So you’re talking to a financial advisor and are currently stuck on whether you should invest via iFAST or an investment-linked policy (ILP).

This is a great question to ask especially since you’re entrusting someone else with your money.

In this post, we go through the considerations you’ll need to decide if you should get an ILP or invest through iFAST.

At the end of this post, we compare the differences in returns between them.

Considerations Before Deciding on iFAST or an ILP

Access to Funds

Firstly, you’ll have to consider the access to funds that the ILP offers as compared to iFAST. Different ILPs in the market have access to different unit trusts.

These unit trusts might or might not be the same as what is currently being offered by iFAST, and is one of the first considerations you should have when making your decision.

iFAST offers 253 fund managers to choose from.

ILPs conversely offers a limited selection to choose from with the AXA Pulsar having up to 101 funds.

It’s also important to note that even though iFAST has 253 fund managers for you to choose from, it doesn’t mean that they have the same funds offered by individual ILPs.

With many overlaps between both ILPs and iFAST in terms of fund offerings, there are some that are exclusive to the ILP that iFAST doesn’t have.

Furthermore, 10 of these fund managers are available to only accredited investors.

Accredited investor funds usually have higher returns as compared to the funds usual retail investors have.

This brings us to our second point – fund performance.

Fund Performance

There’s no point in having so many funds to choose from if the fund performance sucks.

Furthermore, most portfolios will usually have anywhere between 1-10 funds, with 2-4 being the most common amount.

Therefore, the 4 funds you choose from need to provide you with the best risk-adjusted returns.

That’s where the fund performance will come into play.

Will the fund selected by you or your financial advisor in either ILP or iFAST perform well?

Will it provide the right balance of risk and returns?

This is a crucial discussion to have with your financial advisor and it is important to get them to provide you with the analysis for each.

Back to the topic of accredited investor funds, unless you’re an accredited investor, you won’t be able to purchase them through iFAST.

However, ILPs such as AXA Pulsar, Tokio Marine GoClassic, and Tokio Marine #goTreasures allows you to purchase these funds despite not being an accredited investor.

This means that you can expect higher investment returns as compared to the usual funds.

Fund Type

Not applicable to iFAST, but if your financial advisor recommends you an ILP, look at the type of fund they proposed.

Does it invest directly into the fund or through an ILP sub-fund?

The latter is worse as there’s an additional layer of fee that you’ll incur – effectively reducing the returns you’ll see.

If it directly invests into the fund, the returns you’ll see are usually net of the fund management fees.

Read more about the differences between ILP sub-funds and investing directly into the fund here.

Fees Charged

Next up is the fees charged.

FAs usually charge a sales charge of up to 3% for iFAST and an annual fee of up to 2% – the amount you incur here will depend on your FA.

ILPs have a compulsory charge starting at 2.5% per annum with no sales charges involved. Depending on the ILP presented, your fees might be higher than this.

This portion is the most crucial part for you to compare them against.

Because any differences between these charges will affect your decisions.

Click here to understand iFAST charges better.

Time Horizon

Time horizon plays a critical role in your financial planning, especially when it comes to investments.

Understanding how long you have to invest and how long you’d like to invest will help in determining your investment options.

Furthermore, you’d probably want to have different sets of investments for different financial milestones.

Therefore, it’s best to identify these first before making any investment decisions.

Based on our calculations, it’s better to invest using iFAST if your time horizon is less than 11 or 15 years.

If your time horizon is more than 11 or 15 years, you should consider an ILP instead.

You’ll see why later.

Liquidity

Closely tied to your time horizon, liquidity determines how easy it is for you to cash out your investments.

iFAST doesn’t lock you in any contracts and thus your investments are liquid.

As ILPs usually lock you in for the long term, there’s not much liquidity offered by ILPs.

However, the Manulife InvestReady Wealth II offers a 3-year policy for your to invest for minimally 3 years.

If you’ve done your financial planning right, this is an attractive option since you’ll probably won’t invest any shorter than 3 years anyway.

Even so, it’s still not as liquid iFAST.

Bonuses

One of the selling points of ILPs is the bonuses it offers.

ILPs offers bonuses for your investment to get a head start in growing your money.

As the bonuses will directly impact how much returns you’ll see at the end of your time horizon, comparing the returns inclusive of the bonus is important for you to get a fairer comparison.

iFAST does not offer any bonuses, a tradeoff for the lower fees you pay here.

Capital “Guarantee”

This is an underlooked factor that most don’t consider when deciding between iFAST and ILPs.

ILPs are essentially a life insurance policy.

This means that should you pass on, the life insurance part of it will kick in to protect you.

Since we are talking about investments, I’ll be discussing investment-focused ILPs in this portion.

For investment-focused ILPs, you will generally receive the higher of 101% of your premiums paid or your account value when you pass on.

Now if you’re investing in the bull market, chances are your account value will be higher than your premiums paid (assuming you’ve invested long enough).

However, should a market correction occur, your account value might be lesser than the total premiums you’ve paid so far.

If you pass on during this correction, you’ll only receive your account value if you’ve invested via iFAST – which might be lower than your total invested amount.

An ILP will give you 101% of the premiums you’ve paid despite your account value here.

Premium Holidays

Although not much of a concern if you’ve done your financial planning right, premium holidays might be of concern for you when deciding between the 2.

Should you encounter any financial difficulties in the future, you can stop investing without any worries if you’re going with iFAST.

However, ILPs only give you a select period of premium holidays where you can stop payment temporarily.

The only ILP in the market right now that offers unlimited premium holidays is the Tokio Marine #goTreasures – if the length of premium holidays matters.

Otherwise as mentioned, premium holidays shouldn’t matter if you’ve done your financial planning right.

You should have emergency funds set in stone should anything happen to you.

But the ability to stop payment without worry is still nice to have.

iFAST vs ILP Comparison

We’ve promised you a comparison of both iFAST and ILP in terms of the returns you’ll see.

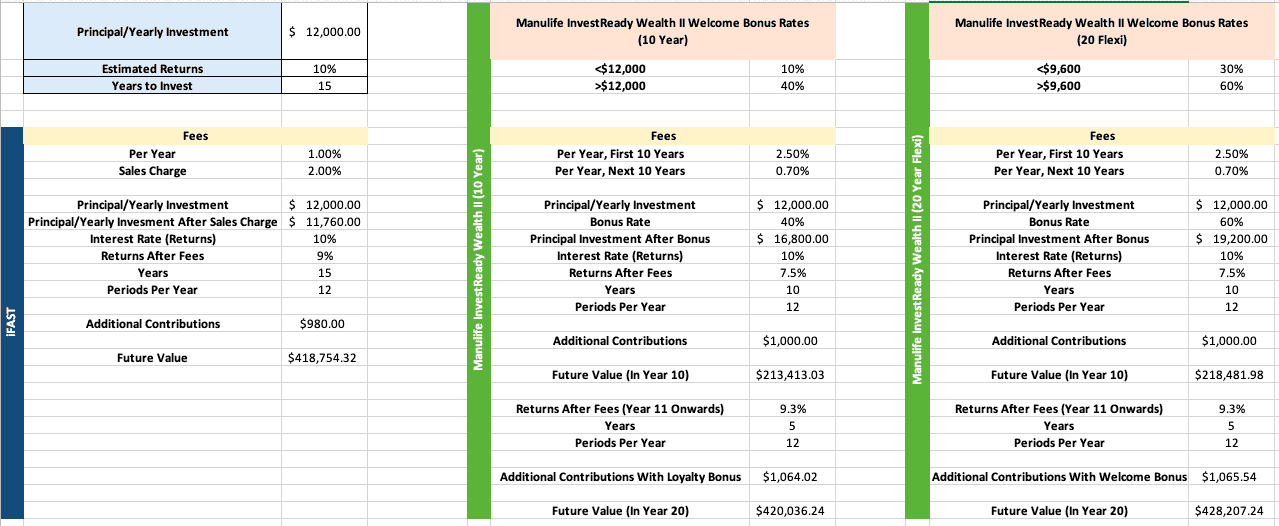

First of all, let me clarify the assumptions we’ve made.

1. The Manulife InvestReady Wealth II was chosen due to it having the lowest fees in the market – 2.5% per year for the first 10 years and 0.7% per year thereafter.

2. We assumed that you will be investing for minimally 10 years – thus, the Manulife InvestReady Wealth II 10-Year and 20-Year Flexi plans were chosen as both plans require a minimum investment period (MIP) of 10 years.

3. iFAST Sales Charge is set at 2% per transaction.

4. iFAST Annual Fees is set at 1% of account value per year.

5. Manulife InvestReady Wealth II’s Loyalty Bonus is at 0.03% of the account value.

6. Both iFAST and the ILP will have the same annualised returns.

7. Both iFAST and the ILP will have the same number of years invested.

The above assumptions ensure that the comparison between the 2 remains as fair as possible.

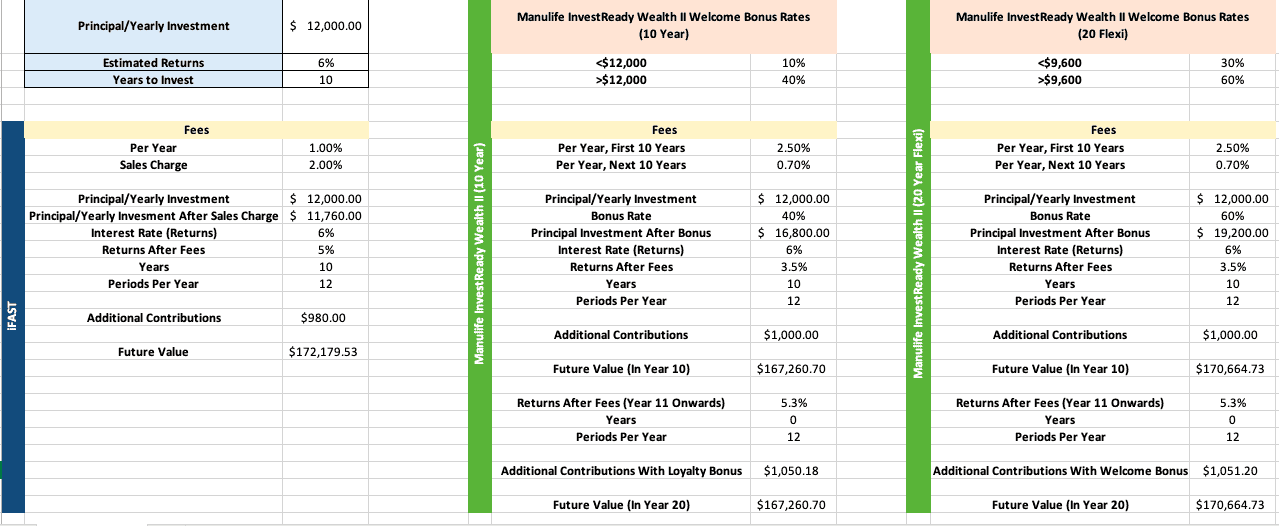

Comparison 1: 10-year MIP, 6% annualised returns, $12k per annum invested

Based on this comparison, here are the returns you’ll see for each.

Take note that after the “Future Value (in Year 10)”, all numbers are for the following years after the first 10 years.

Also do ignore “Future Value (in Year 20)”. This is meant to be the future value based on the total years invested instead of the 20th year.

iFAST: $172,179.53

Manulife InvestReady Wealth II (10-Year): $167,260.70

Manulife InvestReady Wealth II (20-Year Flexi): $170,664.73

A clear winner for iFAST with a $1,514.80 advantage over the 20-year Flexi.

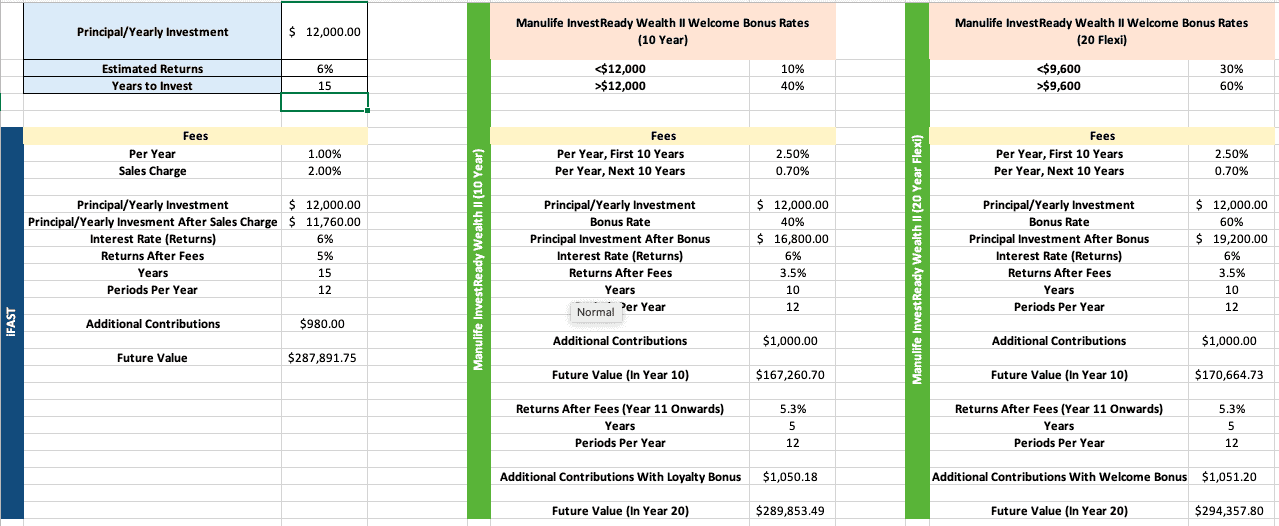

Comparison 2: 15-year MIP, 6% annualised returns, $12k per annum invested

Here are the returns you’ll see for each based on these criteria.

iFAST: $287,891.75

Manulife InvestReady Wealth II (10-Year): $289,853.49

Manulife InvestReady Wealth II (20-Year Flexi): $294,357.80

As you can see, the Manulife InvestReady Wealth II is the clear winner at 15 years by $1,961.74 and $6,466.05 respectively.

In fact, the 20-year Flexi starts to overtake iFAST at the 12th policy year.

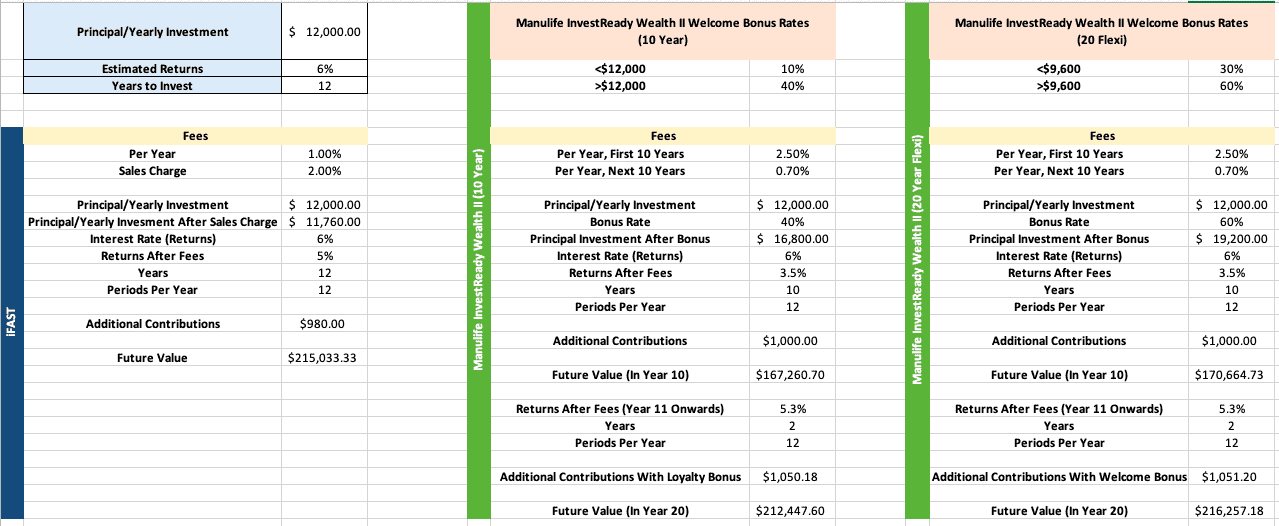

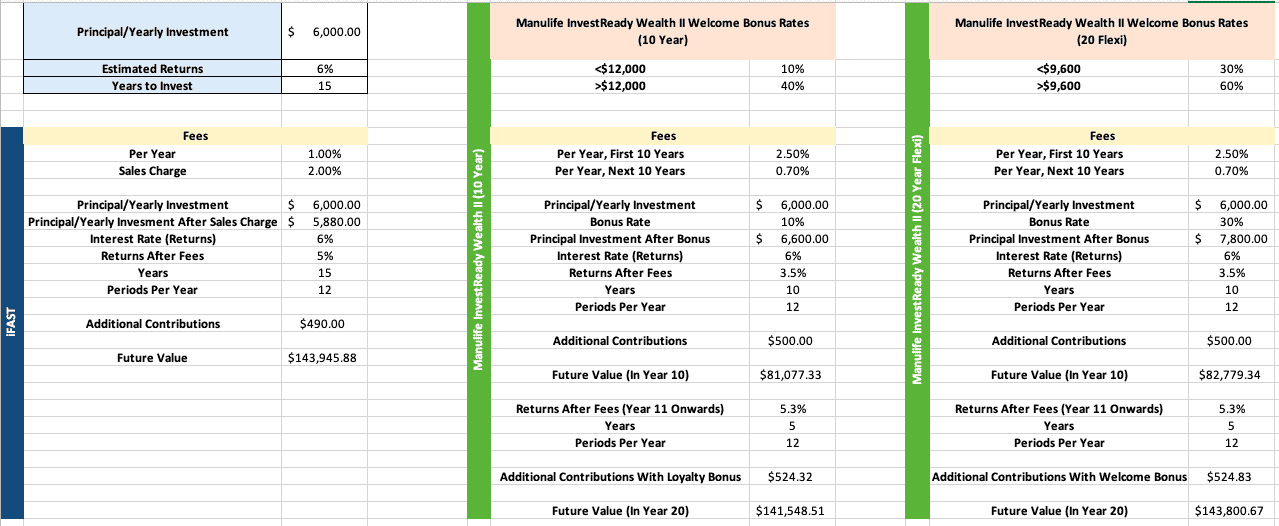

Comparison 3: 10-year MIP, 6% annualised returns, $6k per annum invested

This time, we’ve reduced the yearly investments to $6,000 to see if the results are still the same.

iFAST: $86,089.77

Manulife InvestReady Wealth II (10-Year): $81,077.33

Manulife InvestReady Wealth II (20-Year Flexi): $82,779.34

As you can tell, once the annual investment is reduced to hit the lower tier of the bonus, the Manulife InvestReady Wealth II loses to iFAST by $5,012.44 and $3,310.43 respectively.

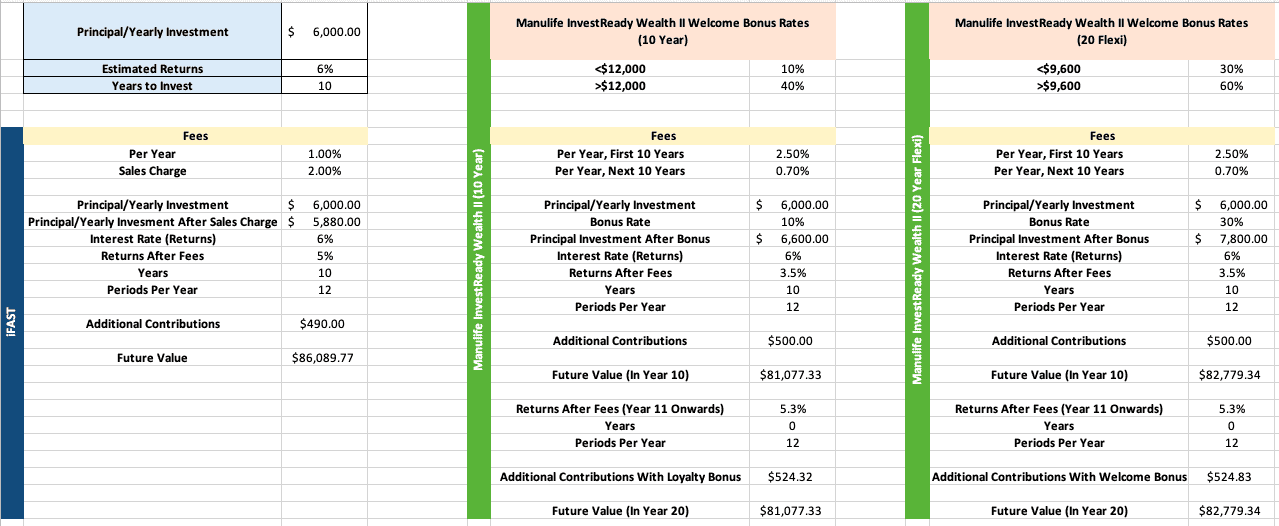

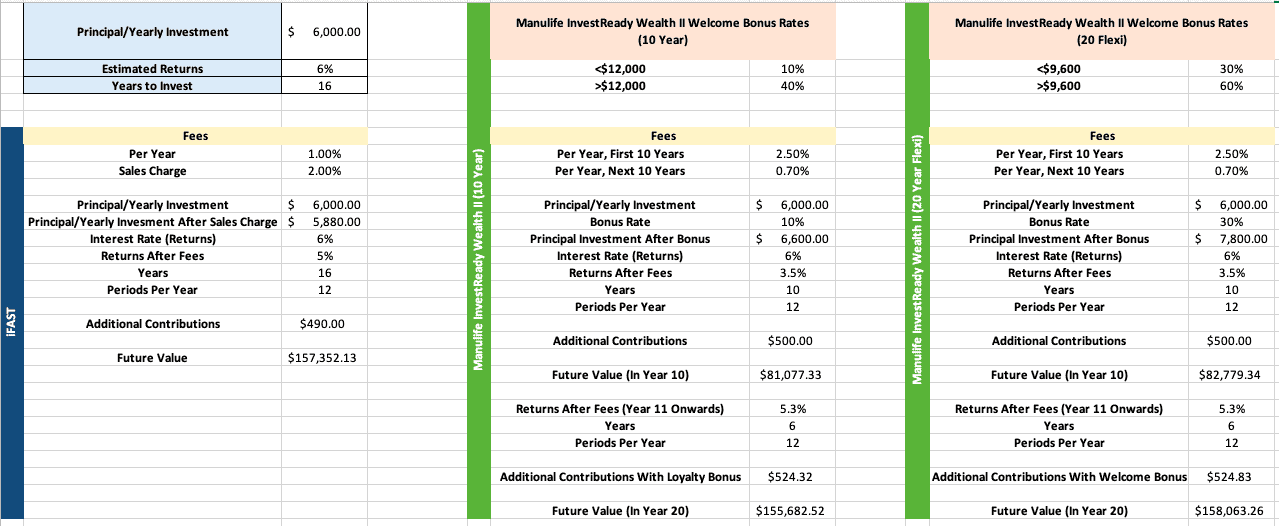

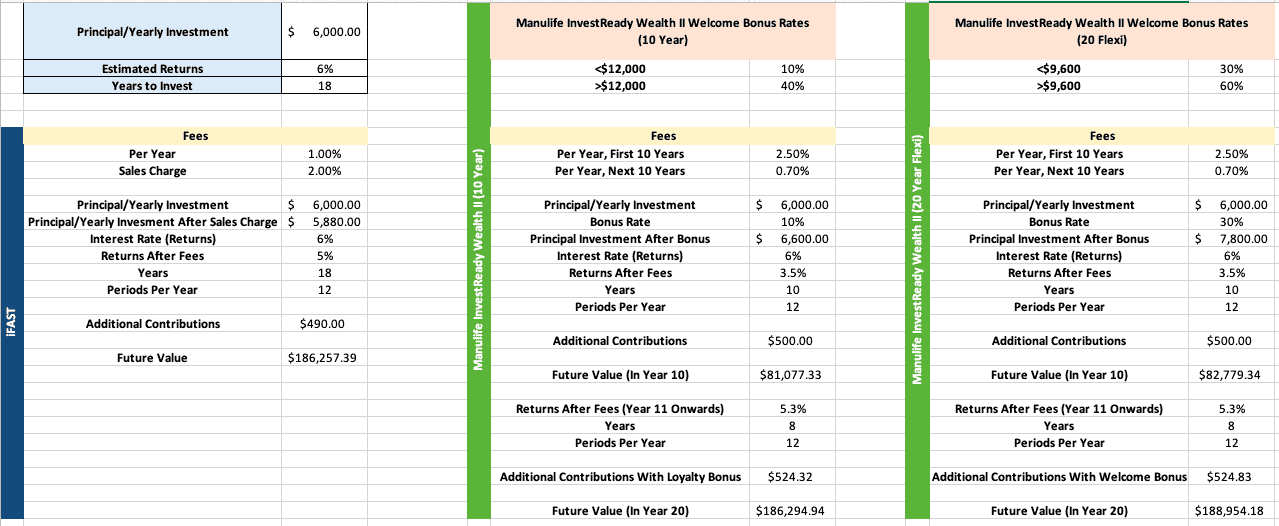

Comparison 4: 15-year MIP, 6% annualised returns, $6k per annum invested

Now we increase the MIP to 15 years and compare how it performs against each other.

iFAST: $143,945.88

Manulife InvestReady Wealth II (10-Year): $141,548.51

Manulife InvestReady Wealth II (20-Year Flexi): $143,800.67

Even at 15 years, the Manulife InvestReady Wealth II loses out to iFAST at the lower bonus tier despite previously winning – showing you the importance of bonuses when choosing an ILP.

However, in the 16th year, Manulife InvestReady Wealth II (20-Year Flexi) outperforms iFAST with a $711.13 lead.

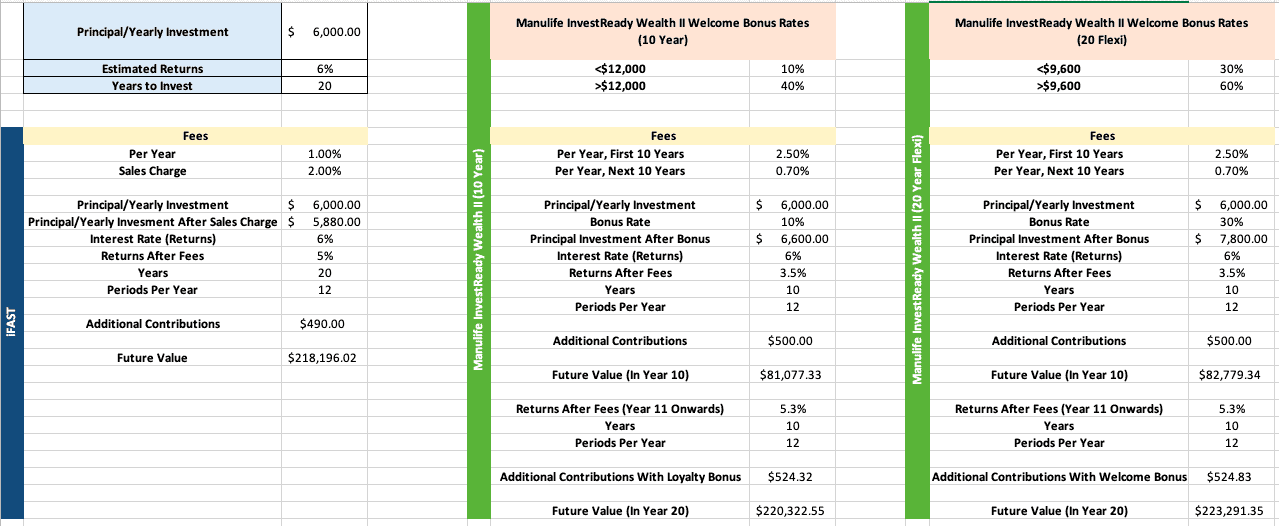

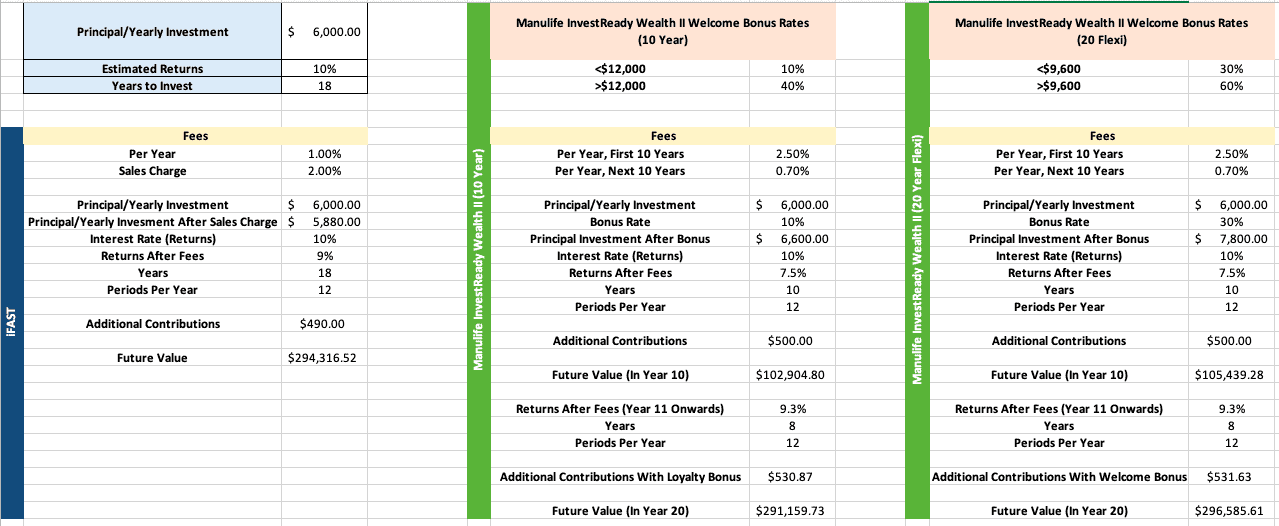

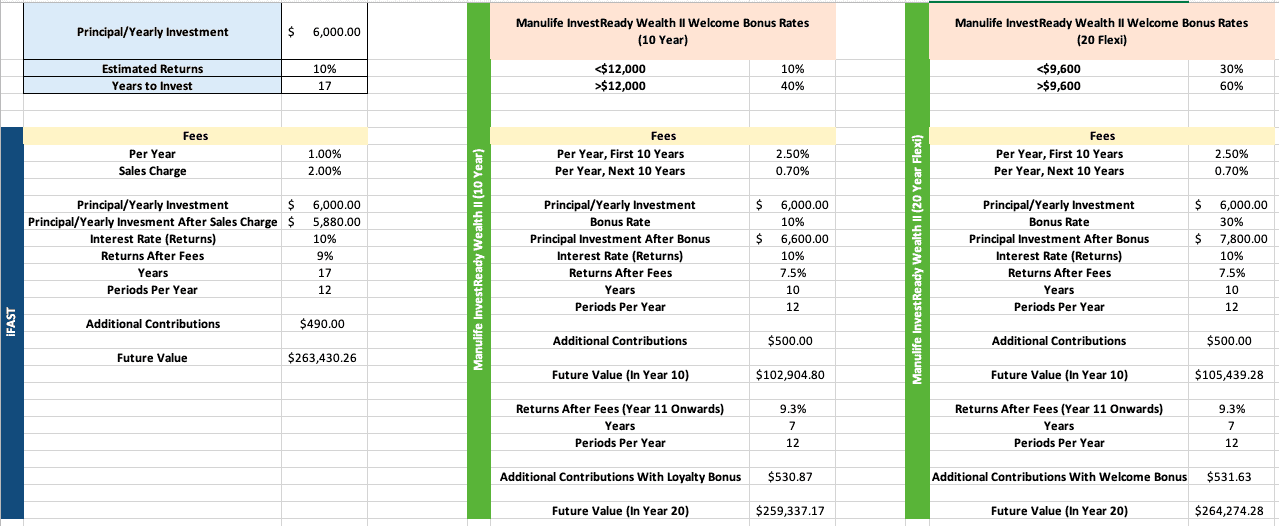

Comparison 5: 20-year MIP, 6% annualised returns, $6k per annum invested

Let’s increase the MIP to 20 years to see how they compare.

iFAST: $218,196.02

Manulife InvestReady Wealth II (10-Year): $220,322.55

Manulife InvestReady Wealth II (20-Year Flexi): $223,291.35

At 20 years, the iFAST loses out to both the 10-year and 20-year Flexi by $2,126.54 and $5,095.33 respectively.

In fact, both ILPs will start to outperform iFAST at 18 years.

However, this is not the case if we changed the annualised returns to 10% while the rest remained constant.

As you can see, only the 20-year Flexi beats iFAST at 18 years with 10% annualised returns.

We initially wanted to stop the comparison here, but since the change of variables, we’ve decided that it’s only fair if we increased the annualised returns and compare.

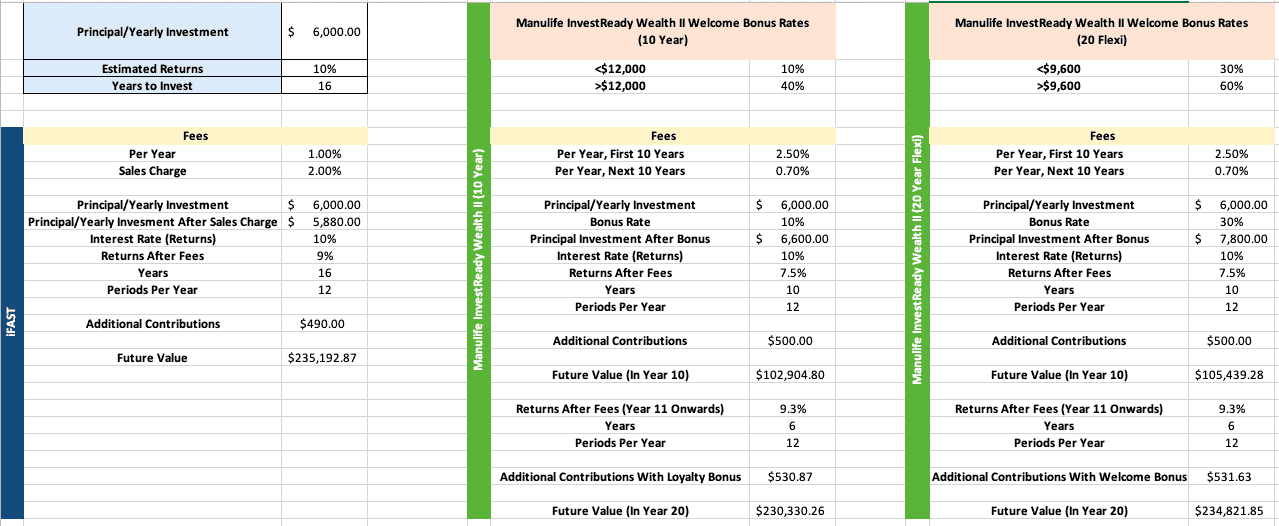

Comparison 5: 16-year MIP, 10% annualised returns, $6k per annum invested

Previously, a 16-year MIP proved the Manulife InvestReady Wealth II 20-year Flexi to perform better than iFAST at 6% returns.

However, the change in annualised returns changed the favour slightly to iFAST.

iFAST: $235,192.87

Manulife InvestReady Wealth II (10-Year): $230,330.26

Manulife InvestReady Wealth II (20-Year Flexi): $234,821.85

This advantage ends at the 17th year with the 20-year Flexi taking the lead.

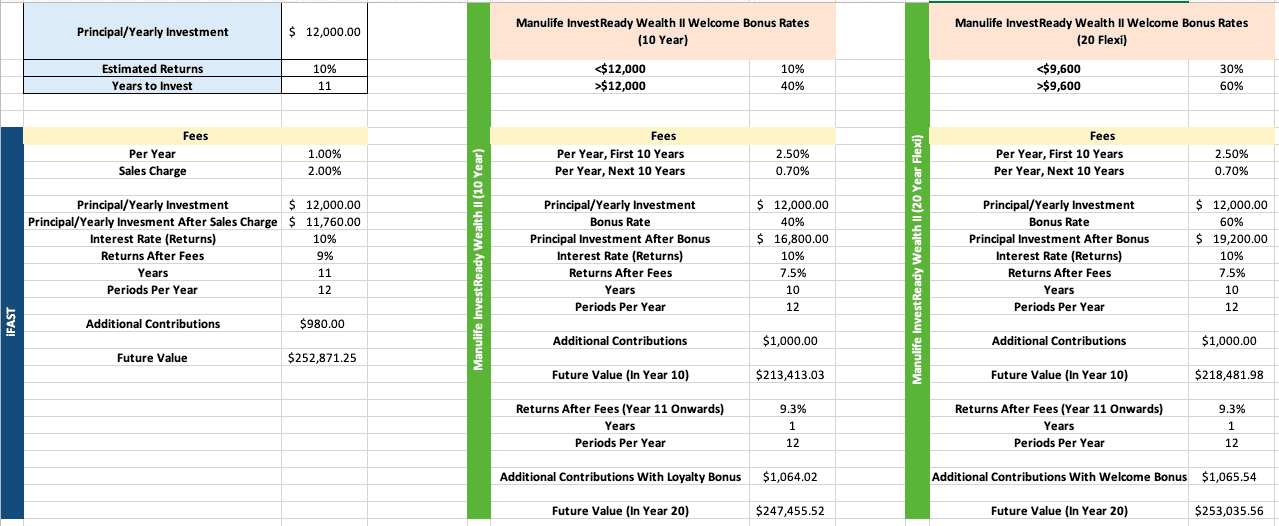

Comparison 6: 11-year MIP, 10% annualised returns, $12k per annum invested

Similar to comparison 1, Manulife InvestReady Wealth II loses out to iFAST at the 10-year mark and only outperforms at the 12th year with 6% returns.

In the 11th year, however, the 20-year Flexi wins under this criteria.

iFAST: $252,871.25

Manulife InvestReady Wealth II (10-Year): $247,455.52

Manulife InvestReady Wealth II (20-Year Flexi): $253,035.56

And by the 15th year, both the 10-year and 20-year Flexi will perform better than iFAST at 10% returns.

So Should You Choose iFAST or ILP?

So with the above comparisons, the question to ask yourself is should you choose iFAST or an ILP?

Based on our comparisons, here are the 3 things to note that will impact your decision:

- The amount invested yearly

- The annualised returns

- Number of years invested

However, it’s recommended to estimate your returns at 6% due to the ups and downs of the market.

Thus, only the amount invested and the number of years invested should impact your decisions.

With this in mind, here’s what I think is best based on our findings.

| Criteria | Decision | |

| Less than $6,000 invested per year | Less than 16 years invested | iFAST |

| 16 years or more invested | Manulife InvestReady Wealth II | |

| Between $6,000 to $9,599 invested per year | Less than 16 years invested | iFAST |

| 16 years or more invested | Manulife InvestReady Wealth II | |

| At least $9,600 invested per year | Less than 12 years invested | iFAST |

| 12 years or more invested | Manulife InvestReady Wealth II | |

Now you may be wondering why I compared based on $12,000 but show $9,600 instead.

That’s because $12,000 was done based on a $1,000 per month investment for easy illustration.

$9,600 is the minimum required to hit the highest bonus rates for the Manulife InvestReady Wealth II.

And based on our calculations (not shown above), the table is accurate for these specified amounts.

It’s important for me to point out that the Manulife InvestReady Wealth II’s Loyalty Bonus is calculated based on the account value at the end of the 10th policy year without taking into consideration yearly increases.

Therefore, the future value for the ILP is underestimated.

Conclusion

You should take note that our comparison is limited to just the Manulife InvestReady Wealth II. Therefore, other ILPs might give different results due to different fees and bonuses involved.

Also, the table above does not include other considerations previously mentioned, so don’t take the potential returns as your sole deciding factor.

Personally, I would have investments in both an ILP and iFAST due to my current age.

Why?

For long-term investments (retirement), the ILP would give me the biggest bang for my buck as seen in the comparisons.

Furthermore, ILPs gives me a chance to get higher returns than 6% due to the accredited investor funds I’ll have access to.

For short-term investments, I’ll use iFAST due to the lower fees I’ll incur.

However, if I have to choose absolutely only 1, my choice would be the ILP.

That’s because I have a long time horizon to invest, which means I’d see better returns with an ILP than iFAST.

Furthermore, I’ve properly planned my financials that I don’t really need the benefits of iFAST – its liquidity and “unlimited premium holidays”.

I have at least 12 months worth of emergency funds, proper insurance coverage, with another 6 months of liquid cash (for investment opportunities, if any).

This means I have essentially 18 months of income should I need it.

And if I spend frugally during these 18 months, I can potentially extend the time past 18 months needed before I can financially recover.

Therefore, I can afford to put my money into an ILP for the long run.

That’s why it’s important to conduct financial planning properly so that you’re prepared for the worst-case scenarios, or to take advantage of these opportunities.

If you’d like to conduct financial planning properly, let me know how I can help.