Manulife’s LifeReady Plus (II) is a participating whole life policy that can help you to supplement your retirement income.

Apart from offering basic protection for death, terminal illness, and total permanent disability, you have the option to add on various critical illness (CI) and premium waiver riders.

Notable features include the health advantage discount and financial flexibility option.

As a participating policy, it accumulates cash value in the form of guaranteed and non-guaranteed bonuses.

My Review of the Manulife LifeReady Plus (II)

If you’re looking for an insurance plan that provides you with both protection while allowing you to plan for your future retirement, Manulife LifeReady Plus (II) is one of the few plans that offer this with its financial flexibility option.

Depending on your expected retirement lifestyle and the sum insured of your policy, you may not even need to purchase another retirement plan. So, if you’re looking to kill 2 birds with 1 stone, this plan is particularly useful.

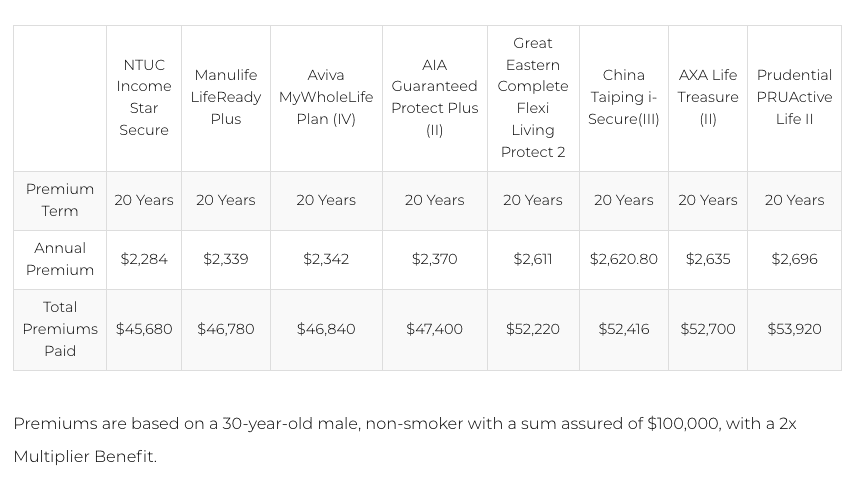

Comparing the annual premiums across the whole life plans that help you to boost your retirement income, Manulife’s premium is priced competitively; Whereas its non-guaranteed benefit based on the illustration rate is one of the highest.

Therefore, it is the most value for money among all the plans.

Based on the above specifications, here’s the surrender value for the Manulife LifeReady Plus (II):

| Year | Guaranteed | Total @ Non-Guaranteed 3% | Total @ Non-Guaranteed 4.25% |

| 5 | $1,600 | $1,755 | $2,014 |

| 10 | $3,700 | $4,166 | $5,247 |

| 20 | $17,600 | $22,016 | $35,916 |

| 30 | $26,300 | $37,043 | $80,190 |

In terms of critical illness coverage, the Manulife LifeReady Plus II’s riders cover you for up to 135 conditions.

| NTUC Income Star Secure | Manulife LifeReady Plus II | Singlife Whole Life | AIA Guaranteed Protect Plus (III) | Great Eastern Complete Flexi Living Protect 2 | China Taiping i-Secure (II) | AXA Life Treasure (II) | Prudential PRUActive Life II | |

| Early Critical Illness | 142 | 125 | 72 | 150 | 35 | 42 | 41 | 74 |

| Intermediate Critical Illness | 33 | 40 | 37 | |||||

| AdvancedCritical Illness | 59 | 52 | 55 | 56 | ||||

| Total CI Conditions | 142 | 125 | 131 | 150 | 120 | 137 | 134 | 74 |

|

Additional Coverage |

||||||||

| Special Benefits (Diabetic Complications, Osteoporosis, etc) | 15 | 10 | 16 | 15 | 10 | 12 | 14 | – |

| Juvenile Benefits (Kawasaki Disease, Severe Hemophilia, etc) | 15 | 12 | 11 | – | 16 | 12 | 14 | – |

| Total additional coverage | 30 | 22 | 27 | 15 | 10+16+5 (Senior Conditions)= 31 | 24 | 28 | 0 |

| Total Conditions Covered | 172 | 147 | 158 | 165 | 151 | 161 | 162 | 74 |

With the speed at which the world is changing, the job market is constantly evolving and jobs are becoming obsolete, increasing the likelihood of retrenchment. This pandemic doesn’t help matters either.

This is where Manulife LifeReady Plus (II)’s retrenchment benefit comes in. It provides you with added assurance so that if you get laid off, you don’t have to worry about paying your policy while you’re in between jobs.

Furthermore, the Manulife LifeReady Plus (II) has been listed as one of the best whole life insurance plans in Singapore in our comparison amongst all life policies in Singapore.

To be specific, they’ve won 2 categories in our list – the best whole life plan to supplement retirement needs and the best whole life plan with the highest overall returns.

And lastly, as Singaporeans, we can’t miss out on a good discount. The Manulife LifeReady Plus (II) is one of the only whole life plans that offer a possible perpetual discount if you are healthy.

All in all, the financial flexibility option, retrenchment benefit, and health advantage benefit makes Manulife’s LifeReady Plus (II) a competitive whole life plan to get.

From the participating fund performance to the types of riders available to the additional benefits available, there are many things to consider when choosing a whole life plan.

However, it doesn’t help that all our needs and priorities differ as well. Therefore, a plan that is suitable for someone else, may not be able to meet your needs.

For instance, if you’re looking for the cheapest plan or the most comprehensive plan for ECI/CI coverage, then the NTUC Income Star Secure Pro is your best bet.

And for those looking for the highest guaranteed returns from a whole life policy, you might find the Singlife Whole Life plan a better option.

With so many things to consider and so many plans in the market, things can get overwhelming real fast.

I suggest starting your research for possible alternatives in our post comparing the best whole life plans.

After that, I suggest getting a second opinion from an unbiased financial advisor to whether the Manulife LifeReady Plus (II) is for you.

Looking for some guidance and advice?

Speak to one of our experienced partners who will objectively compare the available plans in the market and recommend the best one for you.

Now let’s understand the Manulife LifeReady Plus (II) in detail.

Criteria

- Minimum sum assured of $25,000

Basic Product Features

Coverage Duration

LifeReady Plus (II) covers you up to age 99. If you survive past 99, your policy will terminate and you will receive a maturity benefit.

Maturity Benefit

Depending on whether you exercise the financial flexibility option (which will be discussed later on), you will receive the following:

- Guaranteed surrender value or guaranteed surrender value based on the adjusted sum insured (if the financial flexibility option was exercised);

- Any accumulated reversionary bonus;

- Any maturity bonus;

- Less any amounts owed to Manulife

Premium Payment Terms & Options

Manulife LifeReady Plus (II) is a regular premium policy with 5 premium payment term options – 10, 15, 20, 25 years, and up to age 99. In other words, if you opt to pay up to age 99, you will pay premiums annually for the duration of your coverage.

| 10 years | 15 years | 20 years | 25 years | Up to 99 | |

| Annual Premium (S$) | 3,714 | 2,721 | 2,289 | 2,032 | 1,505 |

| Total Premium (S$) | 37,140 | 40,815 | 45,780 | 50,800 | 103,845 |

Premiums generated are based on a 30-year-old, male, non-smoker for a sum assured of $100,000

Health Advantage Benefit

Get rewarded for having a stellar health record! If you are deemed to be in good health under Manulife’s standard underwriting assessment, you can enjoy a premium discount for your first 2 policy years.

This discount applies to your basic premium and the premiums for any multiplier benefit only, but not to any other supplementary benefit.

Following these 2 years, you can continue to enjoy the premium discount for the rest of your premium term if you meet Manulife’s health targets and submit a health advantage form certified by a medical examiner.

However, if you do not meet these health targets at the end of your 2nd policy year, the standard premium rate resumes on your next premium due date following your 2nd policy year.

Coverage

Life Benefit Multiplier (III) (LBM)

Manulife LifeReady Plus (II) allows you to enhance your basic protection coverage with a multiplier (LBM) that increases your basic sum assured by up to 5X.

This multiplier will increase your potential payout by the chosen multiplier and you can opt to have it expire at age 70 or 80. This multiplier applies to your death, terminal illness, and total and permanent disability coverage.

Once the LBM expires, your policy sum assured and the payout you receive reverts back to that of your basic policy. The LBM factor can only be selected when you apply for your policy and cannot be changed after policy inception.

Adding a multiplier will affect your policy’s sum assured and the premium paid, as seen in the table below:

| LBM = 1X (aka no multiplier) | LBM = 3X, expiring at age 70 | LBM =4X, expiring at age 70 | |

| Sum Assured with Multiplier (S$) | 100,000 | 300,000 | 400,000 |

| Annual Premium (S$) | 2,289 | 2,457 | 2,575 |

| Total Premium (S$) | 45,780 | 49,140 | 51,500 |

Premiums generated are based on a 30-year-old, male, non-smoker for a basic sum assured of $100,000 and a 20-year premium term.

Death

If you pass on during the policy term, the sum insured will be paid out in a lump sum and your policy will terminate. The LBM, if attached to your plan, affects the payout you receive:

| Situation |

|

|

| Death Benefit | The sum of the:

Less any amount owed to Manulife |

The higher of:

A. The sum of the:

Less any amount owed to Manulife OR B. Your policy’s basic sum assured multiplied by your LBM factor, less any amount owed to Manulife* *If your payout is B, any accumulated reversionary bonuses and claim bonus on your basic policy will not be paid out. |

Terminal Illness (TI)

A TI diagnosis will accelerate the payout of your death benefit in a lump sum.

Defined as an illness that is expected to result in death within 12 months from the diagnosis date, it needs to be certified by your medical examiner and confirmed by Manulife’s appointed medical examiner.

The maximum amount paid out on all policies on the same life (including this) for a TI or any critical illness (CI) claim is $2,000,000, where the TI claim cannot exceed $1,000,000. When making payment for a TI claim, Manulife will reduce the TI/CI limit by the amount paid out.

The amount paid out will be deducted from the policy’s sum insured. If not fully paid out, the policy will continue to cover death at an amount equal to the reduced sum insured.

Total & Permanent Disability (TPD)

Your death benefit payout will also be accelerated if you were to suffer a TPD during your policy’s term. A claim will only be paid out if the disability lasts for a consecutive period of 6 months.

| Age | Definition of TPD |

| 0 to policy anniversary after turning 99 | Life insured is considered disabled when they suffer total and permanent loss of either one of the following:

(i) sight in both eyes; (ii) use of 2 limbs; or (iii) sight in 1 eye and use of 1 limb |

| 0 to the policy anniversary after turning 18 | When the life insured requires constant care and attention and needs to stay at home, a hospital, or any similar institution for 6 months as a result of an accident, illness, or disease.

And the constant care and attention required, and confinement to a home or similar is expected to be permanent. |

| From the policy anniversary after turning 18 to the policy anniversary after 65 | When due to accident, illness, or disease, the life insured:

(a) Had been unable to take part in any income-generating activity for a continuous period of 6 months due to an accident, illness, or disease; and this inability to engage in such activities is expected to continue indefinitely. OR (b) Cannot carry out at least 3 out of 6 activities of daily living, even with the help of special equipment, and always need the aid of another throughout the whole activity for a period of 6 months in a row. Activities of daily living are:

This diagnosis must be verified by a medical examiner. |

| From the policy anniversary after turning 65 to the policy anniversary after turning 70 | See (b) in the above row. |

The maximum payout for TPD on this policy and any other policy covering the same life insured is $5,000,000. If the basic policy sum insured is not fully paid out after a TPD claim, the policy will remain in-force for death and terminal illness.

Other Features and Benefits

Upgrade Your Cover

Planning to get married anytime soon? Or perhaps getting ready to welcome your first child? With Manulife LifeReady Plus (II), you get to enjoy guaranteed insurability at certain key life stage events without the need for any medical underwriting.

So, you won’t have to worry about facing health exclusions or having to pay higher premiums due to certain ailments when you want to increase your coverage at selected life milestones such as when:

- You graduate from tertiary education;

- Your marital status changes, be it getting married or divorced;

- Your purchase your first home;

- You become a parent (including adopting).

Terms and conditions do apply for this benefit, the ones of note are that:

- Your basic policy should be fully underwritten and accepted at standard risk without additional premiums, health exclusions, or counteroffers;

- The sum insured of the new basic policy cannot exceed either the lower of S$300,000 or 100% of your Manulife LifeReady Plus (II) basic sum assured

- The life stage event happens before the policy anniversary following your 50th birthday

- Regardless of the number of policies you have with the guaranteed insurability benefit, this option can only be exercised twice in your entire lifetime

For the full terms and conditions, do refer to your policy contract.

Retrenchment Benefit

If you or your spouse gets retrenched and remain unemployed for at least 30 days, your future premiums on the basic policy and any supplementary benefit will be waived for 6 months.

This benefit only applies if the retrenchment occurs before the policy anniversary after you or your spouse turns 65. To receive this benefit, you would need to submit the required form to Manulife within 6 months of your retrenchment.

Your premium waiver will kick in on the premium due date following the approval of your request and is only payable once.

Financial Flexibility Option

Looking for protection with the opportunity to supplement your retirement nest egg? Then Manulife’s Life ReadyPlus (II) might be a good choice with its option to convert your policy’s cash value into annual payouts for 10 years when you turn 70 or 80, depending on your policy.

If your basic policy has the LBM rider, you can exercise this benefit anytime after your LBM expiry age to the policy anniversary when you turn 89. Without the LBM rider, you can exercise this benefit anytime after you turn 70 up to age 89.

This benefit can only be applied once provided your policy fulfils the minimum sum insured requirement and any outstanding amounts owed have been paid off.

Annual Payout Amount

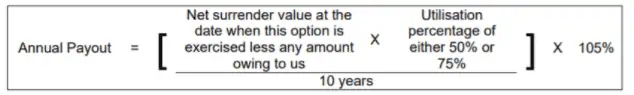

The minimum annual payout is $500, calculated using the formula below:

Depending on your needs, you can choose whether to use 50% or 75% of the net surrender value. Your first payout starts on the next policy immediately after you exercise this option.

Things to Note

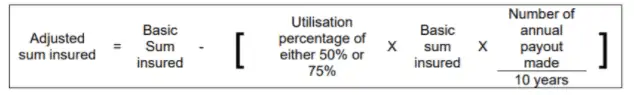

Most importantly, making use of this option will reduce your policy’s sum insured and cash value. The adjusted sum insured can be calculated using the following formula:

Other terms and conditions:

- Once exercised, you cannot change or cancel this benefit or return to the original policy

- You cannot decrease your sum insured during the payout period but can surrender your policy

- Annual payouts will still continue even if there is a decrease in sum assured due to partial claims, until the surrender value equals 0, upon which your policy will terminate

- The adjusted sum insured applies for the remaining policy term even after your payout period ends

- This benefit ceases in the following events:

- Full policy surrender

- Policy lapse

- Conversion into paid-up insurance

- Full payout of the sum insured from a claim

Add-On Riders

Manulife LifeReady Plus offers various critical illness (CI) and premium waiver riders that you can add based on your priorities.

A summary of the types of riders can be found below. Due to the lack of information online, please refer to your policy contract or speak to a financial advisor for the full details.

Critical Illness Riders

Early Critical Care Rider (III)

This rider covers you for 125 critical illnesses across different stages from early, intermediate, advanced, to extended, as well as 10 special benefit conditions.

Upon diagnosis of a covered condition, Early Critical Care Rider (III) accelerates the payout of your basic policy’s sum insured.

A payout will also be given to you if you get admitted into the intensive care unit for 4 or more days. The payout is equal to 20% of your rider’s sum insured or $25,000, whichever is lower.

Known as the Recovery Plus Benefit, this can only be claimed once and terminates after you turn 85. A major plus is that a claim under this benefit doesn’t reduce your basic policy and rider’s coverage.

Your child(ren) will also get free advanced stage CI coverage of up to $10,000 per child. Claims can only be made when your child(ren) is older than 30 days but less than 18 years old when they are diagnosed.

Critical Care Rider (III)

Offering protection for 37 severe-stage and 20 extended advanced-stage CI, Critical Care Rider (III) is another CI rider that accelerates your death benefit payout.

The payout is equal to 100% of your rider’s sum insured, with the only exception being for Angioplasty and Other Invasive Treatment for Coronary Artery, in which only 10% of your rider’s sum insured can be claimed.

Similar to the Early Critical Care Rider (III), this rider also allows you to enjoy the Recovery Plus Benefit and the free advanced stage CI coverage for your children.

Premium Waiver Riders

Critical Illness Premium Waiver Riders

You can also add on the Early Critical Care Rider Waiver Rider (III) or Critical Care Rider Waiver Rider (III).

Both waive your premiums if you were to be diagnosed with a critical illness, with the former covering early, intermediate, advanced, and extended CI diagnosis, while the latter only covers advanced and extended CIs.

Payor Benefit Riders

There are 3 different payor benefit riders – Payor Benefit (I) Rider, Payor Benefit Plus (II) Rider, Payor Benefit Plus (II) Spouse Rider.

If you’re purchasing this plan for your loved ones, the Payor Benefit (I) Rider waives all future premiums if you were to pass on, contract a terminal illness, or suffer from total and permanent disability.

In addition to the above, the Payor Benefit Plus Rider (II) also waives premiums in the event of a covered advanced or extended CI diagnosis.

Payor Benefit Plus (II) Spouse Rider works in the same way as the above but covers your spouse’s death instead of you.

Bonus Features

Reversionary Bonuses

Manulife might declare a reversionary bonus annually, but the bonus rate is not guaranteed. Once declared, the reversionary bonus becomes guaranteed and will be paid out, regardless of the par fund performance.

The accumulated reversionary bonus pays out on death, TPD, TI, on policy maturity, or if you surrender your policy.

Choosing to surrender would result in a bonus payout that is less than the guaranteed accumulated reversionary bonus, with any amounts owed to Manulife subtracted.

At an illustrated rate of return of 4.25% p.a., the reversionary bonus is S$7.65 per $1,000 sum insured, with an annual compounding rate of 0.765%.

The interest added to the accumulated compounding rate and interest built up on reversionary bonuses is determined by the annual compounding rate.

Surrender Bonus

Upon surrendering a policy that has been in-force for at least 3 years, you may get an additional bonus if Manulife declares a non-guaranteed surrender bonus.

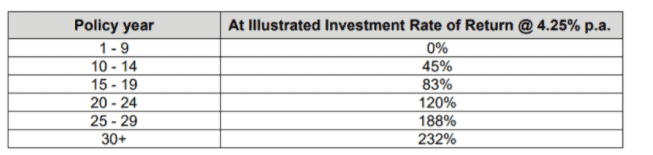

It is indicated as a percentage (illustrated in table 1) of the accumulated reversionary bonus surrender value and varies depending on when you surrender your policy.

Claim Bonus

Manulife may also declare a non-guaranteed claim bonus, which is payable in the event of a policy claim. The amount paid out is a percentage of the accumulated reversionary bonuses as indicated in Table 1 above.

Maturity Bonus

Lastly, if Manulife declares a non-guaranteed maturity bonus, you will receive an additional payout upon policy maturity. This is 232% of the accumulated reversionary bonus, assuming an illustrated investment rate at 4.25% p.a.

Participating Fund Performance

When deciding on which insurer to purchase your whole life plan, you should consider their par fund performance over the past few years. After all, one of the major reasons for choosing whole life over other types of insurance is its ability to grow your savings.

But do keep in mind that the ultimate objective of whole life insurance is still about getting you the protection you need. If you’re looking for great returns, there are many other types of pure investment products to consider.

With that said, let’s take a look at what to consider when determining the par fund’s performance:

Annual Investment Performance

Firstly, it is Manulife’s par fund performance in recent years, which has generally been performing well.

| Investment Returns | 2018 | 2019 | 2020 |

| Manulife Par Fund | -1.2% | 11.9% | 8.6% |

Geometric Average

Unlike taking the average rate of return, the geometric average provides a more accurate indicator of the performance of the par fund, accounting for compounding as well as the returns and losses which affect how much you can reinvest in the following years.

Manulife takes the cake when it comes to average net investment returns in the last 3 years, but performed average for the last 5 and 10 years. However, these are pre-COVID results so they may not be indicative.

Expense Ratio

Compare Manulife’s expense ratio across the other insurers, it has one of the highest average expense ratios. This can significantly affect the final profits that would be shared among those participating in the par fund.

Source: Moneysmart

Overall Performance

Manulife’s par fund has been performing quite well in recent years, but do note that they are also one of the insurers with the highest expense ratio which reduces the profits that can be shared.

Ultimately though, past fund performance may not be indicative of future results. On top of that, the final returns you receive are not the same as the fund’s rate of returns, but instead, dependent on the bonus that Manulife declares.

Of course, we can generally assume that if the fund performs well, the declared bonuses shouldn’t be too far off as well. Still, it is good to take the fund performance with a pinch of salt and use it as a reference only.

References

https://www.manulife.com.sg/en/solutions/life/whole-life-insurance/life-ready-plus.html