The Aviva MyEaserSaver has been renamed to Singlife Steadypay Saver as of 16 August 2022.

Want a policy that not only provides insurance coverage but helps you to save and accumulate money over the years?

A retirement plan like the Singlife Steadypay Saver can do just that for you.

Here’s our review of the Singlife Steadypay Saver:

My Review of the Singlife Steadypay Saver

Let’s dive into the Singlife Steadypay Saver, an endowment plan that’s caught our eye for its blend of savings and insurance benefits.

If you’re on the lookout for a financial product that not only offers coverage but also helps you grow your savings, this might just be what you need.

Here’s a closer look at what makes this policy stand out, along with some aspects that might give you pause.

What Stands Out:

- Age Flexibility: The policy welcomes holders from 17 to 99 years old, making it accessible to a wide audience. Interestingly, it allows for assured individuals as young as 1 year old, offering a unique opportunity to start financial planning early for your children.

- Premium Payment Terms: You have the flexibility to choose from 12, 15, 18, and 25-year payment durations. This variety ensures that you can find a term that aligns with your financial planning.

- Payout Options: From the second year, you’ll start receiving guaranteed cash benefits, amounting to 5% of your sum assured annually until the year before your policy matures. Alternatively, you can reinvest these payouts with Singlife for potential interest returns, though these are not guaranteed.

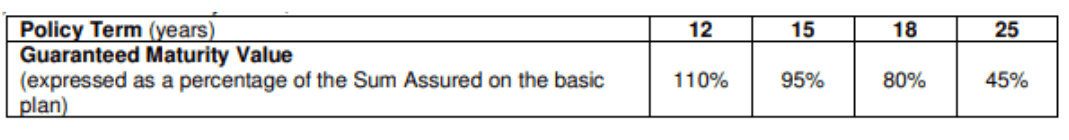

- Maturity Benefits: Upon maturity, you’re eligible for a guaranteed payout, the amount of which depends on your chosen payment term. This is a clear advantage for those looking to secure a definite sum in the future.

Considerations:

- New Product: Given that the Singlife Steadypay Saver was launched in July 2021, there’s no track record of asset allocation or past performance. This uncertainty might be a concern for those who prefer investing in products with a proven history. Singlife’s average par fund performance also doesn’t perform as well as Manulife’s and NTUC Income’s.

- Premium Commitment: With a minimum premium payment duration of 12 years, you’re committing to a long-term financial obligation. It’s crucial to consider whether this fits into your overall financial plan, especially since early surrender could result in significant losses.

Despite the appealing features of the Singlife Steadypay Saver, I strongly recommend getting a second opinion or comparing it with other policies.

The commitment to premium payments over an extended period, such as 30 years, necessitates thorough research to avoid any financial missteps.

For instance, we consider the Manulife RetireReady Plus (III) and the NTUC Income Gro Retire Flex Pro as better alternatives.

But as different individuals have differing needs, what we consider good for ourselves might not be good for you, so consider reading our post on the best retirement plans in Singapore.

This will provide you with a comparative analysis to ensure you’re making an informed decision.

Moreover, we partner with unbiased financial advisors to offer you a free second opinion/comparison session.

This step is crucial to ensure that the policy aligns with your financial goals and circumstances.

Click here for a free comparison session.

Let’s breakdown the Singlife Steadypay Saver in detail:

Criteria

- No medical underwriting is required.

- Minimum premium payment duration of 12 years.

- The minimum age to hold the policy is 17 and the maximum age is 99

- The minimum age to be assured is 1.

Features

Policy Terms

The age range where you can hold the Singlife Steadypay Saver is from 17 to 99 years old.

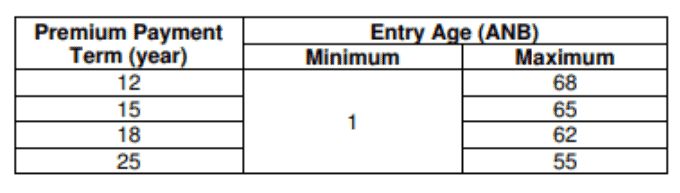

However, the minimum age to be assured is 1 (as shown below) regardless of the payment term you choose. This also means that you can purchase this plan for your children.

Here, the table shows the different premium payment terms you can choose from along with the corresponding minimum and maximum age to be assured by the plan

As you can observe above, you are able to select from payment durations of 12, 15, 18, and 25 years.

Premium Allocation

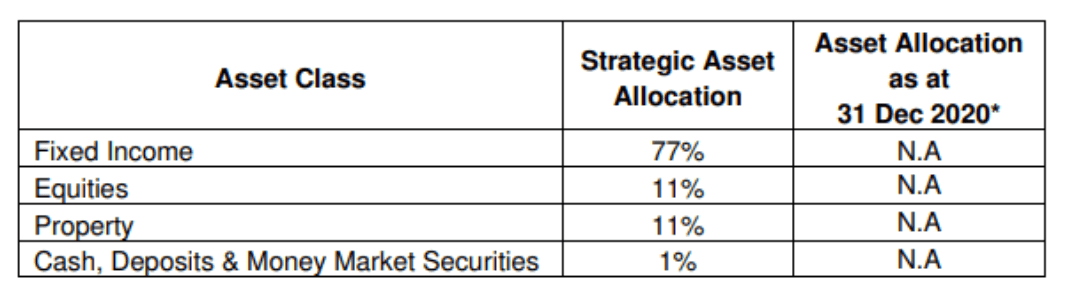

As the Singlife Steadypay Saver was only launched in July 2021, there is no actual asset allocation to present.

Nevertheless, Singlife aims to follow the strategic asset allocation as shown below.

Payout Options

As with most endowment plans, you will have 2 payout options under the Singlife Steadypay Saver as well.

With the first option, you can start receiving your guaranteed cash benefit from your 2nd policy year until the year before your policy matures. In other words, if you have chosen the 12-year payment term, you will receive the cash benefit payouts from your 2nd to your 11th policy year.

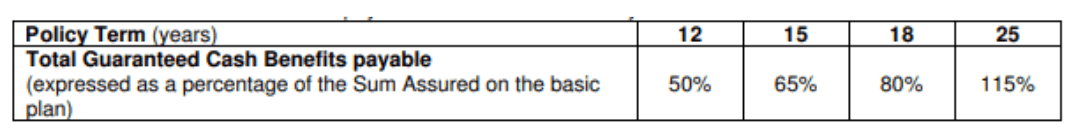

Each payout would amount to 5% of your sum assured and is made at the end of each payable policy year. Hence as you can see in the table below, the total cash benefit payable at the end policy year would differ according to your chosen term.

As usual, any amount that is owed to the company will first be deducted.

For the second option, you can choose to invest your cash benefits back with Singlife to reap interest returns. However, do note that the interest rate is not guaranteed.

Maturity Benefits

When your plan matures you are eligible to receive a guaranteed amount of maturity benefit.

The amount you will receive depends on the payment term that you pick, as observed in the table above.

Similar to the cash benefits, amounts owed to Singlife would be subtracted from your maturity value beforehand.

Bonus features

Bonuses under the Singlife Steadypay Saver are non-guaranteed as they depend on how much profits the participating fund earns.

Reversionary Bonus

When Singlife deems the participating fund to have sufficient surplus, they can announce a reversionary bonus (RB) to be paid out to you on your next policy anniversary.

Once the company declares the RB, it will become a guaranteed benefit to you which may be withdrawn (More under Flexibility section below)

Terminal Bonus

You may receive a terminal bonus (TB) that is determined by Singlife if the following situations happen.

- Your policy matures; or

- You surrender your plan; or

- The insured person dies.

The TB is tabulated by multiplying your corresponding TB rate by your accumulated RB.

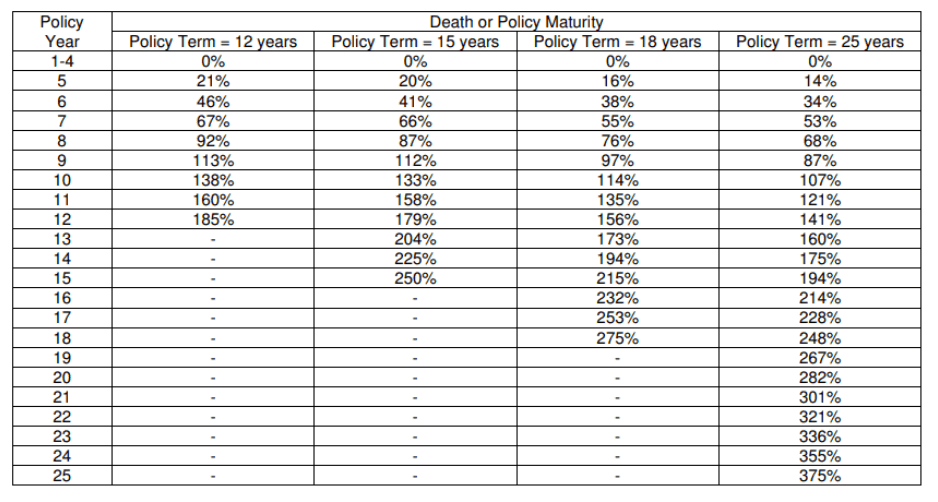

Here, the table shows the different TB rates based on the different policy years the person insured passes on or the policy matures.

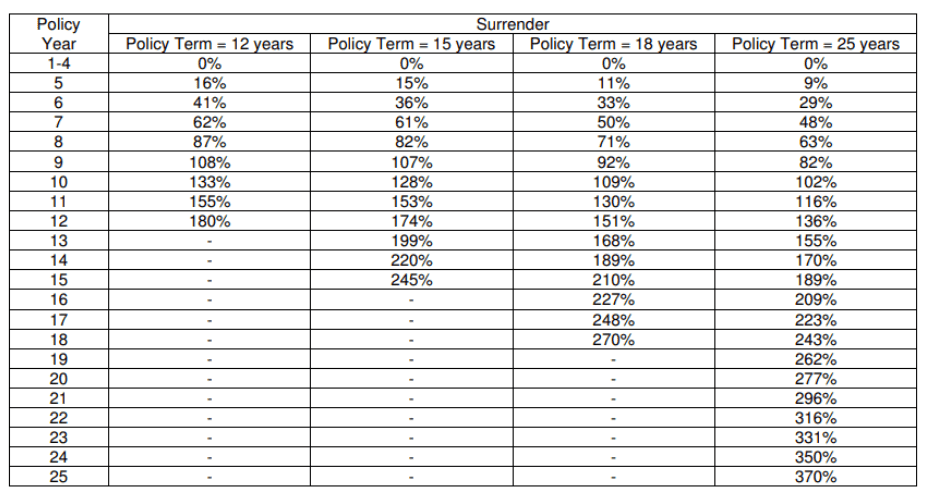

If you decide to surrender your plan, your TB rates based on the policy year you decide to do so can be observed below.

Both tables assume that the participating fund earns a return rate of 4.75% per annum. However, your participating fund’s actual rate of return would probably not be the same.

Past rate of return of the investment

As mentioned before, the Singlife Steadypay Saver is newly launched this year and thus does not have any past rate of return yet.

Protection

Death Benefit

In the unfortunate event that you pass on, the following death benefit will be paid out to your loved ones.

| 1. | The higher of: | 101% of your sum of premiums paid (pertaining to basic plan only) less any cash benefits already paid out; or |

| Your guaranteed cash surrender value (See more under Surrender/Ending the Policy section) | ||

| 2. | Any reversionary and terminal bonus which you have accumulated. | |

| 3. | Any cash benefits that you have invested back with Singlife. | |

| 4. | Less any sum owed to Singlife. | |

Accidental Death Benefit

Not only will the family receive a death benefit when the insured passes on from an accidental injury before the age of 80, but they will also receive an additional 100% of the sum assured on the basic policy.

However, the accidental death benefit is subject to a maximum of S$2,000,000.

Singlife refers to accidental death as an unexpected and unintentional event, which is not a sickness, that causes the death of the assured.

The accidental death benefit will also be paid out if the insured suffers from an accidental injury that is the sole cause of death. (Within 180 days from the accident)

Terminal Illness Benefit

The insured shall receive the terminal illness benefit as an advance of the death benefit should he/she be diagnosed with a terminal illness (TI) during the effective period of the plan.

The company defined TI as a diagnosis of a sickness that is expected to result in the assured’s death in a span of 12 months.

Naturally, the TI diagnosis has to be provided by a specialist and also verified by Singlife’s registered medical doctor.

Do note that if the insured suffers from Human Immunodeficiency Virus (HIV) infection, he/she will not be eligible for this benefit.

Flexibility

Withdrawal of cash benefits re-invested with the company

Say you have chosen to invest your cash benefits back with Singlife, you have the option to withdraw the full sum or a portion of it. You can do this by hand in your application of withdrawal to the company.

However, you have to withdraw at least S$1,000 or whatever sum you have left in your balance.

Withdrawal of Reversionary Bonus accumulated

You also have the option of withdrawing a part of or the full figure of your accumulated reversionary bonus. Likewise, there is a minimum withdrawal amount of S$1,000 or your available balance.

Policy Loan

With your Singlife Steadypay Saver policy, you have the option to take on a loan from your policy. You can borrow a maximum of 65% of your Cash Surrender Value net of any amounts owed to Singlife, at a non-guaranteed interest rate.

However, be mindful that you will have to abide by the minimum loan amount and policy loan rate set at that point in time.

Termination of the Policy

Your plan shall no longer be in force and terminated on the date when:

- The person insured dies;

- Your death, accidental death, TI, or maturity benefit is paid out by Singlife fully;

- Your grace period ends from non-payment of your premium due;

- Your request for your policy to be terminated is accepted by Singlife (Surrendering your policy, see more in next section);

- Any other events as stated in your policy happen, which would cause the cessation of your plan.

An exception to this would be if suicide is committed by the insured person during the first year from the commencement of or last reinstatement date of his/her policy. In this situation, the policy would become void instantly before the date of death.

Surrendering of the policy

As long as you pay your premiums on time, your policy shall accumulate a cash value starting from the 3rd policy year. You will receive this cash surrender value when you surrender your plan fully, which effectively terminates your policy as well.

Besides fully surrendering your plan, you may also choose to surrender part of your plan to receive a portion of your cash surrender value. This may be useful in the event that you require a sum of cash to tide you over a rough financial period or help you attain a goal of yours, such as purchasing a property.

Still, it is important to note that by partially surrendering your policy, you lower your sum assured and your guaranteed cash benefits to be paid out to you in the future.

Furthermore, by surrendering your plan early, you would incur huge costs which would greatly reduce your cash surrender figure. It may even possibly lower your surrender value to zero.

Coverage Add-ons (Riders)

You have the option to add on the following riders for additional security and peace of mind.

| Easy Term | Receive a maximum of 5 times your basic plan’s annual premium, should you (person insured):

|

| Cancer Premium Waiver II | Waives future premiums for you if you receive a diagnosis of major cancer. |

| Critical Illness Premium Waiver II | Waives your future premiums if you are diagnosed with critical illness of a severe stage, which is covered by Singlife. |

Besides these riders, you may also speak to your trusted financial advisor for more riders which you can add to your plan.

Hassle-free Application

You will be happy to note that no medical underwriting is required under this plan which makes it so easy to apply for.

Fees and charges

There are essentially zero fees and charges due to the fact that they have already been factored into your premium amounts.

How much will I receive upon maturity of the Singlife Steadypay Saver?

The timeline above assumes that the participating fund is performing at a 4.75% rate of return (ROR) and the sum assured is S$25,000.

In the scenario where you don’t make any withdrawals and accumulate the full amount, save S$261.05 monthly, choose the 15-year premium payment term, you would receive a total benefits figure of S$49,651 throughout the years that the policy is in force.

Below are the calculations:

Total Premiums Paid:

S$261.05 x 12 months X 15 years = S$46,989

| Guaranteed Portion | Non-Guaranteed Portion | |

| Policy Year 2-14 | S$1,250 x 13 years = S$16,250 | – |

| Policy Year 15 (Maturity Benefits) | 95% x S$25,000 = S$23,750

Since the insured selected the 15-Year term, his maturity benefit is 95% of his sum assured as stated in the table from the Maturity Benefit Section. |

Potential Bonus: S$9,651

The potential bonus is made up of amounts from your RB and TB which depends on the participating fund’s performance. |

| Total | S$40,000 | S$9,651 |

| Grand Total: | S$49,651 | |