The FWD Big 3 is a non-participating critical illness insurance term policy that provides basic protection against cancer, heart attack and stroke.

With guaranteed renewal up till the age of 85, the policy is a simple and fuss-free comprehensive plan offering a one time 100% cash payout.

My Review of the FWD Big 3 Critical Illness

The FWD Big 3 has the following benefits for consideration when choosing a CI plan best suited for your needs:

- Provides coverage for cancer, heart attack and stroke.

- Coverage for all stages of cancer.

- No requirements for medical examination.

- Guaranteed renewal up till age 85.

- Coverage for COVID 19 vaccine side effects.

- Included complimentary FWD Care Recovery Plan.

- $20,000 death benefit

| FWD Big 3 (Basic Plan) | FWD Big 3 (With Heart and Neurological Disorder add-on Rider) | Singlife Essential Critical Illness | |

| Policy Term | From 18 years old to 85 years old | From 18 years old to 85 years old | Minimum 15 years term, up to 85 years old |

| Annual Premiums | $253.8 | $487.8 | $393 |

| Max Sum Assured | $200K | $200K | $500K |

In comparison with the annual premiums across the critical illness plans available in the market, the FWD Big 3 has the most affordable premiums, but with just basic coverage for the 3 main most common critical illnesses – Cancer, heart attack, and stroke. Premiums are based on a 30-year-old male, non-smoker for Singlife Essential Critical Illness with a sum assured of $100,000, with policy term up to age 75.

If you saw the above premium comparisons, the basic plan beats Singlife’s Essential Critical Illness.

However, if you add on the Heart and Neurological Disorder Rider, premiums become more expensive yearly.

| FWD Big 3 with Rider | Singlife’s Essential Critical Illness | |

| No of Critical Illness Conditions Covered | 3 + 21 | 14 |

| No of Special Conditions Covered | 0 | 7 4 Diabetic Conditions, Angioplasty & other invasive treatment benefits, TPD Benefit, TI Benefit |

| Rider Enhancement Option | Yes | Yes |

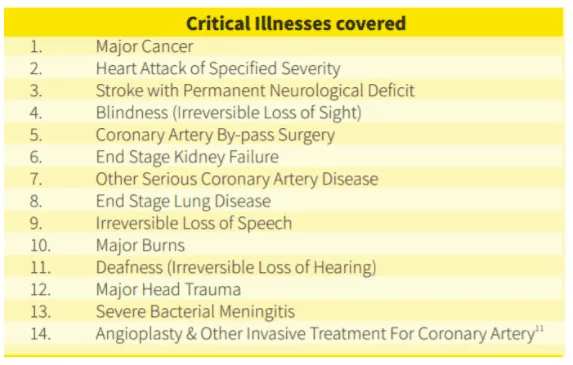

Here are the CIs that the Singlife Essential Critical Illness offers:

I understand that these are completely different plans, covering different CIs as well.

But most visitors that come to us regarding the FWD Big 3 are looking for the cheapest CI plans.

So even though it’s not an apple-to-apple comparison, it’s worth mentioning that if you’re looking for a broader range of CIs covered, the Singlife Essential Critical Illness covers 14 CI while FWD’s Big 3 only covers 3 + 21 CIs.

And it’s not limited to cancer, heart, and neurological conditions.

But it’s also important for me to mention that Singlife’s plan doesn’t cover early-stage cancer as FWD’s does.

So it’s really up to you.

If you’re looking for general CI coverage at the “cheapest” premiums, Singlife’s Essential Critical Illness seems to me as of more value.

But if budget is an issue and you’re okay with just the Big 3 conditions, then the FWD Big 3 is definitely for you.

There’s a reason why the FWD Big 3 made it into our list of the best critical illness plans in Singapore.

If you’re looking for a potentially even cheaper CI coverage than the FWD Big 3 – may I suggest checking out the MINDEF/MHA Group Term Insurance plan with their CI rider?

If you qualify for it, it might just be cheaper than FWD’s Big 3.

The downside is that it doesn’t provide you with early-stage cancer protection unless you get the ECI rider – which might then be more expensive than FWD’s Big 3.

For critical illness policies, it is recommended to consider the coverage, instead of just the policy premiums.

This is especially true when you’re purchasing for ECI/CI coverage. Check the definitions and whether what’s covered aligns with your medical history and your family’s.

And because you can add ECI/CI riders to term and whole life plans, you might find more comprehensive or affordable combinations that will suit you better.

Basic Product Features

Policy Terms

To be eligible for insurance coverage for the FWD Big 3, you need to be between 18 to 65 years old.

Premium Payment Terms

- All premiums are payable during the policy term.

- It is possible that CI premiums may be adjusted, as with all CI premiums.

There are several factors that determine the final premium amount, including age, gender, smoking status, sum assured, policy type, and premium period length.

Protection

Big 3 Benefit (CI)

During the period when the policy remains active, upon experiencing symptoms that might be related to and upon diagnosis by a certified medical practitioner for all stages of cancer, heart attack or specified severity of stroke with permanent neurological effects, you’ll receive:

- 100% of the sum assured or

- The total premiums paid less any sum owed to FWD, whichever is higher.

Upon full payment of this benefit, the policy will terminate.

Other Features and Benefits

Death Benefit

In case of the insured’s death, you will receive the sum assured less any amounts owed to FWD. The policy will then terminate.

Heart and Neurological Disorder Rider

Upon diagnosis by a certified medical practitioner of a heart or neurological disorder, while the policy and rider are active, you will receive a payout equivalent to 100% of the Big 3 Benefit, or the total premiums paid less any amount owed to FWD, whichever is higher.

Afterwhich, the policy will terminate.

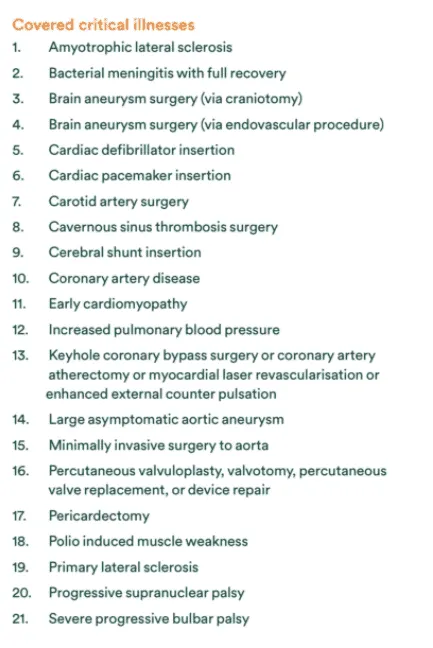

The below table provides the list of Critical illnesses covered by the heart and neurological disorder add-on rider.

In the first 90 days following the policy’s issuance, or whichever comes later, the heart and neurological disorder benefit will not be paid.

FWD Care Recovery Plan

Offers complimentary support services beyond just claim support.

The below services can be booked in consultation with your dedicated nurse.

Home Assistance

Home cleaning and/or home modification/ renovation best suited for your recovery needs.

Counselling

Provides counselling assistance in times when you require someone to talk to or require advice on issues you need to resolve.

Home Nursing Care Assistance

High-level professional nursing procedures at the convenience and comfort of your home. Offers 24/7 experienced and trained home nurses.

Local Medical Transport

Travel to medical appointments with ease with dedicated transport services.

Physiotherapy

Assist in improving physical functions and mobility post-injury or during rehabilitation.

Dietician Consultation

Receive professional dietician advice and curated diet plans to help you regain your energy, regardless of your condition.