The AXA Wealth Harvest is now called the HSBC Life Wealth Harvest.

If you are looking for a long-term wealth accumulation plan that offers a wide range of investment options, the HSBC Life Wealth Harvest could be a good option.

This investment-focused investment-linked plan (ILP) allows you access to up to 90 sub-funds, and the opportunity to earn both Start-up and Loyalty Bonuses.

Plus, you’ll be protected against Death and Terminal Illness during your policy term.

And with a range of investment-linked funds managed by financial experts, you can choose to invest in up to 10 different sub-funds.

Here’s our review of HSBC Life Wealth Harvest to help you decide if it’s the right policy to help you reach your financial goals.

My Review of the HSBC Life Wealth Harvest

The HSBC Life Wealth Harvest is a decent policy for you if you’re looking for help investing in the long term.

You can access retail and accredited investor funds as an HSBC Life Wealth Harvest investor. And I’ve looked at these funds; some are really good – similar to what the HSBC Life Pulsar offers.

However, I feel that the 11-year lock-up period can be a bit too long – it would be better if HSBC Life offers a range of minimum investment periods for you to choose from, something like the Manulife InvestReady III.

Also, the 3.5% account maintenance fee is high and will eat away at your investment. This charge is higher when compared to other options on the market.

Personally, if you’re looking for a long-term investment and don’t mind lock-in periods, I would think the FWD Invest First Plus as it charges the lowest fees in the market.

If you prefer liquidity, then the Manulife InvestReady III or the Singlife Savvy Invest are better options due to lower fees than the HSBC Life Wealth Harvest.

However, there are no perfect plans in the market. What’s good for me might not be good for you.

That’s why I suggest reading our post on the best ILPs in Singapore so that you know what your possible alternatives are and possibly even choose one that’s best suited for you.

An investment plan is a long-term commitment, and in the case of the HSBC Wealth Harvest, it’s minimally 11 years of regular investing.

If you’re about to commit to a policy for this long, it’s best you do a bit more research just to ensure you’re not selecting something that is not your needs.

You should also consider getting a second opinion from an unbiased financial advisor for confirmation if the HSBC Life Wealth Harvest is the best for you.

If you’re unsure or are looking for a second opinion, we partner with MAS-licensed financial advisors to help you with your investing decisions.

Click here for a free, non-obligatory second opinion..

Criteria

- Life assured: 1 month to 70 years old

- Policyholder: 18 to 99 years old

- Minimum investment period: 11 years

- Minimum investment amount: $300

General Features

Premium Payments

You may pay regular monthly, quarterly, semi-annually, or yearly premiums.

The following table is an illustration of the minimum investment amount every month:

| Premium Frequency | Amount (SGD) | Amount (USD) |

| Monthly | $300 | Not allowed |

| Quarterly | $900 | |

| Semi-annually | $1,800 | |

| Annual | $3,600 | |

Premium Reduction

With this policy, you can reduce your regular premium by up to 25% at any point until the end of the policy tenure, as long as it meets the minimum investment amounts above.

Ad-hoc Top-ups

While you can’t increase your regular premium, the policy allows premium top-ups on an ad-hoc basis during your policy tenure – as long as you are below 70 years old.

There is a minimum top-up amount of S$250 or U$250 per month, and must be in multiples of $10.

Recurring Single Premium Top-Ups

Apart from single top-ups, you can opt for a recurring single premium top-up if your policy is in SGD.

The minimum single premium top-up is $50 monthly and must be in multiples of $50.

Single nor recurring single premium top-ups are not allowed during premium holiday.

Protection

Death Benefit

If you meet an untimely demise, your loved ones will receive a lump sum payment equal to 102% of your account value.

Once that payment is made, the policy will automatically come to a close.

Terminal Illness Benefit

If you are diagnosed with a terminal illness, you will receive a lump sum payment for the Terminal Illness Benefit.

This is an advance on the Death Benefit – so it’ll deduct from your total sum assured if the Terminal Illness Benefit is lower than your Death Benefit.

The amount payable is limited to either $3 million or the Death Benefit at the time of the terminal illness claim, whichever is lower.

Key Features

Start-up Bonus

During the first year of your policy, you will receive a Start-up Bonus of 35% upon every regular premium payment.

It doesn’t matter if you reduce your Basic Premiums within the first 11 years of your policy – you’ll still be eligible for this bonus.

Loyalty Bonus

As a policyholder, you’ll be rewarded with a monthly Loyalty Bonus of 0.0125% starting from your 10th year.

This bonus is a percentage of your account value and will continue throughout the life of your policy.

Life Replacement Option (LRO)

With this policy, you may request to change the life assured under the LRO.

Of course, specific requirements must be met – such as insurable interest in the new life assured at the point of request;

Premium Holiday

With the HSBC Life Wealth Harvest, you can go on a premium holiday as long as sufficient funds are in your account to pay the policy fees.

Take note that should there be insufficient funds to pay for the policy fee, your policy will lapse.

Partial Withdrawals

After the first year, you can partially withdraw your funds if the remaining balance is above $3,600.

The minimum partial withdrawal is S$250 or U$250 and must be in multiples of $10 and could impact your loyalty bonuses.

Regular Withdrawals

You can withdraw from your account regularly with options for annual, semi-annual, quarterly, or monthly payouts.

The minimum regular withdrawals are shown here:

| Monthly | Quarterly | Semi-annually | Annually | |

| SGD | 100 | 300 | 600 | 1,200 |

| USD | Not allowed |

As long as your account holds its minimum holding amount, you can withdraw in increments of $10.

Keep in mind making partial or regular withdrawals may affect your loyalty bonus.

Fund Switching

The policy allows you to make fund switches to any available funds. The minimum value per switch is S$1,000.

HSBC Life Wealth Harvest Fees and Charges

Sales Charge

The HSBC Life Wealth Harvest levies a 5% sales charge every time you make adhoc top-ups or recurring single premium top-ups.

Account Maintenance Fee

A 3.5% p.a. fee is charged monthly on your total account value.

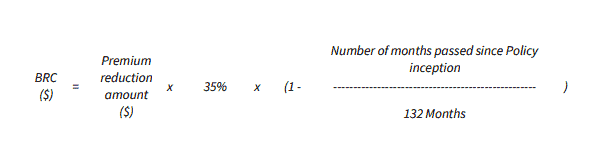

Bonus Recovery Charge (BRC)

This charge is imposed when you reduce your premium during the initial 11 years as shown here:

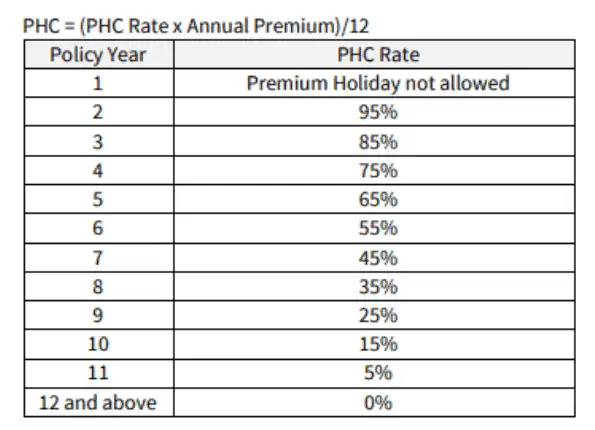

Premium Holiday Charge (PHC)

If you decide to take a premium holiday between years 2 and 11, a Premium Holiday Charge will be imposed.

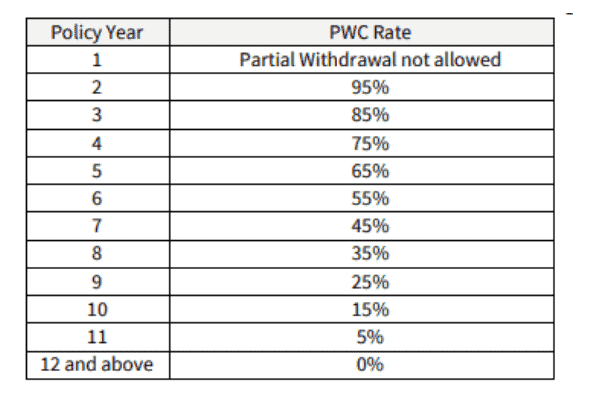

Partial Withdrawal Charge (PWC)

Every time you make a partial withdrawal from policy years 2 to 11, you will be charged the PWC.

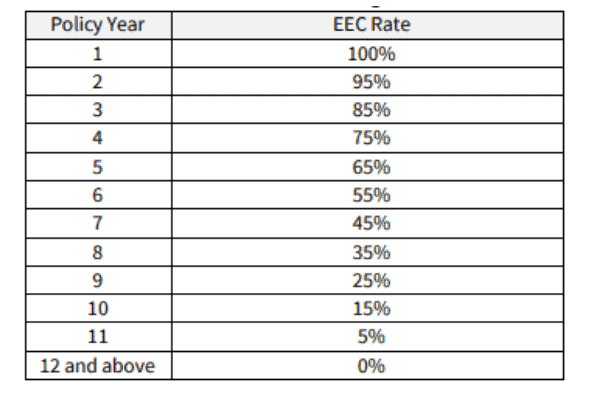

Early Encashment Charge (EEC) / Surrender Charge

Should you decide to surrender your policy within the first 11 policy years, the following charges will be imposed:

Switching Fee

Currently, the switching fee is waived.

Fund-Related Charges

The HSBC Life invests in unit trusts; thus, these are the fees related to it.

Sales Charge

Each fund imposes a one-time sales charge (up to 5%) every time you invest in the fund.

Charges differ based on the funds selected by you/your financial advisor.

Fund Management Charge

Based on a quick glance, the HSBC Life Wealth Harvest’s funds charge a fund management fee between 0.55% to 2.04%.

These charges are already included in your returns. Thus, the returns you see from your funds are net charges.

Summary of the HSBC Life Wealth Harvest

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Value Benefits | Yes |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | No |

| Terminal Illness | Yes |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Optional Add-on Riders | No |