MoneyOwl will be shutting operations on 31 December 2023. We recommend checking out Syfe as a possible alternative.

Are you starting new in the investment world and looking for help developing a fit-for-purpose financial plan?

Are you wondering how to include national schemes into your life goals as you kickstart your journey in investment?

Do you need to start making conflict-free financial decisions as you prepare for your retirement days?

If your answers are positive in all or one of the questions, then you are in the right place.

In this article, you will learn how MoneyOwl works and how it can assist you in creating a comprehensive and competent financial plan.

What is MoneyOwl?

Previously, MoneyOwl is a social enterprise by NTUC Enterprise Co-operative Ltd in ventures with Providend Holding. However, as of 1 June 2022, MoneyOwl is now 100% owned by NTUC Enterprise.

It takes pride in ranking itself as Singapore’s first-ever bionic financial advisor.

However, don’t panic; you will not be getting your financial advice from robots. Instead, it combines the benefits of technology and professional financial advice from a certified financial advisor.

This means you get extra support on top of what you’ll get from robo advisors in the market.

So, rather than creating an account, choosing your portfolio, and leaving it to the app, MoneyOwl offers a platform where you can invest, but with the help of a human financial advisor.

MoneyOwl Features

MoneyOwl offers different features for various individuals.

They offer investments via their robo advisor, will writing, insurance, and financial planning as a platform.

In this post, we’ll focus on their robo advisor feature.

Whether you want to grow the spare cash you have after setting aside your emergency fund, your CPF funds, or even your Supplementary Retirement Scheme (SRS) account, the features offered by MoneyOwl will help you grow your wealth.

These are discussed below:

MoneyOwl’s Robo Advisor Investment Portfolios

MoneyOwl takes pride in helping many Singaporeans with reliable, long-term, low-risk investment opportunities.

For this reason, they provide all its members with well-researched and globally diversified portfolios to choose from.

Their investment solutions come under 2 umbrellas:

- Savings – WiseSaver

- Investment – WiseIncome and Dimensional

Let’s take a look at each portfolio:

1. WiseSaver Portfolio

Sometimes, you just want to leave your money somewhere safe and be able to get it anytime.

This is where MoneyOwl comes in with its WiseSaver portfolio – a cash management account.

MoneyOwl makes it possible to grow your savings at a higher daily interest as compared to bank savings account and fixed deposits while being able to withdraw them at any time.

This portfolio invests in Fullerton SGD Cash Fund, managed by Fullerton Fund Management.

With MoneyOwl’s WiseSaver, you can earn higher returns without fund lock-in periods. You can save your emergency cash using this portfolio; so when you need it, it will be readily available.

The minimal investment for the WiseSaver portfolio starts as low as $10. With this, you can earn interest rates of up to 2.75% p.a (5-day Moving Average as of 23 September 2022).

Other benefits you can enjoy from the WiseSaver Portfolio include:

- Higher returns compared to fixed deposits.

- Minimal risk.

- High liquidity.

- No platform, advisory, or sales charges. This means you only have to pay the 0.15% p.a fees to the fund manager.

- Professional fund management by Fullerton Fund Management.

2. WiseIncome Portfolio

WiseIncome is a portfolio aimed to provide you with a steady source of passive income in the long run

The WiseIncome portfolio is designed to help you complement your CPF LIFE, your income as you retire, and give you quarterly dividends.

The portfolio offers:

- Global equities to boost return and capital growth

- S-REITs for those interested in real estate and rental yields

- Asian fixed income

- US/Singapore bonds

With the WiseIncome portfolio, you can comfortably supplement your CPF LIFE payouts and enjoy more financial comfort, even after retirement.

Other benefits you stand to gain include:

- A broad list of assets that you can use for sustainable income

- Flexible quarterly payouts as dividends

- No lock-in periods

- Minimal investment requirement

- Low fund-level fees

This portfolio has a management fee of 0.4% and accepts both cash and SRS investments.

3. Dimensional Portfolio

The Dimensional portfolio aims at providing you with long-term capital growth through broad market exposure at low costs.

The Dimensional portfolio is structured to evaluate markets more objectively. The structure relies on scientific and financial insights instead of predictions used in conventional investment firms.

The Dimensional portfolio comes with 5 different asset allocation portfolios, depending on the risk/return ratio.

| Portfolio | Fixed Income/Equity Composition | Projected Returns (p.a.) | Standard Deviation | Most suitable for |

| Conservative | 80/20 | 3.19% | 2.48% | Capital preservation over short-medium terms (4-5 years) |

| Moderate | 60/40 | 4.65% | 5.37% | Accumulating wealth over the medium term (6-7 years) |

| Balanced | 40/60 | 5.60% | 8.4% | Accumulating wealth over the medium-term (8-11 years) |

| Growth | 20/80 | 6.34% | 8.4% | Accumulating wealth long-term (12-14 years) |

| Equity | 0/100 | 6.83% | 14.23% | Slow wealth accumulation over the long term >15 years |

4. CPF Portfolios

The Central Provident Fund (CPF) portfolio is another portfolio offered by MoneyOwl for those interested in growing their CPF funds.

Worthy to note that the interest you earn will depend on your willingness to take risks and your ability to sustain the investment. These portfolios also differ depending on the strategic asset allocation.

The 3 portfolio classifications and their respective returns under the CPF investments include:

| Portfolio | Allocation | Annualised Returns | Standard Deviation p.a | Expense Ratio | |||

| Equities | Bonds | 5 years | 7 years | 10 years | |||

| CPF Balanced | 60% | 40% | 7.74% | 7.17% | 8.31% | 7.89% | 0.40% |

| CPF Growth | 80% | 20% | 9.85% | 8.68% | 9.99% | 10.29% | 0.41% |

| CPF Equity | 100% | 0% | 11.36% | 10.15% | 11.64% | 12.70% | 0.42% |

Although the above are the actual returns, MoneyOwl conservatively plans your investments by projecting 4.81% p.a for balanced portfolios, 5.03% p.a for Growth portfolios, or 5.19% p.a for CPF Equity portfolios.

These rates are calculated using the 15-year rolling return from February 2004 to December 2021, adjusted for retrocessions.

MoneyOwl Fees

Investing with MoneyOwl is very easy for beginners. It has minimal entry barriers, making it very accessible to new investors. The entry fees depend on your chosen portfolio and how you commit to investing.

Previously, the platform had a 0.18% fee p.a., which is now absorbed by the institution, making it even more affordable for investors, or at least 31 December 2022.

This 0% fee applies to investments below $10,000. Any additional investment attracts an additional management fee, which also varies, depending on the type of investment.

For instance, the Dimensional portfolios charge 0.25% to 0.27% p.a as fund management fees.

|

Portfolio |

Assets Under Management | Fees | ||

| Platform Fees | Advisory Fees | Fund Level | ||

| Dimensional | Up to S$100,000 | 0% | 0.6% | 0.25% to 0.27% |

| Above S$100,000 | 0.5% | |||

| WiseIncome | Up to S$100,000 | 0.6% | ~0.4% | |

| Above S$100,000 | 0.5% | |||

| WiseSaver |

Any amount |

0% | 0.15% | |

| CPF Portfolios | 0% until 31 December 2022 | ~0.4% to 0.42% | ||

Take note that the returns you see on MoneyOwl are already inclusive of fund-level fees.

Funding Your MoneyOwl Account

When you choose an investment option at MoneyOwl, you have 3 funding methods.

These include:

1. Investing with CPF

One way to grow your retirement income is by investing your CPF Ordinary Account (CPF OA) funds in a platform like MoneyOwl.

Doing so lets you accumulate your wealth and earn more than the 2.5% p.a risk-free interest offered by CPF.

Investing with CPF with MoneyOwl is beneficial because:

- They offer a one-stop investment management

- There are no hidden charges and zero sales charges

- The portfolios are simple and reliable

- You get honest advice and remain transparent on your options and possible solutions

Who is Suitable to Invest with CPF?

If you are thinking of collecting your retirement saving scheme, you might want to consider investing with MoneyOwl if:

- You have at least 10 years to invest.

- You are willing to pull through fluctuations in portfolios with at least 60% equity.

- You have extra CPF OA money for other needs like loan repayment, education, etc.

- You have set aside some cash for emergency payments in case of income loss.

- You want to attempt to beat the 2.5% risk-free interest rate.

2. Investing with Cash

You can also fund your investment at MoneyOwl with cash. For this, you can choose any of MoneyOwl’s cash portfolios, i.e., WiseIncome, WiseSaver, or Dimensional portfolios.

3. Investing with SRS

Finally, you can grow your wealth by investing with your SRS account. With this, you can maximise your untouched money that only has an 0.05% annual interest.

Minimum Deposits at MoneyOwl

If you choose to invest with MoneyOwl, each portfolio bears its minimum deposit and fee charges.

The minimum investments are as listed below:

| Portfolio | Minimum Investment |

| Dimensional |

|

| WiseIncome |

|

| WiseSaver |

|

| CPF Portfolios |

|

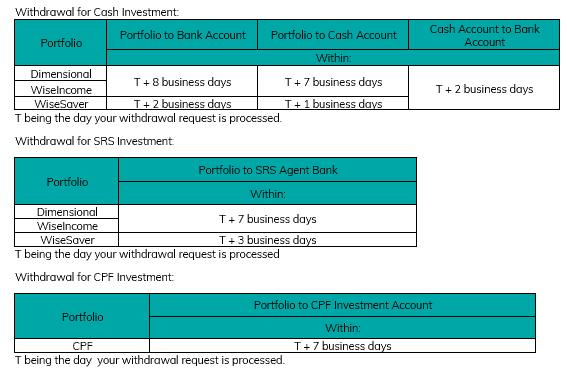

Withdrawals at MoneyOwl

Once it’s time to withdraw your money from MoneyOwl, you can do so by selling part of or all of your portfolio.

However, minimum withdrawals apply:

| Portfolio | Minimum Withdrawal |

| Dimensional | $50 |

| WiseIncome | |

| WiseSaver | |

| CPF Portfolios | $200 |

You can redeem your funds via bank or cash account. Here’s a screenshot from MoneyOwl to show how long it’ll take to withdraw your funds.

Is MoneyOwl safe?

MoneyOwl has a Capital Markets Services License (CMS100758) from MAS.

Through the license acquisition process, the company undergoes scrutiny from the licensing body.

This thorough inspection seeks to prove that the company is fit and capable of providing the services listed in its description.

In other words, MoneyOwl is a reliable investment company when it comes to fund management, compliance, risk management, and operations.

Most importantly, the license to operate in fund management means they have the adequate capital and resources to handle risks and compliance-related issues.

Finally, the company undergoes an internal audit at least once a year, values customer assets independently, and accurately reports them for financial management.

So, if you are worried that the company might use your money and fail to pay in case it goes bankrupt, the license issued by MAS protects you from such.

How to Sign up for an Account at MoneyOwl

When it is time to channel your investment for growth, you can start by opening an account. For this:

- Visit the Create Your Account page, where you will fill in your data and set a password for your account

- After logging into your account, click on Start Investing and follow the instructions given

- Once approved, you can start investing your money for financial growth

Final Thoughts

To live comfortably with financial freedom, your money should work for you.

With robo advisors like MoneyOwl, you can have your spare cash invested and earn handsome interest annually.

The platform allows for cash, SRS, and CPF investments, making it a top choice in the market.

However, if you’re investing via cash, we think Syfe is a better option despite its higher fees at 0.65% vs MoneyOwl’s 0.6%.

Why?

Firstly, Syfe’s 0.65% is only up to the first $20,000, which drops to 0.5% after.

In fact, the more you have with Syfe, the lower the fees it gets.

Here are Syfe’s fees.

| Investment Amount ($) | Tier | Management Fee (%) |

| No minimum investment amount | Blue | 0.65% |

| Minimum $20,000 | Black | 0.50% |

| Minimum $100,000 | Gold | 0.40% |

| Minimum $500,000 | Private Wealth | 0.35% |

Next, Syfe’s projected and actual returns on their portfolios are higher than MoneyOwl’s, with lower standard deviations.

So, if you want to invest with minimal risk, minimal fees, and no hassle, Syfe might be better.

We recommend using our Syfe referral link to get fees waived off your investments. Or you can check out this page for updated Syfe promotions.

If you’re looking to invest your CPF and SRS funds, MoneyOwl may be what you want.

However, for CPF and SRS funds, we prefer Endowus due to more portfolios that you can choose from.