The GREAT Flexi Living Protect 2 and the GREAT Complete Flexi Living Protect 2 is a life insurance policy policy that provides basic protection for death, total and permanent disability, accidental total and permanent disability, terminal illness, and critical illness.

The GREAT Complete Flexi Living Protect 2 also includes the following benefits: special benefit, juvenile benefit, senior benefit, and benign tumour benefit.

As a participating policy, both plans accumulate cash value in the form of guaranteed and non-guaranteed bonuses.

Here’s our review of it.

My Review of the GREAT Flexi Living Protect 2 and GREAT Complete Flexi Living Protect 2

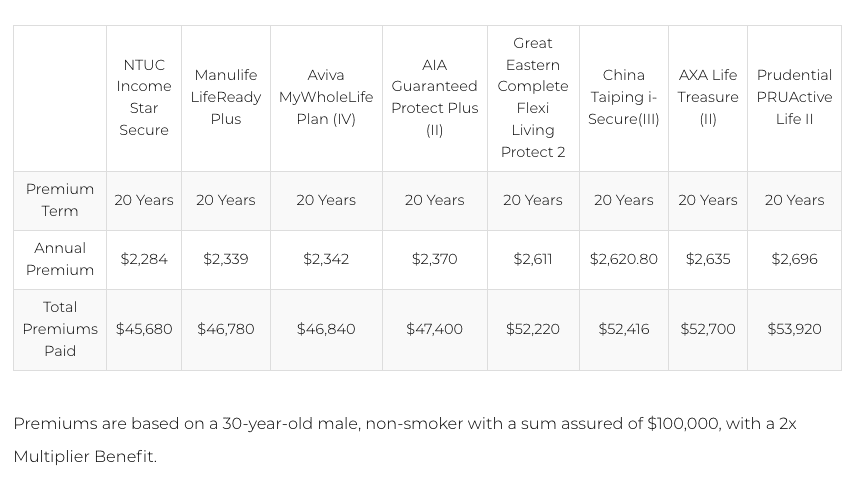

In comparison with the annual premiums across the whole life plans, GREAT Complete Flexi Living Protect 2 has one of the most expensive premiums in the market.

Critical illness conditions covered:

| NTUC Income Star Secure | Manulife LifeReady Plus II | Singlife Whole Life | AIA Guaranteed Protect Plus (III) | Great Eastern Complete Flexi Living Protect 2 | China Taiping i-Secure(II) | HSBC Life – Life Treasure (II) | Prudential PRUActive Life II | |

| Early Critical Illness | 142 | 125 | 72 | 150 | 35 | 42 | 41 | 74 |

| Intermediate Critical Illness | 33 | 40 | 37 | |||||

| AdvancedCritical Illness | 59 | 52 | 55 | 56 | ||||

| Total CI Conditions | 142 | 125 | 131 | 150 | 120 | 137 | 134 | 74 |

| Additional Coverage | ||||||||

| Special Benefits (Diabetic Complications, Osteoporosis, etc) | 15 | 10 | 16 | 15 | 10 | 12 | 14 | – |

| Juvenile Benefits (Kawasaki Disease, Severe Hemophilia, etc) | 15 | 12 | 11 | – | 16 | 12 | 14 | – |

| Total additional coverage | 30 | 22 | 27 | 15 | 10+16+5(Senior Conditions)= 31 | 24 | 28 | 0 |

| Total Conditions Covered | 172 | 147 | 158 | 165 | 151 | 161 | 162 | 74 |

Comparison of the number of critical illnesses coverage and additional coverage.

On top of the above-mentioned benefits, Great Eastern also has decent performing participating funds, based on their other current existing products available in the market in recent years.

It also has the following benefits for consideration when choosing a whole life insurance best suited for your needs:

- Multiplier benefit protection up till 100, as compared to the majority of other insurance providers offering only up to 70 or 75, some even only till 65 years old.

- Has one of the lowest expense ratios for its participating funds.

The policy also has its downsides as well. These include:

- Not as flexible premium payment options with only 20 years or up to the age of 65.

- Lower guaranteed surrender value if the policy is surrendered in its early stages.

- Has one of the weaker performing participating funds.

- One of the most expensive whole life plans in Singapore

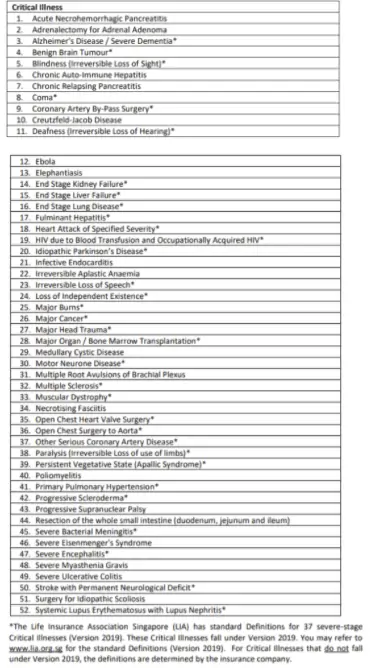

- Lesser ECI/CI conditions covered as compared to HSBC Life – Life Treasure II, NTUC Income Star Secure, and Singlife Whole Life

- Low multiplier options of only 2X and 3X while other policies offer up to 5X

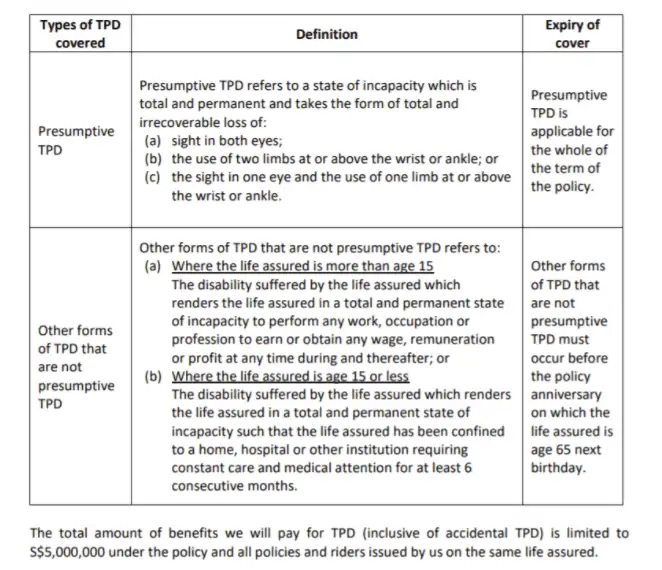

- Does not include ADL in its TPD definitions

If the multiplier benefit up to 100 and low expense ratios are something you’re looking for in a whole life plan, then the Great Eastern Complete Flexi Living Protect 2 is for you.

Apart from these, the plan does not seem to be as competitive as its counterparts.

For instance, the NTUC Income Star Secure Pro is the best whole life plan, is the cheapest in the market, and is the best for those looking for ECI/CI coverage.

If you’re looking to slowly cash out your cash value through annuity payments, the Manulife LifeReady Plus II is the best for this while providing you highest potential returns.

The HSBC Life – Life Treasure II is great for those looking for severe disability coverage and even ECI/CI protection.

Basically, before choosing any policies or investments, you should assess your insurance coverage and investment objectives.

For whole life policies, it is recommended to consider the coverage, par fund performance, and expense ratios, instead of just the policy premiums.

This is especially true when you’re purchasing for ECI/CI coverage. Check the definitions and whether what’s covered is in line with your past medical history and your family’s.

We suggest reading our post on the best whole life insurance plans in Singapore to help you understand what your available alternatives are.

You should also consider getting a second opinion from an unbiased financial advisor to whether the Great Eastern Complete Flexi Living Protect 2 is the best option for you.

This is crucial as you’re about to commit to a policy for 20 to 30 years, and you don’t want to make decision you’ll regret a few years down – especially when surrender charges will eat into your capital should you give up the policy.

If you need someone to talk to for a second opinion, we partner with MAS-licensed financial advisors to help you with this.

Click here for a free non-obligatory consultation.

Let’s now explore the Great Eastern Complete Flexi Living Protect 2 in detail.

Basic Product Features

Premium Payment Terms

The GREAT Flexi Living Protect 2 and GREAT Complete Flexi Living Protect is a regular premium policy with payment term options of 20 years or up to the age of 65 years old.

Your final premium amount is determined by factors such as age, gender, smokers status, sum assured, policy type, and length of premium period.

Protection

Death Benefit

Upon the death of the insured, the sum assured plus any accumulated bonuses will be paid out after deduction of any payables.

The policy will automatically be terminated once the death benefit has been paid out.

Total and Permanent Disability Benefit (TPD)

Upon the diagnosis of Total and Permanent Disability (TPD), Great Eastern will pay out a lump sum as an advancement of the Death Benefit.

If the life assured is below 1 year old, 20% of the sum assured plus any accumulated bonuses will be paid out after deduction of any payables.

Accidental Total and Permanent Disability Benefit (ATPD)

A lump sum payout of the death benefit if you encounter TPD due to an accident, before the age of 80 years old.

If the life assured is below 1-years-old, 20% of the sum assured plus any accumulated bonuses will be paid out after deduction of any payables.

The maximum limit of SGD5,000,000 per life whichever is of lower value, including all other policies and riders with Great Eastern for the same assured life.

Terminal Illness Benefit (TI)

Upon diagnosis with Terminal Illness (TI), Great Eastern will payout a lump sum as an advancement of the Death Benefit.

To qualify for the TI Benefit, you are required to be diagnosed with an illness that results in death within 12 months.

The policy will automatically be terminated once the Terminal Illness benefit has been paid out.

Critical Illness Benefit (CI)

A lump sum payout of the death benefit, upon diagnosis of critical stage CI or critical stage CI-related procedures.

The CI Benefit will be paid only once regardless of the number of CI diagnosed.

The maximum limit of SGD3,000,000 per life whichever is of lower value, including all other policies and riders with Great Eastern for the same assured life.

However, payments made under the Additional Benefit, will not count towards the limit of SGD3,000,000.

The GREAT Complete Flexi Living Protect 2 provides additional coverage for early and intermediate stage CIs.

The maximum limit for early and intermediate stage CI diagnosis or procedure is S$350,000 and S$1.05 million for all claims.

The below table shows the CI covered.

Other Features and Benefits (Riders)

Additional Benefit

This policy has 3 additional benefits: Special Benefit (i), Juvenile Benefit (ii) and Senior Benefit (iii).

However, there are specific conditions for the additional Benefits:

In order to receive additional benefits, the conditions may include, but do not limit to, the following:

- There can only be one Additional Benefit claim per condition under the policy.

- The Additional Benefit under the policy will be paid up to six claims.

- Additional Benefit claims are not subject to a waiting period.

- You must have survived at least 7 days after being diagnosed with the condition

- undergoing the procedure.

- There will not be any reduction in the basic sum assured if additional payments are made.

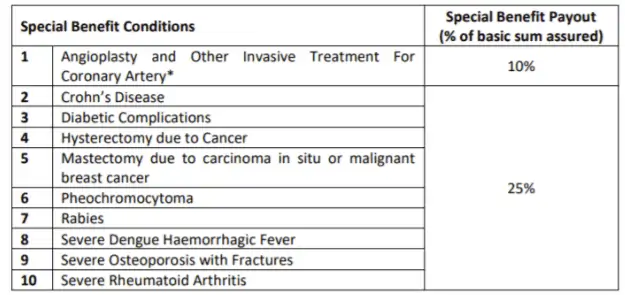

Special Benefit

Upon diagnosis of any of the below conditions or procedures (excluding angioplasty and other coronary artery invasive treatments), you will receive a payout of 25% of the basic sum assured subject to a maximum payout of S$25,000.

10% of the basic sum assured will be paid out for angioplasty or coronary artery invasive treatments, with a maximum payout of S$25,000.

The Special Benefit will only be paid once for the same condition or procedure.

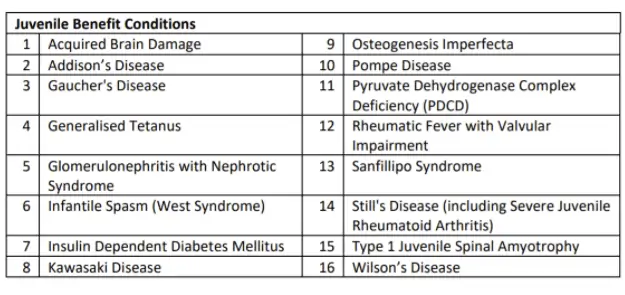

Juvenile Benefit

The Juvenile Benefit applies to all life assured below the age of 18.

Upon diagnosis of any of the below conditions or procedures (excluding angioplasty and other coronary artery invasive treatments), the life assured will receive a payout of 25% of the basic sum assured subject to a maximum payout of S$25,000.

The Juvenile Benefit will only be paid once for the same condition or procedure.

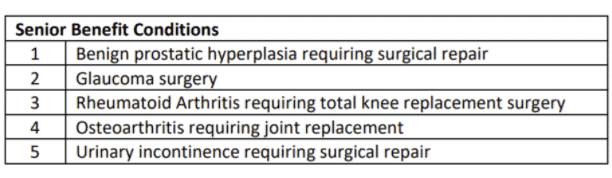

Senior Benefit

The Senior Benefit applies to all life assured above the age of 51.

Upon diagnosis of any of the below conditions or procedures (excluding angioplasty and other coronary artery invasive treatments), the life assured will receive a payout of 25% of the basic sum assured subject to a maximum payout of S$25,000.

The Senior Benefit will only be paid once for the same condition or procedure.

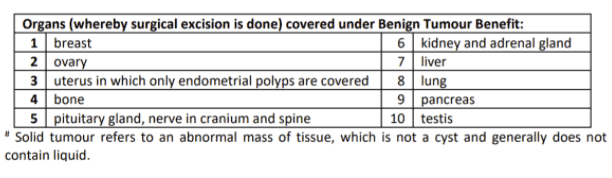

Benign Tumor Benefit

A payout of 5% of the basic sum assured with a maximum amount of S$5,000 per organ and S$10,000 for the entire benefit when undergoing surgical excision of a solid tumour.

The Benign Tumor Benefit can only be claimed for a maximum of two different organs.

Bonus Features

Reversionary Bonuses

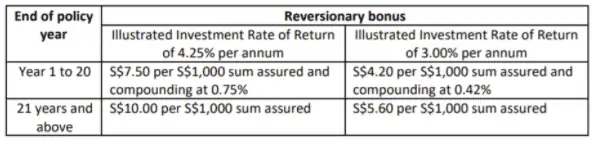

Great Eastern might allocate a reversionary bonus annually, but the bonus rate is not guaranteed.

Upon declaration, the reversionary bonus becomes guaranteed and will be paid out, regardless of the performance of the participating fund, less any payables to Great Eastern.

A withdrawal of the reversionary bonus in cash value is allowed, but the bonus payout will be less than the guaranteed accumulated reversionary bonus.

The cash value of the accumulated reversionary bonus will be determined by Great Eastern.

After withdrawal, the policy continues to be active with zero accumulated reversionary bonus.

Future reversionary bonuses can be added to the policy.

The table below illustrates the projected reversionary bonus offered by Great Eastern.

The annual compounding rate determines the interest built up on reversionary bonuses.

Terminal Bonus

Upon policy termination due to a claim, surrender or maturity, you might receive an additional bonus if Great Eastern declares a non-guaranteed terminal bonus, less any payables to Great Eastern.

The terminal bonus is indicated as a percentage of the accumulated reversionary bonus surrender value and the bonus might vary, depending on when you surrender your policy.

Participating Fund Performance

The GREAT Flexi Living Protect 2 and GREAT Complete Flexi Living Protect 2 is also a participating policy that allows you to accumulate cash value in the form of guaranteed and non-guaranteed bonuses.

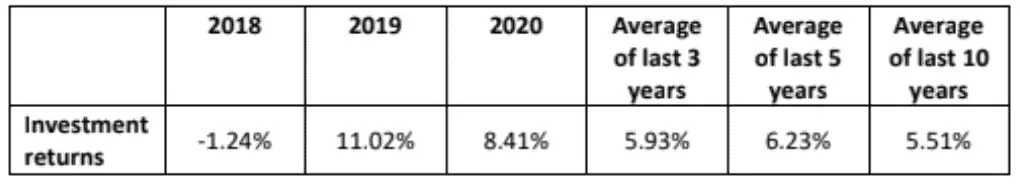

Annual Investment Performance

Great Eastern’s Participating Fund in recent years has generally been performing well.

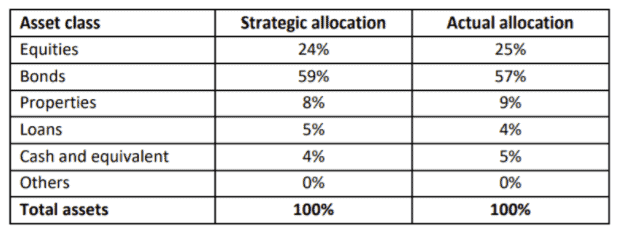

The table below illustrates the investment mix of Great Eastern based on strategic asset allocation.

The actual asset allocation might slightly differ from the Strategic Asset Allocation indicated above but will fall between an asset allocation range stated in Great Eastern’s Investment Policy.

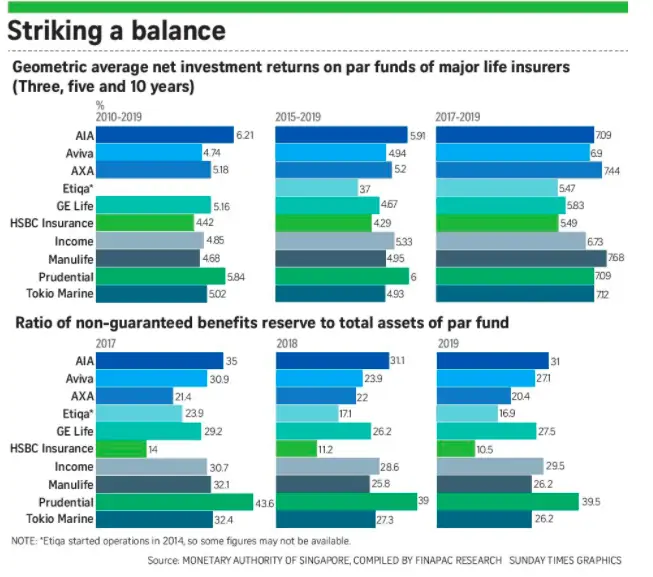

Geometric Average

The Geometric Average will be more suitable and accurate in calculating profits for investment portfolios such as that of participating funds.

Instead of just taking the average rate of return, the geometric average takes into account compounding and returns and losses, which has a part to play in the amount reinvested in the following years.

Great Eastern’s Participating Funds has not been performing as well as its competitors based on geometric average net investment returns, though steadily growing for the past decade and 5 years, it has been one of the weaker performing participating funds for the past 3 years (2017-2019), at 5.83%, lower than the group average of 6.69%.

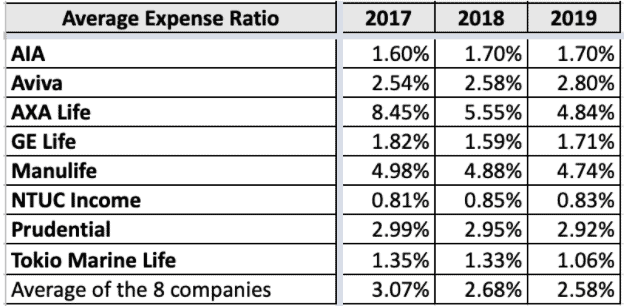

Expense Ratio

Great Eastern has one of the lowest expense ratios against the average in the past 3 years. The expense ratio is one of the important factors to take note of as it can significantly affect the final profits generated for the participating fund.

Overall Performance

Great Eastern has been one of the weaker performing participating funds over the past decade.

Despite weaker par funds performance, they managed to keep their expense ratio low, lower than the industry average in 2018 and 2019.

This might be a point to consider for policyholders who are looking for insurers with a steady and healthy participating fund record.

The results mentioned above are based on past fund performance and may not be indicative of future profits and results.

It is also important to understand that the final returns distributed to you are not the same as the funds’ rate of returns. The bonuses are decided and declared by Great Eastern.