The Singlife Choice Saver is a participating endowment plan that guarantees your capital at the end of the policy term.

This policy lets you set a savings goal that works for you and then offers flexible terms and bonuses to help you achieve them.

Here’s a comprehensive review of the Singlife Choice Saver to decide if it’s right for you.

Keep reading.

My Review of the Singlife Choice Saver

The Singlife Choice Saver is an excellent endowment plan designed to meet the savings and protection needs of individuals looking for a secure way to accumulate wealth while ensuring capital preservation.

This policy combines the benefits of savings with the security of life insurance coverage, making it a versatile financial planning tool.

Pros

1. Capital Guarantee: A standout feature of the Singlife Choice Saver is the guarantee of your capital upon the policy’s maturity. This assurance is crucial for conservative savers who prioritise the safety of their principal amount over high-risk, high-return investments.

2. Flexible Premium Payment and Policy Terms: The policy offers a wide range of premium payment terms (5 to 25 years) and policy terms (10 to 25 years or up to age 99), allowing you to tailor your savings plan according to your financial goals and life stages. This flexibility ensures that you can align your investment horizon with your long-term objectives, such as retirement planning or legacy building.

3. Comprehensive Protection Benefits: Besides its savings component, the Singlife Choice Saver provides a death benefit, including an accidental death benefit before the age of 80, and a terminal illness benefit. These protection features offer peace of mind, knowing that your loved ones are financially safeguarded in the event of unforeseen circumstances.

4. Potential for Bonus Accumulation: The policy participates in the insurer’s fund, offering the potential for annual reversionary bonuses and a terminal bonus. While these bonuses are not guaranteed, they can significantly enhance your policy’s value over time, potentially leading to higher payouts upon maturity or surrender.

5. Withdrawal Flexibility: You can withdraw accumulated reversionary bonuses, subject to a minimum amount, providing some liquidity during the policy term. This feature can be particularly useful in meeting unexpected financial needs without fully surrendering the policy.

Cons

1. Dependence on Fund Performance: While the capital is guaranteed, the actual returns, including reversionary and terminal bonuses, depend on the performance of the insurer’s participating fund. Singlife is ranked 4th among 8 positions in our comparison of participating funds in Singapore, so this isn’t a very strong selling point for them.

2. Limited Cash Withdrawal Benefits: Like most endowment plans, the Singlife Choice Saver does not offer cash withdrawal benefits beyond the reversionary bonuses. This limitation may restrict access to funds, especially for those who may require more flexibility in managing their savings.

The Singlife Choice Saver offers a balanced approach to saving and protection, making it suitable for you if you’re seeking a secure and flexible way to accumulate wealth while ensuring financial protection for your loved ones.

However, you should carefully consider the plan’s features, including the impact of fund performance on returns and the limitations regarding liquidity and coverage, to determine if it aligns with your financial goals and risk tolerance.

If you’re looking for a place to invest your money to make high returns on your capital, this is not the option for you.

Consider an ILP for that instead.

Although we consider the Singlife Choice Saver as one of the best endowment plans, if you’re interested in a savings plan, shopping around and comparing different endowment plans from multiple providers is key.

This is because different policies might suit different goals better.

For example, we think that the Manulife ReadyBuilder (II) is the best endowment plan if flexibility is necessary for you, while the NTUC Income Gro Saver Flex Pro is a pretty balanced endowment in terms of potential returns and flexibility offered.

Or if you like the Singlife brand, consider other Singlife endowment plans like the Singlife SteadyPay Saver.

Still, feeling unsure?

We recommend that you get a second opinion from an unbiased financial advisor on whether the Singlife Choice Saver is the best endowment plan for you.

With you about to commit to a premium payment term of up to 25 years, it’s essential that you take extra time to explore your options.

If you need someone to talk to for a second opinion or to get a comparison of endowment plans, we partner with unbiased financial advisors to help you with this.

Click here for a free second opinion.

Here’s more on what the Singlife Choice Saver offers.

Criteria

- The policy offers a wide range of premium payment options from 5 to 25 years.

- You can choose a policy term from a flexible range of 10 to 25 years OR coverage up to the Policy Anniversary following your 99th birthday.

General Features

Premium Payment Terms

With the Singlife Choice Saver, you can choose a premium payment term based on your needs – 5, 10, 12, 15, 18, 20, or 25 years.

The Singlife Choice Saver offers the following premium payment frequencies:

- Every month

- Once a quarter

- Semi-annually

- Annually

You may opt to pay your premiums using the following methods;

| Type | Payment Mode |

| Initial Premium |

|

| Renewing Your Premium |

|

Policy Term

You can select a policy term between 10 to 25 years or up until you are 99 years old.

Premium Allocation

100% of your investment is used to invest in the participating fund.

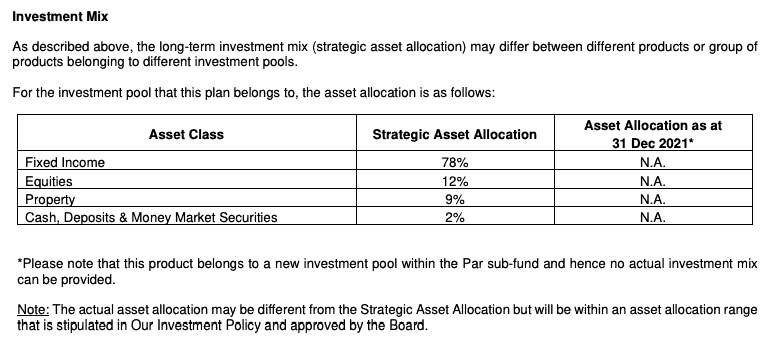

The asset allocation as of 31 December 2021 is seen below:

Payout Options

You will receive payouts when policy tenure ends, also called the maturity benefit.

This consists of the full Sum Assured, Reversionary Bonus (if any), and a Terminal Bonus.

A deduction will also be made for any debts owed on the policy before any payout.

Protection

Death Benefit

If death occurs during the policy tenure, your beneficiaries will receive the death benefit composed of 3 elements.

- Firstly, the payout will consist of the greater of 105% of premiums paid on your basic plan before the passing date or the guaranteed cash surrender value.

- Secondly, any accumulated reversionary bonuses will be added to the payout.

- Finally, if applicable, a terminal bonus will also be included.

Debts owed to the policy are deducted, and the death benefit terminates.

Accidental Death Benefit

If the policyholder passes away due to an accidental injury before their 80th birthday, the insurer will pay out 100% of the basic plan’s sum assured on top of the regular death benefit in one lump sum.

The maximum payout for accidental death benefits across all policies issued by Singlife (excluding Singlife Accident Guard) is $2,000,000.

Terminal Illness Benefit

If you become terminally ill during the policy tenure, you’ll receive the TI Benefit. The TI is paid as a lump sum, and the death benefit terminates once paid.

Terminal illness is an illness that will result in death within a year of the diagnosis, appointed by Singlife’s Medical Practitioners.

Waiver of Interest Benefit

The Waiver of Interest Benefits waives your premiums due to retrenchment or unemployment faced by your if you’re between 19 to 75.

Basically, if you lose your job and can’t pay your premiums, you can request to exercise this benefit.

Any unpaid premiums are free from accruing interest during the Waiver of Interest Period, which lasts up to 12 months or until you secure a stable job.

Just make sure to submit evidence of your situation within 6 months of the event.

Your overdue premiums will be waived off during the Waiver of Interest Period, but you must pay them off within 12 months from the end of the period.

However, if you default on payments, the unpaid premiums will accrue interest at a rate set by the provider. You can make use of this benefit two times over the policy term.

Key Features

Capital Guaranteed

Your capital is guaranteed upon maturity.

Reversionary Bonuses

You can receive a non-guaranteed bonus payment known as the Reversionary Bonus every year.

This bonus is based on your basic sum assured; for every $1,000, you could earn $5 in reversionary bonuses.

Once declared, this bonus becomes part of your guaranteed benefit and will compound under the accumulated reversionary bonus rates.

Terminal Bonus

You could be rewarded with a bonus upon maturity, policy surrender, or the unfortunate loss of the Life Assured.

Accumulated Reversionary Bonuses Withdrawals

Interestingly, you can withdraw a portion or your entire reversionary bonus as long as it meets the minimum amount of $1,000.

Partial or Full Policy Surrender

You can fully surrender your policy anytime for a lump sum payment of its cash surrender value, effectively ending your coverage.

Alternatively, you can choose a partial surrender, reducing your sum assured and receiving a portion of the cash surrender value in a lump sum.

However, these are subject to surrender charges.

To determine how much you’ll obtain from surrendering your policy, you will need to refer to your policy illustration.

Policy Loan

Should you need it, you may choose to take a policy loan to borrow up to 65% of your Cash Surrender Value minus any outstanding amounts owed.

But keep in mind the minimum loan amount and interest rate will depend on the time of application and may fluctuate based on prevailing conditions.

Change of Life Assured

You can make up to 3 changes to your life assurance policy after the first year, with satisfactory evidence of insurable interest.

Singlife Choice Saver Fees And Charges

The fees and charges you will incur are already calculated in the premiums you pay based on the sum assured you have selected.

When it comes to policies that invest in its participating funds, the biggest fees you’ll be paying are its expense ratios.

Expense Ratio

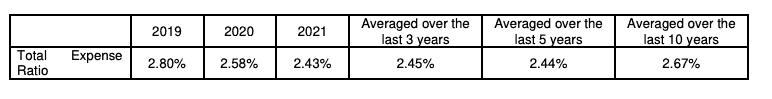

As of 31 December 2021, here are the expense ratios for the participating funds in the Singlife Choice Saver:

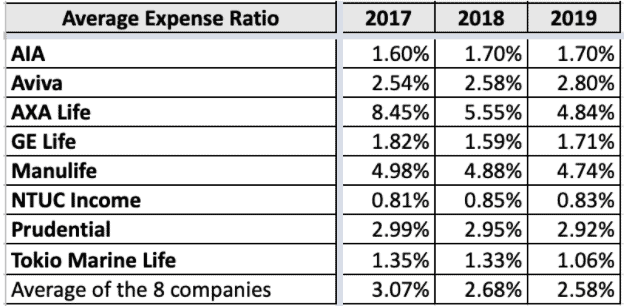

Singlife (previously Aviva) has expense ratios below the mean compared to industry averages.

Singlife Choice Saver Fund Performance

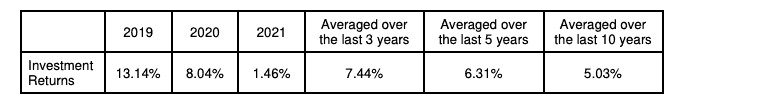

Here is how the participating funds that the Singlife Choice Saver invests in perform:

From 2019 to 2020, their par funds perform pretty well at above 8% returns. However, it dropped significantly in 2021 to 1.46% due to the pandemic – which is still better than negative.

The average performance of the annualised 10-year returns are at 5.03%, which is pretty good, especially when your investments will be with them for at least this long.

How does the Singlife Choice Saver work?

Peter is a 40-year-old family man who values financial stability and legacy.

With retirement on his mind, he decided to take matters into his own hands and secure his future with Singlife Choice Saver, a smart way to build up his savings.

By choosing a Sum Assured of a maximum cap of $100,000 and a policy term covering him until the ripe age of 99, Peter is paving the way to a comfortable retirement for himself and his wife.

And he’s not just thinking about himself; he wants to leave an inheritance for his son to cherish long after he’s gone.

With a 10-year premium payment term, Peter can rest easy knowing his financial goals are in good hands.

| Policy Year and Age | Event | Figures and Narration |

| Age 40 | Buys Singlife Choice Saver. | Sum Assured $100,000

Annual Premium $5,135.20 |

| Age 50 | Nominates son as the Life Assured | Total premiums paid $51,352 |

| Age 68

(27th year) |

Cash Surrender Value | $84,367

Where;

|

| Capital guaranteed, chooses to continue growing his savings | ||

| Age 80 | Transfers policy ownership to son. | – |

| Age 90 | Passes on. | – |

| Age 99 | Policy matures, son receives the maturity benefit | $431,088

Whereby;

|

The above figures are provided by Singlife and are based on an IIRR of 4.25% p.a. Take note that the actual returns you will receive are based on how the participating funds perform.

Singlife Choice Saver Summary

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Withdrawal Benefits | No |

| Health and Insurance Coverage | |

| Death | Yes (Including Accidental Death Benefit) |

| Total Permanent Disability | No |

| Terminal Illness | Yes |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Optional Add-on Riders | Yes |

| Additional Features and Benefits | Yes |