The PRUActive Life III is a whole life insurance policy offering up to 5 times your sum assured.

With protection against death, terminal illness, and total and permanent disability on your basic policy, you may opt to enhance this coverage with early and late-stage critical illnesses!

This is also the newer version of the PRUActive Life, with the previous one being the PRUActive Life II.

Continue reading our review to find out if this is the whole life policy for you!

My Review of the PRUActive Life III

My honest review is that the PRUActive Life III is an okay whole life insurance plan that provides lifelong coverage while letting you to build cash value over time. I say this because it has higher premiums and fewer features as compared to other alternatives in the market.

Let’s first talk about what the PRUActive Life III has going for itself.

First, you can choose the duration of your premium payments, ranging from 5 to 35 years, based on what works best for you.

If you face financial difficulties, you can defer your premium payments for up to 2 years without any interest charges, ensuring your coverage remains intact during challenging periods.

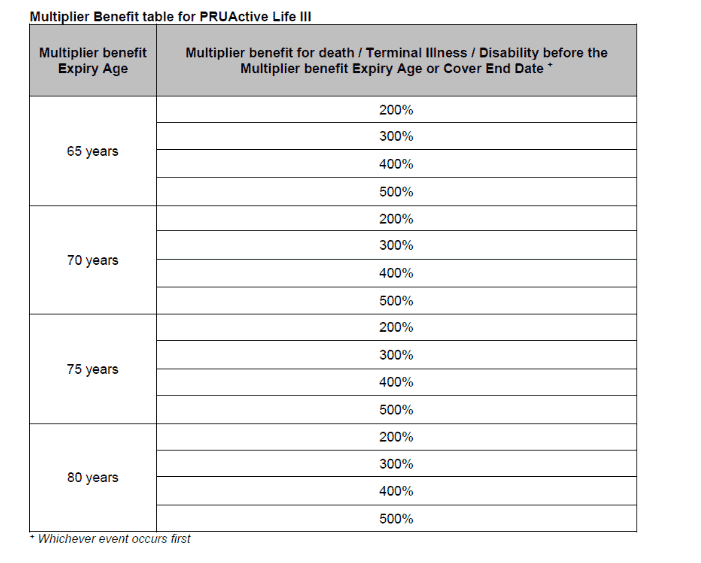

With the multiplier benefit, your coverage can be boosted up to 5 times until you reach the age of 80.

If you’re looking for a whole life policy with the most flexible multiplier benefit, the PRUActive Life III is for you.

In addition, the premium and family waiver benefits come into effect in times of loss.

If an immediate family member passes away, your premium payments will be waived for up to a year, easing your financial burden during this difficult period.

You can also opt for coverage against early, intermediate, and late-stage critical illness conditions through the optional riders offered.

Lastly, as an added advantage, if you are below 50, you can purchase an additional whole life, endowment, annuity, or term policy without providing evidence of good health.

This simplifies the process of increasing your coverage when you reach important milestones in your life.

However, there are drawbacks to this policy.

Let’s first compare the ECI/CI conditions covered by PRUActive Life III against other insurers in the market:

| NTUC Income Star Secure | Manulife LifeReady Plus II | Singlife Whole Life | AIA Guaranteed Protect Plus (III) | Great Eastern Complete Flexi Living Protect 2 | China Taiping i-Secure(II) | AXA Life Treasure (II) | Prudential PRUActive Life III | |

| Early Critical Illness | 142 | 125 | 72 | 150 | 35 | 42 | 41 | 74 |

| Intermediate Critical Illness | 33 | 40 | 37 | |||||

| AdvancedCritical Illness | 59 | 52 | 55 | 56 | ||||

| Total CI Conditions | 142 | 125 | 131 | 150 | 120 | 137 | 134 | 74 |

| Additional Coverage | ||||||||

| Special Benefits (Diabetic Complications, Osteoporosis, etc) | 15 | 10 | 16 | 15 | 10 | 12 | 14 | – |

| Juvenile Benefits (Kawasaki Disease, Severe Hemophilia, etc) | 15 | 12 | 11 | – | 16 | 12 | 14 | – |

| Total additional coverage | 30 | 22 | 27 | 15 | 10+16+5(Senior Conditions)= 31 | 24 | 28 | 0 |

| Total Conditions Covered | 172 | 147 | 158 | 165 | 151 | 161 | 162 | 74 |

As you can see, the PRUActive Life III offers the lowest number of ECI/CI conditions – 74 conditions to be exact – while even the next best policy, the Manulife LifeReady Plus II, offers 147 conditions – almost double!

In fact, if you’re looking to get critical illness coverage, the NTUC Income Star Secure Pro is your best bet with 172 conditions!

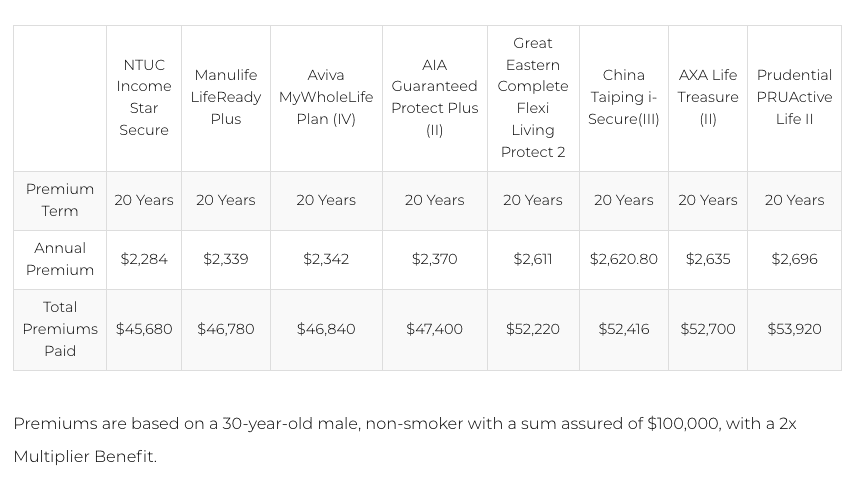

Looking at premiums, the Prudential PRUActive Life III is the most expensive whole life plan (based on the above demographic) – with NTUC Income Star Secure Pro, Manulife LifeReady Plus II, and Singlife Whole Life plan being the 3 cheapest plans.

Since part of your premiums is used for investment, it’s also important to consider the ROI.

In terms of ROI from its participating funds, the PRUActive Life III also has the lowest ROI of 191.61%, while the policy with the highest ROI is the Manulife LifeReady Plus II at 261.35%.

Objectively, in my opinion, I think there are better whole life plans in Singapore that you should consider.

And given that a whole life insurance plan is something you’ll pay premiums for the next 20 to 35 years, it’s important that you do a little bit more research to choose an alternative that suits you best.

Perhaps you should start with an unbiased financial advisor’s second opinion on whether the PRUActive Life III is a good policy for you before exploring other options.

If you need someone to help you with this, we partner with MAS-licensed financial advisors who have helped hundreds of our readers in selecting a policy suited to their needs.

Talk to one of our partner financial advisors today!

Let’s now dive deeper into what the Prudential PRUActive Life III offers.

Criteria

- Assured age: 1-79 years

- Premium payment term: 5 to 35 years

- Minimum sum assured: $50,000

General Features

Premium Payment Term

You may choose a premium payment term between 5 to 35 years and how often to make these payments – monthly, quarterly, half-yearly, or yearly.

This allows you to select a payment frequency that aligns with your financial preferences and convenience.

Protection

Death Benefit

A death benefit is paid out if the insured chooses to include the multiplier benefit and passes away before the selected multiplier benefit expiration age.

The payout amount is the higher between:

- the specified sum assured and all the bonuses to the policy, or

- the multiplier benefit

However, if the assured did not add the multiplier benefit, the death benefit will be the amount assured and all the bonuses added to the policy.

This benefit will also be reduced by any outstanding amounts owed.

Accelerated Terminal Illness Benefit

Similarly, when the insured chooses to include the multiplier benefit and passes away before the selected multiplier benefit expiration age, the higher of the following will be paid out:

- the death benefit amount and all the bonuses added to the policy, or

- the multiplier benefit

However, if the assured did not add the multiplier benefit, only the death benefit specified in the policy and all the bonuses is paid out.

This benefit will also be reduced by any outstanding amounts owed.

Accelerated Disability Benefit

This benefit is claimed when the person assured ends in total and permanent disability (TPD) before the cover expires.

At 15 years old or younger, TPD is defined as when one is totally and permanently confined at home, a hospital, or another care facility for at least 6 consecutive months and requires constant medical attention.

At over 15 years old to before the expiry of the policy, TPD is considered when the person assured is either:

- Loses eyesight in both eyes.

- Loses 2 limbs, either at or above the wrist or ankle.

- Loses eyesight in 1 eye and 1 limb from the ankle or wrist.

- Prevented from working and earning any income or profits (up to the age of 65).

- Cannot perform 2 out of the 6 Activities of Daily Living (ADLs) (for age 66-70).

The following criteria are used to determine the Accelerated Disability Benefit amount:

- When the policy includes the multiplier benefit and the disability occurs at the age of below 1, this benefit will be equal to 20% of the multiplier benefit.

- If the disability occurs when above the age of 1 and before the multiplier expiry age, the higher amount between the amount of death benefit specified in the policy, including all the bonuses and the multiplier benefit.

- Without the multiplier benefit, the death benefit specified in the policy, including all the bonuses, is paid. Similarly, this benefit will also be reduced by any outstanding amounts owed.

- The maximum payout for this benefit is $2,000,000. If it exceeds this amount, the remaining sum assured will be paid as a lump sum payment, either 12 months later during the continuity of the disability or in the event of the life assured’s death, whichever happens first.

Key Features

Multiplier Benefit

The multiplier benefit is an optional feature that allows you to increase your sum assured (thus your payout amount) of the policy up to 1, 2, 3, 4, or 5 times.

You may opt for the multiplier benefit to last until you’re 65, 70, 75, or 80 years old.

Kinship Booster

When a family member (such as a spouse, parent, or child) also purchases a PRUActive Life III policy, you get an additional 10% of the basic sum assured (maximum $100,000) to your own policy.

However, for you to benefit from this booster, the following conditions apply:

- You should be 55 years or below when your close family member purchased their policy.

- You bought the policy under normal conditions.

- You have paid all the required premiums.

- You have not made any claims on your PRUActive Life III policy.

- You need to provide evidence of your direct family relationship.

Premium Defer Benefit

You can defer premium payments for a maximum of 2 years or the remaining premium term, whichever is shorter.

During the premium deferment period, you will get an interest-free policy loan to cover the premiums.

This means that your surrender value (the amount you would receive if you cancel the policy) will not be affected, even if you haven’t made premium payments.

However, if any payments are made during this period, the interest-free policy loan will be deducted from those payments.

You must repay the loan after the premium deferment period to avoid interest charges.

Family Waiver Benefit

The family waiver benefit in PRUActive Life III provides a waiver of premiums in difficult times for up to 12 months.

This applies, for instance, when an immediate family member of the life assured (such as the spouse or legal children) passes away.

This benefit will only be activated on a claim with the life assured showing proof of the immediate family relationship.

You can claim this benefit only once for each PRUActive Life III policy.

Hence, you must provide evidence of your immediate family relationship when making a claim.

Surrender Benefit

If you decide to surrender your life insurance policy after paying premiums for 36 months, you will receive the guaranteed surrender value plus any non-guaranteed surrender value.

However, it’s important to note that terminating the policy early comes with high costs.

Therefore, the amount receivable can be much less than what you have contributed as total premiums.

The surrender table will be available in your policy documents, otherwise, check with your financial advisor.

Purchase Additional Policies Without Medical Underwriting

You can purchase an additional whole life, endowment plan, annuity plan, or term policy without needing a medical examination.

This option is available to you in specific life events such as getting married, becoming a parent, the demise of a spouse, or your child’s marriage.

To be eligible for this additional policy, you must be below the age of 50, and the policy must be issued under normal conditions.

Loans

PRUActive Life III offers Automatic Premium, Policy, and Surgical & Nursing Loans at a non-guaranteed loan interest except for the policy loan, which is interest-free.

It’s important to understand that taking these loans will impact your policy’s long-term value, reducing its value over time.

Reversionary bonus

Beginning in the second policy year, you will receive the Reversionary Bonus, which is guaranteed and will be added to the benefits you already received from your policy.

Performance bonus

This is an additional amount of money you may get when you surrender your policy or make a claim for basic benefits.

This bonus is calculated as a percentage of the total Reversionary Bonuses that have been added to your policy over time.

Optional Add-On Riders

Early Crisis Care (PRUActive Life III)

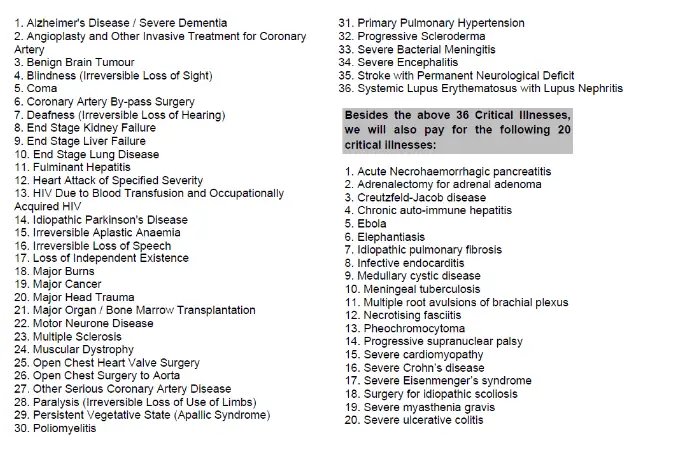

With Early Crisis Care, you get early critical illness coverage for up to 74 early, intermediate, and late-stage critical illnesses for up to $350,000.

Unfortunately, we cannot find the table of early critical illnesses that they cover under this benefit.

Crisis Care (PRUActive Life III)

The PRUActive Life III lets you add the Crisis Care add-on, a critical illness rider covering up to 56 conditions.

Below is a list of the critical illnesses covered:

For angioplasty or any other invasive treatment for the coronary artery before the multiplier benefit expiry age, the benefit is 10% of the multiplier benefit, with a maximum limit of $25,000.

From the multiplier benefit expiry age and onwards, angioplasty or any other invasive treatment for coronary artery, 10% of the sum assured for the Crisis Care benefit is paid, with a maximum limit of $25,000.

This rider also has the Crisis Care Accelerator Benefit – where Prudential will pay 50% of your Crisis Care (PRUActive Life III) benefit if the life assured:

- Has surgery for any of the following vital organs as a result of illness or an accident

- Heart, lung, brain, kidney or liver, and

- Is admitted to the Intensive Care Unit (ICU) for at least 3 continuous days due to the surgery.

PRUActive Life III Fund Performance

When choosing a whole life plan, it’s important to consider the performance of its participating fund since a portion of your money will be invested.

Asset Investment Mix

Here is the asset allocation as of 31 December 2021:

| Type of Asset | Allocation Goals

(%) |

Actual Allocation

(%) |

| Bonds | 50 | 59.4 |

| Equities | 29.5 | 25.8 |

| Property | 7.5 | 7.8 |

| Cash, Loans and others | 13 | 7 |

| Total | 100% | 100% |

Investment rate of return

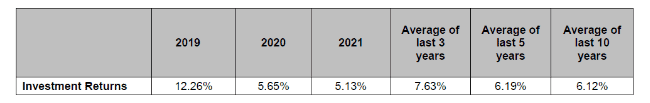

Here is the fund performance as of 31 December 2021:

The par funds are pretty impressive, with 5 and 10-year returns at 6.19% and 6.12%, respectively.

Prudential stands out among other participating plans in Singapore, with impressive geometric net investment returns.

Their par funds have performed admirably over 3, 5, and 10-year averages, exceeding the industry average.

However, don’t have the best-performing participating funds.

Total Expense Ratio (TER)

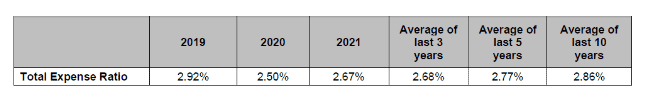

One important factor in evaluating a participating fund is the total expense ratio. This is the total annual cost incurred by the fund as a percentage of the fund’s total assets.

The ratio includes management fees, operating expenses, and other fund running costs.

High TER can eat into the fund’s returns, making it more expensive for investors.

Here is the total expense ratio for the PRUActive Life III par funds:

When it comes to investing in insurance funds, performance isn’t the only thing to consider. Keep an eye on costs, too, by comparing expense ratios.

To help you make an informed decision, we’ve compiled a table comparing Prudential’s expense ratios to other leading industry players.

As you can see, Prudential has one of the highest expense ratios from 2017, averaging above 2.90%.

I would say this ratio is comparatively high compared to other insurance providers in Singapore – but it’s still not bad.

When selecting an insurance product, it’s important to consider both the costs and the returns.

Summary of PRUActive Life III

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Withdrawal | No |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | Yes |

| Terminal Illness | Yes |

| Critical Illness | Yes, with rider |

| Early Critical Illness | Yes, with rider |

| Health and Insurance Coverage Multiplier | |

| Death | Yes |

| Total Permanent Disability | Yes |

| Terminal Illness | Yes |

| Critical Illness | Yes |

| Early Critical Illness | Yes |

| Policy Add-ons | |

| Crisis Care (Critical Illness coverage),and

Early Crisis Care (Early Critical Illness coverage) |

Yes |