NTUC Income Gro Saver Flex Pro is an endowment and savings policy offered by NTUC Income.

The plan is designed to help you save for mid- to long-term financial goals while offering flexibility and protection.

Here’s our review of the NTUC Income Gro Saver Flex Pro. Keep reading!

My Review of the NTUC Income Gro Saver Flex Pro

The NTUC Income Gro Saver Flex Pro is pretty good as it offers flexible premium payment terms, policy terms, and a wide array of features and riders for you.

Firstly, you can get another insurance policy with NTUC Income upon hitting the major milestone indicated, ensuring you can always increase your coverage when needed – even if you’re uninsurable.

You can make partial withdrawals through partial surrenders, which is a plus given that this is an endowment plan and withdrawals are generally not to be expected.

And, of course, the riders – more specifically, the Savings Protector Pro – which gives the life insured 2 years’ worth of premiums upon TPD and waives off all future premiums!

Not forgetting its Retrenchment Benefit that makes sure you receive the support you’ll need should you get retrenched for work.

In terms of fund performance, NTUC Income has the best-performing par funds across 3, 5, and 10 years and the second-best performance over 15 years, just behind Manulife – making it a highly attractive option for long-term savers.

We’ve also named it the best endowment plan and the best SRS endowment plan in Singapore.

I would say the NTUC Income Gro Saver Flex Pro would be for those looking to save money for medium-term life goals, such as a child’s education or buying a new house.

As usual, it is important for you to carefully consider your financial goals and needs before committing to any financial product.

You can start by understanding the different types of products available, and if endowment plans are something you’re looking for, our post on the best endowment plans will help.

Even though we really like the NTUC Income Gro Saver Flex Pro, you should still get a second opinion of this policy as what’s good for me might not be good for you.

And if you’re about to commit to an endowment plan for the next 10 years minimally, you definitely want to choose the best.

If you’d like to get a second opinion or compare policies, we partner with unbiased financial advisors who can help you with this.

Click here for a free comparison session.

Now let’s explore what the NTUC Income Gro Saver Flex Pro has to offer in detail.

Criteria

- Coverage Term: Minimum 10 years; Maximum till 120 years old.

General Features

Premium Payments

There are options for you when deciding on the premium payment terms – Single, 5, 10, 15, 20, 25, or 30 years.

Based on the premium payment terms selected, the policy term ranges.

| Premium Payment Term (Years) | Policy Term (Years) |

| Single Premium | 10, 15, 20, 25, 30, or till age 120 |

| 5 | |

| 10 | 15, 20, 25, 30, or till age 120 |

| 15 | 20, 25, 30, or till age 120 |

| 20 | 25, 30, or till age 120 |

| 25 | 30 or till age 120 |

| 30 | Till age 120 |

There are 2 choices for you to make your premium payments – Cash or your Supplementary Retirement Scheme (SRS) account.

Payout Options

Once the policy matures at the end of the policy term, you will be given the maturity benefit – also known as the surrender value.

Take a look at your policy summary to determine how much you’re expected to receive upon maturity.

However, if a loan was taken against the policy, that amount plus any interest would be removed from the payout.

The policy will also terminate after this payout.

Premium Allocation

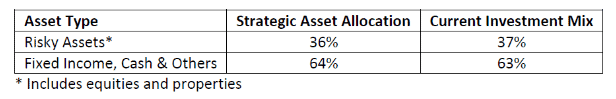

To make the most of your investment in an endowment or annuity plan, it’s crucial to keep an eye on the participating fund’s performance.

This is where most, if not all, your premiums will be allocated.

This could spell the difference between a healthy return on investment and a disappointing result at the end of the day.

The participating fund puts its money into many different investments like stocks, bonds, property, and cash, with some doing better than others.

Hence, the fund might change the mix of investments to ensure it does well and meets its goals.

Here is the investment mix as of 31 December 2021.

Protection

Death Benefit

Should the life insured pass away while the insurance policy is still active, their loved ones will receive a payout.

This payout will be either 105% of all the money paid in premiums, or 101% of the policy’s surrender value, whichever is more.

If the policyholder had taken a loan against the policy, that amount plus any interest would be removed from the payout.

Once the payout is made, the policy will terminate.

If a secondary person was named to take over the policy in case of the death of the life insured, then their loved ones won’t receive the payout.

Instead, the secondary assured takes over the policy and continues with it.

Terminal Illness (TI) Benefit

Should the life insured be diagnosed with a terminal illness while the insurance policy is still in effect, the policy will pay out.

The payout will be either 105% of all the money paid in premiums, or 101% of the policy’s surrender value, whichever is more.

After this payout, the policy will then be terminated.

However, if there is a named secondary assured to take over the policy, the terminal illness benefit will not be paid if something happens to the life assured.

Instead, the secondary assured becomes the new insured.

Optional Add-On Riders

Savings Protector Pro

If the life assured becomes totally and permanently disabled after turning 70, future premiums are waived for your basic policy.

The policy will still be active, and they’ll get a lump sum payment equal to 2 years’ worth of premiums.

The Savings Protector Pro also has a Retrenchment Benefit –

Retrenchment Benefit

In the unfortunate scenario of being laid off and being unable to find employment for the next 3 months, you’ll also be covered and not have to pay premiums for your basic policy for 6 months.

If you’re still jobless after the 5th month, you can defer payment for the next 6 months.

This gives you peace of mind knowing you’re still covered even if you’re out of work.

Cancer Premium Waiver (GIO)

Should the life insured be diagnosed with major cancer, future premiums will be waived during the period of the rider.

This thus allows the insured to focus on their health and recovery without worrying about paying for their insurance.

Key Features

Guaranteed Insurability

If you experience the following events in life, you can get a new insurance policy that covers only death and disability benefits without having to prove you’re healthy:

- Turning 21

- Getting married

- Getting a divorce

- Becoming a parent

- Losing your spouse

- Buying a home

The new policy will only cover up to half of your current policy’s coverage or S$100,000, whichever is less.

To get these benefits, here are the conditions that, as the original insured, you must meet.

- You must not be more than 50 years of age,

- You can consider this option within 3 months from the milestone,

- You must not have a serious illness diagnosis at the time of signing up,

- NTUC Income may require documentary evidence at their request, with special terms from the parent policy being added if any were included.

- This policy option can only be taken up twice due to its relation to different life circumstances.

Partial or Full Surrender

You can either partially or fully surrender this insurance policy for its cash value.

If you surrender partially, the minimum amount left for your coverage cannot be lower than the policy’s minimum sum assured, which is S$10,000 and S$25,000 for single and regular premiums, respectively.

NTUC Income may also determine the amount to be paid upon surrender.

If you surrender your policy fully, it will end.

You can receive a surrender value if you’ve paid premiums for at least 2 years, provided the premium term is 5 years or more.

You can receive the surrender value after the net single premium has been paid for single premium terms.

Annual bonus

Every year, you’ll receive bonuses on your insurance policy based on a percentage of the basic amount you’re insured for and the past year’s bonuses.

Once these bonuses are added, they’re guaranteed to you no matter how well the insurer’s participating funds are doing.

Terminal Bonus

A terminal bonus is payable when you apply for a claim, your policy matures, or you surrender it.

However, any future bonuses that haven’t been added yet aren’t guaranteed.

NTUC Income will decide each year how much bonus to allocate to each policy.

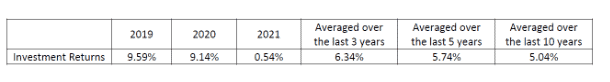

NTUC Income Gro Saver Flex Pro Fund Performance

When selecting an endowment plan, it’s important also to consider how well the participating funds are performing.

This will determine how much you’ll actually receive when your policy matures.

Here’s how the NTUC Income Gro Saver Flex Pro’s funds have been performing:

Accurate as of 31 December 2021.

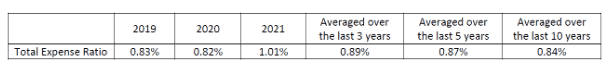

NTUC Income Gro Saver Flex Pro Fees and Charges

The fees and charges you will incur are already calculated in the premiums you pay based on the sum assured you have selected.

When it comes to policies that invest in its participating funds, the biggest fees you’ll be paying are its expense ratios.

Total Expense Ratio

This ratio is the total expenditure on things like managing and investing money, taxes, and other costs, compared to how much money is in the fund.

This cost constitutes part of your premiums but is not an additional cost.

However, should the actual level of expenses range significantly from the expected level of expenses, it may impact the non-guaranteed benefits you could get from the policy.

Here are the Total Expense Ratios for past years.

And here’s a table showing the average expense ratios from major life insurers in Singapore.

As you can see, NTUC Income’s par funds perform exceedingly well in terms of the expense ratio, ranking 1st out of 8 companies measured.

Illustration of How the NTUC Income Gro Saver Flex Pro Works

Meet Sam, a 55-year-old man planning to secure his daughter’s future.

He’s joined Gro Saver Flex with the goal of accumulating $30,000 for his 12-year-old daughter.

He opts for a single premium of $30,000 for a policy term that extends till he turns 120 years.

As time flies, his daughter June becomes the secondary insured after 5 years.

Fast forward 22 years later, June turns 27, and the illustrated total cash value is now $46,056.

At age 80, Sam passes away, leaving June to continue with the Gro Saver Flex policy.

The policy continues until June reaches 77, and the illustrated total maturity value is now $387,505.

Thanks to Sam’s insightful investment, his daughter could enjoy a bright future and live the life she deserved.

The policy promises a payoff of almost $289,919 if June were to pass away at age 70.

This would be nearly 10 times the amount of premiums she paid.

Let’s simplify things with this table to make it clear.

| Mr. Sam’s Age | June’s Age | Event |

| 55 | 12 | Sam pays a single premium of $30,000 |

| 60 | 17 | Appoints June as secondary insured |

| 70 | 27 | Total cash value is $46,056 |

| 80 | 37 | Passes away |

| Sam passes away | 77 | Total Maturity Value $387,505 |

The above illustration assumes a 4.25% p.a return.

NTUC Income Gro Saver Flex Pro Summary

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Withdrawal Benefits | No |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | No |

| Terminal Illness | Yes |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Optional Add-on Riders | Yes |

| Additional Features and Benefits | Yes |