There are many investment tools available for you in Singapore. Many of which are more popular than others. In this article, we’ll cover one of the more infamous tools – unit trusts.

What is a unit trust, and how does it work?

A unit trust, or a mutual fund, is a portfolio of various investment instruments managed by a professional fund manager. Your money, together with other investors, are pooled together to invest in this fund.

The funds may contain a range of assets or a mixture of stocks, bonds, and other financial instruments. Depending on the fund objective, the fund manager will decide the investment products to purchase.

When you invest in a unit trust, you do not invest in a single company or asset. Instead, you invest in the collective share or percentage of assets allocated to the specific unit trust.

When the unit trust assets are diversified, there’s technically less investment risk involved than purchasing individual financial instruments.

When the value of these securities in the unit trust increases, you earn from the difference called capital gain. Vice versa.

However, if one company doesn’t fare well in the market, it can be saved by another’s performance due to the weightage of each asset. Hence, all the companies included in the unit trust shoulders the profits and losses.

Every year, the value of your investment compounds depending on the fund’s performance.

Therefore, with most investments, investing in them long-term while observing the fund’s performance will help grow your money.

The different types of unit trusts

There are different types of unit trusts in Singapore. Since unit trusts are a collective of companies’ financial instruments, you can expect each type of unit trust to have a different composition of assets.

As mentioned previously, this will depend on the objective of the fund.

Also, the following are the different types of asset classes (the kind of funds based on the assets invested):

Equity Funds |

These funds mostly invest in shares of various companies. These usually possess the highest risks but has the highest potential returns. |

Index Funds |

These funds try to track a particular market index, hoping to perform similarly or better than the market index. |

Money Market Funds |

You primarily invest in money market devices like government debentures or bonds. Probably has the lowest risk with the lowest potential returns. |

Income Funds |

These are a form of funds that will focus on generating income. It could be a mixture of bonds or dividend-paying stocks. |

Sector Funds |

Here, the type of investment focuses on specific sectors. The most common sectors are the health sector, industrial, real estate, or financial. |

Bond Funds |

This invests in mainly fixed-income asset classes, namely treasury certificates, corporate bonds, or government bonds. |

Growth Funds |

The type of fund wherein the investment is mainly in stocks with high growth potential. |

Balanced Funds |

As the name suggests, the investment strikes a balance of both risks and returns from stocks and bonds. |

What fees are involved in unit trusts?

Investments in lucrative market instruments require timely and efficient management. The management of the funds is the responsibility of fund managers managing the funds and financial advisors who determine your investment objectives and investment strategy.

This is done by selecting asset classes that are profitable for you and give you maximum returns based on your risk profile.

However, nothing in the world is free, and neither are the services of a financial manager. Since they procure a valuable investment portfolio for you and your investments, the types of fees generated may differ from unit trust to unit trust.

| Type of Fee | When you will incur | How much you will pay |

| Fund manager fees | Yearly | Usually 0.5% of invested funds |

| Sales charge /

Service charge |

Every time you buy | 0.5% – 5% of the transaction |

| Redemption fee | Every time you sell (if there’s no sales charge) | 0.5% – 5% of the transaction |

| Switching fee | If you change funds | Usually 1% of the transaction |

| Brokerage fees | Yearly | Varies |

| Management fees | If you engage a financial advisor | 0.5% – 2% of net asset value |

| Trustee fees | As long as you are investing | 0.1% – 0.2% of net asset value |

| Miscellaneous fees | Depends | Depends |

There are broadly 3 categories in which the fees fall. Firstly, are the fees you pay to the fund manager. This is usually built into the returns you see from the fund you purchased.

So when you see a 10% return, it already includes the fund manager’s fees. This usually is about 0.5% and is entirely unavoidable.

Secondly, there are one-time fees deducted from your investment amount. Think of it as a “service charge” where you pay for the financial advisor’s time and work.

When you invest, the first fee you will incur is called the Initial Service Charge / Sales Fee. There are different terms for this.

When you are interested in liquidating the fund, you pay a Redemption Fee. Usually, a waiver of the fee is possible if you’ve paid the Initial Service Charge.

A deduction between 0.5 to 5% of the investment amount occurs in either case.

Next is the Switching Fee, wherein you pay the financial advisor to change between two funds. This would usually amount up to 1% of the switching value.

Depending on the financial advisor, you might be paying for all or none of the above fees. If you’re buying unit trusts through an online brokerage, you might incur these fees as well.

I know the above assumes you engage a financial advisor, but the above fees are relevant for you if you’re doing it via an online broker as well, albeit at much lower rates.

The last type of fee is more maintenance & performance-based.

They are as follows:

Annual Management fees

The financial advisor’s fee to be paid for managing your investment portfolio. This is deducted from the fund’s Net Asset Value (NAV). Your FA will usually tell the amount here beforehand, and you can expect to pay between 0.5 to 2% of your NAV. This ensures he/she successfully maintains and grows your wealth.

This fee is not applicable if you’re doing it yourself.

Trustee fees

An organisation is responsible for safeguarding your funds. The fee levied on the investor varies between 0.1 – 0.2% of the NAV. This applies to all investments – through online brokerages or a financial advisor.

Miscellaneous fees

It includes different types of charges like admin-related and audit fees. Applicable to all.

Advantages of Unit Trusts

Here are some of the advantages of investing in unit trusts in Singapore.

Quick and relatively simple

Investing in these funds is fast and more straightforward compared to individually investing in different companies. You only have to study the fund as a whole. Furthermore, with digital portals working just as well, you can make more investments with a click of a button.

Affordable and diverse

Even though there are convenience fees levied against the investment, unit trusts open a world of investments to you. You can easily create a diversified portfolio with the many types of funds available. Furthermore, your risks are diluted through the various securities in the fund.

Ease of access and allocation

When you hire a financial advisor, they observe the market trends, track the performance in reports, and gain insights about a fund’s potential, although this would come with higher fees. Most online brokerages also offer a wide variety of funds to choose from; you incur fewer fees but have to do more work on your part.

The convenience of buying and selling

The primary benefit of unit trusts is their liquidity. Redemption of units for cash is possible and a cakewalk.

Technical expertise and resource utilisation

Your funds are managed by a single fund manager or a team of experts. Hence, you get to leverage their in-depth knowledge in the field.

Active management

Unit trusts are actively managed. This means that the fund managers are continuously analysing how to increase returns while managing risks significantly. Due to this, you can expect unit trusts to perform better than more passively managed investment tools.

Disadvantages and Risks of Unit Trusts

Like any other form of financial investment, unit trusts are not without risks and disadvantages. The following are what’s associated with unit trusts:

Risk of redemption

When you’re ready to sell the units of your fund, you should be careful about the days you choose to do so. You should redeem the units only on trading days and within trading time.

This is because your NAV stands to change and can vary from one day or one hour to the next, too.

Interest rates risk

The interest rates are a variable that continually changes depending upon the market performance and critical global phenomena. Either of the trends can affect the values, and they either rise or fall. This usually occurs in stocks whose value is inversely proportional to the value of the interest rates.

Market Risk

The market is easily affected by various social, political, economic, and environmental issues. Any clashes directly affect the market and hence, the value of the funds. Just like they show an uphill rise in peak performing conditions, they also show a downhill slide in bad situations.

Foreign Exchange Risk

If you invest in an overseas fund, a significant decline in the foreign currency rate affects the exchange of funds. Hence, you stand at the risk of facing a loss.

Capital not Guaranteed

Like most investments, unit trusts are not capital guaranteed.

High Fees

Probably one of the most common disadvantages of unit trusts raised by many. Points 1 – 5 apply to most investment instruments. However, due to the more active approach in managing the funds, unit trusts possess one of the highest fees involved.

What are your objectives and risk profile?

First and foremost, you should consider all aspects of your life before starting any investments. To better understand your overall situation, it is beneficial to assess your short and long-term investment goals, risks, and the amount you have to invest.

It would be best if you asked relevant questions that are related to your investment objectives, such as

- What is your primary purpose of growing wealth growth?

- What sort of diversification do you need?

- What investment options should I buy to achieve my goals?

Having a clear investment objective helps in your financial progress and in maintaining the growth of your assets.

Next, you need to be aware of the stability and potential offered by the funds. Your investment is fruitful only when you can maintain it consistently and handle the fees involved too.

Like many other investment instruments, mutual funds are easily affected by the upheavals and downfalls of the market. If you are ready to gain maximum returns on your investments, be prepared to face losses. You should be well acquainted with large possible fluctuations.

What to look out for when choosing a unit trust?

Choosing from the unit trusts available in Singapore can be challenging. They are complicated to pronounce because of their extensively long names, but even difficult to understand because of the different types in the market.

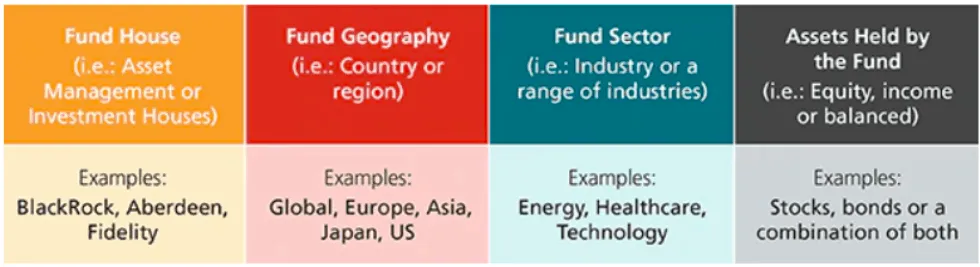

The image below shows how a unit trust is named and how you can understand what a unit trust does just by reading its name.

Source: DBS

To make it simpler for you, we have a list of factors you can consider before investing in mutual funds in Singapore.

| Type of fund | You will have a gamut of funds to choose from depending on your objective and appetite for risk. There is a fund for everyone, and you can choose whether you want liquidity, short-term or long-term returns, tax savings, and so forth. |

| Allocation of Financial Products | You can choose from a variety of the options available. Whether it is balanced, hybrid, or growth funds, the prospectus is available for you to understand its nature. |

| Price of the units | Each unit that you invest in has a defined price tag associated with it. The cost varies because of the constant fluctuation in the shared values of the companies involved. |

| Value of investment required | Each of these funds has a defined minimum investment necessary. Knowing the minimum value helps you in keeping aside a certain percentage of your savings. |

| Key Performance Indicators | On today’s digital platforms, it has become significantly easier to track your fund’s historical performance and its corresponding returns. However, past performance does not dictate future performance. |

| Fund agencies or houses | Focussing on the popular ones certainly does a lot for your investments. These companies can include Franklin Templeton, BlackRock, and so forth. |

| Geography | Believe it or not, geography plays a significant role in narrowing down an option. If the mutual fund scale is more expansive, it is subject to many changes amidst geopolitical variations. |

| Sector | You want to know which sector the unit trust is investing in. The more sectors invested in, the better your risks are managed. However, you’ll need to note that certain sectors perform better than others. So it’s a matter of risk vs returns. |

Most of the information above can be found in fund documents, regular fund reports, and relevant fund prospectus.

We suggest keeping a checklist handy. Make sure the funds you look through meet most if not all of your requirements before you even consider putting your money in.

These documents will share with you the objectives of the fund, the variety of assets invested in, potential risks involved, and fees involved in purchasing the fund.

You should also do a thorough background check of your fund manager and the fund house. You’re “hiring” them to manage your savings and assets so, be careful about your choice. You don’t want to fall prey to suspicious activities or malpractices.

If you’re engaging a financial advisor, it would be best if you also understood how the funds work and the calculation of the returns, associated risks, and so forth.

This way, you won’t be duped easily by dubious characters.

Some of the best mutual funds/unit trusts in Singapore

If you’re looking for the best and popular unit trusts in Singapore, you can take a look at the following:

Aberdeen Singapore Equity Fund

This fund offers an excellent opportunity for Singaporean investors to invest in the holdings of top-notch companies like OCBC, DBS, and so forth. Further, you can do so without spending a large amount of money. The risks involved are generally low, and you have exposure to the top-level companies in the portfolio.

This unit trust caters to investments in bonds and falls under the balanced category of funds. The expected returns on the annual scale are stable with low risk and volatility. The annual maintenance charge is also low, which is 0.5% of the NAV compared to its counterparts.

United Asia Pacific Real Estate Income Fund

The unit trust is geographically bound in Singapore, catering to the Asia-Pacific (APAC) region. It is an equity fund wherein the investor invests mainly in Real Estate Investment Trusts (REIT). Further, the annual maintenance charge is 1.5% of the NAV.

Where can you invest in unit trusts if you’re in Singapore?

This depends if you’re ready to do it yourself or you will need someone to help you. If you think you’re savvy enough to do so, many online brokerages offer various unit trusts to choose from.

Some of the more popular brokerages are POEMs, DBS Vickers, and FSMOne.

If you decide to go to the DIY route, make sure you’re well equipped to analyse market trends, asset composition, industry sectors, and the risks involved.

You don’t want to invest your money blindly.

Take note that purchasing unit trusts from these online trading platforms have high minimum investments involved.

If you’re someone who would instead get an expert to do it for you or have lower capital to start off with, you can engage financial advisors to do it for you. There are 2 ways that a financial advisor can invest for you.

Firstly, your financial advisor can invest your money through investment-linked policies. We highly recommend you read our guide to understand if ILPs are for you and the best ILPs in Singapore guide.

If you decide ILPs are for you, make sure to choose investment-based ILPs that technically do not have an insurance component.

Secondly, your financial advisor can invest your money through iFAST, the B2B branch of FSMOne. The fees you incur here are technically lesser than an ILP but more than investing yourself.

However, it also doesn’t come with the perks that ILPs offer.

Conclusion

We hope this guide was sufficient to provide you with an objective view of unit trusts in Singapore. Although many despise mutual funds due to the higher fees involved, it is theoretically possible for unit trusts to perform better than passively managed funds like exchange-traded funds.

However, it is also crucial to note that not all unit trusts will perform better than exchange-traded funds. This depends on market conditions, the expertise of the fund managers, and the funds chosen.

So you have to weigh the risk involved for the potentially higher returns.

Remember, the future performance of your investments are unpredictable, but choosing the right types of funds and making the right investment decisions will help with its potential capital growth.

Before beginning any investments, it’s always best to engage a financial advisor. This ensures that your scenario is carefully analysed and proper investments can be recommended from the advice you receive. It is then up to you if you’d like to invest yourself or through an FA.