With many types of sub-funds in the market, it’s critical to understand the intricacies between the different types.

One of the most important aspects is to recognise the differences between a unit trust, sub-fund, and an ILP sub-fund.

In this post, we explore the difference between a typical unit trust and a unit trust by an insurance company.

What is a unit trust?

In the investment world, unit trusts are portfolios of investment instruments that are actively managed by professionals. This fund pools your money with that of other investors.

There may be a range of assets in the fund, such as stocks, bonds, and other instruments. Fund managers decide which investment products to purchase depending on their fund’s objective.

Although unit trusts and mutual funds are commonly used interchangeably, they are actually different instruments.

Unit trusts are funds that adopt a trust structure, and not all funds do so.

Typically in a unit trust, any returns you see go straight to you. Mutual funds, on the other hand, reinvest it back into the fund.

Apart from this difference, unit trusts and mutual funds don’t differ too much.

For this piece, we’ll use funds and unit trusts interchangeably.

What are sub-funds?

Although completely different from the actual meaning, the term sub-funds and funds are commonly used by financial advisors in Singapore to refer to unit trusts.

The reason behind this is due to insurance products offering unit trusts as an investment. If you were to get an investment product from an insurance company, the unit trusts offered are generally called sub-funds.

That’s because the unit trusts are managed under a different management company (usually the insurer) than the main fund, thus “sub-fund”.

However, sub-funds could be managed by different management companies apart from the insurer too!

So if you hear sub-funds, funds, or unit trusts from an FA, they generally refer to the same thing.

What are ILP sub-funds?

ILP sub-funds are the funds offered by investment-linked policies. This could be an investment directly into the unit trust or through the insurance company’s own funds.

Now when you are considering an ILP, it’s important to take note of what type of funds they invest in.

Do they invest directly into the unit trust, or does the ILP only offer their own company’s funds?

For instance, if you see the insurance company’s name on the fund, it means that the ILP sub-funds are the insurer’s own funds.

Here are a few examples:

- AIA Acorns of Asia Fund

- AXA Fortress Fund

- GreatLink China Growth Fund

- Manulife European Equity Fund

- PruLink America Fund

But if you don’t see the insurer’s name, chances are they are directly invested into the funds.

Here are a few examples:

- Aberdeen Standard Asian Smaller Companies Fund

- Allianz Global Investors Premier Funds – Allianz Global High Payout Fund – SGD

- Fidelity Funds – America Fund SR-ACC-SGD

- Franklin Templeton Investment Funds – Franklin India Fund AS (acc)SGD

- Schroder Asian Equity Yield Fund SGD Class A

Direct vs ILP sub-fund

Now that you know the differences between the two, it’s crucial to understand whether you should invest in one or the other.

The most important difference between the two is the fees involved. For unit trusts, the returns you see are generally net of the fund management fees.

The insurer’s sub-funds are usually not net of fund management fees.

Let me show you an example.

Assume your returns this year is 8% and the fund management fees are 1.5%.

This means that if the returns you see on your portfolio is 8%, investing directly into the funds will bring you a return of 8% as it already includes the fund management fees.

However, for the insurer’s sub-funds, your returns would be 6.5%, taking into consideration the fund management fees.

And this doesn’t include any fees payable to the ILP wrapper (or what we call the investment-focused ILPs).

So if the fee for the ILP is 2.5%, your total net return for the direct fund investment would be 5.5%, and 4% for ILP sub-funds.

The difference in the net returns you see is one of the many reasons why there are a handful of Singaporeans who detest ILPs.

But now that you know the difference between these funds, you’ll have a more objective opinion when considering investing via an investment-linked plan.

But are all ILP (insurer) sub-funds bad?

Now I’m not going into detail on the potential returns despite the fees ILP sub-funds carry. There are too many factors to consider and an entire article can be dedicated just for that debate.

But what I’m going to focus on here is whether you should totally avoid ILP sub-funds when you are presented with them.

Here are a few things you should look into:

How are you paying for this product?

Is the product an ILP that you will be purchasing with cash, your SRS account, or CPF-IS?

If this involves purchasing with cash, you’re better off avoiding ILP sub-funds.

Why?

The additional fees of course.

With that additional fee you’ll incur, you could use it to get higher gains if you were to invest via an ILP that directly purchases the fund.

Here are the best ILPs in Singapore that does so.

However, if this is an SRS investment or a CPF investment, an ILP sub-fund might be all you have.

For those who are willing to take the time and effort to stock pick or conduct your own analyses, of course you’d probably avoid ILPs in the first place.

But for most who are too busy or do not have the knowledge to do so, ILP sub-funds can help you grow your money easily without any hassle.

Think of it as a convenience fee.

1.5% of your money for the additional time you have to spend with your family, friends, and even yourself.

What type of product is this?

Again, if it’s an ILP paid with cash, you’d probably want to avoid them.

If it’s an ILP paid with your SRS or CPF, then it’s something unavoidable depending on the policy as well.

But if this is a participating life insurance policy, endowment plan, or annuity, you have no control over which funds are invested into.

And usually participating funds invest in the ILP sub-funds (or a better term would be the insurer’s sub-funds).

Even though you don’t really have a choice, it doesn’t mean ILP sub-funds are bad.

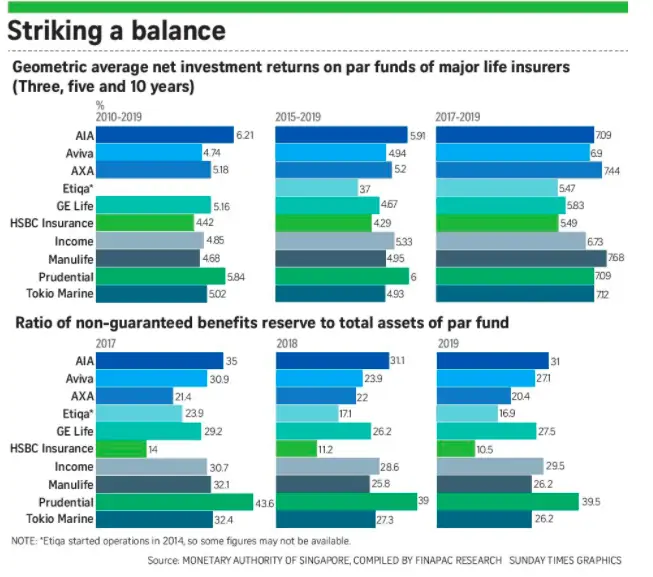

Based on the geometric average, participating funds perform well too with a group average of 5.12% over a 10-year average and 6.69% over a 3-year average.

Depending on the participating funds, the expense ratios differ and so does the fund management fees as well.

That’s why most par policies illustrate 4% non-guaranteed returns despite having such performance – it’s not net fees yet.

Even with 4% returns, it’s not too bad given that you’re purchasing a life insurance policy instead of an investment plan.

Even so, the 4% return is still better than the 0.05% returns on your SRS accounts and 2.5% on your CPF-OA – highlighting that the insurer’s sub-funds might not be so bad after all.

At least, relatively.

We have comparisons and guides on the best whole life insurance plan and the best annuity plans in Singapore if that’s something you’re considering.

Conclusion

Now that you know the differences between a fund and an insurance company’s sub-fund, you can make better choices when you’re financial planning.

Remember, when it comes to financial planning, there’s no blanket solution that’s best for everyone.

Every individual is unique and thus would require proper analysis and a customised solution.

Someone’s “bad” might be good for you, and your “good” might be bad for someone else.

That’s why it’s always important to engage a financial advisor to review your needs and provide a plan customised just for you.