Do you believe in growing in an eco-friendly way even when you invest your funds? Do you want to impact society positively with your investments?

Are you willing to invest in institutional-quality funds at the lowest possible cost?

And most importantly, do you want to invest your CPF funds?

Well, in all these cases, Endowus can potentially be the perfect option for you. It is a solution to the high fees often charged by the investment providers. This is a convenient platform that emphasises improving your experience of money.

Here, this Endowus review is aimed at providing you with a detailed and elaborate idea about how Endowus works.

What Is Endowus?

Endowus is the first Singapore-based digital advisor that lets you invest your SRS, CPF, and cash. It is structured with an eye for holistic investment and concentrates mainly on unit trusts.

While you talk about Endowus, the dominant currency for transactions here in Singapore Dollars. It’s just to avoid the inconveniences involved with currency conversions.

Enriched with expert advisory at the lowest possible cost, this private limited company provides you with advice based on Harry Markowitz’s Nobel Prize-winning research on Modern Portfolio Theory.

According to that, along with diversification as the standard base of their investment portfolios, their investment theory is designed around 3 principles: better advice, better products, and lower costs.

Endowus Features

So, what specialities does Endowus offer you?

Well, Endowus’ Chief Investment Officer (CIO) Sam Rhee has stated what the Endowus community is aimed at:

“We find the world’s best funds, negotiate lower fees for all of us, and help you build optimal investment portfolios to reach your goals.”

Let’s discuss the features provided by Endowus in detail.

Endowus Investment Portfolios

The Endowus portfolios are broken into a percentage of stocks versus bonds. Basically, Endowus lets you invest in 5 portfolios –

Endowus Core

Endowus Core portfolios are strategised according to their Strategic Passive Asset Allocation framework. These low-cost portfolios are optimised based on risk-adjusted returns. This category includes 3 kinds of portfolios.

1. Flagship

Flagship portfolios are designed based on evidence-based investing. With these portfolios, you can expect a wide diversification with institutional quality and low-cost funds.

The best thing with these Flagship portfolios is that they are open to broad market exposure with a focus on long-term performance. You can invest in these portfolios using cash, SRS, and/or CPF.

With 6 types of diverse asset allocation, Flagship portfolios are good examples of their diversification strategy.

In this section, we will examine the 6 Flagship portfolio categories with a focus on their allocations and annualised returns versus annualised volatility according to their 10-year records –

- Very Aggressive:

-

- Allocation: 100% equities

- Annualised returns: 12.18% annualised returns against 11.03% annualised volatility

- Aggressive:

-

- Allocation: 80% equities, 20% fixed income

- Returns: 10.77% against 9.27% volatility

- Balanced:

-

- Allocation: 60% equities, 40% fixed income

- Returns: 9.31% against 7.56% volatility

- Measured:

-

- Allocation: 40% equities, 60% fixed income

- Returns: 7.78% against 5.89% volatility

- Conservative:

-

- Allocation: 20% equities, 80% fixed income

- Returns: 6.26% against 4.58% volatility

- Very Conservative:

-

- Allocation: 100% fixed income

- Returns: 4.72% against 3.87% volatility

2. Environmental, Social, and Governance

These ESG portfolios are a new addition. These portfolios are designed so that you can invest while at the same time positively contributing to a better sustainable future.

These portfolios are built by choosing the best ESG, sustainable and climate-related funds for both fixed income and equities from the best ESG fund managers.

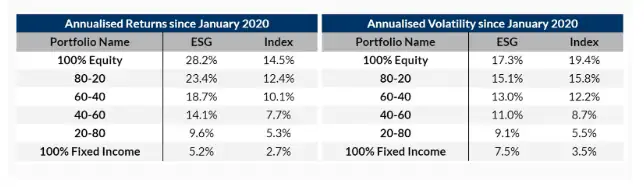

ESG portfolios, too, are classified into 6 categories. Let’s discuss those based on their allocations and 10 years of annualised internal returns –

- Very Aggressive:

-

- Allocation: 100% equities

- Annualised returns: 12.17%

- Aggressive:

-

- Allocation: 80% equities, 20% fixed income

- Annualised returns: 10.20%

- Balanced:

-

- Allocation: 60% equities, 40% fixed income

- Annualised returns: 8.19%

- Measured:

-

- Allocation: 40% equities, 60% fixed income

- Annualised returns: 6.09%

- Conservative:

-

- Allocation: 20% equities, 80% fixed income

- Annualised returns: 3.98%

- Very Conservative:

-

- Allocation: 100% fixed income

- Annualised returns: 1.86%

The following table represents past return vs. volatility of Endowus ESG portfolios –

3. Factor

Factor portfolios are characterised by global diversification. These are systematic, multi-factor portfolios designed based on your risk-return objectives.

Factor portfolios are structured based on 3 factors – value, high profitability, and small-size companies.

Factor portfolios again are classified into 6 varied categories based on different stages of risk levels.

Here are the details about their allocations and 10-year annualised returns –

- Very Aggressive:

-

- Allocation: 100% equities

- Annualised returns: 10.99% against an annualised market volatility of 11.60%

- Aggressive:

-

- Allocation: 80% equities, 20% fixed income

- Returns: 9.40% returns against 9.45% volatility

- Balanced:

-

- Allocation: 60% equities, 40% fixed income

- Returns: 7.78% returns against 7.35% volatility

- Measured:

-

- Allocation: 40% equities, 60% fixed income

- Returns: 6.13% returns vs. 5.36% volatility

- Conservative:

-

- Allocation: 20% equities, 80% fixed income

- Returns: 4.45% returns against 3.68% volatility

- Very Conservative:

-

- Allocation: 100% fixed income

- Returns: 2.74% returns against 2.88% volatility

Endowus Income

Endowus Income portfolios are focused on income, dividends, and stability. These portfolios let you gain monthly payouts while preserving or growing your capital.

With these, you get access to some of the best income-generating funds and opportunities in the industry worldwide. This, again include 6 different portfolio categories –

- Stable Income: This is a low-risk portfolio focused 100% on a fixed income. You can get stable and dependable monthly payouts with it.

- Higher Income: This portfolio involves a higher risk compared to the previous one with a focus of 20% equities and 80% fixed income. This moderate-risk portfolio is a great option if you want to maximise your monthly payout along with growing your capital by taking moderate risk.

- Future Income: With a focus of 40% on equities and 60% on a fixed income, this is the highest risk involving portfolios under Endowus Income portfolios. It can be a great option if you have long-term goals.

Endowus Satellite

This portfolio category involves 6 types of portfolios, which are structured to target specific regions, asset classes, megatrends, and themes.

- Global Real Estate: With a focus of 100% on equities, this portfolio is a great way to invest in global real estate and infrastructure, thereby earning high dividends and capital appreciation.

- Technology: This 100% equity-based portfolio is primarily focused on the world’s most technologically innovative companies.

- China Equities: This particular portfolio, as its name suggests, is focused on the potentially growing Chinese market.

- China Fixed Income: This portfolio is mainly allocated to China’s onshore and offshore corporate and government bonds.

- Megatrends: The Megatrends portfolio lets you invest primarily in future-driven themes like healthcare, clean energy, and AI.

- Low Volatility Fixed Income: This portfolio is aimed at providing you enhanced downside protection to market volatility.

Endowus Cash Smart

With no extra costs or lock-ups, this Cash Smart portfolio is a novel way to grow your wealth with higher yields. With this portfolio, you can invest with multiple modes including cash, CPF, and SRS. This portfolio allows you to earn up to 0.8% to 2.7% per annum.

Endowus Fund Smart

With Endowus Fund Smart, you can create custom portfolios by choosing your favourite funds from the 250+ available funds.

Endowus Fees

The fee is a primary concern when you consider investing your funds. When the fees are high, it will eat up a good deal of your investment returns.

However, you’d be glad to know that Endowus is one of the cheaper Singapore-based Robo advisors out there in the market. As they claim, their fees are just one-third of the industry average.

Here are some key takeaways of the fees charged at Endowus –

First and foremost, Endowus doesn’t charge any sales fees or transaction fees. You get a 100% rebate on trailer fees with them. So, whenever they recommend you a product, they are not impacted by any kind of incentivisation.

With Endowus, you get charged only an annual fee that is inclusive of GST. Since this fee is based on the value of assets you hold with the platform, it is known as Assets Under Advice (AUA).

However, you’ll find different fee structures for different portfolios. This access fee is charged every quarter.

Endowus doesn’t have any lock-ups, penalties, or redemption fees.

With this robo advisor, you pay a fund-level fee or the Total Expense Ratio (TER) charged by the fund managers such as Dimensional, PIMCO, etc for their contribution to managing and investing your funds. Endowus endeavours to keep this fee as low as possible. Usually, you pay 0.1% to 1.39% for this fee.

Furthermore, when it comes to CPF or SRS funds, some other charges are involved. You’ll have to pay the agent bank a charge of S$2-S$2.50 per transaction, and an extra charge of S$2-S$2.5 as the service charge per quarter.

However, SRS funds involve no transaction fees. But, for rejected trades or unsuccessful transactions, whether it’s related to CPF or SRS funds, you have to pay S$5.

You don’t have to pay any extra charge for holding your Endowus investment account at UOB Kay Hian.

Now, let’s look at the fee structure for their all-in-one access fee –

| Portfolios | |||||

| Investment

Type |

Core, Satellite, Income | Fund Smart | Cash Smart | ||

| Cash | Up to S$200K – 0.60% | Single Fund – 0.30% | 0.05% | ||

| S$200k to S$1m – 0.50% | |||||

| S$1m to S$5m – 0.35% | Multi-Fund Portfolio – Same as Core, Satellite, Income Portfolios | ||||

| S$5m and above – 0.25% | Short-Term Cash Management Portfolio – Similar to Cash Smart | ||||

| CPF | 0.40% | 0.30% | N/A | ||

| SRS | 0.40% | 0.30% | 0.05% | ||

Endowus’ Minimum Deposits

Endowus involves a minimum investment amount of S$1,000. Although it might be a cause of frustration for a beginner in the field of investing, the relieving thing is that you are not bound to pay the entire $1,000 with the same payment mode.

You can choose to use different methods such as a combination of CPF, cash, and SRS to fulfil this initial minimum investment amount.

For example, a cash investment of S$400 and a CPF investment of S$600 will do while fulfilling this criterion.

On the other hand, this initial minimum investment amount is calculated across all your goals, and not per goal.

Then, you need to pay a minimum investment amount of S$100 for subsequent one-time investments.

Endowus’ Minimum Withdrawals

On the other hand, the minimum withdrawal amount with Endowus is S$1.

The whole process of executing your withdrawal request takes around 4-8 business days.

However, the actual withdrawal amount that you receive may differ from your requested amount, as the calculation process is based on the latest available Net Asset Value (NAV) or trading price.

When you withdraw your cash investments, they provide you with the option to transfer your redemption amount to the cash balance of your Endowus account or a bank account in your own name.

Endowus’ Funding & Withdrawal Methods

As you already know, Endowus supports three methods for transactions you make – cash, CPF, and SRS.

As mentioned above, you can choose any one or multiple methods to make your deposit with the platform. Likewise, you can choose your preferred method to withdraw your funds.

When you decide to invest with your CPF or SRS, you simply need to link your CPF or SRS accounts to your Endowus account.

For cash investments, you are provided with multiple currencies. You can choose from USD, EUR, GBP, AUD, JPY, CHF, and some others according to your convenience.

However, in case you choose to invest with your CPF, you must have more than S$20,000 in your Ordinary Account (OA). You can invest all of your OA balance above this maintenance balance.

As for the redemption of your investment, different modes will take different time-span to reach your account.

For instance, you can expect a cash redemption to reach your account in around 4-6 business days, while a CPF or an SRS redemption will take approximately 6-8 business days to be received by you.

Is Endowus Safe?

Well, you can gauge the answer to this question by peeking at their Monetary Authority of Singapore (MAS) licence. They hold the MAS licence no. 101051.

The most significant point is that Endowus provides you with double-ledger security when it comes to safety. When you create your investment account with this fintech provider, they create a custody account in your own legal name at one of Singapore’s largest brokers UOB Kay Hian.

This means that your assets and transactions are recorded by 2 MAS-licensed authorities. And more importantly, in case anything happens to Endowus, your account along with your funds will be safe and secure with UOB Kay Hian.

Who Is Endowus Best for?

Endowus is the first digital advisor that lets you invest in CPF funds. Moreover, along with CPF, you get here the investment option of SRS too.

So, if you are seeking such a platform that will let you invest in CPF or SRS, or both along with cash, it will be a suitable platform for you.

Then, as mentioned earlier, Endowus lets you invest in institutional-level funds at the lowest possible cost. Thus, those who are willing to invest conveniently in funds that are top in the industry at a considerably low cost can proceed with their investment career with Endowus.

Again, with the minimum investment amount being S$1,000, Endowus can be a great option for the investors holding sizeable capital who want to invest through a high-yield cash management account.

As you already know, Endowus invests through unit trusts. So, in case you want to invest only through unit trusts, Endowus might be for you.

Endowus is well-known for its customer support and advisory principles. Along with providing the investors with expert-level advice, the community organises regular webinars and podcasts on financial management. This makes the platform to be significantly helpful for beginners.

Moreover, their investment portfolios are designed and diversified based on your preferred risk appetite.

They introduce rebalancing of your portfolios based on the market condition. Thus, if you are planning for long-term investment and better returns, Endowus can be the perfect option for you.

Conclusion

So, as you can see, not many robo advisors in Singapore let you invest in both CPF and SRS funds along with cash.

Moreover, it’s really exciting for a retail investor to invest in institutional-quality funds at an actually low cost. From these standpoints, Endowus is irresistible.

But, the biggest hindrance with this platform is its high minimum investment amount, which is not affordable for all.

Moreover, you don’t have any other choice apart from unit trusts.

Although there are no sales charges and trailer fees are rebated to you, you still face higher-than-normal fees as compared to a robo advisor who invests in ETFs.

This is because, on the fund level, it’s still higher. So you’ll be incurring higher fees when you combine both fund-level fees and Endowus level fees.

In these contexts, if you compare Endowus with other Singapore-based Robo advisory platforms, they are generally more expensive as compared to others.

Note: If you’re investing using CPF or SRS, Endowus is the only option for you here – and it’s totally worth it.

But if you’re investing cash, you can consider Syfe instead. With Syfe, you can get started with no minimum investment amount and monthly investments.

Its platform fees are comparable to Endowus’ as well.

Along with that, here you get a whole arena of ETFs to invest with.

To understand Syfe better, you can visit our article reviewing Syfe. If you consider investing through Syfe, click on this link to use our Syfe referral code will save you considerable fees.