The National Cancer Centre Singapore (NCCS) says that cancer cases in Singapore have been increasing over the years and will continue to do so.

In fact, on a daily basis, 39 people are diagnosed with cancer and 15 people are dying from it.

Although Singapore’s healthcare system is deemed one of the best in the world, cancer treatment is not cheap.

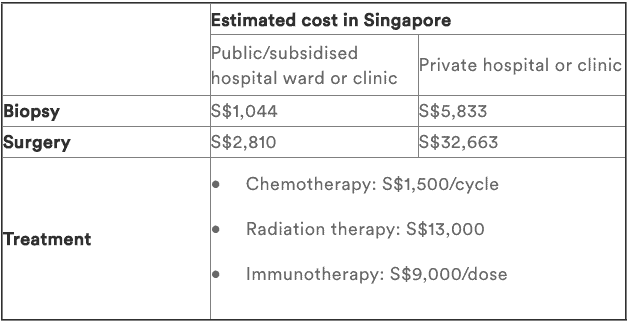

The following is a breakdown of an estimated cancer treatment cost in Singapore for the 5 most common cancers – breast cancer, prostate cancer, lung cancer, colorectal cancer, and skin cancer:

The usual process begins with cancer detection through a biopsy, then depending on the stage of cancer, surgery may also be needed.

Afterwards, treatment would begin in the form of chemotherapy, radiation therapy, or immunotherapy, which would also cause a variation in the total cost according to the cycles or doses needed.

In Singapore, the median salary $4,534 monthly.

Although this amount might be enough to pay for the public hospital costs of cancer treatment for both a biopsy and surgery, there are also other costs to consider such as transportation, hospital stays, medications, as well as other daily expenses.

These additional costs are usually not covered by any health insurance and are separate expenses.

In addition, if the treatment needed is radiation or immunotherapy, $4,534 is definitely not enough.

On the other hand, many other illnesses such as pneumonia, are also taking their toll on Singaporeans.

Therefore, as many look into insurance policies to aid in their finances, one question remains; should you get CI or Cancer insurance?

What is a CI Insurance?

As the name suggests, Critical Illness (or CI) insurances cover Critical Illnesses.

Typically, most policies cover the 37 CIs like major cancers (including, but not limited to, leukaemia, lymphoma and sarcoma), heart attack, kidney failure, coma, and so on.

How It Works

If your diagnosis meets the criteria of the pay-out, you can claim a sum of money, according to the policy terms.

This lump sum amount will then belong to you and may be used for your medical costs or even your daily expenses.

Policy Terms and Coverage

Currently, in the market, there is a wide range of CI policies available, and each one has different specifications, but most do cover cancer as well.

However, for older CI plans or those that only provide basic-level coverage, pay-outs are only given in the advanced stage of an illness.

In terms of cancer, what this means is that there would only be a pay-out when the illness becomes terminal, and the person is not expected to recover.

Although this plan still has its benefits, it may not be useful for someone that may have had their illness diagnosed at an early stage and needs immediate financial aid.

Of course, there are also CI plans that cover the early and intermediate stages of illnesses, which means that you can claim money if you have an early diagnosis of an illness.

In addition, there are also multi-claim CI plans that you can consider.

Unlike the typical CI plans that terminate after a single claim, it allows multiple claims throughout the policy.

As a lot of cancers may recur after remission, multi-claim plans are very helpful, as you can rest assured knowing that you can make another claim and not have to worry about your finances.

Read more about early critical illness insurance here.

Read more about critical illness insurance here.

What is Cancer Insurance?

While CI plans cover a wide range of illnesses including major cancers (subject to each policy’s terms), cancer insurance focuses only on cancer but covers all types and stages.

How It Works

Depending on the plan purchased, you may receive a lump sum payout or a percentage of the sum assured, should you be diagnosed with cancer at an early stage.

Again, similar to the way CI plans work, the pay-out you receive will be entirely yours, and may be used to cover anything from medical costs to lost income.

Comparing Critical Illness & Cancer Plans

Critical Illness Plans

First, let’s take a look at the pros and cons of CI insurance plans.

| CI Insurance | |

| Pros | Cons |

|

|

As previously mentioned, most CI plans cover a wide range of illnesses that includes cancer.

However, the downside is that for the basic ones, you can only collect your claim if your illness is terminal.

Hence, if you are diagnosed with an early-stage illness, you won’t be able to claim any money.

In the current climate of technological advancements, diagnosis of illnesses can be made at an early stage, and a good insurance plan should be easing your financial burdens even then.

Of course, if you have the budget, you can opt for an early-stage CI plan, which would entail higher premiums, but more on the cost comparisons later.

Other than the basic CI plans, there are also multi-claim policies. The reason that this is an advantage is that you can make claims for your illnesses, should they reoccur.

However, do note that this is subject to the terms of your policy, as there are some plans that offer multiple claims but for not for the same illness, which is not very useful as people are more likely to get the same illness again than a different one.

Hence, do read through your policy terms thoroughly.

Cancer Insurance Plans

| Cancer Insurance | |

| Pros | Cons |

|

|

Now, for cancer plans, because it targets one type of illness (cancer), it covers all types and stages.

This is especially useful for someone that may have a family history of cancer or is simply more concerned about getting any type of cancer.

Other than cheaper premiums, which will be covered later, another plus for cancer insurance is that some plans provide post-treatment coverage.

Although going through cancer treatments can already be draining, post-treatment can equally be difficult.

Depending on the cancer you may have, you may require post-treatment medications, reconstructive surgeries, in-home nursing care, or maybe even some financial assistance should there be income loss.

Hence, an insurance plan that looks after you even after your battle with cancer, could really relieve you of your financial worries.

However, with that said, the one drawback of cancer insurance is that it does not cover other illnesses.

For someone that may be susceptible to more illnesses due to existing health issues, having just cancer insurance may not be sufficient.

Thus, you will need to evaluate your needs to determine which policy suits you best.

The Premiums

To level the playing field, the comparison would be made with an Early CI insurance and cancer insurance, as they both cover all stages of the illnesses.

For a 30-year-old non-smoker male, the premiums calculated before discounts are as follows:

| Multipay CI/ECI insurance | Cancer Insurance | |

| Plan | AXA SuperCriticare | FWD Cancer Insurance |

| Coverage | S$100,000 | S$100,000 |

| Annual Premiums | S$1,165 | S$148 |

As can be seen, the cancer insurance premium is much more affordable than that of the Early CI insurance.

Which Should You Pick?

Now for the big question, as mentioned before, you will need to evaluate your needs.

To guide you, perhaps you may want to consider the following:

- Your budget

- Your existing health conditions, and

- Family history of health issues (if any)

In Singapore, statistics show that the number one cause of death is cancer, with a percentage of 28.4% of total deaths.

Although cancer is usually due to genetic history or smoking (for some cancers), any healthy person can also get cancer.

In fact, a recent article also found that even non-smokers in Singapore have increasingly been diagnosed with lung cancer.

Hence, if you want a plan that is easy on your wallet and want to protect yourself from financial burdens should you get cancer, cancer insurance is a good choice for you.

However, cancer is not the only illness one can get, as other than cancer, the other top causes of death in Singapore is due to illnesses such as pneumonia and heart disease, with percentages of 20.7% and 18.8% of total deaths, respectively.

Either way, you will need to use the cancer or CI payouts wisely.

Although, as said before anyone can get cancer, some people may be more susceptible to other illnesses instead.

For instance, if you have diabetes, you may be more prone to kidney disease. As such, cancer insurance would not be as useful to you, as it does not cover other illnesses.

Hence, although it would cost more, a CI insurance would be more beneficial to you.

Read our list of the best critical illness plans in Singapore.

Conclusion

Of course, the best option would be to have both CI and Cancer insurances, as it would give you the best of both worlds – coverage for a wide range of critical illnesses as well as for all types of cancers.

Hence, if you have the financial capability, getting both policies is highly useful to you.

However, if you do not fall into this category, fret not, for you can still decide after determining what your specific needs are, according to the three guiding factors mentioned previously.

Additionally, it is also always helpful to consult a financial advisor who can enlighten you more on the various policies and how they may be of use to you, to better lead you to a decision.

References

https://www.nccs.com.sg/patient-care/cancer-types/cancer-statistics