Are you a beginner in the mighty realm of investors willing to invest a small amount?

Do you believe in investing for a purpose along with profit?

Do you want to make your post-retirement days safe and rich with financial independence?

If your answers are positive, then this article is for you.

What Is StashAway?

Launched in the year 2016, StashAway is one of the first as well as trusted robo advisory platforms in Singapore.

With affordable annual management fees and no minimum investments, it’s been embraced significantly by especially beginner investors with small amounts to invest.

The platform is remarkable at providing the investors with 2 primary services –

- Personalised wealth management

- Financial planning

StashAway, through its Economic Regime-based Asset Allocation (ERAA) framework, is aimed at facilitating “the best combination of protection and performance”.

With StashAway Risk Index (SRI), you can even get to optimise your potential returns.

StashAway encompasses its investments to a wide, global level. With 145 countries investing on the platform, StashAway contains more than US$1 billion in total assets under management as it claims.

They are aimed at protecting your wealth irrespective of the market condition.

Based upon asset allocation rather than securities collection, StashAway is a great option to invest through Exchange Traded Funds (ETFs) with diversified institutional-level asset allocation.

Here, you can choose to invest based on your goal or goal-set.

Different investment portfolios here let you grow your wealth in your preferred way.

StashAway Features

StashAway Investment Strategy

StashAway’s investment algorithm follows its Economic Regime-based Asset Allocation (ERAA) framework.

The framework is designed to minimise your risks while maximising your potential returns on the basis of macroeconomic data.

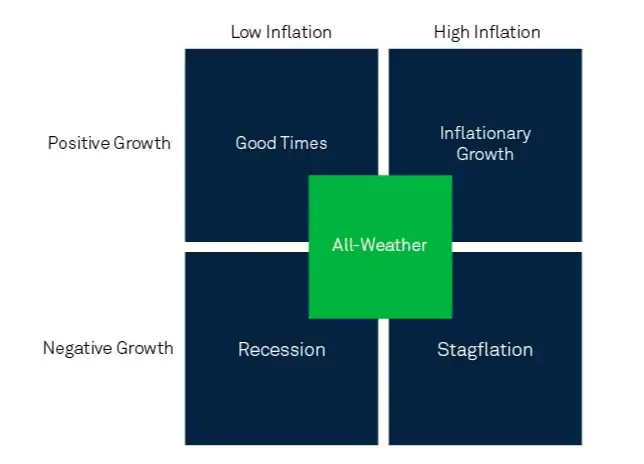

According to ERAA, at StashAway, your assets are allocated based on 5 economic regimes marked by them, which are structured based on the relative relationship between growth and inflation —

- Good times

- Inflationary growth

- All-Weather

- Recession

- Stagflation

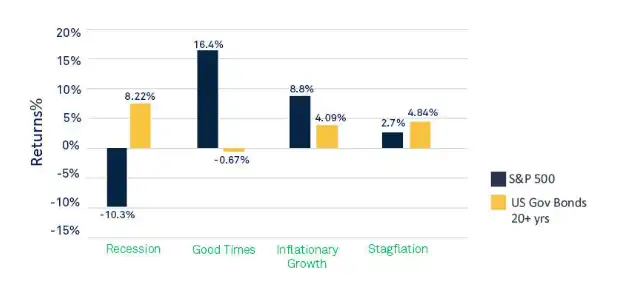

As this methodology states, depending upon the particular economic regime prevailing at a time, asset classes behave differently.

ERAA is structured to change and rebalance your portfolio’s asset allocation as a preparatory measure for the current or the upcoming regime while maintaining your risk appetite at the same time.

This framework sets a risk index of 20% while ensuring that you are not going to lose your portfolio’s value above this 20% under any condition.

Remarkably, StashAway ensures that you’ll not lose more than you can afford to.

While opening an account with the platform, you are required to select your preferred risk level.

However, they attempt to provide you with a relatively practical risk level that you can actually measure.

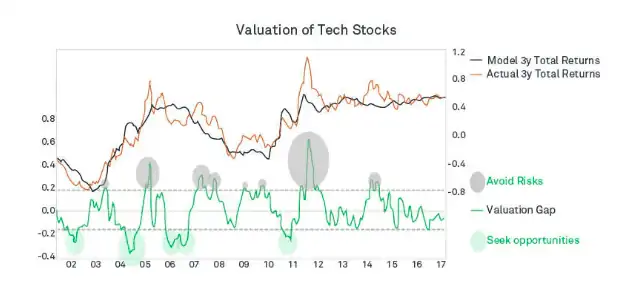

The strategy depends upon 3 pillars —

- Asset allocation determined by economic regimes

- Risk Shield

- Valuation gaps

Any alteration in any of these 3 pillars can trigger the re-optimisation of the portfolios.

StashAway includes 2 types of returns in each individual portfolio — time-weighted return and money-weighted return.

Where a time-weighted return is a common way to calculate returns, a money-weighted return assigns a weight to every deposit and withdrawal made by you.

Leveraging historical and live data, the ERAA framework is structured to spot the first signs of any prospective trouble in the economic environment.

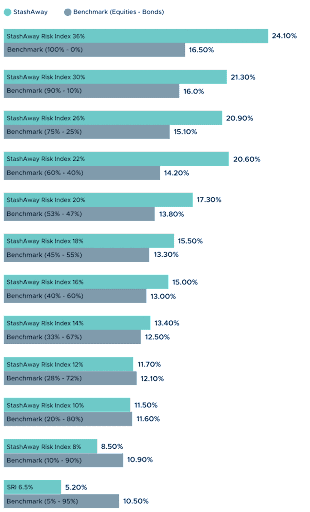

As they claim, this strategy has outperformed at times of significant market downtime.

For instance, StashAway claims that during the hostile pandemic-stricken period of 2020 with high market volatility, its portfolios outperformed above the risk benchmark as shown in the following chart.

Investment Portfolios

At StashAway, you come across multiple distinguished portfolios structured based on your prospective financial goals.

General Investing Portfolios

These are long-term portfolios. They provide you with exposure to risk-managed, globally-diversified, and valuation-adjusted investments. The asset allocation based on different risk levels.

The asset classes these General Investing portfolios deal with are —

- International Equities

- US Equities

- Government Bonds

- Corporate Bonds

- Real Estate

- Commodities

- Cash

Responsible Investing (ESG) Portfolio

This portfolio enables you to invest in some noble cause while at the same time earning profits from that.

With it, you can keep your values intact while investing your money.

ESG stands for Environmental, Social, and Governance. Thus, while investing through this long-term portfolio, you can responsibly impact these 3 aspects of our world.

This portfolio shares the same diversification and risk management as the General Investing portfolio.

The only difference is that the ESG portfolio provides you with the opportunity to maintain your environmental, social, ethical, and sustainable responsibility towards the world.

Income Portfolio

This portfolio is aimed at generating passive income in varied market conditions.

To lower the risks inherent in income products, the Income Portfolio is designed to generate your income from government bonds, REITs, corporate bonds, and stocks based on their dynamic association.

To keep the risk level of your Income Portfolio under control, the ERAA framework keeps on adjusting your portfolio’s asset allocation.

The asset classes you can invest on through this portfolio are —

- Singapore Govt Bonds

- Asia Corporate Bonds

- REITs

- ETFs

Thematic Portfolios

These portfolios are trends-based portfolios that allow you to invest without any unnecessary risk involved.

These professionally-crafted portfolios are designed to offer you sector diversification as well as thematic exposure.

StashAway involves 4 world-changing themes for these thematic portfolios —

- Technology Enablers

- The Future of Consumer Tech

- Healthcare Innovation

- Environment and Cleantech

Thematic Portfolios consist of 2 types of assets — theme assets and balancing assets. Provided that the portfolios can be potentially risky, they include balancing assets to keep your preferred risk level in check.

The asset classes these portfolios invest in are —

- International Equities

- US bonds

- International bonds

- Commodity

Flexible Portfolios

Flexible Portfolios are StashAway’s customisable portfolios.

From their curated list of ETFs representing more than 55 asset classes, you can pick the ones you prefer.

Not just that, you can choose their exact allocations and change them whenever you want.

The curated list of ETFs related to the StashAway Flexible portfolios includes varied sectors and geographical allocations such as S&P 500, Healthcare, Emerging Markets, Blockchain, etc.

Some of the top ETFs from this list include —

- Global X Robotics & Artificial Intelligence ETF

- iShares MSCI All Country Asia ex Japan ETF

- iShares MSCI Australia ETF

- iShares Biotechnology ETF

- Amplify Transformational Data Sharing ETF

- iShares MSCI Canada ETF

StashAway SRS Investments

With StashAway, you can conveniently invest your Supplementary Retirement Scheme (SRS) funds.

It’s a great way to save on taxes by a considerable amount while growing your retirement funds.

At StashAway, you can potentially reduce your payable taxes by investing your SRS funds on the platform by SG$15,300 per year (SG$35,700 for foreigners).

Thus, you can consider investing your SRS funds on StashAway via curated portfolios specifically designed to maximise your potential returns without any lock-up.

StashAway Simple

StashAway Simple is StashAway’s cash management account that lets you store and grow your funds with complete safety.

It’s free, with no minimum balance and no lock-ups.

A StashAway Simple portfolio allows you a projected annual return of 1.3%.

StashAway Reserve

StashAway Reserve provides you with an Institutional-level private investment opportunity. With StashAway Reserve, you qualify for their completely personalised wealth advisory.

This particular plan exposes you to the private market with private equities and venture capital.

Other Features

- Unlike certain financial advisory and investment platforms, StashAway provides you with financial advice and guidance. For that purpose, they introduce certain educational resources such as free courses, blogs, podcasts, and videos. Hence, even if you are a newbie, StashAway assures that your investment journey is smooth and less difficult than it should otherwise have been.

- StashAway performs rebalancing of customer portfolios based on their daily monitoring of market volatility. Furthermore, the ERAA framework involves a re-optimisation methodology for the investment portfolios depending on the ever-changing economic environment.

StashAway Fees

StashAway introduces a transparent fee structure for its annual management fees ranging from 0.2% to 0.8% based on your investment amount.

This is inclusive of re-balancing, re-optimisation, and transaction fees.

Relieving for you, StashAway doesn’t charge any additional or hidden fees the likes of the following —

- Account setup or exit fees

- Withdrawal fees

- Fees regarding transfers between portfolios

| Plan/Portfolios | Invest Amount (SGD) | Applicable Annual Fees |

| Investment Portfolios | First $25,000 | 0.8% |

| $25,000 — $50,000 | 0.7% | |

| $50,000 — $100,000 | 0.6% | |

| $100,000 — $250,000 | 0.5% | |

| $250,000 — $500,000 | 0.4% | |

| $500,000 — $1,000,000 | 0.3% | |

| $1,000,000+ | 0.2% | |

| StashAway Simple | — | Free |

| StashAway Simple Net Fee | — | 0.172% Approximately |

As you can see, the fee structure with StashAway works in a way where the fee rate descends only when your investment amount ascends.

They claim that with lower fees the returns are potentially high. That means, if you invest more, StashAway can prove to be the right investment platform for you.

Funding at StashAway

StashAway allows you to fund your account in any currency of your preference.

Deposits made in any currency other than USD will incur a currency conversion fee from the preferred currency to USD.

There are certain limits regarding funding and funding methods for different portfolios marked by StashAway —

- The General and Goal-based Portfolio supports all currency types. While SGD deposits are free, it includes currency conversion fees. On the other hand, USD deposits require a minimum investment amount.

- Only SGD deposits are allowed with the Income Portfolio.

- Likewise, StashAway Simple Portfolio also supports SGD deposits exclusively without the need for any minimum deposit amount.

Usually, it takes around 1 to 3 business days for your personal funds to appear in your StashAway account. For SRS funds, the process normally takes approximately 2 to 4 business days.

You can also deposit your funds from a joint bank account.

Here’s a table showing the applicable minimum deposit or investment amounts at StashAway —

| Different Funding/Investing Methods | Minimum Amounts/Balance |

| SGD Deposits | N/A |

| USD Deposits | US$10,000 per deposit |

| Account maintenance balance | N/A |

| Income Portfolio | SG$10,000 |

| StashAway Reserve | US$50,000 |

Note that StashAway only accepts funds from Financial Institutions (FI) licensed under the Monetary Authority of Singapore (MAS).

Deposits made from any other Financial Institutions might be subject to rejection.

Also, the acceptance of your funds at StashAway is subject to their Anti-Money Laundering (AML) checks.

Withdrawals with StashAway

Along with withdrawing your fund to a local bank, StashAway lets you make telegraphic transfers to withdraw your fund to an international bank.

However, this might cost you a comparatively longer time to get hold of the money, currency conversion fees, and additional fees for telegraphic transfers.

StashAway doesn’t introduce any minimum withdrawal amount. You can withdraw as low as $1. Also, you can withdraw your fund at any time.

The withdrawal process usually takes around 2 to 3 business days for the Global Portfolio and the Income Portfolio alike.

With the StashAway Simple Portfolio, the process might take approximately 3 to 4 business days.

Is StashAway Safe?

When the question of safety and security comes around, note in the first place that StashAway is a Monetary Authority of Singapore (MAS) licensed body with the license no. CMS100604.

The platform possesses a Capital Market Services License for Retail Fund Management from MAS. Their legal entity is Asia Wealth Platform Pte. Ltd.

To keep the customers’ security in check, StashAway introduces a Vulnerability Disclosure Programme (VDP), through which you can report suspected vulnerabilities and weaknesses related to the platform.

StashAway keeps your funds segregated from its finances and keeps them with DBS Bank as a custodian. Thus, your money is safe on the platform.

Apart from that, they hold your securities and investable cash in a separate custodian account via Saxo Capital Markets Pte Ltd or Lion Global for Simple. Thus, even if something unexpected happens to StashAway, your money will be safe in your custodian bank.

Moreover, to protect your assets from cyber attacks, the platform implements a two-factor authentication process.

Who Is StashAway Best for?

As StashAway mandates no minimum investment amount, it can potentially be a great option for beginners with a small investment amount.

Despite that, considering their fee structure, it can be said that StashAway is a great investment platform only for those investing with a substantial investment amount (>$1 million).

If investing with a small amount, you’ll end up getting charged higher fees while obtaining a lower potential return.

Not all and any digital financial investment platform will provide you with the space to invest in SRS funds. But, StashAway does.

If you have SRS funds, you can give it a go with StashAway.

A significant specification about StashAway is that it provides you with global exposure when it comes to investing.

So, if you are keen on investing on a global level, StashAway can be a good fit for you.

Last but not the least, if you are looking to invest in multiple portfolios within the same investment account, StashAway allows you to do that.

Conclusion

If you analyse the marketplace, you’ll notice that throughout its journey since, StashAway has been able to secure a significant place in the robo advisory market despite the tough and increasing competition.

With reasonable and affordable pricing, it’s indeed an acceptable option worth trying.

But, it’s not the cheapest either. And as for small-scale investors, there are yet better and cheaper options available.

We mean Syfe.

For example, with StashAway, you’ll end up getting charged a 0.8% annual management fee for your first $25,000.

At Syfe, you’ll have to pay a cheaper rate of 0.65% (up to $20,000) or 0.5% (above $20,000).

At the same time, Syfe is also a no minimum (and even maximum) investment robo advisor.

Besides, if you are keen to invest in real estate and equities, Syfe is a better choice in that case with exclusively dedicated portfolios.

If you feel excited about these features, you can very well give Syfe a try.

We recommend you sign up with Syfe using our referral code as we have partnerships with them to give you special rewards!

So, happy investing!