Walking past a great area bedecked with celebratory lights and sparkles certainly adds a little pop to your step. What if someone were to give you ownership of that space?

Thinking that this person is insane, you would probably keep walking and not give it a thought. But why not?

You should think again and look into the world of real estate. You don’t need loads of capital to own the space, because there’s an option for retail investors.

The answer to your question lies in Real Estate Investment Trusts (REITs) in Singapore.

What are REITs?

REITs are listed companies found on the Singapore stock exchange (SGX). Purchase of REITS in Singapore occurs similarly to stocks.

Usually, public companies take money from investors to operate their business effectively. However, REITs utilise the investments to purchase and manage properties.

How do REITs work?

REITs work on the basis of accumulating funds from a variety of investors to purchase and run the properties under the trust.

By investing in REITs, you are essentially purchasing a series of properties which allows you to diversify your risks from the exposure to a large number of properties in your portfolio.

Renting out the properties under the REIT helps in obtaining rent, which gets paid as dividends to you as investors.

Payment of the dividends occurs as quarterly or half-yearly pay-outs.

Furthermore, REITs are required by Singapore law to distribute a minimum of 90% of their taxable income. Hence, you stand to earn a lot by investing in REITs in Singapore. This also provides a relatively steady inflow of money for you.

Types of REITs

There are a variety of REITs that you can invest in. Here are the different types, which fall into 6 broad categories:

Retail REITs

The shopping malls you usually frequent are classified as Retail REITs.

While you might be more interested in the mall’s look and get enamoured by the décor, you certainly should focus more and think about the returns rate and consistency of the mall as a real estate.

After all, the maintenance of shopping malls is only possible with rents procured from tenants.

If tenants cannot keep up with their leases, it gets tough for both the owners and tenants to keep the malls afloat.

This in turn affects you if you have invested in such retail REITs.

Thus, you need to ensure that the Retail REITs you plan to invest in hold well-performing shopping malls that have mostly stable shop tenants. This would help to ensure a higher level of security for your investment in the REIT.

Healthcare REITs

Healthcare REITs are possible because of Singapore’s well-established healthcare systems. These REITs invests in hospitals, clinics, rehabilitation centres, and senior citizen homes.

The success of these trusts relies upon the progress of the healthcare system.

Although healthcare is a booming sector right now, it is still essential that you know the underlying components as well.

It is important for you to search for healthcare REITs in Singapore that not only have one particular type of property but many different types.

Also, you should ensure that the properties in your REIT of choice have a good and wide mix of patient types as well.

Doing so ensures that your investments are diversified so that you minimise any risks.

Corporate REITs

Corporate REITs invest in office spaces. The dividends you obtain from investing in corporate REITs are because of rental space agreements drawn out with the office tenants.

Before you venture into office REITs in Singapore, take a closer look at the economy and its condition.

If an economic downfall or a recession is looming, it would probably affect businesses and their ability to make rent.

Further, the condition of the vicinity around the office properties also determines the state of the REITs to a large extent.

The accessibility of the property, convenience, and facilities are a few of the factors you should consider.

Hospitality REITs

This particular type of REIT is involved in the running and effective operation of the chains of hotels, resorts, vacation homes, and recreation centres. The condition of the economy affects the investments in this sector.

Singapore is a tourism-driven economy. This effectively means that hospitality REITs can easily gain in value.

If there is a sudden downturn in the economy’s state, it is better to rethink your investment strategy in investing with hospitality REITs.

Since the market is volatile, the chances of the occupancy rate going downhill are high.

Hence, in Singapore, investments in hospitality REITs can be profitable or can suffer a great deal as we rely a lot on tourism to drive the economy.

Industrial REITs

Warehouses and factory spaces are included in this sector of REITs.

The higher the capacity of the rented space, the chances of earning higher returns are more significant. This also means that if an industrial space is vacant, your losses are also significant.

Lease agreements for warehouses and factories generally last for shorter periods than the other types of REITs.

Simply put, this translates to a higher possibility of the asset depreciating in value and higher dividend yields are used to compensate investors for this.

Residential REITs

Residential REITs involves the rental of any housing properties, such as apartments or studios. When thinking to invest in Residential REITs, you should think about factors that would result in higher rental prices and rates.

For example, major cities see a high influx of people coming to work here, who require housing.

Also, in locations where many residents are not able to afford to purchase property, they would turn to rent housing.

Both situations drive up the demand for housing rentals causing the prices to rise.

What fees are involved in REITs?

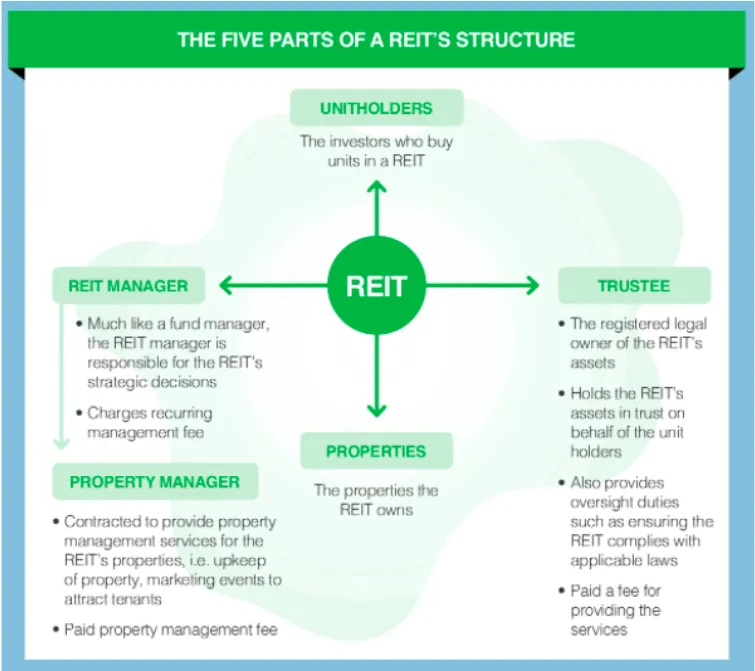

Source: Standard Chartered – REITs 101

The structure of a typical REIT is seen above. This provides you with an illustration of the different levels of management involved.

Different managers are responsible for the performance of the fund. Each of them is paid a certain base amount in addition to a performance-related bonus and incentive.

As seen in the figure mentioned above, the outline of the expenditures are known from the beginning and appropriately divided amongst the REIT fund manager, property manager, and trustee.

The allocation of a fee to the fund manager is typically 0.25-0.5% of the property’s deposited value.

The property manager who shoulders the efficient management of the properties in the portfolio gets allocated around 2-3% of the net worth.

The trustee’s responsibility, usually carried out by the bank and is given a share of approximately 0.01-0.1% of the deposited property value.

And of course, there are brokerage fees involved as well.

Advantages of REITs

The benefits of REITs are pretty clear. Here are the enlisted factors:

Low Investment Capital Needed

The initial investment is meagre, and you can easily manage it with low capital. The requirement is as low as a few cents that can get your investment in REITs in Singapore up and running.

For example, as of May 2021, the Lippo Malls Indo Retail Trust costs $0.66 per unit, the lowest of all S-REITs.

When you compare this amount with that of physical properties, you can heave a sigh of relief knowing you do not require thousands of dollars to buy a single property for rental.

Investment Diversity

Not only do you gain access and exposure to multiple properties at a time, but you also reap its benefits with a single investment. REITs help to diversify your investment portfolio since you are investing in a collection of properties.

You get access and partial ownership to the spaces in retail, healthcare, and other sectors.

Ease of Trade (and Liquidity!)

The buying and selling process for investing in REITs is quite effortless and straightforward. It’s the same as stocks, and hence, facilitation of the purchase occurs in a speedy manner.

In comparison with physical properties, you’re stuck with bids and multiple buyers until an appropriate value appears.

Managed For You!

Unlike physical areas where the tenants need to be vetted and later the properties need to be checked for issues, with REITs in Singapore, managing the property spaces is seamless and carried out in a hassle-free manner.

In the case of REITs, an allotted manager ensures that the properties are managed well.

Non-Taxable Returns

The income earned and dividends generated as surplus from REITs in Singapore are non-taxable. Furthermore, dividends are received in a timely fashion and with no hassles.

Risks of REITs

REITs have a couple of risks associated with them. The risks mentioned below give an overview of the risk profile of the REITs:

Market Risks

Since they are similar to stocks, the value of REITs can fluctuate a lot every day. This is due to the fact that REITs are traded in public markets as well. High fluctuations relate to higher risks for your investments too.

Interest Rates Risks

There is no fixed relationship between interest rates and the value of REITs.

Generally, when the interest rate goes up due to better economic conditions, the value of the underlying assets held by the REIT tends to increase as well.

However, higher interest rates can also drive investors to take out investment funds from REITs in favour of less risky or risk-free investment options that have higher returns now.

Therefore there is no definite relationship between them, but it is still good to know that such a risk exists in REITs investments.

Concentration Risks

This risk refers to the properties being held under a particular REIT being too similar. In such an instance, the portfolio of that REIT is not diversified, and investors are exposed to higher amounts of the same type of risks or disadvantageous situations.

Leverage Risk

This risk occurs when the borrowed money is used to purchase the property assets in the REITs.

Through using loans, there are additional expenses incurred and investors also run the risk of investment loss when the property values underperform or if the REIT becomes insolvent.

However, The Monetary Authority of Singapore has set a regulation of a 45% leverage limit on all REITs in Singapore. This would help to limit the leverage risk taken on by investors

Refinancing Risks

There are instances when a REIT manager might take on a new loan to pay off the existing one because they believe the new terms will be more beneficial.

However, the risk here occurs when the manager’s analysis is inaccurate and the new financing term is actually worse off than the original terms of borrowing.

Furthermore, there could be cases of the REIT not being able to obtain a new loan and having to sell some of their property assets to pay off the initial loan.

What are your objectives and risk profile?

As an investor, your objectives should be known and understood well. Whether you’re looking into a long-term investment or a short-term plan, it is entirely your lookout. The type and nature of the REIT will drive these choices.

In the case of commercial or industrial REITs, the asset’s depreciation can turn it into a liability sooner than later.

Healthcare REITs are generally very stable as healthcare is considered a commodity that everyone can require at any time.

However, not all healthcare REITs are created equal and you will still have to analyse the portfolio’s distribution to ensure proper diversification of property types for stable performance.

One would assume that corporate REITs would provide relatively stable returns. However, the occurrence of COVID-19 has shown us that it is not completely necessary for people to work in office spaces, which might drive down the performance of corporate REITs

Typically, hospitality and retail REITs have a direct relationship with the condition of the economy. A poorly performing economy, such as during a recession, relates to decreasing REITs returns due to low occupancy rates in hotels and low tenant rates in malls.

In conclusion, losing out on rent and tenancy is a massive loss for REITs and investors. Hence, it is essential that a risk analysis is done so that you know what you’re investing in.

What to look out for when choosing a REIT?

While investing in a REIT, there are a couple of vital factors that need attention.

Net Asset Value (NAV)

The value of a REIT occurs through the units’ net worth, which are the individual properties present in the portfolio. The NAV is calculated by a formula that establishes the difference between the assets and the liabilities.

Further, unlike unit trusts, the trading of REITs is slightly different. Their trading doesn’t occur on the price per unit. Instead, it’s determined by the total value of the real estate property

Weighted Average Lease Expiry (WALE)

The WALE is one of the key findings to know more about the performance and the rating of REITs. It’s a measure of the average duration till which the lease agreement or contract expires with the current tenants.

Knowing the WALE helps you as an investor to understand the level of “protection” your REITs investment has. However, WALE shouldn’t be considered alone.

Instead, the condition of the economy requires close observation as well.

For instance, in excellent economic conditions, a lower WALE value is still beneficial, as leases of higher amounts can be taken advantage of instantly. Hence, WALE isn’t an absolute measure of investment in REITs.

Condition of the economy

REITs in Singapore are undeniably affected by the economic condition, and it is an essential factor that needs consideration.

Depending on the types of REIT, you can quickly know whether it will be a worthwhile investment during different economic conditions.

For instance, in a hospitality REIT, learning details about the tourism and travel industry will undoubtedly help a great deal.

Learning more about how many people will stay in the hotels in a specific location determines how well the REIT will fare.

Likewise, in a global economic downturn, hospitality REITs might be more of a long-term investment as you’ll have to wait until it recovers again.

Potential Capital Gains and Dividends

Potential capital gains and dividends play a significant role in determining which REITs in Singapore are worth investing in. The larger the potential for gains and dividends, the more likely investors will want to invest in the particular REIT.

Depending on the growth in Singapore’s economy, you can quickly realise the returns of your REITs.

For dividends, you are also able to select the best dividend frequency which fits your needs. You can choose between the quarterly and half-yearly options to receive your dividends.

Ultimately, the decision to invest in a particular REIT is something that lies entirely in your hands.

Best REITs in Singapore

A few popular REITs in Singapore include the Sasseur REIT, Frasers Hospitality Trust, and Dasin Retail Trust.

However, if you’re interested in what REITs we think are the best, check out our guide to the best REITs in Singapore.

When you’re residing in Singapore, you can make the choice of investing in REIT ETFs (Exchange Traded Funds) too.

Here’s our take on the best REIT ETFs in Singapore.

Lastly, there are unit trusts that invest in REITs too! However, we’ll be keeping that for future pieces we write on.

Where to buy REITs in Singapore?

Simply put, you’ll only need a brokerage account in Singapore to buy REITs.

But we go in-depth here in our guide on how to buy REITs in Singapore.

Conclusion

REITs in Singapore are a great form of investment for beginners who don’t know where to accumulate wealth. With relatively good yields and minimum investments, it is one of the most common assets that Singaporeans purchase.

Let’s not forget the dividends, Singaporeans love their dividend payouts!

At the end of the day, investing requires serious time and effort needed for research. Notwithstanding that you must know what to look for and what are the right questions you need to ask.

If this might be too much for you, always engage a financial advisor for financial advice. They are able to analyse your needs and guide you towards the best investment options for your situation.

References:

https://investor.cict.com.sg/misc/ar2020.pdf

https://www.drwealth.com/singapore-reits/

https://sginvestors.io/analysts/singapore-s-reit-target-price