The NTUC Income Star Secure is now obsolete. The new version is the NTUC Income Star Secure Pro.

The NTUC Income Star Secure is a whole life insurance that offers basic coverage against death, terminal illness, and total permanent disability.

It also allows for customisation and flexibility of premium payment from 5 to 30 years (in five-year intervals) or up to 64 years old, multiplying up to 500% the sum assured, enhancement of critical illness coverage, as well as with the option of several other optional riders.

As a participating policy, it accumulates cash value in the form of guaranteed and non-guaranteed bonuses.

Here’s our review of it.

My Review of the NTUC Income Star Secure

Looking for an insurance plan that offers protection and savings?

NTUC Income Star Secure can provide you with this solution.

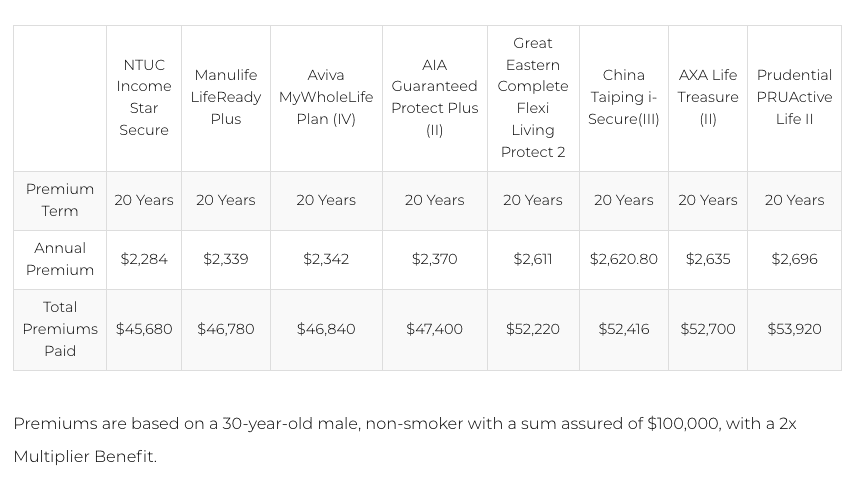

In comparison with the annual premiums across whole life plans, NTUC Income’s Star Secure has one of the most affordable premiums, with a decent amount of coverage of adult CI conditions as compared with other insurance providers.

| NTUC Income Star Secure | Manulife LifeReady Plus II | Singlife Whole Life | AIA Guaranteed Protect Plus (III) | Great Eastern Complete Flexi Living Protect 2 | China Taiping i-Secure(II) | HSBC Life – Life Treasure (II) | Prudential PRUActive Life II | |

| Early Critical Illness | 142 | 125 | 72 | 150 | 35 | 42 | 41 | 74 |

| Intermediate Critical Illness | 33 | 40 | 37 | |||||

| AdvancedCritical Illness | 59 | 52 | 55 | 56 | ||||

| Total CI Conditions | 142 | 125 | 131 | 150 | 120 | 137 | 134 | 74 |

| Additional Coverage | ||||||||

| Special Benefits (Diabetic Complications, Osteoporosis, etc) | 15 | 10 | 16 | 15 | 10 | 12 | 14 | – |

| Juvenile Benefits (Kawasaki Disease, Severe Hemophilia, etc) | 15 | 12 | 11 | – | 16 | 12 | 14 | – |

| Total additional coverage | 30 | 22 | 27 | 15 | 10+16+5(Senior Conditions)= 31 | 24 | 28 | 0 |

| Total Conditions Covered | 172 | 147 | 158 | 165 | 151 | 161 | 162 | 74 |

On top of the above-mentioned benefits, NTUC Income has also been one of the most stable and decent performing participating funds with the lowest expense ratio among insurance companies in recent years as well.

It also has the following benefits for consideration when choosing a whole life insurance best suited for your needs:

- One of the most affordable premiums for whole life plans in the market

- Provides coverage for Covid-19 and other unknown diseases.

- Double coverage payouts for accidental death.

- Option to defer premium payment for up to 6 consecutive months in case of involuntary retrenchment.

- Waiver of premiums if there is a death, TPD, or TI of a family member.

- Has one of the highest Total Death Benefits at 90 of $339,101 (based on a sum assured of $100k).

- Up to 5 times multiplier benefit up till the age of 70.

- Top 3 best performing participating funds in 2020 with the lowest expense ratio among participating funds in the market.

The policy also has its downsides as well. These include:

- One of the policies that provide lesser coverage for early, intermediate, and advanced medical conditions (total of 113 conditions), as compared with China Taiping i-Secure (III) (137 Conditions) and Aviva MyWholeLifePlan (III) (136 Conditions).

- Provides one of the least coverage for special benefits (10 Conditions) and juvenile benefits (9 Conditions), as compared to Manulife Ready Plus (21 Special Conditions and 13 Juvenile Conditions).

- Multiplier Benefit Payout only up till the age of 70, whereas some competitors such as China Taiping i-Secure offer up till the end of policy (up to 4x multiplier benefit) and Great Eastern Complete Flexi Living Protect 2 up till the age of 100 (up to 3x multiplier benefit).

- TPD benefits end at age 85, whereas some competitors such as Manulife LifeReady Plus, China Taiping i-Secure (III), and Great Eastern Complete Flexi Living Protect 2, offer up till the age of 99.

Despite its cons, the NTUC Income Star Secure was labelled as one of our best whole life insurance policies in Singapore multiple times in our 2021/2022 edition.

However, since it’s now obsolete, it’s no longer in the list.

But it’s successor, the NTUC Income Star Secure Pro, has taken its spot by winning 3 categories – and for good reason.

Before deciding on a whole life plan, we strongly advise you to assess your life insurance coverage needs and investment objectives and do your due diligence before deciding on any policies and investments.

For whole life policies, it is recommended to consider the coverage, par fund performance, and expense ratios, instead of just the policy premiums.

This is especially true when you’re purchasing for ECI/CI coverage. Check the definitions and whether what’s covered is in line with your past medical history and your family’s.

To start, read our post on the best whole life plans in Singapore to know your alternatives.

Once you know your alternatives, you should speak to an unbiased financial advisor for a second opinion to understand if the NTUC Income Star Secure (or Pro) is the best for you.

As insurance will require 20 to 30 years of premium payments, you want to make sure you choose what’s best for you. Many don’t and regret it years later, only to realise that it’s too late.

If you need someone to talk to for a second opinion, we partner with MAS-licensed financial advisors that are more than happy to help.

Click here for a free non-obligatory chat.

Now let’s explore the NTUC Income Star Secure.

Criteria

- Minimum sum assured of $20k.

- Entry Age

-

- Life Assured entry age: 0 years old to 64 years old.

- Policyholder: 10 years old to no stated maximum entry age.

Basic Product Features

Coverage Duration

The NTUC Income Star Secure offers you coverage for your whole life with the multiplier benefit payout up till the age of 70 years of age.

Policy Terms

The NTUC Income Star Secure is a regular premium policy with flexible policy term options ranging from 5 to 30 years (in multiples of 5 years) or when the insured reaches 54, 59, 64 years of age.

| Premium Term | Minimum Age (Based on last birthday) | Maximum Age (Based on last birthday) |

| 5,10,15, 20 years | 0 | 64 |

| 25 years, up to 64 years old | 0 | 59 |

| 30 years | 0 | 54 |

Premium Payment Terms and Options

Flexible premium payment options of monthly, quarterly, bi-annually, and annually are offered.

Although there is no minimum premium payment, there is a minimum sum assured of S$20,000. Your final premium amount is determined by factors such as age, gender, smokers status, sum assured, policy type, and length of premium period.

Protection

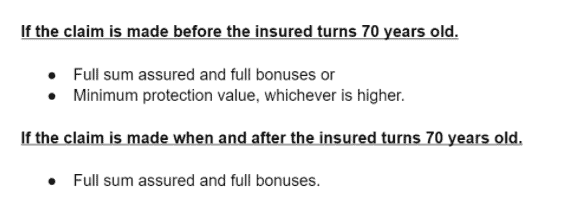

Death Benefit

The sum assured plus any accumulated bonuses will be paid out after deduction of any payables, when death is encountered by the insured.

The policy will automatically be terminated once the death benefit has been paid out.

The death benefit does not cover death caused by committing suicide within 1 year of the cover start date. The total premiums paid excluding interest, less any claims and amount owed to NTUC Income, from the cover start date will be refunded.

Accidental Death Benefit

Upon the death of the insured due to an accident, 200% of the sum assured will be paid out, together with the death benefit. If the accidental death was caused by participation in a restricted activity, 60% of the sum assured will be paid out, together with the death benefit.

In order to qualify for the benefit of Accidental Death:

- Required to be below the age of 70 years old when the accident took place.

- Accident occurrence needs to fall within the policy term and a claim needs to be done within 365 days of the accident.

The policy will automatically be terminated once the death benefit has been paid out.

Terminal Illness (TI) Benefit

Upon the diagnosis of Terminal Illness by a registered medical practitioner, the TI Benefit is payable to you after deduction of any payables.

To qualify for the TI Benefit, the insured is required to be diagnosed with an illness that results in death within 12 months.

The policy will automatically be terminated once the Terminal Illness benefit has been paid out.

Total and Permanent Disability (TPD) Benefit

Upon the diagnosis with a total and permanent disability, the sum assured plus any accumulated bonuses will be paid out after deduction of any payables.

The maximum disability benefit inclusive of all other policies issued by all insurance companies is S$6,500,000, excluding bonuses.

TPD benefit will reduce the basic sum assured due to it being an accelerated payment of the death benefit.

The policy will automatically be terminated if the TPD benefit is the same as the basic sum assured.

In order to qualify for the TPD benefit payout, the following must be met:

| If the insured encounters the following before he or she turns 65 years old. | Disablement continuously for at least 6 months, certified permanent by a medical practitioner appointed by NTUC leading to the inability to partake in any work, occupation, profession, or other related activities that allow income generation. |

| If the insured encounters the following after he or she turns 65 years old. | Disablement as a result of an accident or illness continuously for 6 months, certified permanent by a medical practitioner appointed by NTUC Income, leading to severe disability or physical loss. |

The definition of physical loss is:

physical or inability to use any 1 limb at or above the wrist or ankle. |

|

Other Features and Benefits

Retrenchment Benefit

You can opt for the Retrenchment Benefit if you encounter involuntary retrenchment, and for a continuous period of 3 months of unemployment.

The benefit allows waiver of premium payment for up to a maximum of 6 months, if a minimum of 6 months premium payment is made.

To be eligible for the benefit, you must have been retrenched no earlier than 6 months from the policy cover start date.

Once you are reemployed, premium payment will be reinstated and the Retrenchment Benefit ends.

Regardless of the duration of the premium payment waiver, the Retrenchment Benefit can only be utilised once, despite the number of months of premium payment waiver.

Family Waiver Benefit

Upon death, TPD, or TI of a family member (before he or she turns 70 years of age) occurring during the premium term, you are exempted from future premiums and riders payments.

To qualify for the Family Waiver Benefit, the family member has to be 64 years old or younger, when the policy is issued.

Upon a successful claim or when the basic policy is vested, whichever is earlier, the Family Waiver Benefit will end.

Family member refers to the insured’s legal spouse or the insured’s natural or legal parents (if the insured is a juvenile).

Vested refers to the transfer of policy ownership from the original policyholder to the insured named in the policy schedule to the basic policy. This occurs when the insured reaches the vesting age.

Add On Riders

Advanced Secure Accelerator

Offers comprehensive coverage against 49 specified dread diseases and Major Impact Benefit. You are also entitled to the minimum sum assured for the basic policy, if you are below the age of 70.

With the Major Impact Benefit (more on this later), you are offered coverage against future unknown diseases such as Covid-19 or serious infections due to surgery or Intensive Care Unit (ICU) stay for 5 days or more at a go, due to an infection.

This is only valid if you are less than 85 years old.

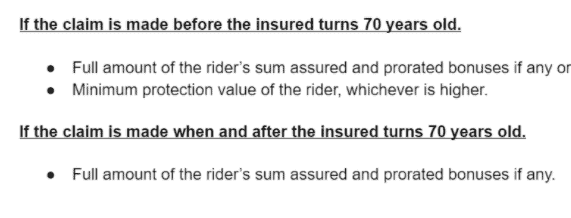

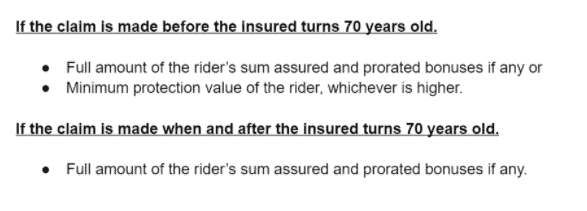

Dread Disease Benefit

During the rider term, upon diagnosis with one of the 49 specified dread diseases (excluding angioplasty and other coronary artery invasive treatments), you are entitled to the following payouts.

You will receive 10% of the rider assured sum, up to a maximum amount of S$25,000 for angioplasty and other coronary artery invasive treatments. This will only be paid once, and will result in the reduction of the sum assured after payout.

The payout will be less any payables to NTUC Income, and the policy will automatically be terminated thereafter.

In the event there are incidents that qualify for multiple claims under the Advance Secure Accelerator rider, other riders, and the basic policy, NTUC Income will only pay the benefit with the highest amount.

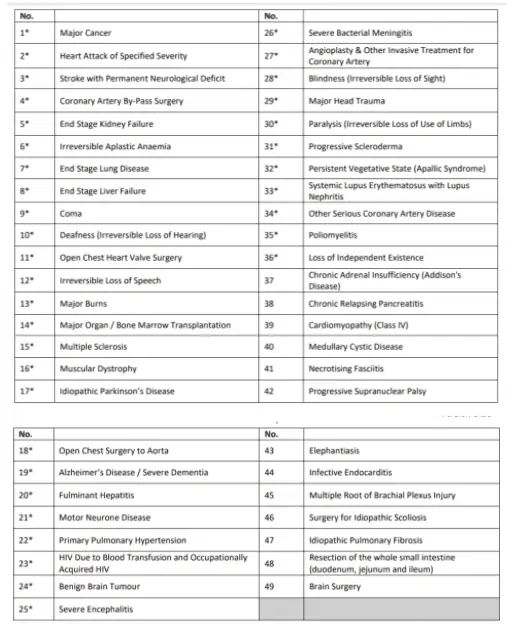

Below is the list of 49 specified dread diseases (critical illnesses) covered under the Advanced Secure Accelerator Rider.

A waiting period of 90 days from the cover start date is required for medical conditions such as heart attack of specified severity, angioplasty and other coronary artery invasive treatments, and major cancers.

In the case of angioplasty and other coronary artery invasive treatments, the date of diagnosis refers to the date the insured is diagnosed with the medical condition, and not the date of the surgical procedure.

Major Impact Benefit

In the event you encounter the following before you turn 85 years old:

- Suffer from an infection or requires surgery, and

- Is admitted to an intensive care unit (ICU) for a duration of 5 days or more in one hospital admission.

You are entitled to the following:

The payout will be less any payables to NTUC Income, and the policy will automatically be terminated thereafter.

The rider will reduce the basic sum assured due to it being an accelerated payment of the death benefit.

In the event there are incidents that qualify for multiple claims under the Advance Secure Accelerator rider, other riders and the basic policy, NTUC Income will only pay the benefit with the highest amount.

There is a waiting period of 90 days from the cover start date (not inclusive of accidents) for medical conditions under the Major Impact Benefit.

In the event of early and intermediate stage dread diseases, the Early Secure Accelerator rider offers increased coverage for 142 medical conditions and claims up to S$350,000.

If you are below the age of 70 years old, you also qualify for the minimum protection value based on the basic policy.

Recovery Benefit

You are entitled to an additional assured sum for each day of hospital stay. This does not apply if the hospital stay takes place before or within 30 days from the policy cover start date (not inclusive of accidents).

Guaranteed Insurability Option (GIO)

This gives you the option to purchase new riders for extension of rider coverage without the need of a health assessment.

Advanced Restoration Benefit

Provides additional coverage for medical conditions such as major cancers, heart attack of specified severity, and stroke with permanent neurological deficit, after an early or intermediate dread disease claim is made.

The Early Secure Accelerator rider also allows additional payouts under the Special and Mental Benefit and Juvenile Benefit.

Special and Mental Benefit

Provides coverage for 15 medical conditions and a payout of 30% of the rider’s sum assured.

The Special Benefit provides coverage for 10 medical conditions including diabetic complications and Zika before the age of 85.

The Mental Benefit provides coverage for 5 medical conditions including major depressive disorder and obsessive-compulsive disorder before age 75 and Tourette Syndrome before age 21.

Juvenile Benefit

If the insured is below the age of 18, he or she will be provided coverage for 15 medical conditions including Kawasaki Disease and insulin-dependent diabetes mellitus.

The Juvenile Benefit also provides a payout of 20% of the rider’s sum assured.

Hospital Cash Aid Rider

You will be able to receive payouts if you are hospitalised to aid in hospitalisation expenses. Below are the benefits of the Hospital Cash Aid Rider:

Hospital Cash Benefit

Receive payouts for each day of hospital stay (not exceeding 750 days of continuous stay in the same hospital).

Additional Intensive Care Unit Benefit

You are entitled to 2 times the sum assured for each day of Intensive Care Unit (ICU) hospital stay.

The Intensive Care Unit Benefit can be paid on top of the Hospital Cash Benefit. However, if the Hospital Cash Benefit has been paid out, not exceeding 750 days for the same hospital stay, the insured does not qualify for the Additional Intensive Care Unit Benefit.

Major Impact Benefit

The Major Impact Benefit entitles you to 10 times the sum assured of the rider if you encounter an infection or require surgery (inclusive of future unknown diseases), resulting in ICU Stay for 5 days or more in a single hospital admission.

This benefit is limited to one claim per policy year.

The surgery, infection, and ICU stay needs to be verified as compulsory medical treatment and required to be due to the same cause.

For all the benefits under the Hospital Cash Aid Rider, It is only applicable to hospital stays that take place after 90 days from the start of policy coverage (not inclusive of accidents).

Dread Disease Premium Waiver

No future premium payments are required for your basic policies upon dread disease diagnosis (not inclusive of angioplasty and other coronary artery invasive treatments).

This does not apply if the disease is diagnosed within 90 days policy start date for angioplasty, coronary artery by-pass surgery, serious coronary artery diseases, heart attack of specified severity and major cancers.

Enhanced Payor Premium Waiver

No future premium payments are required for basic policies purchased for loved ones, if the policyholder passes on, becomes totally and permanently disabled before 70, or suffers from dread diseases (not inclusive of angioplasty and other coronary artery invasive treatments).

This does not apply if the disease is diagnosed within 90 days of the policy start date for angioplasty, coronary artery by-pass surgery, serious coronary artery diseases, heart attack of specified severity, and major cancers.

For both the Dread Disease Premium Waiver and this rider, in the case of angioplasty and coronary artery invasive treatments, there will be a payout of 10% of the rider’s assured sum, up to a maximum amount of S$25,000.

These rider benefits will only be paid out once and will result in the reduction of the sum assured.

Bonus Features

Reversionary Bonuses

NTUC Income might allocate a non-guaranteed reversionary bonus annually.

Upon declaration, the reversionary bonus becomes guaranteed and will be paid out, regardless of participating fund performance, less any payables to NTUC Income.

The accumulated reversionary bonus is paid out upon maturity of the policy, surrender of the policy, in the event of death, TPD, or TI.

A withdrawal of the reversionary bonus in cash value is allowed, but the bonus payout will be less than the guaranteed accumulated reversionary bonus.

After withdrawal, the policy continues to be active with zero accumulated reversionary bonus. Future reversionary bonuses can be added to the policy.

Terminal Bonus

Upon policy termination due to a claim, surrender or maturity, you might receive an additional bonus if NTUC Income declares a non-guaranteed terminal bonus.

The terminal bonus is indicated as a percentage of the accumulated reversionary bonus surrender value and the bonus might vary, depending on when you surrender your policy.

Participating Fund Performance

The NTUC Income Star Secure is also a participating policy that allows you to accumulate cash value in the form of guaranteed and non-guaranteed bonuses.

Annual Investment Performance

NTUC Income’s Participating Fund in recent years has generally been performing well.

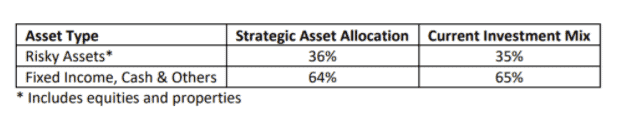

The table below illustrates the investment mix of NTUC Income as of 31 December 2020.

And the table below shows the past 3 years’ returns for its par funds.

| 2018 | 2019 | 2020 | |

| Investment Returns | 0.82% | 9.59% | 9.14% |

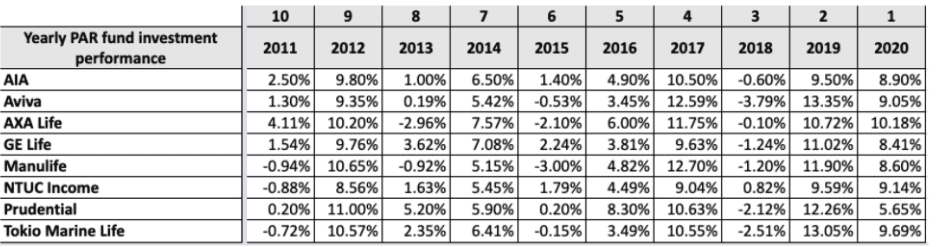

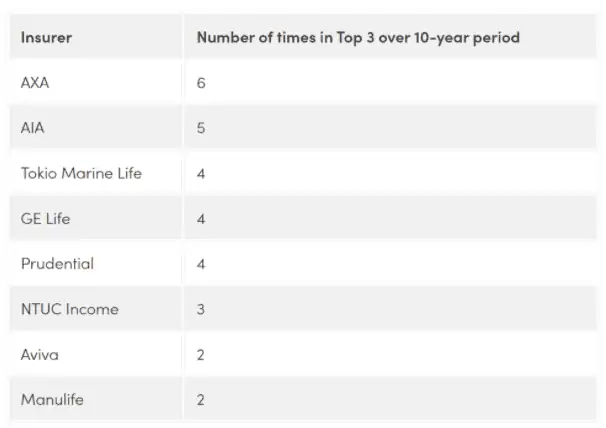

In fact, it has been one of the decent-performing participating funds in recent years, being ranked top 3 in 2020 when the economy was pretty affected by the Covid 19 situation. Below is an illustration of yearly par fund investment performance in the past decade.

With the illustration of the table below, NTUC Income has also managed to rank “top three” 3 times in the past decade for participating fund performance, being a stable performing participating fund in the market.

Geometric Average

The Geometric Average will be more suitable and accurate in calculating profits for investment portfolios such as that of participating funds.

Instead of just taking the average rate of return, the geometric average takes into account compounding and returns and losses, which has a part to play in the amount reinvested in the following years.

NTUC Income has been one of the few better-performing participating funds based on geometric average net investment returns on participating funds, with steady growth for the past decade and 5 years, with stable performance for the past 3 years (2017-2019), at 6.73%, higher than the group average of 6.69%.

Expense Ratio

NTUC Income has one of the lowest average expense ratios in the past 3 years. The expense ratio is one of the important factors to take note of as it can significantly affect the final profits generated for the participating fund.

Overall Performance

NTUC Income has held steady growth and maintenance over the past decade for its participating funds. They have also been able to keep a healthy expense ratio, below the industry average of 2.58% in 2019.

This might be a positive indication for you if you are looking for insurers with a steady and healthy participating fund record.

The results mentioned above are based on past fund performance and may not be indicative of future profits and results.

It is also important to understand that the final returns distributed to policyholders are not the same as the funds’ rate of returns.