The Aviva MyCoreCI (II) has been renamed to Singlife Essential Critical Illness as of 16 August 2022.

The Singlife Essential Critical Illness is a term critical illness insurance policy that provides multi-protection against 14 critical illnesses, 4 diabetic conditions, Total and Permanent Disability, Terminal Illness and death.

The policy provides coverage even for individuals diagnosed with type 2 diabetes, pre-diabetes and/or the 3 Highs (high blood pressure, high cholesterol and high body mass index).

Here’s our review.

My Review of the Singlife Essential Critical Illness

| Manulife Critical Select Care | Singlife Essential Critical Illness | |

| Policy Term | From 40 years old to 85 years old | Minimum 15 years term, up to 85 years old |

| Annual Premiums | $1422.80 | $393 |

| Max Sum Assured | $200k | $500K |

Premiums are based on a 30-year-old male, non-smoker with a sum assured of $100,000, with a policy term up to age 75 – with the exception of the Manulife Critical Select Care, which only provides coverage from 40 years old. Premiums are paid annually.

In comparison with the annual premiums across similar critical illness plans available in the market, Singlife’s Essential Critical Illness has an attractive and affordable premium amount with a decent amount of advanced-stage critical illnesses Conditions and Special Conditions covered (14 CI Conditions and 7 Special Conditions), as compared to Manulife’s Critical SelectCare.

| Manulife Critical Select Care | Singlife Essential Critical Illness | |

| No of Critical Illness Conditions Covered | 7 | 14 |

| No of Special Conditions Covered | 2 | 4 Diabetic Conditions, Angioplasty & other invasive treatment benefits, TPD Benefit, TI Benefit |

| Rider Enhancement Option | Yes | Yes |

The Singlife Essential Critical Illness has the following benefits for consideration when choosing a CI plan best suited for your needs:

- Provides coverage for 14 Critical Illnesses and 7 Special Conditions – including 4 diabetic conditions, angioplasty and other invasive treatments, Total and Permanent Disability, and Terminal Illnesses.

- Receive a 20% rebate of your total premiums paid, if no claim has been made on any of the benefits throughout the policy term.

- Provides an additional 20% payout, up to a maximum of S$25,000, per Life per condition, on top of the basic lump sum payout against 4 Diabetic Conditions.

- Receive an early 10% payout of the sum assured, up to a maximum of S$25,000, for angioplasty or any coronary artery invasive treatments.

- Lump-sum payout as Death Benefit.

- Protection even with pre-existing conditions such as Type 2 Diabetes, pre-diabetes, and 3 highs.

- Coverage for type 2 diabetes smokers.

- Reduced health questions of 6 questions and no requirements for medical checkups.

- Instant customisation of premiums based on current health conditions and requirements.

The policy also has its downsides as well. These include

- Does not offer coverage for diabetic conditions for insured age below 25 years old.

- Diabetes type 1 patient not covered.

- Premium varies depending on sugar level, high blood level, BMI, cholesterol and Triglycerides levels.

Although affordable, Singlife Essential Critical Illness is an insurance plan for those with pre-existing medical conditions.

I believe you can purchase it even though you’re in the pink of health, but it’s recommended that you opt for something more comprehensive, such as Singlife’s Multipay Critical Illness Plan or Manulife’s CI FlexiCare (Deluxe).

These cover you for over 120+ critical illness conditions, and you can make claims up to 9X!

They’re more expensive, but with the rise of ECI/CI diagnosis in Singaporeans (1 in 4!), it’s better to be safe than sorry.

If budget is a concern, you can consider the MINDEF/MHA Group Term Insurance Plan + their ECI/CI riders, or even the FWD Big 3 Critical Illness, which covers you for the 3 most common critical illnesses, including early-stage cancer – which is the biggest cause of critical illness in Singapore.

If you need help, our best critical illness plans in Singapore post can serve as a starting point for your research to help you find possible alternatives.

However, if you’re someone with pre-existing medical conditions and are looking for insurance coverage, I suggest starting off by reading this post.

This will help you understand what your possible choices and the outcomes of those choices might be.

Don’t limit yourself to a plan with lesser covered conditions without applying for standard policies (or getting a financial advisor with connections with underwriters to apply for you).

You should also consider getting a second opinion from an unbiased financial advisor as to whether the Singlife Essential Critical Illness Plan is for you – since ECI/CI coverage is an important aspect of your insurance protection.

You don’t want to make premium payments for the next 20 to 30 years only regret your purchase or, even worse, to realise that you’re not properly covered.

Should you need someone to talk to for a second opinion, we partner with MAS-licensed financial advisors who are happy to help.

Click here for a non-obligatory chat.

Basic Product Features

Premium Policy Terms

The Singlife Essential Critical Illness provides flexible insurance coverage for the insured from 15 years to 85 years.

Premium Payment Terms

- Payable throughout the premium term of the policy, from 25 years old to 65 years old.

- As with all CI premiums, premiums are not guaranteed and may be adjusted.

Your final premium amount is determined by factors such as age, gender, smoker status, sum assured, policy type, and length of premium period.

Protection

Critical Illness Benefit

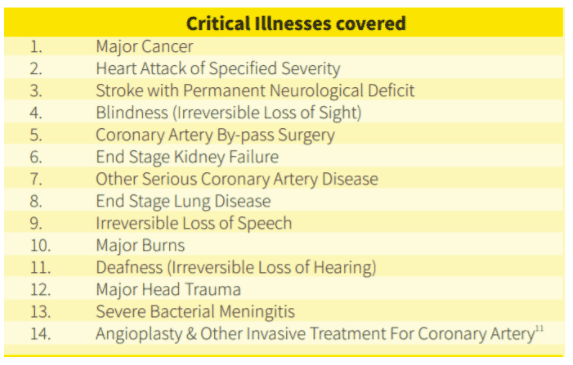

The Singlife Essential Critical Illness provides a lump sum payout against 14 Critical illnesses.

The table below provides the Critical Illnesses covered by Singlife’s Essential Critical Illness.

Upon the death of the Life Assured and if no prior claim has been made, receive either:

- Entire Sum Assured; or

- Total premiums paid;

Whichever is higher.

If there is any prior claim(s) on the benefits, receive either:

- Full sum Assured less any claim(s) paid on the benefits (other than claim(s) paid on Diabetic Conditions Benefit); or

- Total premiums paid less any claim(s) paid on the benefits;

Whichever is higher.

Critical Illness Benefit – Waiting Period

The following conditions do not qualify for a claim under the Critical Illness Benefit if the claim occurs within 90 days from policy issue date/cover start date/the last policy reinstatement date, whichever is later:

- Heart Attack of Specified Severity

- Major Cancer

- Other Serious Coronary Artery Disease

- coronary artery disease leading to the performance of Coronary Artery By-pass Surgery or Angioplasty and other Invasive Treatment For Coronary Artery

Total and permanent disability Benefit

Upon diagnosis of total and permanent disability, you’ll receive a lump sum payout as an early payout of the death benefit.

The diagnosis must be supported by a specialist and confirmed by a registered medical practitioner approved by Singlife with Aviva.

If the total Sum Assured for the Total and Permanent Disability Benefit under all Singlife with Aviva policies for the same Life Assured is more than S$2,000,000:

- Waiver of premiums for the Total and Permanent Disability Benefit starting on the Policy Anniversary immediately following claim admission for Total and Permanent Disability and

- Payment of the total Sum Assured in 3 payments as follows:

- S$2,000,000 upon admission of your claim; and

- The remainder is in 2 equal instalments. The first instalment will be paid one year after the date on which the S$2,000,000 was paid, and the second instalment will be paid two years after the date on which the S$2,000,000 was paid.

All benefits will end once a payout has been made under this benefit.

Total & Permanent Disability Benefit – Waiting Period

The Total and Permanent Disability Benefit does not provide coverage for claims made within 90 days from:

- Policy Issue Date

- Cover start date

- The last reinstatement date of the policy

- Whichever is later.

- The waiting period does not apply if the disability is due to an accident.

Terminal Illness Benefit

Upon diagnosis of a terminal illness, you’ll receive a lump sum payout as an early payout of the death benefit.

To be eligible for the terminal illness benefit, you need to be certified by a medical practitioner that the illness will result in death within 12 months.

The diagnosis is required to be supported by a specialist and confirmed by a registered medical practitioner approved by Singlife with Aviva.

All benefits will end once a payout has been made under this benefit.

The presence of the Human Immunodeficiency Virus (HIV) does not qualify for the Terminal Illness Benefit.

Diabetic Conditions Benefit

The Singlife Essential Critical Illness provides an additional 20% payout, up to a maximum of S$25,000, per Life per condition, on top of the basic lump sum payout against 4 Diabetic Conditions.

If part of the Death Benefit has been approved as an early payout in a previous claim, the Diabetic Conditions Benefit payout will be based on the prevailing Death Benefit Sum Assured.

The same Diabetic Condition is only limited to one claim.

Any claim made under the Diabetic Condition Benefit does not reduce the sum assured of the policy.

The Diabetic Condition Benefit ceases once the additional 20% of the Death Benefit sum assured is fully paid out, or upon policy termination.

The below table provides the Diabetic Conditions covered by the Singlife Essential Critical Illness.

Diabetic Benefit – Waiting Period

The following conditions do not qualify for a claim under the Diabetic Benefit if the claim occurs within 90 days from the policy issue date/cover start date/the last policy reinstatement date, whichever is later :

- Hyperosmolar Hyperglycemic State (HHS) leading to Coma

- Diabetic Nephropathy

- Gangrene leading to undergoing of limb amputation

- Diabetic Ketoacidosis;

There is no waiting period in between claims made under the Diabetic Benefit.

Diabetic Benefit – Survival Period

To be eligible for claims under the Diabetic Benefit, the Life assured is required to survive for a period of seven days after:

- The date of diagnosis of Hyperosmolar

- Hyperglycemic State (HHS) leading to Coma

- the date of diagnosis of Diabetic Nephropathy

- the date of undergoing limb amputation due to

- gangrene

- the date of diagnosis of Diabetic Ketoacidosis.

Other Features and Benefits

Angioplasty and other invasive treatments for coronary artery disease

Receive an early 10% payout of the sum assured, up to a maximum of S$25,000 under Angioplasty.

Any claims made under the angioplasty and other invasive treatment for coronary artery disease reduce the sum assured amount.

The benefit only applies for a claim once and is an early payout of the Death Benefit.

All other benefits continue to be payable after the angioplasty payout and other invasive coronary artery disease treatment based on the prevailing sum assured.

No Claim Payout Benefit

If no claims have been made on any of the benefits throughout the policy term, you are entitled to a 20% rebate of your total premiums paid.

Death Benefit

If no prior claims have been made, receive:

- 100% of the sum assured; or

- total premiums paid

Whichever is higher.

If prior claims have been made, receive:

- 100% of the sum assured less any claim(s) paid on the benefits (excluding diabetic conditions benefit claims); or

- Total premiums paid less any claim(s) paid on the benefits;

Whichever is higher.

After the death benefit has been paid out, the policy benefits will end.

References

https://singlife.com/critical-illness-insurance/essential-critical-illness

https://singlife.com/content/dam/public/sg/documents/life/my-core-critical-illness-plan-ii.pdf