FWD Recover First is a critical illness plan that offers protection against illnesses, impairments, injuries, and disabilities.

As well, it’s a standalone and non-participating policy with regular premium payments that provides coverage against late-stage critical illnesses.

In addition, it offers Future Protect Benefits whereby you get the sum assured if an event affects your health. Also, the Special Benefit coverage pays a lump sum amount if death occurs.

Here is a comprehensive FWD Recover First policy review, including fees, benefits, and our recommendation.

My Review of the FWD Recover First

The FWD Recover First is ideal if you are looking for a CI plan that is not complicated but offers basic coverage. Its main advantage is that it covers you for illnesses that have not yet been discovered or unknown illnesses. It also resets the sum assured after the payment of the first claim.

Think of it as a multipay plan for late-stage CIs instead of early and intermediate-stage CIs.

Overall, the FWD Recover First is attractive due to its features and multiple benefits.

However, for the premiums it charges, I personally prefer other plans.

These are the premiums for other multipay plans that cover early, intermediate, and advanced-stage critical illnesses:

Premiums shown are based on a 30-year-old male, non-smoker, 100K sum assured with policy term up to age 75.

And the FWD Recover First’s premium for the same demographic is $1,124.

Pros of FWD Recover First:

- Focus on Late-Stage Critical Illnesses: Plans like FWD Recover First typically offer substantial coverage for late-stage critical illnesses, which can be crucial for you during advanced stages of serious health conditions.

- Multipay Feature: The ability to make multiple claims, often a key feature of such plans, provides ongoing financial support, which can be invaluable during prolonged medical treatments.

- Comprehensive Coverage: These plans usually cover a wide range of critical illnesses (37 + 10), ensuring broad protection for policyholders.

Cons of FWD Recover First:

- Limited Early-Stage Coverage: As the focus is on late-stage critical illnesses, there is no coverage for early and intermediate stages, which could be a drawback for those seeking comprehensive illness protection.

- Higher Premiums: Plans that offer extensive coverage for late-stage illnesses often come with higher premiums, which might not be feasible for everyone.

- Complexity of Terms: Understanding the terms and conditions, especially regarding the multipay feature and claim eligibility, can be complex and requires careful consideration.

Given the coverage and price differences, with just an additional top-up of $41 yearly, you can get covered for 132 conditions and make claims up to 600% with the HSBC Life Super Criticare.

With an approximate top-up of $300 yearly, you can access the Singlife Multipay Critical Illness Plan, Manulife CI FlexiCare (Deluxe), or Tokio Marine MultiCare – offering 140+ conditions and up to 900% in multi claims – something that brings you more value for every dollar you spend.

Heck, if affordability is a concern, you can even consider purchasing a term plan + ECI/CI rider for potentially more comprehensive coverage at lower prices.

The Singlife Elite Term with ECI/CI rider is popular amongst many budget-conscious Singaporeans and those looking for the best value.

With multiple types of ECI/CI riders available, you can choose from a single-claim ECI or CI rider, or a multi-claim ECI or CI rider – that’s 4 riders to choose from based on your preferences – excluding premium waivers.

The thing about insurance is that there are many solutions to solve a problem – and many focus on just one way of doing things without thinking out of the box to meet their unique individual needs.

That’s why we always recommend exploring possible alternatives first.

We recommend starting with our posts on the following:

- 11 Best (Early & Late-Stage) Critical Illness Insurance Plans in Singapore

- 11 Best Whole Life Insurance Plans in Singapore [2023 Edition]

- 9 Best Term Life Insurance Plans in Singapore (2023 Edition)

You’ll find the various ECI/CI plans available and even get coverage for them via riders on a whole or term life insurance plan.

Once you know your potential alternatives, we recommend getting a second opinion from an unbiased financial advisor to understand if the FWD Recover First is best for you.

For coverage as important as ECI/CI, it’s crucial that you take some time to explore your options, as you’ll be paying premiums for the next 20 to 30 years.

The last thing you want to face is to realise that you’re not covered for the conditions you’re struck with – only to be paying all those years for nothing.

If you need someone to get a second opinion from, we partner with MAS-licensed financial advisors to help you with this.

Click here for a non-obligatory second opinion.

Let’s explore the FWD Recover First in detail.

Criteria

- Minimum sum assured: S$50,000

- Maximum sum assured: S$350,000

- Premium payments: Monthly, quarterly, semi-annual, or annually

Product Features

Policy Terms

| Person Insured | Policy Owner | |

| Minimum Age Entry | 30 days | 18 years |

| Maximum Age Entry | 65 years | 100 years |

Policy Tenure

| Premium payment

duration (ALB) |

Minimum

policy term |

Maximum

policy term |

| Throughout the term of

the policy |

5 years |

Entry Age – 85 years |

Protection

Recover First Benefit

Recover First Benefit is also known as the base benefit. It covers up to 37 late-stage critical illnesses and pays close to 100% of the basic sum assured. Notably, this is paid in one single lump sum.

Another feature of this benefit is that you’ll be paid 10% of the basic sum assured subject to the S$25,000 maximum sum payable in the event of angioplasty or invasive treatment for the coronary artery.

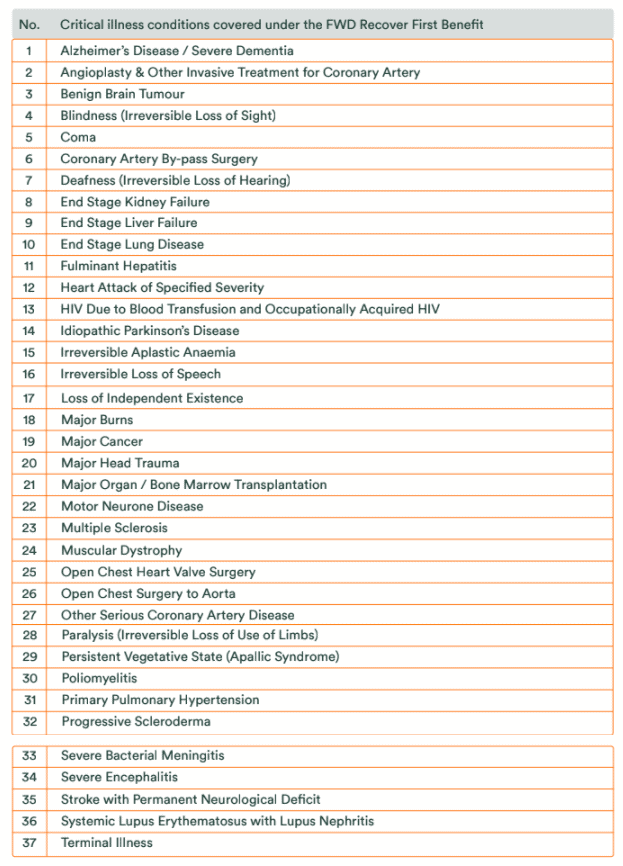

Critical illnesses covered under Recover First Benefit

Here is a list of Critical Illnesses covered under Recover First Benefit.

Future Protect Benefit

The Future Project Benefit is the most recent feature that covers more illnesses. With this feature, you’ll get coverage even for illnesses that are yet to be discovered.

Therefore, it’s future-proof for uncertainties that may occur later.

For example, if an insured person slides into a coma and then suffers a stroke probably due to an underlying or unknown illness, the policy covers the undiscovered illness.

After diagnosing the covered illnesses under the Future Protect Benefit, you’ll be paid 100% of the basic sum assured as one single lump sum. However, this amount is less than other claims paid under Angioplasty or invasive treatment for coronary arteries.

The Future Protect benefit ends after you get paid, and the base benefit reduces to zero. Nonetheless, the policy doesn’t end, but you’ll get a waiver on the residual premiums.

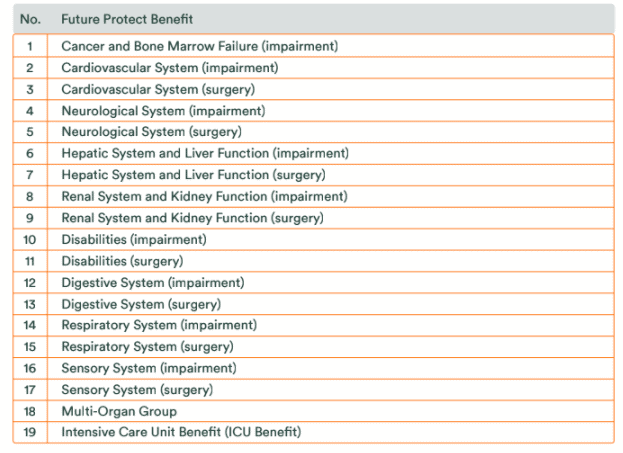

Conditions covered under Future Protect Benefit

Here are critical illnesses covered under Future Protect Benefit.

Reset Benefit

As mentioned earlier, if you claim the Future Protect Benefit, the base benefit doesn’t end immediately but stays in force up to the end of the policy.

It reduces to zero for 12 months after you’ve been diagnosed under the Future Benefit claim. Subsequently, you’ll be fully insured for the late-stage critical illnesses covered again.

It’s worth noting;

- The amount excludes claims paid for angioplasty and other invasive coronary artery treatment.

- The base benefit cannot be reset more than once.

Special Benefit

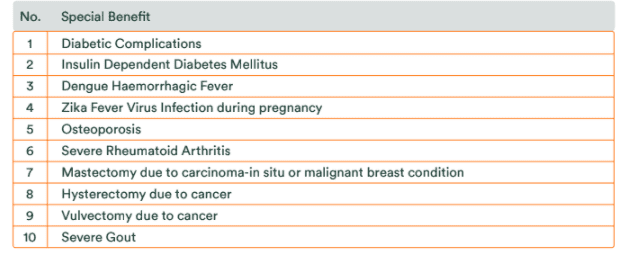

If you are diagnosed with any of the 10 critical illnesses covered, you can be paid an extra S$25,000 under the special benefit. It is important to note that your sum assured and the death benefit remains the same.

To clear any doubt,

The special benefit does not trigger a waiver of premiums.

-

- You can only claim for each condition.

- Only 6 claims are allowed under the special benefit to a maximum of S$25,000 per life per condition.

- The benefit terminates if you previously claimed the Future Protect Benefit.

Here are the 10 Special Benefits illnesses:

Death Benefit

In the event of death, the Death Benefit is paid to the tune of S$5,000 as a single payment. Subsequently, the policy ends.

Other Features

Waiver of Premiums

After a successful claim, the Future Protect Benefit ends, and subsequently, the remaining premiums are waived.

The waiver takes effect from the next premium date after you claim Future Protect Benefit.

Emotional Support

The FWD Recover First has some of the unique features on the market today. For instance, Emotional Support is available after recovery from a critical illness.

In this respect, you will be paid for up to 10 life coaching and counselling sessions if previously you had a claim under Future Protect Benefit, Recover First Benefit, or Death Benefit.

Only the policy owner can receive this benefit for emotional support or a nominee who receives the death benefit.

Medical Second Opinion Support

You can qualify for the medical second opinion support benefit after a diagnosis of any critical illness under the Future Protect Benefit or the Recover First Benefit.

In this context, the beneficiary is the insured person who has been diagnosed with a CI.

As well, it’s important to note that you’ll only receive the benefit after presenting proof of illness or diagnosis.

Here are examples to illustrate how FWD Recover First Policy works:

Example one

Assuming John, who is 30 years old, purchases an FWD Recover First Policy of 35 years and a basic sum insured of S$150,000. The annual premium is approximately S$1,372.50.

Supposing John is diagnosed with any covered critical illness that requires admission to ICU for 5 days. But luckily, he recovers from the CI. Unfortunately, many years later contracted late-stage lung cancer.

Here is what happens.

- The policy pays John S$150,000 for the ICU admission for the 5 days.

- If there is no claim under base or death benefit within the next 12 months, the sum insured is reset or restored to the initial amount. Remember that this can only be done once.

- Therefore, the coverage continues for 37 late-stage critical conditions even after recovery, and the premiums are waived. This means that after diagnosis with lung cancer, John will be paid another $150,000 should he face any other CIs.

- Consequently, the policy terminates.

Therefore, this policy’s total amount payable to John is S$300,000.

John can also receive up to S$10,000 worth of Recovery or Emotional Support benefits if he has previously joined the Recovery Support program.

Example 2

Supposing Sam, who is 30 years old, purchases an FWD Recover First policy with a 35-year policy term and a basic sum assured of S$150,000. In this circumstance, the annual premium is S$1,580.

Sam faces a couple of illnesses during the policy duration, including diabetes and high blood sugar complications. Consequently, he falls into a coma for 2 days and suffers a major stroke. The cause of the stroke is not immediately established, but there is a possibility of an unknown illness.

Here is how Sam can get various claims under the FWD Recover First under the circumstances.

- He will be paid a Special Benefits claim of up to S$25,000 for every illness.

- The policy doesn’t end there, but the coverage continues for 37 late-stage critical illnesses. There is also the Reset Benefit, which leads to a waiver of the premiums. Notably, there is a 12-month period before the reset.

- After that, Sam will be paid Future Protect up to $150,000 for the coma.

- Because Sam eventually suffers a stroke, he will be paid a sum of S$150,000 for the late-stage critical illness, even if the illness is unknown.

- Afterwards, the policy ends.

Therefore, the total amount payable to Sam is S$325,000.

Like the first scenario, Sam can also receive up to S$10,000 worth of benefits for recovery or emotional support if he had previously joined the recovery support program.