Accidents, as its name implies, are unfortunate events that happen unexpectedly and unintentionally. At certain times, with no fault of our own!

And accidents may also cause you to lose a limb or two or, worse – become temporarily or partially disabled. Or, what if you accidentally contract a disease from others?

Moreover, you might incur medical expenses from being admitted to a hospital when you’re met with an accident. These hospitalisation expenses can be covered by Integrated Shield Plans (IPs).

But what if you’re not hospitalised? How would you be able to claim your medical expenses?

Thus, it is important to have a personal accident insurance plan to protect against such unforeseen circumstances and to bridge this gap.

Not sure which is the best accident insurance plan for your needs? Read on to find out.

What are Personal Accident Insurance plans?

Personal accident insurance plans are policies that compensate you in the event of an accident (we’ll be covering what is classified as an accident later in this article).

Depending on the plan you have purchased, the basic coverage comes in the form of reimbursed medical fees or a lump sum payout based on the extent of your injuries from the accident. This could be a permanent or partial disability.

A benefit might also be provided to your beneficiaries in the event of accidental death.

Some plans include reimbursement for physiotherapy, chiropractic, and Traditional Chinese Medicine (TCM) – which come at the cost of pricier premiums, of course.

What classifies an accident?

You may wonder what exactly classifies as an “accident” in these plans. The following would be considered accidents:

- An event that causes accidental death

- An event that causes permanent disability

- An event that causes temporary disability

- An event that causes temporary partial disability

- Contracting an infectious disease such as Dengue Fever, Chicken Pox, HFMD, etc. (for some personal accident plans)

Who should get Personal Accident Insurance plans?

If you’re someone who generally wants higher protection against accidents or just “kiasu” in general, you should definitely include personal accident insurance plans into your coverage.

Personal accident plans are also great for those who work in blue-collar jobs, engage in outdoor sports and high-impact activities regularly, or if you’re just clumsy by nature.

Those who are self-employed and not covered by company-sponsored insurance should also consider such plans.

Comparing the Best Personal Accident Insurance Plans in Singapore

In this article, we will be comparing 11 personal accident insurance plans on the market, mainly:

- Allianz Accident Protect Plus (Silver, Gold, and Platinum)

- AIG Sapphire Enhanced Choices (Plans 1, 2, 3, and 4)

- FWD Personal Accident Insurance (100k, 200k, 300k, 500k, 1000k)

- GE PA Supreme (Plans A, B, C, and D)

- Manulife ReadyProtect (Headstart, Accelerate, Advantage, Ultimate, and Signature)

- MSIG Protection Plus (Silver, Gold, and Platinum)

- NTUC Income PA Secure (Plans 1, 2, and 3)

- Starr Urban Cover Personal Accident Plan (Bronze, Silver, and Gold)

- Singlife with Aviva PA (Lite, Standard, and Plus)

- SOMPO PA Ease (Plans 1, 2, and 3)

- Tokio Marine PA Insurance (Plans A, B, C, and D)

Cheapest Personal Accident Insurance Plan – NTUC Income PA Secure (Plan 1)

For this comparison, we will be using the lowest tier across all insurers as a basis. Keep in mind that this is purely based on premiums and not considering the plan’s coverage.

It is also based on occupations that are more administrative or clerical in nature.

| Personal Accident Insurance Plan | Annual Premiums for an Adult Individual |

| Allianz Accident Protect Plus (Silver) | $168.00 |

| AIG Sapphire Enhanced Choices (Plan 1) | $256.00 |

| FWD Personal Accident Insurance (100k) | $120.00 |

| Great Eastern PA Supreme | $158.36 |

| Manulife ReadyProtect (Headstart) | $96.00 |

| MSIG Protection Plus (Silver) | $123.05 |

| NTUC Income PA Secure (Plan 1) | $68.00 |

| Starr Urban Cover Personal Accident Plan (Bronze) | $132.00 |

| Singlife with Aviva PA (Lite) | $140.00 |

| SOMPO PA Ease (Plan 1) | $94.16 |

| Tokio Marine PA Insurance (Plan A) | $198.00 |

As you can tell, NTUC Income PA Secure wins hands down for offering the cheapest annual premiums amongst the other insurers. It costs almost 48% below the average premium for basic personal accident plans, and if that isn’t a steal, we don’t know what is.

Relative to its cheap premium, its coverage includes an accidental death benefit and a permanent disability benefit (per policy year) of $50,000, $1,000 of medical expenses for injury due to an accident or infectious disease (per accident), and a daily hospital income of $50 (per day; up to 50 days per policy year).

What’s really interesting about this plan is that there are no differences in premiums regardless of your occupation. So whether you’re an admin-based personnel or a construction worker who deals with heavy equipment, you will still be paying the same annual premium of $68!

This plan’s competitive premium also means you can top-up with optional add-ons such as benefits for (1) child and student care expenses and/or (2) event and staycation expenses of $500, respectively, at only $18/year per insured person.

For instance, if you or your child gets hospitalised due to an accident or from contracting an infectious disease and misses a non-refundable ticketed concert, attraction, or hotel staycation, each insured member will get a reimbursement of up to $500.

However, take note that the claims cannot be less than $50.

So due to the low cost and simple coverage of this plan, NTUC Income PA Secure would be a good fit for the low-risk, average person in a white-collar job.

It’s also a good entry point for blue-collar workers such as delivery personnel, though the coverage is pretty basic.

Best Personal Accident Insurance Plan for Highest Coverage for Medical & Surgical Expenses – Manulife ReadyProtect (Signature)

Since we will be comparing the highest coverage for medical expenses coverage, we will naturally be using the highest tier across all insurers as a basis. It is also based on occupations that are more administrative or clerical in nature.

| Personal Accident Insurance Plan | Annual Premiums for an Adult Individual | Coverage for Medical & Surgical Expenses (per accident) |

| Allianz Accident Protect Plus (Platinum) | $696.00 | $7,000 |

| AIG Sapphire Enhanced Choices (Plan 4) | $1,005.00 | Up to $10,000 |

| FWD Personal Accident Insurance (1000k) | $1,333.34 | $15,000 |

| GE PA Supreme (Plan D) | $594.92 | $7,000 |

| Manulife ReadyProtect (Signature) | $924.00 | $10,000 |

| MSIG Protection Plus (Platinum) | $347.75 | $5,000 |

| NTUC Income PA Secure (Plan 3) | $165.00 | $3,000 |

| Starr Urban Cover Personal Accident Plan (Gold) | $372.00 | $6,000 |

| Singlife with Aviva PA (Plus) | $272.00 | $5,000 |

| SOMPO PA Ease (Plan 3) | $261.08 | $3,000 |

| Tokio Marine PA Insurance (Plan D) | $1,020,00 | $10,000 |

Looking at the table above, it can be seen that FWD’s Personal Accident Insurance (1000k) offers the highest coverage for medical and surgical expenses at a whopping $15,000!

However, its premiums reach a high of over $1,000, which is pretty high for most average Singaporeans, even for such high coverage.

Suppose you’re considering something of a lower tier with a lower price (i.e. < $1,000) but still relatively substantial. In that case, you can consider plans that give you coverage of $10,000 instead, provided by 3 insurers– AIG, Manulife, and Tokio Marine.

And Manulife ReadyProtect (Signature) offers the cheapest premiums among the 3!

If you can get reasonably high coverage at an affordable price, why wouldn’t you?

Plus, on top of offering $1m coverage for accidental death and dismemberment, it also offers a double payout if either situation happened on public transport!

They also cover 21 infectious diseases, including the Zika virus and Hand, Foot, and, Mouth disease, and medical refunds for accidents, TCM, chiropractor fees, ambulance fees, and mobility aids.

Overall, it sounds like a pretty good deal for an annual premium of less than $1,000.

Best Personal Accident Insurance Plan for Active Individuals – Great Eastern GREAT Protector Active

Let’s ignore the 11 choices of PA plans and bring your focus to Great Eastern GREAT Protector Active.

Solely catered for those with a more active lifestyle, the Great Eastern GREAT Protector Active is a high coverage plan that protects you from accidental death and permanent disablement while you go on extraordinary adventures and travels, increased-risk activities like scuba diving and rock-climbing, and even on the daily commute.

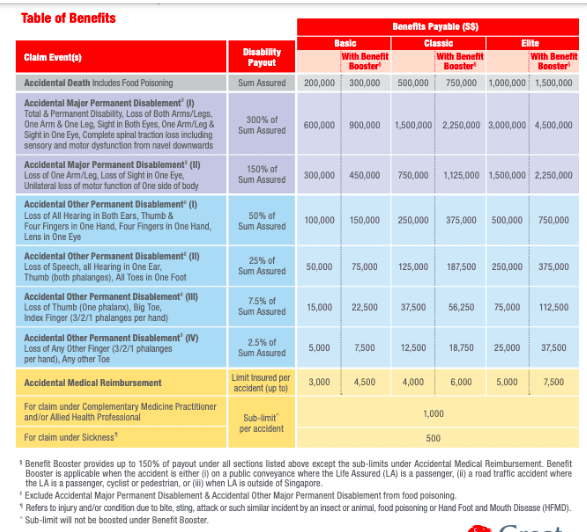

There are 3 tiers under this plan: Basic, Classic, and Elite, where its annual premiums stand at $320, $520, and $850, respectively. Here’s the breakdown of benefits offered:

Source: Great Eastern Life

Some of the notable highlights of this plan are if you get injured in an accident as a pedestrian or cyclist on the road or as a passenger in a private car or public transport, you’ll receive up to 1.5 times the protection you were covered for!

This benefit booster applies to any accidental death or injury that happens overseas. Great for those who are overseas thrill-seekers by nature.

Plus, it’s good to know that this feature is typically not included in most PA plans.

You will also get to choose your preferred form of medical treatment and care by a Complementary Medicine Practitioner or Allied Health Professional after an accident.

So consider Great Eastern’s GREAT Protector Active if you fit the profile of an active and adventurous person by heart.

Best Personal Accident Insurance Plan for High-Risk Occupations – Allianz Accident Protect Plus (Silver)

Insurance companies’ plans have their respective classifications, but these classifications follow very similar guidelines. In general, there are 4 categories of occupations:

- [Low risk] Persons in clerical and administrative jobs. Examples: clerks, office staff, authors, doctors, teachers, and students.

- [Medium risk] Persons in skilled or semi-skilled non-hazardous work and administrative work in an industrial setting. It also includes supervisory jobs of manual skilled work. Example: foreman, hairstylists, photographers, waitstaff, lab workers.

- [High risk] Persons engaged in jobs that require heavy machines, manual labour, and/or exposure to hazards. Example: carpenters, technicians, mechanics, chefs.

- [Very high risk] Persons engaged in jobs with heavy manual labour and highly hazardous conditions. Examples: firefighters, police, woodworkers, and armed security staff.

For this comparison, we will use the lowest tier across all insurers as a basis. Although it is also based on premiums, it also considers the coverage provided.

Keep in mind that these insurers listed do impose occupational loading, which means that premiums are higher for occupations that are considered more “dangerous”.

| Personal Accident Insurance Plan | Annual Premiums for an Adult Individual and for Occupations that are manual in nature) | Coverage for Medical & Surgical Expenses (per accident) |

| Allianz Accident Protect Plus (Silver) | $276.00 | $3,000 |

| GE PA Supreme (Plan A) | $284.62 | $2,000 |

| MSIG Protection Plus (Silver) | $203.30 | $1,000 |

| NTUC Income PA Secure (Plan 1) | $68.00 | $1,000 |

| SOMPO PA Ease (Plan 1) | $128.40 | $1,000 |

| Tokio Marine PA Insurance (Plan A) | $347.00 | $2,500 |

If you’re looking at price alone, then NTUC Income PA Secure takes the cake in this one. Their premiums are the cheapest out of these insurers, at only $68. However, the medical and surgical expenses benefit they offer is pretty low.

But if you’re already working in a high-risk occupation, choosing a PA plan with higher coverage would make better economic sense. Thus, Allianz Accident Protect Plus (Silver) would be the most ideal given that it offers a coverage of $3,000 – the highest among the plans.

What’s more, this plan is just $8 cheaper than GE and $29 cheaper than Tokio Marine for even better coverage!

If you scale up the plans and compare them again, similar results are seen, whereby Allianz Accident Protect Plus offers the most medical coverage at the lowest premiums!

Best Personal Accident Plam for Delivery PMD Riders and Cyclists – NTUC Income Personal Mobility Guard

Let’s again ignore the 11 choices of PA plans and bring your attention to NTUC Income Personal Mobility Guard.

Launched in 2016, it is the first plan for heavy users of bicycles and personal mobility devices (PMD) such as electric scooters and hoverboards in Singapore only.

Its premiums are also pretty well affordable, at only $96 a year – which extensively covers you for up to $200,000 in the event of accidental death or permanent disability due to an accident that involves your bicycle or PMD.

In addition, you are covered for up to $2,500 of medical expenses for the accident.

Throughout the years, you may have heard many news articles that showcase PMD or cycling accidents that involve third parties.

The NTUC Income Personal Mobility Guard takes care of this by covering you against personal liabilities of up to a million if you accidentally injure someone or damage someone’s property while riding a bicycle or PMD.

If you’re a frequent delivery PMD rider or cyclist or considering being one, you should consider getting NTUC Income Personal Mobility Guard as your choice of PA plan.

Most Value Personal Accident Insurance Plan – FWD Personal Accident Insurance

Let’s talk about getting a PA plan of “most value” in terms of cost-to-benefit ratio for medical expenses coverage and accidental death and permanent disablement coverage, respectively.

For this comparison, we will use the lowest tier across all insurers as a basis.

| Personal Accident Insurance Plan | Annual Premiums for an Adult Individual | Coverage for Medical & Surgical Expenses (per accident) | Cost-to-Benefit Ratio | Coverage for Accidental Death & Permanent DIsablement | Cost to Benefit Ratio |

| Allianz Accident Protect Plus (Silver) | $168.00 | $3,000 | 17.86 | $100,000 | 595.24 |

| AIG Sapphire Enhanced Choices (Plan 1) | $256.00 | $4,000 | 15.625 | $100,000 | 390.63 |

| FWD Personal Accident Insurance (100k) | $120.00 | $2,000 | 16.67 | $100,000 | 833.33 |

| GE PA Supreme | $158.36 | $2,000 | 12.63 | $100,000 | 631.47 |

| Manulife ReadyProtect (Headstart) | $96.00 | $1,000 | 10.42 | $50,000 | 520.83 |

| MSIG Protection Plus (Silver) | $123.05 | $1,000 | 8.13 | $100,000 (Accidental Death)

$150,000 (Permanent and Total Disablement) | 812.68 (Accidental Death)

1219.02 (Permanent and Total Disablement) |

| NTUC Income PA Secure (Plan 1) | $68.00 | $1,000 | 14.71 | $50,000 | 735.29 |

| Starr Urban Cover Personal Accident Plan (Bronze) | $132.00 | $2,000 | 15.15 | $100,000 | 757.58 |

| Singlife with Aviva PA (Lite) | $140.00 | $3,000 | 21.43 | $100,000 | 714.29 |

| SOMPO PA Ease (Plan 1) | $94.16 | $1,000 | 10.62 | $50,000 (Accidental Death)

$75,000 (Permanent Disablement) | 531.01 (Accidental Death)

796.52 (Permanent Disablement) |

| Tokio Marine PA Insurance (Plan A) | $198.00 | $2,500 | 12.63 | $100,000 | 505.05 |

As you can see, 2 PA plans stand out in terms of their cost-benefit ratio based on what they cover.

Firstly, FWD Personal Accident Insurance’s cost-to-benefit ratio for accidental death and permanent disablement coverage ranks the highest.

And for good reason – amongst the plans that pay out $100,000 for this benefit, it offers the cheapest premium of only $120!

However, its medical expenses benefit is quite average at only $2,000.

Most Value Personal Accident Insurance Plan (Option 2) – Singlife with Aviva PA

If you’re looking at these medical expenses specifically, Singlife with Aviva PA would definitely have to be at the top of the list since they offer the highest cost-to-benefit ratio of $21.43!

Even though it may not offer the highest medical expenses benefit of $4,000 like AIG Sapphire does, it still comes close at $3,000 – and for $100 cheaper!

So this category depends on what you’re looking for – accidental death and permanent disablement or medical and surgical expense?

To the Dollar Bureau team, we prefer the medical & surgical coverage as the point of a PA plan is to bridge the insurance gap.

If you want higher accidental death and permanent disablement, you could always consider a term life plan that offers this.

Conclusion

As you can see, no specific PA plan can be considered the “best” on the market.

It is truly dependent on your needs and what type of coverage you place as a priority.

It may also be highly dependent on your lifestyle or occupation, for instance, being a highly active individual or a frequent delivery rider.

But one thing’s for sure, it is highly encouraged for anyone to purchase a personal accident plan simply because you will never know what will happen at any moment.

Our advice stays the same as usual – it is always better to be safe than sorry!

Need advice on which is better for you?

We partner with MAS-licensed financial advisors to help you with this.