When it comes to investing, risk management is key.

You want to make sure that you are doing everything possible to protect your investment and minimise your chances of losing money.

There are many different strategies that you can use for risk management, and in this blog post, we will discuss 7 of them.

Each strategy has its own benefits and drawbacks, so you will need to decide which ones work best for you.

Read on to learn more about investment risk management!

Risk Management Strategy #1 – Diversification

Diversification is one of the most important risk management strategies.

When you diversify your investments, you are spreading out your risk and giving yourself a better chance of making money.

For example, let’s say that you invest all of your money in one stock. If that stock goes down, then you will lose all your money.

But if you diversify and invest in multiple stocks, then even if one stock goes down, you still have a chance to make money with the others.

It’s also important to invest in multiple asset classes.

Ray Dalio, the famous investor is known for his “All-weather portfolio” which is designed to do well in all economic conditions.

It is a combination of stocks, bonds, and commodities. He also has diversified into Bitcoin for exposure to cryptocurrency and risk reduction to fiat inflation.

Some investors prefer to bet big on one asset that they think is going to do well. But if you are risk-averse, then diversification is the way to go.

Many investors lose a lot of money during market crashes because they were not diversified.

Don’t this happen to you!

Advantages of Diversification

The benefits of diversification are clear – it helps to spread out your risk and gives you a better chance of making money.

Another benefit is that it can help to protect you from panic selling.

This is because if you have a diversified portfolio, then you are less likely to sell all of your assets when the market is crashing.

Why?

When the market is crashing, it can be tempting to sell all of your assets and get out.

But if you have a diversified portfolio, you are less likely to do this because you know that not all of your assets will be affected by the market crash.

This can help you to keep your cool and avoid making rash decisions that you might regret later.

Disadvantages of Diversification

Diversification is not without its drawbacks though.

One is that it can be hard to find enough different investments to diversify properly.

Diversification can also take a lot of time and effort.

The reason for this is that you need to research each investment carefully before you put your money into it.

Another drawback of diversification for reducing risk is that it can actually increase your risk in some cases.

This is because when you diversify, you are usually investing in different asset classes. For example, you might invest in stocks, bonds, and real estate.

While these asset classes usually don’t move in the same direction at the same time, there are times when they can.

This is called correlation risk. So even though diversification can help to reduce your overall risk, it can also increase your risk in some cases.

Although it can be easy to diversify for assets such as stock market index funds, other investments such as cryptocurrency or real estate can be more difficult.

Overall, diversification is a great way to manage risk. But you need to make sure that you are doing it properly, or else it could lead to lower returns.

Over diversification can also be a problem, so you need to find the right balance.

Risk Management Strategy #2 – Dollar Cost Averaging

Dollar-cost averaging is a strategy where you invest a fixed amount of money into an investment regularly.

This helps to smooth out the ups and downs of the market and can help you make money in the long run.

For example, let’s say that you invest $100 into a stock every month. If the stock goes down in value one month, you will still have invested $100 the next month.

Over time, this can help you make money even if the stock market is volatile.

It also helps lower the probability of buying at market tops right before a pullback.

Many investors will speculate and invest based on FOMO (fear of missing out) and allocate a larger sum of money into an investment when it’s peaking.

By dollar-cost averaging, you are buying the investment at a fixed amount which will smooth out the effects of price volatility.

This strategy may not be right for everyone, but it can be a good way to manage risk if you are investing in volatile assets.

Advantages of Dollar-Cost Averaging

There are both advantages and disadvantages to using this strategy. Here is an explanation of some of the most important advantages.

A major benefit is that It allows you to lower your average price. If you are investing in a volatile asset, you may be able to buy more shares when the price is down.

This can help you make money in the long run.

For example, if you invest $100 in a stock every month and the price goes down, you will be able to buy more shares.

Another advantage is that It takes the emotion out of investing.

When you invest the same amount of money regularly, you don’t have to worry about timing the market.

You can just set it and forget it.

Stress can cause investors to make bad decisions, so this can be a good way to avoid that.

Finally, dollar-cost averaging is also much less time-consuming.

This is because you don’t have to worry about timing the market or making sure you are investing at the right time.

Disadvantages of Dollar-Cost Averaging

It’s important to be mindful of the drawbacks of this strategy.

For example, you could miss out on big gains. If the stock market goes up quickly, you will only be able to buy a fixed number of shares each time.

Thus, this reduces your overall return.

It can also be expensive. If you are investing in a stock with a broker that has high transaction costs, this strategy can be costly.

The same can be said for paying off a mortgage. If you have a lump sum to invest, you may be better off using that money to pay down your mortgage.

This is because the principal of the loan will be lower, and you will save on interest payments.

The most important drawback you should be aware of is that you could end up dollar-cost averaging into a bad investment.

This would be disastrous if you kept investing in an asset that is destined to fail.

In trading terms, this would be called “catching a falling knife”.

This strategy is still a great way to lower risk, but you need to be aware of the drawbacks.

If you select an asset with a low probability of success, you could end up losing a lot of money.

However, assets such as the S&P500 have a much higher probability of success.

This is because the S&P500 is a basket of the 500 most successful companies in the United States.

Risk Management Strategy #3 – Investment Horizon

Your investment horizon is the amount of time that you are willing to invest.

This can be a short-term investment, such as investing in a stock for one year or it could also be a long-term investment, such as investing in a property for ten years.

The longer your investment horizon, the more time you have to ride out the ups and downs of the market.

This is because you are less likely to need the money in the short term.

For example, if you are investing for retirement, you have a very long time horizon. This means that you can afford to take more risks.

Conversely, if you are investing in a child’s education, you have a shorter time horizon. This means that you need to be more cautious with your investments.

It’s important to have a clear investment horizon when you are managing risk. This will help you make decisions about which assets to invest in and how much risk you are willing to take.

A longer time horizon also lowers the probability of losing money for some assets.

For example, the S&P500 has a historical return of around 11% annually. This means that if you kept investing in this asset for multiple decades, you’ll technically face lower risks due to market volatility.

However, in some years the market may go down. If you can only invest for a few months and it ends up being in a bear market, you may sell at a loss.

By having a clear investment horizon, you can avoid these situations.

Advantages of Longer Time Horizons

The main advantage of this strategy is that it can help you avoid short-term losses.

If you have a long time horizon, you don’t need to worry about the ups and downs of the market. This is because your investment will have time to recover from any losses.

Another advantage of this strategy is that it can help you compound your returns.

This is because the longer you invest, the more time your money has to grow.

With compounded returns, you can withstand some short-term moments of losses because your investment will continue to grow long-term.

Disadvantages of Longer Time Horizons

The main disadvantage of this strategy is that it can tie up your money for a long period of time.

This means that you may miss out on other opportunities.

For example, if there was a once-in-a-lifetime opportunity to invest in a new company, you may not have the cash available if you have a long time horizon.

Another disadvantage of this strategy is that your investment may not perform as well as expected.

This is because no asset is guaranteed to make money. Even the best investments can go through periods of losses.

This also isn’t the best strategy to apply if you don’t have the patience or the time to monitor your investments.

If you can’t monitor your investment, you can use a Robo-advisor or hire a financial advisor to do it for you.

However, if you are near retirement, you may not have time to wait for your investment to recover.

Risk Management Strategy #4 – Research with Devil’s Advocate

When it comes to investment research, always consider the possibility that you could be wrong. This is known as the Devil’s Advocate approach.

By critically examining your investment thesis from all angles, you can reduce the chances of being blindsided by unforeseen events.

For example, let’s say you are excited to invest in Bitcoin. You read all the news articles and research reports supporting your decision.

But what if there was a key piece of information that you missed? What if the entire Bitcoin bubble is about to burst?

If you see a hot property, you can ask yourself what you would do if you were the seller.

If you are buying a stock, you can ask yourself what short-sellers are saying about the company.

By critically examining your investment thesis from all angles, you can reduce your risk exposure.

You can even make a conscious effort to honestly listen to opposing views.

This can be done through videos, reading a variety of blogs, or formulating a mastermind group to discuss investments periodically.

When it comes to risk management, the key is to always be learning and investigating all sides of an investment before you make a decision.

By playing Devil’s Advocate with your investment decisions, you can force yourself to think about all the potential risks and rewards before putting any money on the line.

Ray Dalio, the billionaire hedge fund manager, is a big proponent of this approach.

In a tweet, Dalio writes:

“Most people make bad decisions because they are so certain that they’re right that they don’t allow themselves to see the better alternatives that exist.”

Advantages of Researching with Devil’s Advocate

Confirmation bias is one of the biggest dangers in investing. This is when you only seek out information that confirms your existing beliefs.

By playing Devil’s Advocate, you can avoid this trap and make more informed investment decisions.

Another advantage of this approach is that it can help you identify potential problems early on.

If you are only looking at one side of an investment, you may not be able to see the potential red flags.

By critically examining an investment from all angles, you can avoid making a costly mistake down the road.

By becoming a contrarian, you can also reduce the risk of investing based on hype and social influences.

For example, if everyone is talking about how Bitcoin is going to make them rich, you may be tempted to jump on the bandwagon without doing your own due diligence.

By taking a contrarian approach, you can avoid being caught up in the hype and making an emotionally-driven investment decision.

Disadvantages of Researching with Devil’s Advocate

Paralysis by analysis is a real danger when it comes to risk management. If you overthink an investment, you may never pull the trigger.

This is why it’s important to strike a balance between being too cautious and too reckless.

Another potential downside of this approach is that you may talk yourself out of a good investment.

If you are too focused on the potential risks, you may miss out on a great opportunity.

The key is to find a balance between being too risky and too risk-averse.

By playing Devil’s Advocate with your investment decisions, you can help reduce your risk exposure without sacrificing potential upside.

Risk Management Strategy #5 – Hedging

Hedging is another important risk management strategy. When you hedge, you take action to offset the risk of loss in your investment portfolio.

For example, if you own stocks and are concerned about a potential decline in the stock market, you might buy put options on a stock index.

Put options give you the right to sell shares at a set price, so if the stock market falls, your put options will increase in value.

This offsetting position limits your downside risk and protects your investment portfolio from losses.

Another form of hedging is to purchase insurance against the risk of loss. For example, you can buy homeowner’s insurance to protect your home from fire or theft. If your home is destroyed, the insurance will pay to rebuild it.

Bitcoiners and gold investors will often describe the cryptocurrency or precious metal as digital/physical “insurance” against the risk of loss in fiat currencies.

This is because inflation erodes the purchasing power of paper money, but commodities like gold and Bitcoin tend to hold their value over time.

If you are investing in new inventory for your business, you can hedge against your risk of loss by buying “insurance”. This way, if your inventory is lost or damaged, you will be reimbursed for the loss.

Even if you are investing in a consumer good, you can ensure your purchase with a warranty. The more money you have on the line, the more insurance you may want to consider.

This is because the higher the value of your investment, the greater the potential loss if something goes wrong.

Hedging can be a complex topic, but it is an important risk management strategy to understand. By hedging your bets, you can protect your investment portfolio from losses and sleep better at night knowing that you have a safety net in place.

Advantages of Hedging

The main advantage of hedging is that it can help you protect your investment portfolio from losses. By offsetting the risk of loss in one area, you can minimise the impact on your overall portfolio.

Another advantage of hedging is that it can help you take advantage of opportunities.

For example, if you are bullish on a stock but are worried about a potential decline in the market, you could buy the stock and hedge your position with put options.

Finally, hedging can help you manage your emotions. If you are worried about a potential decline in the stock market, hedging can help you stay calm and focused on your long-term investment strategy.

Disadvantages of Hedging

While hedging can be an effective way to manage risk, it’s important to remember that hedges come with their own set of risks.

For example, if you buy put options and the stock market doesn’t fall, you’ll lose money on your investment.

Additionally, hedging can be a complex and expensive process. If you are not careful, you could end up spending more on hedges than you would have lost without them.

Hedging is not a perfect solution, but it is an important risk management tool to understand.

By carefully considering the risks and rewards of hedging, you can make an informed decision about whether or not it is right for you.

Risk Management Strategy #6 – Double and Out

The sixth risk management strategy is to “double and out.” This means that when you invest in something, you take out your initial investment as soon as you make a 100% return. By doing so, you end up only investing with profits as you let your initial investment grow.

This is a good strategy if you’re investing in something that has a lot of potential but is also very risky.

It allows you to take some money off the table while still giving you the chance to make a lot more if the investment pays off.

Here’s an example of how this strategy would work. Imagine you invest $1,000 into a stock.

The shares are trading for $1 which means you would receive 1,000 shares.

As soon as the stock reaches $2 you would sell 500 shares for a 100% return. You would then be left with 500 shares and $1,000 cash.

You can leave the 500 shares for more upside potential while your entire risk is reduced because you’ve already taken your initial investment out.

As you can see, this is a great way to manage risk while still giving yourself the chance to make money.

Advantages of The Double and Out Strategy

The main advantage of this strategy is that it allows you to take your initial investment out while still giving you upside potential. By doing so, you reduce your risk of losing your initial capital.

Another advantage of this strategy is that it can help you stay disciplined. When you invest in something, it can be easy to get emotionally attached to your investment and hold on for too long.

It also allows you to lower your risk because many markets eventually crash and by taking your initial investment out you’ve already made money.

Disadvantages of The Double and Out Strategy

The main disadvantage of this strategy is that it can limit your upside potential. If the investment goes up a lot, you’ll miss out on a lot of gains.

Another downside to this strategy is that it requires you to be very disciplined and have a clear exit plan. Otherwise, you could end up holding onto your investment for too long and missing out on profits.

Finally, some investments may not ever produce a 100% return on investment. In this scenario, you would have to sell at a loss or wait a very long time for the investment to produce gains.

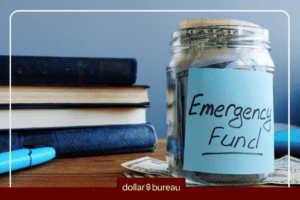

Risk Management Strategy #7 – Don’t Use Debt To Invest

The seventh risk management strategy is to avoid using debt to invest. This means that you should only use money that you already have saved up to invest.

There are a few reasons why this is a good strategy. First, it allows you to stay disciplined with your investing.

When you’re using other people’s money, it can be easy to take on more risks than you can afford.

Second, it keeps you from losing your home or going bankrupt if your investment goes bad.

Finally, debt often comes with interest payments which can eat into your profits. For these reasons, it’s generally a good idea to avoid using debt to invest.

Advantages of Avoiding Debt To Invest

Debt can be a big risk when investing. That’s because if you’re using debt to finance your investments, you’re essentially taking on more risk.

You’re also putting your investment at risk of being repossessed if you can’t make your payments.

If you use debt, you can not only lose your money but you could also owe money to someone.

This could put you in a debt spiral where you’re paying interest on the money you borrowed to invest.

It’s important to remember that when you’re investing, there is always the potential for a black swan event.

A ‘black swan’ is an event that is unpredictable and has a massive impact.

Avoiding debt is one of the best ways to manage risk when investing. It can be tempting to use debt to finance your investments, but it’s important to remember the risks involved. By avoiding debt, you can minimize your risk and keep your investment safe.

Disadvantages of Avoiding Debt To Invest

There are a few disadvantages to avoiding debt when investing. First, you may miss out on opportunities to invest in something that could go up in value.

Second, you may have to save up for longer to get the money you need to invest.

Finally, if you’re able to borrow money at low-interest rates, you may be missing out on a chance to invest at a time when the market is good. For example, if the interest rate was only 4% and you’ve found an asset that yields 15% you’re essentially missing out on an 11% return.

Leverage is a double-edged sword. It can help you make more money, but it can also put you in a difficult financial situation if things go wrong.

If you are looking to reduce your risk, avoiding debt is a good strategy.

Conclusion

The bottom line is that there is no perfect risk management strategy. The key is to find an approach that works for you and stick with it. By critically examining your investment thesis from all angles, you can reduce your exposure to risk and increase your chances of success.

Of course, you don’t have to only select one of these strategies. Many of the best investors use a combination of all of them.

The important thing is to be aware of the different risk management strategies out there and how you can use them to protect your portfolio.

As a review, here are the seven risk management strategies we discussed:

- Diversification

- Dollar-Cost Average

- Investment Horizon

- Research with Devil’s Advocate

- Hedging

- Double and Out

- Don’t Use Debt

An example of how you can synergise these strategies would be to diversify with a few index funds, REITs, and cryptocurrencies.

You can dollar cost-average into these assets for the long term and talk to people with opposing views.

A hedge would be to short the market with put options or to invest in inverse ETFs.

Once you’ve doubled your money on speculative investments, you can take your profits and move them into more stable investments. By doing so you can avoid using debt.

As a final note, it’s important to diversify your risks from hacks.

By following these risk management strategies, you can sleep soundly at night knowing your investments are well-protected.