The Manulife ReadyBuilder is now obsolete and is replaced by the Manulife ReadyBuilder (II).

The Manulife ReadyBuilder is classified as a savings endowment plan which provides you with much flexibility with withdrawals and the option to transfer to your children.

Not sure if this is good for you?

Here’s our review of the Manulife ReadyBuilder.

My Review on Manulife ReadyBuilder

I think that the Manulife ReadyBuilder is a decent option for you should you require discipline in saving your money.

After 15 years, you officially break even and all your returns are based on the participating fund performance.

The Manulife ReadyBuilder’s 5-year average return on their investment is 4.51%, which is pretty impressive given that this is a savings plan and not an investment plan.

Furthermore, Manulife’s participating funds have the best annualised return rate across all insurers over all time periods.

| Insurer | Geometric Mean | 3-Year Geometric Mean (2020-2022) | 5-Year Geometric Mean (2018-2022) | 10-Year Geometric Mean (2013-2022) | 15-Year Geometric Mean (2008-2022) |

|---|---|---|---|---|---|

| AIA | 3.88% | 0.25% | 1.88% | 3.33% | 3.53% |

| Etiqa | 4.17% | – | – | – | – |

| Great Eastern | 4.14% | 0.48% | 2.15% | 3.69% | 3.43% |

| HSBC Life | 2.80% | -4.24% | -0.58% | 1.59% | 1.99% |

| Manulife | 4.65% | 1.17% | 2.74% | 3.17% | 3.65% |

| NTUC Income | 4.49% | 2.84% | 3.74% | 4.09% | 3.58% |

| Prudential | 3.62% | -3.50% | -0.26% | 2.82% | 2.64% |

| Singlife | 3.57% | -1.79% | 0.65% | 2.37% | 2.82% |

| Tokio Marine | 4.22% | -3.54% | -0.22% | 2.10% | 2.43% |

As you can see, with 3.65% p.a in annualise returns over 15-years, Manulife’s participating funds outperform its competitors and is the closest to the illustrations provided in your quotations.

Usually, I’m not a big fan of endowment plans. This is because I am still young and would like to have my money liquid and easily accessible.

However, I see the value in this plan for those who require a low-risk option to save and potentially grow their money – especially if you’re expecting to use this money for a big expense.

And since you’ll be saving for a long-period of time (5 to 20 years), you need to make sure that you’re choosing the right policy for your specific needs.

You don’t want to be committed to a policy only to realise years down the road that it’s not suited for you at all.

That’s why it’s important to get a second opinion, especially from an unbiased opinion, as to whether the Manulife ReadyBuilder is the best policy for you or if there are better alternatives.

if you need someone to get a second opinion from, we partner with MAS-licensed financial advisors who has helped hundreds of our readers in this exact situation – and they can assist you too!

Criteria

- Minimum premium of S$1,159.33 yearly.

- No medical underwriting needed.

Features

Policy Terms

Under Manulife ReadyBuilder, you can choose from 4 premium payment terms 5, 10, 15, or 20 years. If you can afford to, Manulife also accepts a single lump-sum premium payment under this plan.

The table below shows the corresponding minimum premium amount for your selected payment term:

| Premium payment term | Minimum annual premium amount (S$) | Minimum sum assured (S$) |

| Single | 9,909.09 | 10,900 |

| 5 years | 4,645.22 | 25,200 |

| 10 years | 2,325.79 | 24,500 |

| 15 years | 1,741.94 | 24,300 |

| 20 years | 1,159.33 | 19,200 |

The above table is set out under the assumption that the person insured is a 24-year-old female, who is a non-smoker.

Premium Allocation

Since minimum premium amounts are net, which means that fees and charges have already been factored in, 100% of your premiums paid will be allocated to purchase the participating fund units.

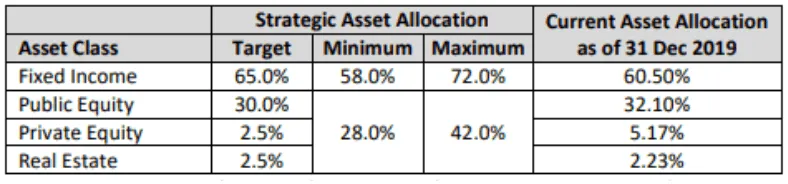

Manulife aims to use the following asset allocation to ensure that your policy stays solvent, attain the guaranteed benefit, and draw off new opportunities.

Your guaranteed benefits are mainly derived from bonds, which are a fixed income asset class. The fixed income asset class also includes cash and money market instruments.

The use of public equity, private equity, and real estate assets generates your non-guaranteed bonuses as they furnish higher returns to investors.

Payout Options

There are 2 choices for withdrawal of cash value under this plan, namely Bonus withdrawal or Cash-in the policy.

With the bonus withdrawal option, you can take out part of or the entire cash-in value of your accumulated bonus and your cash-in bonus.

Your plan would accordingly lose some cash value.

Likewise for cash-in the policy option, you are able to cash in a part of or all of your policy.

However if you have chosen to only cash in a selected portion of your policy, be mindful that your insured amount, future premiums payable, and future cash value of your plan will be decreased.

If you have opted to make a single premium, you are allowed to make a cash-value withdrawal once your policy becomes valid.

Otherwise, if you have chosen to make regular premium payments instead, you can only make the withdrawals after making premium payments for 3 years and your policy is in effect.

Cashing in your policy basically refers to “selling” or “surrendering” your policy in exchange for money.

To put it simply, you can either make withdrawals/payouts from your bonuses or the actual account value (guaranteed portion).

Maturity Benefits

If you did not perform any withdrawals while your policy was in force, you will receive the benefits when the plan matures on the policy anniversary right after your 120th birthday (maturity date).

You shall receive the following benefits upon the maturity date:

- Your guaranteed cash-in value;

- Your accumulated reversionary bonus (if any); and

- Any non-guaranteed cash-in bonus as at maturity date.

Manulife will deduct off any amounts owed to them first.

Bonus features

The bonuses that you will receive are non-guaranteed and is dependent on how the policy’s participating fund is performing. The bonus levels are announced every year (if any) after taking into consideration the performance of the funds.

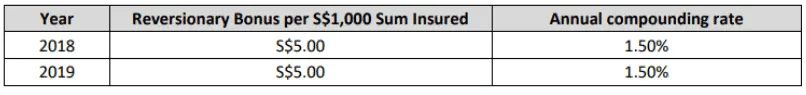

Reversionary Bonus

The reversionary bonus refers to amounts that are declared by Manulife to be given to you, which will be accumulated in your policy and are to be paid out on your plan’s maturity date.

Once the reversionary bonus is announced, it will become a guaranteed benefit to you, regardless of how the participating fund performs.

Here are the reversionary bonus amounts declared in previous years.

The compounding rate is used to calculate the interest amount based on your reversionary bonus amount. This tabulated interest value will then be included with your accumulated reversionary bonuses, which now acts as the base for the next compounding.

Please be mindful that bonus amounts of the past do not necessarily indicate nor predict future bonuses declared.

Surrender (Cash-in) Bonus

A cash-in bonus might be declared by Manulife when you cash in your policy, which is calculated as a percentage of your accumulated reversionary bonus’s cash-in amount.

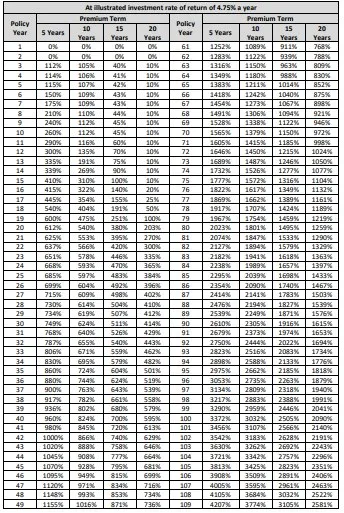

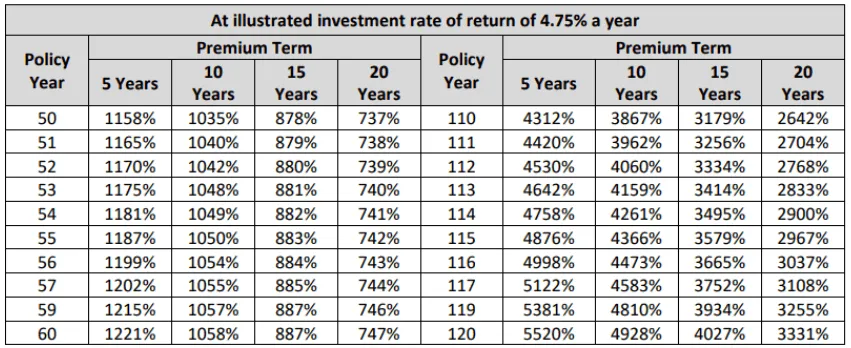

The table below shows the percentages that change accordingly with the policy year.

However, do note that the percentages will adjust upwards or downwards according to the actual rate of return of the participating fund. The percentages in the table are portrayed with a 4.75% rate of return and are for illustration purposes only.

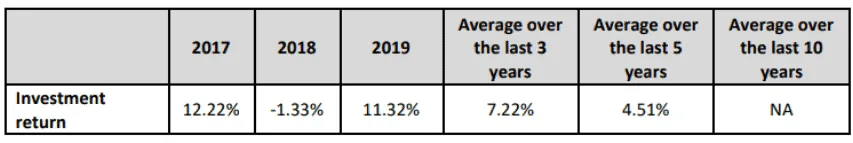

Past rate of return of the investment

The following table shows the net past rate of return of the participating fund, whereby the expenses have already been subtracted.

Please remember that the above return rates are historical rates and do not predict future performances.

Protection

The coverage under Manulife ReadyBuilder is as follows:

On the onset of death of the insured, the higher of 105% of your paid premiums or 101% of your cash-in value will be paid out. Naturally, any amounts owing to Manulife will be subtracted off first.

It is also possible for the above-mentioned death benefit to be paid out should the insured individual be found to have a terminal illness (TI) during the policy term.

However, the maximum amount to be paid out for TI is S$1 million. Furthermore, the maximum amount to be paid out for both TI and critical illness is S$2 million.

Manulife deems a TI to be a sickness whereby the infected person is expected to die in 12 months from the diagnosis date provided by a medical examiner. However, this diagnosis will have to be confirmed by Manulife’s appointed medical examiner as well.

In addition, if you suffer from a total or permanent disability (TPD) before your premium payment term ends or on your TPD expiry date, you will be eligible for a waiver of future basic premiums.

The TPD expiry date refers to the anniversary date of your policy right after you turn 70 years old.

The TPD definition differs according to the insured person’s age, as shown in the table below.

| Period classification | TPD Definition |

| Before the insured person’s 18th birthday* | Due to an accident or sickness, for 6 successive months:

|

| Duration after the insured person’s 18th birthday* and after his / her 65th birthday* | Due to an accident or sickness, for 6 consecutive months:

OR

|

| Duration after the insured person’s 65th birthday* and the TPD expiry date | Due to an accident or sickness, for 6 consecutive months:

|

| At any age before the TPD expiry date | For minimally 6 months, the insured has

|

* The exact date occurs on the policy anniversary right after the indicated birthday. ** Click here for the 6 activities of daily living | |

Flexibility

2 years interest-free loan

Under Manulife ReadyBuilder, you have the option to take an interest-free loan of up to 50% from them up to 2 times. As long as all premiums have been paid and your policy is still active, you are eligible for this loan.

With an interest-free loan, you can not only save money by not paying interest, but you can also put the money to better or more urgent use.

You could, for instance, use the loan to finance an expensive purchase towards achieving a goal or dream you have. The loan can also be used to pay off large bills that will incur penalties if not paid on time.

However, Manulife did not indicate if the loan amount will come from your policy or from the company itself.

Should you be unable to repay the loan after the 2 years is up, a non-guaranteed interest rate will be charged. A notice will be provided 30 days in advance if there are changes to the interest rate to be charged.

Premium freeze

Premium freeze here refers to stopping premium payment for a year while your policy is still valid. For this to apply, your policy must have been in force for 2 policy years, during which you have fully paid all premiums.

Once your application for a premium freeze is accepted, your regular premiums and premiums for any riders taken on will not need to be paid for 1 year, starting from the next premium payment date.

Naturally, there will be no declaration of bonuses for the duration. Furthermore, the maturity date and premium payment term will be pushed back a year

If you have selected the 5-year premium payment term, you can only apply for the premium freeze once.

Should you have chosen the other premium payment terms (10,15, and 20 years), you can apply for the premium freeze twice.

Secondary life insured

By appointing your child as a secondary life insured (SLI), you can ensure that the policy continues after your death for greater wealth accumulation.

As an option, Manulife ReadyBuilder lets you add a second person to your policy during the application process or during the policy term.

This is provided that your policy is in force.

Furthermore, you are allowed to change the SLI up to 3 times within your policy term. Only the policyholder from the policy start date, who is also the primary life insured (PLI), can appoint, change and remove an SLI.

The exceptions to this rule are when:

- Your policy has a nomination of the beneficiary; or

- Your policy has a trust.

When the PLI passes away, the SLI will become the plan’s new insured person and the plan stays valid. The SLI will receive the benefits mentioned in the policy and will also need to continue any premium payments. However, any attached optional riders will now be cancelled.

The plan will continue to be in force until the earlier of

- The date when the SLI passes away; or

- The policy’s original maturity date.

Change of life insured

Change of life insured will only be relevant if a corporation holds the policy.

This flexible option will only be useful on the condition that the policy is assigned from one corporation to another corporation.

Should the person who is insured discontinue employment with the owner of the policy, the life insured may be changed upon request, so long as it has been 2 years since the policy issue date.

The new person to be insured will have to be alive on the new policy effective date and the policy’s owner (corporation) must have an insurable interest on the new person insured on the change date.

Of course, this request would be subjected to Manulife’s approval, whereby a fee might be charged.

Surrender/Ending the Policy

Your Manulife ReadyBuilder policy ends at the earliest of the following:

- When your request to end the policy is received by Manulife;

- When the policy lapses;

- When the PLI dies and there is no SLI appointed;

- When the SLI dies, provided that the SLI become the new life insured;

- On the benefits end date shown on the schedule page; or

- When the death benefit is paid out fully

In the event that you surrender (cash-in) your plan, you will obtain the following benefits:

- The guaranteed cash-in value;

- Any cash-in value of the accumulated reversionary bonus; and

- Any non-guaranteed cash-in bonus

Likewise, Manulife will subtract off any amounts that you owe to them first.

The surrender benefit is only applicable after you have made full premium payments for 3 years and your plan is still in effect.

Manulife ReadyBuilder Surrender Value

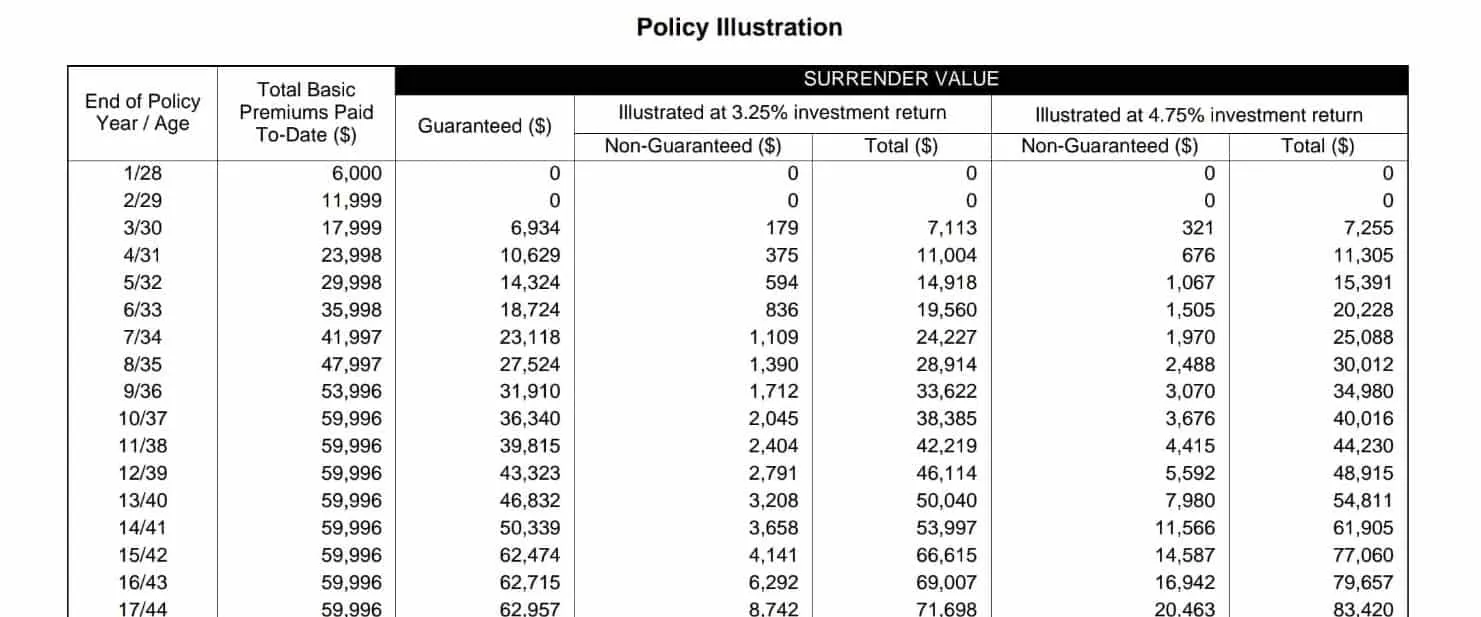

Here’s a snippet of the benefit illustration (BI) of someone who’s saving about $6,000 every year for 10 years with the Manulife ReadyBuilder. As you can see, the individual will save up to $60,000 during this period.

The guaranteed portion of this plan allows him to “breakeven” at the 15th policy year with $62,474 should he surrender then. Now, many financial advisors would try to sell you the policy based on both the non-guaranteed and guaranteed portion of the plan.

Although they are not wrong to do so, here are some reasons why we only look at the guaranteed portion.

- This is what you are sure to get when you surrender the plan. Anything more is a bonus to you as you might or might not get it.

- The BI’s returns are based on an illustrated value. This means you could receive much less or much more in your non-guaranteed portion depending on the performance of the investment (note that this is not an investment plan).

However, you shouldn’t ignore the non-guaranteed portion entirely. Even though the insurer can claim that there are no returns for you in that portion, it makes little to no business sense to do so.

If they do this to their customers, imagine the backlash and the potential legal issues they will face. So they will almost always include the non-guaranteed portion, just that the exact amount is usually unknown.

Hassle-free Application

You will not need to answer any questions regarding your health in your application for this plan, which means no underwriting is needed. You can put your mind at ease that your application is guaranteed to be accepted by Manulife.

Coverage Add-ons (Riders)

Manulife offers additional optional riders which cover critical illness, disability or death.

There was not much information provided in Manulife’s product information but other sources have mentioned that the following riders are offered.

- Joint Life Premium Waiver

- Easy Payer Premium Waiver

- Cancer Premium Waiver

- Critical Illness Premium Waiver

- Payer Critical Illness Premium Waiver

Fees and charges

You will be happy to note that there is essentially no fees and charges for the policy due to the fact that the minimum premium amounts mentioned above are net, meaning that the fees and charges have already been factored in beforehand.

How much will I receive upon maturity of the Manulife ReadyBuilder?

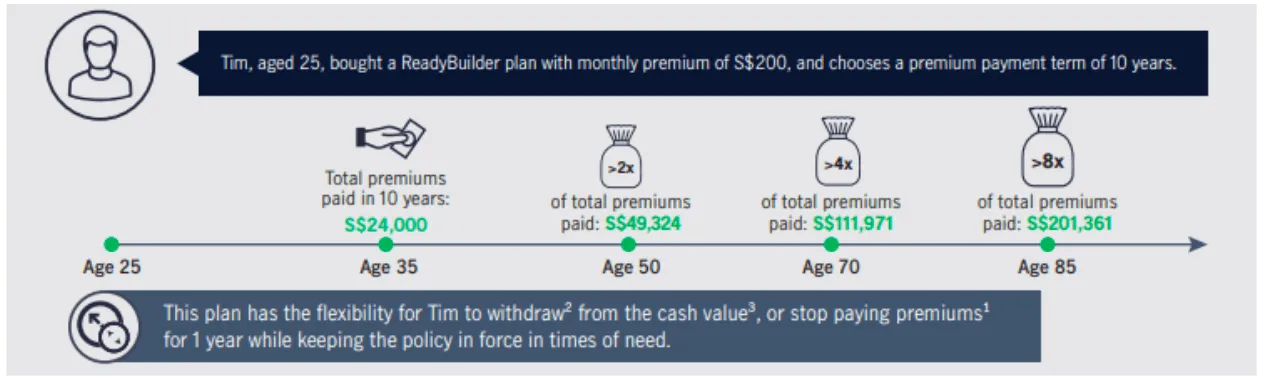

The timeline above is under the assumption that the participating fund is performing at a 4.75% return rate.

In the scenario where you don’t make any withdrawals and accumulate the full amount, save $2,400 yearly, and choose the 10-year term, you will receive a total of S$201,361 upon maturity at the age of 85.

However, the policy actually matures when you turn 120, so imagine how much more your investment could grow and be left behind for your children and dependents.

As mentioned in the illustration above, policyholders have the choice to withdraw cash value from their plan. Yet, please bear in mind that by doing withdrawals you will reduce the long term value of your plan.

Likewise, by taking on the premium freeze option there will be consequences as well. You will not receive any bonuses declared in that year (if any) and both your payment term and your maturity date will be delayed by 1 year too.

References

https://www.manulife.com.sg/en/solutions/save/savings-plans/ready-builder.html