Tokio Marine’s MultiCare is a non-participating, regular premium multipay critical illness (CI) policy. It provides protection against three categories of critical illnesses, namely;

- Early

- Intermediate

- Advanced stage

It pays you after you’ve been diagnosed with a critical illness or a condition that occurs at different stages of severity.

Moreover, the plan allows for multiple claims from early or intermediate to an advanced stage of the critical illness.

Quite often, the payouts can extend up to 900% of the basic sum assured. To understand how Tokio Marine MultiCare works, here is our comprehensive review.

Keep reading.

My Review of the Tokio Marine MultiCare

If you are looking for a standalone multipay CI policy without any complications, the Tokio Marine MultiCare plan might be a good choice.

Let’s first do a high-level comparison of every multipay plan in Singapore:

| AIA Beyond Critical Care | Tokio Marine MultiCare | Manulife Ready CompleteCare | Singlife Multipay Critical Illness Plan | HSBC Life Super CritiCare | FWD Recover First | |

| No of Critical Illness Conditions Covered | 43 CIs and 5 Rediagnosed CIs at an advanced stage.

Or 104 CIs if you opt for the Early Critical Cover Extra Rider |

109 | 106 | 132 | 111 | 37. Future Protect Benefit Provides coverage for early and intermediate CI. |

| No of Juvenile Conditions Covered | – | 10, claim up to 5 times, 20% of the assured sum, with a maximum limit of $25K | 18, claim up to 6 times, 20% of the assured sum, with a maximum limit of $25K | 11, claim up to 6 times, 20% of the assured sum, with a maximum limit of $25K | 11, claim up to 3 times,10 % of the assured sum, with a maximum limit of $25K | – |

| No of Special Conditions Covered | – | 10, claim up to 5 times, 20% of the assured sum, with a maximum limit of $25K | – | 16, claim up to 6 times, 20% of the assured sum, with a maximum limit of $25K | 11, claim up to 5 times,10% of the assured sum, with a maximum limit of $25K | 10, claim up to 6 conditions,10%, maximum limit of $25K per claim |

| Rider Enhancement Option | Yes | Yes | Yes. With “Cover Me Again” Option | Yes | Yes | No |

Next, let’s compare them based on the premiums:

| AIA Beyond Critical Care w/ Early Critical Cover Extra Rider | Tokio Marine MultiCare | Manulife Ready CompleteCare | Singlife Multipay Critical Illness Plan | HSBC Life Super CritiCare | FWD Recover First | |

| Policy Term | Up to age 85 or 30 years | Up to age 70,75 or 85 | Up to age 75 or 99 | From 10 years old to 99 years old | Up to age 50,55,60,

65, 70 or 75 Or Renewable term of 5,10,25,20,25, or 30 years |

From 5 years to age 85. |

| Annual Premiums | $3,104.80 | $1,505 | $1,475 | $1,465 | $1,165 | $1,124 |

| Max Sum Assured | $3 Million | $350K | $500K | $250K | $1 Million | $350K |

Premiums are based on a 30-year-old male, non-smoker with a sum assured of $100,000, with a policy term up to age 75 – with the exception of the AIA Beyond Critical Care. Premiums are paid annually.

The first thing I like about Tokio Marine MultiCare is the lack of a waiting period for claims between Layer 1 and Layer 2.

In addition, the maximum payout of S$350,000 for Early-stage Critical Illness is the highest so far.

Compared to its competitors, it’s competitively priced with a premium costing up to S$1,505 per year.

One aspect that this policy loses is a lack of flexibility. Personally, I feel that the protection term until 70, 75, and 85 is a bit rigid and does not allow for flexibility, thereby limiting your choices.

Also, Layer 3 is not flexible as it covers Major Cancer only at the advanced stage.

But how does it compare to its competitors?

Tokio Marine MultiCare vs. AIA Beyond Critical Care

AIA Beyond Critical Care is distinguished by its coverage of mental health conditions and the unique feature of premium refunds.

While both plans offer comprehensive protection against a wide range of critical illnesses, including early and intermediate stages, and allow for multiple claims, the lack of waiting periods in Tokio Marine MultiCare is a significant advantage.

This feature ensures continuous protection, which can be crucial for individuals who may face multiple health challenges in a short period.

In contrast, AIA Beyond Critical Care’s inclusion of mental health coverage and premium refunds might appeal more to those prioritising these aspects of their critical illness insurance – albeit at a much higher cost (2x more).

Tokio Marine MultiCare vs. Singlife Multipay Critical Illness Plan

Singlife’s Multipay Critical Illness Plan, like Tokio Marine MultiCare, offers multiple payouts (900%) for different stages of critical illnesses and covers a wide range of conditions.

The key difference lies in the waiting period policy. Tokio Marine MultiCare’s absence of waiting periods offers an edge for those who need immediate and successive coverage.

Singlife’s Multipay Critical Illness Plan, however, might be more suitable for individuals looking for more critical illness conditions (132 vs 124) and a longer policy term (up to 99 years old).

Tokio Marine MultiCare vs. HSBC Life Super CritiCare

HSBC Life Super CritiCare is known for its broad coverage and financial support during the course of an illness.

While it shares similarities with Tokio Marine MultiCare in terms of the range of illnesses covered (132 for HSBC Life vs 129) and the multiple claims feature, the lack of waiting periods in Tokio Marine’s plan is a unique selling point.

This feature makes it a compelling choice for those who require uninterrupted coverage.

HSBC Life’s plan, on the other hand, might be preferred by those who value the balance between more comprehensive coverage in terms of conditions covered and lower premiums.

However, it’s worth pointing out that despite having lower premiums and more conditions covered, the HSBC Life Super CritiCare only covers up to 600% of claims, while Tokio Marine MultiCare does up to 900%.

Tokio Marine MultiCare vs. Manulife CI FlexiCare (Deluxe)

Manulife CI FlexiCare offers long-term coverage up to the age of 99, which is a significant advantage for those seeking extended protection.

Compared to Tokio Marine MultiCare, Manulife’s plan might appeal more to individuals prioritising coverage duration over immediate claim availability.

The Manulife CI FlexiCare also covers up to 169 critical illness conditions across all stages for up to 800% in claims, compared to Tokio Marine’s 129 conditions but for 900% of claims.

So if you’re looking for more conditions covered and are willing to let go of the 1 additional claim, the Manulife CI FlexiCare (Deluxe) is a plan to consider.

In summary, Tokio Marine MultiCare’s unique feature of no waiting periods sets it apart from other critical illness plans like AIA Beyond Critical Care, Singlife Multipay Critical Illness Plan, HSBC Life Super CritiCare, and Manulife CI FlexiCare (Deluxe).

Each plan has its distinct advantages, and the choice should be based on individual health concerns, coverage needs, and financial capacity.

It’s best to start by understanding what alternatives are available for you, so that you can make a better decision as to which policies might suit you better.

As you probably know, no policy can have all positive aspects, and once in a while, you may need to find a middle ground.

We suggest reading our comparison of the best critical illness plans in Singapore to begin.

Once you know your options, you should get a second opinion on whether the Tokio Marine MultiCare is good for you or if there are better alternatives.

This is crucial as critical illness coverage is considered one of the most important insurance coverage you’ll need, and for this protection, you’re expected to make premium payments for the next 20 to 30 years.

You don’t want to rush into a plan not knowing if there are better options for you – something that many Singaporeans are guilty of.

If you need someone to talk to for a second opinion, we partner with MAS-licensed financial advisors who can assist you with this.

Click here for a non-obligatory chat.

Let’s now dive deep into what the Tokio Marine MultiCare has to offer.

Criteria

- Maximum sum assured starts at S$350,000

- Maximum coverage age: Up to 70, 75, or 80 years old

Basic Product Features

Payment Terms and Options

The premiums are payable yearly throughout the policy duration. Like most CI premiums, these are not guaranteed and may change from time to time.

Protection

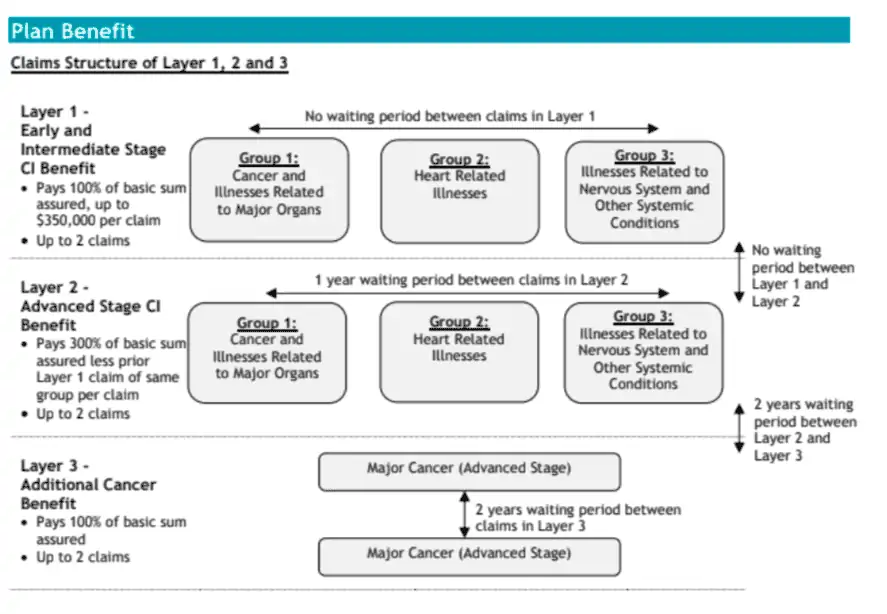

Tokio Marine MultiCare policy has a three-layer structure as shown in the table below.

Keep the diagram in mind because I’ll be explaining more about this later – and it’s important.

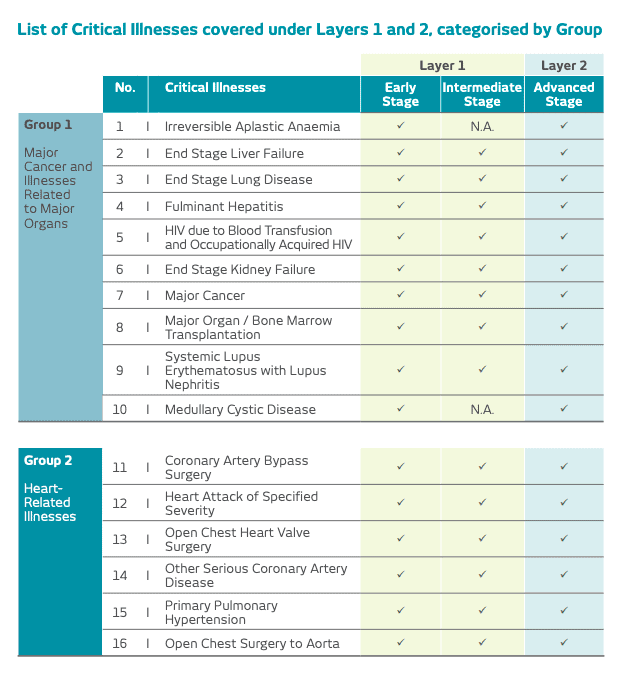

Critical Illnesses Covered by Tokio Marine MultiCare

Worth noting,

- There is no waiting period between Layers 1 and 2

- There is a two year waiting period between Layers 2 and 3

- There is a two year waiting period between claims in Layer 3

Early and Intermediate Stage CI Benefit

Layer 1 covers critical illnesses in the early and intermediate stages. As well, there are three categories for the various illnesses and these falls under Group 1, 2, and 3.

If you are diagnosed with an early or intermediate stage of a critical illness, you’ll get 100% of the basic sum assured. However, this is subject to the maximum claim limit minus any debt that you owe the policy.

In addition, you can only claim once in each group; however, this is subject to a maximum claim of two groups. It means that, after the 2nd claim under Layer 1 or Layer 2, you can’t enjoy the benefit again.

Likewise, the maximum Critical Illness benefit payable is;

- S$350,000 under the early and intermediate stage of the same critical illness

- S$2,500,000 under all stages

Advanced Stage Critical Illness (CI) Benefit under Layer 2

As you already know, Layer 2 covers Critical Illnesses under Groups 1, 2, and 3. If you are diagnosed with a critical illness at an advanced stage, you’ll be paid 300% of the basic sum assured.

However, this amount is minus any claim you made under Layer 1 from the same group if the critical illness is at the advanced stage.

Also, this is subject to the maximum claim limit minus any debts you owe the claim.

Notably, you can only claim once under each group, which is subject to a maximum claim from two groups.

Simply put, if you have made two claims under Layer 2, you can’t make any other claim.

After the first claim under Layer 2, there is a waiting period of 1 year between the successive diagnosis dates.

Particularly, the maximum you can get under all the stages is S$2,500,000, including other policies from the company.

Additional notes for Layers 1 and 2

Example 1

Suppose you are diagnosed with multiple critical illnesses from various groups under the same layer.

In that case, the insurer will determine if the illness is a direct or indirect result of the first CI. In this case, they will pay the claim for the first CI.

However, if there’s no relationship between the critical illnesses, they will pay for the second claim.

- If you have a liver illness that requires surgery, the CI will fall under Layer 1, Group 1. If, for instance, you fall into a coma for 48 hours, you’ll be paid 100% of the basic sum assured for the liver surgery claim if there is a direct or indirect relationship between the surgery and the comma. Therefore, they’ll not pay for the coma claim.

- If there’s no relationship between liver surgery and coma, you’ll receive 200% of the basic sum assured. These fall under Layer 1 Group 1 and Group 3.

Example 2

The following conditions will apply if you are diagnosed with multiple critical illnesses falling under Layer 1 and 2.

If the subsequent Critical Illness is a direct or indirect result of the initial CI, you’ll be paid the higher benefit claim.

Suppose the subsequent illness is not due to the direct or indirect result of the initial CI; you’ll be paid for both claims.

- If, for example, you are diagnosed with Carcinoma in Situ condition under Layer in Group 1 and fall into a coma for 96 years hours, the following conditions will apply.

- If the condition directly or indirectly leads to the coma for 96 years, you’ll receive 300% of the sum assured under Layer 2 Group 3.

- If the subsequent condition is not a result of the Carcinoma in Situ, you’ll be paid for both claims, which are equivalent to 100% of the basic sum assured for Layer 1 Group 1 and 300% for Layer 2 Group 3.

On another note, if you are diagnosed with any state of critical illness and, as a result, you cannot perform any task by yourself, you’ll only be paid the claim under the CI.

However, you’ll not be paid for the permanent disability (Loss of Independence Existence) or terminal illness.

Additional Cancer Benefit (Layer 3)

Layer 3 typically covers Major Cancer, which is diagnosed after you make a claim under Layer 2 Group 1. In addition, you can also get the benefit if you make both claims from Layer 2 Group 2.

After a Major Cancer diagnosis, you’ll be paid 100% of the basic sum assured. However, this is subject to the maximum claim limit minus any debts that you owe to the policy.

You can also make a maximum of 2 claims under Layer 3 if Major Cancer has persisted, recurred, or first diagnosed preceding Major Cancer.

However, you can only be paid after a 2-year waiting period after diagnosing a CI under Layer 2 or Major Cancer under Layer 3, whichever comes later.

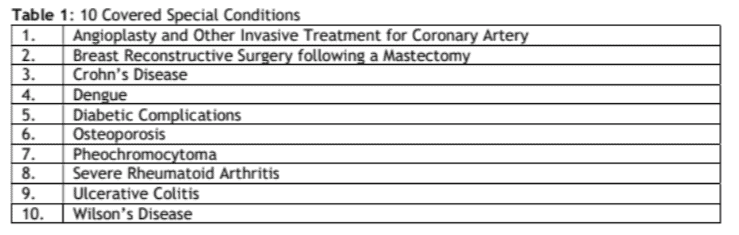

Special Benefit

Tokio Marine’s Multicare offers a Special Benefit whereby 20% of the sum assured minus any debts and is paid if you are diagnosed with any of the ten covered special conditions as shown in the table below.

Make note that special benefit is only paid once subject to five benefits on the list.

Juvenile Benefit

The Juvenile Benefit is payable to children before they celebrate their 19th birthday. You’ll get 20% of the basic sum assured minus any debts.

One unique thing about Juvenile Benefit is that it doesn’t reduce the basic sum assured.

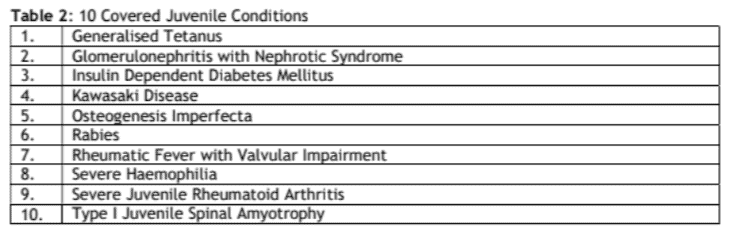

Here are the 10 conditions covered under Juvenile Benefit;

Like the Special Benefit, the Juvenile Benefit is only paid once to a tune of S$25,000 for each condition.

Juvenile Waiver Benefit

Juvenile Waiver Benefit is an application for children below or equal to 18 years. After a claim under Layer 2, you’ll get a waiver on future premiums. Notably, claims under Layer 1, Juvenile or Special benefits don’t trigger Juvenile Waiver Benefit.

Death Benefit

In case of death, while the policy is still running, the policy pays 10% of the basic sum assured minus any debts. The amount is paid as a lump sum, and subsequently, the policy ends.

Under Special or Juvenile Benefits, the survival period clause states that you can only be paid under Layer 1, 2, and 3 if you survive beyond seven days after a diagnosis.

However, if death occurs, the death benefit is paid, and the policy automatically ends.

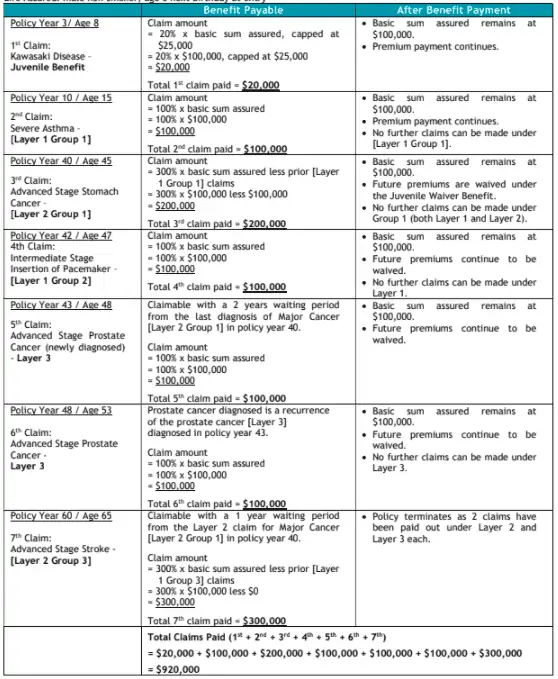

Example 1. Sum assured 100,000

Here is a simple illustration to show the benefits depending on your age. The basic sum assured is $100,000 for a male non-smoker aged 5 years at the time of entry.

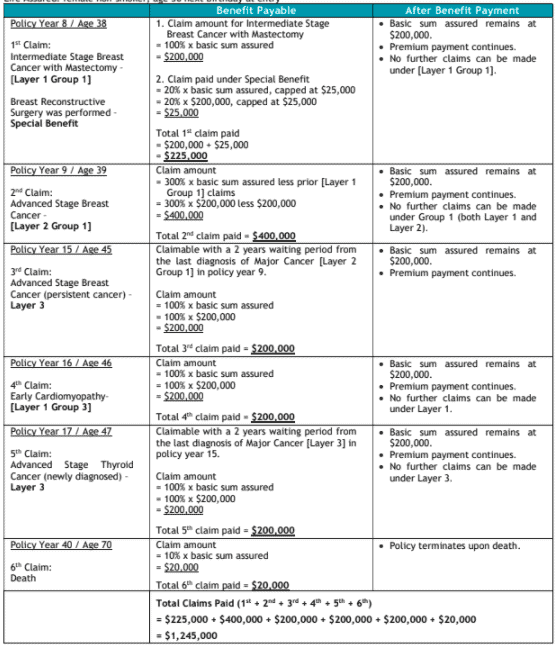

Example 2. Sum assured 200,000

Here is a simple illustration to show the benefits depending on your age. The basic sum assured is $200,000 for a male non-smoker aged 30 years at the time of entry.

Optional Waiver Riders

To increase your protection, you can opt for the Optional waiver riders. Tokio Marine’s MultiCare plan has the following optional riders

- Waiver of Premium Rider

- Payer Benefit Rider

- Enhanced Payer Benefit Rider

- Spouse Rider/Enhanced Spouse Rider

To enjoy the premium waiver feature, you can choose a higher sum assured beyond S$350,000 as this will allow the coverage to continue after the initial payout. Here is a simple example to illustrate this;

Suppose John, 30 years old male, non-smoker, would like ECI coverage and continuous coverage as well as premium waivers. He may choose TM ECI cover with a basic sum assured of $500,000 up to 70 years.

In this case;

- The policy sum assured is capped at S$350,000

- The policy term is 40 years

- Premium term is 40 years

- Premiums are equal to S$3,005 per annum

In an ECI claim, John will receive a lump sum amount of S$350,000, and all future premiums waived. Subsequently, the balance of the sum assured is claimable in the case of an advanced stage CI.

With a waiver of premium rider in place, there is a waiver of future premiums.

Termination

As a special note, the policy terminates automatically after payment of two claims under Layer 2 and two claims under Layer 3.

Summary Of Tokio Marine’s MultiCare

| Cash Value & Withdrawal Benefits | – |

| Policy cash value | Not available |

| Surrender or Maturity value | Not available |

| Renewable or Convertible features | Not available |

| Health & Insurance coverage | – |

| Death coverage | Available |

| Terminal Illness coverage | Not available |

| Total and Permanent Disability coverage | Not available |

| Critical Illness coverage | Available |

| Early Critical Illness coverage | Available |

| Optional insurance riders | – |

| Insurance riders to enhance coverage | Available |

| Other perks | – |

| Multiple pay-outs for all CI stages | Available |

| Claims for 2 advanced stage CI | Available |

| Two extra claims for Major Cancer | Available |

| Payout of up to 900% of the basic sum assured | Available |

| 10 Juvenile and 10 Special conditions coverage | Available |