Many of us may crave for greater financial freedom. However, not many of us have the appetite to take great risks with our money.

If you’re scrolling and probing around for alternatives to invest safely in, then you might want to read on to find out more about what the Singapore Savings Bonds can do for you.

What are SSBs?

Short for Singapore Savings Bonds, these are bonds that are issued by the Monetary Authority of Singapore (MAS) on a monthly basis and are backed by the government.

As the name suggests, these Singapore Savings Bonds aim to help Singaporeans save more in the long term, and in a secure manner.

Cutting to the chase, what you might be most interested in is the face value of the bond. Upon maturity, you receive your entire capital together with all the coupons you’ve earned throughout the period.

Typically, the Singapore Savings Bonds take 10 years to mature. Your total payout will then be dependent on the coupon rates from the month you have decided to invest.

Say you decide to invest in June 2021’s bonds and your average return is 1.53% per annum over 10 years. Meaning to say, if you have invested $100,000 today, you will be receiving a total of $15,700 in returns by June 2031 together with $100,000 of your invested capital.

The cherry on top of this – your returns are tax-exempted.

While you have to wait a full decade to reap its maximum returns, investors also do have a choice to redeem your bonds at any given point in time. Best part? There are no penalties involved! (Apart from a small transaction fee of $2).

The flexibility of exit here gives the Singapore Savings Bonds an edge over the Singapore Government Securities (SGS bonds) due to its higher liquidity.

While Singapore Savings Bonds is a type of investment product under the Singapore Government Securities (SGS), it is important to note that there are key differences between the two.

Typically, the stakes are lower with Singapore Savings Bond – not only does it involve virtually no risk, but the minimum investment amount is also lower; all you need is $500 to get you started!

With that said, these lower stakes also mean that the maximum investment limit remains at $200,000, while Singapore Government Securities steer free from an investment ceiling.

How does SSBs work?

If you think the Singapore Savings Bonds is too good to be true, then understanding how it works might promise you greater peace of mind.

After all, it is better to be thoroughly informed about where you are putting your money.

With the Singapore Savings Bonds, what you are essentially doing is lending the government your money for them to invest.

Think of it as a borrower-lender relationship; in order for you to get your money back, you have to trust that the party who’s borrowing will have the capability to return what you have been promised.

Generally, a bond will only be considered investment-grade if it receives a minimal credit rating of “BBB-” by rating agencies.

Since Singapore has constantly been within healthy annual budget balances, the government has been endorsed with the highest “AAA” credit ranking, and we’ve been consistent with this rating since 2011.

This means you can be assured that your money is safe, and you are almost definitely promised your returns either when the bonds mature, or when you choose to exit. In either scenario, you will receive both your principal amount and your interests.

Scenario 1: Receiving your returns as dividends while holding onto maturation

To remain assured that your money is growing and that the government is accountable to your investment, dividends will be paid bi-annually to bondholders.

Your returns here will be dependent on the coupon rates which are released at the start of every month on this site.

Scenario 2: When you choose to exit before the bonds mature

On the other hand, if you decide during the 10-year period to liquify your bonds and redeem them, you will still receive your capital.

Not only will you receive the principal amount you’ve initially invested, but you will also receive your interest up to whenever you have chosen to withdraw.

Singapore Savings Bonds (SSBs) vs Singapore Government Securities (SGS)

Here are the key differences between SSBs and SGS:

| Investment Types / Factors to Consider | Singapore Savings Bonds (SSBs) | Singapore Government Securities (SGS) |

| Risk | Lower risk:

Guaranteed par value when you sell your bonds (i.e. you will definitely receive your principal amount when you exit) Plus, you will receive your interests too! |

Higher risk:

You might receive either a premium or a discount when you sell your bonds (i.e. your returns might be lesser or higher than what you initially invested) |

| Flexibility of Exit | Yes – exit anytime without penalties | No – cannot be redeemed early |

| Investment Limits | Up to $200,000 | None |

| Minimum Investment | $500/unit | $1,000/unit |

Advantages of SSBs

Secure Investment Option

Since the Singapore Savings Bonds are not tradeable on the open market, this means that their interest rates are generally not dependent on market movements, unlike other forms of investments or bonds which are reliant on supply and demand.

Instead, the interest rates of Singapore Savings Bonds are determined by the long-term earnings generated from Singapore Government Securities.

Since these savings bonds are fully backed by the government, you can be sure that this investment choice is almost a risk-free option to put your money in.

Flexible Exits

While it is encouraged for you to wait for the bond to mature to reap its full interests at the end of 10 years, you do have the option of exiting before the entire term completes.

This means that if you do suddenly need to withdraw your investments for urgent reasons, you have the flexibility to do so in any given month.

This is the part where you will heave a sigh of relief – you will not be made to pay any penalties for this choice.

Typically, the redemption period will take anywhere between a week to a month.

Now, what you might be concerned about is how much your bonds will be valued, should you choose to redeem them before maturation.

The good news is – since the Singapore Savings Bonds are not tradeable, they will always be at par value.

Not only will you be guaranteed your original investment amount, but you will also receive a pro-rated interest in accordance with when you have chosen to exit.

Low Barriers to Entry

With the Singapore Savings Bond, all you need to get started is a minimum sum of $500. This makes it an ideal option for young adults, NS men, or even university students to be a bondholder.

However, the reality remains that you might not be receiving much in return for such a small sum due to the low-interest rates.

This minimal amount is considered low as compared to other alternatives such as endowment plans which can require a huge lump sum of $10,000 to start you off.

If you do want to increase your investments, do note that both investing and divesting have to be done in multiples of $500.

Scheduled Payments

With the consistency of the bi-annual payment, putting your money in Singapore Savings Bonds gives bondholders a good sense of confidence that your money is growing.

Besides, you can also have a greater expectancy as to how you can better plan your expenses with this additional income.

Especially if you are holding onto maturation at the end of 10 years, the promised returns can help you plan for a big-ticket purchase in advance.

Disadvantages of SSBs

Low Interest Rates

A couple of years ago, bondholders could expect about 2-3% average return rates per annum from Singapore Savings Bonds by the maturation term.

However, if we take a look at it now, the average annual returns have only ranged from 0.9% in January this year to a maximum of 1.61% this June.

While this would still be a better option than putting your money in banks with a less-than-1% interest rate, it definitely pales in comparison to other alternatives such as ETFs or stocks which can offer much higher returns. (Of course, not without higher risks.)

The Singapore Savings Bonds, then, might not be able to fulfil the hunger of those with a bigger risk appetite as you might prefer greater returns for your investments, especially if you are going to nest your money here for a full decade.

To get a good gauge of your potential returns, check out this page to get a quick snapshot of what you can expect.

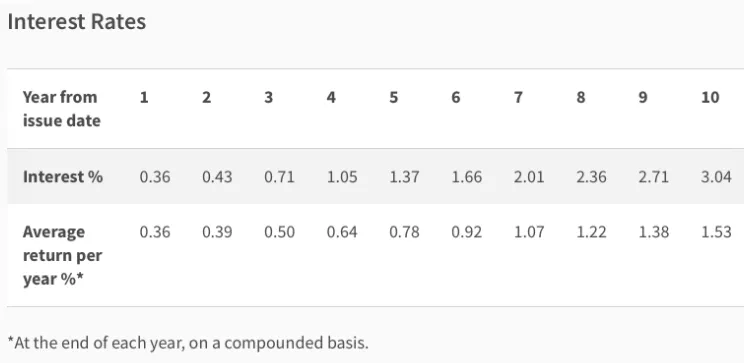

Here is a quick snapshot of the interest rates for July 2021:

Higher Rewards Towards 10-Year Mark

While the Singapore Savings Bonds offer the flexibility of exiting anytime, it is also good to note that the interest typically gets higher only towards the 10-year mark. This is referred to as the step-up interest.

Generally, between the 1st and 6th year, your average interest rates remain at less than 1% and only start exceeding this mark from the 7th year onwards. Even then, the maximum average interest rate upon maturation has been set at only 1.5% for the past two months.

If you are someone who doesn’t quite believe in delayed gratification, then the Singapore Savings Bonds might not be something that appeals to you.

Unless you are willing to wait a decade to maximise your returns, you might be able to rake in similar returns from other investment products for lower periods of time.

Perhaps it is also good to ensure that while waiting it out for full maturation, you have other investment opportunities in your basket which can be liquefied easily.

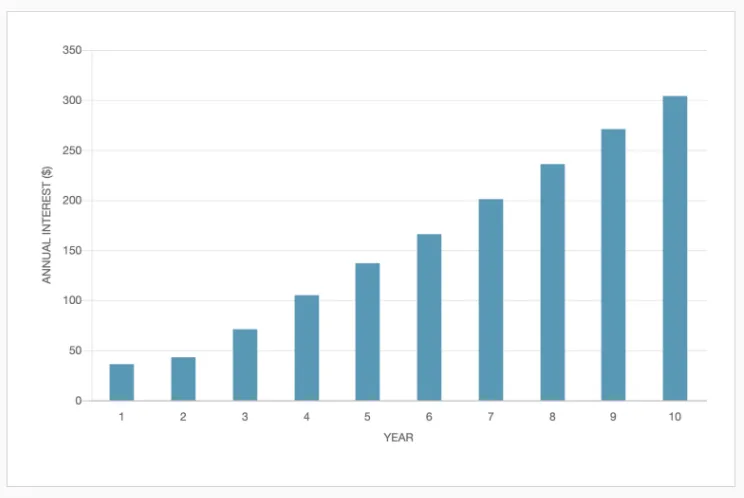

This calculator will be useful for you, should you be interested to know how much interest you can earn each year.

Note: the above graph is based on SBJul2021 GX20170X Bond Details, for a $10,000 principle

Investment Limits of $200,000

While the Singapore Savings Bonds seems almost like a no-brainer for those seeking returns over time, there is also a maximum investment of $200,000 for any individual.

Meaning to say, in an instance where you choose to invest $200,000 in the month of July 2021 and you hold your bonds till maturity, you will only get $31,400 in returns.

Conversely, if you invest the same $200,000 into a mid to long-term participating endowment plan, there are some products that offer you an opportunity to earn returns that can go up to 4.57% per annum instead, whilst still guaranteeing your principle capital upon maturity.

This option would be a good alternative to consider if you wish to go bigger.

If you’re looking to get even higher returns with little to no complications, getting an investment plan that invests in unit trusts or even getting a regular savings plan is a better alternative.

Who should get SSBs?

Images from Pexels

Despite its name, the bonds are not limited to only Singaporeans; these investments are also open to PRs and foreigners.

With its low barriers to entry and the government’s secure “AAA” credit ratings, the Singapore Savings Bonds is a virtually risk-free investment product, making it ideal for those who are looking to diversify your investment portfolio and lower your risks.

If you are a retiree, or if you are planning for your retirement, this investment product might be a safe and viable option.

To make saving easier for you, the Singapore Savings Bonds is also one of the SRS investment options where you can apply with your Supplementary Retirement Scheme (SRS) account.

Your interest payments will be received there too.

Alternatively, couples or individuals who are planning for your family’s finances might wish to consider this as well as you will still be growing your money, but at risks which are almost negligible.

However, with that being said, it is still up to personal preference, especially with varying risk appetites of individuals. This investment product would be highly suitable for those with a lower risk appetite and want the security of guaranteed returns upon maturation.

Those with a higher risk appetite might think these returns at the end of 10 years are not worth the wait.

Ultimately, taking into consideration that the interest rates of Singapore Savings Bonds are relatively low, you might not want to be putting all your eggs in this basket.

Considering how the returns even after maturation are not outstandingly high, the sum of money you receive would probably only be a supplement to your lifestyle, rather than a deep pot to dig into.

How to buy SSBs?

If you are now convinced that this investment product is one you would like to commit to, the purchase process is actually pretty simple and fuss-free:

Step 1: Ensure you have fulfilled these prerequisites

In order to buy these bonds, you have to first ensure that you are 18 and above, and have registered for a CDP Securities account. Besides these, the other pre-requisite includes owning a bank account with either one of these banks: Standard Chartered, UOB, POSB/DBS, Citibank, Maybank, or OCBC.

Step 2: Apply through either ATMs or Internet Banking

MAS will announce the amount available for issuance, as well as interest rates, on the 1st business day of each month.

If you prefer to apply through the ATM, watch this video for an easier understanding of how you can go about it.

For the tech-savvy millennials, Internet Banking may be the preferred option.

Regardless of choice, you will need your CDP account number. Once you have applied, the money will be deducted directly from your bank account. Do note that a transaction fee of $2 will also apply once you have completed your application successfully.

Step 3: Check if you’ve been allotted

Simply check your mail to know if you have been successfully allotted. You should be notified about 3 days before the end of each month.

However, just because you have applied for an allotment does not mean you are guaranteed one. Think of it from a supply and demand point of view; if the application amount exceeds the issuance amount, the excess in demand means there will be some who will not receive their allotments.

Your money will then be refunded to you by the next working day.

Try again next month!

How to Redeem SSBs

After you’ve been successfully allotted, you will receive your first interest returns on the 1st business day of the 6th month.

You will receive your returns in either your bank account via your CDP account, or in your Supplementary Retirement Scheme fund – depending on which application you have opted for.

However, if at any point in time you decide to redeem your bonds before maturity, you can submit a redemption request in multiples of $500.

These redemption requests can be done via iBanking or ATMs of your bank.

Regardless of where you make your redemption request from, a transaction fee of $2 will apply.

Conclusion

In summary, while the interest rates of the Singapore Savings Bonds may not be outstanding, its security and guaranteed returns make it quite an ideal option to invest in if you are looking to diversify your portfolio and spread your risks out.

Not only does it have a fuss-free application process, but the information is also made transparent on the MAS site if you need more details or if you have further inquiries about this bond.

With the government getting your back on this, surely it will give you peace of mind for common folks like you and me to help us save in the long-term!

Of course, you’d definitely want to talk to a financial advisor to understand where SSBs should play a part in your overall financial portfolio.