At DollarBureau, Syfe had earned its title of being the ‘Best Overall Robo Advisor in Singapore’.

But what makes it popular and the ‘best’ exactly, especially amongst newbie investors?

Whether you’re considering Syfe as an investment option or just being curious, this article should address any doubts you have, as well as provide a comprehensive review at your disposal.

And if you’ve decided to pick Syfe as your preferred robo-advisor, stick around to find out how to earn additional cash just by using our referral code!

What is Syfe?

Established in 2019, Syfe is a leading robo-advisor in Singapore that provides simple, smart, and affordable investing for all.

Syfe was also built to bridge the increasing knowledge gap in Exchange Traded Funds (ETF) investing and to teach the general population how to get started with investing.

This is what Syfe prides itself upon, which other robo-advisors pale in comparison.

Like all robo-advisors, Syfe has its algorithm which helps you manage your investments, which is their Automated Risk-Managed investment (ARI) strategy.

ARI helps to automatically adjust your portfolios so that you would get the best possible returns at any time.

For instance, during the initial COVID-19 pandemic stages when markets were crashing, ARI automatically adjusted Syfe’s portfolios so that they did not crash substantially.

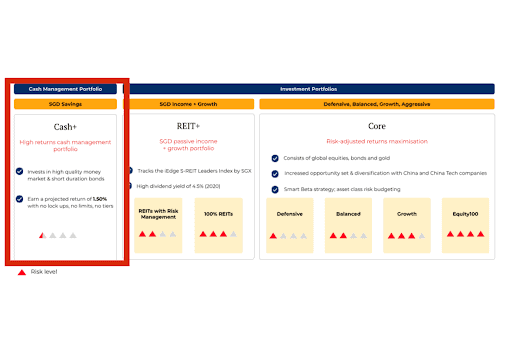

As of today, Syfe offers two accounts – Syfe Wealth and Singapore’s first-ever neobrokerage, Syfe Trade.

Let’s first get started with Syfe Wealth.

Features of Syfe Wealth

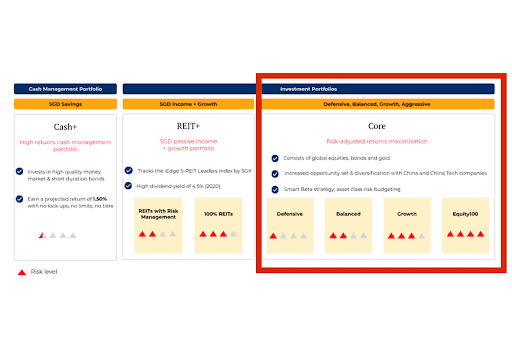

Core Portfolios

Syfe offers 4 types of Core Portfolios namely: Core Equity100, Core Balanced, Core Growth, and Core Defensive.

Just a quick overview, most of Syfe’s Core Portfolios are suitable for those with a higher risk appetite, where they can leverage on market dips and accumulate more of your investments when the market recovers.

These portfolios are also suitable for those who are young and can hold them for a longer term.

Let’s look at these portfolios respectively.

Core Equity100

Just like its name, Core Equity100 is designed for those who want maximum exposure to global equities (i.e. 100% investment into equities).

This portfolio also allows investors to gain access to over 1,500+ stocks in the world’s best companies.

These ETFs are diversified among many various sectors such as information technology, consumer discretionary, consumer staples, health care, communication services, financials, industrials, and many others.

They are also diversified among various countries such as the U.S, China, Japan, the UK, and others. So overall, this investment portfolio is centred around the idea of diversification.

When compared to the rest of Syfe’s Core portfolios, Core Equity100 will provide the highest return precisely because of its 100% investment in equities – which also makes it the portfolio that holds the highest risk.

This is because equities have been known to grow much faster than any other asset class.

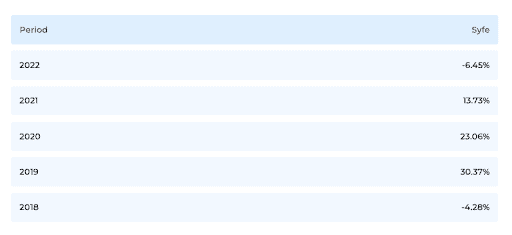

You can see it here in their annual returns over the past few years.

After all, it’s just like the basic investment principle: the higher the risk, the higher the return.

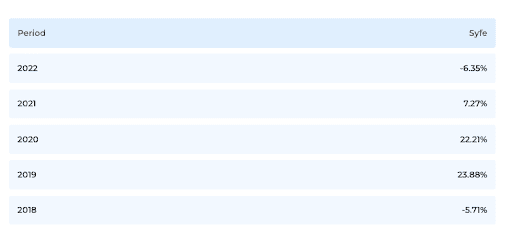

Core Growth

Core Growth focuses on equity (although less than Core Equity100). It has a risk rating of 3 compared to Equity100.

Therefore, this is perfect for those who still want the high return potential but still want a certain level of risk protection.

With investment in over 3500+ stocks, they have a focus on Technology and Chinese stocks, which tends to grow exponentially in the long run.

This breakdown of this portfolio’s annual returns is as follows.

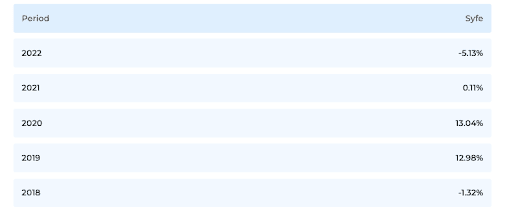

Core Defensive

Core Defensive invests significantly in high government and corporate bonds, which are suitable for those who want more stable returns.

It has the lowest risk rating of 1 out of all Syfe’s core portfolios.

As you can probably tell, its annual returns are also much safer as compared to the rest of the portfolios’ returns.

Core Balanced

Core Balanced focuses somewhat on what is offered by Core Growth and Defensive.

With a moderately low-risk rating of 2, it is balanced in the way that it is optimally diversified across equities, bonds, and commodities.

As you can probably guess, here’s a breakdown of the annual returns for this portfolio.

Syfe Satellite Portfolios

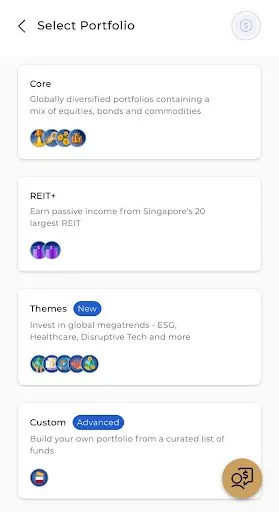

Syfe offers two types of satellite portfolios – REIT+ and themed portfolios.

REIT+

For REIT+ portfolios, you have a choice between the REITs with Risk Management or the 100% REITs. As seen above, the former has a lower risk level as compared to the latter.

Let’s first talk about the one with the higher risk which is – 100% REITs (i.e 100% investments in REITs listed on SGX).

If you did not know, REIT stands for Real Estate Investment Trust. We have also put together a list of the 11 best REITs in Singapore, in case you’re interested.

Basically, the main goal of these REIT+ portfolios is to generate dividend income without having to spend loads of money to purchase a property.

However, a point to note is that dividend payouts are given every 3 months.

When you look at 100% REITs’ performance history, you can see that it fluctuates up and down every year. The current average dividend yield also stands at 4.8%.

Despite the fluctuations, its past returns are still increasing overall.

However, it is understandable that some people are not comfortable with their portfolio fluctuating too much just like how 100% REITs do.

Thus, Syfe’s REITs with Risk Management help to ease such discomfort.

Basically, what it does is that it throws in some bonds in there.

If the market is doing well, the REITs with Risk Management portfolio will reduce the bond percentage and vice versa when the market is not doing as well.

But in exchange for a “safer” portfolio with lesser risk compared to 100% REITs, you can definitely expect lesser dividend returns as well.

Overall, both portfolios are suitable for those who wish to receive consistent passive income.

However, if you have a longer time investment horizon (i.e the amount of time you are willing to hold on to a portfolio), you can consider going for the 100% REITs portfolio because it will increase your chances of getting higher returns in the long-run.

Thematic Portfolios

Thematic portfolios, like its name, are tied to a specific theme.

If you are passionate about a certain real-world topic, themed portfolios are suitable for you to best reflect your values and investment preferences.

Under Syfe’s themed portfolios, you can choose from 5 types mainly: ESG & Clean Energy, Disruptive Technology, Healthcare Innovation, China Growth, and Global Income.

ESG & Clean Energy

ESG stands for Environment, Social and Governance. As such, this portfolio was made to invest equally in socially responsible companies that rank highly in ESG criteria and those that focus on clean energy.

With 5 being the highest risk, Syfe ranks this portfolio at a 5/5 overall risk rating – precisely because it has a highly diversified exposure across various sectors and geographies and invests 100% into equities.

In my personal opinion, this portfolio has the potential to grow and do better in the future – due to the rising trends of ESG movements and efforts.

Currently, it also stands the highest in terms of Average Annual Return (5Y) of 18.87%.

Disruptive Technology

This portfolio invests in companies that can disrupt the way we do things in the future and those that are the leaders in cutting-edge technologies and innovation.

This essentially refers to investments in new-age technologies such as robots, Artificial Intelligence (AI), FinTech, Cloud Computing, and more.

This portfolio also has a 5/5 overall risk rating. However, this is because of the high risk that is present in some of these companies – whose technologies are still in the experiment or growth stage, which may fail easily.

Similar to the ESG & Clean Energy portfolio, it also invests 100% into equities.

Syfe warns that investors of this portfolio should already have a well-diversified portfolio before they do so.

Healthcare Innovation

As you can probably guess, this portfolio invests in healthcare-related companies that focus on various healthcare sectors such as pharmaceuticals, biotech, or even services such as insurance or medical devices.

In addition, it also contains a hint of disruptive elements just like the Disruptive Technology portfolio mentioned earlier.

I mean, this should be the case – since healthcare is getting more and more advanced now especially by tapping on new-age technologies and science.

With that in mind, Syfe also gave this portfolio a 5/5 overall risk rating.

This is because it also factors in the issue with such healthcare-related companies, where it requires a relatively longer-term to see any returns because cures or new discoveries are something that cannot be easily developed in the short term.

As such, most of the funds in this portfolio are healthcare ETFs of equities which are essentially the big, well-known healthcare and biotech companies like Moderna Inc or Pfizer Inc that created the COVID-19 vaccines.

For investors who believe strongly in the healthcare sector soaring in the near future, you can consider adding the Healthcare Innovation portfolio to your list.

China Growth

This portfolio invests in China companies, especially those that are at the forefront of their economy.

I’m pretty sure you’ve heard of these big names before, Tencent, Alibaba, or even Baidu?

Well, these heard-of names are indeed within the top 5 companies that the China Growth portfolio invests in.

Overall, it consists of a total of 6 ETFs that covers consumer discretionary, communication services, and information technology.

If you’re someone who wishes to take advantage of China’s future growth without going through the hassle of picking the right Chinese stocks – then this portfolio is for you.

However, do keep in mind that this portfolio also holds an overall risk rating of 5/5.

This is because it may be considered risky for someone who does not possess sufficient knowledge or research about companies in China and their working ethics – given how they operate very differently from US companies.

Read more:

Global Income

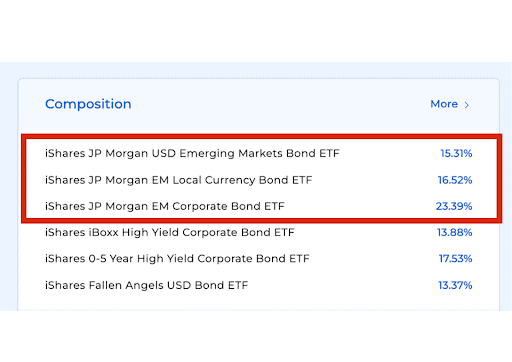

Out of all themed portfolios, the Global Income portfolio holds the lowest overall risk rating of 3/5.

This is because this portfolio provides a steady 4.25% annual dividend yield – where it holds high-yielding corporate and government bonds and is globally diversified.

If you look at the composition of this portfolio, you can see that it comprises a high percentage of EM bonds ETFs, where EM bonds stand for Emerging Market bonds.

According to Investopedia, emerging markets bonds typically have comparative or more attractive yields compared to traditional US bonds.

This can be attributed to how they are riskier, since developing countries have a lot more room to grow rapidly as compared to developed countries.

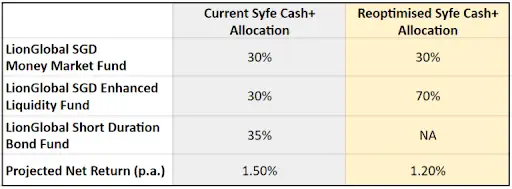

Cash+

Alas, we’ve reached the portfolio with the least risk level among Syfe’s portfolio offerings: the Cash+ portfolio. And you must be wondering – why does it have the least risk?

Well, for this portfolio, its investments lie in short-term government and corporate bonds from Singapore.

Cash+ also offers high-quality interest rate securities – which are definitely higher than bank savings accounts that provide a very low interest rate.

Syfe has even laid the comparison out for you, where you can generate up to 17 times more with Cash+ (1.2%) as compared to bank deposits (0.07%).

At the start of 2022, Syfe has since re-optimised its Cash+ portfolios. Here’s a summary of their latest allocation:

Thus, this portfolio will be suitable for those who wish to grow their short-term wealth (i.e money that you simply cannot lose because of financial commitments and priorities).

Sort of like treating it like a savings account, rather than an account for investment.

In fact, it’s a cash management account instead of an investment portfolio.

This certainly beats letting your cash remain idle in the bank, where you can simply invest it in Cash+.

There are also no limits as to how much you can put into this account, so this would be best for any spare cash you have lying around.

Syfe Select (Custom Portfolios)

The Syfe Select Custom feature allows you to pick from a curated list of over 100 best-in-class ETFs available on Syfe.

In this list, there are various categories that can help you navigate such as Trending, Recommended, Top Performers, Bottom Performers, or more.

Here, you can even decide the % you can allocate to each chosen ETF! But keep in mind, you can only select up to a maximum of 8 ETFs.

At the end of your customisation process, Syfe also provides a warning if you have created a portfolio that is of a higher risk than your current risk profile.

Syfe Trade

Now that we’ve finished with the features of Syfe Wealth, let’s move on to Syfe Trade which is Singapore’s first-ever neobrokerage platform.

You may be wondering – what is a neobroker?

Well, neo brokers are a new class of brokers that aim to transform the stock trading landscape through innovative concepts – like low fees and easy-to-use platforms.

This basically means Syfe Trade is an easier intermediary for people to invest and make transactions.

However, as of right now, Syfe Trade only has access to the US market.

Syfe Wealth Fees

Here’s an overview of the management fees in Syfe. They are dependent on the amount you invest in Syfe.

| Investment Amount ($) | Tier | Management Fee (%) |

| No minimum investment amount | Blue | 0.65% |

| Minimum $20,000 | Black | 0.50% |

| Minimum $100,000 | Gold | 0.40% |

| Minimum $500,000 | Private Wealth | 0.35% |

For Syfe Cash+ portfolios, there are 0 management fees involved.

And in comparison with other robo-advisors in Singapore, Syfe has one of the cheapest management fees and with no minimum investment amount involved.

Syfe Trading Fees

Syfe Trade provides you with 2 free traders per month and charges US$1.49 in fees thereafter.

They are also having an introductory offer where you can get up to 5 free trades per month and from the 6th trade onwards – it will be US$0.99 per trade as compared to the usual U$1.49.

Minimum Deposits and Withdrawals

Syfe Wealth offers a seamless process for anyone looking to invest – in the form of no minimum holding or lock-in periods.

This essentially means that there would never be a time when you are restricted to redeem or sell your investments on Syfe.

Funding and Withdrawal Methods

If you wish to add funds to your portfolio, you can do so via two methods – an Internet bank transfer or Paynow.

If you wish to withdraw funds, simply select ‘Manage Funds’ on your selected portfolio.

You can then input your reason for withdrawal.

Withdrawals can come in the form of full or partial withdrawal, where partial withdrawal allows you to withdraw up to 90% of the funds from your portfolio.

If you are transferring to an SGD currency bank account, remember to select SGD to avoid incurring any currency conversion charges.

You can then enter other additional details such as the bank’s name, account holder’s name, account number, and whether it is a Singapore account.

Is Syfe Safe?

In short, yes, Syfe is safe.

This can be attributed to a variety of reasons:

- They are regulated by the Monetary Authority of Singapore (MAS)

Syfe is also licensed under the Capital Markets Services (CMS) with CMS License No (CMS100837) for retail fund management after meeting all stringent standards set by MAS for financial and investment services companies.

- Your money is held separately in another account

For any deposits that you hold in Syfe, they are kept separately from Syfe’s personal accounts and stored in a DBS Trust Account. For transactions within Syfe Trade, the funds will be stored in an HSBC Trust Account.

So this means that whatever happens to Syfe’s accounts would not affect your money at all.

- All your investments are held in a custodian account through Saxo Capital Markets

This essentially means that Syfe cannot touch your investments too.

In the unlikeliest of cases, Syfe will ensure the orderly transfer of assets to another licensed fund manager, or the return of all assets and funds to you. This will also be regulated by MAS.

- Two-factor Authentication

On top of your password, Syfe provides you with the option for a One-Time Password (OTP) that can be sent to your mobile number.

- Syfe’s data is stored and secured in Amazon Web Services (AWS)

Your personal data and particulars are encrypted and stored in AWS data centres in Singapore.

Such bank-grade protection practices are also compliant with some of the world’s top security standards – so you can rest assured that your data won’t be compromised.

Syfe Financial Advisors

Syfe has a pool of wealth experts under its wing that can help you make better financial decisions.

You can also schedule a 15-min call to address general enquiries you may have.

Should you not be able to schedule a slot, you could also join in their live Q&A sessions!

Some of these sessions can be very insightful where Syfe advisors would answer commonly asked questions, demystify their portfolios and strategies, and conduct goal analysis for various client profiles.

Who is Syfe Best for?

Now begs the most important question – is Syfe for you?

Syfe is suitable if you are:

- An individual with a modest budget but still wishes to invest

This is because Syfe has a starting Blue tier with no minimum investment amount and no withdrawal fees involved. You can even invest as low as $1 SGD.

- A beginner investor

As you can probably tell, Syfe has plenty of portfolios catered for beginner investors who will typically start out more risk-averse – such as Core Defensive or REITs with Risk Management.

Besides that, Syfe’s wealth experts are always there to dish out any tips you may need to start your investment journey.

- A long-term investor

And even if you are a long-term investor who is hungrier for more returns, there are many portfolios available such as Core Equity100 or Core Growth portfolios.

- An individual for thematic investments or REITs investments

If you’re one for big ideas or rising megatrends, Syfe also has curated thematic portfolios, 5 of them in fact, with corresponding ETFs for you that are well-suited to your needs and passion.

And for those who wish to leverage on the diversification and high yield from REITs, and of course, invest in properties without owning any building or apartment – the REIT+ portfolios are certainly for you.

- An advanced investor who knows what he/she wants

An advanced investor who possesses much knowledge about investing and already knows what you’re looking for? Then Syfe Select’s Custom portfolios allow you to do just that.

So you see, it is certainly well-deserving of its title of being the “Best Overall Robo-Advisor”, especially with its affordability and extensive range of portfolios that cater to specific investment objectives and preferences.

How to sign up for a Syfe Account?

The process is pretty straightforward.

First, you’ll have the option of creating an account with either Syfe Trade or Syfe Wealth.

For Syfe Wealth, you can then proceed to select a portfolio type from those available.

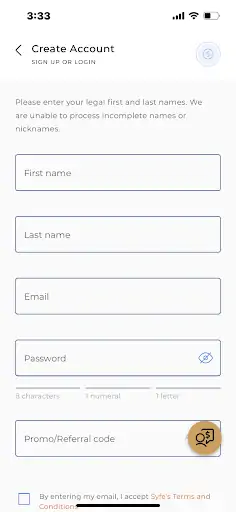

After making your decision, you can then enter your personal particulars such as your full and last name, email address and a dedicated password.

This is where you can also input a promo/referral code that may help you unlock some benefits!

And lucky for you, we have a unique referral code from us that you can include in this field which is “DollarBureau”, to unlock up to 6 months waiver fee with an investment amount of up to $50,000.

The referral promotions are always changing, so click here to view the updated referral promotions by Syfe.

Alternatively, you can also click here to get these rewards.

If you found this Syfe review useful, do remember to share it with anyone who’s considering robo-advisors for investment and for them to receive the above benefits as well!

Still unsure and would like a financial advisor to help you invest instead?

We partner with MAS-licensed financial advisors to help you with this.