Critical illness can strike anyone at any time, and it can have a devastating impact on your life and finances.

While we all hope we never have to face a serious illness, it’s important to be prepared for the worst-case scenario.

Investing in critical illness coverage is one of the best ways to protect yourself and your loved ones.

If you’re considering purchasing critical illness coverage in Singapore, you may wonder how much coverage you need.

The answer to this question depends on various factors, including your age, health, and lifestyle.

In this article, we’ll take a closer look at critical illness coverage and help you determine how much coverage is right for you.

Why is critical illness insurance necessary?

Critical illness insurance is necessary in Singapore because it provides financial protection for individuals and families in the event of a serious illness.

In Singapore, the cost of medical treatment can be high, and critical illnesses such as cancer, heart attack, and stroke can be financially devastating.

Critical illness insurance provides a lump sum payout upon diagnosis of a covered illness, which can be used to cover medical expenses, living expenses, and other associated costs. We covered more on what you can do with your critical illness payouts here.

Without this type of insurance, individuals and families may struggle to pay for necessary treatment and care.

In addition, critical illness insurance can provide peace of mind and financial stability during a difficult time.

How much critical illness coverage is recommended for me to get in Singapore?

The recommended amount of critical illness coverage in Singapore is, on average, 3.9X of your annual income, according to the 2017 Life Insurance Association (LIA) Singapore Protection Gap Study.

The same study also mentions that Singapore’s average critical illness protection gap is up to 3.1X of a Singaporean’s annual income and that it generally takes up to 5 years for someone to recover from a critical illness.

Thus, it is advised to have CI coverage that is at least 3 to 5 times your annual income.

For example, if your annual income is $50,000, you should consider getting coverage between $150,000 to $250,000.

How to calculate my critical illness coverage gap?

To calculate your critical illness coverage gap in Singapore, you need first to determine the amount of coverage you currently have for critical illness insurance.

This can include any insurance policies you have in place and any coverage provided by your employer.

In the same calculation, you can also include how much liquid savings you have that you can use to pay for the CI treatment.

However, this is usually not recommended as it will wipe out your savings and cause potential gaps in other coverages.

Once you have this information, you can compare it to the estimated cost of treatment for critical illnesses in Singapore.

This can include the cost of medical treatment, hospitalisation, additional expenses such as transportation or home care, and providing for your dependents during the recovery period.

Based on the 2017 LIA study, this is, on average, 5X of your annual income.

Thus, the formula to calculate your critical illness coverage gap would be:

Current CI coverage + savings (not recommended) – (Annual income X 5) = critical illness coverage gap

If the amount of coverage you currently have is less than the estimated cost of treatment, then you have a coverage gap that needs to be addressed.

Alternatively, you can use annual expenses instead of annual income. However, it’s generally recommended that you’re in the higher income brackets to use annual expenses.

Why? If you’re earning $200,000 per year and have only about $100,000 in annual expenses, getting 3X to 5X annual expenses makes more sense as you’re likely to have liquid cash to pay for any gaps.

But if you’re earning $200,000 and spending almost $200,000 annually, taking multiple of your annual income might be a safer bet.

You can work with a financial advisor or insurance agent to determine the best course of action to fill this gap, which may include purchasing additional critical illness insurance coverage.

Considerations before deciding how much critical illness insurance coverage you’ll need

Despite having gaps in your critical illness coverage, you might not have to top it up. The thing about LIA guidelines is that they are, well, guidelines.

Just a rule of thumb.

It might be more or might be less, and this depends on a case-by-case basis.

There are other considerations to consider when deciding how much CI coverage you need.

Are you diagnosed with any critical illnesses?

Before deciding how much critical illness insurance coverage you’ll need, it’s important to consider your current health status.

If you’ve been diagnosed with any critical illnesses, you may require more coverage than someone healthy.

Critical illnesses can include things like cancer, heart attack, and stroke. If you have a pre-existing CI, you may need to pay higher premiums or have certain exclusions in your policy.

If you are already diagnosed with any CIs, then it’s best to consider more coverage.

It’s important to disclose any pre-existing conditions when applying for critical illness insurance to ensure that the underwriter can decide whether to reject your application, exclude certain conditions, or just pay higher premiums.

This is critical so that your claims won’t get rejected later on.

Are you diagnosed with any medical conditions?

Before deciding how much critical illness insurance coverage you’ll need, it’s important to consider any medical conditions you may have been diagnosed with that are not critical illnesses.

If you have a pre-existing medical condition, you may need more coverage than someone healthy.

This is because certain medical conditions may increase your likelihood of developing a critical illness in the future.

For example, if you have hyperthyroidism and the doctor prescribes some medicine to control your heart rate.

Even though you may not have any CIs yet, you may be at a higher risk for developing these conditions yourself.

The insurer will then decide if they can cover you for all or selected CIs or impose higher premiums (loading) on your policy.

Sometimes if your pre-existing medical condition has recovered (or not relapsed) after 1 to 2 years, you might be able to get full coverage or reduced loading.

But it might not be worth waiting it out to purchase a CI plan until then as you will never know what might happen in those 2 years, and your premiums will increase due to age.

If you find yourself rejected due to any medical conditions or you might have an existing CI, there are 2 plans in the market for you – Singlife Essential Critical Illness or Manulife Critical SelectCare.

However, if you don’t have any pre-existing medical conditions, you may opt for lower coverage to save on your premiums!

Does your family have a history of critical illness?

One important consideration when deciding how much critical illness insurance coverage you’ll need is whether or not your family has a history of critical illness.

If there is a history of illnesses such as cancer, heart disease, or stroke in your family, you may want to consider purchasing a higher level of coverage.

This is because the risk of developing a critical illness is higher if there is a family history of such illnesses.

On the other hand, if there is no history of critical illness in your family, you may be able to get by with a lower level of coverage.

How long do you want the critical illness insurance coverage for?

Before deciding how much critical illness insurance coverage you’ll need, it’s important to consider how long you want the coverage for.

Do you want coverage for a specific period, such as until your children are grown and financially independent (such as when you turn 50 to 60), or do you want coverage for the rest of your life?

The length of coverage will impact the policy’s cost. Note that CI coverage doesn’t cover you for your whole life, even if you bought it via a rider on a whole life plan.

Depending on the insurer, most riders will expire when you turn 70/75 years old. So if you think you’re at higher risk of CI, you can opt for coverage until then.

Otherwise, you may opt for a rider that expires when you’re 65 or even cancel the rider after a certain period, although that’s not recommended.

It’s important to weigh the cost of the coverage against the potential benefits, such as financial security and peace of mind.

Consider consulting with a financial advisor to determine the best length of coverage for your individual needs and circumstances.

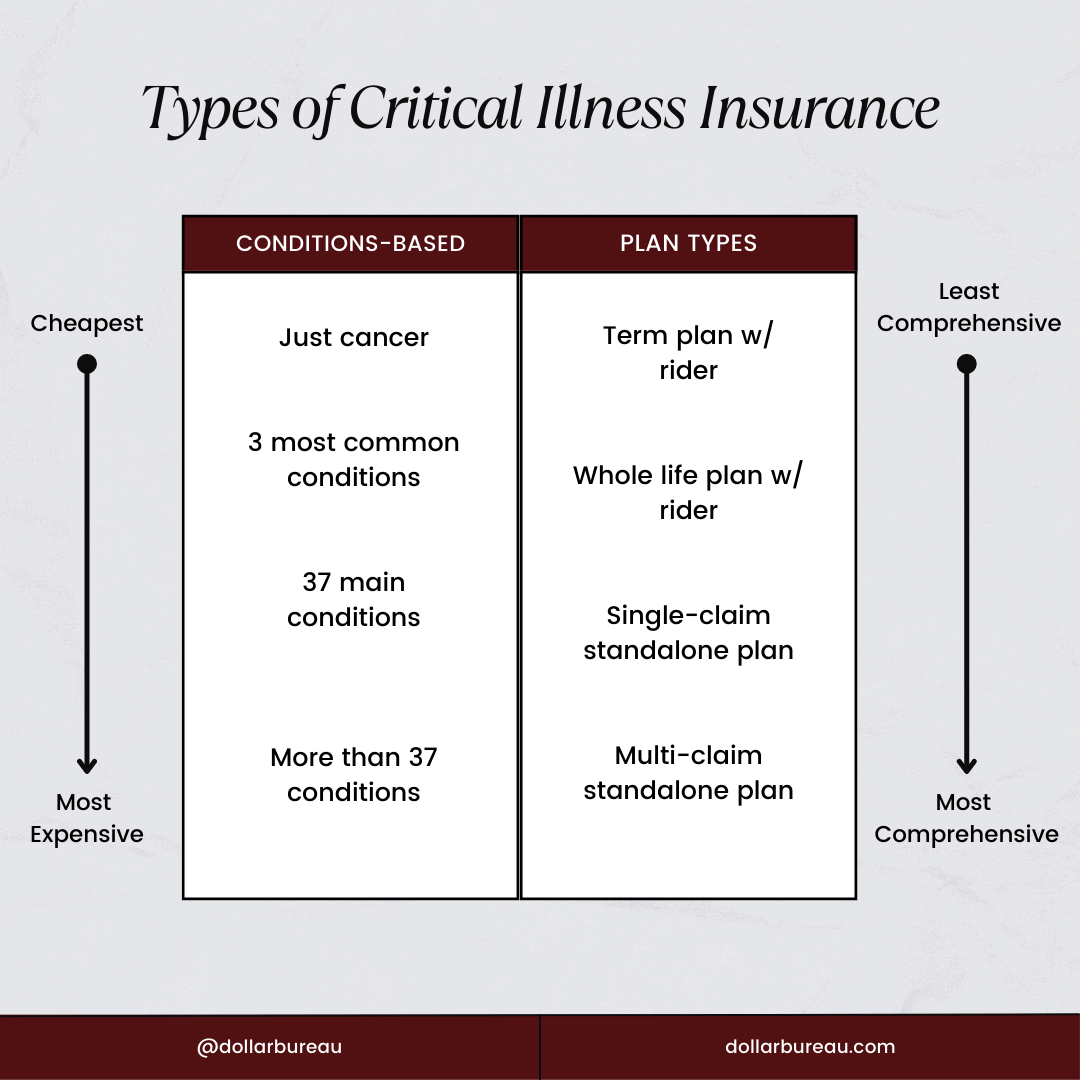

What do you want to be covered under your critical illness insurance?

Critical illness insurance typically covers a specific list of illnesses and medical conditions, such as cancer, heart attack, and stroke.

The exact coverage will vary depending on the policy you choose and the insurance provider you work with.

However, for critical illness policies, the LIA has a list of standardised definitions for 37 critical illnesses. These 37 conditions will be the same throughout all insurers.

Some policies may also cover additional conditions, such as Alzheimer’s disease, Parkinson’s disease, and multiple sclerosis.

If you’re kiasi or at higher risk, you can opt for a CI policy that covers the 37 conditions + additional conditions.

Otherwise, a plan that covers just these 37 will be enough. Take note; I’m talking about critical illness insurance here, not early critical illness conditions, which I will cover in a later post.

Alternatively, some policies let you cover the most common CI conditions that occur in Singapore – cancer, heart attack, and stroke.

One such policy is the FWD Big 3, which we reviewed here.

Your last alternative is to get cancer insurance, which covers all cancer stages and is the cheapest amongst all 3 types of CI plans mentioned in this section.

As 1 in 4 Singaporeans get cancer, it also makes sense to just opt for cancer insurance.

Read more about cancer insurance vs critical illness insurance here, then read this post about the best cancer insurance plans if you think it might be for you.

It’s important to review the policy details carefully to understand what specific illnesses and medical conditions are covered and any exclusions or limitations that may apply.

Again, reviewing the policy details carefully is important to understand what benefits are included and how they apply to your situation.

Do you want a critical illness rider or a standalone plan?

When deciding how much critical illness insurance coverage you’ll need, one important consideration is whether you want a critical illness rider or a standalone plan.

A critical illness rider is an add-on to a life insurance policy (such as a term life policy or a whole life policy) that provides coverage for specific illnesses.

A term policy + CI riders are usually the cheapest, followed by whole life insurance plans with CI riders.

On the other hand, a standalone plan is a separate policy that provides coverage for a range of illnesses.

A standalone plan can let you claim once – like the Manulife CI FlexiCare – or make multiple claims (AKA multiclaim or multipay policies) – like the Manulife CI FlexiCare with Cover Me Again Benefit or the Singlife Multipay Critical Illness.

Choosing between a rider and a standalone plan depends on your individual needs and circumstances.

Riders can be less expensive and more convenient as they are added to your existing policy. However, they may have limited coverage and may not cover all the illnesses you are concerned about.

Standalone plans may offer more comprehensive coverage and even allow you to make multiple claims, but they may also be more expensive and require a separate application process.

Furthermore, standalone plans will not reduce your death, total and permanent disability (TPD), and terminal illness (TI) coverage, while most riders will also affect this coverage.

If you might be interested in a standalone plan, open and read our post on the best critical illness insurance plans in Singapore to read after this post.

How much can you afford to pay for a critical illness insurance policy?

Before deciding how much critical illness insurance coverage you’ll need, the most important point to consider is how much you can realistically afford to pay for a policy.

While having adequate coverage is important, you don’t want to overextend yourself financially.

Look at your budget and determine how much you can comfortably afford to pay for a critical illness plan each month or year.

Consider your other financial obligations and expenses, such as mortgage payments, car payments, and other insurance premiums.

It’s also important to compare policies and rates from different insurance providers to find a policy that fits your budget and provides the coverage you need.

Keep in mind that higher coverage limits and more comprehensive policies will generally come with higher premiums, so it’s important to balance your coverage needs with your financial situation.

So, how much critical illness insurance coverage do you think you need?

After reading this article, you’ll realise there is no one-size-fits-all answer to how much critical illness insurance coverage you need.

The amount of coverage you require will depend on several factors, including your age, health, lifestyle, and financial situation.

It is important to consider the potential costs of a critical illness, such as medical bills, lost income, and ongoing care.

You should also consider any existing insurance coverage you have and whether it would be sufficient in the event of a critical illness.

To summarise, here’s an image for you to better understand the different types of critical illness insurance plans:

If in doubt, use the guidelines provided by LIA to determine how much critical illness coverage you’ll need.

It’s a pretty good study considering Singaporeans & Permanent Residents of different income groups.

A financial advisor can also help you determine how much coverage to purchase based on your specific needs.

And if you need a trusted financial advisor, we partner with MAS-licensed financial advisors to help you with this.

Remember, always disclose any medical conditions you might have!