The AXA Super CritiCare is now known as the HSBC Life Super CritiCare.

AXA is one of the most recent insurers to jump onto the multipay critical illness (CI) bandwagon with its Super CritiCare. And with good reason as well, with people becoming increasingly aware of the high risk of contracting multiple CIs due to us living longer.

Coverage-wise you can claim up to 600% of your basic sum assured for various early, intermediate, and advanced stage CIs. It also boasts first in market coverage for all stages of rediagnosed cancer and relapsed heart attack or stroke, and a diabetes care programme.

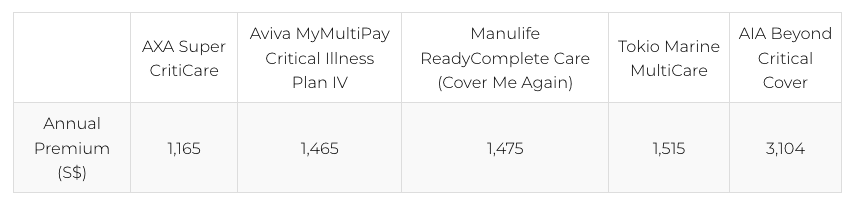

Touted as one of the most affordable multipay CI plans, let’s take a look at how the plan works and how it holds up against its other competitors despite being late to the party.

My Review of the HSBC Life (previous AXA) Super CritiCare

The AXA SuperCritiCare has been selected as one of the best critical illness plans in Singapore – in fact, we awarded it the overall best in our 2021/2022 edition of our post.

The only plan in the market that covers rediagnosed cancer, heart attack and stroke for all stages, and that have a dedicated, curated programme for managing diabetes, these features give AXA’s Super CritiCare a significant advantage over its other competitors.

The former is a particularly valuable benefit to have if your family has a history of cancer. But do note that the plan is subjected to underwriting, so having a history of cancer might warrant higher premiums.

However, the extra premiums paid are nothing compared to the strain on your wallet if you were to be inadequately covered for critical illnesses.

It’s not lacking price-wise either, beating out all its other multipay critical illness competitors.

*Premiums are based on a 30-year-old male, non-smoker for a sum assured of $100,000 and coverage to age 75.

Unfortunately, it’s not possible to be the best at everything; trade-offs have to be made.

One area this plan loses out in is that it only allows you to claim an early/intermediate stage critical illness once. All other multiple payout CI plans allow multiple claims on the same critical illness, subject to varying waiting periods.

Also, the AXA Super CritiCare only pays you 100% of your sum assured, regardless of the CI stage.

This means that if you are immediately diagnosed with advanced-stage CI, you only get 100% of your sum assured. Similarly, if you’re immediately diagnosed with early/intermediate-stage CI, you also only get 100% of your sum assured.

For the latter, the 100% sum assured might be fine.

However, if you’re straight away diagnosed with advanced-stage CI, perhaps you don’t go for regular check-ups or treat symptoms as nothing serious, the 100% sum assured will not be enough to pay for 5 – 7 years of treatment, as advised by the Life Insurance Association of Singapore.

This means that you’ll need to supplement your advanced CI coverage (not ECI) with another term or whole-life plan + rider, potentially increasing your total premiums.

If you’re looking for a plan that provides higher levels of coverage, I personally feel that the Singlife Multipay Critical Illness Plan or Tokio Marine’s MultiCare might be a better fit as they offer a maximum claimable sum assured of 900%.

On top of that, they pay out a maximum of 300% of your basic sum assured for advanced-stage diagnosis. As seen in the premium comparison above, it’s only $300 more per year for higher advanced-stage CI coverage.

Assuming your sum assured is 100k, you’ll need to top up another 200k in coverage from other plans to ensure you’re sufficiently covered. This is likely to cost more than the $300 more per annum in premiums.

And with the entrance of the Manulife CI FlexiCare (Deluxe), the HSBC Life Super CritiCare has been dethroned.

Manulife’s CI FlexiCare (Deluxe) blends affordability and comprehensive coverage in a way that makes it the best CI plan in Singapore.

However, as many CI plans are available, all of them provide varying levels of coverage, for different types of CIs defined in many ways, for different stages – ranging from early, intermediate to advanced, with different waiting periods between claims.

Attempting to decipher them might be headache-inducing and leave you more confused as compared to when you first started.

As such, I recommend reading our comparison post of the best ECI/CI plans first to explore possible alternatives for yourself.

After understanding your options, you should look into getting a second opinion from an unbiased financial advisor to which might be better for you – whether it’s the HSBC Life Super CritiCare or another policy.

Insurance coverage is a long-term commitment, and you don’t want to pay premiums for the next 20 to 30 years only to realise that it’s not the best option for yourself.

If you need someone to assist you, we partner with MAS-licensed financial advisors who are happy to help.

Click here for a non-obligatory chat.

Now let’s explore the HSBC Life Super CritiCare in more detail.

Criteria

Policy Entry Age

Depending on whether you are purchasing the plan for yourself or your loved one, as a 3rd party policy, certain age restrictions apply:

- Life Insured: 1 month to 70 years old

- Policyholder: 18 to 99 years old

The policyholder refers to you – the person purchasing the plan, while the life insured refers to the person who will be covered by the policy, which can either be you or your loved one.

Sum Assured

In terms of coverage, you can choose a sum assured from $50,000 up to $1,000,000.

Basic Product Features

Policy & Premium Term

When it comes to choosing how long you wish to be covered, you have 2 types of options – to-age term or renewable term. On top of that, there are no premium term options, your premium term corresponds to your selected policy term.

With a to-age term, you can choose to have your plan cover you up until 50, 55, 60, 65, 70, or 75.

Alternatively, if you go for a renewable term, your policy will get renewed at regular intervals of 5, 10, 15, 20, 25, or 30 years, based on your selected term.

For the latter, your plan gets automatically renewed until you turn 75, but has a policy expiry age of 99. That is to say, if you opt for a renewable term of 25 or 30 years and your policy gets renewed at 75, your coverage will not last until 100 or 105 years; instead, it will only cover you to age 99.

Based on the above, a to-age term can only cover you until age 75 maximum, while a renewable term can cover you up to age 99.

So, do consider your needs and circumstances before selecting your type of policy term to avoid an unfortunate situation where your coverage expires when you need it the most.

Coverage

Multiple Claims – up to 600% Sum Assured

As a multiple payout CI plan, AXA’s Super CritiCare allows you to claim up to 6 different times when you are diagnosed with various early, intermediate, and advanced stage CIs.

The AXA Super CritiCare only lets you claim a maximum of 100% of your sum assured for each claim, regardless of the CI stage. The following maximum claim limits apply for the different CI stages:

| CI Stage | Maximum Claim Each Time | Maximum for all CI Claims on same life insured |

| Early | $350,000 | $3,000,000 |

| Intermediate | $350,000 | |

| Advanced | $1,000,000 |

Based on the above, even if your basic policy’s sum assured is $500,000, your plan will only pay out $350,000 for an early/intermediate CI diagnosis.

Critical Illnesses Covered

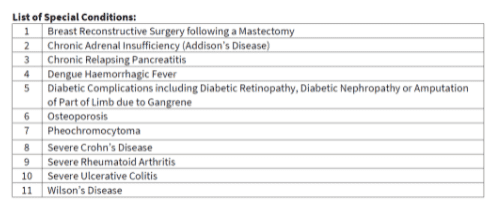

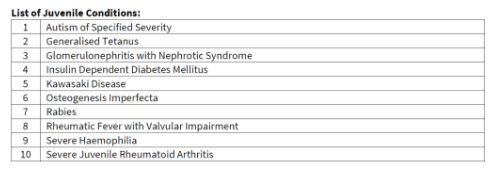

Super CritiCare covers you for up to 111 CI conditions, 11 special, and 10 juvenile conditions.

The special/juvenile conditions covered are:

In the case of special and juvenile conditions, you can claim 10% of the sum assured, with a cap of $25,000. Special conditions can only be claimed 3 times and juvenile conditions 5 times.

As CIs are definition-based, we recommend that you run through the definitions in your policy contract to better understand what you will actually be covered for to be on the safe side. And if in doubt, do clarify them with your financial advisor before making your decision.

Rediagnosed Cancer, Recurrent Heart Attack & Stroke

Though we are expected to live longer lifespans, it comes with an increased likelihood of facing a stroke, heart attack, or cancer diagnosis.

Adding fuel to the fire, once these conditions occur, the likelihood of relapse is high even after a full recovery.

What gives AXA Super CritiCare an edge over the others is that it is the first and only plan in the market to offer coverage for re-diagnosed cancer and recurrent heart attack or stroke for all stages.

Claims are subjected to a claim limit and a waiting period, which we’ll discuss later on.

But of course, there is a fine print, and you can only claim re-diagnosed/recurring CI if it meets the criteria below:

| Critical Illness | Scenario | CI Stage Covered | Criteria |

| Cancer | Recurrent / Re-diagnosed | Early, Intermediate, & Advanced | Unrelated to past diagnosed cancer and happens in a different organ |

| Relapse | Advanced | Relapsed cancer in any organ following a minimum 2 year remission period from initial cancer diagnosis | |

| Metastasis | Advanced | Spread of cancer to any organ after a minimum 2 year remission period from the initial diagnosis | |

| Heart Attack | Recurrent | Early, Intermediate, & Advanced | Unrelated to previous heart attack claim of any stage |

| Stroke | Recurrent | Early, Intermediate, & Advanced | Unrelated to previous stroke claim of any stage |

There is also one downside, which is that Super CritiCare only covers specific organs for carcinoma in situ (aka Stage 0 cancer) whereas other insurers tend to cover the whole body.

Death Benefit

If you pass on while your policy is still in force, you’ll receive a death benefit of $10,000. The aim of this plan is to provide critical illness coverage. Therefore, the death benefit is just a bonus and is not a lot.

Looking for something that provides substantial death and CI coverage? Consider getting a whole or term life insurance plan with a CI rider instead.

Claim Scenarios & Waiting Period

As with everything, there’s no free lunch. While you can claim more than once with a multipay plan, there are certain conditions that dictate your claim eligibility and how much you can claim.

This is where things can get complicated and technical, but try not to glaze over this as it’s good to know what claims you are entitled to. After all, you’re forking out money for the coverage.

Same Critical Illness

You’re only entitled to claim for an early or intermediate stage CI once for each CI condition. The amount claimable is the lower of:

- The claim limit of $350,000; or

- 100% of your basic sum assured

Meaning that if your sum assured is $500,000, your payout will only be $350,000. If the CI becomes an advanced stage, your remaining sum assured of $150,000 will be paid out without a waiting period.

In other words, if your sum assured is less than $350,000, your full sum assured for a certain CI will be paid out upon diagnosis of an early/intermediate stage CI. Progression to an advanced stage CI will not be claimable.

Different Critical Illness

If after your initial early/intermediate CI diagnosis, you contract a different CI in less than a year and your basic sum assured is above $350,000, the payout will be equal to your sum assured minus your initial claim of $350,000, subject to the claim limit table above.

To be able to claim the full 100% sum assured (subject to claim limits) upon diagnosis of a different CI, there is a waiting period of 12 months, regardless of the CI stage.

Rediagnosed Cancer, Recurrent Heart Attack & Stroke

For claims on rediagnosed cancer, a recurrent heart attack or stroke, there is a minimum waiting period of 24 months since the last successful claim for cancer, heart attack or stroke, no matter which stage it is.

The sum assured for each claim is 100% of the basic sum assured and the total sum assured payable for all claims under this benefit is 300% of your sum assured.

Other Features

Diabetes Care Program

1 in 3 Singaporeans are at risk of developing diabetes in their lifetime, and when not controlled properly could lead to complications like stroke and heart attack.

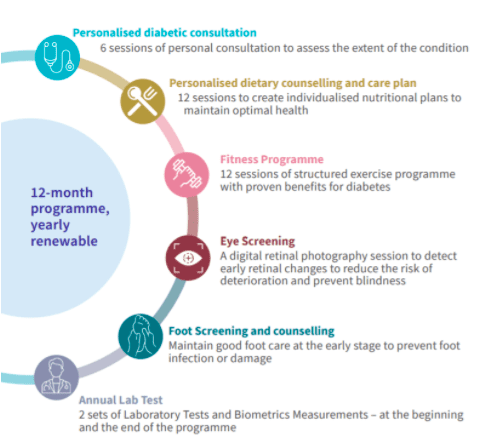

With this in mind, AXA has set up a comprehensive 12-month diabetes care programme to keep your condition under control, and it is the only one in the market at the moment. This programme is complimentary and will not reduce your sum assured.

Worth $2,500 per year and renewable on a yearly basis if you’re still diagnosed as diabetic, the programme consists of:

To be eligible for this programme, your diabetes diagnosis will need to be confirmed by AXA’s appointed doctors with an annual blood test report.

Add-On Riders

Premium Waiver

This rider waives all future premiums if you get diagnosed with an early to advanced-stage CI, and covers you for your entire rider policy term.

You won’t have to worry about financing your plan to keep your coverage, allowing you to focus fully on receiving treatment and recovering from your ailment.

If you were to experience an involuntary loss of income before you turn 50, the rider waives your next 6 months of premiums as well.

Payer PremiumEraser

If you’re purchasing this plan on behalf of your loved one, the Payer PremiumEraser waives all future premiums in the event that you pass on or get diagnosed with a CI from early to advanced stage.

With this, you can rest assured knowing that your loved one will still be protected even if anything happens to you. However, this rider expires when you turn 65.

It also comes with the involuntary loss of income benefit that the premium waiver rider has.