Financial investments are an essential part of your retirement planning.

In Singapore, many are well educated and thus probe and analyse financial instruments so that they can be understood better.

Bonds are one such type of investment.

Developing a better understanding of what bonds are will undoubtedly take you a long way when investing.

If you’ve been reading up on bonds, you’d probably know that it’s a great source of income while being relatively low risk.

Thankfully, the bond investing process in Singapore is simple and straightforward to understand.

We have prepared a step-by-step guide to bond investing in Singapore. Let us break it down for you and help you in understanding more about these fixed income securities.

What are bonds and how do they work?

In simple words, bonds are a way companies and government agencies borrow money. The corporations decide how many bonds they would like to issue, the coupon rate, and the maturity period.

These bonds are then sold on brokerages to raise money, where the money raised is used to finance activities within their companies.

Bonds are commonly referred to as fixed-income securities because of the provision of a guaranteed income in the form of dividends to the investors.

There are 2 significant parts of the bonds, namely Par Value and Coupons.

Par value, also known as face value, is how much the bond is worth. It is also the total value that needs to be given to the bondholders when the bond matures.

Coupons are the interest rate and are clearly expressed as the percentage of the bond’s face value. You will receive these as “dividend” payouts yearly.

Bonds come with a credit rating affixed to them, and the returns you see from these bonds largely depend upon the credit standing of the issuing authority.

The credit ratings may also change until the bond matures.

How do I earn from bonds?

The 2 main ways of earning from bonds are coupon payments and capital gains.

If you purchase the bond at its issuance and hold it until maturity, the coupon rates are what you’ll earn from.

If you’re looking to buy or sell bonds after their issuance, the value of the bond might increase or decrease, depending on the bank interest rates.

The way you earn money from bonds here depends on whether you purchase it at a discount or a premium.

A discount means you bought it below the face value, and a premium means you bought it above the face value.

You make money through capital gains for discount bonds when the bond matures (par value – price you paid) and the coupon rates.

Conversely, you “lose” money for premium bonds when the bond matures and only earn through the coupon rates.

Here’s a table to illustrate:

| Face Value | Current Market Price | Trading at |

| $1000 | $1000 | Par Value |

| $1000 | $1200 | Premium |

| $1000 | $900 | Discount |

Thus, if you’re looking to make a sizable return, it only occurs when you sell the bond at a higher price than your initial cost.

Now you may be wondering why I would pay more than the face value of a bond? Well, that depends on the bank interest rates.

Bank Interest Rates

This might get a little bit confusing but stay with me because it’s important.

Say a corporation is planning to issue new bonds and the bank interest rate is currently 3%, they will probably put their coupon rate higher than this to attract individuals like you to lend them your money.

I mean… if the coupon rate is at 3% or lower, it’s much safer to put it with the bank, right? For illustration purposes, the coupon rate is 5%, and you buy it.

After some time, the bank interest rates increase to 5% or more. What do you think investors will do?

They’d put their money with the bank. You and other bondholders don’t want to lose out on this opportunity and decide to sell away the bonds you have.

Here comes the problem, more supply than demand. This means that the market price will change, and the bond will most likely trade at a discount.

Now, if we switch the scenario to the inverse and bank interest rates drop to 1%. Bond prices significantly rise and thus would command more in the market.

If you decide to sell now, this is one way you can earn through capital gains.

Then there are scenarios wherein the investors request an additional amount and the face value of the bond from the issuer to prepare themselves for the unpredictability of the future. Such a possibility occurs in the case of long-term bonds.

Types of bonds in Singapore

There are 2 main types of bonds in Singapore – government-issued bonds and corporation-issued bonds.

Government-Issued Bonds

The Singapore government provides vital support to mainly two types of bonds: the Singapore Government Securities (SGS bonds) and the Singapore Savings Bonds (SSB).

The curation of such government-backed bonds specifically occurs for investors worried about risk while looking for a low minimum investment amount.

There are a few distinct differences between these 2 types of bonds.

| Singapore Savings Bonds | Singapore Government Securities | |

| Minimum Investment | $500 | $1,000 |

| Maximum Investment | $100,000 | – |

| Maturity Period | 10 Years | 2, 5, 10, 15, 20, 30 Years |

| Coupon Rate | Fixed | Depends on Market Rate |

| Coupon Payment | Every 6 Months | Every 6 Months |

| Investment Options | Cash & SRS | Cash, SRS, CPFIS |

Corporate Bonds

Corporate bonds are bonds issued by companies. As compared to government bonds, company bonds contain higher risks – determined by credit ratings.

As they are of higher risk, the coupon rates are comparably higher than government bonds and are determined by bank interest rates.

Bond ETFs and Unit Trusts

Although there are mainly 2 types of bonds, bond ETFs and unit trusts are worth a mention. A bond ETF and unit trust is a basket of bonds that trades in an exchange.

Instead of owning individual bonds, having multiple bonds in small amounts will mitigate the risks you face. Due to the diversification offered, many Singapore investors prefer these options.

Read more about exchange-traded funds and unit trusts by clicking the links respectively.

Advantages of bonds

Here is a list of the advantages of bonds.

Regular Income

Bonds are known to provide a steady stream of income through coupon payments. This feature is attractive as you can plan to use these payouts to invest in other assets or your expenses.

“Safer” Investments

Bonds are excellent for safeguarding your principal amount while allowing you to make a profit through capital gains.

As bonds are regarded as one of the safest investment options in the market, it attracts risk-averse investors and retirees looking to grow their wealth.

The “safety” of the bond you purchased is highly tied to the credit ratings given. A poorly rated bond might be riskier than a share of a stable company.

Liquidity

Bonds are liquid in nature as you can easily buy and sell them in secondary markets.

Tax-Free

Taxation doesn’t apply to government savings bonds. This means that you pocket the entire earnings you get from purchasing these bonds without having to worry about additional fees you might incur.

Disadvantages and Risks of Bonds

Here are a couple of disadvantages and risks associated with the bonds:

Credit Risk

The credit score is an essential indicator of the existing health and value of the bond. At any point in time, if the credit quality falls or reduces, then the bond faces the risk of declining credit value.

A declining credit value would mean that the issuing organisation might not return your capital, and the bond is said to have defaulted.

Although this is highly uncommon, investors should be sure about their investments and do a thorough check before buying any bonds.

Price Risk

Next, the market value of the bonds plays a massive role in liquidating them as assets. If you’re interested in selling them and at a sizable profit, then the market value should be higher than what you purchased them for.

If you need to sell them off when the market value is high, you might face liquidity issues – though this wouldn’t generally be a problem.

However, if you have to sell them off at a lower price than what you bought, you’re incurring a loss.

This won’t affect the investors who are interested in buying and holding their assets.

Inflation Risk

The condition of the economy largely determines the state of your bonds too. In the case of inflation, bonds start to lose out on the principal amount value, and so does the value of your coupons as well.

You should consider the effects of inflation on the average returns of your investments.

Currency Exchange Risk

When you’re looking at overseas bonds, foreign exchange rates are crucial to the value of bonds. Any fluctuation in the foreign market condition directly affects the value of bonds investing in Singapore.

Who should buy bonds?

As bonds are considered one of the safest assets to invest in, retirees and risk-averse investors should buy bonds.

Furthermore, if you’re investing for the long-term, you can easily invest in bonds according to the financial milestones you might have.

What to look out for when choosing a bond?

Certain factors carry considerable weightage when choosing a bond.

Credit Rating

The credit report helps in knowing which of the bonds suits your profile the best. There are portions of the credit score that give you a closer look at the bonds and all the related insights when properly evaluated.

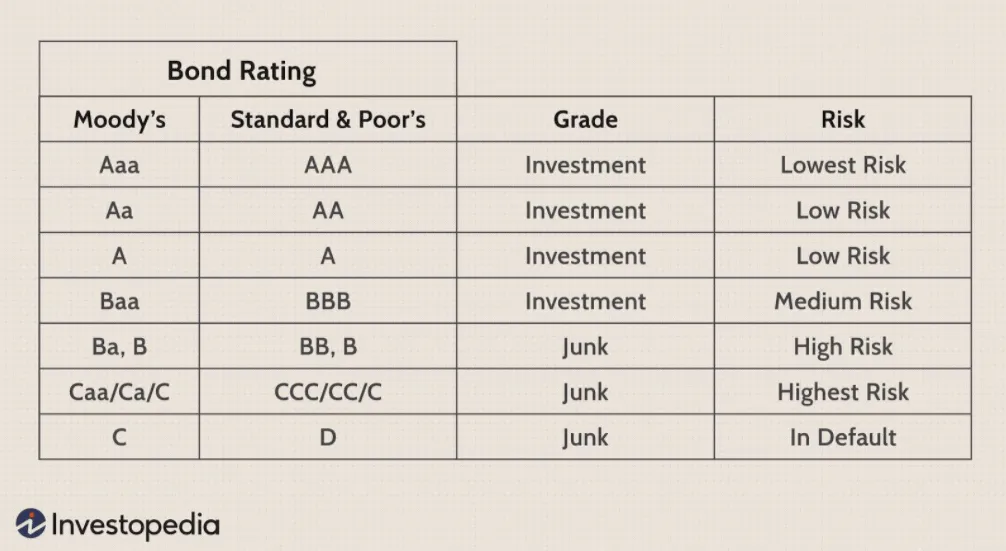

These reports are rated by credit rating agencies such as Moody’s, Standard and Poor’s, and Fitch Ratings. Here’s a breakdown of the ratings you can expect a bond to have:

For your knowledge, generally, bonds with high ratings have the lowest risk. Thus, the coupon rates will be lower as well (but higher than bank rates).

Interest Cover Ratio

The interest cover ratio measures how many times an organisation can pay its interest with its current earnings. If the ratio value is low, then the company might be unable to cover the coupon payments.

Revenue and Profits

Revenue and profit margin, when considerably high, drive the value of bonds. It’s best to always measure by percentages than absolute numbers as it creates a better visualisation of how effective the company’s financials are.

Cash Flow

The organisation’s cash flow is vital as it determines whether the company has enough cash on hand to handle daily operations and make payments.

Maturity Period

The bond’s maturity period explains its worth and the interoperability of the bond with other assets in your portfolio. You want to make sure that the bonds you hold mature at the right timing so that you can make financial decisions upon its maturity.

Findings reveal that longer-duration bonds fare better in the market than the ones with a shorter period of investment.

Type of Bond

The type of bond is another factor that should undergo careful thought and consideration. Are you willing to put your investment at higher risk for higher returns? If so, corporate bonds are the way to go.

If not, government savings bonds are for you.

Coupon Rate

Of course, not missing out on the coupon rate. Be sure to tally the coupon rates to similar bonds with similar credit ratings and compare them against the bank interest rates.

Best bonds in Singapore

Here are the two most popular bonds ETFs on the financial radar of Singapore:

ICBC CSOP FTSE Chinese Government Bond Index ETF

The bond listing occurs on the Singapore Exchange with open access to the offshore market in China. Hence, investors gain exposure to Chinese bonds and a high-yield generation.

The government bond index is lucrative and even offers diversity to your portfolio as and when needed.

Nikko AM SGD Investment Grade Corporate Bond ETF

It is among the first few corporate bonds that provide a significant offering of easy and open access to the corporate bonds’ Singaporean market.

The offering is affordable and easily managed by an investor with minimum investment capacity. The dynamic nature of the bonds is due to the ease of trading and exchange, with risk reduced to a bare minimum.

Here are 2 other bonds ETFs that are being looked at by investors.

ABF Singapore Government Bond Index Fund

Xtrackers II Singapore Government Bond UCITS ETF

If you’re looking to purchase individual bonds, a good way to find the best bonds to invest in is to observe what most bond ETFs and unit trusts have in their composition.

Where can you invest in bonds if you’re in Singapore?

Similar to stock investing, you can invest in bonds via the secondary market through banks, broker accounts, and the Singapore Exchange.

Newly issued bonds are usually available via ATMs and banks.

Conclusion

All of the points mentioned above will help you evaluate, analyse, and understand bonds better. However, you will still need to conduct your research on understanding credit ratings, what happens when a bond defaults, and choosing the right bond for yourself.

If you need assistance in planning your investment portfolio or financial planning, you should always engage a financial advisor to not make the wrong decisions.