The NTUC Income Star Secure Pro is a whole life insurance plan that financially protects you and your family in adverse circumstances.

It’s the sequel to the NTUC Income Star Secure that we awarded up to 3 categories in our selection of the best whole life insurance plans in Singapore.

Those constantly worried about financing an insurance policy may find this plan attractive considering its various optional benefits, which waive premium payments in the event of different unforeseen scenarios, on top of the usual insurance coverage.

Apart from those unique situations, the NTUC Income Star Secure Pro also allows you to choose how much protection (and thus your premium payments) you are comfortable with.

If you are one of those who are now more intrigued or invested in the details of this policy, read on to find out more about it!

Here’s our review of the NTUC Income’s Star Secure Pro.

My Review of the NTUC Income Star Secure Pro

With the NTUC Income Star Secure Pro, you can rest assured knowing that you are well protected both in your health and your finances.

While the basic policy only provides you with some basic coverage against death, TI, and TPD, the flexibility of adding on riders also protects you against a myriad of dread diseases, such as cancer.

The NTUC Income Star Secure Pro covers you for up to 152 critical illness conditions – the highest in the market – and possibly the cheapest.

Financially, the NTUC Income Star Secure Pro takes excellent care of you by waiving off premiums in various scenarios, such as retrenchment or when your loved ones pass away or suffer from TI or TPD.

This allows you to focus on caring for yourself or your loved ones while being relieved of the stress of coping with your regular premium payments.

In addition, investing the premiums in a participating fund also ensures that you are able to get back some returns after a certain period of time.

However, be mindful that some of the benefits in the NTUC Income Star Secure Pro and its optional riders are only claimable once throughout the policy term, and you would be vulnerable if the same situation (requiring you to claim under that benefit) occurs again.

Compared to its predecessor, the NTUC Income Star Secure, the NTUC Income Star Secure Pro may, at first look, appear to have more stringent entry requirements and benefits.

Apart from an increase in the minimum policyholder entry age from 10 to 16 years old, there is also a decrease in the accidental death benefit coverage from 200% and 60% (for restricted activity) of the sum assured to 30% and 10% (for restricted activity) respectively.

There is also a decrease in the major impact benefit under the advanced accelerator rider from the full sum assured to just 20% of the sum assured.

However, the new policy has compensated for these drawbacks with an additional lump sum payment under the family waiver benefit, ensuring you are better cared for.

There is also an increase in the number of recognised DDs, which increases the chances of your condition (if any) being claimable under the Advanced Life Accelerator rider.

The Early Life Accelerator rider also now protects you for up to 152 critical illness conditions instead of just 142!

Looking at other similar whole life policies, it appears the NTUC Income Star Secure Pro is one of the few that covers you in the event of accidental death and retrenchment, which would otherwise require additional policies to make up for.

Furthermore, NTUC Income’s participating fund has the second-best track record over 15 years of returns and the best track record over 3, 5, and 10 years – so you’ll have a better peace of mind knowing that your savings are growing at the best possible returns for you.

With that, it is undeniable that the NTUC Income Star Secure Pro has certain limitations in its surrender value and the coverage amount for some benefits.

Despite this, it is still a comprehensive package that provides you with sufficient coverage that would otherwise be absent in other whole life policies, saving you the trouble of selecting multiple policies.

In fact, it’s been awarded 3 categories in our list of best whole life insurance plans in Singapore – Overall Best, Cheapest Whole Life Plan, and Best Whole Life Plan for ECI/CI coverage!

Nonetheless, it is always important to compare different policies and get a second opinion from an unbiased financial advisor to find a plan that is the best for you.

That’s because you’re about to pay premiums for up to 30 years and rely on the NTUC Income Star Secure Pro for your entire life.

Given the long-term financial commitment you’re about to enter, you should definitely take some extra time to research what’s best for you.

The last thing you want is to get lower than expected cash value or, worse, be unable to make claims in your times of need.

Need someone to assist?

Thousands of our readers have engaged our MAS-licensed financial advisory partners in the same scenario you’re in.

If you’d like to compare alternatives or get a second opinion, our partners are happy to assist you with this.

Click here for a free non-obligatory session.

Now let’s explore what the NTUC Income Star Secure Pro has to offer:

Criteria

- The minimum entry age for the policyholder is 16 years old

- Minimum and maximum premium terms of 5 and 30 years, respectively

General Features

Premium Payment Terms

For the NTUC Income Star Secure Pro policy, you can choose to make premium payments every 1, 3, 6, or 12 months, for the entire duration of the chosen premium term.

These are the available premium payment terms and their respective maximum entry age.

| Premium Payment Term | Maximum Entry Age for Insured |

| 5, 10, 15 or 20 years | 64 years old |

| 25 years, up to age 64 | 59 years old |

| 30 years | 54 years old |

Those who prefer some consistency will be glad to hear that the premium rates will remain the same throughout the premium term, provided no adverse health conditions arise.

Surrender Value

For those who may require urgent cash flow during the policy or premium term, you may choose to surrender your policy.

If your premium term is 5 years, there will be a surrender value from your plan after you have paid premiums for at least 1 year.

If your premium term is more than 5 years, there will only be a surrender value from your plan if you have made premium payments for at least 2 years.

Nonetheless, it is key to note that ending the policy early can come with significant costs, resulting in you losing all the surrender value or receiving less than the premiums paid.

As such, ensuring you have sufficient savings or liquid funds before making any long-term commitments is always important.

If you’re looking for the surrender value of your policy, check your policy documents or talk to your financial advisor, as each policy is different.

Protection

Death Benefit

Like most other policies, this benefit in the NTUC Income Star Secure Pro protects you against death.

Should the insured pass before the insured turns 75 or 80 (whichever is applicable), their loved ones will be eligible to receive the higher of:

- 100% of the sum assured and 100% of bonuses; or

- Minimum protection value (Between 100% to 500% of sum assured as per chosen coverage)

The death benefit is payable once as a lump sum to the beneficiaries, and the policy terminates.

Terminal Illness Benefit

The NTUC Income Star Secure Pro also protects the insured against terminal illnesses (TI).

According to the policy, the insured can be deemed to have contracted a TI if a registered medical practitioner has diagnosed that the insured is likely to pass away within 12 months.

If the diagnosis of the TI occurs before the insured turns 75 or 80 (whichever is applicable), their loved ones will be eligible to receive the higher of:

- 100% of the sum assured and 100% of bonuses; or

- Minimum protection value (Between 100% to 500% of sum assured as per chosen coverage)

Total and Permanent Disability Benefit

For total and permanent disability (TPD), it would require the insured to suffer from a total physical loss if they are under 65 years old (or a severe disability if they are 65 years old and above).

A total physical loss would then refer to:

- Total and permanent loss of sight in both eyes;

- Total and permanent loss of (or use of) 2 limbs at or above the wrist or ankle; or

- Total and permanent loss of sight in 1 eye and the loss of (or use of) 1 limb at or above the wrist or ankle.

The insured can also be determined to be suffering from a severe disability if they are unable to perform at least 3 of the following activities of daily living and constantly require another person’s assistance.

- Entering and exiting the toilet, alongside taking a bath or shower

- Dressing and undressing clothes, braces, artificial limbs, and other surgical appliances

- Transferring between a bed and a chair or a wheelchair

- Moving indoors from room to room

- Using the lavatory while managing bowel and bladder functions to maintain a satisfactory level of personal hygiene

- Consuming food by oneself after it has been prepared

If the event TPD occurs before the insured turns 75 or 80 (whichever is applicable), their loved ones will be eligible to receive the higher of:

- 100% of the sum assured and 100% of bonuses; or

- Minimum protection value (Between 100% to 500% of sum assured as per chosen coverage)

If the above conditions occur after the insured turns 75 or 80 (whichever is applicable), the payout will only comprise of the sum assured plus any bonuses earned.

However, the payout will be made only after deducting any policy loan and interest owed to NTUC Income, and the policy will be deemed terminated thereafter.

Accidental Death Benefit

An additional payout of 30% of the sum assured will be made if the insured passes away within 365 days of reaching the age of 70 due to an accident.

If the accident involves a restricted activity, this benefit will only pay out an extra 10% of the sum assured on top of the death benefit.

Like the previous death, TI, and TPD benefits, the payout will also be made only after deducting any policy loan and interest owed to NTUC Income, and the policy will be deemed terminated thereafter.

For existing and prospective policyholders, it is important to note that if you are also covered for accidental death benefits under other NTUC Income policies, there is a cap on the total accidental death benefit payable from all these policies at $3 million (excluding bonuses).

Key Features

Coverage Multiplier

Depending on your needs and preferences, you are given the option to choose between different multiplier values of the sum assured.

The primary objective of a multiplier is to amplify your coverage during working years when you are more financially active and subsequently reduce it back to the base amount when you don’t need it to lower your premiums later on.

However, opting for a higher multiplier also entails higher premium payments initially as the main trade-off.

With this policy, you have the flexibility to select a coverage amount tailored to your specific requirements, with the option to multiply your coverage by 100%, 200%, 300%, 400%, and 500% of the sum assured until you reach the age of 75 or 80.

Retrenchment Benefit

As mentioned earlier, those worried about financing the insurance policy with the uncertainty in today’s job market can rest assured with this benefit.

The NTUC Income Star Secure Pro ensures that should you lose your job, you will be relieved from paying premiums for the basic policy and the Star Secure Pro – Protection Benefit for 6 months starting from the next premium due date.

However, to be eligible for this benefit, you must have:

- Paid premiums for 6 months or more;

- Lost employment 6 months and over after the policy started;

- Remained unemployed for 3 consecutive months after the retrenchment; and

- Not claimed this benefit before during the policy’s duration.

Upon successfully regaining permanent paid employment, you will then be required to resume your premium payments, and this benefit will terminate.

Family Waiver Benefit

NTUC Income is also aware that apart from one’s own predicament, family is also of utmost importance to all their customers.

Under this benefit, the term ‘family member’ would refer to the following:

| If the Insured Person is: | The Family Member Will Be: |

| Yourself | Your Legal Spouse |

| Your Legal Spouse | Yourself |

| A Juvenile | The Juvenile’s Legal or Natural Parents |

As such, the following benefits can be claimed if the insured’s family member passes away, or suffers from TI or TPD.

- Waiver of premium payments for this policy and its riders; and

- Lump sum payment of 24 months premiums of this policy and its riders

However, claimants should note that there is a cap of $1 million that can be claimed under this benefit, and a TPD claim under this benefit will also be aggregated within the TPD limit of $6.5 million.

To be eligible for this benefit, the following conditions must also be met:

- The event must occur during the premium term of this policy;

- The event must occur before the family member reaches the age of 70; and

- The family member must be below the age of 64 when this policy is issued

Once the benefit is successfully claimed, or the basic policy is vested (whichever is earlier), this benefit will be deemed terminated.

Bonuses

This policy becomes eligible for bonuses after being active for 2 years from the policy start date.

Annual / Reversionary Bonus

Each year, NTUC Income calculates the amount of annual bonus you are eligible for as a percentage of the basic sum assured and past year’s bonuses.

Once these bonuses are calculated and added to your policy, they are guaranteed, and you are entitled to receive it regardless of the fund’s performance.

Terminal / Special Bonus

Conversely, the terminal bonus is a non-guaranteed bonus paid out at the time of a claim, maturity, or surrender of the policy.

Optional Add-On Riders

Do you still feel like the basic policy’s protection is insufficient? Do you want to increase your coverage yet avoid multiple insurance plans?

Erase those worries now! The NTUC Income Star Secure Pro allows you to enhance your protection by adding the available non-participating riders for additional benefits.

Advanced Life Accelerator

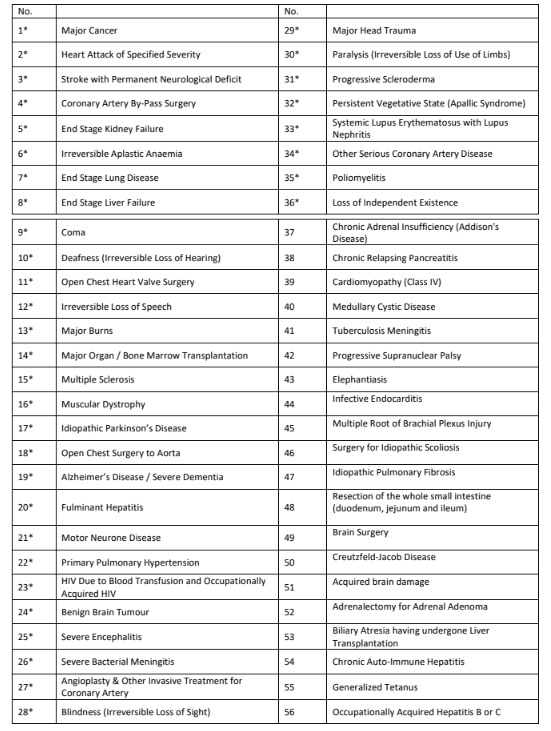

The Advanced Life Accelerator is a critical illness (CI) rider that protects you against 56 dread diseases (DD) and future unknown diseases or serious infections that may require surgery or an extended stay in an intensive care unit (ICU).

For this rider, the minimum protection value and applicable age will follow that of the basic policy, as a percentage of the sum assured (from 100% to 500%) before the insured reaches the age of 75 or 80 (whichever is applicable).

Any payouts under this rider will serve as an accelerated payment, thus reducing the sum assured and any bonuses of the rider, its basic policy, and other accelerated riders by the same amount as the payout.

Premium Payment Terms

Similar to the basic policy, the premiums for this rider are payable every 1, 3, 6, or 12 months throughout the premium term.

The premium rates are also not guaranteed and subject to changes, with NTUC Income informing you 6 months before any changes in the premium rates.

Dread Disease (DD) Benefit

If the insured gets diagnosed with any of the specified DDs during the rider coverage term (except for certain heart treatments), your payout depends on when the illness was diagnosed.

| Age at Occurence of Claim Event | Benefit |

| Before the age of 75 or 80 (whichever is applicable) | The higher of:

|

| Above the age of 75 or 80 (whichever is applicable) |

|

If the insured is required to undergo specific heart treatments (including angioplasty and other invasive treatments for coronary arteries), the payout will also be dependent on when the event occurs.

| Age at Occurence of Claim Event | Benefit |

| Before the age of 75 or 80 (whichever is applicable) | The higher of:

|

| Above the age of 75 or 80 (whichever is applicable) |

|

It is important to note that the payout for these specific heart treatments will only be made once under this benefit, with a maximum cap of $25,000 (excluding bonuses).

For those with policies that already cover DDs, the total payout from all these policies, including the NTUC Income Star Secure Pro, has a limit of $3.6 million.

Upon the successful claim of this benefit, less any loan amount and interest, this rider will also be deemed terminated.

Those curious about the DDs covered may also wish to refer to the list below for the 56 DDs that are encompassed within this rider:

Major Impact Benefit

Apart from protecting against DDs, this optional rider also protects you when you:

- Undergoing surgery or suffering an infection; and

- Requiring an ICU stay for 5 days or more.

However, for the benefit to be applicable, the surgery or infection and the ICU stay must arise from the same cause and be deemed necessary.

The major impact benefit also depends on the insured’s age at which the event resulting in the surgery, infection, or ICU stay occurs, and is only effective if the insured is below 85 years old.

| Age at Occurence of Claim Event | Benefit |

| Before the age of 75 or 80 (whichever is applicable) | The higher of:

|

| Above the age of 75 or 80 (whichever is applicable) |

|

The final payout receivable will be calculated after deducting any policy loan and interest applicable, and can only be claimed once under this rider.

If you purchase this rider, be mindful that there is a 90 days waiting period from the cover start date for illnesses that fall under the major impact benefit.

For those with other major impact benefit policies issued by NTUC Income, the maximum benefit will be $100,000 (excluding bonuses) for each insured person.

Early Life Accelerator

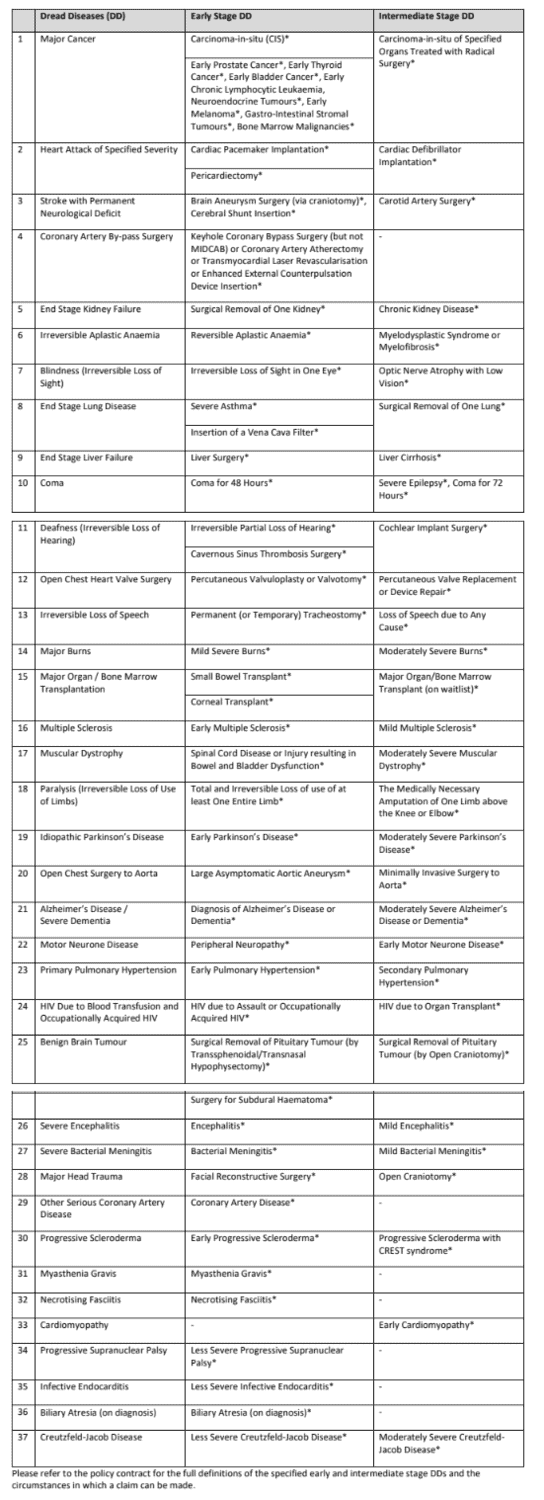

Another optional rider offered under the NTUC Income Star Secure Pro is the Early Life Accelerator, an early critical illness (ECI) rider covering up to 152 conditions (the highest in the market at the point of writing!).

Like the Advanced Life Accelerator rider, this add-on protects you against DDs from their early, intermediate, and advanced-stage DDs.

However, this rider also gives you ease of mind by providing a range of other benefits for conditions not classified as DDs.

Premium Payment Terms

Similar to the basic policy, the premiums for this rider are payable every 1, 3, 6, or 12 months throughout the premium term.

The premium rates are also not guaranteed and subject to changes, with NTUC Income informing you 6 months before any changes in the premium rates.

Early and Intermediate Stage Dread Disease Benefit

Should the insured get diagnosed with any of the listed early or intermediate-stage DDs, the benefit will be paid out depending on when the diagnosis occurs.

| Age at Occurence of Claim Event | Benefit |

| Before the age of 75 or 80 (whichever is applicable) | The higher of:

|

| Above the age of 75 or 80 (whichever is applicable) |

|

The final amount paid out to you or your loved ones will be less the policy loan and interest applicable.

It is important to note that this is a one-time claim benefit, and the sum assured under this rider will become $0 upon a successful claim.

Additionally, subsequent premium payments for this rider are no longer required, and the juvenile and special benefits are terminated.

Nonetheless, the advanced restoration and special therapy benefits will remain in effect.

In addition, if the insured has other policies with early and intermediate-stage dread disease benefits issued by NTUC Income, the maximum benefit will be $350,000 (excluding bonuses).

To make a claim, do be sure to look through the list below to check if the insured’s condition is eligible:

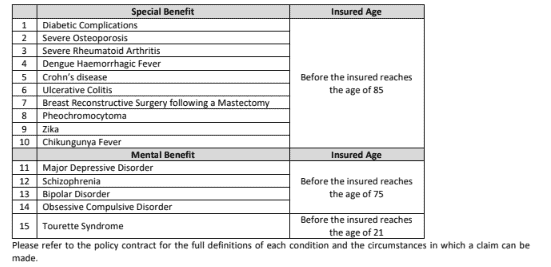

Special and Mental Benefits

Suppose the insured is diagnosed with any of the listed conditions or undergoes any specified procedures before reaching a specified age, their loved ones will receive a payment equal to 30% of the sum assured of the rider.

A mouthful, I know, but bear with me.

Despite the claim not reducing the sum assured of this rider, a cap of 5 claims can still be made under this benefit, provided each claim attributes to a unique condition in the list and is 3 years apart from each other.

If the insured has other policies with special or special and mental benefits issued by NTUC Income, the maximum benefit will be $30,000.

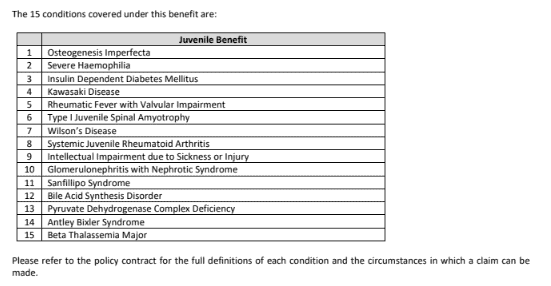

Juvenile Benefit

In addition to the numerous conditions listed in the above benefits, this rider also takes extra care of your child if they are the insured and below 18 years old.

By covering against 15 different conditions, the insured’s beneficiary is eligible to receive a payout of 20% of the rider’s sum assured

Similar to the special and mental benefits, there is also a cap of 5 claims that can be made under this benefit, although each claim has to be for different juvenile benefits.

Should the insured possess any other NTUC Income policies with juvenile benefits, the maximum payment is $30,000 for every insured child, regardless of the number of policies.

Advanced Restoration Benefit

After a successful claim under the early and intermediate stage DD benefit, the insured is eligible to receive additional protection against the following advanced-stage DDs:

- Major Cancer

- Heart Attack of Specified Severity

- Stroke with Permanent Neurological Deficit

While this is a one-time claim benefit, it does not reduce the sum assured of this rider, its basic policy, and other accelerated riders.

However, if the accelerated payment for the early and intermediate stage DD benefit reduces the rider’s sum assured to $0, this benefit will be based on the sum assured before this accelerated payment is made.

| Age at Occurence of Claim Event | Benefit |

| Before the age of 75 or 80 (whichever is applicable) | 20% of the rider’s minimum protection value |

| Above the age of 75 or 80 (whichever is applicable) | 20% of the rider’s sum assured |

If you are insured by other NTUC Income policies with an advanced restoration benefit, the total benefit is capped at $3.6 million.

Special Therapy Benefit

Cancer is one of the more talked about conditions, and NTUC Income understands their customers’ worries.

As such, they have included a special therapy benefit in this rider which will provide financial support if the insured is diagnosed with catastrophic cancer requiring advanced treatments such as cell, tissue, and gene therapy.

This benefit is also claimable only once and does not reduce any of the sum assured.

However, if the rider’s coverage is exhausted due to an accelerated payment of the early and intermediate stage DD benefit or the DD benefit from the Advanced Life Accelerator, this benefit will be based on the sum assured before that accelerated payment.

| Age at Occurence of Claim Event | Benefit |

| Before the age of 75 or 80 (whichever is applicable) | 20% of the rider’s minimum protection value |

| Above the age of 75 or 80 (whichever is applicable) | 20% of the rider’s sum assured |

Where other policies issued by NTUC Income include the special therapy benefit, the maximum payment is $50,000 for each insured person.

NTUC Income Star Secure Pro Fund Performance

Premium Allocation

Ever wondered where your premium payments go to?

Those who purchase this policy will have their regular premium payments invested in a participating fund managed by various external fund managers who help you to spread the money over multiple types of assets.

As of 31st December 2021, the strategic and current breakdown of the fund is as such:

| Type of Asset | Strategic Allocation | Actual Allocation |

| Risky Assets (Including Equities & Properties) | 36% | 37% |

| Fixed Income, Cash & Others | 64% | 63% |

| Total | 100% | 100% |

Investment Rate of Return

Before committing to this long-term policy, it is vital that you take a look at the fund’s performance over the past years, as this allows you to compare it against that of other investment-related plans.

The implications of this?

The better the performance of the fund, the more bonus you are likely to get over the years.

This includes the non-guaranteed bonus, which also translates to higher cash value for you!

| 2019 | 2020 | 2021 | Average of Last | |||

| 3 Years | 5 Years | 10 Years | ||||

| Investment Returns | 9.59% | 9.14% | 0.54% | 6.34% | 5.74% | 5.04% |

From the table above, we understand that the fund has constantly been performing very well, averaging more than 5% in the 3, 5, and 10-year averages.

There is also a year-on-year return of more than 9%, except for 2021, where the drop could have been attributed to several factors, such as economic conditions and changes in investment strategies.

In fact, if you look at the geometric average net investment returns of NTUC Income compared with other par funds, it’s clear that NTUC Income has been performing within the industry average across the years.

The high ratio of non-guaranteed income to invested assets is also a sign of good investment strategies over the years, allowing for the issuance of higher bonuses.

Total Expense Ratio

Apart from the past IRR, it is also advisable to study the total expense ratio of the participating fund.

This gives you an idea of the costs of managing the participating fund compared to its assets and how it can impact your policy’s performance and potential benefits.

| 2019 | 2020 | 2021 | Average of Last | |||

| 3 Years | 5 Years | 10 Years | ||||

| Total Expense Ratio | 0.83% | 0.82% | 1.01% | 0.89% | 0.87% | 0.84% |

From an investor’s perspective, the low average total expense ratio over the past years indicates that the fund did not incur any extravagant costs and is unlikely to hamper the amount of bonuses you may receive.

Compared to other funds, NTUC Income has been consistently maintaining the lowest average expense ratio compared to its other major competitors.

As a result, you can be sure that most of your premiums invested would actually go into the fund’s investments and not be wasted on other fund-related expenses.

NTUC Income Star Secure Pro Fees and Charges

In the NTUC Income Star Secure Pro, the fees and charges incurred by running and investing in the participating fund are already accounted for in your regular premium payments.

As such, you can rest assured that there will not be any additional charges.

An Illustration of How the NTUC Income Star Secure Pro Works

Edmund is 28 years old, married, and a non-smoker. He decided to get the NTUC Income Star Secure Pro insurance plan with a sum assured of $100,000 and a premium payment term of 20 years.

He also gets coverage with the minimum protection value of 300% of the sum assured until he turns 75.

In addition, Edmund also opts for the Advanced Life Accelerator rider and the Early Life Accelerator rider with coverages at $100,000 and $50,000, respectively.

As a result of his above choices, he is required to pay an annual premium of $4,343.

| Policy Year | Edmund’s Age | Sequence of Events |

| 0 | 28 | Edmund purchases the policy. |

| 8 | 36 | Edmund, unfortunately, is diagnosed with early-stage colon cancer.

Early Life Accelerator Rider Early and Intermediate Stage Dread Disease Benefit = $50,000 Minimum Protection Value Percentage of Sum Assured = 300% Final Payout Payout Received = $50,000 x 300% = $150,000 |

| Remaining Sum Assured

Basic Policy = $50,000 Advanced Life Accelerator Rider = $50,000 Early Life Accelerator Rider = $10,000 Policy Changes Premium payments for the Early Life Accelerator rider will stop. However, this rider will continue providing coverage for:

|

||

| 11 | 39 | Edmund’s wife, unfortunately, was diagnosed with a terminal illness (TI).

Premium Waiver Mr Lim’s subsequent premiums of $1,808 for the Basic Policy and the Advanced Life Accelerator rider will be waived. Basic Policy Family Waiver Benefit = Lump sum of 24 months of premiums for his basic policy and rider |

| 22 | 50 | Edmund contracted an unknown disease and was warded in the ICU for 7 days.

Advanced Life Accelerator Rider Major Impact Benefit = $50,000 Minimum Protection Value Percentage of Sum Assured = 20% x 300% = 60% Final Payout Payout Received = $50,000 x 60% = $30,000 |

| Remaining Sum Assured

Basic Policy = $40,000 Advanced Life Accelerator Rider = $40,000 Early Life Accelerator Rider = $10,000 |

||

| 32 | 60 | Edmund was diagnosed with advanced stage lymphoma and had to undergo cell, tissue, and gene therapy.

Advanced Life Accelerator Rider Dread Disease Benefit = $40,000 Early Life Accelerator Rider Advanced Restoration Benefit = $10,000 Special Therapy Benefit = $10,000 Minimum Protection Value Percentage of Sum Assured = 300% Final Payout Payout Received = ($40,000 + $10,000 + $10,000) x 300% = $180,000 |

| Policy and riders end. | ||

| Total Payout from Policy and Riders = $369,035 | ||

Summary of the NTUC Income Star Secure Pro

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Withdrawal | No |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | Yes |

| Terminal Illness | Yes |

| Critical Illness | Optional (as a form of Dread Disease) |

| Early Critical Illness | Optional (as a form of Dread Disease) |

| Health and Insurance Coverage Multiplier | |

| Death | Yes |

| Total Permanent Disability | Yes |

| Terminal Illness | Yes |

| Critical Illness | Optional (as a form of Dread Disease) |

| Early Critical Illness | Optional (as a form of Dread Disease) |