Ever wondered how the Singapore Government helps you in your journey to retirement?

Well, that’s what the CPF Lifelong Income for The Elderly (a.k.a CPF LIFE) scheme is for!

In fact, it is the default retirement plan for Singaporeans, and for most – their only retirement plan.

Don’t worry – we’re here to break it down in all aspects so you fully understand how it aids in building your retirement nest.

What is CPF LIFE?

Simply put, the CPF LIFE plan is an annuity scheme that provides recurring passive income from a payout eligibility age (at age 65) for as long as you live.

Before you turn 65, CPF Board will send you a letter detailing more information about this annuity plan if you’re automatically included.

To be automatically included in CPF LIFE, you’ll have to be

- A Singaporean or Permanent Resident (PR)

- Born in 1958 or after; and

- Have at least $60,000 in your Retirement Account (RA) when monthly payouts start

The retirement savings in your Retirement Account, which is created at 55 years old, will be used as lump-sum premiums to pay for this scheme.

Take note that the premiums you pay to CPF LIFE, which determines your payout amounts, will also depend on how much you have in RA savings up to a Basic Retirement Sum (BRS), a Full Retirement Sum (FRS), or an Enhanced Retirement Sum (ERS).

The BRS, FRS, and ERS as of 2022 are

|

Retirement Sum |

Amount |

| Basic Retirement Sum (BRS) | $96,000 |

| Full Retirement Sum (FRS/BRS x 2) | $192,000 |

| Enhanced Retirement Sum (ERS/ BRS x 3) | $288,000 |

If you wish to know more details about your RA and how to manage its savings, you can check out this article here.

What happens if you do not meet the BRS?

If you do not meet the BRS, don’t fret because you’ll still be receiving CPF LIFE payouts from age 65.

The only thing is that the existing amount you have in your RA will thus form your retirement sum, which will act as a basis for pro-rated payouts.

Differences between CPF LIFE and Retirement Sum Scheme (RSS)

Just like CPF LIFE, the Retirement Sum Scheme (RSS) is also a similar annuity scheme that provides monthly retirement payouts.

However, the main difference between the two is how long the payouts actually last!

For RSS, the payouts last up till age 90 or until your RA’s savings runs out (whichever is earlier).

Another difference is that most people who are automatically enrolled in RSS, are those in the Pioneer and Merdeka Generation (i.e born before 1958). Although, they are provided with the option of switching to CPF LIFE before they reach age 80.

Furthermore, you can only be on the RSS or CPF LIFE at a time.

The only way for those in the younger generation to be in RSS is if they fail the auto-inclusion criteria of CPF LIFE as stated previously.

As you can probably tell, CPF LIFE is way more attractive than RSS because no one knows how long they’ll live.

It was even reported that Singapore is one of the leading countries and territories in the world with the highest life expectancy of 87.5 years!

And with such advancements in technology and healthcare, you may even live up to a century – who knows?

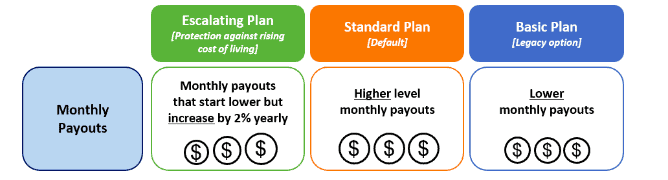

Types of CPF LIFE Plans

There are 3 plans for CPF LIFE mainly Standard, Basic, and Escalating – which correspond to the number of monthly payouts you will receive.

Regardless of whether you’ve met your BRS/FRS/ERS, you will be given the choice to pick from these 3 plans. Otherwise, you’ll be placed on the CPF LIFE Standard Plan, by default.

Standard Plan

Here’s a table to show you the monthly payouts you will potentially receive from this default plan*:

| Desired Monthly Payout from 65 | RA Savings you need at 65 to provide for CPF LIFE

(i.e the Lump Sum Premium you need to pay) |

RA Savings You Need at 60 | RA Savings You Need at 55 |

| $350 – $370 | $60,000 | $45,700 | $35,000 |

| $540 – $570 | $97,300 | $75,900 | $60,000 |

| $790 – $850 | $149,500 | $118,900 | $96,000

(This is the Basic Retirement Sum as of 2022) |

| $960 – $1,030 | $184,400 | $147,500 | $120,000 |

| $1,470 – $1,570 | $288,900 | $233,500 | $192,000 |

| $1,520 – $1,630 | $300,500 | $243,000 | $200,000 |

| $2,140 – $2,300 | $428,300 | $348,000 | $288,000 |

*Numbers are estimates for members who turn 65 in 2032, computed as of 2022.

Keep in mind that the RA earns an interest rate of up to 6%, so the savings you have at 55 will continue to grow through compound interest.

What it means is that if you had set aside RA savings up to the 2022 BRS ($96,000) at age 55, you will have about $149,500 when you reach age 65 due to the compounded interest earned – which corresponds to about $790 – $850 in payouts from the CPF LIFE Standard Plan.

And assuming you are eligible for an $800 monthly payout, I did a quick little estimation to show when you’ll start to receive “free” money from the Government.

| RA Savings you have at 55 | $96,000 (BRS) |

| RA Savings you have at 65 | $149,500 |

| Monthly Payout | $800 |

| Yearly Payout | $9,600 |

| Number of years it will take to finish $149,500 | ~15.5 years |

So, at approximately age 80 (65 + 15), you’ll essentially be receiving a “free” $800 every month to carry on with your retirement plans!

Sounds pretty good right?

Well, let me explain why I’m kind of on the fence here.

First off, one of the main disadvantages of this plan is that the monthly payouts are fixed until the day you pass on.

What if, you wish to live a more affluent retirement lifestyle? This probably means receiving the highest level of payouts ($2,140 – $2,300).

But you may be unable to, given that you have only saved till the BRS at age 55, which guarantees you a lower tier of payouts ($790 – $850).

This can pose a challenge to those who may lack budgeting control and other sources of retirement savings to make up for the difference in payouts.

Besides the lifestyle you desire, it also boils down to whether you have been good at managing your personal finance and how well your budgeting habits are.

In such cases, the CPF LIFE Standard Plan might be better for you if you are not as confident in budgeting for the future.

You ensure that you have a fixed amount monthly so that you can budget better.

If you’re on the contrary, the CPF LIFE Escalating Plan might be better for you!

Let’s take a look.

Escalating Plan

The CPF LIFE Escalating plan is slightly unique – in a way that

- The monthly payouts start out lower than that of the Standard Plan, but

- It increases by 2% yearly to keep pace with inflation and the rising costs of living.

Assuming you receive a monthly payout of $750 at age 65, you’ll receive up to ~$1000 when you reach age 80.

In my opinion, this plan would be suitable for those who can better manage their spending habits especially if you have other sources of retirement savings to make up for the low initial payouts.

You can also feel more assured as the gradual increase in payouts is set to combat rising prices, where the core inflation rate was reported at 1.49% over the past 2 decades.

In 2022, the core inflation went up as high as almost 4%.

With the 2% increasing payouts, your retirement income is adjusted for the increasing prices, making it a more attractive option.

The downside is, of course, that you start at a low monthly payout.

You get the idea.

Basic Plan

Last but not least, The CPF LIFE Basic Plan.

Instead of having 100% of your RA savings deducted to pay for CPF LIFE premiums, only 10 – 20% will be deducted instead.

This leaves you with about 80 – 90% in your RA, which continues to earn an interest of up to 6%.

Your monthly payouts will be made out of your deducted RA savings first until age 90 and from the CPF LIFE premium thereafter.

If they are both depleted, you’ll still continue to receive payouts for as long as you live just like the other plans.

However, do take note that since the payout is first paid out from 80-90% of your RA, this plan provides you with lower monthly payouts as compared to the other two.

Furthermore, the Basic Plan’s monthly payouts will continue to get progressively lower when your combined CPF balance falls below $60,000.

The rationale here is that retaining funds in RA will seem to earn at least a bit more interest as compared to the rest.

All things considered, this legacy plan is likely to get phased out in the coming years so if you’re a young reader, this plan might not be available for you when you reach age 65.

To summarise, here’s a quick breakdown of the 3 plans that have been discussed earlier!

Source: CPF Board

When you pass on, your beneficiaries will receive your CPF LIFE premium balance (if any) together with any remaining CPF savings.

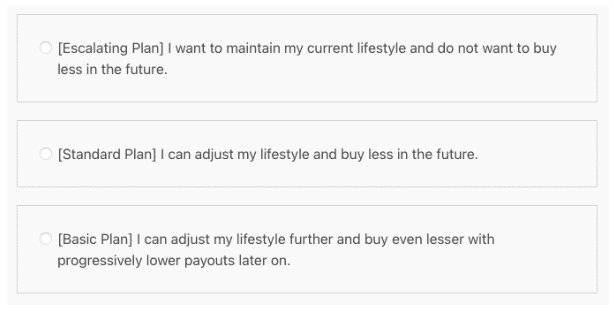

So, how do you know which plan is best for you?

From the looks of it, there are a few factors you should first consider before you make your decision mainly:

- Choice of lifestyle

- Budgeting habits

- Inflation rates in Singapore

- Other sources of retirement savings

- Other purposes such as leaving monies for your loved ones, etc.

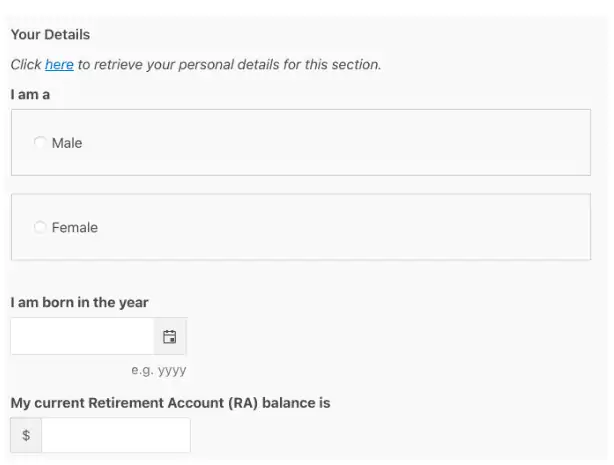

Well, a useful tool that you can use is the CPF LIFE Estimator at age 55 to find out the amount of CPF LIFE premium needed to achieve your desired monthly payout under your selected CPF LIFE plan.

Here’s how it goes:

First, you’ll have to decide how you will adjust your retirement lifestyle when things become more expensive in the future. This corresponds with the CPF LIFE Plan you would be on.

You’ll then proceed to input your details such as your gender, the year you were born, and the current balance in your RA.

The amount you can key in would be between $40,000 and $300,000.

You can use Singpass to retrieve these details in due course.

As a final result, CPF Board will show the estimated payout at various ages for you to decide whether it is sufficient.

It also provides 2 sliders that indicate when you would like to start your payout from (65 – 70) and the RA amount you can top up to reach a more desirable monthly payout.

Keep in mind the max you can top up to your RA is to the current ERS of that year.

Pros and Cons of CPF LIFE

So you may ask, what are some of CPF LIFE’s pros and cons? Here’s the breakdown.

| Pros | Cons |

|

|

Ways to increase CPF LIFE Payouts

RA Top Ups

You are encouraged to top up your RA through the Retirement Sum Topping-Up (RSTU) Scheme, especially since higher payouts are dependent on the more savings you have inside.

If you’re below the age of 55, you can make voluntary top-ups to your CPF Special Account (SA) – because the RA formed at age 55 takes savings from your SA, followed by your Ordinary Account (OA).

For more information, you can refer to this article here to find out how to go about the top-up process.

Deferring your CPF Life Payouts

This simply means not taking your payouts at age 65 but at a later age!

If you feel like you do not have an immediate need for the money, or you wish to continue working past the retirement age and take home a salary – you should consider deferring your payouts so you can increase your payout amounts!

This deferment means you’ll continue to earn more interest in your CPF savings, with up to 6% risk-free interest every year.

And what’s more, each year of deferment increases your payout amount by ~7%.

You may be wondering if it’s such a good deal – what’s the catch? Well, the catch is that you can only defer these payouts until you reach age 70.

Nevertheless, you’ll still be earning a total increase of up to 35% if you start your payouts at 70!

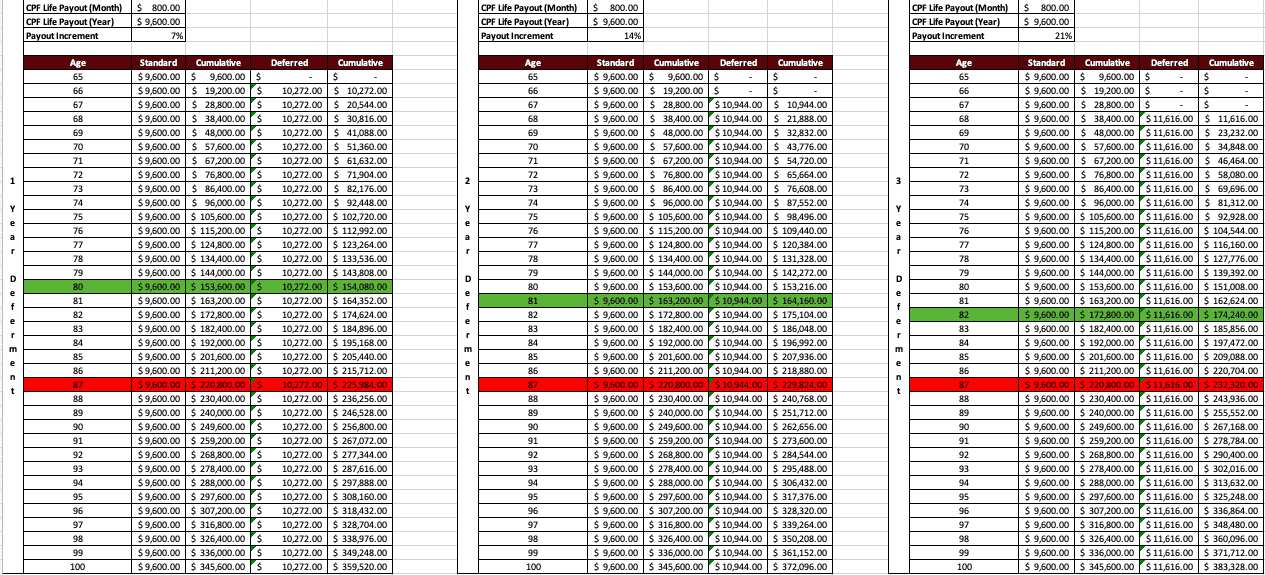

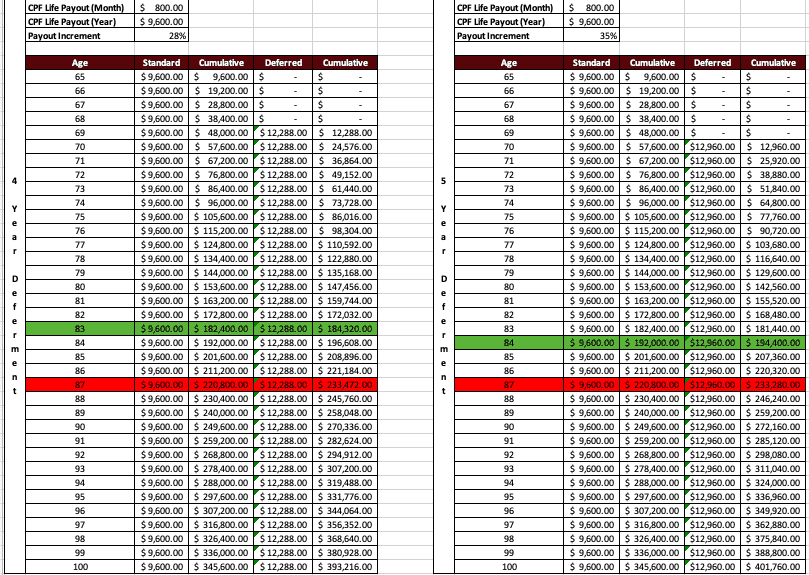

We did some calculations to see if it’s worth deferring.

Our first set of calculations ranges between 1-3 year deferments:

As seen above, you would officially get more payouts (let’s call this breakeven year) after your 80th birthday if you deferred for a year.

In fact, for every year you defer, you add the same amount of years to break even if you didn’t defer at all.

You can see the breakeven year for years 4-5 below:

This excludes any opportunity costs you incur within your deferred years.

As of 2022, the average life expectancy of Singaporeans is 87 years old. Thus, we highlighted it in red.

Assuming you live to only 87, you might not enjoy the increment in your CPF LIFE payouts for long.

We’re not saying this should be the only factor you decide on whether you should defer, but it’s definitely something worth considering.

Take it as you may.

Monetising Your Home through LBS

This essentially means using the value of your property through the Lease Buyback Scheme (LBS) to top up your CPF RA, which in turn leads to higher CPF LIFE payouts.

You do this by selling off the few remaining years of your lease of your

- 3-room or smaller flat to receive up to $30,000 of LBS Bonus,

- 4-room flat to receive up to $15,000 of LBS Bonus, or

- 5-room flat to receive up to $7,500 of LBS Bonus respectively

For households with a single owner, he/she will use the LBS bonus to top up his/her RA to the current age-adjusted Full Retirement Sum (FRS).

For households with ≥ 2 owners, each of them will use his/her share of proceeds to top up his/her RA to the current age-adjusted Basic Retirement Sum (BRS) – which is $96,000 as of 2022.

However, this is only applicable to those who own an HDB flat and are eligible under these criteria:

| Age | Flat owners must have reached the eligibility age of 65 |

| Citizenship | At least one owner must be a Singapore Citizen |

| Income | Gross monthly household income of ≤ $14,000 |

| Flat type | All flat types except short-lease flats, HUDC, and Executive Condominium units |

| Property Ownership | No concurrent ownership of second property |

| Minimum Occupation Period | All owners have been living in the flat for at least 5 years |

| Minimum Lease | At least 20 years of lease to sell to HDB |

Private Annuity Plans

This simply means getting other annuity plans for external insurance providers, instead of CPF LIFE that can provide you with a higher amount of payouts!

You can check out our list of the best retirement annuity plans in Singapore here, but the Dollar Bureau team personally prefers the Manulife RetireReady Plus, Singlife with Aviva’s MyLifeIncome, and the NTUC Income Gro Retire Flex.

However, there are several implications to choosing such private annuity plans in comparison. So, choose wisely!

| CPF LIFE | Private Annuity Plans | |

| Interest Rate | Highest, guaranteed and risk-free interest rate of up to 6% | Guaranteed and non-guaranteed returns, but some private annuity plans may provide a higher overall return – depending on factors |

| Risk | Government-backed, risk-free | Not 100% risk-free |

| Duration of Payouts | Payouts last a lifetime | Payouts are over fixed periods

(Except Aviva MylifeIncome II, where payouts last a lifetime) |

| Premium Payments | Premiums are paid with CPF savings and are technically more affordable | Premiums are not paid by CPF savings and are not as affordable

Additional cash outlay or SRS funds |

| Flexibility | Not flexible or customisable, given that it is a universal scheme for CPF LIFE members | Flexible, where payout periods, payout eligibility age, payout currencies, and withdrawal conditions can all be customised |

Of course, this really isn’t an apple-to-apple comparison as private annuity plans are supposed to complement your CPF LIFE.

How to sign up for CPF LIFE?

As mentioned, you will be automatically included if you meet the criteria stipulated by the Government.

But, the good news is that for those who are not automatically included in CPF LIFE, you can still voluntarily choose to sign up for this scheme to start receiving payouts from age 65!

Just so long as you’re 3 months away from turning 65 and a month before you turn 80.

Simply click here to enrol by retrieving your Singpass details, and fill up a simple form to start your payouts upon successful application and eligibility.

Opting out of CPF LIFE

Despite the automatic inclusion, you can opt-out of CPF LIFE by withdrawing all your CPF retirement savings before 55 if you choose to purchase your own private annuity plan or retirement insurance.

You can also opt-out of CPF LIFE due to medical reasons or by leaving Singapore permanently.

Upon successful exit of the scheme, any unused portion of your CPF LIFE premiums minus any monthly payouts you’ve already received will be refunded to you.

However, you must meet a checklist of conditions before you can do so:

- You must be age 55 and above

- You must be receiving monthly payouts from a private annuity or pension

- You must be both the policyholder and sole insured person of the annuity policy

You can, however, use multiple annuity policies for the withdrawal – but the use of investment instruments such as endowments and bonds are not allowed.

Conclusion

Now comes a very important question – Is CPF LIFE enough?

Well, with an ageing population, it is indeed heartening to know that the government provides a well-grounded foundation to cater to retirement in Singapore.

But whether you feel is sufficient, it’s solely up to you, your desired lifestyle, and retirement needs to be judged.

You’re definitely more than welcome to build your nest egg through other ways – such as private annuities, real-estate investment trusts (REITs), properties, investment-linked plans (ILPs), stocks, or even ETFs.

However, keep in mind that the core and healthcare inflation rate in Singapore over the past 20 years was 1.49% and 10% respectively, which are important factors to consider as you age.

You should also foresee that you’ll not be bringing home a monthly salary during your golden years, and more health issues are bound to surface.

So make sure you have health insurance and ECI/CI coverage.

If you’ve found this content helpful, share this article with your peers or even those who are approaching retirement age – it’s bound to happen anyways!

Need some help with your retirement planning?

Talk to a financial advisor to get started.