AIA Absolute Critical Cover is a standalone critical illness insurance policy offering protection against 187 critical illnesses, age-related illnesses, and chronic diseases.

The plan has multiple benefits alongside riders to boost your protection.

Here’s a review of AIA Absolute Critical Cover to help you decide if it’s the best product to meet your needs.

Read on.

My Review of the AIA Absolute Critical Cover

The AIA Absolute Critical Cover is a logical choice for many due to its multipay feature, cash value, and wide range of 187 CIs covered. It’s also unique in the sense that you get a surrender value at the end, adjusted for claims – the only policy in the market offering this!

Other than that, you have incentives to extend coverage to your young ones by enjoying a 5% or 10% premium discount.

Another reason to consider this policy is that your premiums don’t go to waste thanks to the plan accumulating cash value up till you’re 100 years old.

This is unique to the AIA Absolute Critical Cover, unlike most standalone policies on the market.

Speaking of other policies, here’s a comparison of premiums across the different multipay plans:

| AIA Absolute Critical Cover w/ ASCC Booster | AIA Beyond Critical Care w/ Early Critical Cover Extra Rider | Tokio Marine MultiCare | Manulife Ready Complete Care | Singlife Multipay Critical Illness Plan | HSBC Life Super CritiCare | FWD Recover First | |

| Policy Term | Up to 65, 75, or 100 | Up to age 85 or 30 years | Up to age 70,75 or 85 | Up to age 75 or 99 | From 10 years old to 99 years old | Up to age 50,55,60,

65, 70 or 75

Or

Renewable term of 5,10,25,20,25, or 30 years |

From 5 years to age 85. |

| Annual Premiums | $1,999 | $3,104.80 | $1,515 | $1,475 | $1,465 | $1,165 | $1,124 |

Premiums are based on a 30-year-old male, non-smoker with a sum assured of $100,000, with a policy term up to age 75 – with the exception of the AIA Beyond Critical Care. Premiums are paid annually.

Even though the premium payable is higher, especially with the ASCC Booster, AIA Absolute Critical Cover is a comprehensive plan with multiple benefits.

It beats the AIA Beyond Critical Care in terms of premium price and benefits provided. While the AIA Beyond Critical Care gives you a premium refund if no claims were made, the AIA Absolute Critical Cover adjusts it based on any previous claims.

At a lower premium with some form of money back, together with the 187 conditions covered, we think the AIA Absolute Critical Cover absolutely crushes the AIA Beyond Critical Care.

Despite the positive aspects of the AIA Absolute Critical Cover, there are a few cutbacks.

For example, type 2 diabetes, which is a common critical illness condition, is missing from the Chronic Disease Benefit.

Also, under the ASCC Booster Benefit, the claim limit for multiple CI diagnoses is only 500%, whereas Singlife’s Multipay Critical Illness Plan, Tokio Marine MultiCare, and Manulife’s Ready CompleteCare “Cover Me Again” allow for up to 900% of sum assured.

Furthermore, the premiums here are much higher than others in the market.

| AIA Absolute Critical Cover | AIA Beyond Critical Care | Tokio Marine MultiCare | Manulife Ready Complete Care | Singlife Multipay Critical Illness Plan | HSBC Life Super CritiCare | FWD Recover First | |

| No of Critical Illness Conditions Covered | 150 | 43 CIs and 5 Rediagnosed CIs at an advanced stage.

Or 104 CIs if you opt for the Early Critical Cover Extra Rider |

109 | 106 | 132 | 111 | 37. Future Protect Benefit Provides coverage for early and intermediate CI. |

| No of Juvenile Conditions Covered | – | – | 10, claim up to 5 times, 20% of the assured sum, with a maximum limit of $25K | 18, claim up to 6 times, 20% of the assured sum, with a maximum limit of $25K | 11, claim up to 6 times, 20% of the assured sum, with a maximum limit of $25K | 11, claim up to 3 times,10 % of the assured sum, with a maximum limit of $25K | – |

| No of Special Conditions Covered | 25 Special Conditions, 13 Pre-Early Conditions with a maximum limit of $25k | – | 10, claim up to 5 times, 20% of the assured sum, with a maximum limit of $25K | – | 16, claim up to 6 times, 20% of the assured sum, with a maximum limit of $25K | 11, claim up to 5 times,10% of the assured sum, with a maximum limit of $25K | 10, claim up to 6 conditions,10%, maximum limit of $25K per claim |

| Rider Enhancement Option | Yes. With ASCC Booster Option | Yes | Yes | Yes. With “Cover Me Again” Option | Yes | Yes | No |

However, it is undeniable that the AIA Absolute Critical Cover will cover you for 187 conditions (ECI/CI + Special Conditions), which beats every other market policy.

Overall, considering everything it has, it’s of great value for the price you pay.

Despite its pros and cons, you’re not likely to find a CI policy that is 100% perfect; however, the AIA Absolute Critical Cover encompasses many aspects, making it a great choice for many.

Ultimately, the decision is up to what you want and what you need.

Would you need a policy that gives up to 900% in multiple payouts at a much more affordable price, or would you prefer some form of money back with only 500% claims but have more conditions covered?

Our first recommendation would be for you to read our best critical illness insurance plans in Singapore to understand the available alternatives available in the market.

This is important as you’re about to commit to paying premiums for the next 20 to 30 years, and you don’t want to make a financial decision that you’ll regret in the future – especially since the AIA Absolute Critical Cover comes at a premier pricing as compared to other plans in the market.

And since this is for your ECI/CI coverage, more attention should be given to it so that you’re not left uncovered at a time when you need it most.

We also suggest talking to an unbiased financial advisor for a second opinion on whether the AIA Absolute Critical Cover is the best for you or whether there are better plans.

If you need someone to get a second opinion from, we partner with MAS-licensed financial advisors who have helped thousands of our readers with their financial planning needs.

Click here for a free, non-obligatory chat.

Let’s now dig deeper into what the AIA Absolute Critical Cover has to offer.

Criteria

- The minimum sum assured starts at S$100,000

- Policy Entry Age: 2 weeks to 65 years old

Policy Terms

There are 3 policy term options available: up to 65, 75, or 100 years old.

Premium Payment Terms

Like most policies, you can make monthly, quarterly, biannual, and yearly payments.

Also, you can integrate your AIA Absolute Critical Cover (ASCC) with AIA Vitality and enjoy upfront premium discounts as well as future vitality status-dependent premium discounts.

Protection

AIA Absolute Critical Cover (ASCC) has the following benefits.

Death Benefit

If death occurs while the policy is still in force, the death benefit is paid less any debts owed to the policy.

Subsequently, the policy comes to an end after a claim is made.

Notably, the Death Benefit is 5% of the insured amount and surrender value.

This means that if you’re insured for $100,000, your Death Benefit is $5,000.

Critical Illness Benefit

If you are diagnosed with any of the 150 critical illnesses, you can enjoy the CI Benefit.

If you survive at least 7 days from the diagnosis or surgical procedure date, you’ll be paid the maximum claim limit or lower of 100% of the insured amount.

If you undergo a surgical procedure for Angioplasty and Coronary Artery procedure and survive 7 days later, you’ll be paid a lower of 10% of the Insured amount or the maximum claim limit. Notably, any amount paid is less debts owed to the policy.

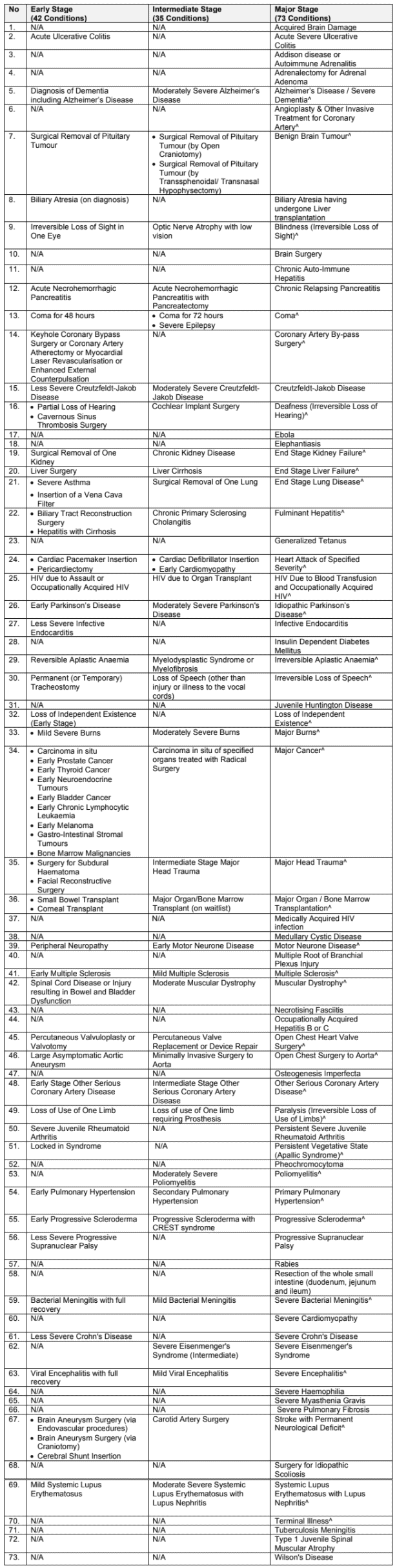

Each critical Illness stage has a maximum claim limit, as highlighted in the table below.

| Critical Illness Stage | Maximum Claim Limit |

| Early-stage CI | S$350,000 |

| Intermediate stage CI | S$350,000 |

| Major Stage CI (For Angioplasty and Invasive treatment for Coronary Artery) | S$25,000 |

| Major Stage CI (Except for Angioplasty and Invasive treatment for Coronary Artery) | N/A |

List of Critical Illnesses covered

Pre Early Benefit

The policy has 3 Pre Early Benefits available for The AIA Absolute Critical Cover to age 65, 75, and 100.

To understand how this works, here is a simplified table.

| AIA ASCC Value | Conditions |

| Age 65 | Available up to the policy’s anniversary if it occurs on or after your 65th birthday |

| Age 75 | Available up to the policy’s anniversary if it occurs on or after your 75th birthday |

| Age 100 | Available up to the policy’s anniversary if it occurs on or after your 85th birthday |

Further, the Pre-Early Benefit consist of

i) Benign Tumour and Borderline Malignant Tumour Benefit

This benefit applies when you have surgical removal of a benign tumour from specific organs.

You can only make one claim under this benefit, subject to a limit of S$25,000 per life.

Thereafter, the benefit ends after a claim is made.

ii) Chronic Disease Benefit

As the name suggests, the benefit covers chronic disease conditions or surgery to treat chronic disease.

The benefit is only paid once to a maximum limit of S$10,000.

Examples of covered illnesses include;

- Thyroid disorders

- Severe Hypertension

- Varicose veins that require surgery

- Psoriatic arthritis

- Age-related hearing disorder or severe presbycusis

- Age-related macular degeneration accompanied by visual impairment

- Mixed-sleep Apnoea

iii) Senior Silver Benefit

This benefit starts at the policy anniversary or when you turn 51 years old. It’s applicable if you suffer from a Senior Silver Condition or surgery to treat the illness.

The maximum amount payable under this benefit is S$25,000, and like other benefits, only a single claim is allowed.

Examples of covered Senior Silver Conditions include;

- Urinary incontinence that may require surgery

- Glaucoma condition that may require surgery

- Benign prostatic hyperplasia that may require surgery

Special Condition Benefit

The Special Condition Benefit covers you up to 65 and 75 years old, depending on your plan’s maturity.

If your coverage is up till you’re 100 years old, the benefit is limited until you turn 85.

As well, the maximum payable across the ASCC policies is S$25,000.

The following conditions are covered under this benefit.

- Mastectomy caused by breast condition or carcinoma-in-situ

- Cancer-related vulvectomy

- Cancer-related Hysterectomy

- Tourette Syndrome

- Autism Spectrum Disorder (ASD)

- Attention Deficit Hyperactivity Disorder (ADHD)

- Dyslexia

- Severe Central Sleep Apnoea

- Severe Chronic Obstructive Pulmonary Disease (COPD)

- Idiopathic Pulmonary Fibrosis

- Gastrointestinal Disease with surgery

- Pulmonary Embolism

- Osteoporosis

- Congenital Septal Defect requiring surgery

- Dengue Haemorrhagic Fever

- Diabetic Complications

- Rheumatic Fever with Heart Involvement

- Kawasaki Disease with Heart Complications

- Spinal Disease requiring surgery

- Severe Rheumatoid Arthritis

- Necrotising Fasciitis requiring surgery

- Severe Gout

- Wolff-Parkinson-White and Supraventricular Tachycardia (SVT) with surgical intervention

- Chronic pancreatitis due to obstruction of the pancreatic duct

- Glomerulonephritis with nephrotic syndrome

Features

Safety Net Cover Benefit

If you are admitted to the ICU due to any illnesses while this policy is still running, you’ll be paid 20% of the insured amount up to a maximum limit of S$25,000.

The Safety Net Cover Benefit covers you up to 65 and 75 years old, depending on your plan’s maturity.

If your coverage is up till you’re 100 years old, the benefit is limited until you turn 85.

Maturity Benefit

The maturity benefit is only applicable if you opted for coverage up to 100 years old.

At the policy’s anniversary or when you turn 100 years old, you’ll be paid 150% of the insured amount minus all debts owed to the policy.

However, if you’ve previously made CI Benefit claims, the amount you receive will be adjusted accordingly.

Think of this as cash value, similar to a whole life plan.

Surrender Benefit

Similar to the Maturity Benefit, the Surrender Benefit only applies to plans up to 100 years old.

For this benefit, you can surrender your policy on or after the 60th anniversary or before after your 75th birthday, whichever comes earlier.

If you do so, you’ll receive a surrender amount equivalent to 75% of your sum assured minus any previous claims.

For every year past your 75th birthday, you’ll receive an additional 1% up to 99% of the sum assured.

Child Premium Benefit

The Child Premium Benefit is a discount for any AIA Absolute Critical Cover policy.

The benefit insures your child separately if you are insured under any of AIA ASCC.

If you have many children and hold several AIA ASCC policies, your children are eligible for premium discounts.

However, the benefit ceases after the child reaches 21 years of age. The rates for the discount are indicated in the table below;

| No. of children | Rate of premium discount (%) |

| One child | 5% of premium payable |

| Two or more | 10% of premium payable |

Optional Riders

ASCC Booster

ASCC Booster is a non-participating supplementary benefit attached to your AIA Absolute Critical Cover.

This benefit has Power Relapse and Power Reset benefits that offer you protection against various critical illnesses occurring in different states.

It restores your current CI amount and lets you claim up to 500% of your basic policy. Examples of the conditions covered under Power Relapse CI include;

- Recurred Stroke

- Re-diagnosed Major Cancer

- Repeated Heart Valve Surgery

- Recurred Heart Attack

- Repeated Major Organ / Bone Marrow Transplantation

Notably, the ASCC Booster doesn’t provide maturity, surrender, or death benefit.

Think of the ASCC Booster as the multiclaim feature.

Early Critical Protector Waiver of Premium II Rider

Under this rider, you can enjoy a waiver of premiums if you are diagnosed with any of the 149 covered critical illnesses.

Critical Protector Waiver of Premium II Rider

With this rider, enjoy premium waivers if you’re diagnosed with any of the 72 late-stage critical illnesses.

Early Critical Protector Payor Benefit II Rider

AIA will waive off the premiums for the earlier of

- Your child’s AIA Absolute Critical Cover plan until they’re 25 years old, or

- The end of your premium waiver rider term

If you’re diagnosed with any of the 149 covered critical illnesses.

Payor Benefit Rider

AIA will waive off the premiums for the earlier of

- Your child’s AIA Absolute Critical Cover plan until they’re 25 years old, or

- The end of your premium waiver rider term

If you’re diagnosed with any disability or have passed on.

Illustration

Here is an illustration to help you understand how the AIA ASCC works.

At 30 years of age, Sam considers AIA Absolute Critical Cover. At 35 years old, he was diagnosed with Severe Obstructive Sleep Apnea.

At this point, he receives the Pre-Early Benefit for Chronic Disease equivalent of S$10,000, which is 10% of coverage amount up to S$10,000.

At 41 years, tragedy strikes, and Sam is diagnosed with Early Stage Lung Cancer.

Subsequently, he will receive a CI payout of S$100,000. If he had bumped up his cover with the Early Critical Protector Waiver of Premium III, he would have enjoyed a premium waiver after a CI diagnosis.

If he suffers from a relapse of cancer, he can take advantage of the extra riders under the ASCC Booster benefit.

For instance, they can make multiple claims under the Power Reset Benefit as long as 12 months have passed after the CI diagnosis. In this case, his coverage will be reset to a tune of 100%.

Also, if he suffers from any of the 5 CI conditions under the Power Relapse Benefit after 24 months, he can make multiple claims of up to 200%.

At 44 years old, Sam was admitted to ICU for 4 days. Here, he receives a Safety Net Cover Payout of S$20,000, an extra 20% of the coverage amount payable to a maximum limit of S$25,000. This benefit ends after a claim.

At 45 years, the coverage is automatically reset to S$100,00 since now 12 months have passed from the diagnosis of cancer.

Unfortunately, at 47 Sam suffers a heart attack and receives a CI payout of S$100,000.

At 48 years, the coverage is automatically reset to S$100,00 since 12 months have passed from the Heart attack illness.

At 55 years, Sam is diagnosed with Benign Prostatic Hyperplasia and requires urgent surgery. He receives the Pre-Early Benefit(Senior Silver) Payout of S$10,000, equivalent to 10% of coverage, amounting to a tune of S$25,000.

Notably, with the ASCC Booster benefit, Sam can make multiple CI claims up to age 85 and 500% of the coverage amount.

References

https://www.aia.com.sg/en/our-products/critical-illness-protection/aia-absolute-critical-cover.html