

As you can see, China Taiping i-Secure covers up to 161 total conditions, which is among the highest, and therefore it’s not surprising that the premiums are a bit higher.

In the dynamic landscape of whole life insurance in Singapore, China Taiping’s i-Secure II stands out for its unique blend of benefits and features.

Pros:

- High Critical Illness Coverage: One of the most compelling aspects of the i-Secure II is its extensive coverage for critical illnesses (CI), providing a robust safety net for policyholders.

- Lifetime Multiplier Benefit: The plan offers a multiplier benefit that extends for the entire life of the policy, a feature not commonly found in other whole life plans.

- Flexibility in Premium Payment Terms: i-Secure II allows policyholders to choose their premium payment terms, offering much-needed flexibility in financial planning.

Cons:

- Premium Rates: While offering extensive coverage, the premium rates for i-Secure II can be on the higher side compared to some other options in the market.

- Complexity in Policy Terms: Some users might find the policy terms and conditions a bit complex, requiring thorough understanding before purchase.

Singlife Whole Life is known for its comprehensive coverage and investment component, which allows policyholders to participate in the insurer’s investment profits.

This can be an attractive feature for those looking to combine life insurance with an investment opportunity.

However, i-Secure II stands out with its high critical illness coverage and lifetime multiplier benefit, which are particularly beneficial for those prioritising health protection.

In terms of premiums, Singlife’s plan might offer more competitive rates, but this could come at the cost of lower CI coverage compared to i-Secure II.

Manulife LifeReady Plus II is another strong contender, offering flexibility in coverage and premium payment terms.

One of its notable features is the Health Advantage benefit, which provides premium discounts for maintaining good health.

While this is an innovative approach to encourage healthy living, i-Secure II’s emphasis on extensive CI coverage and the lifetime multiplier benefit may be more appealing to those seeking comprehensive health protection.

The premium rates for both plans are competitive, but the choice may ultimately depend on whether the policyholder values health-related incentives or higher CI coverage.

NTUC Income’s Star Secure Pro is an upgraded version of the Star Secure plan, offering enhanced coverage options and additional riders for more comprehensive protection.

This plan is particularly known for its flexibility and the ability to tailor coverage to individual needs. While Star Secure Pro offers a wide range of benefits, i-Secure II’s lifetime multiplier benefit remain its unique selling points. For those prioritising this, i-Secure II could be a more suitable choice.

However, for individuals looking for customisable coverage, the ability to add various riders, cheaper premiums, and more CI conditions covered, the NTUC Income Star Secure Pro might be a better fit.

Ultimately, whether the China Taiping i-Secure is for you really depends on your current situation and future needs and wants.

I suggest checking out our list of best whole life insurance plans in Singapore so that you know what are your available alternatives and where each policy stands out.

Next, you should seek an unbiased second opinion to whether the China Taiping i-Secure or any other whole life insurance plans fit your needs best.

This is because insurance is a 20 to 30 year commitment, and surrendering early could lead to large financial loss – something that we see happening more and more the longer we work on Dollar Bureau.

If you need someone to talk to, we partner with MAS-licensed financial advisors who are happy to help.

Now let’s explore the China Taiping i-Secure in detail.

Criteria

- Minimum sum assured starts at $50k

- Life Assured: 0 to 65 years

- Policyholder: 18 to indefinite

Basic Product Features

Coverage Duration

The China Taiping i-Secure II offers lifetime coverage with two multiplier options of up to 71 or 86 with an option of extending indefinitely.

Payment Terms and Options

China Taiping’s i-Secure is a limited premium policy with competitive premium and flexible options ranging from 5, 10, 15, 20, or 25 years.

As well, your premium amount depends on several factors such as; age, sum assured, premium period, and gender.

Protection

Death Benefit

If death occurs while the policy is still running, the sum assured and accumulated bonuses will be paid out minus any amount owed by the insured. After that, the policy automatically ends after the payout.

Terminal Illness Benefit

In case you’re diagnosed with a terminal illness, you’ll be paid a lump sum from the death benefit. However, this reduces the death benefit, whereas the balance is paid upon death.

For you to qualify for terminal illness benefit, you must be diagnosed with an illness that results in death in 12 months. It also excludes terminal illness due to the presence of HIV.

The maximum terminal illness benefit payable is equal to S$3,000,000.

Total and Permanent Disability Benefit

Upon diagnosis with a total and permanent disability, you’ll get a lump sum of the death benefit as an advance payment.

Notably, the payout reduces the basic sum assured and accumulated bonus in equal proportions. Given that, the premium of the remaining sum assured is adjusted accordingly.

On the same note, the policy ends if the TPD benefit is equivalent to the basic sum assured.

Here are the requirements for you to qualify for the TPD benefit payout

| Occurrence | Requirements |

| If you encounter the following at any age before the anniversary of the policy on which 18 is your next birthday. |

|

| If you encounter the following before turning 65 years old |

|

| If you encounter the following after turning 65 years old and before the age of 70. |

|

| If at any age you experience the following. |

|

Surrender Benefit

You may surrender your insurance policy in full or part after it acquires a surrender value.

Upon surrender, you’ll get a guaranteed surrender value, surrender value on the accumulated bonus, and a non-guaranteed terminal bonus.

Partial surrender is only acceptable if the policy maintains a minimum basic sum assured. Subsequently, the amount payable will be less any debt owed to the policy.

Worth noting, a life insurance policy is a long-term venture, and therefore early surrender may involve a lot of costs. Therefore, your total payout may be less than your sum of premiums or zero.

Basic Guaranteed Benefit Extender

The basic guaranteed benefit may be extended if it expires and the current basic sum assured plus accumulated bonus amount is lower than the basic guaranteed benefit.

This basically means that your multiplier option can be extended past 86 years old.

Add-On Riders

Critical Illness Riders

You can boost your Critical Illness cover by opting for the below critical illness riders.

AdvancedCare Rider II

China Taiping’s i-Secure II policy has the AdvancedCare Rider II which is an accelerator payment for critical illnesses.

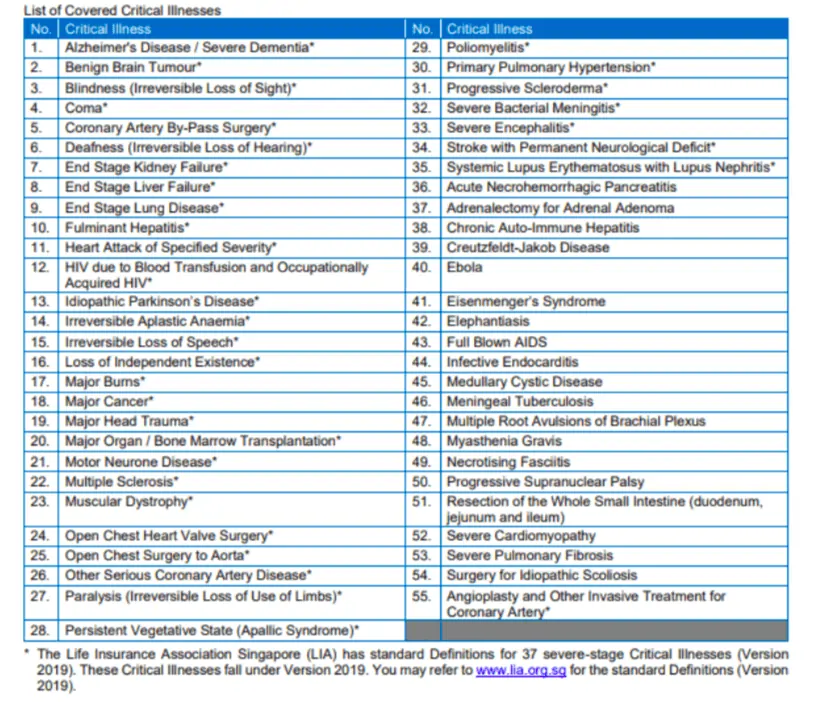

It provides a whole coverage against 55 advanced-stage critical diseases.

Below is the list of 55 specified critical illnesses covered under AdvancedCare Rider II.

EarlyCare Rider II

The plan also includes a critical illness benefit which is a comprehensive package covering up to 161 early, intermediate, advanced, and special illnesses.

The early critical illness coverage includes a total of 161 CIs

- 42 Early-stage CIs

- 40 Intermediate CIs

- 55 Advanced-stage CIs

- 12 Special Conditions

- 12 Juvenile Conditions

You’ll enjoy the critical illness benefit after a diagnosis of any of the specified conditions.

You will receive 10% of the CI benefit up to a maximum of $25,000 per policy upon diagnosis of Angioplasty or invasive surgery for Coronary Artery. Notably, you can only claim this benefit once under the policy.

The maximum critical illness benefit payable is equivalent to $3,000,000 and this amount includes other policies and riders issued by China Taiping. However, if the amount payable is less than any amount you owe the policy, it can lead to automatic termination.

The payout for CI benefit significantly reduces the basic sum assured and bonuses in equal proportions. After payout, the premium payable for the balance of the basic sum assured is adjusted accordingly.

Other Riders

Besides the above, you can increase your protection by choosing the following riders:

| Rider | Benefit |

| Payer Rider | Waiver of future premiums on your plan or that of your child in case of death, total and permanent disability, and terminal illness. |

| Early Payer Rider | Waiver of future premiums on your plan or that of your child in case of death, total and permanent disability, and all stages of the terminal illness and critical illness. |

| Early Waiver Rider | The future premiums are waived upon diagnosis with a critical illness. |

| Enhanced Waiver Rider | Waiver of future premiums after a diagnosis of an advanced-stage critical illness |

| Enhanced Payer Rider | Waiver of future premiums for death, TI, TPD, and advanced-stage of CI if you purchased the plan for your spouse or child. |

| Spouse Rider | Waiver of future premiums for you if your spouse faces death, TI, TPD, if you purchased the plan for your child. |

| Early Spouse Rider | Waiver of future premiums for you if your spouse faces death, TI, TPD, any stage of CI, if you purchased the plan for your child. |

| Enhanced Spouse Rider | Waiver of future premiums for you if your spouse faces death, TI, TPD, advanced-stage CI, if you purchased the plan for your child. |

Bonus Features

Reversionary Bonuses

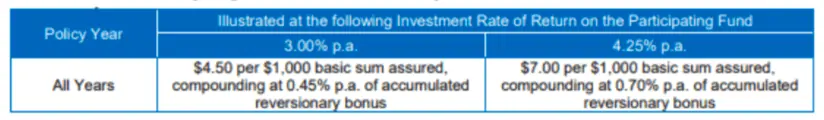

The policy may allocate a non-guaranteed annual reversionary bonus. However, the bonuses may vary depending on the prevailing conditions of the participating fund.

After declaration, the reversionary bonus is added to your policy at the anniversary and at this point becomes guaranteed.

The table below highlights the reversionary bonus

For illustration purposes, the reversionary bonus will offer $4.50 per $1000 sum assured and $7.00 per $1000 sum assured on accumulated reversionary bonuses.

Terminal Bonus

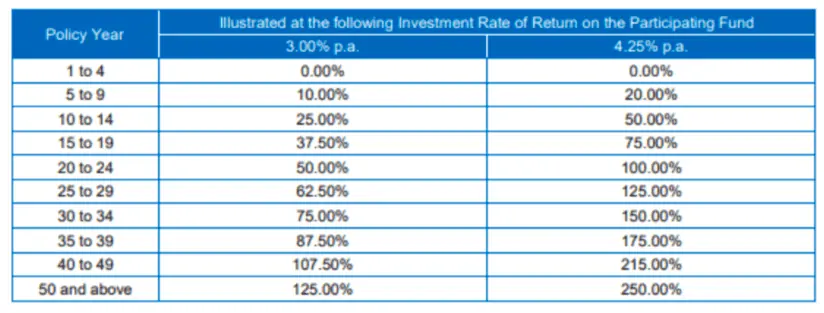

Terminal bonus is paid once upon surrender of the policy or claim.

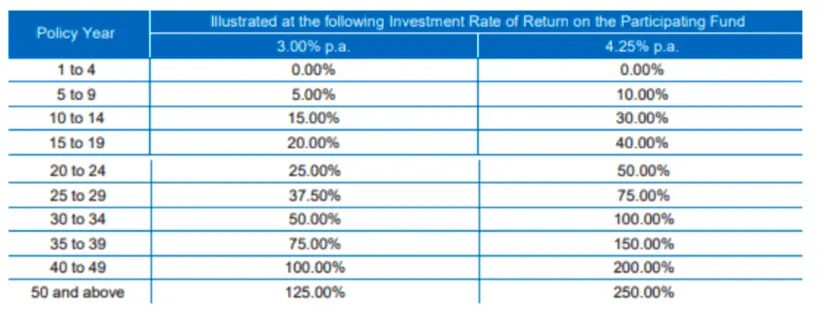

On claim, it’s expressed as a percentage of the sum of accumulated reversionary bonus. To get a better idea, look at the table below which shows the percentage based on the accumulated reversionary bonus.

On surrender, it’s expressed in terms of the percentage of the surrender value on the sum of accumulated reversionary bonus as highlighted in the table below.

As you can see, there’s no guarantee of the investment rate of return as this depends on the earnings of the participating fund. Therefore, the bonus rates are not guaranteed and may vary.

Investment of Assets

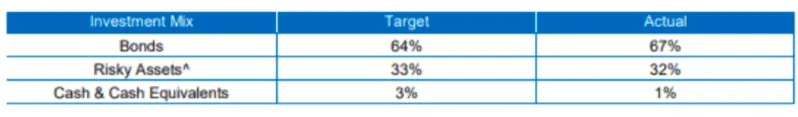

In order to maximise long-term benefits for policyholders, China Taiping manages its funds with a balanced investment mix.

The participating fund has an investment objective of maximising return while ensuring there is an acceptable risk level.

China Taiping manages the participating fund alongside the external manager, Taiping Assets Management (HK) Company Limited. Notably, the office may have different external managers at any time.

Here is what the portfolio mix looked like in the year ending 31st December 2020.

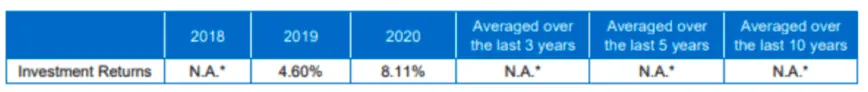

The Rate of Return

The rate of return only applies to the participating fund’s performance but don’t reflect what you’ll get. The actual bonuses you receive from the policy are what determines the actual return you’ll earn. Here is a historical reflection of the investment returns have been.

Because the participating fund was launched in December 2018, the data is only available from 2019.

Further, do note that these figures are not an indicator of how the returns will be in the future.

Geometric Average

As China Taiping’s participating funds is newly set up, there is no geometric average available for reference.

However, you can still view how other insurers fair through the table below:

Total Expense Ratio

The participating funds may incur expenses such as distribution, investment, management, and taxation costs.

Further, there is an acceptable level of costs incurred by the participating fund, which is not an additional expense to you.

However, if the actual expenses vary by significant amounts, it can affect your non-guaranteed benefits.

Worth noting, the Participating fund was launched in 2018; therefore, the total expense ratio for the first three years is not a true reflection of the long-term TER. The fund is still in its setup stage, and there are significant costs associated with it.