The HSBC Life Flexi Protector is an insurance-focused investment-linked policy that safeguards you against death while offering a range of investment funds for potential long-term financial returns.

HSBC Life Flexi Protector lives up to its name, offering a wealth of flexibility.

It offers you 2 levels of coverage, Choice Cover or Max Cover, and your choice determines the payout for the Death, Terminal Illness (TI), and Total Permanent Disability (TPD) benefits.

Let’s explore the benefits and coverage of HSBC Life Flexi Protector and find out if it best suits your financial goals and protection.

Here’s our review of the HSBC Life Flexi Protector – keep reading to learn more about it.

My Review of the HSBC Life Flexi Protector

The HSBC Life Flexi Protector is a pretty flexible and potentially lucrative insurance-focused investment-linked policy.

It starts at just S$100 per month and gives you many options to tweak and boost your protection.

You’re covered for the usual suspects: terminal illness, death, and TPD.

Plus, if you want to get all specific and customise your coverage, you can add riders that cover you for disability income, early critical illness, critical illnesses, multipay ECI/CI, and premium waivers!

As the HSBC Life Flexi Protector is an ILP, part of your premiums are also used to invest through the funds you choose.

There’s a good selection of funds – including AI funds that potentially bring in higher returns than your regular retail funds.

And the best part? You can pass the policy on to your loved ones.

However, it’s not your go-to if you’re all about guaranteed long-term returns or looking for cash outs in the early years.

And that 5% charge for premium top-ups? Kinda steep, especially when you can find other options with lower fees.

The insurance charges are also front-loaded, so your investments will take longer to grow.

One last thing: the HSBC Life Flexi Protector is more of a traditional insurance-focused ILP. Not exactly our top pick.

We think many will do better with a term plan or a whole life insurance plan paired with an investment-focused investment plan.

That way, you separate your insurance and investments and get more bang for your buck.

This way’s also more cost-effective (even with a whole life plan & an investment-focused ILP), especially in the long term.

Of course, that’s just our 2 cents.

As everyone is in a different situation, what’s best for me might not be the best for you.

That’s why we always suggest taking the time to talk to an unbiased financial advisor – for advice or for a second opinion.

That way, you don’t make costly financial mistakes (it’s more common than you think).

So, if you’re curious, click here for a free, no-strings-attached chat!

Here’s more on the HSBC Life Flexi Protector:

Criteria

- Age of entry: 1 month old to 70 years old

- Policyholder: 18 – 70 years old

General Features

Premium Payment Terms

Unlike other investment-linked plans, this one doesn’t let you use your Supplementary Retirement Scheme (SRS) savings, CPF Ordinary Account (CPF-OA), or CPF Special Account (CPF-SA) for premium payments.

Upon signing up for the policy, you will be required to pay the regular premium in cash, which can be monthly, quarterly, semi-annually, or annually.

Here is a table to illustrate how you can make regular income payments:

| Premium Frequency | Minimum Regular Premium | |

| Amount in SGD | Amount in USD | |

| Monthly | $100 | N/A |

| Quarterly | $300 | $300 |

| Semi-annually | $600 | $600 |

| Annual | $1200 | $1200 |

However, monthly payments in USD is currently unavailable.

Premium Top-ups

Top-up premiums are allowed at any time during the policy tenure.

The minimum amount allowed for top-up is $250 and must be in multiples of $10.

However, note that top-up premiums are not allowed during the Premium Holiday.

Recurring Single Premium (RSP)

A recurring single premium is available on this policy if it is denominated in SGD and if you’re below 70 years old.

This allows you to increase your investments into your ILP sub-funds during the policy term.

The minimum amount allowed for top-up is $50, which must be in multiples of $50.

RSPs aren’t allowed during the Premium Holiday, just like premium top-ups.

Protection

Death Benefit

In the event of death, the insured’s beneficiaries will receive the Death Benefit, which will be paid either as a Choice Cover or Max Cover – depending on what you’ve selected previously.

- Choice Cover: Death Benefit payable is the higher of the account value or the basic sum assured, including the top-up plus RSP minus withdrawals.

- Max Cover: The Death Benefit payable will be a sum of the account value and the Basic Sum Assured.

Either way, the Death Benefit is paid after deducting debts owed to the policy. Subsequently, the policy terminates after payment.

Terminal Illness Benefit

In the event that the life assured is diagnosed with a terminal illness, they will receive the lower of:

- Up to $3 million, or

- The full Death Benefit.

The policy will end if the Death Benefit is fully paid out due to the Terminal Illness claim.

If not, it will stay active with any remaining Account Value after subtracting $3 million from the Terminal Illness Benefit.

Total And Permanent Disability Benefit (TPD Benefit)

This benefit provides financial coverage if the policyholder becomes totally and permanently disabled before they turn 80.

HSBC Life will pay the Basic Sum Assured minus any outstanding policy debts as a lump sum.

The maximum TPD benefit payable depends on the policyholder’s status:

- $6 million for Singapore Citizens, Permanent Residents, or valid pass holders.

- $4 million for individuals who are not Singapore Citizens, Permanent Residents, or valid pass holders.

- $1 million for insured individuals under 16 years old.

Optional Add-On Riders

With this plan, you can bump up your coverage with a versatile range of riders that are tailored specifically for different stages and needs of critical illness coverage.

Super CritiCare Benefit

The Super CritiCare Benefit Rider provides you with multiple payouts for critical illnesses of different stages.

How it works is that you will receive a payout if you are diagnosed with a critical illness.

And if you are subsequently diagnosed with another covered critical illness, you may receive additional payouts for up to 600%, offering comprehensive protection.

This is similar to their standalone multipay CI plan – HSBC Life Super CritiCare.

Disability Income Rider

There’s no information only, but we guess that this rider offers added protection by providing you with a regular income in case you become disabled and unable to work.

Premium Waivers

Similarly, we believe they offer a range of premium waiver riders that will waive the premiums for you/your family should something unfortunate happens to the policyholder.

Other Riders

In addition to the riders mentioned earlier, several other riders are available to further enhance your insurance policy. Here are some examples:

- CI Choice Accelerator Benefit

- CI Max Accelerator Benefit

- CI Additional Benefit

- ECI Choice Accelerator Benefit

- ECI Max Accelerator Benefit

- ECI Additional Benefit

While we are not exactly sure what each of the rider covers as they’re not publicly available, based on their names, we guess that they offer varying coverage for:

- Accelerated ECI coverage

- Accelerated CI coverage

Key Features

Premium Holiday

If you fail to pay your initial regular premium, you will have a grace period of 30 days.

After that, the Premium Holiday is automatically activated if you fail to pay on the premium due date.

However, if you fail to pay the regular premium after the grace period expires, the policy is auto surrendered.

In this case, you will receive a refund of the account value minus policy debts. If a claim arises during the auto-surrender period, the policy will not pay any benefits.

It’s unclear how long the premium holiday is available for.

Life Replacement Option

While the policy is still running, you can request to replace the Life Assured subject to certain conditions.

- You must provide proof of insurable interest in the new Life Assured, and the person must meet the eligible entry age.

- It is only available upon request and not applicable to institutions or organisations.

- The new life assured is either your spouse, child, legally adopted child below 18 years or you if the plan is a third party policy.

- Upon submission of this request, the policy and riders covering the new life assured must undergo underwriting. Riders covering the original life assured are deleted. But those covering the policyholder continue running.

- After exercising this option, the insurance charge applies to new life assured based on smoking status, age and gender.

- Previous assignment of this policy should be revoked before implementation of the LRO.

- Before implementation, previous revocable or revocable nomination of a beneficiary must be revoked.

- Pre-existing conditions are not covered for the new life assured.

Guaranteed Insurability Option (GIO)

The policy allows you to apply for an increase in the basic sum assured or buy a new policy under the Guaranteed Insurability Option (GIO) without medical underwriting.

Still, there are some conditions that you must meet to exercise the GIO feature.

- The policy should start under standard terms.

- You must request the GIO within 90 days of a significant milestone event, with supporting legal documents.

- You must be under 55 years old when using the GIO.

- You can only use the GIO if no successful claims were previously made under the original HSBC Life Flexi Protector Policy.

- The insured person must not have TPD, TI, any stage of CI, or symptoms that prompted seeking medical attention for a Critical Illness before using the GIO.

- If you’ve already used the LRO (Life Reinstatement Option), you can still use the GIO on a new insured person, following all terms and conditions. The Basic Sum Assured will be based on the original amount at the time of using this option.

You may choose to get a whole life, term, investment-linked policy covering death, TI, TPD, and/or critical illness.

While it is unclear what policies qualify under the GIO, here are some of the policies offered by HSBC Life that you might be able to apply for:

- Term life insurance: HSBC Life Term Protector

- Whole life insurance: HSBC Life – Life Treasure (II)

- Investment-linked policy: HSBC Life Pulsar, Wealth Accelerate, Wealth Harvest, Wealth Invest, or another HSBC Life Flexi Protector

- Critical Illness insurance: HSBC Life Super CritiCare

Dividend Distribution

Investing in the ILP Sub-Fund offers 2 options for dividend payouts – reinvest the dividends or receive them in cash.

You are only eligible for a dividend payout if the amount you are entitled to meets the minimum amount of S$30 per sub-fund.

If the amount is less than that, the dividends will be automatically reinvested on your behalf.

Keep in mind that dividend distributions are not guaranteed.

If you choose to reinvest, the dividends will increase your units from the relevant ILP sub-fund.

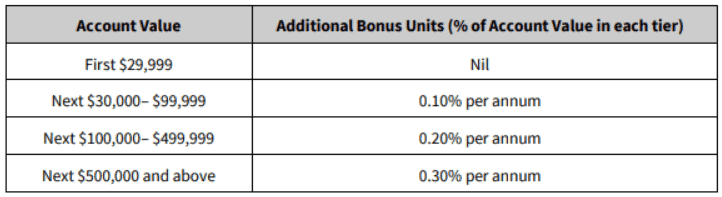

Extra Bonus Units

Extra bonus units are notionally allocated on the policy commencement date depending on the account value, as shown in the following table:

These units are allocated to the sub-fund based on the existing allocation and the net asset value of the sub-fund during allocation.

Partial Withdrawals

The minimum partial withdrawal in SGD or USD is $250. However, certain conditions must be met:

- The remaining account value must be more than $2,500 (Minimum Holding Amount) for partial withdrawals to be allowed.

- The withdrawal amount must be in multiples of $10.

The Minimum Withdrawal Amount and Minimum Holding Amount are subject to change.

Regular Withdrawals

You can make regular withdrawals monthly, quarterly, semi-annually, or annually if your account value does not fall below the allowed amount.

The following table shows the regular withdrawal amount limits:

| Regular Withdrawal Frequency | Minimum Regular Withdrawal Amount |

| Monthly | S$100 |

| Quarterly | S$300 |

| Semi-annual | S$600 |

| Annual | S$1,200 |

Changing The Sum Assured

After signing up for the policy, you may request to increase the sum assured for both basic and rider insurance.

The cost of insurance (COI) for any changes made to the amount of the sum assured will be determined by the insured person’s age at that time.

For the sum assured to be reduced, your policy must be in its 49th month onwards.

This may also reduce attached rider sum assurance such as CI Max Accelerator Rider and CI Choice Accelerator Rider Sum Assured.

Fund Switching

This policy allows you to switch Units from one ILP Sub-Fund to another.

HSBC Life Flexi Protector Fees and Charges

Premium Charge

These are the premium charges you’ll incur every time you make premium payments for the HSBC Life Flexi Protector:

| Policy Year | Premium Allocation to Buy Units (%) | Premium Charge (%) |

| 1st year | 20% | 80% |

| 2nd year | 40% | 60% |

| 3rd year | 55% | 45% |

| 4th year | 100% | 0% |

| 5th year onwards | 102% | 0% |

What this means is that in your first year, 80% of your premiums will be charged by HSBC Life, followed by 60% and 45% in the following 2 years.

Top-Up & Recurring Single Premium Charges

Top-ups and recurring single premiums are subjected to a 5% premium charge.

Administration Fee

HSBC Life imposes an administration fee of $5 is applied every month. The administration fee may increase but will not exceed $12 per month.

Insurance Charge (COI)

Every month, a COI (Cost of Insurance) is assigned to the basic policy and the payment is made through the cancellation of units.

The monthly COI is calculated based on the sum at risk of this policy. Additionally, the COI may vary depending on the Choice Cover or Max Cover as shown in the following table:

| Cover | The COI Calculation |

| Choice Cover | To calculate the monthly Cost of Insurance (COI) for a policy, you need to consider the

Sum At Risk. Sum At Risk = Basic Sum Assured + RSP + Top-up – Partial Withdrawal – Regular Withdrawal – Account Value |

| Max Cover | In this policy, the Sum At Risk is equal to the Basic Sum Assured. The Insurance Charge for the policy increases each year based on the age of the Life Assured.

It’s important to note that the Insurance Charge is not guaranteed and may vary over time. |

Fund Management Charges

The HSBC Life Flexi Protector invests in unit trusts – more specifically, directly into them instead of an ILP sub-fund.

This means that there are fewer layers of fees that you’ll incur – a good thing.

The fund management charges for the sub-funds may differ per fund. The fund managers will determine the fund management charges from time to time.

Based on a quick glance, the HSBC Life Flexi Protector’s funds charge a fund management fee between 0.55% to 2.04%.

These charges are already included in your returns. Thus, the returns you see from your funds are net charges.

Other Charges

Optional services or products provided will be charged that can vary unless it is specified as guaranteed in the policy.

Summary of the HSBC Life Flexi Protector

| Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Withdrawals | Yes |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | Yes |

| Terminal Illness | Yes |

| Critical Illness | Yes, with rider |

| Early Critical Illness | Yes, with rider |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Optional Add-on Riders | Yes |