The Manulife Ready CompleteCare is now obsolete and replaced by the Manulife CI FlexiCare (Deluxe).

In this review, we will look into Manulife’s Ready CompleteCare (RCC) a critical illness insurance policy that covers all stages (early, intermediate, or advanced) of 106 Critical Illnesses and 18 additional conditions, where you can claim up to 500% of the sum insured.

My Review of the Manulife Ready CompleteCare

| Pros | Cons |

|

|

When compared to other companies, the premiums are as such:

| HSBC Life Super CritiCare | Singlife Multipay Critical Illness Plan | Manulife ReadyComplete Care (Cover Me Again) | Tokio Marine MultiCare | AIA Beyond Critical Care | |

| Annual Premium (S$) | 1,165 | 1,465 | 1,475 | 1,515 | 2,043 |

*Premiums are based on a 30-year-old male, non-smoker for a sum assured of $100,000 and coverage to age 75.

Personally, I think that Manulife’s Ready CompleteCare is not a bad option, when weighing the pros and cons, as it does have regular health check-ups which can be helpful in detecting any illnesses early.

However, if you do want more coverage or a shorter-term policy, then perhaps you may want to consider another policy.

Not to mention, this policy allows only one claim for the same condition (unless it is cancer).

In most cases, you are more likely to be diagnosed with the same illness again, and so with the limit of only one claim for the same condition, the Manulife Ready CompleteCare may not be a favourable choice.

Let’s compare this policy to other competitive multipay plans in Singapore.

Singlife’s Multipay Critical Illness Plan is designed to offer multiple payouts for different stages of critical illnesses, similar to Manulife’s Ready CompleteCare.

A notable aspect of Singlife’s plan is its coverage for a wide range of 132 conditions, including less severe ones, providing policyholders with comprehensive protection.

In terms of premium costs and flexibility, both plans offer competitive options, but the choice between them may come down to the specific illnesses covered and the terms of the multiple claims feature.

HSBC Life Super CritiCare is another comprehensive plan that provides coverage for a broad spectrum of critical illnesses, including early and intermediate stages.

One of the strengths of HSBC Life’s plan is its lower premiums of $300 per year based on the demographic above.

While Manulife’s Ready CompleteCare offers the advantage of multiple claims for different conditions, HSBC Life’s plan may appeal to those looking for a balance between comprehensive coverage and affordability during the course of the illness.

However, HSBC Life’s Super CritiCare only covers 111 conditions as compared to 124 conditions offered by the Manulife Ready CompleteCare.

One area the HSBC Life loses out in is that it only allows you to claim an early/intermediate stage critical illness once. All other multiple payout CI plans allow multiple claims on the same critical illness, subject to varying waiting periods.

Also, the HSBC Life Super CritiCare only pays you 100% of your sum assured, regardless of the CI stage.

This means that if you are immediately diagnosed with advanced-stage CI, you only get 100% of your sum assured. Similarly, if you’re immediately diagnosed with early/intermediate-stage CI, you also only get 100% of your sum assured.

This is the trade-off you make for lower premiums.

Next, Tokio Marine MultiCare is known for its flexibility and the ability to tailor coverage to individual needs.

This plan also allows for multiple claims for various stages of critical illnesses, providing substantial protection against 129 ECI/CI conditions.

A unique feature of Tokio Marine’s plan is its ability to let you claim up to 900% of your sum assured – something that they and the Singlife Multipay Critical Illness Plan offers. The max sum assured beats Singlife’s though, maxing out at 350k vs Singlife’s 250k.

With so many policies available and so many things to consider, we recommend you spend some time researching for possible alternatives first.

We suggest starting your research by reading our post on the best critical illness insurance policies in Singapore. This should be a good starting point.

Next, it’s best you obtain a second opinion from an unbiased financial advisor to understand whether the Manulife Ready CompleteCare (Cover Me Again) is good for you or you should look elsewhere for better coverage.

Remember, you’re about to pay premiums for the next 20 to 30 years, so make sure you don’t make a choice you won’t regret in the future.

If you need someone to get a second opinion from, we partner with MAS-licensed financial advisors that are more than happy to help you with this.

Click here for a non-obligatory chat.

Let’s now explore what the Manulife Ready CompleteCare offers.

Criteria

Sum Assured

- Minimum sum assured of $30,000.

Basic Product Features

Policy Term

For Manulife Ready CompleteCare, there are 2 coverage options: a coverage term to either

- Age 75, or

- Age 99

What this means is that once you reach either 75 or 99, the insurance coverage will end.

Premium Term

- Payable throughout the premium term of the policy

- As with all CI premiums, premiums are not guaranteed and may be adjusted

- Change of rates would be with 30 days’ notice

Coverage

Death Benefit

In the event of the death of the life insured, total premiums paid to date would be paid if no prior claims were made (after a deduction of any claim amount paid under the policy).

However, should the total claim amount paid under the policy prior to the death be higher than the total premiums paid as of the date of death, the death benefit is void.

It is also important to note that upon payment of this benefit, the policy will end.

Critical Illness (CI) Benefit

If you are diagnosed with any covered early, intermediate, or advanced stage of critical illness, Manulife will pay the CI Benefit in accordance with the stage of the illness, as follows:

| Critical illness stage | Critical illness benefit |

| Advanced stage | 100% of the Current Sum Insured would be paid |

| Intermediate stage | Either 100% of the Current Sum Insured or S$350,000* |

| Early-stage | 100% of the Current Sum Insured or S$250,000* |

*Whichever amount is lower would be paid

The Current Sum Insured refers to either:

- the basic sum insured after deduction of any CI benefit paid; or

- the basic sum insured after deduction of any CI benefit paid after the Cover Me Again Benefit (more on this benefit later) is activated,

as at the date of diagnosis of the CI.

After the benefit is paid, your future CI claims will only be the balance of what you have left, instead of the Actual Sum Insured.

It’s also important to note that for early-stage Alzheimer’s Disease or Severe Dementia, the coverage will end on the policy anniversary immediately following your (or the life insured’s) 85th birthday.

However, there are prerequisites to this Benefit, such as:

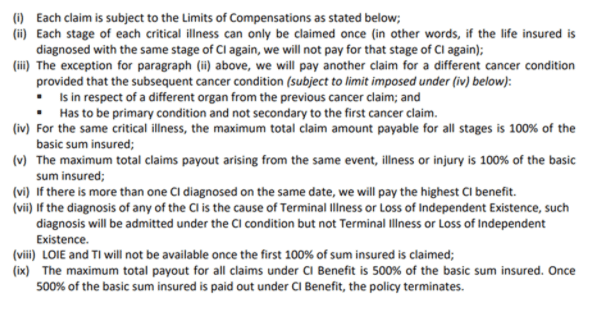

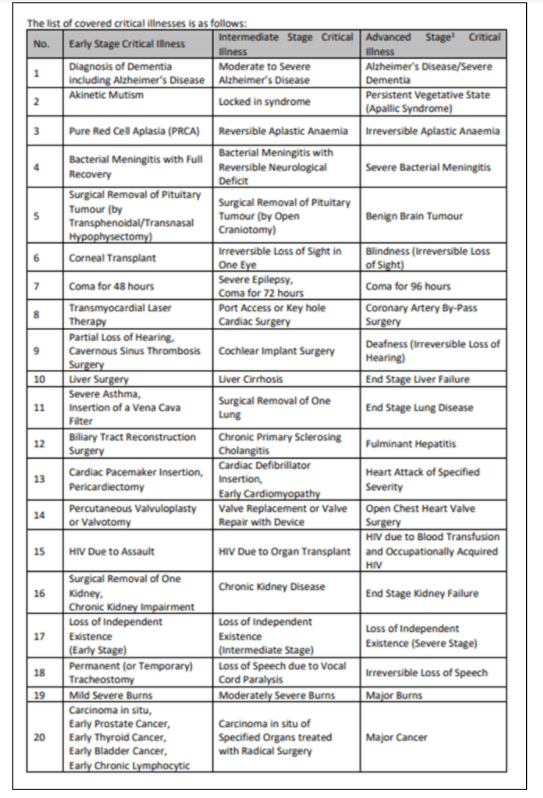

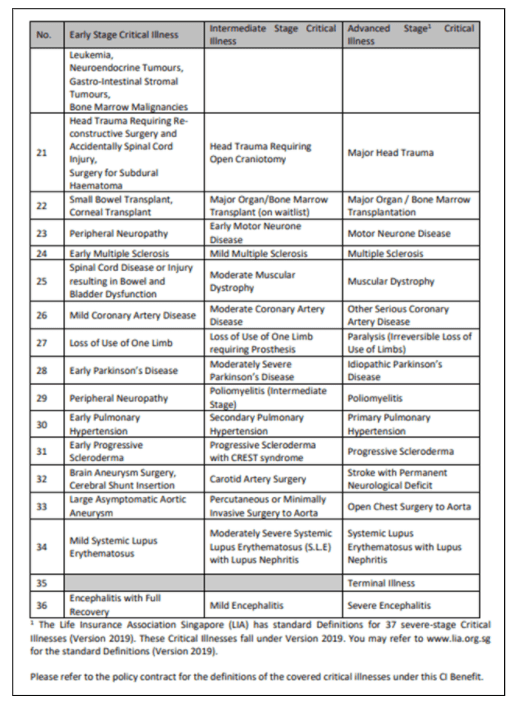

CIs Covered Under the Manulife Ready CompleteCare

Cover Me Again Benefit

The Cover Me Again is the multipay feature of the Manulife Ready CompleteCare and is optional.

If you’ve previously made a CI Benefit claim and don’t make any other CI claims within a year of the past date of diagnosis, your current sum insured will be restored to 100%.

There is no limit to the number of times this benefit may be activated, with the only catch being that the policy should be in-force.

Recurring Cancer Benefit

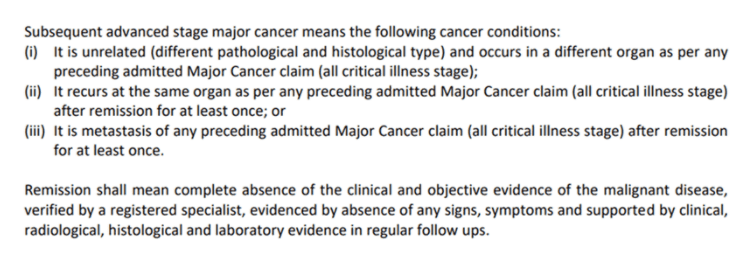

Should you be diagnosed with any subsequent advanced stage major cancer condition 2 years after any previous Major Cancer claim, Manulife will pay 100% of the basic sum insured.

However, the benefit is only payable up to a maximum of 2 times, with a limit of 200% of the basic sum insured.

Some additional things to note:

Additional Major Critical Illness Benefit

An additional 200% of the basic sum insured can be claimed if you are diagnosed with any of the covered advanced stage CIs listed below.

- Major Cancer

- Heart Attack of Specified Severity

- Stroke with Permanent Neurological Deficit

- Alzheimer’s Disease/Severe Dementia

- Multiple Sclerosis

- Idiopathic Parkinson’s Disease

However, this benefit is applied only once throughout the course of this policy, but the payout will not reduce the Current Sum Insured and is receivable in addition to the CI benefit.

Special Benefit

If you are diagnosed with any of the following covered illnesses or medical conditions listed, an additional 20% of the basic sum insured (limited to S$25,000 per life per condition) can be claimed, with no decrease of the Current Sum Insured.

| Until your 85th birthday: |

|

| Until your or your child’s 18th birthday: |

|

Note:

- Each illness or medical condition is limited to 1 claim

- Maximum of 6 claims receivable under this benefit

- For Angioplasty and other invasive treatment for coronary artery, the total amount payable under all policies covering the same life is limited to S$25,000

Serious Illness of a Child Benefit

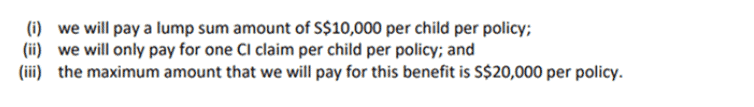

If ever your child is diagnosed with any of the covered Advanced Stage CI, a lump sum amount (subject to Limits of Compensation) will be paid.

Again, this pay-out does not affect the Current Sum Insured, but your child must be at least 30 days old but less than 18 years of age at the date of diagnosis.

Wellness Benefit

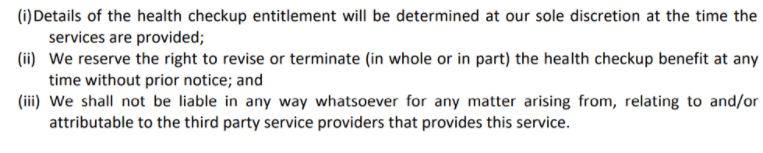

Every 2 years from the first policy anniversary, a health check-up will be provided by Manulife’s designated service provider, on the following conditions:

Main Product Conditions

The following is a rough consolidation, so you should read the actual terms and conditions and/or consult your financial advisor representative if you need further clarifications.

Waiting Period

The company will not pay the benefit for any of the stages of conditions of procedures if you encounter any of the following within 90 days of the policy issue date or reinstatement date:

- Major cancer

- heart attack of specified severity

- Other serious coronary artery diseases

- the diagnosis date of the condition that leads to coronary artery bypass surgery

- the diagnosis date of the condition that leads to angioplasty and other invasive treatment for coronary artery.

Survival Period

You must survive for minimally a week from the date of diagnosis of any covered illnesses or medical conditions before the applicable benefit is payable.

Otherwise, the death benefit will be applied instead.

Exclusions

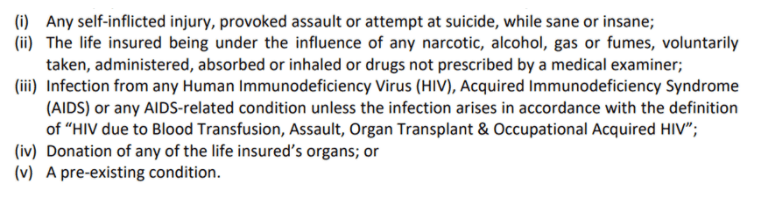

To CI Benefit, Additional Major CI Benefit, Recurring Cancer Benefit, and Special Benefit

No coverage if the illness or medical condition is caused by:

For Serious Illness of the Child Benefit

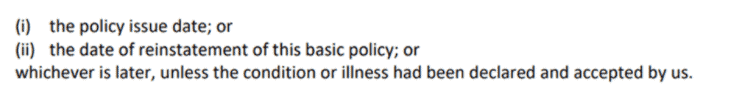

No coverage if the illness of your child is caused directly or indirectly, fully, or partly by pre-existing conditions, before:

For CI Benefit, Additional Major CI Benefit, Special Benefit, and Recurring Cancer Benefit

Manulife will not pay the increase in the basic sum insured if your sickness is caused by pre-existing conditions before the date of increase in basic sum insured, unless the conditions are declared to and approved by the company.

Should this happen, Manulife will only pay you the basic benefit sum for each of the above Benefits.

Limits of Compensation

For each early-stage and intermediate-stage CI claim, S$250,000 and S$350,000 will be the maximum to be paid under all policies Manulife is liable for of the same life.

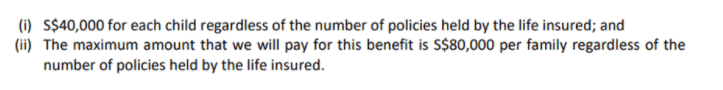

As for the Serious Illness of a Child Benefit, the pay-out is influenced by the following limitations:

If you have multiple policies that cover the aforementioned benefit, the maximum pay-outs are limited by:

Termination Clause

The Manulife Ready CompleteCare is considered terminated if the life insured

- Passes on

- Reaches the end of the policy term

- Wrote in to terminate the policy

- Lapsed the policy

- Fully claimed 500% of the basic sum insured under the CI benefit

Note: If you choose to end the policy as per clause (c), there is a prorated refund of your total unused premiums receivable, provided there are no claims paid by the company and that the policy is not a monthly premium payment mode.