The Tokio Marine GoClassic is an investment-linked plan (ILP) mainly focusing on investments. This plan boasts the flexibility to make premium payments in 5 major currencies.

My Review of the Tokio Marine GoClassic

Firstly, I find it great that the Tokio Marine GoClassic offers a short premium payment term of minimally 5 years (Although this can’t beat Manulife InvestReady Wealth II’s 3 years).

Although investing is a long-term game, having the liquidity option helps when needed.

I mean, you could always let your investments compound after the minimum investment period too!

I would think that the Tokio Marine GoClassic is one of the most flexible ILPs in the market. Apart from the common top-ups and withdrawals, this plan offers recurring single top-ups, and free partial and regular withdrawals after the premium payment term.

This implies that you can continue regular investing after the MIP (although you’ll incur the 5% charge that the bonus won’t offset) and can liquidate your investments FOC when you need it!

The funds the Tokio Marine GoClassic has access to are performing well too! As you can see, picking the right fund that can grow your ILP is very important.

Fees-wise, if you’re going for a long-term plan (highly recommended), the bonuses you receive will offset much of the fees, making this plan well worth.

The downsides to this policy are the basic death benefit only covers 101% of the policy value, while other ILPs give you the higher of 101% of the policy value or the total premiums paid.

This means you might lose out on a portion of your total premiums paid if you pass on during a market downturn. The minimum investment amount is S$630 monthly, which can be a significant commitment to most.

If you want to invest with a Tokio Marine ILP and the minimum investment here is too high, you can consider checking out Tokio Marine #goTreasures. The minimum is only $300/month with the same funds as the GoClassic.

Otherwise, this policy is comparable to Manulife InvestReady Wealth II. The main difference is that Manulife InvestReady Wealth II offers shorter MIPs, dividend-paying funds, and much lower fees.

Would I consider getting the Tokio Marine GoClassic? Yes, previously due to their strong performing funds, flexibility, and relatively low fees.

It’s also been selected as one of the best investment plans in Singapore.

However, with many new additions to the ILP market, I would no longer consider the Tokio Marine GoClassic – mostly because i feel like that are better options based on my needs.

For example, apart from the Manulife InvestReady, there is the Singlife Savvy Invest that combines low fees and access to accredited investor funds.

There’s also the FWD Invest First Plus, which gives you the lowest fees in the market if you’re able to commit for the long term.

Despite my thoughts, this review should not be construed as financial advice. Hence, if you are unsure if the Tokio Marine GoClassic is suitable for you, seek advice from a certified financial advisor.

Criteria

- Minimum investment period of 5 years

- Minimum investment amount of S$630, A$660, £380, U$420, or €460 per month

- Minimum age of the policyholder is 1 month old. (You can buy this policy for your child).

General Features

The features of Tokio Marine GoClassic are as follows:

Premium Payment & Options

Tokio Marine GoClassic offers 5 major currencies and various payment frequencies for regular premium payments.

Here is a table that shows the minimum amount for every payment frequency and currency available.

| Nature of Premium payment | Minimum Amount in SGD | Minimum Amount in USD |

| Yearly | 7,560 | 5,040 |

| Half-yearly | 3,780 | 2,520 |

| Quarterly | 1,890 | 1,260 |

| Monthly | 630 | 420 |

Premium payment terms

The premium payment term for the Tokio Marine GoClassic policyholder is between 5 to 25 years. After selecting how long you would like to make premium payments, you can choose your premium payment frequency based on the above.

Premium Allocation

If you choose to invest with Tokio Marine GoClassic, 100% of the basic regular premium will be used to buy fund units. Funds will be invested under your latest investment allocation instructions.

Premium Accounts

The Tokio Marine GoClassic has two premium accounts.

The Initial Units Account (IUA) is where fund units purchased with your regular premium due in the first 24th month are allocated. Fund units purchased with your initial bonus are also allocated here.

The Accumulation Units Account (AUA) is where the fund units purchased with your regular premium from the 25th month are allocated. The AUA also includes fund units purchased with any recurring single premium, top-up premium, Loyalty Bonus, and Additional Bonus.

Plan Flexibility

Reduction in Regular Premium

After the first 2 policy years, you have the option to reduce your regular premium amounts.

This is provided that the new regular premium payments are higher than the minimum amounts mentioned above.

Furthermore, the amount to be reduced must be at least the minimum regular premium reduction amount set by Tokio Marine at that point.

If you have decided to opt-in for recurring single premium payments (more on this later), it will first be reduced before regular premiums are reduced.

Increase in Regular Premium

Increasing regular premium amounts only apply to you if you have reduced your premium amounts previously. You may increase your regular premiums up to the annualised premium amounts you have committed at the commencement date.

Do note that there is also a minimum increment amount to abide by. The company determines this from time to time.

Suppose you decide to change the policy currency. In that case, the annualised regular premium you committed at the starting date will be adjusted to the newly selected policy currency with a premium conversion factor set out by Tokio Marine from time to time.

Recurring Single Premium

Recurring single premium refers to repeated top-ups you can apply for any time. The minimum single premium amounts are as stated below.

|

Recurring Single Premium Frequency |

Minimum amount (In Policy Currency) |

|

Annually |

$600 |

|

Half-annually |

$300 |

|

Quarterly |

$150 |

|

Monthly |

$50 |

Tokio Marine will purchase fund units bought with your recurring premium at the price the day after your application is accepted or the day after your recurring premium is received.

Furthermore, you can increase, decrease, or even stop your recurring single premium payments anytime by informing Tokio Marine in writing.

However, this is subject to the following criteria determined by the company from time to time:

- The minimum recurring single premium; and

- The minimum increase/reduction in recurring single premium amount.

Top-up Premiums

Once your policy commences, you can choose to top-up premium amounts whenever you want. The minimum amount is $3,000, applicable in all currencies.

Your top-up premium less fees will be fully used to buy fund units and will be allocated in your AUA.

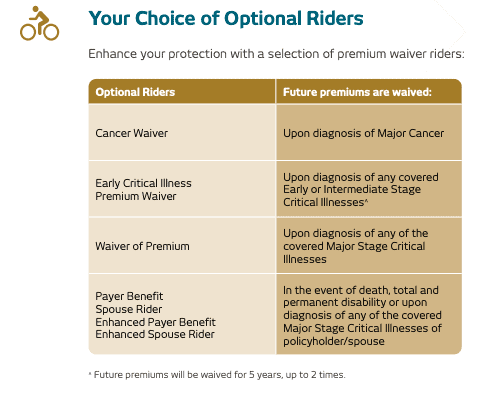

Riders Available

You can take up additional benefits in your policy, such as protection against critical illnesses and disabilities.

The following table shows the riders you can take up with GoClassic.

Premium Holiday

You can apply for a premium holiday once you have paid off the regular premiums in the first 2 policy years.

As long as there is adequate value in your policy for the deduction of fees, your policy will continue to cover you during the premium holiday. You may decide to end the premium holiday at any time by resuming premium payments.

Despite this, your policy will automatically be terminated if you stop regular premium payments within the first 2 years.

Riders Upon a Premium Holiday

Suppose you have riders paid for by premiums before your premium holiday. During your premium holiday, they will be paid monthly by deducting fund units. (if allowable).

In the case where your rider paid by premiums is not allowed to be changed into a unit-deducting rider, it will have to be terminated once your premium holiday begins.

Riders will continue to be in effect so long as the basic plan remains in force and there is sufficient AUA value for unit deduction.

Partial Withdrawal

Tokio Marine understands policyholders might need to use a certain portion of their ILP to tide them over a tough patch or help attain a goal at some point in their lives.

With Tokio Marine GoClassic, you have the possibility to make partial withdrawals for that. The amount to be withdrawn per transaction has to be minimally $500 (in policy currency).

Additionally, the partial withdrawal is subject to additional conditions as follows:

| Possibility of withdrawal from IUA | Possibility of withdrawal from AUA | Criteria | |

| During Premium Payment Term | X | ✓ |

|

| After Premium Payment Term | ✓ | ✓ |

|

| If the policy value after the withdrawal is less than the MAV, the policy will terminate immediately, and the policy value less indebtedness will be paid. | |||

Partial withdrawal is done by selling fund units based on the prices on the day after your withdrawal request is accepted.

Regular Withdrawal

Besides a one-time withdrawal, you can also choose to request regular withdrawals from your IUA and AUA after the premium payment term. You may also choose for the regular withdrawals to be performed yearly, half-yearly, quarterly, or monthly.

The regular withdrawal is subject to the following conditions:

- The value of remaining units in your selected fund after withdrawal has to be above the minimum amount determined by Tokio Marine from time to time; otherwise, the entire fund will have to be fully withdrawn; and

- The remaining policy value has to be at least the MAV.

Full Surrender

You can also terminate your policy with a complete surrender at any time.

If you fully surrender your policy during the premium payment term:

- the surrender value, less indebtedness will be paid out to you.

If you fully surrender your policy after the premium payment term:

-

the policy value less indebtedness will be paid out to you.

Indebtedness refers to any amounts owed to Tokio Marine.

Fund Switch

The Tokio Marine GoClassic also allows policyholders to switch the entire or part of a fund (Original Fund) to another fund (Target Fund).

However, the exception is that your selected fund cannot be switched between IUA and AUA. There is also a minimum amount to switch out of a fund set by the company from time to time.

Furthermore, there are criteria to fulfil for the fund switch as follows:

- The value of the remaining unit in the Original Fund must not fall below the minimum amount determined by the company; otherwise, the entire Original Fund has to be switched out; and

- The value of units in the Target Fund must not be less than the company’s set minimum amount from time to time.

Add, Remove, or Change of Life Assured

Whilst your policy is in force, you have the choice to add, remove, or change the life assured at any time.

This is subject to the following conditions:

- The new life assured is of a minimum age of 1 month;

- At the next policy anniversary, the sum of the age next birthday for the new life assured, and the remaining premium payment term must not exceed 75 years. (Not applicable after premium payment term);

- Proof of insurable interest on the new life assured at application; and

- Upon the change of Life Assured, the monthly protection charge for the Advanced Death Benefit (if applicable) will be adjusted based on the age and sex of the oldest life assured in the policy as of the effective date of such change.

Protection

Death Benefits

If the life assured dies while the policy is in force, the death benefit is paid to the beneficiaries as per the elected benefit: Basic or Advanced.

- Basic: 101% of policy value less indebtedness

- Advanced:

|

During Premium Payment Term |

Higher of:

less indebtedness. |

|

After Premium Payment Term |

101% of policy value less indebtedness |

|

*Net Premium is the sum of Regular Premium, Recurring Single Premium and Top-up Premium, less all amounts withdrawn |

|

You have to note that the death benefit option can only be selected at the start of your policy and cannot be changed afterwards.

Moreover, should you have selected the Advanced option, a monthly protection cost will be imposed. (More on Fees Involved section)

Key Features

Initial Bonus

Tokio Marine GoClassic offers an initial bonus for policyholders in the first 3 years with every regular premium payment made.

To figure out your initial bonus amount, you will first have to calculate your annualised regular premium to determine your premium band from the table below.

|

Annualised Regular Premium Band |

Annualised Regular Premium |

||||

|

SGD ($) |

AUD ($) |

GBP (£) |

USD ($) |

EUR (€) |

|

|

1 |

<12,000 |

<12,573 |

<7,239 |

<7,938 |

<8,691 |

|

2 |

12,000 to <24,000 |

12,573 to <25,143 |

7,239 to <14,478 |

7,938 to <15,876 |

8,691 to <17,382 |

|

3 |

24,000 to <36,000 |

25,143 to <37,716 |

14,478 to <21,717 |

15,876 to <23,811 |

17,382 to <26,073 |

|

4 |

36,000 yo <48,000 |

37,716 to <50,286 |

21,717 to <28,953 |

23,811 to <31,749 |

26,073 to <34,764 |

|

5 |

>=48,000 |

>=50,286 |

>=28,953 |

>=31,749 |

>=34,764 |

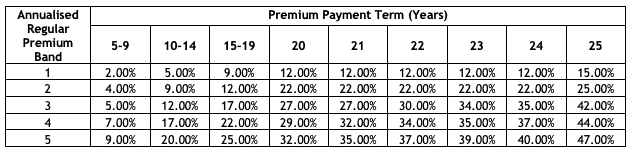

Once you have determined your premium band, you can then find your applicable initial bonus rate from the table below.

The initial bonus rates above are stated on a per-annum basis.

You can find your initial bonus amount from here by multiplying the applicable initial bonus rate with each regular premium received. The initial bonus will be rewarded in the form of additional fund units in your IUA and according to your latest investment allocation instructions.

If you have reduced your regular premium payment, your applicable initial bonus rate will be adjusted to the new premium band.

Loyalty bonus

Tokio Marine also awards loyal policyholders by awarding them with a loyalty bonus from the 4th policy year. This bonus is paid out to you at the end of each policy year.

During your premium payment term, the loyalty bonus is calculated with the formula below:

-

Loyalty Bonus = Adjustment Factor X 0.5% X AUA value

whereby the Adjustment Factor is calculated as follows:

-

Adjustment Factor = (Total regular premium paid in policy year – Total withdrawal made in a policy year) / Annualised regular premium committed at the commencement date

After your premium payment term, 0.5% of your AUA value will be paid annually.

You will not receive any loyalty bonus if your policy is on a premium holiday.

The loyalty bonus is also awarded in additional fund units but allocated to your AUA instead.

Additional Bonus

Besides the loyalty bonus, an additional bonus is awarded from the 4th policy year onwards. Likewise, this bonus is paid out to you at the end of each policy year. The bonus payment occurs from the beginning of the 4th policy anniversary until the end of the premium payment term.

In order to receive the additional bonus, the following specifications must be fulfilled.

- All annualised regular premiums are fully paid when due during the policy year;

- no premium holiday is taken during the policy year;

- there is no reduction in the regular premium during the policy year; and

- no partial withdrawal is made during the policy year.

The absence of any above conditions will result in the non-payment of the additional bonus for that policy year.

Like the loyalty bonus, the additional bonus is also awarded in the form of additional fund units to your AUA.

For all 3 bonuses above, the additional fund units awarded will be bought at the unit price on the next pricing day following the policy anniversary.

Fund offerings

Tokio Marine GoClassic offers a suite of sub-fund offerings on its website. With so many choices picking the right fund can be tricky. We have narrowed down the top 10 performers for you.

Tokio Marine GoClassic’s Top 10 Performing Sub-Funds

The Tokio Marine GoClassic invests in mutual funds that invest directly into the unit trust.

|

Name of Fund |

5 Year Historical Average (%) |

|

Franklin Technology Fund Acc USD |

29.28 |

|

FSSA Greater China Growth Fund Acc USD |

19.01 |

|

FSSA Regional China Fund Acc SGD |

18.68 |

|

Schroder ISF China Opp Acc USD |

18.37 |

|

Schroder ISF China Opp Acc SGD-H |

17.45 |

|

Fundsmith Equity Fund Acc GBP |

17.03 |

|

Fidelity Asian Special Sit Dis USD |

14.81 |

|

Fidelity European Dynamic Gr Acc USD-H |

14.31 |

|

FSSA Asian Equity Plus Fund Acc USD |

14.08 |

|

Fidelity Emerging Markets Acc USD |

13.97 |

Accurate as of April 2021.

Please be reminded that all investment types have risks involved. The above 5-year annualised returns are past historical rates and do not determine future performance.

Fees Involved

As with all ILPs, you will need to incur certain fees and charges. The following table shows all the Tokio Marine GoClassic fees & charges you might encounter.

|

Initial Charge |

|

|

Policy Charge |

|

|

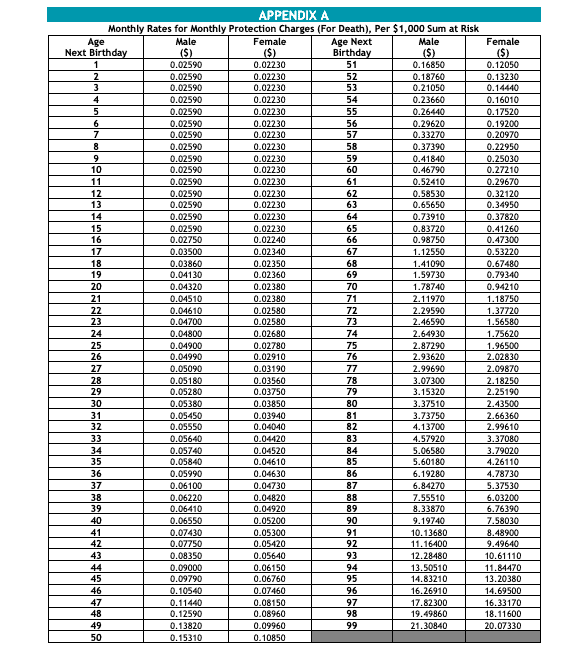

Monthly Protection Charge (Insurance Cost) |

For the first 2 policy years:

From the 3rd policy year:

*Sum at risk for the basic plan is calculated by the following formula: [Net Premium paid X Premium Conversion factor (Determined by Tokio Marine)] – 101% of your policy value In the event that 101% of the policy value is greater than or equal to Net Premium, sum at risk will be zero. So this means that as long as your investments are losing money due to any market movements, there is sum at risk. When there is a sum at risk, for every $1000, the MPC is shown below.

If your AUA has insufficient value for MPC deduction, your death benefit will be changed to the Basic option, and the Advanced option can’t be reinstated after. Furthermore, outstanding MPC charges will be owed to Tokio Marine and deducted when there are units in your AUA again. |

|

Premium Charge for Recurring Single Premium and Top-up Premium |

|

|

Administrative Charge |

Currently, there are no fees for administrative charge. |

|

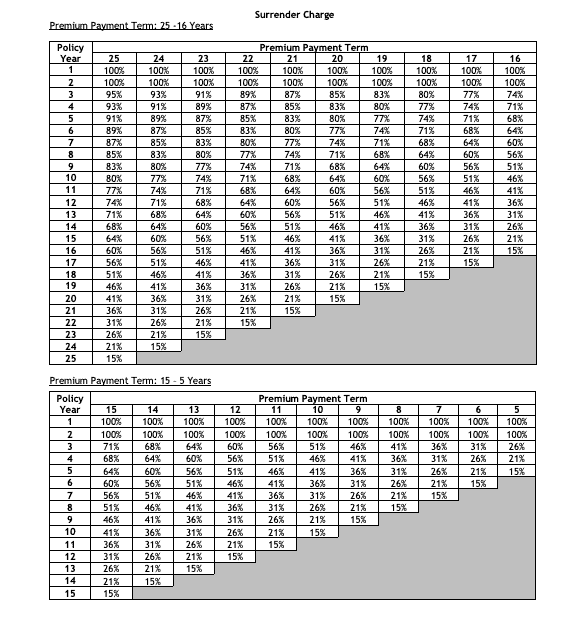

Surrender Charge |

Applicable surrender charge (%) X IUA value.

|

|

Partial Withdrawal and Regular Withdrawal Charge |

Currently, there are no fees for partial withdrawal and regular withdrawal. |

|

Credit Card Charge |

|

|

Policy Currency Change Charge |

Currently, there are no fees for policy currency change. |

|

Fund Management fee |

|

|

Switching Charge |

Currently, there are no fees for fund switches. |

|

Take note that for any charges deducted in the form of fund units above, the unit’s price is based on the price on the next pricing day. |

|

Compulsory fees

Typically, if you commit to Tokio Marine GoClassic from start to maturity without any charges, you will not be exposed to so many fees as shown above.

Instead, you will only need to incur the following charges (In SGD):

- Initial Charge – 5.4% p.a.

- Policy Charge – 1.35% p.a.

The above case is also under the assumption that premiums are not paid with a credit card, and you have selected the basic death benefit option.

This would mean that you will incur fees of 6.75% p.a. during your selected premium payment term. It seems like a really high charge. However, note that this is an overestimation as the policy charge should only be based on your IUA value.

After your premium payment term, you will only incur a 1.35% p.a. fee on your policy value.

Policy Termination

The policy will be deemed to have reached maturity when one of the following occurs.

- The policy is terminated based on the policy’s terms and conditions;

- death of the last life assured of the policy;

- the policy value is insufficient to pay for any charges;

- the policy value is less than the MAV;

- non-fulfilment of regular premium payment for the first 2 policy years; or

- any other cause of termination

Furthermore, you may choose to end the ILP on your own accord by fully surrendering your policy or writing in a policy termination request accepted by Tokio Marine.

How much will I receive upon maturity of the Tokio Marine GoClassic?

We engaged a Tokio Marine advisor to do the calculation for you (In SGD).

Assuming that you invest S$750 monthly for 25 years and let it compound for another 5 years, the funds perform at 10% per annum, you made no withdrawals, and you did not take up any premium holidays; you can expect the below:

|

First 10 Years |

|

| Monthly premium: | S$750 |

| Premium Payment Term: | 20 years (240 months) |

| Annual Fund Performance: | 10% |

| Fees in the first 10 years: | 1.51% |

| Net Fund Performance for the first 10 years: | 8.49% |

| Investment value: | $438,734.88 |

|

Next 20 Years |

|

| Fees in the next 10 years: | 1.35% |

| Net Fund Performance in the next 10 years: | 8.65% |

| Total Investment Value over 30 years: | $1,005,771.83 |

Total Premiums paid after 25 years: $180,000

Total Interest Earned: $825,771.83

ROI: 458.76%

You may be wondering, wasn’t the compulsory fees 6.75% per annum? Well, bonuses play a part in reducing the fees you incur and are thus included in our calculations.

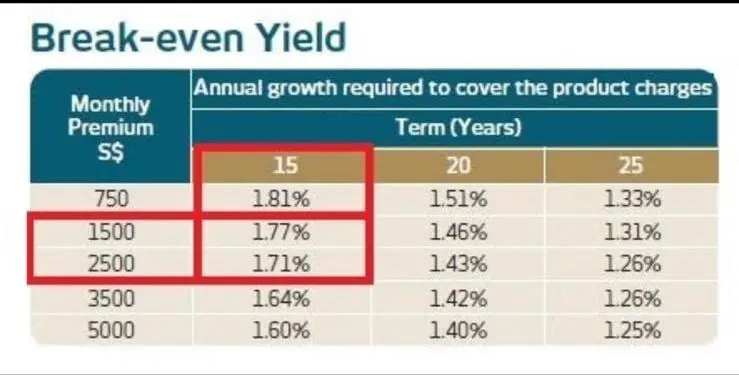

Here’s the Tokio Marine GoClassic breakeven table:

The breakeven table shows you how much your investments must perform on an annualised basis for you to not make a loss. For example, if you’re investing $750 monthly and have a premium payment term of 25 years, your funds’ performance must at least be 1.33%.

Essentially, you can see the values in the table as the fees that you will technically incur in this plan. So despite having 6.75% of compulsory fees during your premium payment term, your bonuses will reduce it to the table you see above.